In the fast-evolving semiconductor industry, SkyWater Technology, Inc. and indie Semiconductor, Inc. stand out with distinct but overlapping focuses on innovation and market reach. SkyWater specializes in custom silicon manufacturing and development services, while indie Semiconductor targets automotive semiconductors and software solutions. This comparison explores their strategic positioning and growth potential to help you decide which company deserves a place in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between SkyWater Technology, Inc. and indie Semiconductor, Inc. by providing an overview of these two companies and their main differences.

SkyWater Technology, Inc. Overview

SkyWater Technology, Inc. provides semiconductor development and manufacturing services, focusing on co-creating technologies with customers. It serves diverse industries including aerospace and defense, automotive, bio-health, consumer, and industrial IoT. Founded in 2017, SkyWater is positioned as a specialized provider of silicon-based analog, mixed-signal, power discrete, MEMS, and rad-hard integrated circuits, headquartered in Bloomington, Minnesota.

indie Semiconductor, Inc. Overview

indie Semiconductor, Inc. delivers automotive semiconductors and software solutions for advanced driver assistance, connectivity, user experience, and electrification applications. The company’s products include devices for parking assistance, wireless charging, infotainment, and telematics, alongside photonic components for optical sensing and communication markets. Established in 2007, indie Semiconductor is headquartered in Aliso Viejo, California, focusing on automotive innovation.

Key similarities and differences

Both companies operate in the semiconductor industry within the technology sector and are listed on NASDAQ. SkyWater emphasizes semiconductor manufacturing services with a broad industry reach, while indie Semiconductor concentrates on automotive-specific semiconductors and software solutions. SkyWater’s business model centers on process development and manufacturing, whereas indie Semiconductor integrates hardware and software focused on automotive applications, reflecting different market specializations and customer bases.

Income Statement Comparison

The table below compares the key income statement metrics for SkyWater Technology, Inc. and indie Semiconductor, Inc. based on their most recent fiscal year data for 2024.

| Metric | SkyWater Technology, Inc. (SKYT) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Cap | 1.58B | 883M |

| Revenue | 342M | 217M |

| EBITDA | 25.3M | -93.9M |

| EBIT | 6.56M | -137M |

| Net Income | -6.79M | -133M |

| EPS | -0.14 | -0.76 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

SkyWater Technology, Inc.

SkyWater Technology’s revenue increased consistently from 140M in 2020 to 342M in 2024, with net income losses narrowing from -20.6M to -6.8M. Gross margin improved to 20.3%, supporting moderate operating margins. In 2024, revenue growth accelerated by 19%, with a significant 144% EBIT increase, reflecting improving operational efficiency and margin expansion despite continued net losses.

indie Semiconductor, Inc.

indie Semiconductor’s revenue surged dramatically from 23M in 2020 to 217M in 2024 but declined slightly by 2.9% in the latest year. Gross margin remained strong at 41.7%, yet EBIT margins stayed deeply negative at -63.2%, reflecting heavy operating expenses. The 2024 net loss of 133M indicates persistent profitability challenges despite improved EPS growth of 6.2%.

Which one has the stronger fundamentals?

SkyWater demonstrates stronger fundamentals with favorable overall income statement trends including solid revenue and margin growth, and significant improvements in EBIT and net margin. indie Semiconductor shows impressive revenue scale but struggles with deep net losses and unfavorable EBIT margins. SkyWater’s more balanced profitability trajectory contrasts with indie’s persistent negative earnings and margin pressures.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for SkyWater Technology, Inc. (SKYT) and indie Semiconductor, Inc. (INDI) for the fiscal year 2024, offering insight into their operational efficiency, profitability, liquidity, and leverage.

| Ratios | SkyWater Technology, Inc. (SKYT) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | -11.79% | -31.73% |

| ROIC | 3.40% | -19.25% |

| P/E | -100.26 | -5.35 |

| P/B | 11.82 | 1.70 |

| Current Ratio | 0.86 | 4.82 |

| Quick Ratio | 0.76 | 4.23 |

| D/E (Debt-to-Equity) | 1.33 | 0.95 |

| Debt-to-Assets | 24.46% | 42.34% |

| Interest Coverage | 0.74 | -18.37 |

| Asset Turnover | 1.09 | 0.23 |

| Fixed Asset Turnover | 2.07 | 4.30 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

SkyWater Technology, Inc.

SkyWater Technology exhibits mostly unfavorable financial ratios, including negative net margin (-1.98%) and return on equity (-11.79%), alongside a weak current ratio (0.86) and interest coverage (0.74). However, it shows favorable asset turnover (1.09) and a low debt-to-assets ratio (24.46%). The company does not pay dividends, likely prioritizing reinvestment and growth given its financial challenges.

indie Semiconductor, Inc.

indie Semiconductor’s ratios reveal significant weaknesses such as a steep negative net margin (-61.2%), poor return on equity (-31.73%), and negative interest coverage (-14.8). It benefits from a strong quick ratio (4.23) and high fixed asset turnover (4.3). The firm also does not pay dividends, presumably focusing on R&D and growth in a high-investment phase amid losses.

Which one has the best ratios?

Both companies face considerable financial challenges with predominantly unfavorable ratios. SkyWater shows slightly better leverage and asset efficiency metrics, whereas indie Semiconductor has a stronger quick ratio and fixed asset turnover. Overall, their financial profiles reflect high risk and ongoing operational struggles, with neither demonstrating a clearly superior ratio set.

Strategic Positioning

This section compares the strategic positioning of SkyWater Technology, Inc. and indie Semiconductor, Inc. in terms of Market position, Key segments, and Exposure to technological disruption:

SkyWater Technology, Inc.

- Mid-sized semiconductor provider facing significant competitive pressure in multiple tech sectors.

- Key revenue from advanced technology services and wafer manufacturing across diverse industries.

- Exposure includes semiconductor process innovation and mixed-signal integrated circuits development.

indie Semiconductor, Inc.

- Smaller semiconductor firm with competitive challenges in automotive-focused niche markets.

- Revenue driven mainly by product sales and services in automotive semiconductor and software.

- Focused on automotive semiconductors and photonic components, sensitive to automotive tech shifts.

SkyWater Technology, Inc. vs indie Semiconductor, Inc. Positioning

SkyWater exhibits a diversified business model spanning multiple industries, benefiting from various revenue streams. indie Semiconductor concentrates on automotive semiconductors and software, which may limit market breadth but allows focused innovation. Diversification offers risk mitigation; concentration may drive specialization advantages.

Which has the best competitive advantage?

Both companies are currently value destroyers, but SkyWater shows improving profitability trends while indie Semiconductor faces declining returns. SkyWater’s growing ROIC trend suggests a comparatively stronger ability to sustain competitive advantage despite current challenges.

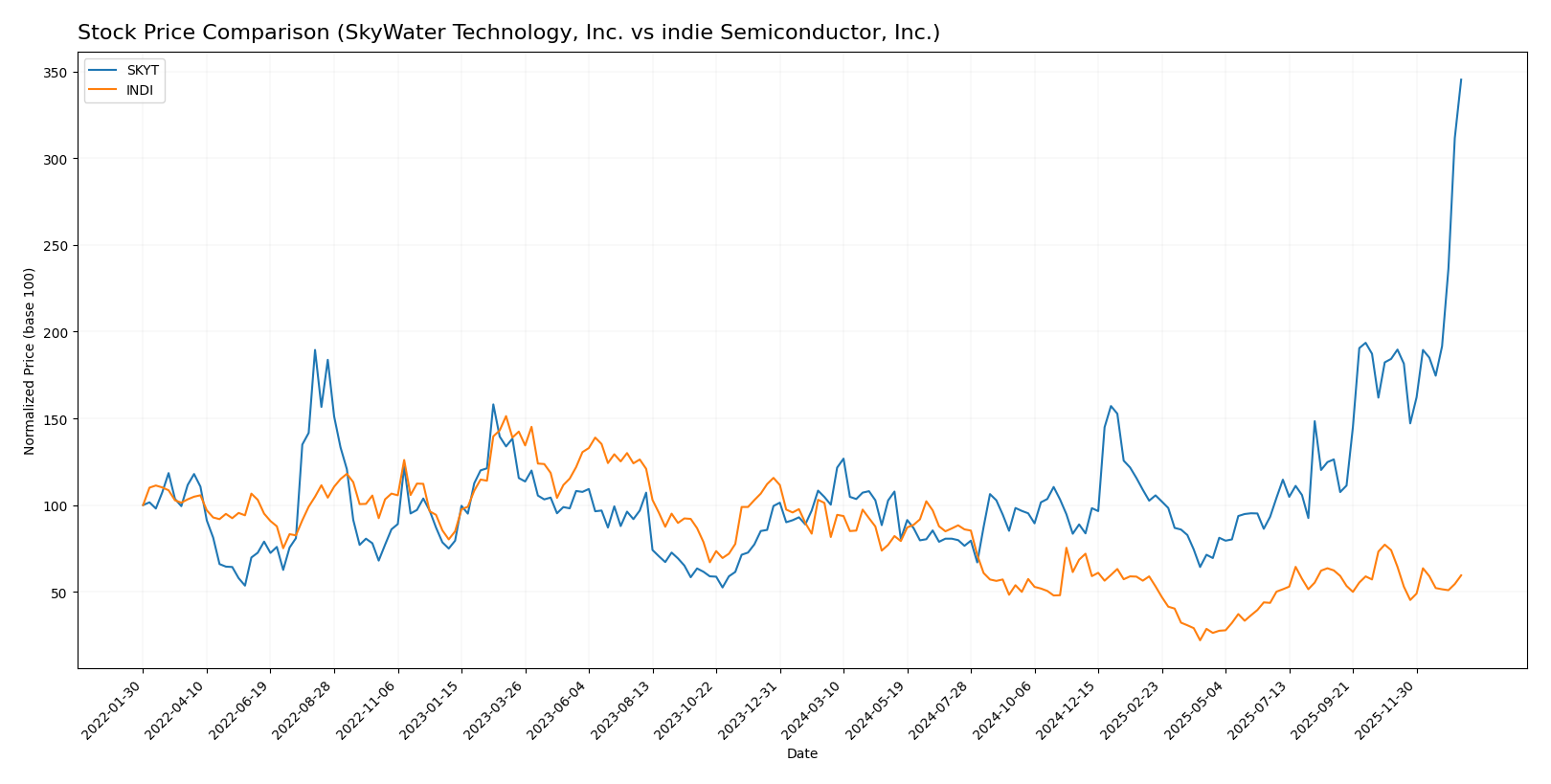

Stock Comparison

The stock prices of SkyWater Technology, Inc. and indie Semiconductor, Inc. have exhibited contrasting dynamics over the past year, with significant divergence in performance and trading activity.

Trend Analysis

SkyWater Technology, Inc. showed a strong bullish trend over the past year with a 244.62% price increase, marked by acceleration and a high volatility level (std. dev. 4.45). Prices ranged from 6.1 to 32.77, reflecting substantial gains.

indie Semiconductor, Inc. experienced a bearish trend, declining 27.09% over the same period with deceleration and lower volatility (std. dev. 1.35). The stock fluctuated between 1.6 and 7.43, indicating subdued market interest.

Comparing both, SkyWater Technology, Inc. delivered the highest market performance with significant price appreciation, while indie Semiconductor, Inc. showed sustained weakness and downward momentum.

Target Prices

The current analyst consensus presents clear target prices for both companies, indicating focused expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| SkyWater Technology, Inc. | 25 | 25 | 25 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

Analysts set a target of $25 for SkyWater Technology, which is below its current price of $33.03, suggesting potential downside. indie Semiconductor’s target of $8 is nearly double its current price of $4.36, indicating expected growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for SkyWater Technology, Inc. and indie Semiconductor, Inc.:

Rating Comparison

SkyWater Technology, Inc. Rating

- Rating: B+, evaluated as Very Favorable overall.

- Discounted Cash Flow Score: 1, Very Unfavorable.

- ROE Score: 5, Very Favorable, indicating strong profit generation from equity.

- ROA Score: 5, Very Favorable, showing excellent asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk.

- Overall Score: 3, Moderate overall financial standing.

indie Semiconductor, Inc. Rating

- Rating: C-, evaluated as Very Favorable overall.

- Discounted Cash Flow Score: 1, Very Unfavorable.

- ROE Score: 1, Very Unfavorable, indicating weak profit generation.

- ROA Score: 1, Very Unfavorable, showing poor asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk.

- Overall Score: 1, Very Unfavorable overall financial standing.

Which one is the best rated?

Based strictly on provided data, SkyWater Technology holds a higher rating (B+) and better profitability scores (ROE and ROA) compared to indie Semiconductor’s lower rating (C-) and weaker financial scores. SkyWater’s overall score is also notably stronger.

Scores Comparison

The following table presents a comparison of the Altman Z-Score and Piotroski Score for SkyWater Technology, Inc. and indie Semiconductor, Inc.:

SKYT Scores

- Altman Z-Score: 2.20, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 5, classified as average financial strength.

INDI Scores

- Altman Z-Score: 0.12, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial strength.

Which company has the best scores?

Based on the provided data, SkyWater Technology, Inc. shows stronger financial health with a higher Altman Z-Score in the grey zone and an average Piotroski Score, compared to indie Semiconductor, Inc., which is in the distress zone with a very weak Piotroski Score.

Grades Comparison

Here is the comparison of recent and reliable grading data for SkyWater Technology, Inc. and indie Semiconductor, Inc.:

SkyWater Technology, Inc. Grades

This table summarizes recent grades assigned by recognized grading companies for SkyWater Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology’s grades show a consistent buy or overweight rating without downgrades from major firms, reflecting stable positive sentiment.

indie Semiconductor, Inc. Grades

This table summarizes recent grades assigned by recognized grading companies for indie Semiconductor, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

indie Semiconductor presents mostly buy or overweight grades from multiple firms, with a single neutral rating by UBS, indicating generally favorable but slightly more varied analyst opinions.

Which company has the best grades?

Both companies have a consensus “Buy” rating, but SkyWater Technology, Inc. has a more uniformly positive grade history with no neutral ratings, suggesting somewhat stronger analyst confidence. This consistency may influence investor perception of reliability in future performance.

Strengths and Weaknesses

The table below summarizes key strengths and weaknesses of SkyWater Technology, Inc. (SKYT) and indie Semiconductor, Inc. (INDI) based on their latest financial and operational data.

| Criterion | SkyWater Technology, Inc. (SKYT) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Moderate: Mix of Advanced Technology Services and Wafer Services with growing service segments | Moderate: Primarily Products with increasing Services segment but less balanced |

| Profitability | Unfavorable: Negative net margin (-1.98%), ROIC positive but below WACC, shedding value | Unfavorable: Large negative net margin (-61.2%), declining ROIC, shedding value more severely |

| Innovation | Growing ROIC trend suggests improving operational efficiency and potential innovation gains | Declining ROIC trend indicates challenges in innovation or business execution |

| Global presence | Not explicitly strong, focused on niche semiconductor services | Similarly limited global reach, focus on semiconductor products and services |

| Market Share | Specialized niche market with moderate asset turnover (1.09) | Smaller turnover (0.23) indicates lower market efficiency or share |

In summary, both companies currently face profitability challenges and are shedding value relative to their cost of capital. SkyWater shows signs of operational improvement with a growing ROIC trend, while indie Semiconductor struggles with declining profitability and return metrics. Investors should carefully weigh these dynamics against their risk tolerance and investment horizon.

Risk Analysis

Below is a comparison of key risks for SkyWater Technology, Inc. (SKYT) and indie Semiconductor, Inc. (INDI) based on the most recent 2024 data:

| Metric | SkyWater Technology, Inc. (SKYT) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | High beta (3.49) indicates high volatility | High beta (2.54) indicates high volatility |

| Debt level | Debt-to-equity 1.33 (unfavorable), interest coverage 0.74 (weak) | Debt-to-equity 0.95 (neutral), interest coverage -14.8 (very weak) |

| Regulatory Risk | Moderate; operates in semiconductors with defense and aerospace exposure | Moderate; automotive semiconductor industry faces regulatory scrutiny |

| Operational Risk | Moderate; manufacturing complexity and innovation demands | High; highly specialized automotive tech with execution challenges |

| Environmental Risk | Moderate; semiconductor manufacturing has environmental impacts | Moderate; automotive chips linked to emissions and sustainability trends |

| Geopolitical Risk | Present; exposure to US defense and global supply chain risks | Present; global automotive supply chains and trade tensions affect business |

SkyWater’s most impactful risks are high market volatility and weak interest coverage, though it maintains moderate operational stability. indie Semiconductor shows higher operational and financial distress, with a distress-level Altman Z-score and very weak profitability scores, making its bankruptcy risk significantly higher. Investors should carefully weigh these risks against growth potential.

Which Stock to Choose?

SkyWater Technology, Inc. (SKYT) shows a favorable income evolution with 19.39% revenue growth in 2024, improving profitability but still negative net margin at -1.98%. Financial ratios mostly appear unfavorable, with weak liquidity and high debt, though asset turnover is positive. The company’s rating is very favorable (B+), and its moat evaluation is slightly unfavorable due to value destruction despite a growing ROIC.

indie Semiconductor, Inc. (INDI) exhibits mixed income results, with strong gross margin but a deeply negative net margin of -61.2%, and declining revenue in 2024. Financial ratios are predominantly unfavorable, reflecting operational challenges and high intangible assets. Ratings are very unfavorable (C-), with a very unfavorable moat status indicating ongoing value destruction and decreasing profitability.

Investors focused on improving profitability and growth might see SkyWater’s financial and rating profile as more promising, while those with a higher risk tolerance aware of indie Semiconductor’s challenges may interpret its situation differently. The contrasting income and ratio trends suggest that investment suitability could depend on individual risk profiles and strategic priorities.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of SkyWater Technology, Inc. and indie Semiconductor, Inc. to enhance your investment decisions: