Skyworks Solutions, Inc. (SWKS) and indie Semiconductor, Inc. (INDI) both operate in the dynamic semiconductor industry, serving critical markets like automotive and connectivity. While Skyworks boasts a long-established presence with diverse product offerings, indie Semiconductor focuses on innovative automotive solutions and advanced driver assistance systems. This comparison explores their market overlap and innovation strategies to help you decide which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Skyworks Solutions, Inc. and indie Semiconductor, Inc. by providing an overview of these two companies and their main differences.

Skyworks Solutions Overview

Skyworks Solutions, Inc. designs, develops, manufactures, and markets proprietary semiconductor products globally. Its offerings include amplifiers, antenna tuners, front-end modules, and other components used in diverse markets such as aerospace, automotive, broadband, and smartphones. Founded in 1962 and headquartered in Irvine, California, Skyworks serves a broad range of industries through direct sales and distributors, with a market cap of $8.76B.

indie Semiconductor Overview

indie Semiconductor, Inc. focuses on automotive semiconductors and software solutions for driver assistance, connected cars, and electrification applications. Its product portfolio includes devices for parking assistance, wireless charging, infotainment, and optical communication markets. Founded in 2007 and based in Aliso Viejo, California, indie Semiconductor targets advanced automotive technologies and maintains a market cap of $857M.

Key similarities and differences

Both companies operate in the semiconductor industry within the technology sector and are headquartered in California. Skyworks Solutions has a diversified product range serving multiple markets globally, while indie Semiconductor specializes in automotive-focused semiconductors and software. Skyworks is significantly larger in market capitalization and employee count, reflecting broader market reach versus indie Semiconductor’s niche automotive emphasis.

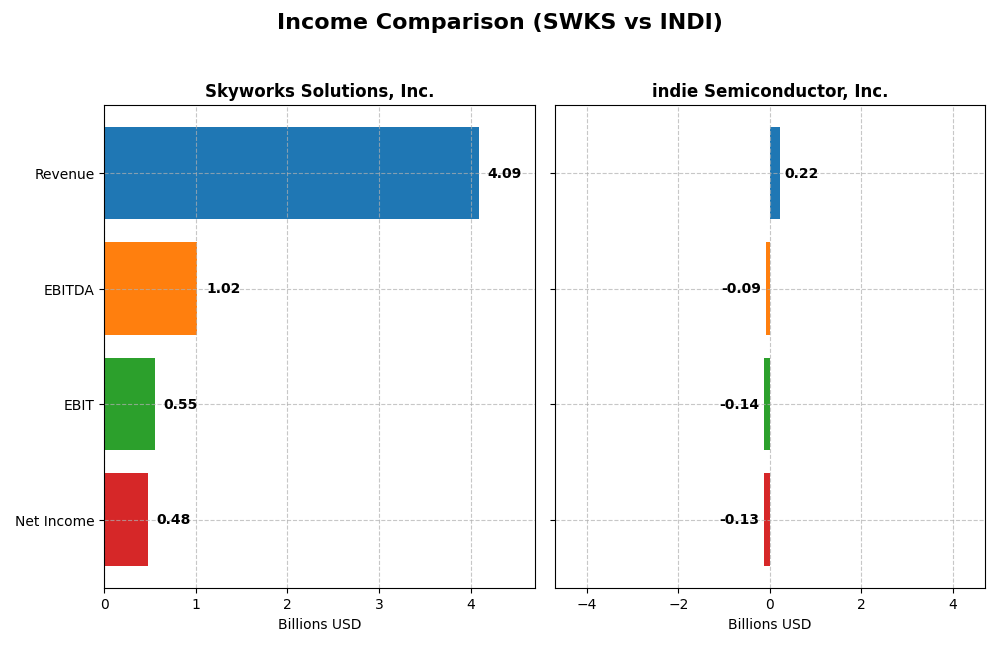

Income Statement Comparison

The table below compares the key income statement metrics for Skyworks Solutions, Inc. and indie Semiconductor, Inc. for the most recent fiscal year available.

| Metric | Skyworks Solutions, Inc. | indie Semiconductor, Inc. |

|---|---|---|

| Market Cap | 8.76B | 857M |

| Revenue | 4.09B | 217M |

| EBITDA | 1.02B | -94M |

| EBIT | 554M | -137M |

| Net Income | 477M | -133M |

| EPS | 3.09 | -0.76 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Skyworks Solutions, Inc.

Skyworks Solutions reported declining revenues and net income from 2021 to 2025, with a 20.01% revenue decrease and 68.16% net income drop over the period. Margins showed overall strength, with a gross margin of 41.16% and net margin of 11.67% in 2025, though recent year growth slowed, showing negative trends across revenue, EBIT, and EPS.

indie Semiconductor, Inc.

indie Semiconductor’s revenue grew substantially by 858.35% from 2020 to 2024, despite a net income decline of 36.01% over the same span. Its gross margin is favorable at 41.68%, though the EBIT margin is deeply negative at -63.22%. The 2024 year saw mixed performance, with gross profit rising sharply but EBIT and net margin continuing negative trends.

Which one has the stronger fundamentals?

Skyworks displays more stable profitability with positive margins and controlled interest expenses despite declining growth, reflecting stronger fundamentals in income quality. indie Semiconductor shows rapid revenue expansion but persistent net losses and negative EBIT margins, resulting in a more volatile financial profile. Overall, Skyworks’ income statement suggests more consistent operational performance.

Financial Ratios Comparison

The table below presents a comparison of key financial ratios for Skyworks Solutions, Inc. and indie Semiconductor, Inc. based on their most recent fiscal year data.

| Ratios | Skyworks Solutions, Inc. (2025) | indie Semiconductor, Inc. (2024) |

|---|---|---|

| ROE | 8.29% | -31.73% |

| ROIC | 6.35% | -19.25% |

| P/E | 24.95 | -5.35 |

| P/B | 2.07 | 1.70 |

| Current Ratio | 2.33 | 4.82 |

| Quick Ratio | 1.76 | 4.23 |

| D/E (Debt-to-Equity) | 0.21 | 0.95 |

| Debt-to-Assets | 15.20% | 42.34% |

| Interest Coverage | 18.45 | -18.37 |

| Asset Turnover | 0.52 | 0.23 |

| Fixed Asset Turnover | 2.95 | 4.30 |

| Payout ratio | 90.67% | 0% |

| Dividend yield | 3.63% | 0% |

Interpretation of the Ratios

Skyworks Solutions, Inc.

Skyworks Solutions exhibits mostly favorable to neutral ratios, with a strong net margin of 11.67% and solid liquidity indicated by a current ratio of 2.33. Some concerns arise from a relatively low return on equity at 8.29%. The company pays dividends with a 3.63% yield, supported by a sustainable payout ratio and free cash flow coverage, indicating balanced shareholder returns without excessive repurchases.

indie Semiconductor, Inc.

indie Semiconductor shows predominantly unfavorable ratios, including a net margin of -61.2% and a negative return on equity of -31.73%, signaling operational losses and weak profitability. Although it does not pay dividends, reflecting its high reinvestment and growth phase, the company maintains some favorable metrics like a quick ratio of 4.23 and fixed asset turnover of 4.3, offset by concerns in interest coverage and asset turnover.

Which one has the best ratios?

Skyworks Solutions holds a more favorable overall ratio profile, balancing profitability, liquidity, and shareholder returns, despite moderate concerns around ROE. indie Semiconductor’s ratios reflect significant financial challenges and a growth-focused strategy with negative profitability metrics, resulting in a generally unfavorable evaluation.

Strategic Positioning

This section compares the strategic positioning of Skyworks Solutions, Inc. and indie Semiconductor, Inc., focusing on Market position, Key segments, and Exposure to technological disruption:

Skyworks Solutions, Inc.

- Established market player with broad semiconductor portfolio, facing competitive pressure in global markets.

- Diverse segments: aerospace, automotive, broadband, cellular, consumer electronics, industrial, and medical applications.

- Exposure to disruption through innovation in wireless analog systems and broad semiconductor technologies.

indie Semiconductor, Inc.

- Smaller market cap, focused on automotive semiconductors amid competitive automotive tech sector.

- Concentrated on automotive applications including advanced driver assistance, connected car, and electrification.

- Exposure to disruption focused on automotive tech innovation, photonic components, and cloud connectivity solutions.

Skyworks Solutions, Inc. vs indie Semiconductor, Inc. Positioning

Skyworks exhibits a diversified business across multiple end markets, reducing dependence on any single sector, while indie Semiconductor concentrates on automotive semiconductors and software. Diversification offers resilience; concentration allows focused innovation but increases sector-specific risk.

Which has the best competitive advantage?

Both companies currently show very unfavorable MOAT evaluations with declining ROIC trends, indicating value destruction and weak competitive advantages based on invested capital efficiency over recent years.

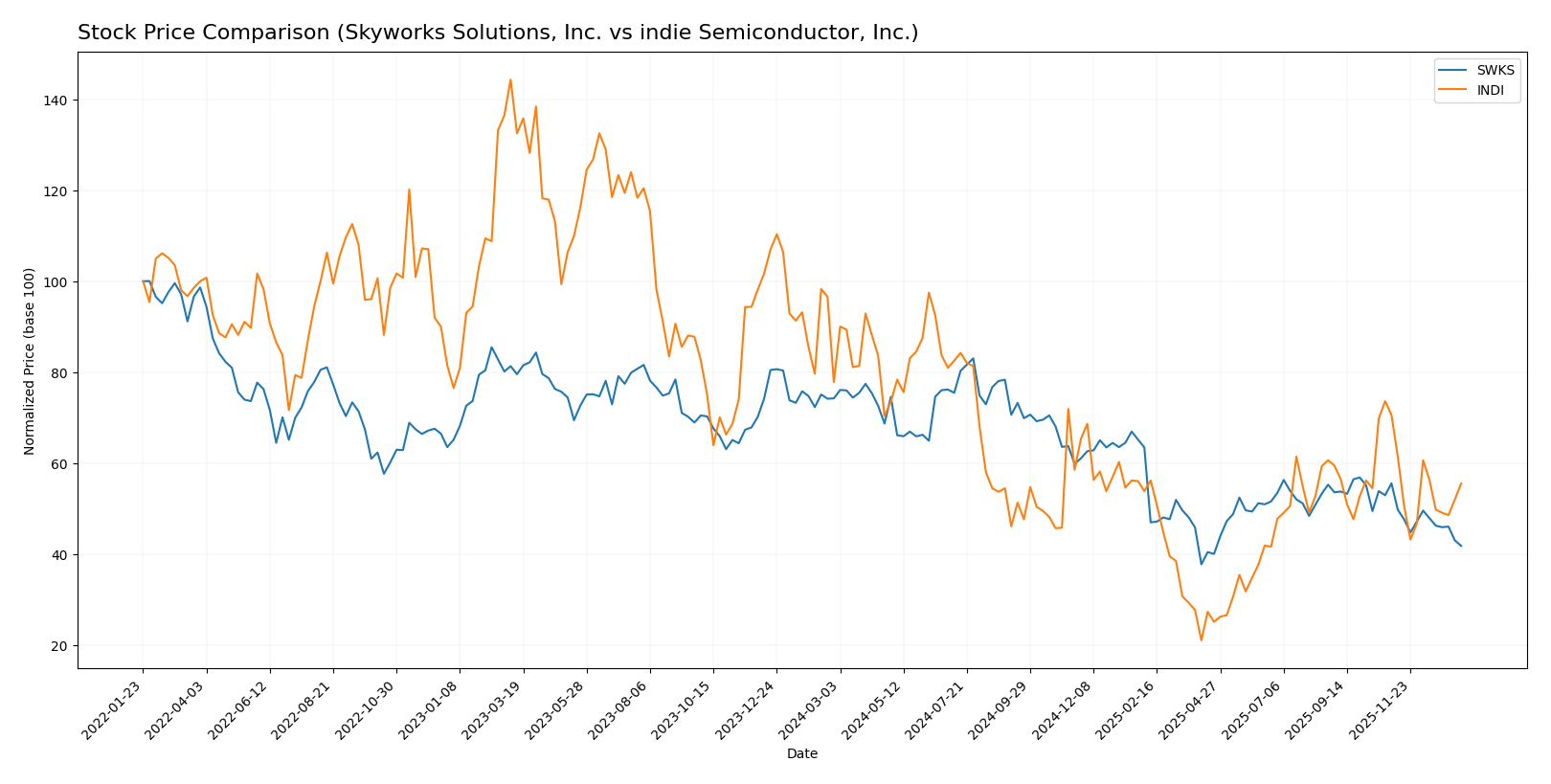

Stock Comparison

The past year has seen both Skyworks Solutions, Inc. (SWKS) and indie Semiconductor, Inc. (INDI) experience notable bearish trends with significant price declines and decelerating downward momentum.

Trend Analysis

Skyworks Solutions, Inc. displays a bearish trend over the past 12 months with a price decrease of 43.71%, showing deceleration in its downward movement and a high volatility level of 16.35. The stock reached a high of 116.18 and a low of 52.78.

Indie Semiconductor, Inc. also shows a bearish trend with a 28.67% price decline over the same period, accompanied by deceleration and lower volatility at 1.35. The highest and lowest prices were 7.43 and 1.6, respectively.

Comparing the two, Skyworks Solutions experienced a larger percentage decline than indie Semiconductor, indicating a weaker market performance over the past year.

Target Prices

The current analyst target consensus reveals a mixed outlook for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Skyworks Solutions, Inc. | 140 | 60 | 85.11 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

Skyworks Solutions shows a wide target price range with a consensus substantially above its current price of 58.46 USD, suggesting potential upside. indie Semiconductor’s target is flat at 8 USD, nearly double its current price of 4.23 USD, indicating moderate growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Skyworks Solutions, Inc. and indie Semiconductor, Inc.:

Rating Comparison

Skyworks Solutions, Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, favorable valuation.

- ROE Score: 3, moderate efficiency in generating profits.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 3, moderate financial risk.

- Overall Score: 3, moderate overall financial standing.

indie Semiconductor, Inc. Rating

- Rating: C-, considered very unfavorable by analysts.

- Discounted Cash Flow Score: 1, very unfavorable valuation.

- ROE Score: 1, very unfavorable efficiency.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 1, very unfavorable overall financial standing.

Which one is the best rated?

Skyworks Solutions, Inc. holds significantly better ratings and financial scores than indie Semiconductor, Inc., with favorable scores in valuation, profitability, and financial risk, while indie Semiconductor scores are very unfavorable across key metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Skyworks Solutions, Inc. and indie Semiconductor, Inc.:

SWKS Scores

- Altman Z-Score: 4.44, in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

INDI Scores

- Altman Z-Score: 0.12, in the distress zone, indicating high bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial health.

Which company has the best scores?

Based on the provided data, Skyworks Solutions shows significantly stronger financial health with a safe-zone Altman Z-Score and a strong Piotroski Score. In contrast, indie Semiconductor is in financial distress with a very weak Piotroski Score.

Grades Comparison

The following presents the latest reliable grades for Skyworks Solutions, Inc. and indie Semiconductor, Inc.:

Skyworks Solutions, Inc. Grades

This table summarizes recent rating actions from major grading companies for Skyworks Solutions, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Upgrade | Neutral | 2025-11-11 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-11-05 |

| Citigroup | Upgrade | Neutral | 2025-10-29 |

| Benchmark | Maintain | Hold | 2025-10-29 |

| Piper Sandler | Upgrade | Overweight | 2025-10-29 |

| Barclays | Upgrade | Equal Weight | 2025-10-29 |

| Keybanc | Upgrade | Overweight | 2025-10-29 |

| UBS | Maintain | Neutral | 2025-10-29 |

| Citigroup | Maintain | Sell | 2025-08-06 |

Overall, the grades for Skyworks Solutions have generally improved from sell and underperform ratings to neutral and overweight, indicating a positive trend in analyst sentiment.

indie Semiconductor, Inc. Grades

This table shows stable rating actions from grading companies for indie Semiconductor, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

The grades for indie Semiconductor have been consistently positive, primarily maintaining buy and overweight ratings over multiple months, reflecting steady analyst confidence.

Which company has the best grades?

indie Semiconductor holds more consistent buy and overweight ratings, indicating stronger analyst conviction, while Skyworks Solutions shows an improving but more mixed rating profile; this difference may affect investor sentiment and portfolio positioning.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Skyworks Solutions, Inc. (SWKS) and indie Semiconductor, Inc. (INDI) based on their recent financial and operational data.

| Criterion | Skyworks Solutions, Inc. (SWKS) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Moderate product range, focused on semiconductors for wireless communication | Limited diversification, primarily product-based with growing but small service segment |

| Profitability | Positive net margin (11.67%), moderate ROIC (6.35%), slightly favorable overall ratios | Negative net margin (-61.2%), negative ROIC (-19.25%), largely unfavorable financial ratios |

| Innovation | Stable but declining ROIC suggests challenges in maintaining innovation advantage | Declining ROIC and value destruction indicate weak innovation or execution struggles |

| Global presence | Established global footprint in wireless markets | Smaller scale, limited global reach compared to SWKS |

| Market Share | Significant in wireless semiconductor market | Emerging player with smaller market share and revenue base |

Key takeaways: Skyworks Solutions maintains moderate profitability and a solid market position despite some decline in capital efficiency, while indie Semiconductor faces significant financial challenges and value erosion. Investors should approach INDI with caution due to its unfavorable profitability and declining returns.

Risk Analysis

Below is a comparative table summarizing key risks for Skyworks Solutions, Inc. (SWKS) and indie Semiconductor, Inc. (INDI) based on the most recent data:

| Metric | Skyworks Solutions, Inc. (SWKS) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | Moderate (Beta: 1.30) | High (Beta: 2.54) |

| Debt level | Low (Debt-to-Equity: 0.21) | Moderate (Debt-to-Equity: 0.95) |

| Regulatory Risk | Moderate (Global semiconductor regulations) | Moderate to High (Automotive safety standards) |

| Operational Risk | Moderate (Global supply chain exposure) | High (Smaller scale, tech development risk) |

| Environmental Risk | Moderate (Industry regulations) | Moderate (Automotive industry pressure) |

| Geopolitical Risk | Moderate (Global market exposure, especially Asia) | Moderate (Supply chain and market access) |

Skyworks shows stronger financial stability with low debt and a safe Altman Z-score, while indie Semiconductor faces high market volatility and financial distress signals, making it a higher-risk investment with potential operational challenges.

Which Stock to Choose?

Skyworks Solutions, Inc. (SWKS) shows a declining income trend with unfavorable growth over 2021-2025, though it maintains favorable net margin and stable debt levels. Its financial ratios are slightly favorable, with strong liquidity and dividend yield, yet its ROE and ROIC are moderate. The company’s value creation is very unfavorable due to declining ROIC below WACC, signaling value destruction.

indie Semiconductor, Inc. (INDI) presents a mixed income profile with neutral overall income evaluation and significant unfavorable profitability ratios, including negative net margin and ROE in 2024. Despite a high current ratio and some favorable asset turnover, its financial ratios are predominantly unfavorable. Its value creation is very unfavorable with a steeply declining ROIC well below WACC, indicating persistent value destruction.

Given the ratings and financial evaluations, SWKS might appear more favorable for investors seeking moderate financial stability and income quality, while INDI’s profile could be interpreted as suitable mainly for those with a high risk tolerance focused on potential turnaround opportunities. The choice depends on an investor’s risk appetite and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Skyworks Solutions, Inc. and indie Semiconductor, Inc. to enhance your investment decisions: