In the fast-evolving semiconductor industry, Taiwan Semiconductor Manufacturing Company Limited (TSM) and SkyWater Technology, Inc. (SKYT) stand out as key players with distinct approaches. TSM is a global leader in advanced wafer fabrication, while SkyWater focuses on specialized manufacturing and co-development services. Both companies innovate within overlapping markets, making their comparison crucial. In this article, I will help you determine which company offers the most compelling investment potential.

Table of contents

Companies Overview

I will begin the comparison between Taiwan Semiconductor Manufacturing Company Limited and SkyWater Technology, Inc. by providing an overview of these two companies and their main differences.

Taiwan Semiconductor Manufacturing Company Limited Overview

Taiwan Semiconductor Manufacturing Company Limited (TSM) is a leading semiconductor manufacturer headquartered in Hsinchu City, Taiwan. Established in 1987, TSMC specializes in manufacturing, packaging, and testing integrated circuits and semiconductor devices worldwide. Its products serve diverse sectors including high-performance computing, smartphones, automotive, and digital consumer electronics, supported by extensive wafer fabrication processes.

SkyWater Technology, Inc. Overview

SkyWater Technology, Inc. (SKYT), founded in 2017 and based in Bloomington, Minnesota, provides semiconductor development and manufacturing services. The company focuses on engineering and process development to co-create technologies with customers, delivering manufacturing services for silicon-based analog, mixed-signal, power discrete, and rad-hard integrated circuits. SkyWater serves industries such as aerospace, automotive, bio-health, and the Internet of Things.

Key similarities and differences

Both TSM and SkyWater operate within the semiconductor industry, offering manufacturing services and engineering support. However, TSMC is a much larger, globally recognized firm with a comprehensive product range and significant market capitalization near 1.7T USD, while SkyWater is a smaller, niche player with a market cap around 1.46B USD. TSMC serves a wider variety of end markets internationally, whereas SkyWater focuses on specialized sectors in the U.S. with a more concentrated workforce.

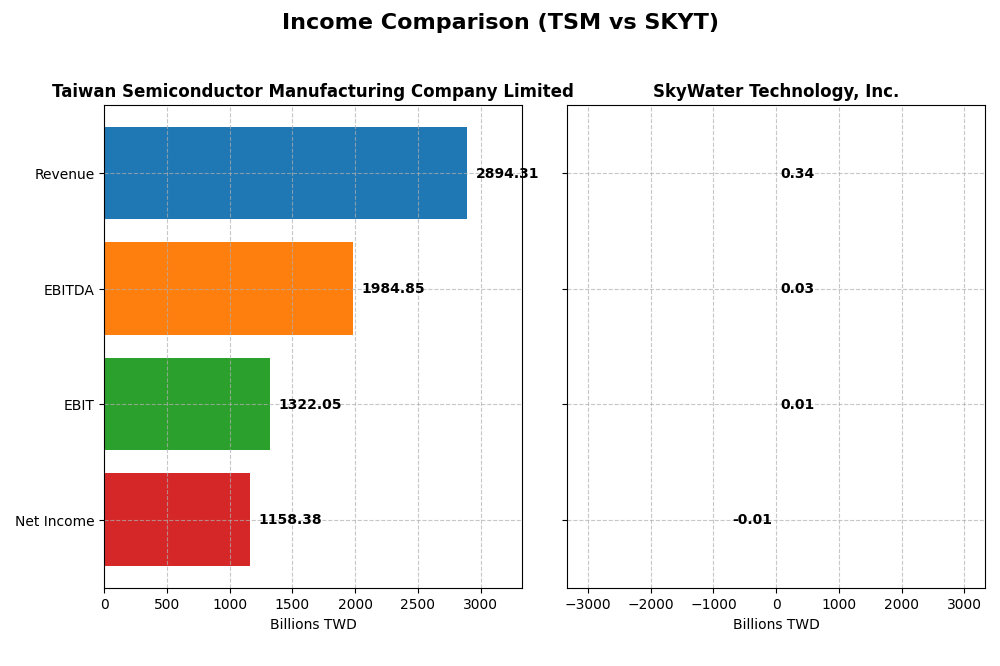

Income Statement Comparison

Below is a comparison of key income statement metrics for Taiwan Semiconductor Manufacturing Company Limited (TSM) and SkyWater Technology, Inc. (SKYT) for the fiscal year 2024.

| Metric | Taiwan Semiconductor Manufacturing Company Limited (TSM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Cap | 1.70T TWD | 1.46B USD |

| Revenue | 2.89T TWD | 342M USD |

| EBITDA | 1.98T TWD | 25M USD |

| EBIT | 1.32T TWD | 6.6M USD |

| Net Income | 1.16T TWD | -6.8M USD |

| EPS | 223.4 TWD | -0.14 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Taiwan Semiconductor Manufacturing Company Limited

TSMC’s revenue and net income demonstrated strong growth from 2020 to 2024, with revenue increasing by 116% and net income by 127%. Margins remained robust and stable, with a gross margin of 56.12% and net margin at 40.02% in 2024. The most recent year showed a significant 33.9% revenue growth and a slight net margin expansion, signaling continued operational strength.

SkyWater Technology, Inc.

SkyWater’s revenue rose steadily by 144% over five years, with net income also improving by 67%. However, its net margin remained negative at -1.98% in 2024 despite a favorable gross margin of 20.34%. The latest fiscal year saw a strong rebound in EBIT and net margin growth, reflecting improved cost control and operational leverage, though profitability is still limited.

Which one has the stronger fundamentals?

TSMC exhibits stronger fundamentals with high and stable margins, substantial net income, and consistent growth across all key metrics. SkyWater shows promising revenue growth and improving margins but continues to report net losses. Overall, TSMC’s scale, profitability, and margin stability present a more favorable income statement profile compared to SKYT’s emerging but still challenged profitability.

Financial Ratios Comparison

The following table compares the most recent key financial ratios for Taiwan Semiconductor Manufacturing Company Limited (TSM) and SkyWater Technology, Inc. (SKYT) for fiscal year 2024.

| Ratios | Taiwan Semiconductor Manufacturing Company Limited (TSM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | 27.3% | -11.8% |

| ROIC | 20.0% | 3.4% |

| P/E | 29.0 | -100.3 |

| P/B | 7.92 | 11.82 |

| Current Ratio | 2.36 | 0.86 |

| Quick Ratio | 2.14 | 0.76 |

| D/E (Debt-to-Equity) | 0.25 | 1.33 |

| Debt-to-Assets | 15.6% | 24.5% |

| Interest Coverage | 126.0 | 0.74 |

| Asset Turnover | 0.43 | 1.09 |

| Fixed Asset Turnover | 0.88 | 2.07 |

| Payout ratio | 31.3% | 0 |

| Dividend yield | 1.08% | 0 |

Interpretation of the Ratios

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company Limited shows predominantly strong financial ratios, with favorable net margin (40.02%), return on equity (27.29%), and return on invested capital (20.0%). However, valuation metrics like PE (29.04) and PB (7.92) appear elevated, which may warrant caution. The company pays dividends, with a modest 1.08% yield and a balanced payout supported by free cash flow, posing limited distribution risk.

SkyWater Technology, Inc.

SkyWater Technology, Inc. exhibits weak financial ratios, including a negative net margin (-1.98%) and return on equity (-11.79%), alongside unfavorable liquidity metrics such as current (0.86) and quick ratios (0.76). The company does not pay dividends, reflecting its loss-making status and focus on reinvestment and growth. Elevated debt levels and low interest coverage highlight financial vulnerability.

Which one has the best ratios?

Taiwan Semiconductor Manufacturing Company Limited presents a more favorable ratio profile with strong profitability, solid liquidity, and manageable debt, despite some expensive valuation indicators. SkyWater Technology, Inc. faces significant challenges with negative profitability, weak liquidity, and high leverage, resulting in an overall unfavorable financial standing in comparison.

Strategic Positioning

This section compares the strategic positioning of TSM and SKYT including Market position, Key segments, and disruption:

Taiwan Semiconductor Manufacturing Company Limited (TSM)

- Leading global semiconductor manufacturer facing significant competitive pressure from top industry players.

- Dominates wafer fabrication with diversified products used in computing, smartphones, automotive, and consumer electronics.

- Exposure driven by rapid technological advancements in wafer processes and integration technologies globally.

SkyWater Technology, Inc. (SKYT)

- Smaller-scale semiconductor developer with higher beta, operating under intense competitive pressure in niche markets.

- Focuses on semiconductor development and manufacturing services for analog, mixed-signal, aerospace, defense, and bio-health sectors.

- Faces disruption risks tied to evolving semiconductor manufacturing technologies and specialized customer demands.

TSM vs SKYT Positioning

TSM pursues a diversified strategy with a broad product portfolio and global reach, benefiting from scale but exposed to intense competition. SKYT adopts a more concentrated approach targeting niche segments, which limits scale but offers specialized market exposure and growth potential.

Which has the best competitive advantage?

TSM demonstrates a slightly favorable moat with consistent value creation despite declining profitability, indicating a stronger competitive advantage than SKYT, which shows a slightly unfavorable moat with value destruction but improving profitability.

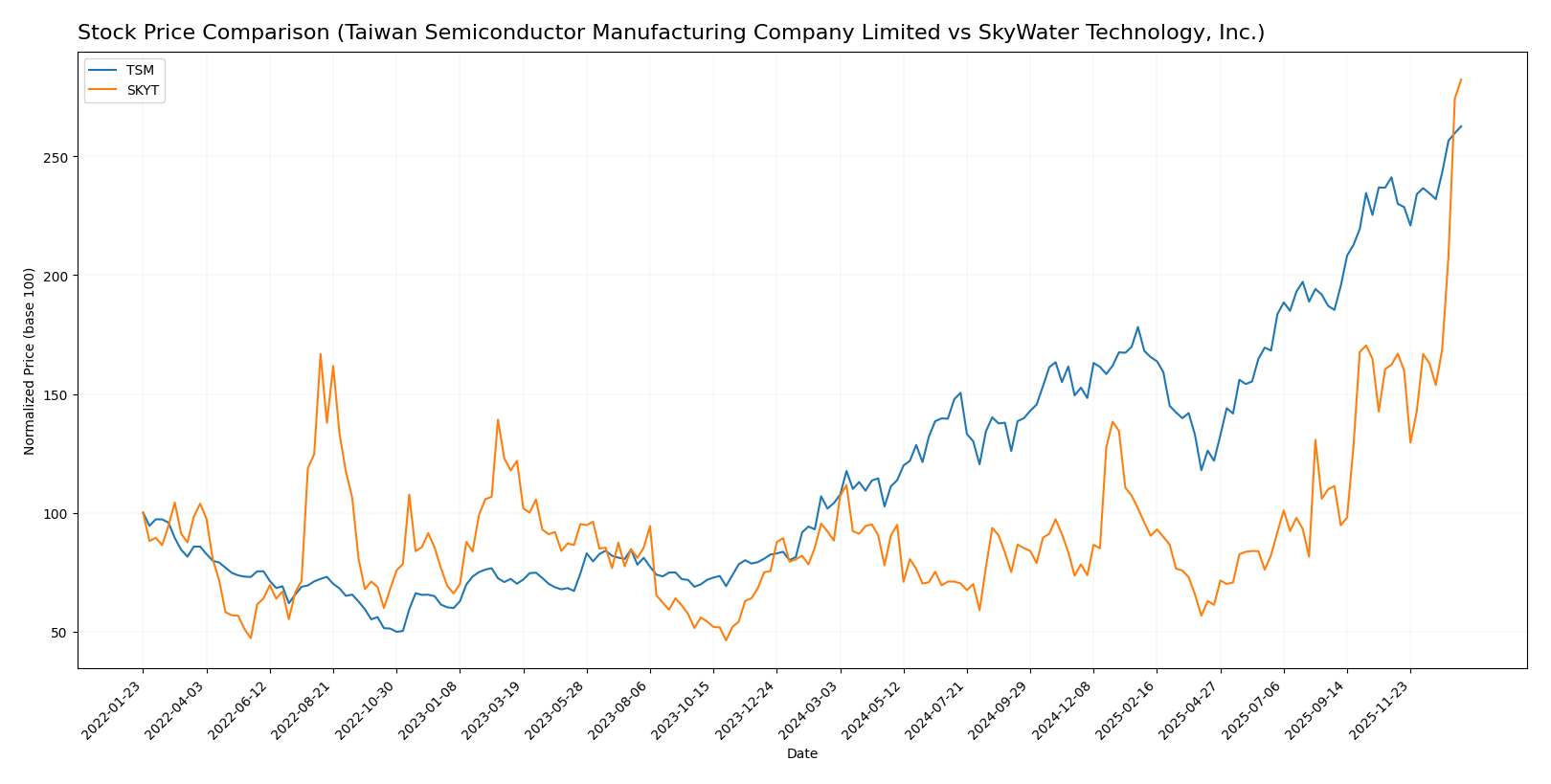

Stock Comparison

The stock price dynamics over the past 12 months reveal strong bullish trends for both Taiwan Semiconductor Manufacturing Company Limited (TSM) and SkyWater Technology, Inc. (SKYT), with notable acceleration and contrasting volume behaviors.

Trend Analysis

Taiwan Semiconductor Manufacturing Company Limited (TSM) exhibited a 152.54% price increase over the past year, confirming a bullish trend with accelerating momentum. Its price oscillated between 127.7 and 327.11, with a high volatility of 51.25 standard deviation.

SkyWater Technology, Inc. (SKYT) showed an even stronger bullish trend with a 220.08% price increase over the same period and accelerating growth. Price ranged from 6.1 to 30.44, with lower volatility at 4.34 standard deviation.

Comparing the two, SKYT delivered the highest market performance with a 220.08% gain versus TSM’s 152.54%, reflecting a more pronounced bullish acceleration during the past 12 months.

Target Prices

The current analyst consensus reveals promising upside potential for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Taiwan Semiconductor Manufacturing Company Limited | 400 | 330 | 361.25 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Taiwan Semiconductor’s consensus target of 361.25 exceeds its current price of 327.11, indicating moderate upside. SkyWater’s fixed target at 25 is below its current price of 30.44, suggesting a potential overvaluation or caution among analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Taiwan Semiconductor Manufacturing Company Limited (TSM) and SkyWater Technology, Inc. (SKYT):

Rating Comparison

TSM Rating

- Rating: A-, considered very favorable overall.

- Discounted Cash Flow Score: 5, indicating very favorable valuation potential.

- ROE Score: 5, showing very efficient profit generation from equity.

- ROA Score: 5, demonstrating very effective asset utilization.

- Debt To Equity Score: 3, reflecting a moderate level of financial risk.

- Overall Score: 4, classified as favorable overall financial standing.

SKYT Rating

- Rating: B+, also considered very favorable overall.

- Discounted Cash Flow Score: 1, indicating very unfavorable valuation potential.

- ROE Score: 5, also showing very efficient profit generation from equity.

- ROA Score: 5, equally demonstrating very effective asset utilization.

- Debt To Equity Score: 1, indicating very unfavorable financial risk.

- Overall Score: 3, classified as moderate overall financial standing.

Which one is the best rated?

Based on the provided data, TSM holds a higher overall rating (A-) and superior discounted cash flow and debt-to-equity scores than SKYT. While both have strong ROE and ROA scores, TSM’s more balanced financial risk profile leads to a better overall rating.

Scores Comparison

Here is a comparison of the key financial scores for TSM and SKYT:

TSM Scores

- Altman Z-Score: 2.94, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 8, very strong financial health suggesting good investment value.

SKYT Scores

- Altman Z-Score: 1.63, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 5, average financial strength, indicating moderate investment potential.

Which company has the best scores?

TSM has better scores with a grey zone Altman Z-Score and a very strong Piotroski Score, compared to SKYT’s distress zone Z-Score and average Piotroski Score. This indicates relatively stronger financial health for TSM based on the provided data.

Grades Comparison

Here is a detailed comparison of the latest grades for Taiwan Semiconductor Manufacturing Company Limited and SkyWater Technology, Inc.:

Taiwan Semiconductor Manufacturing Company Limited Grades

The following table summarizes recent grades from notable grading companies for TSM:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2025-12-08 |

| Needham | Maintain | Buy | 2025-10-27 |

| Barclays | Maintain | Overweight | 2025-10-17 |

| Needham | Maintain | Buy | 2025-10-16 |

| Susquehanna | Maintain | Positive | 2025-10-10 |

| Barclays | Maintain | Overweight | 2025-10-09 |

| Barclays | Maintain | Overweight | 2025-09-16 |

| Needham | Maintain | Buy | 2025-07-17 |

| Susquehanna | Maintain | Positive | 2025-07-14 |

| Needham | Maintain | Buy | 2025-07-01 |

Overall, TSM’s grades consistently indicate a positive outlook with repeated Buy, Outperform, and Overweight ratings from multiple reputable firms.

SkyWater Technology, Inc. Grades

Below is the recent grading data for SKYT from recognized grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

The grades for SKYT also show a stable positive consensus, with repeated Buy and Overweight ratings from multiple respected analysts.

Which company has the best grades?

Both TSM and SKYT have received predominantly Buy and Overweight ratings from credible grading companies, reflecting positive sentiment. However, TSM has a larger volume of ratings and includes an Outperform grade, suggesting a slightly stronger consensus. This may indicate more robust analyst confidence in TSM, which could influence investor perception of relative stability and growth potential.

Strengths and Weaknesses

Below is a comparative overview of Taiwan Semiconductor Manufacturing Company Limited (TSM) and SkyWater Technology, Inc. (SKYT) based on key investment criteria.

| Criterion | Taiwan Semiconductor Manufacturing Company Limited (TSM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | High revenue concentration in wafer production (~1.99T TWD in 2024) with some other products (~380B TWD) | More diversified in advanced technology services and wafer services, but smaller scale (largest segment ~93M USD) |

| Profitability | Strong profitability: Net margin 40.02%, ROE 27.29%, ROIC 20.0%, creating value with slight decline in ROIC trend | Negative net margin (-1.98%), negative ROE (-11.79%), ROIC 3.4% below WACC; currently shedding value but improving ROIC |

| Innovation | Industry leader with consistent high returns and technological edge in semiconductor manufacturing | Smaller player with growing ROIC, investing in advanced technology services, but profitability challenges remain |

| Global presence | Global leader in semiconductor foundry with extensive international client base | More regional focus, limited global footprint compared to TSM |

| Market Share | Dominant market share in semiconductor wafer production worldwide | Niche market player with limited market share |

Key takeaways: TSM excels with strong profitability, global reach, and dominant market share, though ROIC trends show some decline. SKYT shows potential with improving profitability metrics and diversification but currently faces financial challenges and smaller scale. Investors should weigh TSM’s established strength against SKYT’s growth opportunities and risks.

Risk Analysis

Below is a comparative risk assessment table for Taiwan Semiconductor Manufacturing Company Limited (TSM) and SkyWater Technology, Inc. (SKYT) based on the most recent financial year 2024.

| Metric | Taiwan Semiconductor Manufacturing Company Limited (TSM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Moderate (Beta 1.27, large market cap 1.7T USD) | High (Beta 3.49, market cap 1.46B USD) |

| Debt Level | Low (Debt-to-Equity 0.25, Debt-to-Assets 15.65%) | High (Debt-to-Equity 1.33, Debt-to-Assets 24.46%) |

| Regulatory Risk | Medium (Global operations, subject to Taiwan-China-US tensions) | Medium (US-based, aerospace and defense sectors) |

| Operational Risk | Moderate (Large scale manufacturing, complex supply chains) | High (Smaller scale, reliance on niche markets) |

| Environmental Risk | Moderate (Manufacturing impact, compliance with global standards) | Moderate (Manufacturing footprint, emerging compliance) |

| Geopolitical Risk | High (Taiwan geopolitical tensions impacting supply chain) | Moderate (US market exposure, less geopolitical sensitivity) |

TSM faces significant geopolitical risk due to Taiwan’s strategic location and tensions, which is the most impactful concern. SKYT’s high debt level and operational risk pose considerable financial vulnerabilities, while its market risk is elevated due to volatility. Investors should weigh geopolitical stability for TSM and financial leverage for SKYT carefully.

Which Stock to Choose?

Taiwan Semiconductor Manufacturing Company Limited (TSM) shows strong income growth with a 33.89% revenue increase in 2024 and favorable profitability metrics, including a 40.02% net margin and a high return on equity of 27.29%. Its financial ratios are mostly favorable, with low debt and a solid current ratio of 2.36, supported by a very favorable A- rating and a slightly favorable economic moat despite a declining ROIC trend.

SkyWater Technology, Inc. (SKYT) presents positive revenue growth of 19.39% in 2024 but struggles with profitability, reporting a negative net margin of -1.98% and a negative return on equity of -11.79%. The company’s financial ratios are largely unfavorable, including a high debt-to-equity ratio of 1.33 and weak liquidity, though it holds a very favorable B+ rating and a slightly unfavorable moat with improving ROIC.

Investors with a risk-tolerant profile and an interest in growth might find SKYT’s accelerating stock price and improving profitability attractive despite its financial weaknesses, while those prioritizing financial stability and strong profitability could view TSM’s consistent value creation and favorable ratios as more aligned with a quality or value investing approach.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Taiwan Semiconductor Manufacturing Company Limited and SkyWater Technology, Inc. to enhance your investment decisions: