In today’s dynamic tech landscape, Workday, Inc. and SoundHound AI, Inc. stand out as innovative players in the software application industry. While Workday focuses on enterprise cloud solutions for finance and human capital management, SoundHound AI pioneers voice recognition and conversational AI technologies. This comparison explores their market positions and growth potential, helping you decide which company might best enhance your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Workday, Inc. and SoundHound AI, Inc. by providing an overview of these two companies and their main differences.

Workday Overview

Workday, Inc. is a leading provider of enterprise cloud applications, focusing on financial management, human capital management, spend management, planning, and analytics. The company serves a wide array of industries including professional services, healthcare, education, and government. Headquartered in Pleasanton, California, Workday supports organizations in managing business operations and employee lifecycle with advanced cloud solutions.

SoundHound Overview

SoundHound AI, Inc. develops an independent voice AI platform aimed at delivering conversational experiences for businesses across industries. Its flagship product, the Houndify platform, offers tools such as automatic speech recognition and natural language understanding to help brands create voice assistants. Based in Santa Clara, California, SoundHound operates with a smaller workforce focused on voice AI innovation and integration.

Key similarities and differences

Both Workday and SoundHound operate within the technology sector and specialize in software applications, yet their market focus diverges significantly. Workday emphasizes enterprise cloud solutions for business and financial management, while SoundHound concentrates on voice AI platforms for conversational interfaces. Workday has a much larger market capitalization and workforce, reflecting its established position, whereas SoundHound is a smaller, newer company with higher stock volatility.

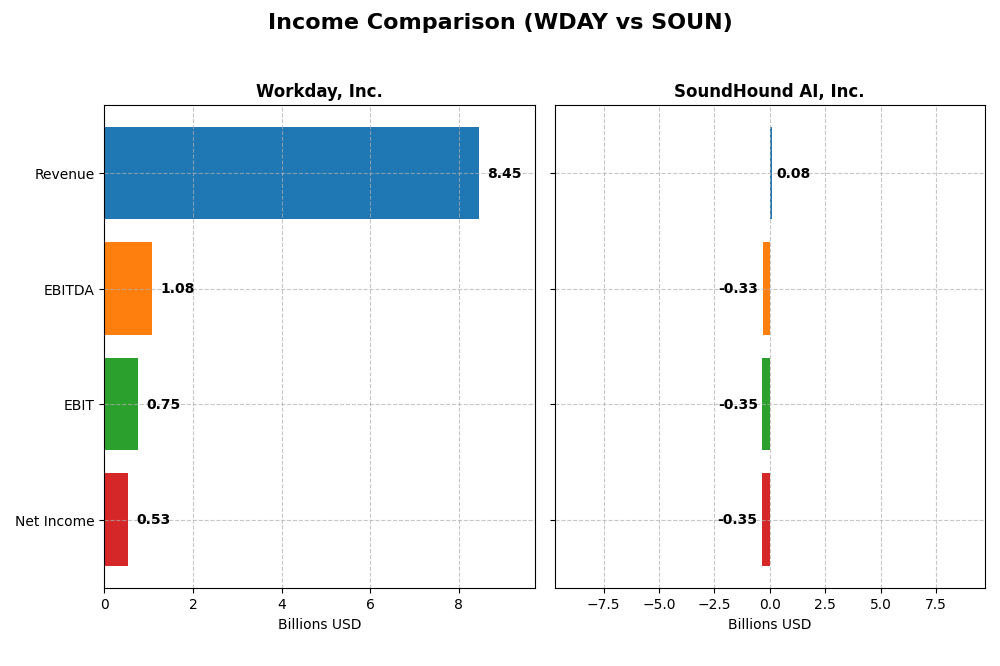

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Workday, Inc. and SoundHound AI, Inc. for their most recent fiscal years, illustrating their financial performance.

| Metric | Workday, Inc. (WDAY) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Cap | 49.9B | 4.7B |

| Revenue | 8.45B | 85M |

| EBITDA | 1.08B | -329M |

| EBIT | 752M | -348M |

| Net Income | 526M | -351M |

| EPS | 1.98 | -1.04 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Workday, Inc.

Workday’s revenue nearly doubled from 4.32B in 2021 to 8.45B in 2025, with net income recovering from losses in early years to 526M in 2025. Gross margin remained strong at 75.5%, reflecting operational efficiency. However, net margin and EPS declined sharply in 2025 despite favorable revenue growth, indicating margin pressure in the latest year.

SoundHound AI, Inc.

SoundHound’s revenue surged 5.5x from 13M in 2020 to 85M in 2024, yet net income remained deeply negative, reaching -351M in 2024. Gross margin improved but EBIT and net margins stayed unfavorable, with high operating expenses eroding profits. The company’s losses widened in the most recent year despite accelerating sales growth.

Which one has the stronger fundamentals?

Workday demonstrates stronger fundamentals with consistent revenue growth, positive net income in recent years, and solid gross margins. In contrast, SoundHound shows rapid top-line expansion but persistent and growing net losses, weak EBIT margins, and high interest expenses, reflecting higher risk and weaker profitability metrics overall.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Workday, Inc. (WDAY) and SoundHound AI, Inc. (SOUN) based on their most recent fiscal year data.

| Ratios | Workday, Inc. (WDAY) FY 2025 | SoundHound AI, Inc. (SOUN) FY 2024 |

|---|---|---|

| ROE | 5.8% | -191.9% |

| ROIC | 2.7% | -68.1% |

| P/E | 132.2 | -19.1 |

| P/B | 7.7 | 36.8 |

| Current Ratio | 1.85 | 3.77 |

| Quick Ratio | 1.85 | 3.77 |

| D/E (Debt-to-Equity) | 0.37 | 0.02 |

| Debt-to-Assets | 18.7% | 0.8% |

| Interest Coverage | 3.64 | -28.05 |

| Asset Turnover | 0.47 | 0.15 |

| Fixed Asset Turnover | 5.36 | 14.28 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Workday, Inc.

Workday shows a balanced ratio profile with favorable liquidity and leverage metrics, such as a current ratio of 1.85 and debt-to-equity of 0.37, indicating sound short-term and financial stability. However, profitability ratios including ROE at 5.82% and ROIC at 2.73% are unfavorable, alongside a high P/E of 132.15, suggesting valuation concerns. Workday does not pay dividends, likely focusing on growth and reinvestment strategies.

SoundHound AI, Inc.

SoundHound AI’s ratios reveal challenges with significantly negative profitability—net margin at -414% and ROE at -192%—and a high weighted average cost of capital at 17.71%, reflecting operational and financial stress. Positively, the company maintains low debt levels and a strong quick ratio of 3.77. Like Workday, it pays no dividends, consistent with a growth-focused approach amid ongoing losses and heavy R&D investment.

Which one has the best ratios?

Comparing both, Workday presents a more favorable financial structure with stronger liquidity and moderate profitability, despite valuation concerns. SoundHound AI exhibits mostly unfavorable profitability and coverage ratios, outweighed by its lower leverage and liquidity strengths. Overall, Workday’s ratio profile is comparatively stronger, while SoundHound faces greater financial challenges.

Strategic Positioning

This section compares the strategic positioning of Workday, Inc. and SoundHound AI, Inc. across market position, key segments, and exposure to technological disruption:

Workday, Inc.

- Leading enterprise cloud applications provider, facing competition in software – application industry.

- Key segments include subscription services (~$7.7B in 2025) and professional services (~$728M in 2025).

- Positioned in cloud applications with machine learning and augmented analytics, exposed to AI-driven innovation.

SoundHound AI, Inc.

- Smaller voice AI platform developer with high beta, competing in conversational AI software market.

- Revenue driven by hosted services ($57M), licensing ($18M), and professional services ($9.5M) in 2024.

- Focuses on voice AI technologies like speech recognition and natural language understanding, sensitive to AI advances.

Workday, Inc. vs SoundHound AI, Inc. Positioning

Workday operates a diversified portfolio with a dominant subscription model across multiple industries, offering broad enterprise cloud solutions. SoundHound AI is more concentrated on voice AI platforms, serving niche conversational AI needs with smaller revenue scale and higher volatility.

Which has the best competitive advantage?

Both companies have a slightly unfavorable moat status, shedding value but showing growing ROIC trends. Neither currently demonstrates a strong competitive advantage, but both improve profitability over time.

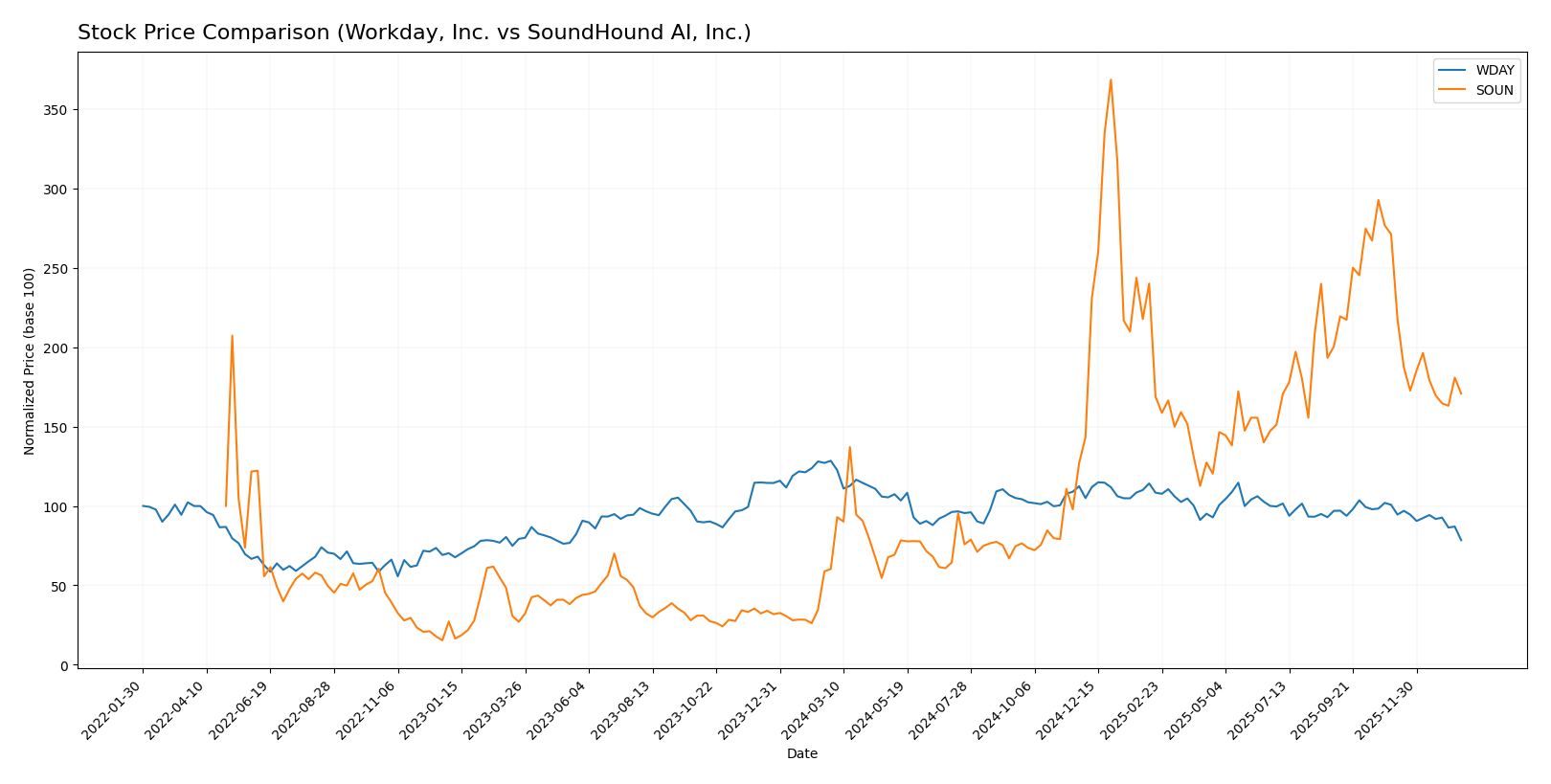

Stock Comparison

The past year revealed stark contrasts in stock price movements and trading dynamics between Workday, Inc. and SoundHound AI, Inc., highlighting a significant divergence in market sentiment and performance.

Trend Analysis

Workday, Inc. (WDAY) exhibited a bearish trend over the past 12 months, with a price decline of 38.91%. The trend showed deceleration, accompanied by high volatility (std deviation 20.22), ranging from a high of 305.88 to a low of 186.86.

SoundHound AI, Inc. (SOUN) demonstrated a strong bullish trend over the same period, with a price increase of 183.16%. Despite deceleration, volatility remained low (std deviation 4.66), with prices moving between 3.55 and 23.95.

Comparing both stocks, SoundHound AI delivered the highest market performance with a robust bullish trend, whereas Workday experienced a significant bearish decline over the past year.

Target Prices

Analysts present a clear target price consensus for Workday, Inc. and SoundHound AI, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Workday, Inc. | 320 | 235 | 274.47 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

The consensus targets for Workday and SoundHound suggest potential upside from their current prices of $186.86 and $11.1, respectively, indicating favorable analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Workday, Inc. and SoundHound AI, Inc.:

Rating Comparison

WDAY Rating

- Rating: B- indicating a very favorable status.

- Discounted Cash Flow Score: 4, rated favorable.

- ROE Score: 3, moderate efficiency in profit generation.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 2, moderate overall financial standing.

SOUN Rating

- Rating: C- with a very favorable status.

- Discounted Cash Flow Score: 1, rated very unfavorable.

- ROE Score: 1, very unfavorable efficiency.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 4, favorable financial risk.

- Overall Score: 1, very unfavorable overall standing.

Which one is the best rated?

Based strictly on the provided data, Workday holds a higher overall rating and better scores in discounted cash flow, ROE, and ROA. SoundHound scores better only in debt to equity, but its overall financial standing is rated very unfavorable compared to Workday’s moderate standing.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Workday, Inc. and SoundHound AI, Inc.:

WDAY Scores

- Altman Z-Score: 4.41, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

SOUN Scores

- Altman Z-Score: 6.62, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

Which company has the best scores?

SoundHound AI has a higher Altman Z-Score, suggesting stronger bankruptcy safety, but a much weaker Piotroski Score than Workday. Workday shows a more balanced profile with average financial strength.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Workday, Inc. and SoundHound AI, Inc.:

Workday, Inc. Grades

The following table presents recent grades from reputable grading companies for Workday, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| TD Cowen | Maintain | Buy | 2025-11-26 |

| DA Davidson | Maintain | Neutral | 2025-11-26 |

| Wells Fargo | Maintain | Overweight | 2025-11-26 |

| Barclays | Maintain | Overweight | 2025-11-26 |

| Keybanc | Maintain | Overweight | 2025-11-26 |

| Citigroup | Maintain | Neutral | 2025-11-26 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| UBS | Maintain | Neutral | 2025-11-26 |

Overall, Workday’s grades predominantly reflect a positive outlook, with multiple Overweight and Buy ratings and a consensus rating of “Buy.”

SoundHound AI, Inc. Grades

The following table shows recent grades from recognized grading firms for SoundHound AI, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI’s ratings are generally positive with several Buy and Outperform grades and a consensus rating of “Buy.”

Which company has the best grades?

Both Workday, Inc. and SoundHound AI, Inc. hold predominantly positive grades, but Workday features a higher volume of Overweight and Buy ratings from top-tier firms. This may indicate stronger analyst confidence, potentially influencing investor sentiment and portfolio allocation strategies more favorably towards Workday.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Workday, Inc. (WDAY) and SoundHound AI, Inc. (SOUN) based on the most recent financial and operational data.

| Criterion | Workday, Inc. (WDAY) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | High reliance on subscription services (7.7B USD in 2025), limited product segmentation | More diversified revenue streams: hosted services, licensing, and professional services, though smaller scale |

| Profitability | Slightly unfavorable profitability; ROIC below WACC but improving; net margin 6.23% | Unfavorable profitability; large negative net margin (-414%), negative ROIC and ROE |

| Innovation | Moderate innovation with steady revenue growth in subscription and professional services | Focus on AI voice tech innovation but struggling to monetize effectively yet |

| Global presence | Strong global presence with significant recurring revenue | Smaller scale, limited global reach compared to WDAY |

| Market Share | Established market player in enterprise software | Emerging player in AI voice recognition, niche market position |

Key takeaways: Workday shows stable growth and a strong subscription base but faces challenges with profitability and valuation. SoundHound AI is still in a development phase with high losses but potential upside from innovation. Both companies currently destroy value but are improving profitability trajectories. Investors should weigh growth prospects against current financial risks.

Risk Analysis

Below is a comparison of key risks for Workday, Inc. (WDAY) and SoundHound AI, Inc. (SOUN) based on the most recent data available in 2026:

| Metric | Workday, Inc. (WDAY) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Risk | Moderate (Beta 1.14) | High (Beta 2.88) |

| Debt level | Low (D/E 0.37) | Very Low (D/E 0.02) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate | High (Smaller scale, rapid tech changes) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate (Global clients) | Moderate (US-focused) |

Workday’s market risk is moderate with a stable debt profile and favorable liquidity, but its valuation multiples suggest caution. SoundHound faces higher market and operational risks due to its smaller size, negative profitability, and volatile earnings. The most impactful risk for SoundHound is its operational and financial instability, while for Workday, market fluctuations and high valuation multiples are key concerns.

Which Stock to Choose?

Workday, Inc. (WDAY) shows a generally favorable income evolution with a 16.35% revenue growth in the last year and a strong 95.6% increase over five years. Its financial ratios present a balanced mix of favorable current and debt ratios but unfavorable profitability and valuation metrics. The company has a moderate debt level and a solid rating of B- with a slightly unfavorable moat due to ROIC below WACC despite improving profitability.

SoundHound AI, Inc. (SOUN) experienced high revenue growth of 84.62% last year and an impressive 550.63% over five years but suffers from negative profitability ratios and high operational expenses. Its financial ratios are mostly unfavorable except for low debt levels. Despite a low rating of C- and a slightly unfavorable moat, its Altman Z-Score indicates financial stability, though profitability remains weak.

For investors prioritizing stable income growth and moderate financial health, Workday’s solid income statement and balanced ratios might appear more favorable. Conversely, those with a tolerance for higher risk and focus on rapid revenue expansion could interpret SoundHound’s profile as offering growth potential amid profitability challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Workday, Inc. and SoundHound AI, Inc. to enhance your investment decisions: