In the fast-evolving world of data platforms, Snowflake Inc. and Teradata Corporation stand out as key players driving innovation and transformation. Snowflake excels with its cloud-native data cloud solution, while Teradata offers a robust multi-cloud data infrastructure aimed at enterprise analytics. Both companies compete in overlapping markets, making their strategies and growth prospects a compelling comparison. Join me as we explore which stock presents the most attractive opportunity for investors today.

Table of contents

Companies Overview

I will begin the comparison between Snowflake Inc. and Teradata Corporation by providing an overview of these two companies and their main differences.

Snowflake Inc. Overview

Snowflake Inc. operates a cloud-based data platform offering the Data Cloud, which consolidates data into a single source of truth to support business insights, data-driven applications, and data sharing. Serving a broad range of industries, Snowflake positions itself as a leader in application software within the technology sector. The company is headquartered in Bozeman, Montana, and employs around 7,800 people.

Teradata Corporation Overview

Teradata Corporation provides a connected multi-cloud data platform called Teradata Vantage, enabling enterprises to leverage data across multiple sources and simplify ecosystems. The company also delivers business consulting and support services to optimize analytics infrastructure and cloud migration. Teradata serves various sectors including finance, government, and healthcare, with headquarters in San Diego, California, and about 5,700 employees.

Key similarities and differences

Both companies operate in the technology sector focusing on data platforms that support enterprise analytics and cloud solutions. Snowflake emphasizes a cloud-native application software model centered on a unified data cloud, while Teradata offers a multi-cloud infrastructure platform combined with consulting services. Snowflake’s market cap is significantly larger at $72.5B compared to Teradata’s $2.8B, reflecting differences in scale and market positioning.

Income Statement Comparison

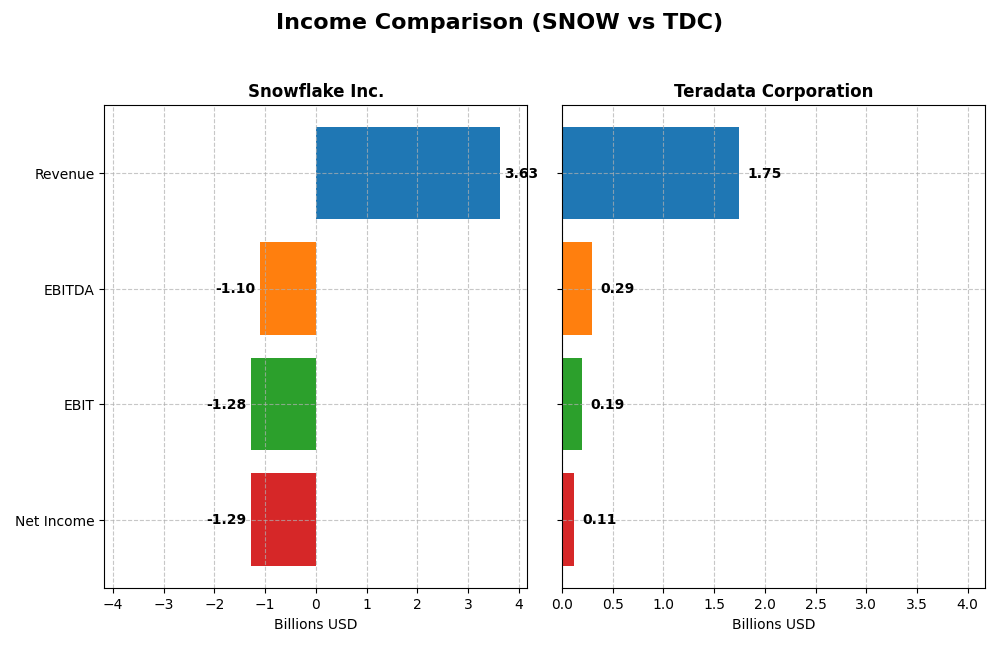

The table below presents a side-by-side comparison of key income statement metrics for Snowflake Inc. and Teradata Corporation for their most recent fiscal years.

| Metric | Snowflake Inc. (SNOW) | Teradata Corporation (TDC) |

|---|---|---|

| Market Cap | 72.5B | 2.8B |

| Revenue | 3.63B | 1.75B |

| EBITDA | -1.10B | 293M |

| EBIT | -1.28B | 193M |

| Net Income | -1.29B | 114M |

| EPS | -3.86 | 1.18 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Snowflake Inc.

Snowflake’s revenue rose sharply from $592M in 2021 to $3.63B in 2025, marking a 513% overall growth, while net income remained negative, deepening from -$539M to -$1.29B. Gross margins are strong at 66.5%, yet EBIT and net margins are unfavorable, with the latest year showing a widening net loss and a 51% drop in EBIT. Despite revenue acceleration, profitability challenges persist.

Teradata Corporation

Teradata’s revenue declined modestly from $1.84B in 2020 to $1.75B in 2024, with net income fluctuating but remaining positive, hitting $114M in 2024. Margins are stable and favorable, with a gross margin of 60.5% and a positive EBIT margin of 11%. The recent year saw EBIT growth of 31% and a near doubling of net margin, reflecting improving operational efficiency despite slight revenue contraction.

Which one has the stronger fundamentals?

Teradata exhibits stronger fundamentals with consistent profitability, positive margins, and recent improvements in EBIT and net margin growth. Snowflake demonstrates rapid revenue expansion but struggles with sustained losses and negative margins. While Snowflake’s growth is impressive, Teradata’s steady earnings and margin stability present a more favorable income statement profile overall.

Financial Ratios Comparison

The table below compares key financial ratios for Snowflake Inc. and Teradata Corporation based on their most recent fiscal year data, providing insights into profitability, liquidity, leverage, efficiency, and shareholder returns.

| Ratios | Snowflake Inc. (2025) | Teradata Corporation (2024) |

|---|---|---|

| ROE | -42.9% | 85.7% |

| ROIC | -25.3% | 16.9% |

| P/E | -47.0 | 26.3 |

| P/B | 20.1 | 22.6 |

| Current Ratio | 1.75 | 0.81 |

| Quick Ratio | 1.75 | 0.79 |

| D/E | 0.90 | 4.33 |

| Debt-to-Assets | 29.7% | 33.8% |

| Interest Coverage | -528 | 7.21 |

| Asset Turnover | 0.40 | 1.03 |

| Fixed Asset Turnover | 5.53 | 9.07 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Snowflake Inc.

Snowflake Inc. shows mixed financial ratios with a slight unfavorable bias. Key concerns include negative returns on equity (-42.86%) and invested capital (-25.32%), along with an unfavorable net margin (-35.45%). However, liquidity ratios such as the current and quick ratios are favorable at 1.75. The company pays no dividends, reflecting its reinvestment strategy and focus on growth in the competitive software application sector.

Teradata Corporation

Teradata Corporation presents a more balanced ratio profile, leaning neutral overall. It reports strong returns on equity (85.71%) and invested capital (16.89%), with a favorable interest coverage ratio of 6.66, but weaker liquidity indicated by low current and quick ratios around 0.8. Teradata also does not pay dividends, likely prioritizing cash flow management and reinvestment in its multi-cloud data platform services.

Which one has the best ratios?

Teradata’s ratios are generally more favorable, especially in profitability and interest coverage, despite liquidity weaknesses. Snowflake’s ratios reveal significant profitability challenges and negative returns, though liquidity remains solid. Given these factors, Teradata holds a more neutral and balanced ratio profile, while Snowflake’s overall ratios are slightly unfavorable.

Strategic Positioning

This section compares the strategic positioning of Snowflake Inc. and Teradata Corporation across Market position, Key segments, and Exposure to technological disruption:

Snowflake Inc.

- Leading cloud-based data platform with strong market cap of 72.5B, facing competitive pressure in software applications.

- Key revenue from cloud data platform products ($3.46B in 2025) and professional services; focus on data consolidation and analytics.

- Positioned in cloud data platforms with ongoing innovation but showing signs of value destruction and declining profitability.

Teradata Corporation

- Smaller market cap of 2.8B, competing in software infrastructure with moderate competitive pressure.

- Diverse revenue streams including consulting ($248M), recurring products ($1.48B), and services ($1.19B) across multiple industries globally.

- Provides multi-cloud analytics platform with integrated migration support, demonstrating durable value creation and profitability growth.

Snowflake Inc. vs Teradata Corporation Positioning

Snowflake is concentrated on cloud data platform products driving rapid revenue growth but with declining profitability. Teradata has a diversified business model across consulting, recurring services, and multi-cloud analytics, showing sustained value creation and broader industry exposure.

Which has the best competitive advantage?

Teradata exhibits a very favorable moat with ROIC above WACC and growing profitability, indicating a durable competitive advantage. Snowflake’s declining ROIC and value destruction suggest a weak or deteriorating competitive moat.

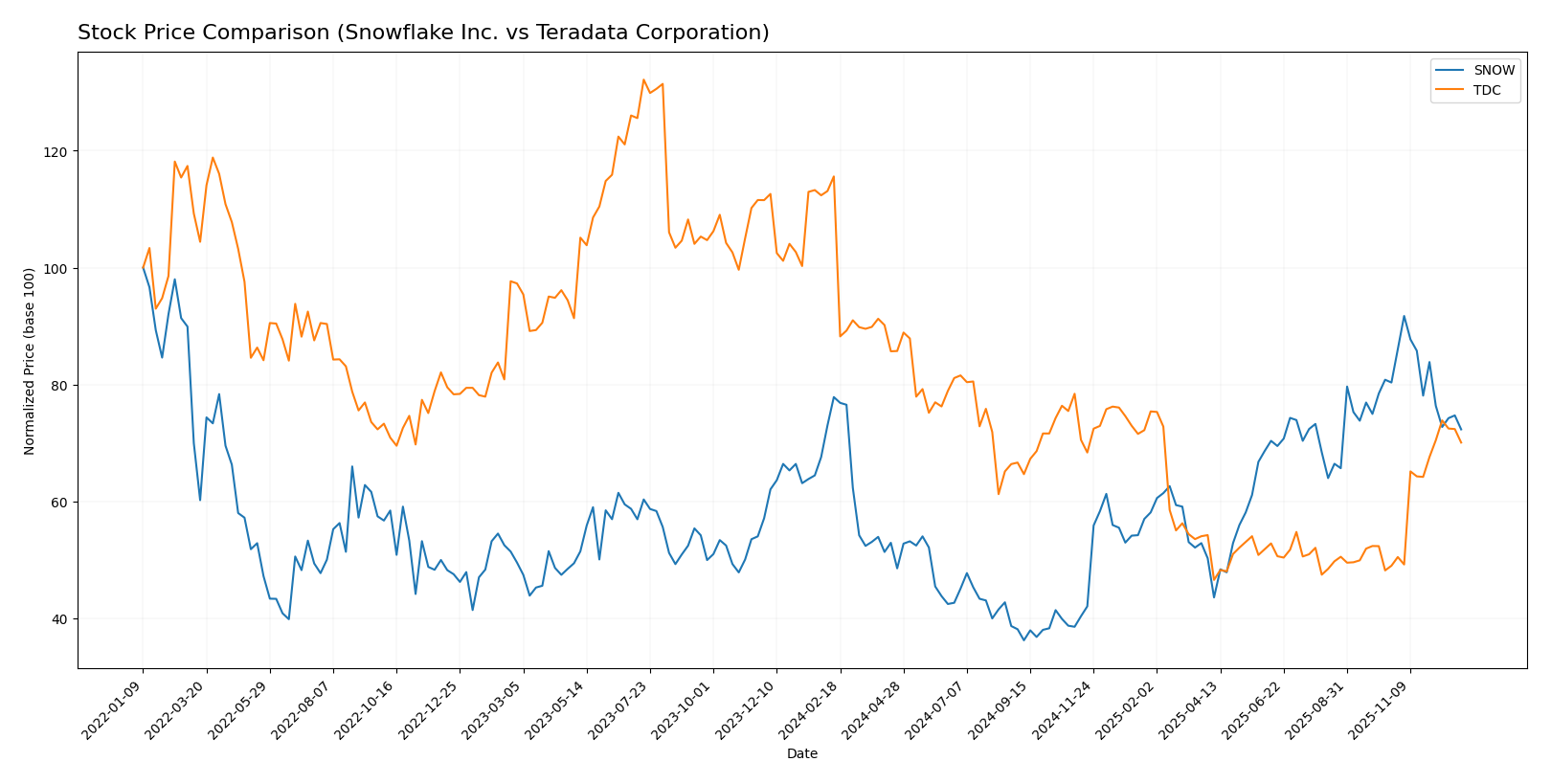

Stock Comparison

The stock prices of Snowflake Inc. and Teradata Corporation have shown contrasting dynamics over the past 12 months, with both experiencing notable fluctuations and shifts in trading volume dominance reflecting changing market sentiment.

Trend Analysis

Snowflake Inc. experienced a bearish trend over the past year with a -7.1% price change and decelerating downward momentum. The stock showed high volatility, ranging between 108.56 and 274.88, with recent sharper declines.

Teradata Corporation also posted a bearish trend with a -39.4% change over the year but exhibited accelerating downward momentum. The stock’s price fluctuated between 19.73 and 48.99, with a recent reversal marked by a 43.02% rise and slight buyer dominance.

Comparing the two, Teradata’s recent strong recovery contrasts Snowflake’s continued decline. Despite Teradata’s larger yearly loss, its recent gains delivered the highest short-term market performance.

Target Prices

Analysts present a clear target price consensus for Snowflake Inc. and Teradata Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Snowflake Inc. | 325 | 237 | 283.25 |

| Teradata Corporation | 35 | 24 | 29.5 |

Snowflake’s consensus target of 283.25 USD suggests a significant upside from its current price of 216.71 USD. Teradata’s consensus target of 29.5 USD aligns closely with its current price near 29.69 USD, indicating a stable outlook.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Snowflake Inc. and Teradata Corporation:

Rating Comparison

Snowflake Inc. Rating

- Rating: C- indicating a very favorable evaluation overall.

- Discounted Cash Flow Score: Moderate at 3, showing neutral valuation.

- ROE Score: Very unfavorable at 1, indicating weak profit generation efficiency.

- ROA Score: Very unfavorable at 1, showing poor asset utilization.

- Debt To Equity Score: Very unfavorable at 1, indicating high financial risk.

- Overall Score: Very unfavorable at 1, reflecting weak overall financial standing.

Teradata Corporation Rating

- Rating: B+ reflecting a very favorable overall evaluation.

- Discounted Cash Flow Score: Favorable at 4, suggesting undervaluation.

- ROE Score: Very favorable at 5, indicating strong profit generation from equity.

- ROA Score: Favorable at 4, reflecting effective asset use.

- Debt To Equity Score: Very unfavorable at 1, indicating similar financial risk.

- Overall Score: Moderate at 3, suggesting a better overall financial position.

Which one is the best rated?

Teradata Corporation is better rated overall, with a B+ rating and higher scores in discounted cash flow, ROE, ROA, and overall score. Snowflake Inc. holds a C- rating with mostly very unfavorable scores, except a moderate DCF score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Snowflake and Teradata:

Snowflake Scores

- Altman Z-Score: 6.22, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 4, showing average financial strength.

Teradata Scores

- Altman Z-Score: 0.65, indicating distress zone with high bankruptcy risk.

- Piotroski Score: 8, showing very strong financial strength.

Which company has the best scores?

Snowflake has a much higher Altman Z-Score, placing it in the safe zone, while Teradata is in distress. Conversely, Teradata’s Piotroski Score is very strong, compared to Snowflake’s average score.

Grades Comparison

The following provides a detailed comparison of recent grades assigned to Snowflake Inc. and Teradata Corporation by recognized grading companies:

Snowflake Inc. Grades

This table summarizes the recent grades given by reputable financial institutions for Snowflake Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-12-08 |

| Needham | Maintain | Buy | 2025-12-04 |

| DA Davidson | Maintain | Buy | 2025-12-04 |

| Stifel | Maintain | Buy | 2025-12-04 |

| Keybanc | Maintain | Overweight | 2025-12-04 |

| Baird | Maintain | Outperform | 2025-12-04 |

| Morgan Stanley | Maintain | Overweight | 2025-12-04 |

| Deutsche Bank | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-04 |

| Canaccord Genuity | Maintain | Buy | 2025-12-04 |

Overall, Snowflake Inc. consistently receives favorable grades, predominantly “Buy” and “Outperform,” reflecting strong analyst confidence.

Teradata Corporation Grades

This table presents the latest grades for Teradata Corporation from established grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

| Barclays | Maintain | Underweight | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Guggenheim | Maintain | Buy | 2025-05-07 |

| Barclays | Maintain | Underweight | 2025-04-21 |

| Citizens Capital Markets | Maintain | Market Perform | 2025-03-18 |

| JMP Securities | Maintain | Market Perform | 2025-02-13 |

Teradata’s ratings display a mixed pattern, ranging from “Buy” and “Outperform” to “Underweight” and “Hold,” indicating diverse analyst perspectives.

Which company has the best grades?

Snowflake Inc. holds generally stronger and more consistent grades, mostly “Buy” and “Outperform,” compared to Teradata’s varied ratings. This may impact investors by signaling more unified positive sentiment for Snowflake, whereas Teradata shows more cautious or mixed evaluations.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses for Snowflake Inc. (SNOW) and Teradata Corporation (TDC) based on recent financial and operational data.

| Criterion | Snowflake Inc. (SNOW) | Teradata Corporation (TDC) |

|---|---|---|

| Diversification | Moderate product focus: mainly cloud data platform with limited services segment (~3.5B product revenue in 2025) | Broad revenue streams: consulting, recurring services, subscription software; well-diversified (total revenue ~2.8B in 2024) |

| Profitability | Negative profitability: net margin -35.45%, ROIC -25.32%, declining profitability trend | Positive profitability: net margin 6.51%, ROIC 16.89%, strong improving trend |

| Innovation | High innovation in cloud data solutions but currently value-destroying | Stable innovation with focus on analytics and recurring software, creating value |

| Global presence | Global cloud platform but financial data less detailed on geographic split | Established international presence with consistent revenues outside US |

| Market Share | Rapid growth but struggling to convert into profit, market share expanding | More mature market position with stable shares and solid customer base |

Key takeaways: Teradata shows a durable competitive advantage with improving profitability and diversified revenue streams. Snowflake, despite strong growth and innovation, is currently value-destructive with negative margins and declining returns, requiring cautious risk management.

Risk Analysis

The table below summarizes key risks for Snowflake Inc. and Teradata Corporation based on their latest financial and operational data from 2025 and 2024 respectively.

| Metric | Snowflake Inc. (SNOW) | Teradata Corporation (TDC) |

|---|---|---|

| Market Risk | High beta (1.09), volatile stock range (120.1-280.67) | Lower beta (0.58), less volatile range (18.43-33.03) |

| Debt level | Moderate debt-to-equity (0.9), favorable debt-to-assets (29.7%) | High debt-to-equity (4.33), neutral debt-to-assets (33.8%) |

| Regulatory Risk | Moderate, US and international operations | Moderate, global presence with regulatory complexity |

| Operational Risk | Negative net margin (-35.45%), poor ROE (-42.86%) | Positive net margin (6.51%), strong ROE (85.71%) |

| Environmental Risk | Not specifically highlighted | Not specifically highlighted |

| Geopolitical Risk | US-based with global clients, moderate exposure | Broad international exposure, moderate risk |

Snowflake’s most impactful risks include its negative profitability and unfavorable financial ratios, indicating operational challenges and higher market volatility. Teradata shows strong profitability but carries higher financial risk due to significant leverage, which could pressure cash flow in adverse market conditions. Both companies face moderate regulatory and geopolitical risks given their global operations.

Which Stock to Choose?

Snowflake Inc. (SNOW) shows strong revenue growth with a 512% increase over five years but suffers from negative profitability, with a -35.45% net margin and declining ROIC well below WACC, indicating value destruction. Its financial ratios are slightly unfavorable, and its rating is very unfavorable despite a safe Altman Z-Score.

Teradata Corporation (TDC) has a favorable income statement with positive net margin (6.51%) and improving profitability, showing a very favorable MOAT with ROIC above WACC and a strong upward trend. Financial ratios are neutral overall, with some concerns on liquidity and leverage, but the rating is very favorable with a very strong Piotroski score.

Investors focused on growth might find Snowflake’s rapid revenue expansion appealing despite its profitability challenges, while those prioritizing value creation and financial stability may view Teradata’s improving returns and favorable rating as more suitable. The choice could depend on tolerance for risk and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Snowflake Inc. and Teradata Corporation to enhance your investment decisions: