In today’s rapidly evolving tech landscape, Snowflake Inc. (SNOW) and MicroStrategy Incorporated (MSTR) stand out as prominent players in the software application industry. Both companies leverage data analytics to empower businesses, yet they adopt distinct innovation strategies and market approaches. While Snowflake focuses on cloud-based data solutions, MicroStrategy emphasizes enterprise analytics platforms. As we delve into this comparison, I aim to help you determine which of these two companies presents the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Snowflake Inc. Overview

Snowflake Inc. is a prominent player in the cloud-based data platform market, enabling organizations to consolidate their data into a unified source for actionable insights. Founded in 2012 and headquartered in Bozeman, Montana, Snowflake serves a diverse clientele across multiple industries, facilitating data-driven applications and sharing capabilities. With a market capitalization of approximately $76.4B and a stock price of $228.33, the company has positioned itself as a leader in the software application sector, reflecting its commitment to innovation and scalability. As of now, Snowflake operates in a highly competitive environment, continually evolving its offerings to meet the growing demands for data management and analytics.

MicroStrategy Incorporated Overview

MicroStrategy Incorporated, established in 1989 and based in Tysons Corner, Virginia, specializes in enterprise analytics software, providing organizations with modern tools for data visualization and reporting. With a market cap of around $51.2B and shares trading at $178.36, the company focuses on delivering insights across various devices through its comprehensive analytics platform. MicroStrategy’s services cater to a broad spectrum of industries, emphasizing customer support and consulting to enhance system performance and ROI. The company’s approach combines robust software solutions with educational resources, reinforcing its reputation in the software application industry.

Key similarities and differences

Both Snowflake and MicroStrategy operate within the software application sector and provide essential analytics solutions. However, Snowflake emphasizes cloud data consolidation and management, while MicroStrategy focuses on enterprise-level analytics and visualization tools. Their distinct approaches cater to different aspects of data utilization, reflecting their unique strengths in the market.

Income Statement Comparison

In this section, I present a comparison of key financial metrics from the income statements of Snowflake Inc. and MicroStrategy Incorporated for the most recent fiscal year.

| Metric | Snowflake Inc. | MicroStrategy Incorporated |

|---|---|---|

| Market Cap | 76.44B | 51.23B |

| Revenue | 3.63B | 463.46M |

| EBITDA | -1.10B | -1.85B |

| EBIT | -1.28B | -1.87B |

| Net Income | -1.29B | -1.17B |

| EPS | -3.86 | -6.06 |

| Fiscal Year | 2025 | 2024 |

Interpretation of Income Statement

In analyzing the income statements, Snowflake’s revenue has shown significant growth from the previous year, reflecting a strong demand for its cloud-based services, despite a net loss of $1.29B in FY 2025. On the other hand, MicroStrategy experienced a decline in revenue compared to the prior year, indicating challenges in maintaining sales momentum. Both companies reported negative EBITDA and EBIT, suggesting operational inefficiencies and substantial expenses affecting profitability. The trends reveal that while Snowflake is expanding revenue, it must address its high cost structure, while MicroStrategy needs to devise a strategy for revenue stabilization and cost management to improve its financial health.

Financial Ratios Comparison

The following table provides a comparative analysis of the most recent revenue and financial ratios for Snowflake Inc. (SNOW) and MicroStrategy Incorporated (MSTR).

| Metric | SNOW | MSTR |

|---|---|---|

| ROE | -43% | -6% |

| ROIC | -25% | -4% |

| P/E | -47 | 20 |

| P/B | 20 | 4 |

| Current Ratio | 1.75 | 0.71 |

| Quick Ratio | 1.75 | 0.83 |

| D/E | 0.90 | 0.40 |

| Debt-to-Assets | 30% | 28% |

| Interest Coverage | -528 | -30 |

| Asset Turnover | 0.40 | 0.10 |

| Fixed Asset Turnover | 5.53 | 5.73 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Snowflake shows significant negative returns on equity (ROE) and invested capital (ROIC), indicating challenges in profitability. Its high price-to-book (P/B) and price-to-earnings (P/E) ratios suggest investor skepticism about future earnings. In contrast, MicroStrategy exhibits a slightly better P/E ratio and a more stable current ratio but still faces profitability issues. Both companies have a concerning interest coverage ratio, highlighting potential liquidity risks.

Dividend and Shareholder Returns

Both Snowflake Inc. (SNOW) and MicroStrategy Incorporated (MSTR) do not pay dividends, reflecting their focus on reinvestment and growth at this stage. SNOW has a negative net income and is in a high growth phase, prioritizing R&D over distributions. MSTR, while also not distributing dividends, recently showed a positive net income, indicating a potential shift towards shareholder value. Both firms engage in share buybacks, which could bolster shareholder returns over time. Overall, their strategies suggest a commitment to long-term value creation, albeit with inherent risks.

Strategic Positioning

Snowflake Inc. (SNOW) and MicroStrategy Incorporated (MSTR) operate in the competitive software application market, with both focusing on data analytics. Snowflake holds a significant market share due to its robust cloud platform, which offers users a unified data source. Meanwhile, MicroStrategy faces competitive pressure from Snowflake and others, but leverages its extensive enterprise analytics services. Technological disruptions in data management continue to shape the landscape, prompting both companies to innovate and adapt to remain relevant.

Stock Comparison

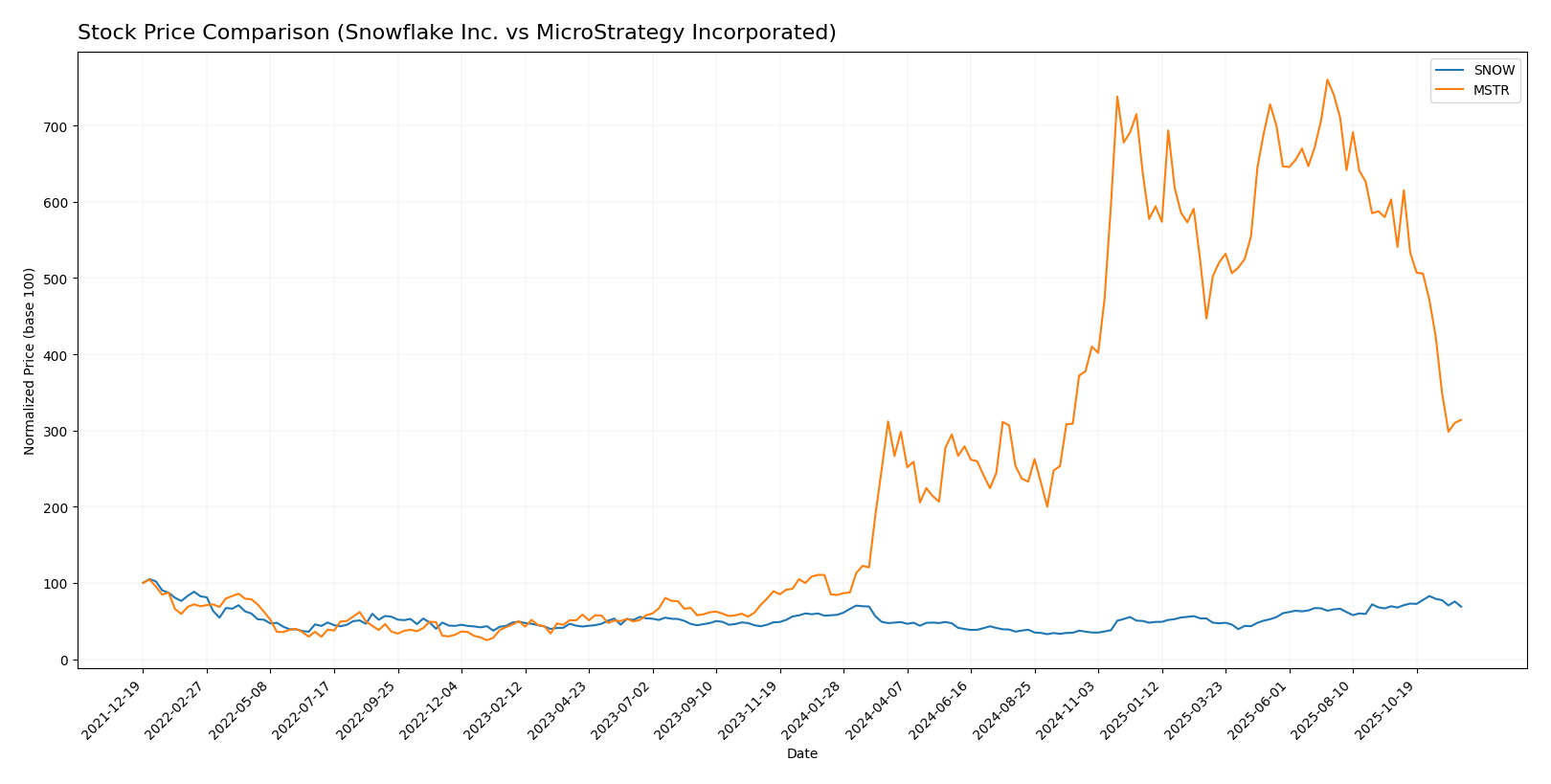

In evaluating the stock performance of Snowflake Inc. (SNOW) and MicroStrategy Incorporated (MSTR) over the past year, we observe significant price movements and trading dynamics that highlight the contrasting trajectories of these two companies.

Trend Analysis

Snowflake Inc. (SNOW) has shown a robust bullish trend with a price change of +19.53% over the past year. The stock reached a notable high of 274.88 and a low of 108.56, indicating substantial volatility with a standard deviation of 42.41. More recently, however, SNOW’s price has decreased by -0.81% since September 21, 2025, with a trend slope of 1.29, suggesting a slight deceleration in momentum.

In contrast, MicroStrategy Incorporated (MSTR) has experienced an impressive price increase of +269.5% over the past year, marking a clear bullish trend as well. The stock’s highest price was 434.58, while the lowest was 48.1, reflecting a higher volatility with a standard deviation of 111.9. However, MSTR has faced a significant decline of -47.97% during the recent period from September 21, 2025, indicating a deceleration in the bullish trend, with a trend slope of -17.35.

In summary, while both stocks exhibit bullish trends over the long term, their recent performance diverges, with SNOW experiencing a minor decline and MSTR undergoing a substantial drop. This analysis emphasizes the importance of monitoring both long-term trends and recent price behaviors when considering investments in these stocks.

Analyst Opinions

Recent analyst recommendations for Snowflake Inc. (SNOW) indicate a cautious stance, with a rating of C- from analysts, reflecting concerns over return on equity and assets. In contrast, MicroStrategy Incorporated (MSTR) received a slightly better rating of C, highlighting its stronger price-to-book ratio. Overall, analysts suggest a hold for both stocks as they exhibit mixed performance indicators. The consensus for the current year leans towards a hold, emphasizing the need for careful evaluation before making investment decisions.

Stock Grades

Recent evaluations from reputable grading companies indicate a mix of stability and shifts in stock recommendations for Snowflake Inc. (SNOW) and MicroStrategy Incorporated (MSTR).

Snowflake Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Buy | 2025-12-04 |

| DA Davidson | maintain | Buy | 2025-12-04 |

| Morgan Stanley | maintain | Overweight | 2025-12-04 |

| Deutsche Bank | maintain | Buy | 2025-12-04 |

| Cantor Fitzgerald | maintain | Overweight | 2025-12-04 |

| Baird | maintain | Outperform | 2025-12-04 |

| BTIG | maintain | Buy | 2025-12-04 |

| Keybanc | maintain | Overweight | 2025-12-04 |

| Scotiabank | maintain | Sector Outperform | 2025-12-04 |

| Rosenblatt | maintain | Buy | 2025-12-04 |

MicroStrategy Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Monness, Crespi, Hardt | upgrade | Neutral | 2025-11-10 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-03 |

| Canaccord Genuity | maintain | Buy | 2025-11-03 |

| BTIG | maintain | Buy | 2025-10-31 |

| TD Cowen | maintain | Buy | 2025-10-31 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-31 |

| Wells Fargo | downgrade | Equal Weight | 2025-09-30 |

| TD Cowen | maintain | Buy | 2025-09-16 |

| Canaccord Genuity | maintain | Buy | 2025-08-26 |

| Mizuho | maintain | Outperform | 2025-08-11 |

Overall, Snowflake maintains a strong outlook with consistent “Buy” and “Overweight” ratings, indicating investor confidence. In contrast, MicroStrategy shows a recent upgrade to “Neutral” but also a downgrade from “Overweight” to “Equal Weight,” suggesting a more cautious sentiment among analysts.

Target Prices

The current consensus target prices for Snowflake Inc. and MicroStrategy Incorporated indicate positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Snowflake Inc. (SNOW) | 325 | 230 | 282.25 |

| MicroStrategy Inc. (MSTR) | 705 | 175 | 478.5 |

For Snowflake Inc. (SNOW), the consensus target price of 282.25 is above its current price of 228.33, suggesting potential upside. MicroStrategy Inc. (MSTR) shows a target consensus of 478.5, significantly higher than its current price of 178.36, indicating strong bullish sentiment among analysts.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Snowflake Inc. (SNOW) and MicroStrategy Incorporated (MSTR) based on their most recent performance metrics.

| Criterion | Snowflake Inc. (SNOW) | MicroStrategy Incorporated (MSTR) |

|---|---|---|

| Diversification | Moderate | Limited |

| Profitability | Negative margins | Negative margins |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Growing | Stable |

| Debt level | Moderate | High |

Key takeaways indicate that while Snowflake demonstrates strong global presence and innovation, it struggles with profitability. In contrast, MicroStrategy has high debt levels and limited diversification, which may pose risks for investors.

Risk Analysis

In the following table, I will outline the key risks associated with two companies: Snowflake Inc. (SNOW) and MicroStrategy Incorporated (MSTR).

| Metric | Snowflake Inc. (SNOW) | MicroStrategy Incorporated (MSTR) |

|---|---|---|

| Market Risk | High | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and operational risks due to the volatility in their respective sectors. Notably, MicroStrategy’s heavy reliance on Bitcoin exposes it to heightened regulatory scrutiny and market fluctuations, making it a riskier investment in the current environment.

Which one to choose?

When comparing Snowflake Inc. (SNOW) and MicroStrategy Inc. (MSTR), both companies exhibit challenges in profitability, with negative net profit margins of -35.5% for SNOW and -2.5% for MSTR. However, their market trends differ significantly; MSTR has seen a remarkable price change of +269.5% over the past year, despite a recent decline of -47.97%. Meanwhile, SNOW’s bullish trend indicates a 19.5% increase with moderate fluctuations. Analyst ratings reveal SNOW at C- while MSTR holds a C rating, suggesting a slight edge to MSTR in overall financial stability.

For growth-oriented investors, MSTR may offer more upside potential, albeit with higher volatility. Conversely, those prioritizing steadiness might lean towards SNOW, given its more consistent performance.

Risks include significant market competition and valuation concerns, especially in the tech sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Snowflake Inc. and MicroStrategy Incorporated to enhance your investment decisions: