In the evolving healthcare landscape, Universal Health Services, Inc. (UHS) and Solventum Corporation (SOLV) stand out as key players. Both operate within the medical care facilities industry but pursue distinct innovation strategies—UHS focuses on hospital and behavioral health services, while Solventum emphasizes medical technology and health information systems. This article will analyze their strengths and risks to help you decide which company merits a place in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Universal Health Services, Inc. and Solventum Corporation by providing an overview of these two companies and their main differences.

Universal Health Services, Inc. Overview

Universal Health Services, Inc. operates acute care hospitals and behavioral health facilities, offering a wide range of medical services including surgery, emergency care, and oncology. Founded in 1978 and headquartered in King of Prussia, PA, UHS manages 363 inpatient and 40 outpatient facilities across 39 states, Washington D.C., the UK, and Puerto Rico. Its business also includes commercial health insurance and management services.

Solventum Corporation Overview

Solventum Corporation, incorporated in 2023 and based in Maplewood, MN, develops and commercializes healthcare solutions across Medsurg, Dental Solutions, Health Information Systems, and Purification and Filtration segments. The company provides products ranging from wound care and dental appliances to healthcare software and filtration technologies, serving critical patient needs through diversified medical and technological offerings.

Key similarities and differences

Both UHS and Solventum operate within the healthcare sector, focusing on medical care and solutions. UHS primarily delivers healthcare services through hospitals and behavioral facilities, while Solventum emphasizes product development and technology across multiple healthcare segments. UHS is more established with a broader geographic presence and larger workforce, whereas Solventum is a newer company with a diversified product portfolio in healthcare technology and supplies.

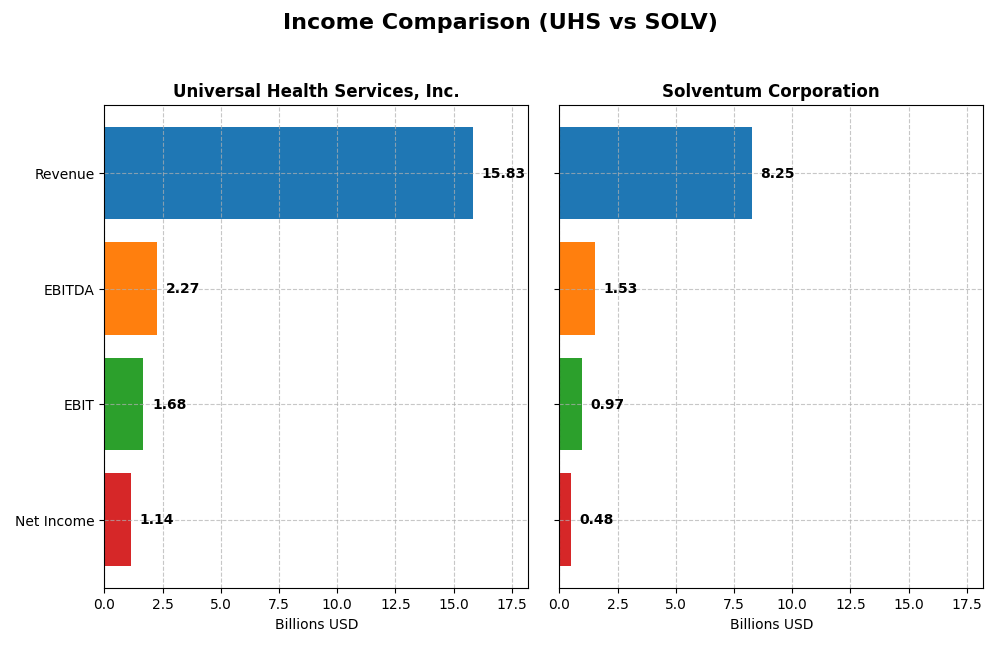

Income Statement Comparison

The table below compares the key income statement metrics for Universal Health Services, Inc. and Solventum Corporation for the fiscal year 2024.

| Metric | Universal Health Services, Inc. | Solventum Corporation |

|---|---|---|

| Market Cap | 13.3B | 14.9B |

| Revenue | 15.8B | 8.25B |

| EBITDA | 2.27B | 1.53B |

| EBIT | 1.68B | 972M |

| Net Income | 1.14B | 479M |

| EPS | 17.16 | 2.77 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Universal Health Services, Inc.

Universal Health Services showed consistent revenue growth from 11.56B in 2020 to 15.83B in 2024, with net income rising from 941M to 1.14B. Margins remained strong, particularly gross margin near 90%, reflecting efficiency. In 2024, revenue growth accelerated by 10.8%, with net income and EPS improving significantly, supporting a favorable income statement outlook.

Solventum Corporation

Solventum’s revenue increased from 7.28B in 2020 to 8.25B in 2024, but net income declined sharply from 1.14B to 479M. Margins were lower than UHS, with gross margin around 55.7% and net margin at 5.8%. The latest year saw stagnant revenue (+0.7%) and significant declines in EBIT and net margin, indicating unfavorable recent performance trends.

Which one has the stronger fundamentals?

Universal Health Services presents stronger fundamentals, with favorable trends in revenue growth, profitability, and margin stability. Solventum, despite modest revenue growth over five years, faces unfavorable declines in net income, margins, and profitability metrics recently. The overall income statement evaluation favors UHS, reflecting more robust financial health.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Universal Health Services, Inc. (UHS) and Solventum Corporation (SOLV) based on their fiscal year 2024 data, providing a snapshot for comparative analysis.

| Ratios | Universal Health Services, Inc. (UHS) | Solventum Corporation (SOLV) |

|---|---|---|

| ROE | 17.1% | 16.2% |

| ROIC | 10.6% | 6.8% |

| P/E | 10.5 | 23.9 |

| P/B | 1.79 | 3.87 |

| Current Ratio | 1.27 | 1.20 |

| Quick Ratio | 1.17 | 0.84 |

| D/E (Debt to Equity) | 0.74 | 2.77 |

| Debt-to-Assets | 34.2% | 56.6% |

| Interest Coverage | 9.0x | 2.8x |

| Asset Turnover | 1.09 | 0.57 |

| Fixed Asset Turnover | 2.26 | 5.09 |

| Payout Ratio | 4.7% | 0% |

| Dividend Yield | 0.45% | 0% |

Interpretation of the Ratios

Universal Health Services, Inc.

Universal Health Services presents a mix of favorable and neutral ratios, with strong returns on equity (17.13%) and invested capital (10.55%), alongside a solid interest coverage of 8.96. Concerns include a low dividend yield of 0.45%, marked as unfavorable, and a debt-to-assets ratio of 34.25%, considered neutral. The company pays dividends with a modest yield, supported by stable payout coverage, yet risks stem from limited yield attractiveness.

Solventum Corporation

Solventum shows moderate financial strength, with favorable return on equity (16.19%) and weighted average cost of capital (5.27%), but weaker leverage indicators, including a high debt-to-equity ratio of 2.77 and debt-to-assets at 56.6%, both unfavorable. The company does not pay dividends, reflecting a reinvestment strategy likely due to its recent incorporation and growth focus, without share buybacks reported.

Which one has the best ratios?

Universal Health Services holds a slightly favorable overall ratio profile with robust profitability and manageable debt, while Solventum faces notable leverage challenges and lacks dividend returns. UHS’s balanced financial metrics contrast with SOLV’s higher risk indicators, suggesting UHS currently has the more stable and appealing ratio set among these two healthcare entities.

Strategic Positioning

This section compares the strategic positioning of Universal Health Services, Inc. (UHS) and Solventum Corporation (SOLV), focusing on market position, key segments, and exposure to technological disruption:

Universal Health Services, Inc.

- Operates 363 inpatient and 40 outpatient facilities with competitive pressure in acute and behavioral health care.

- Key segments are Acute Care Hospital Services ($8.9B) and Behavioral Health Services ($6.9B) driving revenues.

- Limited explicit exposure to technological disruption; operates traditional healthcare facilities with management services.

Solventum Corporation

- Focuses on developing and commercializing medical products and software solutions, facing competition in diversified healthcare segments.

- Operates four segments: Medsurg, Dental Solutions, Health Information Systems, and Purification and Filtration. Revenue mainly from product sales ($6.3B).

- Exposure through Health Information Systems segment offering software solutions, indicating some vulnerability to rapid tech changes.

UHS vs SOLV Positioning

UHS presents a concentrated approach focused on hospital and behavioral health services, leveraging scale across many facilities. SOLV shows diversified operations across product development and healthcare IT, spreading risk but facing neutral profitability. UHS’s long-standing market presence contrasts with SOLV’s recent incorporation.

Which has the best competitive advantage?

UHS holds a very favorable moat with growing ROIC above WACC, indicating a durable competitive advantage and value creation. SOLV’s neutral moat and stable ROIC suggest limited competitive advantage and no clear value creation based on current data.

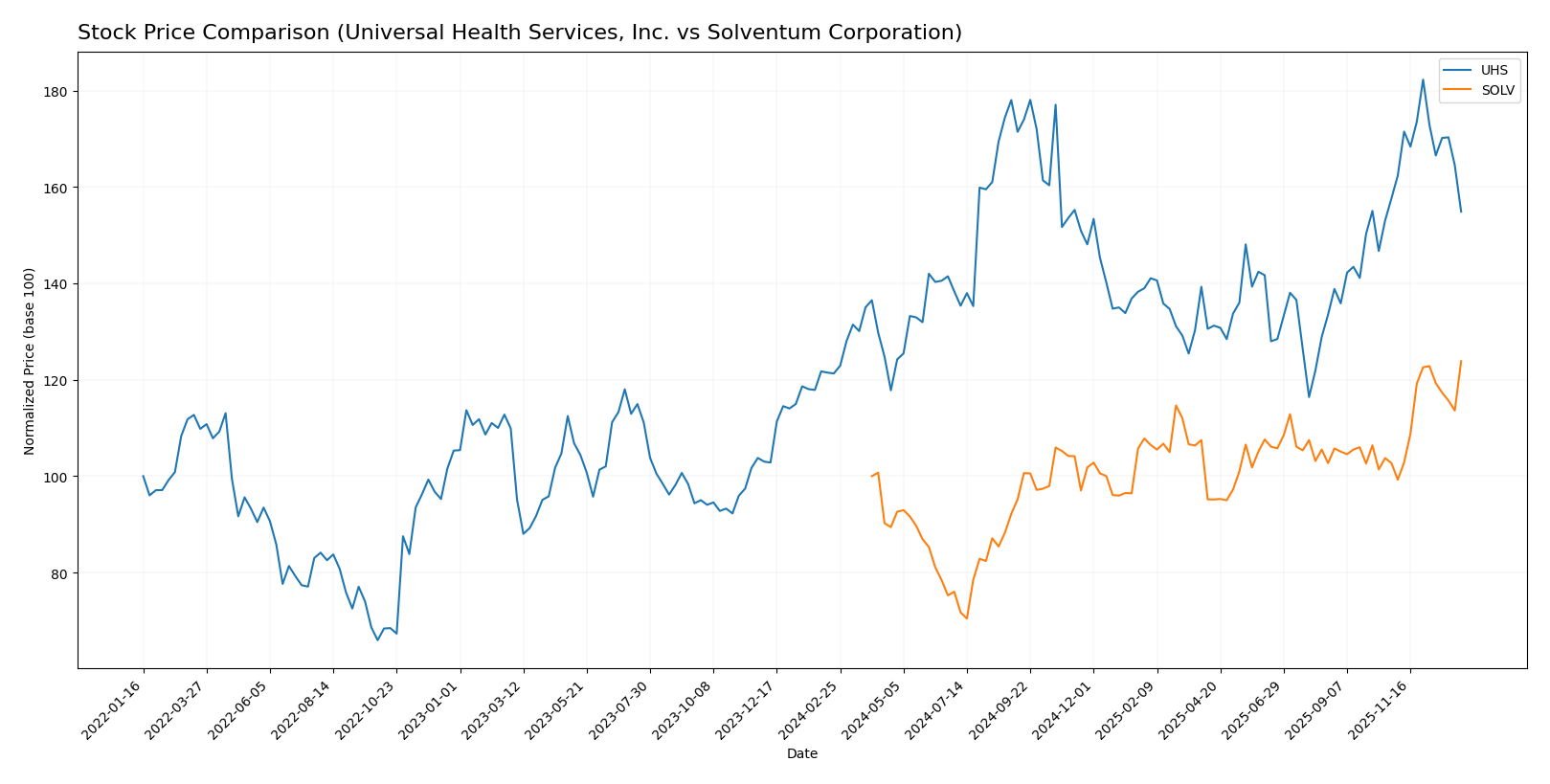

Stock Comparison

The past year showed notable bullish trends for both Universal Health Services, Inc. (UHS) and Solventum Corporation (SOLV), with UHS experiencing a deceleration and SOLV an acceleration in price gains.

Trend Analysis

Universal Health Services, Inc. (UHS) posted a 27.67% price increase over the past 12 months, indicating a bullish trend with deceleration. The stock ranged from 155.6 to 243.63, displaying significant volatility (21.73 std deviation).

Solventum Corporation (SOLV) recorded a 23.85% gain in the same period, maintaining a bullish trend with acceleration. Its price fluctuated between 49.0 and 86.14, with lower volatility (7.6 std deviation) compared to UHS.

Comparing both, UHS delivered the highest market performance over the past year, despite its recent slight downturn, while SOLV showed strong recent momentum and accelerating growth.

Target Prices

The target price consensus for Universal Health Services, Inc. and Solventum Corporation reflects moderate upside potential according to analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Universal Health Services, Inc. | 274 | 203 | 241.5 |

| Solventum Corporation | 105 | 77 | 96.25 |

Analysts expect Universal Health Services to trade above its current price of 207.03, with a consensus target of 241.5, indicating potential growth. Solventum’s target consensus of 96.25 also suggests upside from its current 86.14 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Universal Health Services, Inc. (UHS) and Solventum Corporation (SOLV):

Rating Comparison

UHS Rating

- Rating: A- rating, considered very favorable by analysts.

- Discounted Cash Flow Score: Rated 4, indicating a favorable valuation based on cash flow.

- ROE Score: Maximum score of 5, showing very efficient profit generation from equity.

- ROA Score: Score of 5, demonstrating very effective asset utilization.

- Debt To Equity Score: Low score of 1, indicating very unfavorable financial leverage.

- Overall Score: Score of 4, marking a favorable overall financial standing.

SOLV Rating

- Rating: A rating, also considered very favorable.

- Discounted Cash Flow Score: Rated 5, signaling a very favorable cash flow valuation.

- ROE Score: Also a top score of 5, reflecting very efficient equity profit generation.

- ROA Score: Similarly, a perfect score of 5, indicating very effective use of assets.

- Debt To Equity Score: Also rated 1, showing very unfavorable debt to equity ratio.

- Overall Score: Score of 4, equally indicating favorable overall financial health.

Which one is the best rated?

Based strictly on the provided data, SOLV holds a slight edge with a higher discounted cash flow score and a better overall rating of A versus UHS’s A-. Both have similar strengths in profitability and asset use but share the same unfavorable debt situation.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for UHS and SOLV:

UHS Scores

- Altman Z-Score: 2.63, indicating grey zone with moderate bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

SOLV Scores

- Altman Z-Score: 2.23, indicating grey zone with moderate bankruptcy risk.

- Piotroski Score: 6, classified as average financial health.

Which company has the best scores?

UHS shows a higher Piotroski Score (8) compared to SOLV’s 6, indicating stronger financial health. Both have similar Altman Z-Scores in the grey zone, reflecting moderate bankruptcy risk.

Grades Comparison

Here is a comparison of the recent grades assigned to Universal Health Services, Inc. and Solventum Corporation by reputable grading companies:

Universal Health Services, Inc. Grades

This table lists recent grades and actions from major financial institutions for UHS:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Wells Fargo | Downgrade | Equal Weight | 2026-01-07 |

| Guggenheim | Maintain | Buy | 2025-12-02 |

| Wells Fargo | Maintain | Overweight | 2025-11-13 |

| RBC Capital | Maintain | Sector Perform | 2025-10-30 |

| UBS | Maintain | Buy | 2025-10-29 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-29 |

| Guggenheim | Maintain | Buy | 2025-10-29 |

| Barclays | Maintain | Overweight | 2025-10-28 |

| Wells Fargo | Maintain | Overweight | 2025-10-07 |

The grades for Universal Health Services show a predominance of Buy and Overweight ratings, with some Hold-equivalent evaluations, indicating mixed but generally positive sentiment.

Solventum Corporation Grades

This table details recent grades and actions from established financial firms for SOLV:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-01-07 |

| BTIG | Upgrade | Buy | 2025-12-02 |

| UBS | Maintain | Neutral | 2025-11-10 |

| Piper Sandler | Maintain | Overweight | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-15 |

| Piper Sandler | Maintain | Overweight | 2025-08-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-08 |

| Morgan Stanley | Upgrade | Overweight | 2025-07-15 |

| Argus Research | Upgrade | Buy | 2025-07-01 |

| Piper Sandler | Upgrade | Overweight | 2025-05-19 |

Solventum Corporation’s grades show consistent upgrades with a majority Buy and Overweight ratings, reflecting improving analyst sentiment.

Which company has the best grades?

Solventum Corporation has generally received better grades than Universal Health Services, with more recent upgrades and a higher consensus rating of Buy versus Hold for UHS. This suggests stronger analyst confidence in SOLV’s prospects, which may influence investor sentiment and portfolio decisions accordingly.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Universal Health Services, Inc. (UHS) and Solventum Corporation (SOLV) based on the most recent financial and operational data.

| Criterion | Universal Health Services, Inc. (UHS) | Solventum Corporation (SOLV) |

|---|---|---|

| Diversification | High diversification with two major segments: Acute Care ($8.92B) and Behavioral Health ($6.90B) in 2024 | Single product focus with $6.35B revenue from product sales in 2024 |

| Profitability | Favorable ROIC (10.55%) exceeding WACC (8.01%), positive net margin (7.22%) | ROIC (6.8%) slightly above WACC (5.27%), but net margin moderate at 5.8% |

| Innovation | Moderate innovation with steady asset turnover (1.09) and favorable interest coverage (8.96) | Higher fixed asset turnover (5.09) but weaker liquidity and higher debt burden |

| Global presence | Strong US-based healthcare provider with significant market penetration | More limited geographic footprint implied by product-specific revenue |

| Market Share | Leading position in healthcare services with growing ROIC trend (+16%) | Neutral profitability and stable ROIC, no clear competitive advantage |

Key takeaways: UHS demonstrates strong diversification, profitability, and a durable competitive advantage with growing returns. SOLV, while profitable, shows limited diversification, a heavier debt load, and a neutral market position. Investors should consider UHS as a more stable value creator, whereas SOLV carries higher risks with moderate growth potential.

Risk Analysis

Below is a table summarizing key risks for Universal Health Services, Inc. (UHS) and Solventum Corporation (SOLV) based on their most recent financial and operational data from 2024.

| Metric | Universal Health Services, Inc. (UHS) | Solventum Corporation (SOLV) |

|---|---|---|

| Market Risk | Moderate (Beta 1.28, sensitive to healthcare sector volatility) | Lower (Beta 0.51, less volatile) |

| Debt Level | Moderate (Debt/Equity 0.74, Interest Coverage 8.96) | High (Debt/Equity 2.77, Interest Coverage 2.65) |

| Regulatory Risk | High (Healthcare regulations in US, UK, Puerto Rico) | Moderate (Newer company, healthcare product regulations) |

| Operational Risk | Moderate (Large hospital network complexity) | Moderate (Multiple segments, including software and filtration) |

| Environmental Risk | Low (Mainly service-based with limited direct environmental impact) | Low to Moderate (Manufacturing and filtration products) |

| Geopolitical Risk | Moderate (Operations in US, UK, Puerto Rico) | Low (Primarily US-based) |

The most impactful and likely risks include regulatory challenges for UHS due to its broad geographic reach and operational complexity. For SOLV, the high debt level combined with moderate interest coverage poses significant financial risk, despite its favorable market position. Investors should weigh these risks carefully against growth prospects.

Which Stock to Choose?

Universal Health Services, Inc. (UHS) shows a favorable income evolution with strong revenue and profit growth in 2024, supported by solid profitability metrics and manageable debt levels. Its financial ratios are slightly favorable overall, with robust returns on equity and invested capital, and a very favorable rating of A- reflecting strong fundamentals.

Solventum Corporation (SOLV) presents a mixed income picture with weaker recent growth and several unfavorable income trends, despite a very favorable overall rating of A. Its financial ratios are slightly unfavorable, marked by higher leverage and moderate returns, with stable but less efficient capital use and a neutral moat evaluation.

Investors with a risk-averse or quality-focused profile might find UHS appealing due to its durable competitive advantage and improving profitability, while those more tolerant of risk and seeking growth potential could view SOLV’s accelerating stock trend and strong rating as attractive, despite its financial challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Universal Health Services, Inc. and Solventum Corporation to enhance your investment decisions: