In the fast-paced semiconductor industry, Taiwan Semiconductor Manufacturing Company Limited (TSM) and Silicon Laboratories Inc. (SLAB) stand out with distinct yet overlapping market roles. TSM dominates wafer fabrication with cutting-edge processes, while SLAB focuses on analog-intensive mixed-signal solutions for IoT applications. Both companies harness innovation to drive growth, making them compelling choices for investors. This article will analyze their strengths to identify the most promising investment opportunity for you.

Table of contents

Companies Overview

I will begin the comparison between Taiwan Semiconductor Manufacturing Company Limited and Silicon Laboratories Inc. by providing an overview of these two companies and their main differences.

Taiwan Semiconductor Manufacturing Company Limited Overview

Taiwan Semiconductor Manufacturing Company Limited (TSM) is a leading semiconductor manufacturer headquartered in Hsinchu City, Taiwan. Established in 1987, TSMC specializes in wafer fabrication processes, including CMOS logic, mixed-signal, and radio frequency technologies. Its products support high-performance computing, smartphones, IoT, automotive, and digital consumer electronics markets globally.

Silicon Laboratories Inc. Overview

Silicon Laboratories Inc. (SLAB), founded in 1996 and based in Austin, Texas, operates as a fabless semiconductor company. It focuses on analog-intensive mixed-signal solutions such as wireless microcontrollers and sensors. SLAB’s products are applied in IoT sectors including connected home, industrial automation, smart metering, and medical instrumentation, distributed through direct sales and independent networks.

Key similarities and differences

Both TSM and SLAB operate in the semiconductor industry and serve the IoT sector. However, TSMC functions as a wafer fabricator with a broad technology portfolio and significant global manufacturing presence, while SLAB is fabless, concentrating on analog and mixed-signal components. TSMC’s scale is substantially larger with over 65K employees compared to SLAB’s 1.9K, reflecting different business models and market positions.

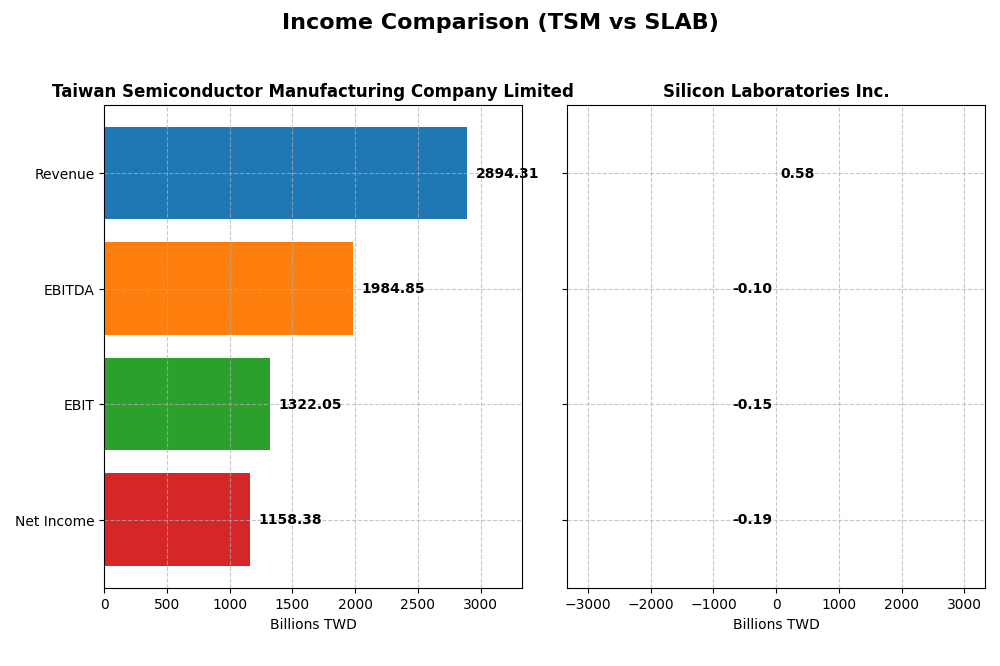

Income Statement Comparison

The following table compares the key income statement metrics for Taiwan Semiconductor Manufacturing Company Limited and Silicon Laboratories Inc. for the fiscal year 2024.

| Metric | Taiwan Semiconductor Manufacturing Company Limited | Silicon Laboratories Inc. |

|---|---|---|

| Market Cap | 1.70T TWD | 4.90B USD |

| Revenue | 2.89T TWD | 584M USD |

| EBITDA | 1.98T TWD | -105M USD |

| EBIT | 1.32T TWD | -154M USD |

| Net Income | 1.16T TWD | -191M USD |

| EPS | 223.4 TWD | -5.93 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company Limited (TSM) showed consistent revenue growth from 2020 to 2024, with revenue rising from 1.34T TWD to 2.89T TWD. Net income more than doubled, reaching 1.16T TWD in 2024. Margins remained stable, with a favorable gross margin of 56.12% and net margin around 40%. The 2024 fiscal year saw strong revenue and profit growth, with a 33.9% increase in revenue and a slight improvement in net margin.

Silicon Laboratories Inc.

Silicon Laboratories Inc. (SLAB) experienced mixed financial results between 2020 and 2024. Revenue peaked in 2022 at 1.02B USD but declined to 584M USD in 2024. Net income turned negative in 2023 and further worsened in 2024, with a net loss of 191M USD. While its gross margin remained favorable at 53.42%, its EBIT and net margins were negative, signaling profitability challenges and a 25.3% revenue decline in the latest year.

Which one has the stronger fundamentals?

TSM presents stronger fundamentals, with predominantly favorable income statement metrics, including robust revenue and net income growth, and healthy margins. Conversely, SLAB struggles with negative EBIT and net margins, declining recent revenues, and widening net losses. The overall income statement evaluation favors TSM, highlighting its stability and profitability over SLAB’s financial difficulties.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Silicon Laboratories Inc. (SLAB) based on their most recent fiscal year data.

| Ratios | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| ROE | 27.3% | -17.7% |

| ROIC | 20.0% | -18.2% |

| P/E | 29.0 | -21.5 |

| P/B | 7.92 | 3.81 |

| Current Ratio | 2.36 | 6.15 |

| Quick Ratio | 2.14 | 5.07 |

| D/E | 0.25 | 0.014 |

| Debt-to-Assets | 15.6% | 1.27% |

| Interest Coverage | 126.0 | -126.3 |

| Asset Turnover | 0.43 | 0.48 |

| Fixed Asset Turnover | 0.88 | 4.42 |

| Payout ratio | 31.3% | 0% |

| Dividend yield | 1.08% | 0% |

Interpretation of the Ratios

Taiwan Semiconductor Manufacturing Company Limited

TSM exhibits strong financial health with favorable net margin of 40.02%, ROE at 27.29%, and ROIC of 20%, indicating efficient profitability and capital use. The company maintains solid liquidity and low leverage, though high P/E and P/B ratios may raise valuation concerns. TSM pays dividends with a stable yield of 1.08%, supported by free cash flow, reflecting balanced shareholder returns without undue risk.

Silicon Laboratories Inc.

SLAB shows weak profitability metrics, including a negative net margin of -32.69% and negative returns on equity and invested capital, signaling operational challenges. Despite a low debt-to-assets ratio and a strong quick ratio, the overall financial condition is unfavorable. SLAB does not pay dividends, likely due to losses, focusing instead on reinvestment and research to support future growth.

Which one has the best ratios?

Based on the evaluations, TSM holds the best ratios with a majority of favorable metrics, strong profitability, and prudent financial management. Conversely, SLAB’s ratios reflect significant weaknesses, negative profitability, and no dividend payouts, suggesting a less robust financial position relative to TSM.

Strategic Positioning

This section compares the strategic positioning of Taiwan Semiconductor Manufacturing Company Limited (TSM) and Silicon Laboratories Inc. (SLAB) in terms of market position, key segments, and exposure to technological disruption:

TSM

- Leading semiconductor manufacturer with significant global scale and moderate beta.

- Focused on wafer fabrication and integrated circuits for computing, smartphones, IoT.

- Invests in technology startups; broad product range reduces risk from disruption.

SLAB

- Smaller fabless semiconductor firm with higher beta, operating mainly in mixed-signal.

- Specializes in analog mixed-signal solutions targeting IoT, industrial, and consumer.

- Concentrated on wireless microcontrollers and sensors, reliant on IoT growth segments.

TSM vs SLAB Positioning

TSM adopts a diversified approach with broad product lines and global manufacturing scale, providing resilience against market shifts. SLAB is more concentrated in analog and IoT segments, which may offer niche opportunities but entails higher exposure to segment-specific risks.

Which has the best competitive advantage?

TSM holds a slightly favorable moat with positive value creation despite declining profitability, indicating better capital efficiency. SLAB shows a very unfavorable moat, shedding value with steeply declining returns, reflecting weaker competitive advantage.

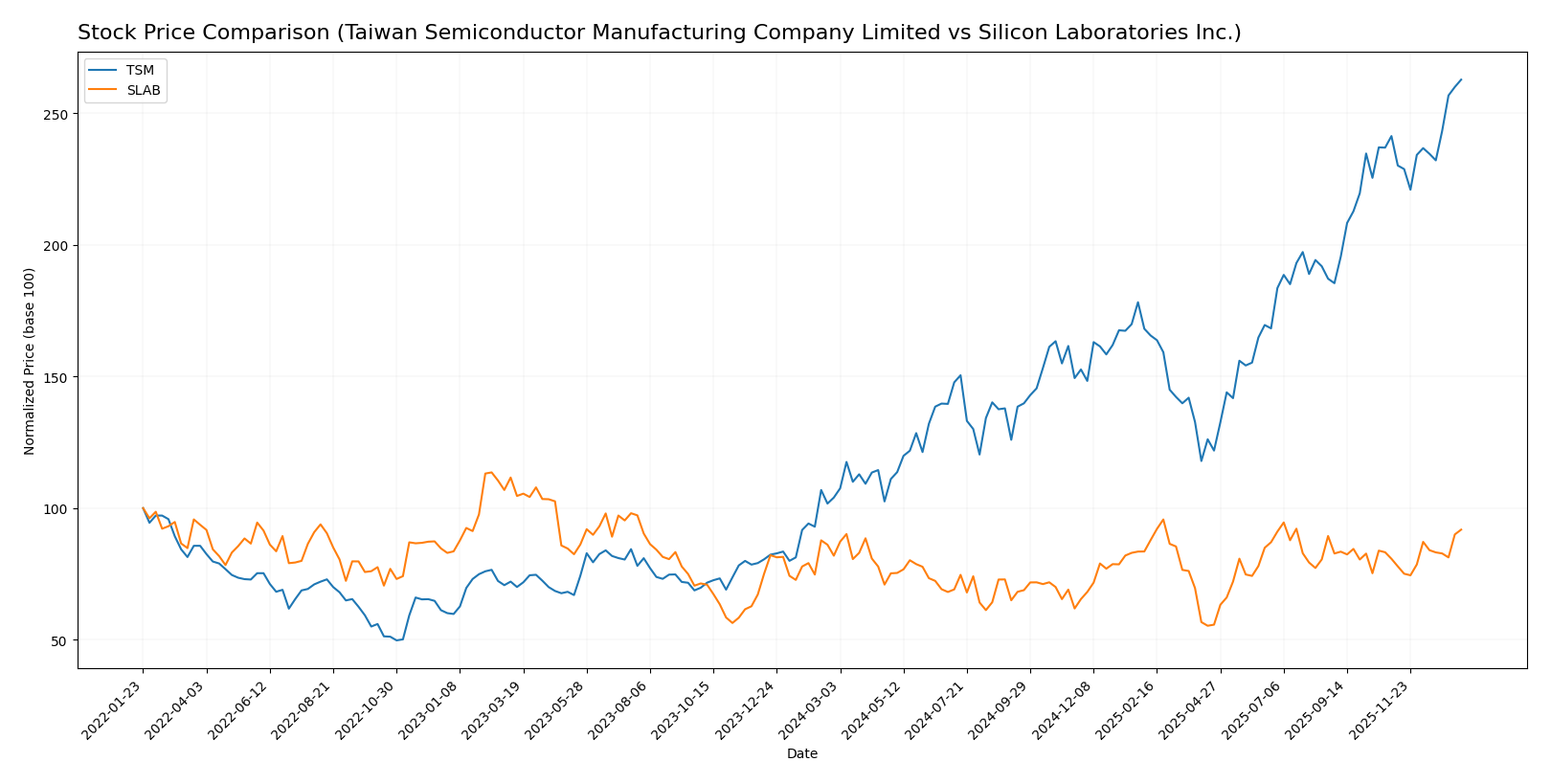

Stock Comparison

The past year shows distinct bullish trends for both Taiwan Semiconductor Manufacturing Company Limited and Silicon Laboratories Inc., with significant price growth and notable volatility in TSM’s stock, alongside differing dynamics in recent trading volumes.

Trend Analysis

Taiwan Semiconductor Manufacturing Company Limited’s stock surged 152.54% over the past 12 months, indicating a strong bullish trend with accelerating growth. The stock experienced high volatility, with prices ranging from 127.7 to 327.11, and recent gains continued with an 8.88% increase.

Silicon Laboratories Inc. showed a 12.08% price increase over the same period, confirming a bullish trend with acceleration. Its price fluctuated between 89.82 and 155.33, and recent performance improved by 13.71%, albeit with lower volatility compared to TSM.

Comparing both stocks, Taiwan Semiconductor Manufacturing Company Limited delivered the highest market performance with a substantially larger price increase, despite Silicon Laboratories’ solid gains and recent momentum.

Target Prices

Analyst consensus target prices indicate a positive outlook for both Taiwan Semiconductor Manufacturing Company Limited and Silicon Laboratories Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Taiwan Semiconductor Manufacturing Company Limited | 400 | 330 | 361.25 |

| Silicon Laboratories Inc. | 165 | 130 | 151.67 |

Target prices for TSM and SLAB suggest upside potential from their current prices of 327.11 USD and 149.05 USD, respectively, reflecting moderate optimism among analysts regarding future performance.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Silicon Laboratories Inc. (SLAB):

Rating Comparison

TSM Rating

- Rated A-, considered very favorable overall.

- Discounted Cash Flow Score of 5, indicating very favorable valuation based on future cash flows.

- Return on Equity Score of 5, showing excellent efficiency in generating profits from equity.

- Return on Assets Score of 5, reflecting very effective use of assets to generate earnings.

- Debt To Equity Score of 3, a moderate level of financial risk from debt.

- Overall Score of 4, rated favorable in financial standing.

SLAB Rating

- Rated C-, reflecting a less favorable overall assessment.

- Discounted Cash Flow Score of 2, suggesting moderate valuation concerns.

- Return on Equity Score of 1, indicating very unfavorable efficiency.

- Return on Assets Score of 1, suggesting very unfavorable asset utilization.

- Debt To Equity Score of 1, indicating very unfavorable financial stability due to high debt relative to equity.

- Overall Score of 1, considered very unfavorable financial standing.

Which one is the best rated?

Based strictly on the provided data, TSM holds a significantly stronger position with very favorable ratings across key financial metrics, whereas SLAB shows very unfavorable scores, indicating TSM is better rated by analysts.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

TSM Scores

- Altman Z-Score: 2.94, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 8, categorized as very strong financial health.

SLAB Scores

- Altman Z-Score: 15.59, in the safe zone indicating very low bankruptcy risk.

- Piotroski Score: 4, categorized as average financial health.

Which company has the best scores?

SLAB shows a significantly higher Altman Z-Score, placing it in the safe zone, while TSM is in the grey zone. Conversely, TSM has a much stronger Piotroski Score compared to SLAB’s average score.

Grades Comparison

Here is a comparison of the recent grades assigned to Taiwan Semiconductor Manufacturing Company Limited and Silicon Laboratories Inc.:

Taiwan Semiconductor Manufacturing Company Limited Grades

The following table summarizes recent grades from reputable grading companies for TSM:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2025-12-08 |

| Needham | Maintain | Buy | 2025-10-27 |

| Barclays | Maintain | Overweight | 2025-10-17 |

| Needham | Maintain | Buy | 2025-10-16 |

| Susquehanna | Maintain | Positive | 2025-10-10 |

| Barclays | Maintain | Overweight | 2025-10-09 |

| Barclays | Maintain | Overweight | 2025-09-16 |

| Needham | Maintain | Buy | 2025-07-17 |

| Susquehanna | Maintain | Positive | 2025-07-14 |

| Needham | Maintain | Buy | 2025-07-01 |

Taiwan Semiconductor shows a consistent pattern of positive ratings, primarily “Buy,” “Outperform,” and “Overweight,” with no downgrades.

Silicon Laboratories Inc. Grades

The following table shows recent grades from recognized grading firms for SLAB:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

| Susquehanna | Maintain | Neutral | 2025-08-06 |

| Barclays | Maintain | Equal Weight | 2025-08-05 |

| Susquehanna | Maintain | Neutral | 2025-07-22 |

| Stifel | Maintain | Buy | 2025-07-18 |

| Keybanc | Maintain | Overweight | 2025-07-08 |

| Benchmark | Maintain | Buy | 2025-05-27 |

| Benchmark | Maintain | Buy | 2025-05-14 |

| Susquehanna | Maintain | Neutral | 2025-05-14 |

| Needham | Maintain | Buy | 2025-05-14 |

Silicon Laboratories displays a mixture of “Buy,” “Overweight,” and “Neutral” or “Equal Weight” ratings, reflecting more moderate enthusiasm.

Which company has the best grades?

Both Taiwan Semiconductor and Silicon Laboratories have consensus ratings of “Buy,” but Taiwan Semiconductor’s grades are stronger and more consistent, leaning heavily on “Outperform” and “Overweight.” This may indicate greater confidence from analysts in its growth prospects, potentially influencing investor sentiment and portfolio decisions accordingly.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Taiwan Semiconductor Manufacturing Company Limited (TSM) and Silicon Laboratories Inc. (SLAB) based on their latest financial and operational data.

| Criterion | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| Diversification | Moderate: Mainly focused on wafer manufacturing, with other products contributing less (~380B TWD in 2024). | Low: Primarily Industrial & Commercial segment (~339M USD in 2024), limited diversification. |

| Profitability | High: Net margin 40.02%, ROIC 20%, ROE 27.29%, showing strong value creation. | Poor: Negative net margin (-32.69%), ROIC (-18.15%), and ROE (-17.69%), indicating value destruction. |

| Innovation | Strong: Leading-edge semiconductor manufacturing capacity, but ROIC trend declining. | Weak: Declining ROIC trend and overall profitability, signaling challenges in innovation or market execution. |

| Global presence | Very strong: Global leader in semiconductor foundry, with significant market share. | Moderate: Niche markets with limited global scale compared to TSM. |

| Market Share | Leading in semiconductor wafer foundry globally. | Small player in specialized segments, limited market share. |

Key takeaways: TSM exhibits strong profitability and a dominant global position despite some declining ROIC trends, indicating solid long-term value creation. Conversely, SLAB is facing significant profitability challenges and shrinking returns, suggesting higher investment risk and operational weakness.

Risk Analysis

Below is a comparative table summarizing key risks for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Silicon Laboratories Inc. (SLAB) based on the latest 2024 financial and market data:

| Metric | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| Market Risk | Moderate (Beta 1.274); exposed to semiconductor cyclicality and global demand shifts | Higher (Beta 1.545); volatile due to smaller market cap and niche IoT focus |

| Debt level | Low (Debt/Equity 0.25; Debt to Assets 15.65%); strong interest coverage | Very low debt (Debt/Equity 0.01; Debt to Assets 1.27%); limited financial leverage |

| Regulatory Risk | Elevated due to geopolitical tensions involving Taiwan, impacting supply chains | Moderate; US-based but exposed to international trade policies |

| Operational Risk | Medium; complexity of advanced semiconductor manufacturing, supply chain dependencies | Higher; smaller scale operations and reliance on innovation and product cycles |

| Environmental Risk | Moderate; industry pressure for sustainability in semiconductor fabrication | Moderate; fabless model reduces direct environmental footprint |

| Geopolitical Risk | High; Taiwan’s political situation and China-US relations pose significant uncertainty | Moderate; US operations but global sales subject to trade tensions |

In synthesis, Taiwan Semiconductor faces the most impactful risks from geopolitical tensions affecting Taiwan and the semiconductor supply chain, which could disrupt operations despite its solid financial footing. Silicon Laboratories, while financially stable with low debt, encounters higher market volatility and operational risks linked to its niche technology products and smaller scale. Investors should weigh geopolitical and market risks carefully with each company’s financial resilience.

Which Stock to Choose?

Taiwan Semiconductor Manufacturing Company Limited (TSM) shows strong income growth with a 33.89% revenue increase in 2024 and favorable profitability metrics, including a 40.02% net margin and 27.29% ROE. Its debt levels are low, and its financial ratios are predominantly favorable, supporting a very favorable A- rating.

Silicon Laboratories Inc. (SLAB) exhibits declining income with a 25.29% revenue drop in 2024 and negative profitability indicators, such as a -32.69% net margin and -17.69% ROE. Despite low debt, most financial ratios are unfavorable, reflected in a very unfavorable C- rating.

Considering the ratings and comprehensive financial evaluations, TSM could appear more favorable for investors prioritizing stability and quality, while SLAB might be of interest to those with a higher risk tolerance seeking potential turnaround opportunities.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Taiwan Semiconductor Manufacturing Company Limited and Silicon Laboratories Inc. to enhance your investment decisions: