Investors seeking growth in the semiconductor sector face a choice between Tower Semiconductor Ltd. (TSEM) and Skyworks Solutions, Inc. (SWKS), two industry players with distinct approaches. Tower Semiconductor specializes in analog mixed-signal foundry services, while Skyworks focuses on proprietary semiconductor components for diverse applications. Their overlapping markets and innovation strategies make them worthy of comparison. This article will help you decide which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Tower Semiconductor Ltd. and Skyworks Solutions, Inc. by providing an overview of these two companies and their main differences.

Tower Semiconductor Ltd. Overview

Tower Semiconductor Ltd. is an independent semiconductor foundry specializing in analog intensive mixed-signal semiconductor devices. It offers customizable process technologies such as SiGe, BiCMOS, RF CMOS, and MEMS, serving diverse markets including consumer electronics, automotive, aerospace, and medical devices. Founded in 1993 and headquartered in Migdal Haemek, Israel, Tower operates globally with a focus on wafer fabrication and design enablement.

Skyworks Solutions, Inc. Overview

Skyworks Solutions, Inc. designs, develops, and markets proprietary semiconductor products and intellectual property for a broad range of applications. Its portfolio includes amplifiers, filters, front-end modules, and voltage regulators, targeting aerospace, automotive, broadband, and smartphone markets. Incorporated in 1962 and based in Irvine, California, Skyworks sells through direct sales and distributors across global regions including the US, Asia, and Europe.

Key similarities and differences

Both Tower and Skyworks operate in the semiconductor industry with a global footprint, serving multiple high-tech sectors like automotive, aerospace, and consumer electronics. Tower focuses on foundry services and analog mixed-signal technologies, while Skyworks emphasizes proprietary semiconductor product design and manufacturing. Skyworks has a larger workforce and dividend payments, whereas Tower is an independent foundry with a broader range of customizable fabrication technologies.

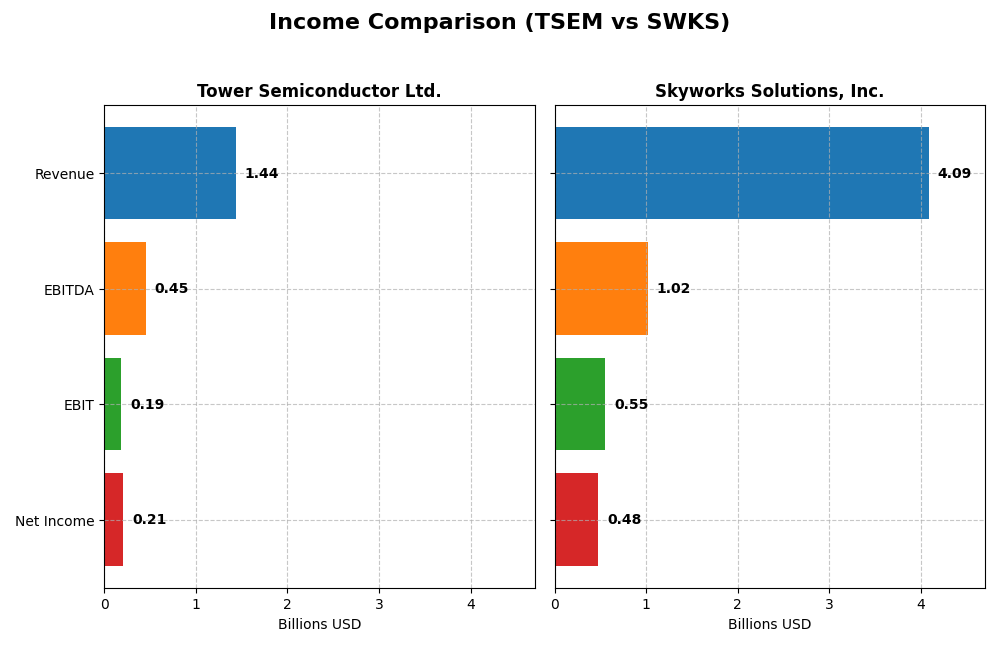

Income Statement Comparison

The table below provides a factual comparison of key income statement metrics for Tower Semiconductor Ltd. and Skyworks Solutions, Inc. based on their most recent fiscal year data.

| Metric | Tower Semiconductor Ltd. (TSEM) | Skyworks Solutions, Inc. (SWKS) |

|---|---|---|

| Market Cap | 13.9B | 8.8B |

| Revenue | 1.44B | 4.09B |

| EBITDA | 451M | 1.02B |

| EBIT | 185M | 554M |

| Net Income | 208M | 477M |

| EPS | 1.87 | 3.09 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Tower Semiconductor Ltd.

Tower Semiconductor’s revenue showed a 13.5% increase over 2020-2024, reaching $1.44B in 2024, while net income surged by 153% overall, despite a sharp decline in 2024. Margins remained favorable, with a gross margin of 23.6% and net margin of 14.5%. However, 2024 saw a slowdown in growth and a 60% drop in net margin and EPS compared to 2023.

Skyworks Solutions, Inc.

Skyworks Solutions experienced a declining trend with revenue falling 20% from 2021 to 2025 to $4.09B, and net income dropping 68% to $477M. Margins are still favorable, with a 41.2% gross margin and 11.7% net margin. The latest fiscal year showed a 2.2% revenue decrease and a near 18% decline in net margin, reflecting pressure on profitability.

Which one has the stronger fundamentals?

Tower Semiconductor maintains a generally favorable income statement, showing growth in revenue and net income over the longer term, despite recent setbacks. Skyworks, conversely, faces ongoing declines in revenue, net income, and margins. The data signals stronger fundamentals for Tower Semiconductor based on income statement trends and margin stability.

Financial Ratios Comparison

This table presents the most recent financial ratios for Tower Semiconductor Ltd. (TSEM) and Skyworks Solutions, Inc. (SWKS), facilitating a straightforward comparison of their key performance metrics as of fiscal year-end 2024 and 2025 respectively.

| Ratios | Tower Semiconductor Ltd. (2024) | Skyworks Solutions, Inc. (2025) |

|---|---|---|

| ROE | 7.83% | 8.29% |

| ROIC | 6.41% | 6.35% |

| P/E | 27.54 | 24.95 |

| P/B | 2.16 | 2.07 |

| Current Ratio | 6.18 | 2.33 |

| Quick Ratio | 5.23 | 1.76 |

| D/E (Debt-to-Equity) | 0.07 | 0.21 |

| Debt-to-Assets | 5.87% | 15.20% |

| Interest Coverage | 32.64 | 18.45 |

| Asset Turnover | 0.47 | 0.52 |

| Fixed Asset Turnover | 1.11 | 2.95 |

| Payout Ratio | 0% | 90.67% |

| Dividend Yield | 0% | 3.63% |

Interpretation of the Ratios

Tower Semiconductor Ltd.

Tower Semiconductor shows a mix of strong and weak financial ratios, with favorable net margin (14.47%) and low debt levels, but an unfavorable return on equity (7.83%) and a high current ratio (6.18) that might indicate inefficient asset use. The company does not pay dividends, reflecting a possible reinvestment strategy or growth focus, with no payout or share buyback program reported.

Skyworks Solutions, Inc.

Skyworks Solutions presents generally favorable ratios, including a solid net margin (11.67%), strong liquidity (current ratio 2.33, quick ratio 1.76), and a manageable debt level (debt to assets 15.2%). Its dividend yield of 3.63% is supported by steady payouts, suggesting consistent shareholder returns without excessive risk from buybacks or unsustainable distributions.

Which one has the best ratios?

Skyworks Solutions holds a stronger overall ratio profile, with more favorable liquidity, debt management, and dividend yield, along with fewer unfavorable metrics. Tower Semiconductor, while showing some strengths, has mixed results with more unfavorable ratios, particularly in asset turnover and equity returns, indicating a less robust financial position comparatively.

Strategic Positioning

This section compares the strategic positioning of Tower Semiconductor Ltd. and Skyworks Solutions, Inc. in terms of market position, key segments, and exposure to technological disruption:

Tower Semiconductor Ltd.

- Independent semiconductor foundry with global presence, facing typical semiconductor industry competition.

- Serves diverse markets: consumer electronics, automotive, industrial, aerospace, medical, and more.

- Provides customizable process technologies and foundry services, indicating moderate exposure to innovation shifts.

Skyworks Solutions, Inc.

- Proprietary semiconductor product designer and manufacturer, competing globally in diverse markets.

- Offers wide product portfolio targeting aerospace, automotive, broadband, gaming, medical, smartphone markets.

- Develops proprietary IP and complex analog/digital chips, implying higher exposure to technological disruption.

Tower Semiconductor Ltd. vs Skyworks Solutions, Inc. Positioning

Tower Semiconductor Ltd. adopts a diversified market approach through foundry services across various sectors, while Skyworks focuses on proprietary semiconductor products with broad applications. Tower’s customization contrasts with Skyworks’ emphasis on intellectual property and product variety.

Which has the best competitive advantage?

Tower Semiconductor shows a slightly unfavorable moat, shedding value but with growing profitability. Skyworks has a very unfavorable moat with declining profitability, indicating Tower may maintain a more resilient competitive advantage based on recent MOAT evaluations.

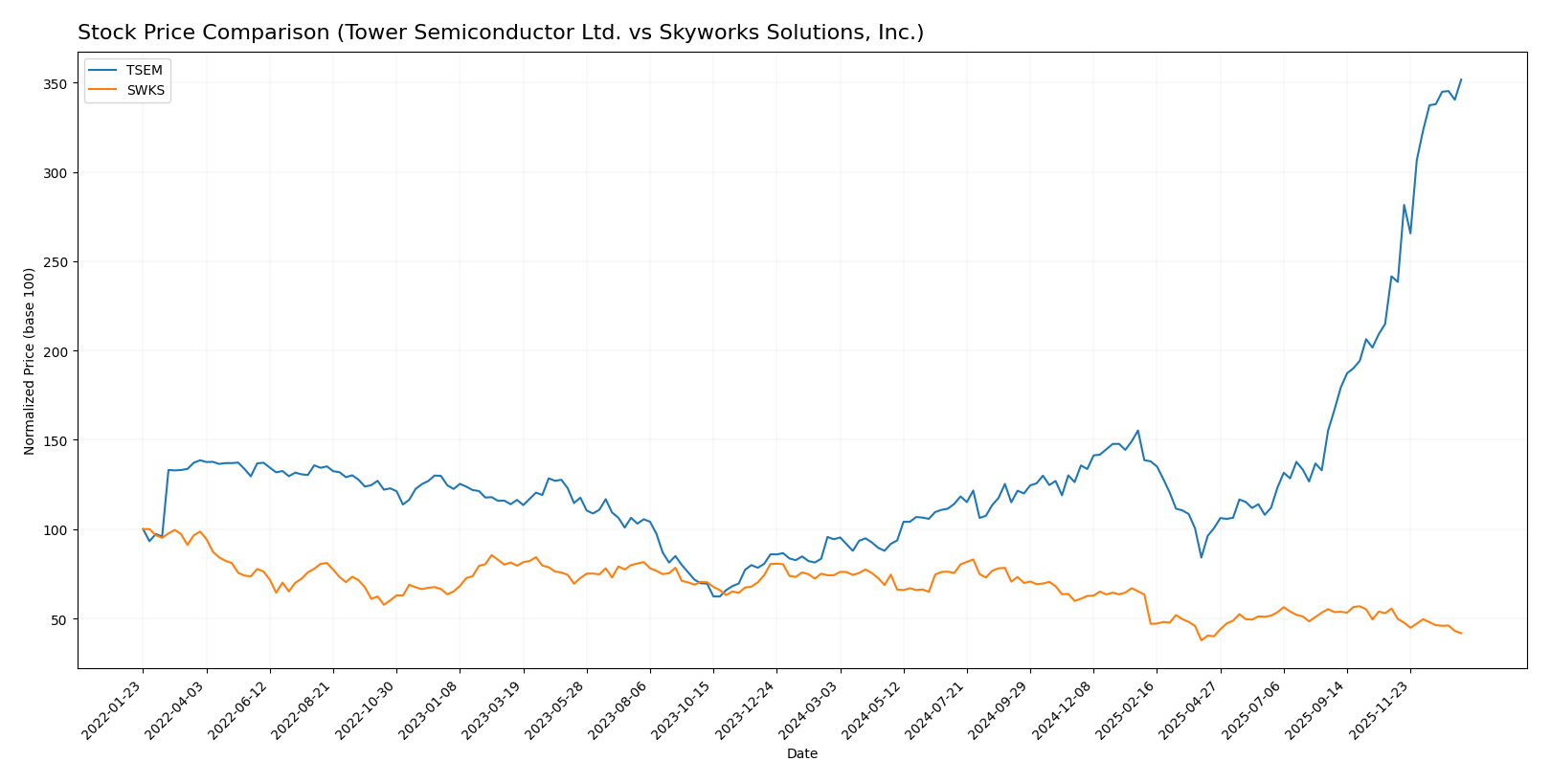

Stock Comparison

The stock price trends of Tower Semiconductor Ltd. (TSEM) and Skyworks Solutions, Inc. (SWKS) over the past 12 months reveal contrasting dynamics, with TSEM showing strong bullish acceleration and SWKS demonstrating a bearish deceleration phase.

Trend Analysis

Tower Semiconductor Ltd. (TSEM) experienced a pronounced bullish trend over the past year with a 272.71% price increase, accompanied by acceleration and elevated volatility (std dev 23.67). Recent months show continued positive momentum with a 45.59% gain.

Skyworks Solutions, Inc. (SWKS) has undergone a bearish trend, declining 43.71% over the last 12 months with deceleration and moderate volatility (std dev 16.35). The recent period reflects a sharper drop of 24.78%, confirming negative momentum.

Comparing both stocks, Tower Semiconductor Ltd. delivered the highest market performance with a strong upward trend, while Skyworks Solutions, Inc. faced sustained price declines and weaker buyer interest.

Target Prices

Analysts present a mixed target consensus for Tower Semiconductor Ltd. and Skyworks Solutions, Inc., reflecting differing market expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Tower Semiconductor Ltd. | 125 | 66 | 96 |

| Skyworks Solutions, Inc. | 140 | 60 | 85.11 |

Tower Semiconductor’s consensus target of 96 suggests modest upside compared to its current price near 124, indicating possible overvaluation. Skyworks Solutions’ consensus target at 85.11 is significantly above its current price near 58.46, signaling potential undervaluation and growth opportunity.

Analyst Opinions Comparison

This section compares the analysts’ ratings and financial scores for Tower Semiconductor Ltd. and Skyworks Solutions, Inc.:

Rating Comparison

Tower Semiconductor Ltd. Rating

- Rating: B+ with a very favorable status.

- Discounted Cash Flow Score: Moderate at 3, indicating fair valuation.

- ROE Score: Moderate at 3, showing average profit generation efficiency.

- ROA Score: Favorable at 4, indicating good asset utilization.

- Debt To Equity Score: Favorable at 4, reflecting lower financial risk.

- Overall Score: Moderate at 3, reflecting average overall financial standing.

Skyworks Solutions, Inc. Rating

- Rating: B+ with a very favorable status.

- Discounted Cash Flow Score: Favorable at 4, suggesting undervaluation.

- ROE Score: Moderate at 3, similar efficiency in profit generation.

- ROA Score: Favorable at 4, also indicating good asset utilization.

- Debt To Equity Score: Moderate at 3, indicating slightly higher financial risk.

- Overall Score: Moderate at 3, also reflecting average overall financial standing.

Which one is the best rated?

Both companies share a B+ rating and an overall score of 3, indicating moderate standing. Skyworks has a more favorable discounted cash flow score, while Tower Semiconductor scores better on debt to equity, showing lower financial risk.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score of Tower Semiconductor Ltd. and Skyworks Solutions, Inc.:

TSEM Scores

- Altman Z-Score: 21.06, indicating a very safe zone

- Piotroski Score: 7, reflecting strong financial health

SWKS Scores

- Altman Z-Score: 4.44, indicating a safe zone

- Piotroski Score: 7, reflecting strong financial health

Which company has the best scores?

Tower Semiconductor Ltd. has a significantly higher Altman Z-Score than Skyworks Solutions, both are in the safe zone. Both companies share the same strong Piotroski Score of 7, indicating comparable financial strength.

Grades Comparison

The following is a comparison of recent grades assigned to Tower Semiconductor Ltd. and Skyworks Solutions, Inc.:

Tower Semiconductor Ltd. Grades

This table presents recent grades and actions for Tower Semiconductor Ltd. by recognized grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-09 |

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| Benchmark | Maintain | Buy | 2025-11-11 |

| Susquehanna | Maintain | Positive | 2025-11-11 |

| Wedbush | Maintain | Outperform | 2025-11-11 |

| Barclays | Maintain | Equal Weight | 2025-11-11 |

| Benchmark | Maintain | Buy | 2025-09-08 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-04 |

Overall, Tower Semiconductor shows a generally positive trend with several “Buy” and “Positive” ratings, although some neutral and equal weight ratings suggest a cautious stance.

Skyworks Solutions, Inc. Grades

This table presents recent grades and actions for Skyworks Solutions, Inc. by recognized grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Upgrade | Neutral | 2025-11-11 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-11-05 |

| Citigroup | Upgrade | Neutral | 2025-10-29 |

| Benchmark | Maintain | Hold | 2025-10-29 |

| Piper Sandler | Upgrade | Overweight | 2025-10-29 |

| Barclays | Upgrade | Equal Weight | 2025-10-29 |

| Keybanc | Upgrade | Overweight | 2025-10-29 |

| UBS | Maintain | Neutral | 2025-10-29 |

| Citigroup | Maintain | Sell | 2025-08-06 |

Skyworks exhibits a range of ratings from “Sell” to “Overweight,” with most recent grades clustered around “Neutral” and “Overweight,” indicating mixed but improving analyst sentiment.

Which company has the best grades?

Both companies have an overall “Buy” consensus, but Tower Semiconductor has more consistent “Buy” ratings from multiple firms, while Skyworks shows a broader spread including several “Neutral” and some upgrades from “Sell.” This consistency for Tower might suggest steadier analyst confidence, potentially affecting investor sentiment toward perceived stability.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Tower Semiconductor Ltd. (TSEM) and Skyworks Solutions, Inc. (SWKS) based on their latest financial and strategic data.

| Criterion | Tower Semiconductor Ltd. (TSEM) | Skyworks Solutions, Inc. (SWKS) |

|---|---|---|

| Diversification | Moderate; focused on semiconductor manufacturing | Moderate; specialized in analog semiconductors |

| Profitability | Net margin 14.47% (favorable), ROE 7.83% (unfavorable) | Net margin 11.67% (favorable), ROE 8.29% (unfavorable) |

| Innovation | Growing ROIC trend indicating improving efficiency | Declining ROIC trend suggests challenges in innovation impact |

| Global presence | Established but smaller scale | Stronger global footprint and market penetration |

| Market Share | Modest, with value destruction concerns | Larger market share but facing profitability pressure |

Key takeaways: Both companies show slightly favorable financial ratios overall, but Tower Semiconductor is improving profitability despite value destruction, while Skyworks struggles with declining returns and value erosion. Risk-conscious investors should weigh growth potential against current profitability trends.

Risk Analysis

Below is a comparison table highlighting key risks for Tower Semiconductor Ltd. (TSEM) and Skyworks Solutions, Inc. (SWKS) based on the most recent data available for 2025-2026:

| Metric | Tower Semiconductor Ltd. (TSEM) | Skyworks Solutions, Inc. (SWKS) |

|---|---|---|

| Market Risk | Moderate beta of 0.876, indicating lower volatility compared to market | Higher beta of 1.297, reflecting greater sensitivity to market swings |

| Debt level | Very low debt-to-equity at 0.07, very favorable leverage | Moderate debt-to-equity at 0.21, still favorable but higher leverage |

| Regulatory Risk | Exposure to multiple regions (US, Asia, Europe) increases regulatory complexity | Similarly global footprint including US, China, Asia-Pacific with regulatory compliance challenges |

| Operational Risk | Moderate asset turnover (0.47), some inefficiencies in operations | Slightly better asset turnover (0.52) but operational scale is larger with 10K employees |

| Environmental Risk | Semiconductor manufacturing involves hazardous materials, requires compliance with environmental standards | Similar industry risks; environmental regulations impact production processes |

| Geopolitical Risk | Headquarters in Israel with operations in politically sensitive areas; supply chain risks | US-based but significant exposure to China and Asia markets, vulnerable to trade tensions |

In synthesis, both companies operate in the highly cyclical semiconductor sector with inherent market risk. TSEM’s low leverage and strong liquidity mitigate financial risk well, but its geographic exposure to Israel and Asia could pose geopolitical challenges. SWKS has higher market volatility and moderate debt but benefits from a diversified global presence. Environmental and regulatory risks remain impactful for both due to industry-specific manufacturing processes. Investors should weigh these risks carefully alongside financial strengths before allocation.

Which Stock to Choose?

Tower Semiconductor Ltd. (TSEM) shows a favorable income statement with a 14.47% net margin but recent declines in revenue and profitability. Its financial ratios are slightly favorable overall, with strong liquidity and low debt, though some valuation metrics appear less attractive. The company’s ROIC is growing but remains below its WACC, indicating value destruction despite improving profitability. Rating stands at B+ with moderate overall scores.

Skyworks Solutions, Inc. (SWKS) has a favorable gross and EBIT margin but faces unfavorable long-term income growth and declining profitability. Its financial ratios are slightly favorable with good liquidity, moderate debt, and a dividend yield. However, the company’s ROIC trends downward below WACC, suggesting ongoing value erosion. The rating is also B+ with moderate scores, supported by a strong Altman Z-score and Piotroski rating.

Investors focused on growth might find Tower Semiconductor’s improving profitability and bullish price trend appealing, while those prioritizing income and stability could view Skyworks’ dividend yield and liquidity profile as favorable despite its bearish trend and declining profitability. The choice could depend on risk tolerance and investment strategy given both companies currently show signs of value destruction.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Tower Semiconductor Ltd. and Skyworks Solutions, Inc. to enhance your investment decisions: