In today’s rapidly evolving tech landscape, Tyler Technologies, Inc. (TYL) and SoundHound AI, Inc. (SOUN) stand out as innovators in the software application industry. Tyler focuses on integrated public sector solutions, while SoundHound leads in voice AI platforms. Both companies leverage cutting-edge technology but target different market needs. This comparison will help investors identify which company offers the most compelling opportunity for their portfolio. Let’s explore their potential together.

Table of contents

Companies Overview

I will begin the comparison between Tyler Technologies and SoundHound AI by providing an overview of these two companies and their main differences.

Tyler Technologies Overview

Tyler Technologies, Inc. provides integrated information management solutions and services primarily for the public sector. Its offerings span financial management, municipal operations, judicial systems, public safety, and property tax solutions. Founded in 1966 and headquartered in Plano, Texas, Tyler supports government agencies with software as a service and cloud-hosted solutions, maintaining a market cap of approximately 18.9B USD.

SoundHound AI Overview

SoundHound AI, Inc. develops an independent voice AI platform that enables businesses to create conversational voice assistants. Their flagship product, Houndify, includes tools for speech recognition, natural language processing, and text-to-speech capabilities. Based in Santa Clara, California, and founded more recently, SoundHound focuses on AI-driven voice technology with a market cap near 4.7B USD and a strong emphasis on innovation in voice interaction.

Key similarities and differences

Both Tyler Technologies and SoundHound AI operate within the software application industry, focusing on technology solutions to improve user interactions. Tyler targets public sector management and operational software, while SoundHound specializes in voice AI platforms for conversational experiences across industries. Tyler’s business model centers on government contracts and SaaS, whereas SoundHound emphasizes AI product development and licensing, reflecting differing market focuses and customer bases.

Income Statement Comparison

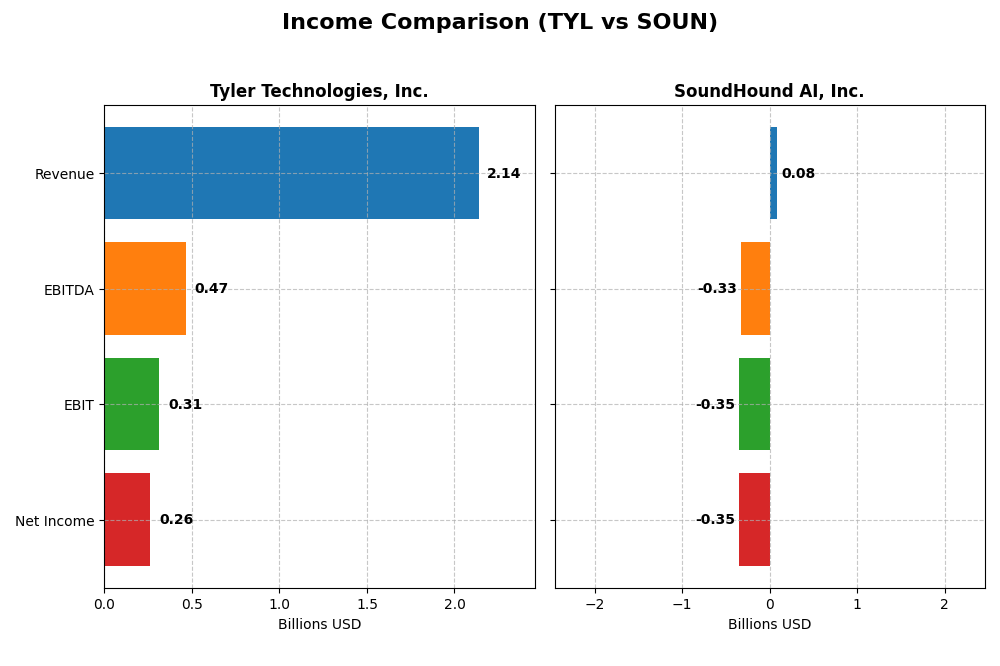

This table presents a side-by-side comparison of key income statement metrics for Tyler Technologies, Inc. and SoundHound AI, Inc. for the fiscal year 2024, highlighting their financial performance.

| Metric | Tyler Technologies, Inc. (TYL) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Cap | 18.9B | 4.7B |

| Revenue | 2.14B | 85M |

| EBITDA | 466M | -329M |

| EBIT | 314M | -348M |

| Net Income | 263M | -351M |

| EPS | 6.17 | -1.04 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Tyler Technologies, Inc.

Tyler Technologies experienced steady revenue growth from $1.12B in 2020 to $2.14B in 2024, with net income rising from $195M to $263M over the same period. Gross margins remained favorable at around 41%, while net margins averaged 12.3%. In 2024, revenue growth slowed to 9.53%, but net income and EBIT margins improved significantly, indicating enhanced profitability.

SoundHound AI, Inc.

SoundHound AI showed rapid revenue growth from $13M in 2020 to $85M in 2024, a 550.63% increase overall. However, net income remained negative, widening from a loss of $77.6M in 2020 to $351M in 2024. Gross margins were strong near 49%, yet EBIT and net margins were deeply negative, reflecting high operating expenses and interest costs, with deteriorating profitability in the most recent year.

Which one has the stronger fundamentals?

Tyler Technologies exhibits stronger fundamentals, with consistent revenue and net income growth, favorable margins, and positive earnings trends. In contrast, SoundHound AI’s impressive revenue growth is overshadowed by persistent and increasing net losses, negative EBIT margins, and high interest expenses. Tyler’s income statement reflects stability, while SoundHound faces significant profitability challenges.

Financial Ratios Comparison

The table below compares the most recent key financial ratios for Tyler Technologies, Inc. and SoundHound AI, Inc., based on their fiscal year 2024 data.

| Ratios | Tyler Technologies, Inc. (TYL) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| ROE | 7.76% | -191.99% |

| ROIC | 6.20% | -68.13% |

| P/E | 93.4 | -19.1 |

| P/B | 7.25 | 36.76 |

| Current Ratio | 1.35 | 3.77 |

| Quick Ratio | 1.35 | 3.77 |

| D/E (Debt-to-Equity) | 0.19 | 0.02 |

| Debt-to-Assets | 12.32% | 0.79% |

| Interest Coverage | 50.50 | -28.05 |

| Asset Turnover | 0.41 | 0.15 |

| Fixed Asset Turnover | 10.95 | 14.28 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Tyler Technologies, Inc.

Tyler Technologies shows a mix of strengths and weaknesses in its 2024 ratios. Favorable metrics include net margin at 12.3%, low debt-to-equity of 0.19, and strong interest coverage of 52.96, while less favorable are return on equity at 7.76% and a high price-to-earnings ratio of 93.42. The company does not pay dividends, reflecting a probable reinvestment strategy for growth.

SoundHound AI, Inc.

SoundHound AI’s 2024 ratios reveal significant challenges with negative net margin (-414.06%) and return on equity (-191.99%), alongside a high weighted average cost of capital at 17.71%. Despite a positive price-to-earnings ratio status, many ratios are unfavorable, including interest coverage at -28.58. The company pays no dividends, indicating a focus on reinvestment and growth phases.

Which one has the best ratios?

Tyler Technologies presents a more balanced and slightly favorable ratio profile, with half of its ratios positive and key financial health indicators strong. In contrast, SoundHound AI’s ratios are predominantly unfavorable, reflecting higher financial risk and operational losses. Overall, Tyler Technologies holds the more robust financial ratios in this comparison.

Strategic Positioning

This section compares the strategic positioning of Tyler Technologies, Inc. and SoundHound AI, Inc., focusing on market position, key segments, and exposure to technological disruption:

Tyler Technologies, Inc.

- Strong market position in public sector software, facing moderate competitive pressure.

- Diverse public sector software segments including enterprise, tax, judicial, and safety solutions.

- Moderate exposure through strategic AWS cloud hosting collaboration, adapting to tech trends.

SoundHound AI, Inc.

- Smaller market cap, positioned in voice AI with high competitive and market volatility.

- Concentrated in voice AI platform with hosted services, licensing, and professional services.

- High exposure to technological disruption due to AI focus and rapid innovation demands.

Tyler Technologies, Inc. vs SoundHound AI, Inc. Positioning

Tyler Technologies shows a diversified approach across multiple public sector software segments, offering stability but potentially slower innovation. SoundHound is concentrated on voice AI technology, enabling rapid growth but higher risk and market volatility.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC; Tyler’s declining profitability contrasts with SoundHound’s improving ROIC trend, indicating differing durability in their competitive advantages.

Stock Comparison

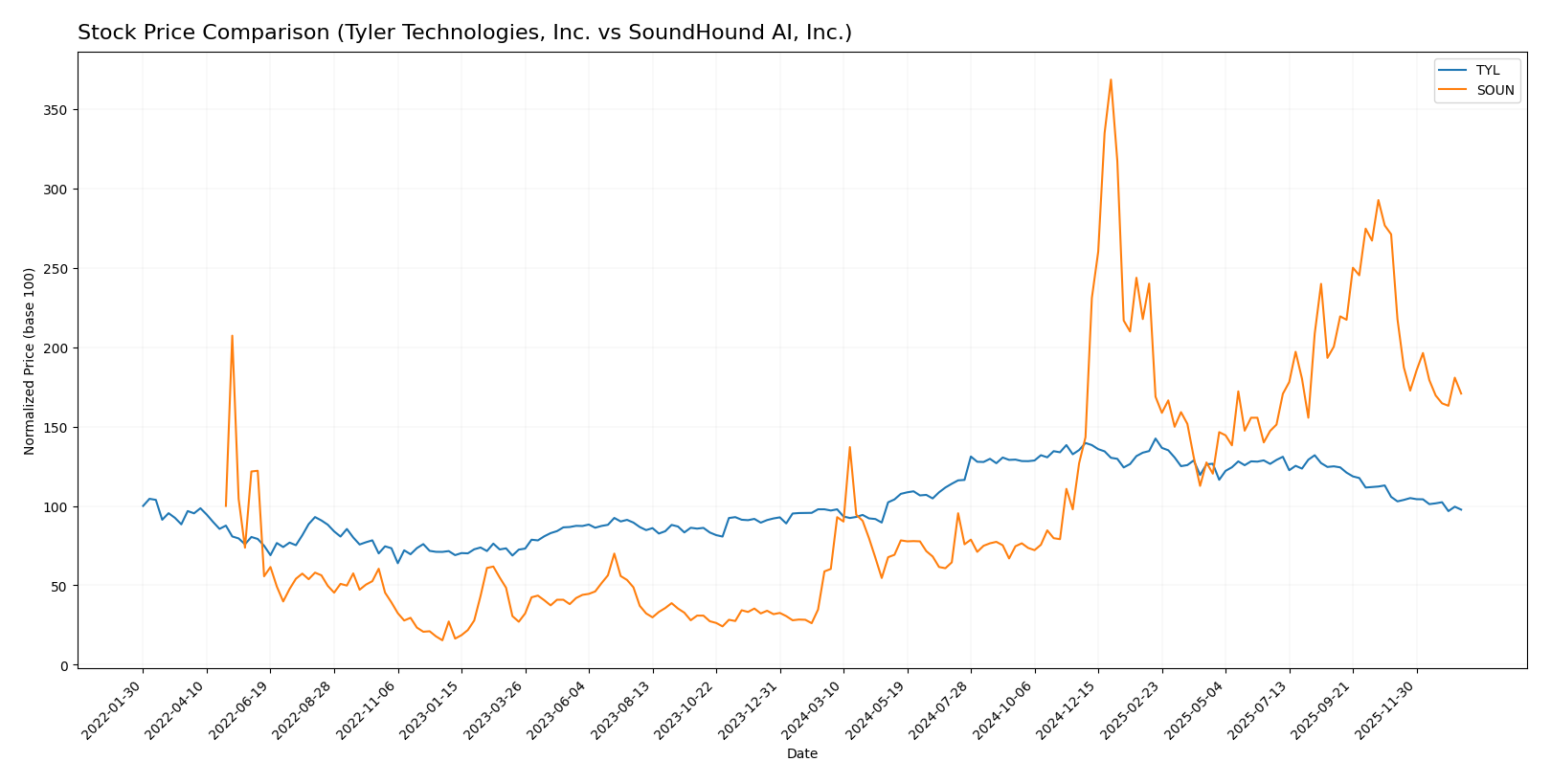

The past year shows contrasting price movements and trading dynamics between Tyler Technologies, Inc. and SoundHound AI, Inc., with both stocks exhibiting bullish trends overall but recent sell-offs impacting momentum.

Trend Analysis

Tyler Technologies, Inc. recorded a modest 0.58% price increase over the past 12 months, indicating a bullish trend with decelerating momentum and a high volatility level (std deviation 61.82). Recent weeks show a 7.61% decline, signaling short-term bearish pressure.

SoundHound AI, Inc. experienced a strong 183.16% gain over the same period, confirming a bullish trend with decelerating acceleration and low volatility (std deviation 4.66). However, recent trading revealed a sharp 37.0% drop, reflecting pronounced short-term weakness.

Comparing both, SoundHound AI has delivered substantially higher market performance than Tyler Technologies over the past year, despite both stocks showing recent downturns in their price trajectories.

Target Prices

Analysts provide a clear consensus on target prices for Tyler Technologies, Inc. and SoundHound AI, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Tyler Technologies, Inc. | 675 | 470 | 584 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

The target consensus suggests substantial upside potential for both stocks compared to their current prices: Tyler Technologies at $440.01 and SoundHound AI at $11.10. Analysts expect moderate to strong growth for these technology firms.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Tyler Technologies, Inc. and SoundHound AI, Inc.:

Rating Comparison

TYL Rating

- Rating: B, categorized as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation outlook.

- ROE Score: 3, considered Moderate in profitability from equity.

- ROA Score: 4, Favorable in asset utilization efficiency.

- Debt To Equity Score: 3, Moderate financial risk level.

- Overall Score: 3, Moderate overall financial standing.

SOUN Rating

- Rating: C-, also categorized as Very Favorable.

- Discounted Cash Flow Score: 1, reflecting a Very Unfavorable valuation.

- ROE Score: 1, marked Very Unfavorable in equity profitability.

- ROA Score: 1, Very Unfavorable in asset utilization.

- Debt To Equity Score: 4, Favorable, indicating lower financial risk.

- Overall Score: 1, Very Unfavorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Tyler Technologies holds a better overall rating and stronger scores in discounted cash flow, ROE, and ROA, while SoundHound AI shows strength only in debt-to-equity but scores poorly elsewhere.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Tyler Technologies and SoundHound AI:

Tyler Technologies Scores

- Altman Z-Score: 7.42, indicating a safe zone and low bankruptcy risk.

- Piotroski Score: 6, rated as average financial strength.

SoundHound AI Scores

- Altman Z-Score: 6.62, also indicating a safe zone and low bankruptcy risk.

- Piotroski Score: 3, rated as very weak financial strength.

Which company has the best scores?

Tyler Technologies has a higher Altman Z-Score and a significantly stronger Piotroski Score compared to SoundHound AI. Both companies are in the safe zone for bankruptcy risk, but Tyler demonstrates better overall financial strength based on the provided scores.

Grades Comparison

The following section presents a comparison of the latest reliable grades for Tyler Technologies, Inc. and SoundHound AI, Inc.:

Tyler Technologies, Inc. Grades

This table summarizes recent grades assigned by reputable financial institutions for Tyler Technologies, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-01-13 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-08 |

| DA Davidson | Maintain | Neutral | 2025-12-09 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| DA Davidson | Maintain | Neutral | 2025-10-31 |

| DA Davidson | Maintain | Neutral | 2025-10-10 |

| DA Davidson | Maintain | Neutral | 2025-08-05 |

| Barclays | Maintain | Overweight | 2025-07-31 |

| Needham | Maintain | Buy | 2025-05-13 |

| Barclays | Maintain | Overweight | 2025-04-25 |

Overall, Tyler Technologies exhibits a consistent pattern of hold and buy-oriented grades, predominantly maintaining overweight and neutral ratings across multiple reputable firms.

SoundHound AI, Inc. Grades

The following table lists recent grades from established grading companies for SoundHound AI, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI shows a generally positive trend with multiple buy and outperform grades, including recent upgrades, reflecting increasing analyst confidence.

Which company has the best grades?

Both Tyler Technologies and SoundHound AI share a consensus “Buy” rating. However, SoundHound AI has received more frequent buy and outperform grades with notable recent upgrades, whereas Tyler Technologies mainly holds neutral to overweight ratings. This difference may affect investor sentiment and portfolio weighting decisions.

Strengths and Weaknesses

Below is a comparison table highlighting the strengths and weaknesses of Tyler Technologies, Inc. (TYL) and SoundHound AI, Inc. (SOUN) based on their recent financial and operational data.

| Criterion | Tyler Technologies, Inc. (TYL) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | Highly diversified revenue streams including SaaS, Professional Services, Maintenance, and Transaction Fees totaling over 2B USD | Less diversified with primary revenue from Hosted Services and Licensing, totaling about 84M USD |

| Profitability | Moderate profitability: Net margin 12.3%, ROIC 6.2% (neutral), but ROIC below WACC, value is being destroyed | Negative profitability: Net margin -414%, ROIC -68%, but ROIC improving over time |

| Innovation | Moderate innovation with steady growth in SaaS and platform segments | High innovation focus in AI and voice technology, reflected in growing ROIC trend |

| Global presence | Strong presence in government software market, mostly US-focused | Emerging global reach but limited scale currently |

| Market Share | Established market leader in public sector software solutions | Small market share in AI voice recognition, early growth stage |

Key takeaways: Tyler Technologies shows solid diversification and moderate profitability but struggles with declining capital efficiency. SoundHound AI, while currently unprofitable, demonstrates promising growth potential driven by innovation and improving operational metrics. Investors should weigh stability versus growth prospects carefully.

Risk Analysis

Below is a comparative table showing key risk factors for Tyler Technologies, Inc. (TYL) and SoundHound AI, Inc. (SOUN) based on the most recent data available for 2024.

| Metric | Tyler Technologies, Inc. (TYL) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Risk | Moderate (Beta 0.92, stable sector) | High (Beta 2.88, volatile tech sector) |

| Debt level | Low (D/E 0.19, favorable) | Very Low (D/E 0.02, favorable) |

| Regulatory Risk | Moderate (public sector software, compliance needed) | Moderate (AI voice tech, data privacy concerns) |

| Operational Risk | Low (Established with 7.5K employees) | High (Small company, 842 employees, rapid tech changes) |

| Environmental Risk | Low (Software sector, minimal direct impact) | Low (Software/AI sector) |

| Geopolitical Risk | Moderate (US-focused, some exposure to government budgets) | Moderate (US-based with global AI market exposure) |

Tyler Technologies shows moderate market and regulatory risks but benefits from low debt and operational risks due to its established position in public sector software. SoundHound AI faces high market and operational risks given its high beta, smaller scale, and volatile AI sector. Both companies have low environmental risks, but SoundHound’s weak profitability and financial health amplify its overall risk profile.

Which Stock to Choose?

Tyler Technologies, Inc. (TYL) shows consistent income growth with a 9.5% revenue increase in 2024, favorable profitability margins, and a solid balance sheet featuring low debt (D/E 0.19). Its financial ratios are slightly favorable overall, though some valuation metrics appear stretched; the rating is very favorable.

SoundHound AI, Inc. (SOUN) exhibits rapid revenue growth of 84.6% in 2024 but suffers from substantial losses and negative profitability ratios. While its debt levels are low, many financial metrics and its rating remain unfavorable, reflecting ongoing challenges despite improving ROIC trends.

Investors focused on stability and proven profitability might find Tyler Technologies’ profile more aligned with their objectives, given its favorable income and financial ratios. Conversely, those with higher risk tolerance and growth-oriented strategies could interpret SoundHound AI’s strong revenue expansion and improving profitability trends as potential upside, albeit with significant caution.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Tyler Technologies, Inc. and SoundHound AI, Inc. to enhance your investment decisions: