Home > Comparison > Technology > UBER vs SOUN

The strategic rivalry between Uber Technologies, Inc. and SoundHound AI, Inc. shapes the future of the technology sector’s software application landscape. Uber operates as a capital-intensive platform connecting millions worldwide through mobility, delivery, and freight services. SoundHound AI, by contrast, focuses on high-margin voice AI solutions enabling conversational experiences. This analysis assesses which business model presents a superior risk-adjusted return for a diversified portfolio in 2026.

Table of contents

Companies Overview

Uber Technologies, Inc. and SoundHound AI, Inc. both shape the evolving landscape of software applications with distinct market focuses.

Uber Technologies, Inc.: Global Mobility and Delivery Leader

Uber dominates the mobility and delivery services sector, generating revenue by connecting riders, drivers, and delivery providers worldwide. Its core business spans three segments: Mobility, Delivery, and Freight. In 2026, Uber strategically emphasizes expanding its logistics capabilities alongside enhancing its ride-sharing platform to capture broader market demand.

SoundHound AI, Inc.: Voice AI Innovator

SoundHound AI leads in voice artificial intelligence platforms, enabling businesses to create sophisticated conversational assistants. Its Houndify platform integrates speech recognition and natural language understanding to power voice solutions. In 2026, SoundHound focuses on scaling its AI tools across diverse industries, aiming to deepen client integration and improve customer experience.

Strategic Collision: Similarities & Divergences

Both companies leverage software to transform user interactions, yet Uber pursues a transaction-based ecosystem while SoundHound builds an embedded AI infrastructure. Their competition unfolds around capturing consumer engagement: Uber through physical services and SoundHound via digital voice interfaces. This contrast defines their investment profiles—Uber as a high-volume service operator, SoundHound as a niche technology enabler.

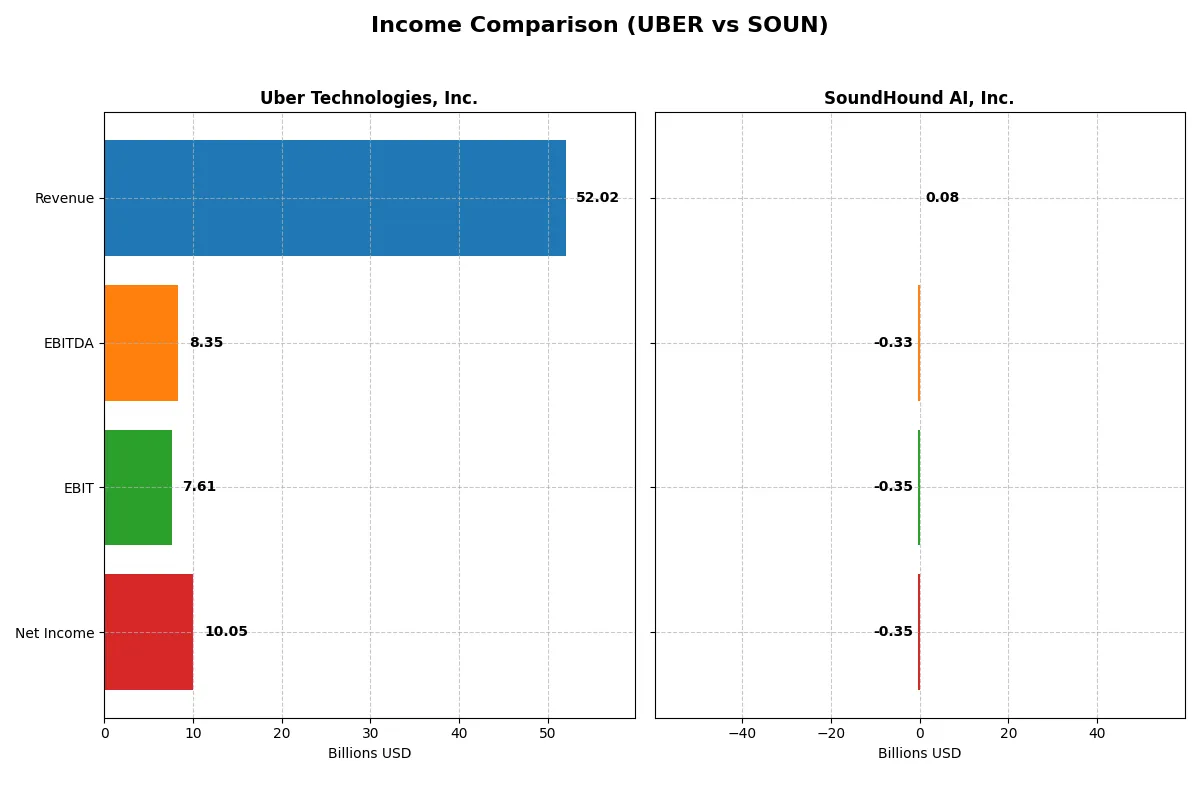

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Uber Technologies, Inc. (UBER) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Revenue | 52.0B | 85M |

| Cost of Revenue | 31.3B | 43M |

| Operating Expenses | 15.1B | 383M |

| Gross Profit | 20.7B | 41M |

| EBITDA | 8.3B | -329M |

| EBIT | 7.6B | -348M |

| Interest Expense | 440M | 12M |

| Net Income | 10.1B | -351M |

| EPS | 4.82 | -1.04 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes which company operates its business with superior efficiency and financial discipline.

Uber Technologies, Inc. Analysis

Uber’s revenue surged from $17.5B in 2021 to $52B in 2025, with net income exploding from a loss to $10B. Gross margin stabilizes near 40%, while net margin holds a solid 19%. The latest year shows robust operating leverage, with EBIT rising 64% year-over-year, signaling strong momentum and improved cost control.

SoundHound AI, Inc. Analysis

SoundHound’s revenue expanded rapidly from $21M in 2021 to $85M in 2024, but it remains unprofitable with a net loss of $351M. Gross margin is healthy at nearly 49%, but negative EBIT and net margins above -400% reflect high operating expenses and interest costs. Despite significant revenue growth, profitability pressures persist and deepen in the latest year.

Margin Strength vs. Growth Struggles

Uber demonstrates a clear fundamental advantage with its profitable scale and improving margins, while SoundHound faces ongoing losses despite top-line momentum. Uber’s mature, efficient model contrasts with SoundHound’s high-burn growth phase. Investors seeking earnings stability may find Uber’s profile more attractive amid SoundHound’s persistent unprofitability.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Uber Technologies, Inc. (UBER) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| ROE | 45.72% (2024) | -191.99% (2024) |

| ROIC | 6.79% (2024) | -68.13% (2024) |

| P/E | 12.82 (2024) | -19.15 (2024) |

| P/B | 5.86 (2024) | 36.76 (2024) |

| Current Ratio | 1.07 (2024) | 3.77 (2024) |

| Quick Ratio | 1.07 (2024) | 3.77 (2024) |

| D/E | 0.53 (2024) | 0.02 (2024) |

| Debt-to-Assets | 22.32% (2024) | 0.79% (2024) |

| Interest Coverage | 5.35 (2024) | -28.05 (2024) |

| Asset Turnover | 0.86 (2024) | 0.15 (2024) |

| Fixed Asset Turnover | 14.14 (2024) | 14.28 (2024) |

| Payout ratio | 0% (2024) | 0% (2024) |

| Dividend yield | 0% (2024) | 0% (2024) |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden operational strengths and risks that shape investor decisions.

Uber Technologies, Inc.

Uber shows a strong net margin of 19.33%, signaling operational efficiency, but its ROE and ROIC stand at zero, indicating limited shareholder profitability. The stock’s P/E ratio of 16.85 is neutral, neither stretched nor cheap. Uber retains earnings to fuel R&D, reflecting a growth-focused reinvestment strategy without dividends.

SoundHound AI, Inc.

SoundHound suffers from deeply negative profitability metrics, with net margin at -414% and ROE at -192%, revealing heavy losses. Its P/E ratio is negative but favored due to accounting conventions. Despite a high price-to-book ratio of 36.76, SoundHound maintains a strong quick ratio of 3.77, relying heavily on R&D for future growth rather than shareholder payouts.

Operational Strength vs. Growth Gambit

Uber balances reasonable valuation with positive operational margins, offering a safer risk profile. SoundHound’s metrics reveal a high-risk growth play with weak profitability and stretched valuation. Investors seeking operational stability may prefer Uber, while those targeting speculative growth might consider SoundHound’s profile.

Which one offers the Superior Shareholder Reward?

I observe Uber Technologies, Inc. and SoundHound AI, Inc. both pay no dividends. Uber trades at a reasonable P/E of 16.9 in 2025, with strong free cash flow of 4.7/share and nearly full FCF coverage of buybacks, signaling sustainable capital return. SoundHound’s massive losses, negative margins, and no buybacks reflect high reinvestment risk. Uber’s disciplined buybacks and improving margins offer a superior total return profile versus SoundHound’s speculative growth strategy. In 2026, I favor Uber for its balanced shareholder reward and capital allocation.

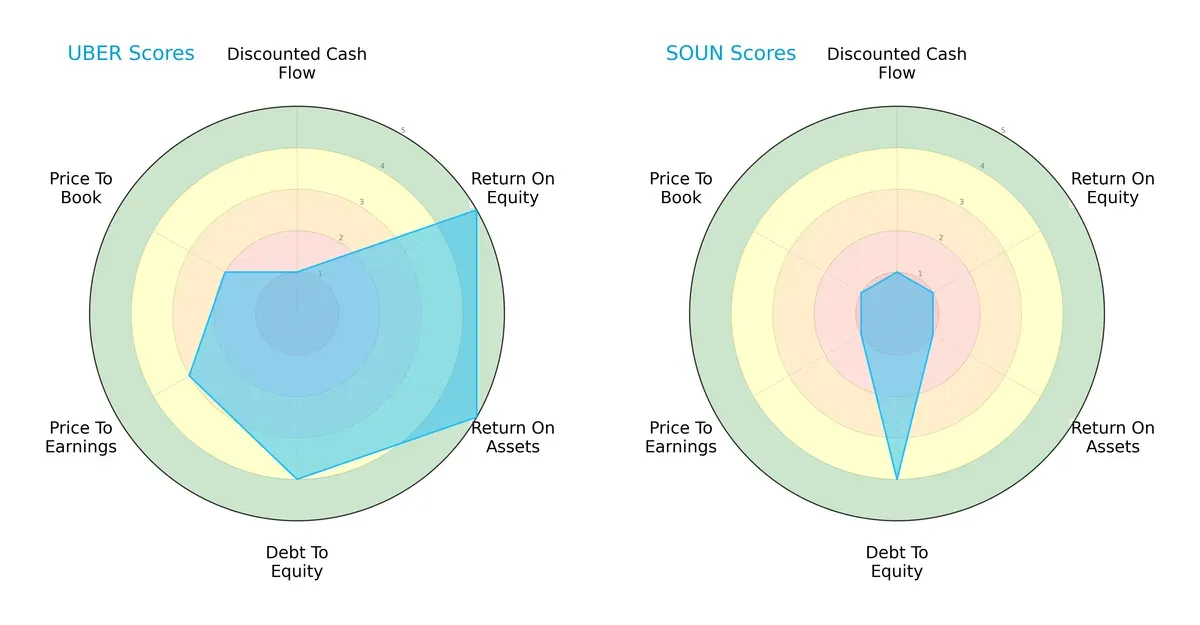

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Uber Technologies, Inc. and SoundHound AI, Inc., highlighting their strategic financial profiles:

Uber shows a more balanced profile with strong ROE (5) and ROA (5) scores, indicating efficient asset use and profitability. Its debt-to-equity score (4) also suggests prudent leverage management. In contrast, SoundHound relies heavily on a moderate debt-to-equity score (4) but scores very low across DCF, ROE, ROA, and valuation metrics, signaling weak operational efficiency and valuation concerns.

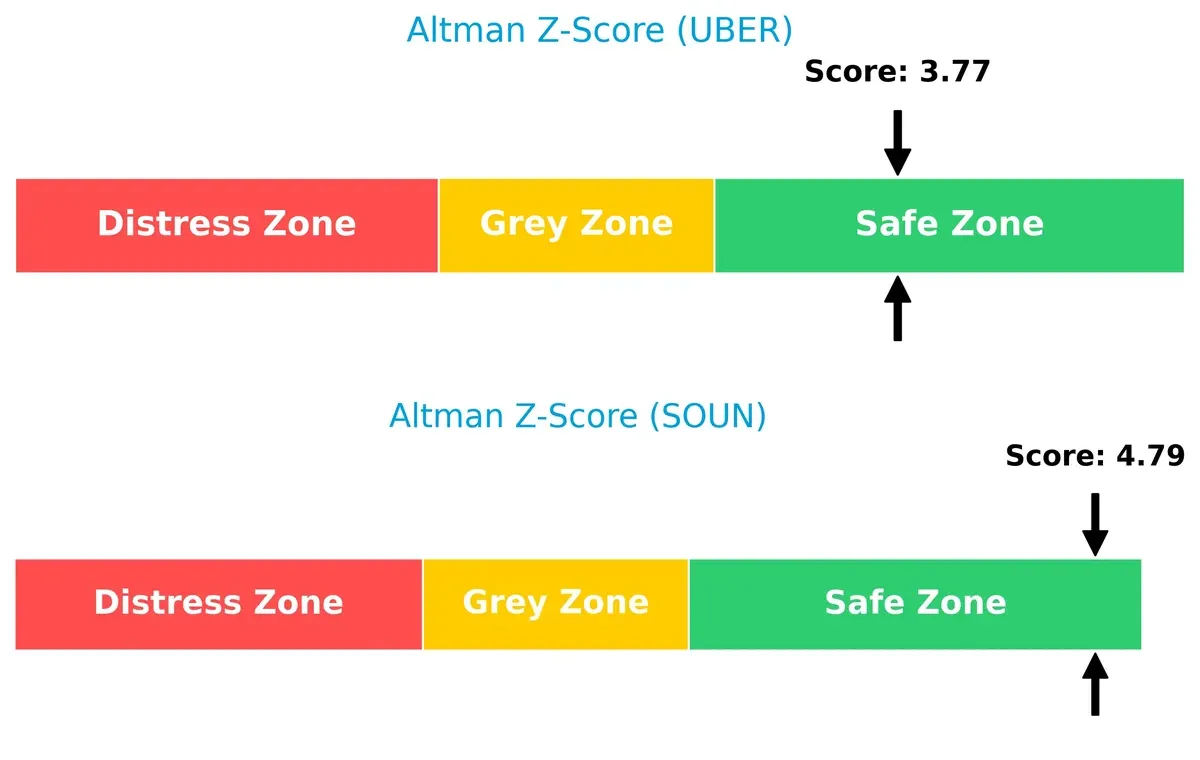

Bankruptcy Risk: Solvency Showdown

Uber’s Altman Z-Score of 3.77 versus SoundHound’s 4.79 places both companies safely above distress thresholds, implying strong resilience for long-term survival in this market cycle:

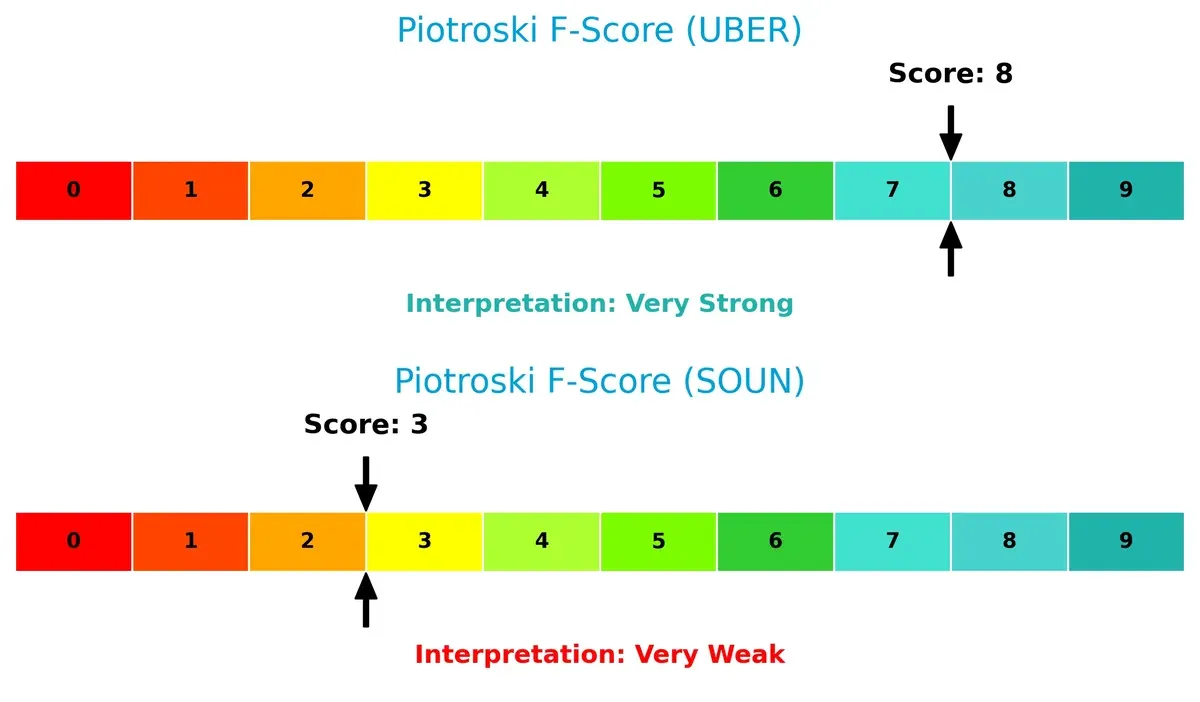

Financial Health: Quality of Operations

Uber’s Piotroski F-Score of 8 signals peak financial health with robust internal metrics, whereas SoundHound’s score of 3 raises red flags about its operational quality and financial strength:

How are the two companies positioned?

This section dissects Uber and SoundHound’s operational DNA by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the strongest, most sustainable competitive advantage today.

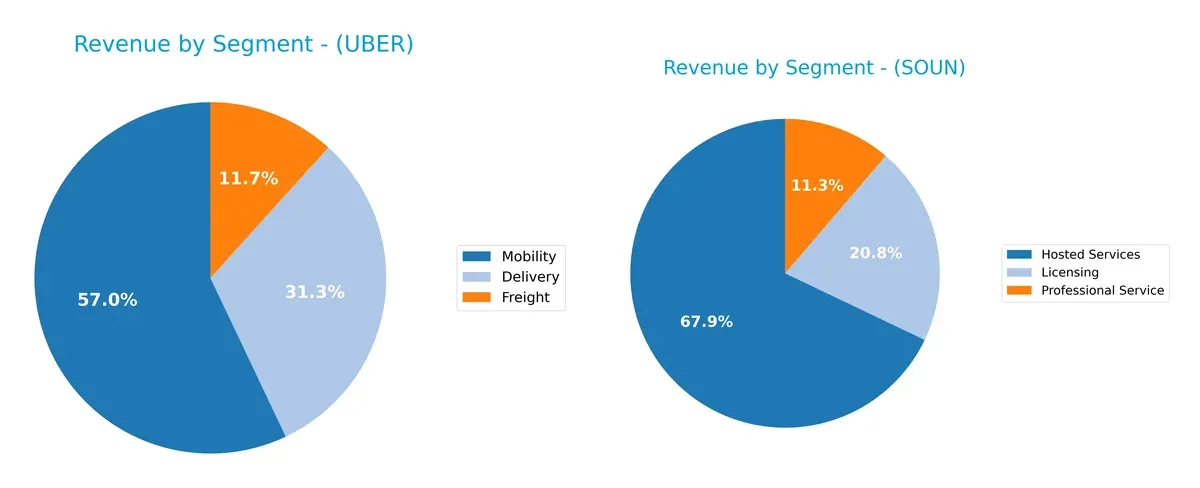

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Uber Technologies and SoundHound AI diversify their income streams and where their primary sector bets lie:

Uber Technologies anchors its revenue in Mobility with $25B, while Delivery and Freight add $13.7B and $5.1B respectively, showing a well-diversified portfolio. SoundHound AI, by contrast, relies heavily on Hosted Services at $57M, with Licensing and Professional Service trailing far behind. Uber’s broad mix supports ecosystem lock-in and mitigates sector risk. SoundHound’s concentration heightens vulnerability but allows focused innovation in AI services.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Uber Technologies, Inc. and SoundHound AI, Inc. based on diversification, profitability, financials, innovation, global presence, and market share:

Uber Strengths

- Highly diversified revenue streams across Delivery, Freight, Mobility

- Positive net margin of 19.33% indicates profitability

- Favorable debt-to-equity and interest coverage ratios

- Strong global presence with significant revenue from US, EMEA, Asia Pacific

- Market leader in mobility and delivery segments

SoundHound Strengths

- Favorable quick ratio indicates strong short-term liquidity

- Low debt-to-assets ratio supports financial stability

- High fixed asset turnover shows efficient asset use

- Presence in multiple countries including US, France, Korea

- Positive P/E status indicates market valuation confidence

Uber Weaknesses

- Zero ROE and ROIC suggest poor capital efficiency

- Unavailable WACC limits cost of capital analysis

- Weak current and quick ratios raise liquidity concerns

- Unfavorable asset turnover metrics indicate inefficiency

- No dividend yield may deter income-focused investors

SoundHound Weaknesses

- Deep negative net margin (-414%) signals unprofitability

- Negative ROE and ROIC reflect capital inefficiency

- High WACC of 17.82% increases financing costs

- Unfavorable interest coverage ratio threatens solvency

- Elevated price-to-book ratio (36.76) suggests overvaluation

Uber demonstrates strong diversification and global scale but struggles with capital efficiency and liquidity ratios. SoundHound shows liquidity strengths and asset efficiency but suffers from severe profitability and valuation challenges. These factors are critical for shaping each company’s strategic priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive pressures. Let’s dissect the economic moats of two tech innovators:

Uber Technologies, Inc.: Network Effects and Multi-Segment Synergy

Uber’s primary moat arises from powerful network effects across its Mobility, Delivery, and Freight segments. This advantage sustains robust 14.6% EBIT margins and 19.3% net margins despite fierce competition. In 2026, geographic expansion and product diversification could deepen its moat by locking in both riders and drivers globally.

SoundHound AI, Inc.: Intangible Assets in AI Voice Technology

SoundHound’s moat centers on intangible assets—proprietary voice AI and natural language understanding. Unlike Uber’s broad network, SoundHound struggles to translate this into profits, evidenced by a negative 410% EBIT margin and value destruction. However, its rapid revenue growth suggests potential to strengthen its moat through new enterprise AI deployments.

Network Effects vs. Intangible Assets: The Moat Showdown

Uber’s moat is wider and more tangible, driven by scalable network effects and diversified revenue streams. SoundHound’s moat is narrower and currently unprofitable, though improving. Uber stands better equipped to defend market share and generate sustainable economic profits in 2026.

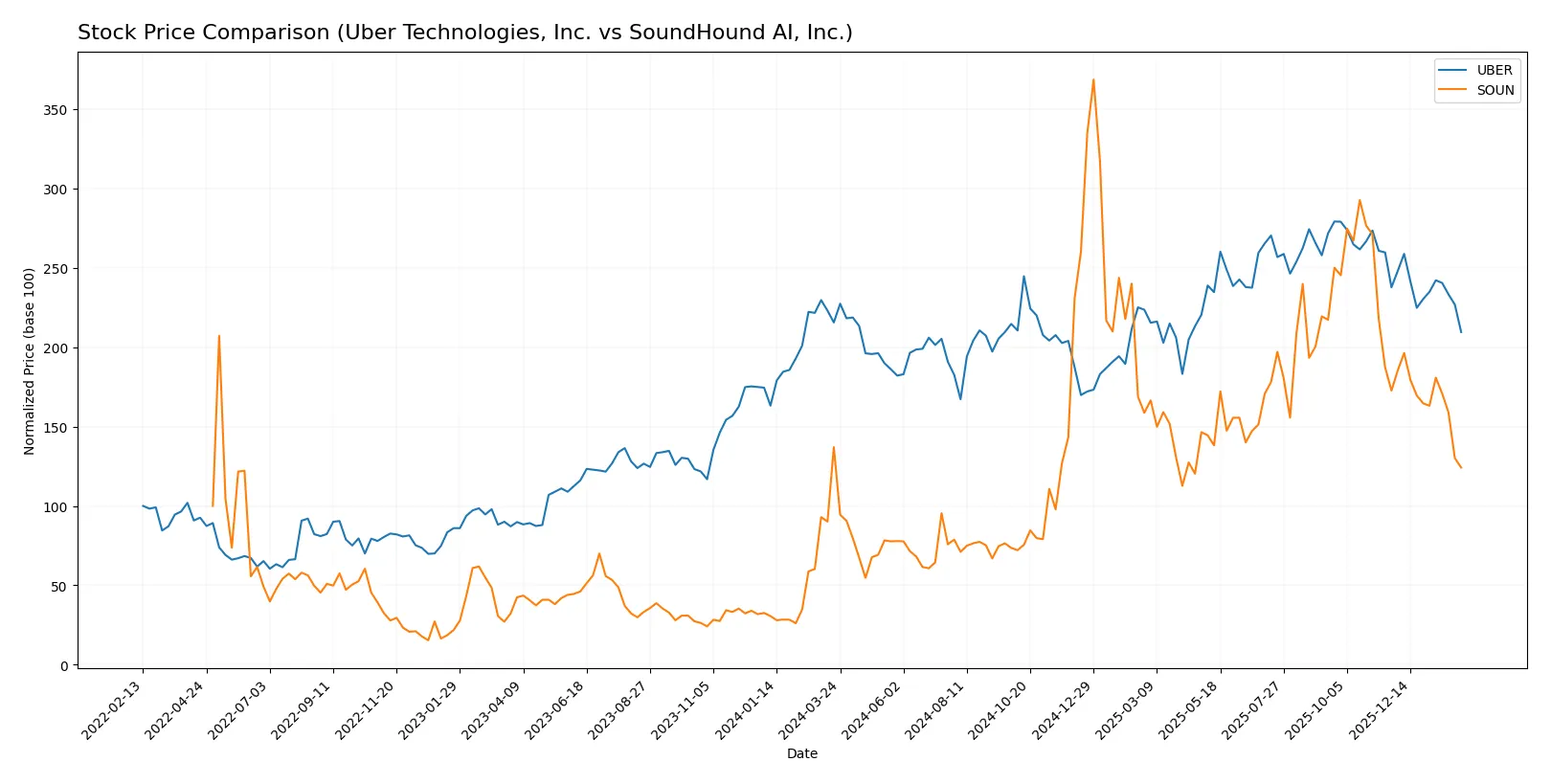

Which stock offers better returns?

Over the past year, both Uber Technologies, Inc. and SoundHound AI, Inc. exhibited declining stock prices with notable volatility and a decelerating bearish trend.

Trend Comparison

Uber’s stock fell 2.83% over the last 12 months, showing a bearish trend with decelerating momentum. Its price ranged between 59 and 99, with high volatility (std. dev. 10.3).

SoundHound’s stock dropped 9.43% over the same period, also bearish with deceleration. Price fluctuated from 3.55 to 23.95, with lower volatility (std. dev. 4.59) compared to Uber.

Uber’s decline was milder than SoundHound’s larger loss. Uber delivered better market performance, despite both stocks trending downward in 2026.

Target Prices

Analysts present a mixed but generally optimistic consensus on target prices for Uber Technologies, Inc. and SoundHound AI, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Uber Technologies, Inc. | 73 | 140 | 110.1 |

| SoundHound AI, Inc. | 11 | 15 | 13.33 |

Uber’s consensus target of 110.1 suggests a significant upside from the current 73.92 stock price. SoundHound’s target consensus at 13.33 also indicates strong growth potential versus its 8.07 share price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Uber Technologies, Inc. Grades

The following table summarizes recent grades for Uber Technologies, Inc. from notable grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-02-04 |

| Needham | Maintain | Buy | 2026-02-03 |

| Stifel | Maintain | Buy | 2026-01-27 |

| Guggenheim | Maintain | Buy | 2026-01-22 |

| Keybanc | Maintain | Overweight | 2026-01-20 |

| BTIG | Maintain | Buy | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Wolfe Research | Maintain | Outperform | 2026-01-06 |

| Wedbush | Maintain | Neutral | 2025-12-19 |

SoundHound AI, Inc. Grades

Below is a summary of recent institutional grades for SoundHound AI, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

Which company has the best grades?

Uber consistently receives buy or equivalent ratings from multiple reputable firms, indicating broad institutional confidence. SoundHound’s grades are more mixed, with several buy and outperform ratings but also neutral and overweight marks. Uber’s steadier buy consensus may suggest stronger market endorsement, potentially influencing investor sentiment toward perceived stability.

Risks specific to each company

The following categories outline the critical pressure points and systemic threats facing Uber Technologies, Inc. and SoundHound AI, Inc. in the 2026 market environment:

1. Market & Competition

Uber Technologies, Inc.

- Operates in highly competitive ride-sharing and delivery markets with established global presence.

SoundHound AI, Inc.

- Faces intense competition in AI voice platforms, with rapid innovation and smaller scale disadvantage.

2. Capital Structure & Debt

Uber Technologies, Inc.

- Maintains a favorable debt-to-equity ratio and strong interest coverage, signaling prudent capital structure.

SoundHound AI, Inc.

- Low debt but weak interest coverage due to losses, raising concerns about long-term financing stability.

3. Stock Volatility

Uber Technologies, Inc.

- Beta around 1.2 indicates moderate volatility relative to the market.

SoundHound AI, Inc.

- High beta near 2.9 suggests significant stock price swings and higher investor risk.

4. Regulatory & Legal

Uber Technologies, Inc.

- Faces ongoing regulatory scrutiny in multiple jurisdictions affecting ride-sharing and delivery sectors.

SoundHound AI, Inc.

- Emerging tech company exposed to evolving AI data privacy and intellectual property regulations.

5. Supply Chain & Operations

Uber Technologies, Inc.

- Complex global logistics and driver network pose operational risks but benefit from scale and tech integration.

SoundHound AI, Inc.

- Relies on software development cycles and cloud infrastructure, vulnerable to tech disruptions and talent retention.

6. ESG & Climate Transition

Uber Technologies, Inc.

- Under pressure to reduce emissions in mobility and delivery; advancing electric vehicle partnerships.

SoundHound AI, Inc.

- Lower direct footprint but exposed to ESG expectations on AI ethics and data sustainability.

7. Geopolitical Exposure

Uber Technologies, Inc.

- Global operations expose Uber to geopolitical risks including trade tensions and local regulatory shifts.

SoundHound AI, Inc.

- Primarily US-focused, less geopolitically exposed but dependent on stable US tech policy environment.

Which company shows a better risk-adjusted profile?

Uber’s most impactful risk is regulatory and operational complexity across global markets. SoundHound’s primary risk lies in its financial instability and high stock volatility. Uber’s safer capital structure and diversified operations yield a stronger risk-adjusted profile. SoundHound’s negative margins and weak profitability metrics highlight sustained execution risk. Investors should weigh Uber’s moderate market risks against SoundHound’s financial fragility and market volatility.

Final Verdict: Which stock to choose?

Uber Technologies, Inc. excels as a cash-generating powerhouse with a growing return on invested capital, signaling operational improvements. Its point of vigilance lies in a slightly unfavorable liquidity profile, warranting close monitoring. Uber suits investors targeting aggressive growth backed by improving fundamentals and market scale.

SoundHound AI, Inc. offers a strategic moat rooted in its intangible assets and cutting-edge AI capabilities, supported by a strong current ratio reflecting liquidity strength. However, its value destruction and high valuation multiples suggest caution. SoundHound fits portfolios focused on high-risk, speculative growth with a tolerance for volatility.

If you prioritize operational efficiency and a proven trajectory of value creation, Uber outshines due to its robust cash flow and improving profitability. However, if you seek exposure to emerging AI innovation and can bear financial instability, SoundHound offers a speculative growth play with potential upside. Both choices require careful risk assessment aligned with your investment profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Uber Technologies, Inc. and SoundHound AI, Inc. to enhance your investment decisions: