In the fast-evolving semiconductor industry, Tower Semiconductor Ltd. (TSEM) and SkyWater Technology, Inc. (SKYT) stand out as innovative players driving growth through advanced manufacturing solutions. Both companies focus on analog and mixed-signal semiconductor devices, serving overlapping markets like automotive, aerospace, and consumer electronics. This article will explore their strategies and performance to help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Tower Semiconductor Ltd. and SkyWater Technology, Inc. by providing an overview of these two companies and their main differences.

Tower Semiconductor Ltd. Overview

Tower Semiconductor Ltd. is an independent semiconductor foundry specializing in analog intensive mixed-signal semiconductor devices. Founded in 1993 and headquartered in Israel, it provides a wide range of customizable process technologies including SiGe, BiCMOS, RF CMOS, and MEMS. Tower serves diverse markets such as consumer electronics, automotive, aerospace, and medical devices, positioning itself as a versatile player in the semiconductor industry.

SkyWater Technology, Inc. Overview

SkyWater Technology, founded in 2017 and based in Minnesota, offers semiconductor development and manufacturing services. The company focuses on co-creating technologies with customers and provides manufacturing for silicon-based analog, mixed-signal, power discrete, and rad-hard integrated circuits. It serves sectors including aerospace, automotive, bio-health, and industrial IoT, aiming to meet specialized demand in these fields.

Key similarities and differences

Both Tower Semiconductor and SkyWater operate in the semiconductor industry and provide analog and mixed-signal technology solutions. However, Tower is a larger, more established foundry with a broader geographic reach and a variety of process technologies. In contrast, SkyWater is smaller, newer, and emphasizes collaborative technology development and niche markets such as rad-hard circuits and industrial IoT. Their employee counts and market caps reflect differing scales and operational focuses.

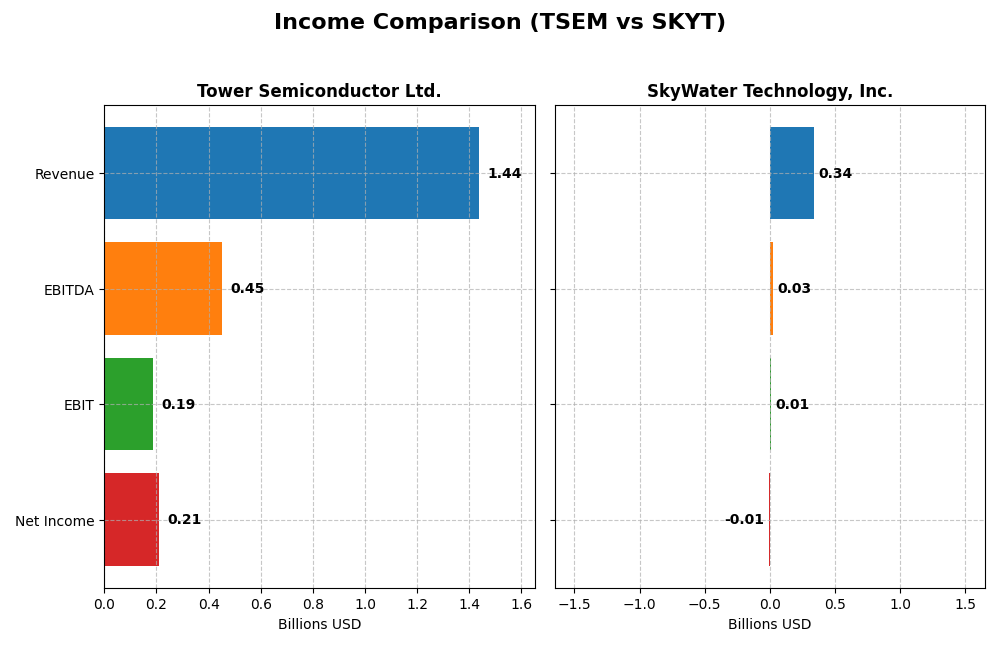

Income Statement Comparison

The table below compares the key income statement metrics for Tower Semiconductor Ltd. and SkyWater Technology, Inc. for the fiscal year 2024.

| Metric | Tower Semiconductor Ltd. (TSEM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Cap | 13.9B | 1.54B |

| Revenue | 1.44B | 342M |

| EBITDA | 451M | 25M |

| EBIT | 185M | 7M |

| Net Income | 208M | -7M |

| EPS | 1.87 | -0.14 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Tower Semiconductor Ltd.

Tower Semiconductor’s revenue showed moderate growth of 13.47% from 2020 to 2024, with net income rising sharply by 152.56%. Margins remained favorable, especially gross margin at 23.64% and net margin at 14.47%. However, the latest year saw a slowdown with a 0.94% revenue increase and a 60.29% decline in net margin, signaling margin pressure despite overall solid fundamentals.

SkyWater Technology, Inc.

SkyWater experienced strong revenue growth of 143.72% over 2020-2024, paralleled by a 67.05% rise in net income. Its gross margin was favorable at 20.34%, but net margin remained negative at -1.98%. The most recent year showed robust improvements, with revenue up 19.39% and net margin growth of 81.5%, indicating enhanced profitability though still below break-even.

Which one has the stronger fundamentals?

Both companies demonstrate favorable overall income statement evaluations, with Tower Semiconductor showing more stable and higher margins alongside significant net income growth. SkyWater boasts faster revenue and net income expansion but continues to operate at a net loss. Tower’s stronger margins and positive net income suggest more solid fundamentals, while SkyWater’s improvements reflect potential but with higher risk.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Tower Semiconductor Ltd. (TSEM) and SkyWater Technology, Inc. (SKYT) for the fiscal year 2024.

| Ratios | Tower Semiconductor Ltd. (TSEM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | 7.83% | -11.79% |

| ROIC | 6.41% | 3.40% |

| P/E | 27.54 | -100.26 |

| P/B | 2.16 | 11.82 |

| Current Ratio | 6.18 | 0.86 |

| Quick Ratio | 5.23 | 0.76 |

| D/E (Debt-to-Equity) | 0.068 | 1.33 |

| Debt-to-Assets | 5.87% | 24.46% |

| Interest Coverage | 32.64 | 0.74 |

| Asset Turnover | 0.47 | 1.09 |

| Fixed Asset Turnover | 1.11 | 2.07 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Tower Semiconductor Ltd.

Tower Semiconductor shows a mix of strong and weak ratios, with a favorable net margin of 14.47% but an unfavorable ROE at 7.83%. Its low debt-to-equity ratio and strong interest coverage indicate solid financial stability, yet the high current ratio suggests potential inefficiency in asset usage. The company does not pay dividends, likely prioritizing reinvestment and growth.

SkyWater Technology, Inc.

SkyWater Technology’s ratios are generally weak, with negative net margin (-1.98%) and ROE (-11.79%), alongside a high debt-to-equity ratio of 1.33. While asset turnover is favorable, most liquidity and profitability ratios are unfavorable, reflecting financial strain. SkyWater does not pay dividends, consistent with negative earnings and a focus on R&D and expansion.

Which one has the best ratios?

Comparing both, Tower Semiconductor’s ratios are slightly favorable overall, showing better profitability, lower leverage, and stronger liquidity than SkyWater. SkyWater’s financials reflect more challenges, with many unfavorable ratios and negative returns. Therefore, Tower Semiconductor demonstrates a more stable and balanced financial profile based on the available ratios.

Strategic Positioning

This section compares the strategic positioning of Tower Semiconductor Ltd. and SkyWater Technology, Inc. including market position, key segments, and exposure to technological disruption:

Tower Semiconductor Ltd.

- Established independent foundry with a 13.9B market cap, moderate beta 0.876.

- Serves diverse markets: consumer electronics, automotive, aerospace, medical.

- Offers customizable process technologies and design enablement platforms.

SkyWater Technology, Inc.

- Smaller player with 1.5B market cap and higher beta of 3.487, indicating more volatility.

- Focuses on advanced technology and wafer services for aerospace, defense, automotive, bio-health.

- Provides semiconductor development, manufacturing, and engineering co-creation services.

Tower Semiconductor Ltd. vs SkyWater Technology, Inc. Positioning

Tower Semiconductor has a diversified market presence across multiple end markets and technologies, while SkyWater focuses on advanced technology services and niche segments. Tower’s broader scope may offer more stable revenue streams than SkyWater’s concentrated approach.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC but show improving profitability trends. Tower Semiconductor’s larger scale contrasts with SkyWater’s higher growth in ROIC, resulting in a similar slightly unfavorable moat evaluation for each.

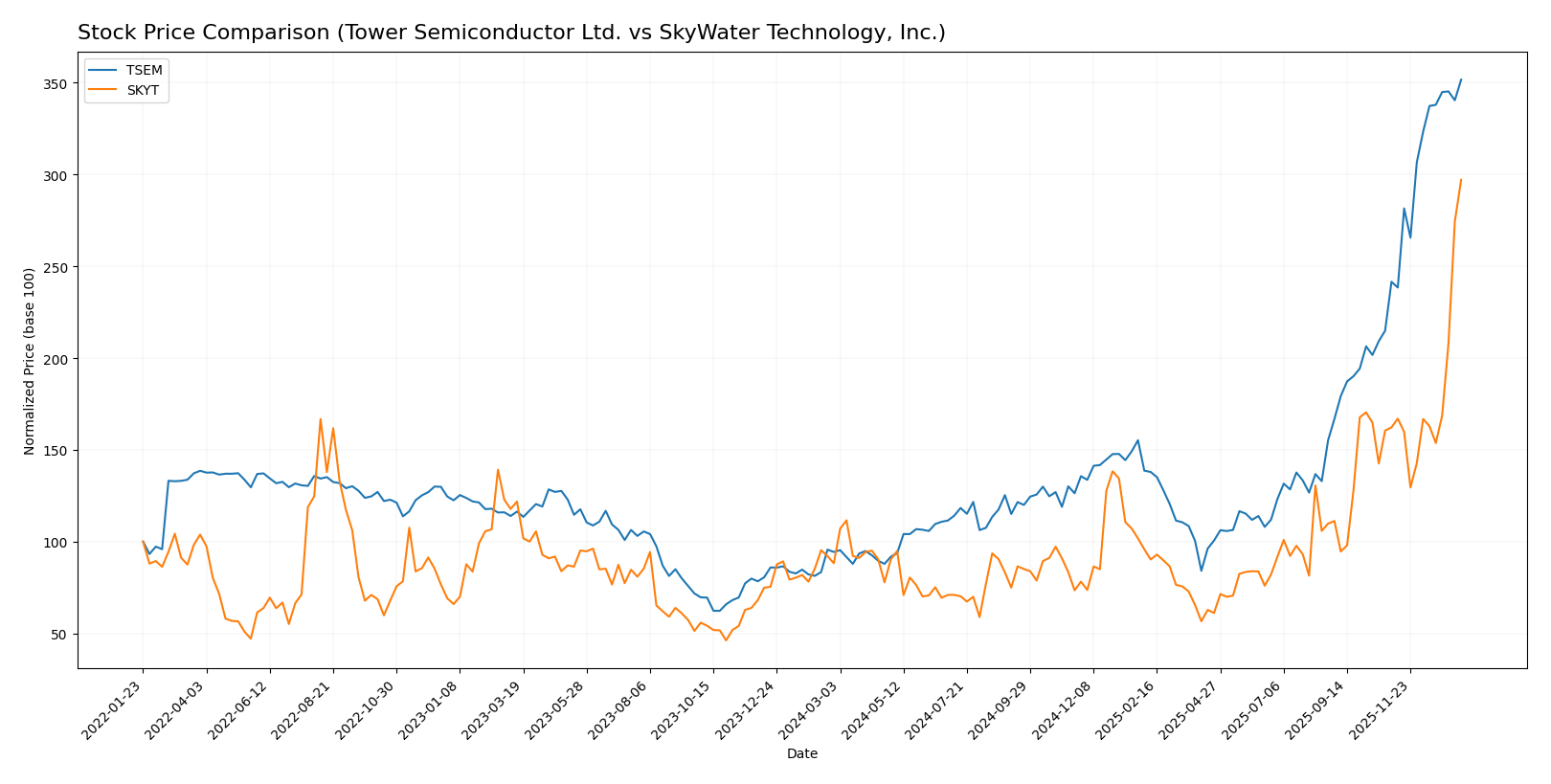

Stock Comparison

The stock prices of Tower Semiconductor Ltd. (TSEM) and SkyWater Technology, Inc. (SKYT) have shown significant bullish momentum over the past year, with both exhibiting accelerating upward trends and distinctive trading volume dynamics.

Trend Analysis

Tower Semiconductor Ltd. (TSEM) experienced a strong bullish trend over the past 12 months, with a price increase of 272.71%, an acceleration in momentum, and a high volatility level indicated by a 23.67 standard deviation.

SkyWater Technology, Inc. (SKYT) also showed a bullish trend over the past year, with a 236.8% price gain and acceleration; its volatility was lower, reflected in a 4.41 standard deviation.

Comparing both stocks, TSEM delivered the highest market performance with a 272.71% increase versus SKYT’s 236.8%, supported by stronger buyer dominance and higher volatility.

Target Prices

Analysts present a clear consensus on target prices for Tower Semiconductor Ltd. and SkyWater Technology, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Tower Semiconductor Ltd. | 125 | 66 | 96 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Tower Semiconductor’s consensus target of 96 suggests a slight downside from the current price of 124, while SkyWater Technology’s fixed target at 25 indicates potential downside from its current price near 32.03.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Tower Semiconductor Ltd. (TSEM) and SkyWater Technology, Inc. (SKYT):

Rating Comparison

TSEM Rating

- Rating: B+, status Very Favorable

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 3, Moderate

- ROA Score: 4, Favorable

- Debt To Equity Score: 4, Favorable

- Overall Score: 3, Moderate

SKYT Rating

- Rating: B+, status Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable

- ROE Score: 5, Very Favorable

- ROA Score: 5, Very Favorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 3, Moderate

Which one is the best rated?

Both companies share a B+ rating and an overall moderate score. SKYT excels in ROE and ROA with very favorable scores but has very unfavorable DCF and debt-to-equity scores. TSEM shows more balanced moderate to favorable scores across metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

TSEM Scores

- Altman Z-Score: 21.06, indicating a safe zone status.

- Piotroski Score: 7, reflecting strong financial health.

SKYT Scores

- Altman Z-Score: 2.20, indicating a grey zone status.

- Piotroski Score: 5, reflecting average financial health.

Which company has the best scores?

Based on the provided data, TSEM has a significantly higher Altman Z-Score in the safe zone and a stronger Piotroski Score than SKYT, which shows moderate scores in both measures.

Grades Comparison

Here is a comparison of the recent grades from verified grading companies for both companies:

Tower Semiconductor Ltd. Grades

This table shows the latest grading actions from recognized firms for Tower Semiconductor Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-09 |

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| Benchmark | Maintain | Buy | 2025-11-11 |

| Susquehanna | Maintain | Positive | 2025-11-11 |

| Wedbush | Maintain | Outperform | 2025-11-11 |

| Barclays | Maintain | Equal Weight | 2025-11-11 |

| Benchmark | Maintain | Buy | 2025-09-08 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-04 |

Tower Semiconductor’s grades show a predominance of “Buy” and positive outlooks, with one recent downgrade to “Neutral” by Wedbush.

SkyWater Technology, Inc. Grades

The following table details recent grades from reputable firms for SkyWater Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology consistently receives “Buy” and “Overweight” ratings from credible grading companies, maintaining a stable positive outlook.

Which company has the best grades?

Both Tower Semiconductor and SkyWater Technology have received predominantly positive grades, with consensus ratings as “Buy.” Tower Semiconductor shows a wider range of opinions including a recent downgrade to “Neutral,” while SkyWater Technology’s grades are more uniformly positive. This consistency may influence investor confidence differently between the two.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Tower Semiconductor Ltd. (TSEM) and SkyWater Technology, Inc. (SKYT) based on their latest financial and operational data.

| Criterion | Tower Semiconductor Ltd. (TSEM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Moderate product and market diversification; wafer fab services focus | More diversified revenue streams with Advanced Technology Services and Wafer Services |

| Profitability | Positive net margin (14.47%), ROIC slightly below WACC, neutral profitability trend | Negative net margin (-1.98%), ROIC below WACC, shedding value but improving ROIC trend |

| Innovation | Moderate innovation with stable asset turnover (1.11 fixed asset turnover) | Higher asset turnover (1.09) and fixed asset turnover (2.07), indicating efficient use of assets |

| Global presence | Established global footprint with moderate market reach | Growing global presence with diverse service offerings |

| Market Share | Stable market position but challenged by competitors | Expanding market share in niche wafer and technology services |

Key takeaways: Both companies are currently shedding value as ROIC remains below WACC, but each shows improving ROIC trends. TSEM offers better profitability and financial stability, while SKYT demonstrates stronger asset utilization and diversification in services. Investors should weigh TSEM’s steadiness against SKYT’s growth potential with caution.

Risk Analysis

Below is a comparative table outlining key risks for Tower Semiconductor Ltd. (TSEM) and SkyWater Technology, Inc. (SKYT) based on their latest financial and operational data for 2024.

| Metric | Tower Semiconductor Ltd. (TSEM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Moderate (Beta 0.876) | High (Beta 3.487) |

| Debt level | Low (Debt-to-Equity 0.07) | High (Debt-to-Equity 1.33) |

| Regulatory Risk | Moderate (Global operations) | Moderate (US-based, defense focus) |

| Operational Risk | Moderate (Complex tech processes) | Moderate-High (Smaller scale, growth phase) |

| Environmental Risk | Moderate (Global footprint) | Moderate (Manufacturing emissions) |

| Geopolitical Risk | Elevated (Israeli HQ, global supply chain) | Moderate (US-based, defense contracts) |

Tower Semiconductor’s most impactful risk lies in geopolitical exposure due to its Israel headquarters and global supply chains, despite strong balance sheet metrics. SkyWater faces higher market volatility and financial risk with elevated debt and a riskier beta, compounded by ongoing operational scaling challenges. Careful risk management is advised for both, with SkyWater requiring particular caution given its weaker liquidity and profitability metrics.

Which Stock to Choose?

Tower Semiconductor Ltd. (TSEM) shows a favorable overall income statement with strong gross and net margins, despite some recent declines. Its financial ratios are slightly favorable, supported by low debt and high liquidity, while profitability remains moderate. The company has a slightly unfavorable moat rating due to value destruction but improving ROIC.

SkyWater Technology, Inc. (SKYT) presents a favorable income statement growth trend and improving margins, though current profitability is negative. Its financial ratios are largely unfavorable, marked by high leverage and weak liquidity, yet asset turnover is favorable. The moat rating is slightly unfavorable with value destruction but a strong ROIC growth trend.

For investors, TSEM might appear more suitable for those prioritizing financial stability and moderate profitability, while SKYT could be interpreted as appealing to risk-tolerant investors focusing on growth potential amid improving fundamentals. This interpretation depends strongly on individual risk profiles and investment strategies.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Tower Semiconductor Ltd. and SkyWater Technology, Inc. to enhance your investment decisions: