Home > Comparison > Technology > SWKS vs SLAB

The strategic rivalry between Skyworks Solutions, Inc. and Silicon Laboratories Inc. shapes the semiconductor industry’s evolution. Skyworks operates as a diversified semiconductor manufacturer with a broad product portfolio serving multiple markets. In contrast, Silicon Labs focuses on fabless, analog-intensive mixed-signal solutions tailored to IoT applications. This head-to-head pits scale and breadth against niche specialization. This analysis aims to identify which company offers a superior risk-adjusted return for a diversified portfolio.

Table of contents

Companies Overview

Skyworks Solutions and Silicon Laboratories stand as pivotal players shaping the semiconductor sector’s competitive landscape.

Skyworks Solutions, Inc.: Semiconductor Innovator with Broad Market Reach

Skyworks Solutions, Inc. leads as a semiconductor product designer and manufacturer with a diverse portfolio including amplifiers, front-end modules, and voltage regulators. It generates revenue primarily through proprietary semiconductor sales across aerospace, automotive, and consumer electronics markets. In 2026, Skyworks focuses strategically on expanding global reach and enhancing product integration for connected devices.

Silicon Laboratories Inc.: Fabless Pioneer in Mixed-Signal Solutions

Silicon Laboratories Inc. operates as a fabless semiconductor firm specializing in analog-intensive mixed-signal solutions, including wireless microcontrollers and sensors. Its revenue stems from supplying IoT applications such as smart homes, industrial automation, and medical devices. The company’s 2026 strategy centers on deepening IoT market penetration and advancing wireless connectivity technologies.

Strategic Collision: Similarities & Divergences

Both companies excel in semiconductors but differ fundamentally: Skyworks’s broad hardware manufacturing contrasts with Silicon Labs’ fabless, focused approach. They compete chiefly in the IoT and connected device arena, where integration and wireless innovation drive market share. Skyworks appeals with scale and diversity; Silicon Labs with specialization and agility, defining distinct investment profiles.

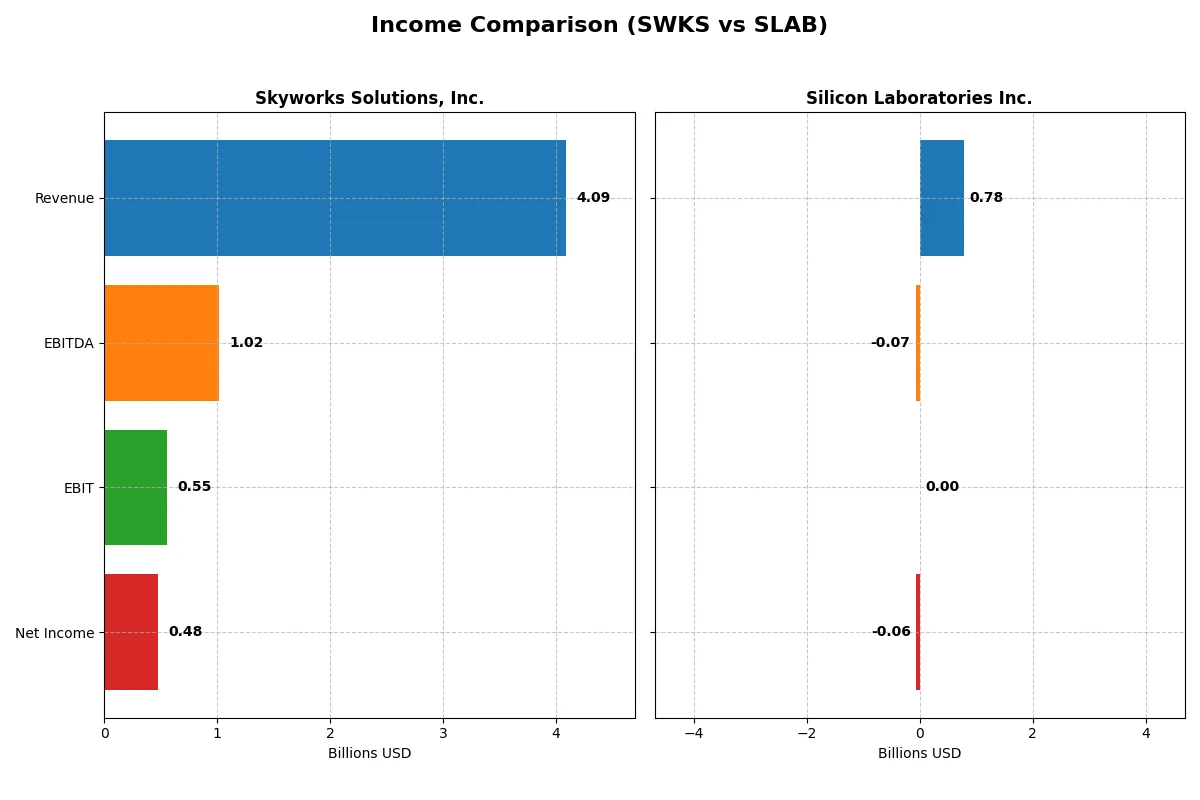

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Skyworks Solutions, Inc. (SWKS) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| Revenue | 4.09B | 784.8M |

| Cost of Revenue | 2.40B | 327.8M |

| Operating Expenses | 1.18B | 527.5M |

| Gross Profit | 1.68B | 457.0M |

| EBITDA | 1.02B | -70.5M |

| EBIT | 554M | 0 |

| Interest Expense | 27.1M | -975K |

| Net Income | 477.1M | -64.9M |

| EPS | 3.09 | -1.98 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes which company drives greater efficiency and profitability in a competitive semiconductor environment.

Skyworks Solutions, Inc. Analysis

Skyworks’ revenue declined from 5.1B in 2021 to 4.1B in 2025, with net income shrinking sharply from 1.5B to 477M. Its gross margin remains solid at 41.2%, while net margin holds at a respectable 11.7%, though both margins and earnings fell significantly in the latest year, signaling pressure on profitability and efficiency.

Silicon Laboratories Inc. Analysis

Silicon Labs increased revenue from 721M in 2021 to 785M in 2025, showing 34% growth last year. Despite a healthy 58.2% gross margin, it posted a net loss of 65M in 2025, though this marks improved momentum from prior years’ deeper losses. The company’s operating expenses rose in line with revenue growth, reflecting its investment-heavy phase.

Profitability Stability vs. Growth Recovery

Skyworks dominates in absolute profits and margin stability but suffers from declining revenue and shrinking net income over five years. Silicon Labs shows strong recent revenue and gross profit growth but struggles to translate this into consistent net profitability. For investors, Skyworks offers steady margin resilience, while Silicon Labs presents a turnaround profile with growth potential yet elevated risk.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Skyworks Solutions, Inc. (SWKS) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| ROE | 8.3% | 0% |

| ROIC | 6.4% | 0% |

| P/E | 24.95 | -66.51 |

| P/B | 2.07 | 0 |

| Current Ratio | 2.33 | 0 |

| Quick Ratio | 1.76 | 0 |

| D/E | 0.21 | 0 |

| Debt-to-Assets | 15.2% | 0 |

| Interest Coverage | 18.45 | 72.35 |

| Asset Turnover | 0.52 | 0 |

| Fixed Asset Turnover | 2.95 | 0 |

| Payout Ratio | 90.7% | 0 |

| Dividend Yield | 3.63% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, unveiling hidden risks and operational strengths crucial for investment decisions.

Skyworks Solutions, Inc.

Skyworks displays solid profitability with an 8.29% ROE and favorable 11.67% net margin, signaling operational efficiency. Its P/E ratio of 24.95 is neutral, indicating a fairly valued stock. The company rewards shareholders with a 3.63% dividend yield, balancing income distribution and reinvestment into R&D.

Silicon Laboratories Inc.

Silicon Labs struggles with negative net margin (-8.27%) and zero ROE, reflecting profitability challenges. Despite a favorable negative P/E ratio, its financial health is weak with no dividend and unfavorable liquidity ratios. The firm heavily invests in R&D, aiming for growth amid operational stress.

Balanced Profitability vs. Growth Risk

Skyworks offers a more balanced risk-reward profile with consistent profitability and shareholder returns. Silicon Labs presents higher operational risk but potential upside through intensive R&D. Conservative investors may prefer Skyworks’ stability, while growth seekers might tolerate Silicon Labs’ volatility.

Which one offers the Superior Shareholder Reward?

Skyworks Solutions, Inc. (SWKS) delivers a superior shareholder reward compared to Silicon Laboratories Inc. (SLAB). SWKS offers a 3.63% dividend yield with a high payout ratio of 90.7%, backed by strong free cash flow coverage (85%). It also runs a consistent buyback program, enhancing total returns. SLAB pays no dividends and struggles with profitability, posting negative net margins and free cash flow. Its reinvestment focus on R&D and growth is high-risk given recent losses. Historically in tech, stable dividends combined with buybacks like SWKS’s create sustainable, long-term value. I favor SWKS’s balanced distribution and cash flow strength for 2026 total return.

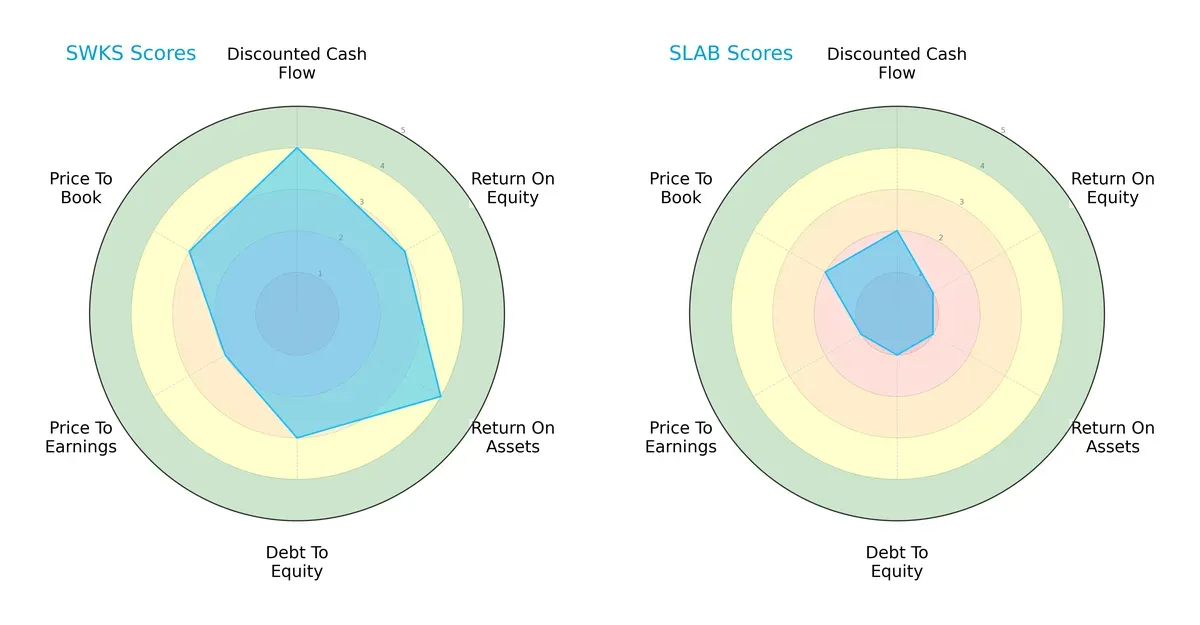

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Skyworks Solutions, Inc. and Silicon Laboratories Inc., highlighting their strengths and vulnerabilities:

Skyworks Solutions displays a more balanced profile with solid DCF (4), ROA (4), and moderate ROE (3) and debt-to-equity (3) scores. Silicon Laboratories relies heavily on a weak financial base, scoring mostly 1s, except for a moderate price-to-book (2). Skyworks’ valuation scores indicate moderate market pricing, while Silicon Labs faces valuation challenges. Overall, Skyworks commands a stronger, more stable financial footing.

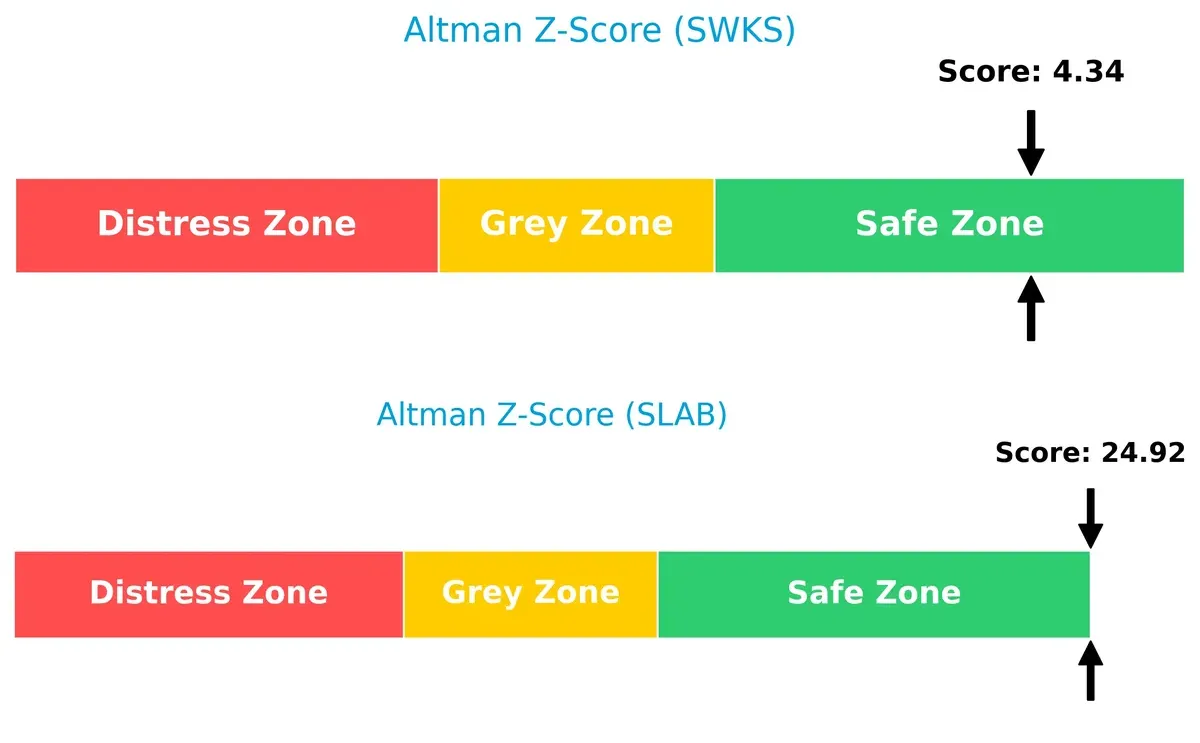

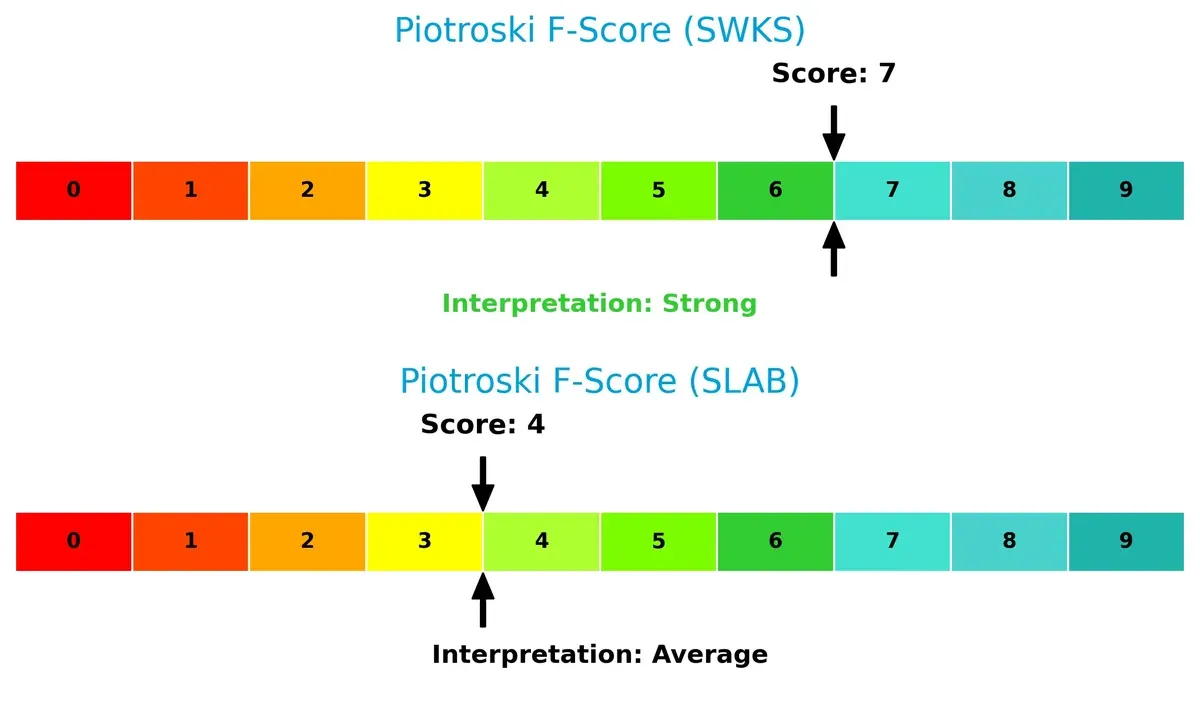

Bankruptcy Risk: Solvency Showdown

Skyworks’ Altman Z-Score of 4.34 versus Silicon Laboratories’ 24.92 places both firms safely above distress, but Silicon Labs shows exceptionally robust solvency, suggesting stronger resilience in economic downturns:

Financial Health: Quality of Operations

Skyworks scores a strong 7 on the Piotroski F-Score, indicating solid financial health and operational quality. Silicon Labs’ average score of 4 signals potential internal weaknesses and red flags for investors:

How are the two companies positioned?

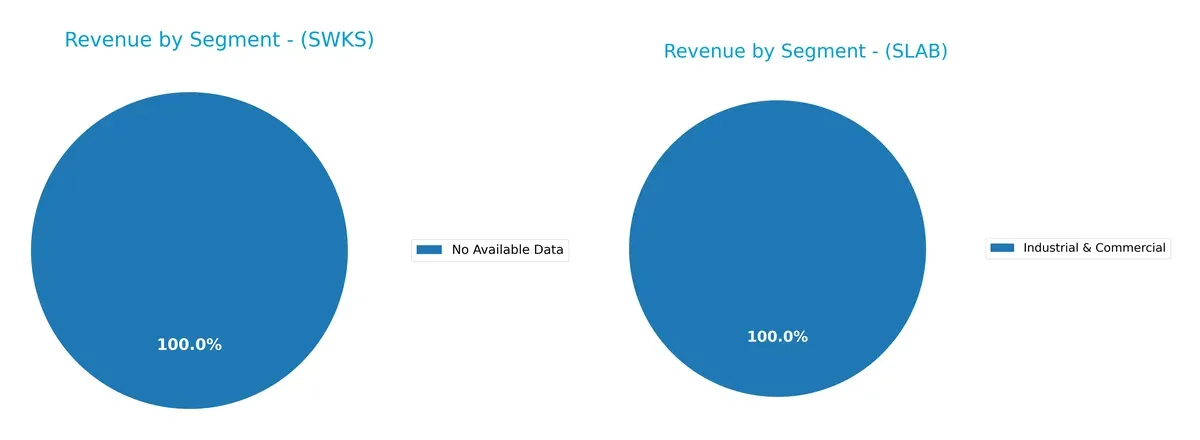

This section dissects Skyworks Solutions and Silicon Laboratories by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and reveal which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Skyworks Solutions and Silicon Laboratories diversify their income streams and where their primary sector bets lie:

Skyworks Solutions lacks available segmentation data, limiting direct comparison. Silicon Laboratories pivots heavily on its Industrial & Commercial segment, generating $338M in 2024. This concentration suggests reliance on specific markets, posing concentration risk but also signaling focused expertise. Unlike a diversified portfolio, Silicon Labs’ revenue anchors on fewer segments, which may impact resilience amid sector shifts. Investors should weigh this against broader benchmarks favoring diversified tech firms.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Skyworks Solutions, Inc. and Silicon Laboratories Inc.:

Skyworks Solutions Strengths

- Favorable net margin at 11.67%

- Strong liquidity with current ratio 2.33 and quick ratio 1.76

- Low debt-to-assets at 15.2% and high interest coverage at 20.44

- Significant U.S. and Asia-Pacific global revenue presence

- Dividend yield of 3.63% indicates shareholder returns

Silicon Laboratories Strengths

- Favorable price-to-earnings and price-to-book ratios imply valuation appeal

- Favorable debt metrics with zero debt-to-assets and debt/equity

- Diverse industrial and commercial revenue streams

- Geographic revenue spread includes China, Taiwan, U.S., and rest of world

Skyworks Solutions Weaknesses

- Unfavorable return on equity at 8.29%, below WACC

- Neutral return on invested capital versus WACC, indicating weak capital efficiency

- PE and PB ratios are neutral, showing limited valuation upside

- Asset turnover ratios are neutral, suggesting moderate operational efficiency

Silicon Laboratories Weaknesses

- Negative net margin at -8.27% reflects unprofitability

- Zero ROE and ROIC mark poor capital returns

- Unfavorable liquidity with current and quick ratios at zero, signaling potential short-term risk

- Negative interest coverage and no dividend yield

- Asset turnover metrics unavailable or zero, indicating operational challenges

Both companies show contrasting financial profiles. Skyworks demonstrates operational strength and solid liquidity, supporting a stable market position. Silicon Laboratories faces profitability and liquidity challenges, which may constrain strategic flexibility and investor confidence moving forward.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only lasting shield protecting profits from relentless competitive erosion in the long run:

Skyworks Solutions, Inc.: Intangible Assets and Diversified Market Reach

Skyworks leverages proprietary semiconductor IP and broad end-market exposure, reflected in stable gross margins near 41%. However, declining ROIC signals weakening moat strength by 2026.

Silicon Laboratories Inc.: Innovation-Driven Mixed-Signal Solutions

Silicon Labs relies on innovation in analog-intensive mixed-signal tech, fueling rapid revenue growth and a rising ROIC trend. Its moat deepens as IoT adoption expands in 2026.

Innovation Momentum vs. Legacy Diversification

Silicon Labs shows a growing moat with accelerating returns, while Skyworks faces a shrinking moat and value erosion. Silicon Labs is better equipped to defend and expand market share.

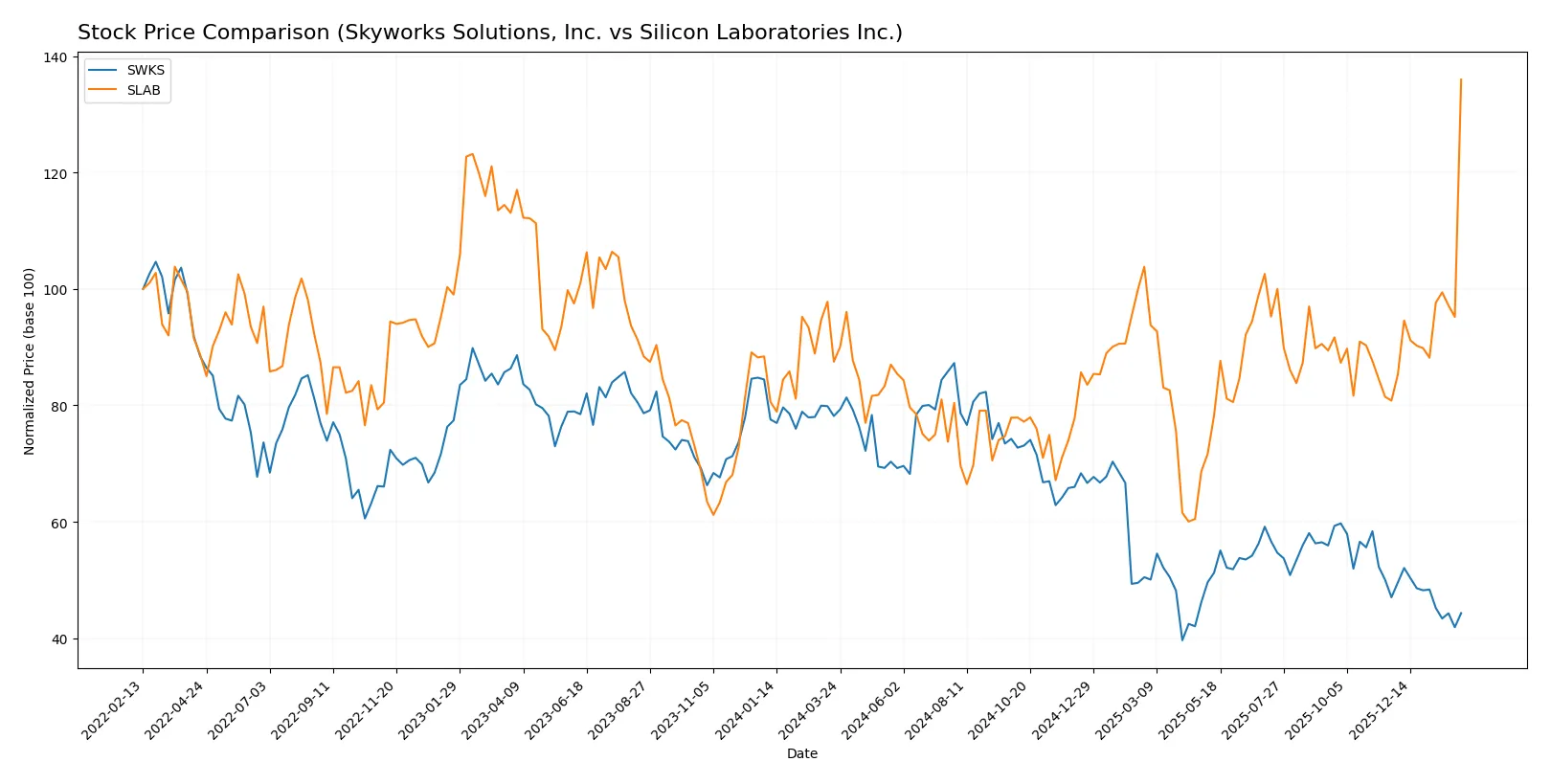

Which stock offers better returns?

The past year reveals divergent trajectories: Skyworks Solutions, Inc. faced a pronounced decline, while Silicon Laboratories Inc. accelerated gains with strong buyer dominance and upward momentum.

Trend Comparison

Skyworks Solutions, Inc. shows a bearish trend over 12 months with a -43.31% price decline and deceleration, reaching a high of 116.18 and a low of 52.78, marked by elevated volatility (16.49 std deviation).

Silicon Laboratories Inc. delivered a bullish trend over the same period, gaining 55.39% with acceleration, hitting a peak of 203.41 and a low of 89.82, alongside significant volatility (16.05 std deviation).

Silicon Laboratories outperformed Skyworks Solutions in market returns, demonstrating sustained upward momentum and stronger recent buyer dominance.

Target Prices

Analysts present a mixed but generally optimistic target consensus for these semiconductor companies.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Skyworks Solutions, Inc. | 58 | 140 | 77.36 |

| Silicon Laboratories Inc. | 130 | 231 | 173.67 |

Skyworks trades near its low target, suggesting limited upside or market caution. Silicon Labs exceeds its consensus target, indicating strong recent momentum or potential overvaluation risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Skyworks Solutions, Inc. Grades

The following table summarizes recent grades for Skyworks Solutions, Inc. from reputable institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Neutral | 2026-02-04 |

| Stifel | maintain | Hold | 2026-02-04 |

| Benchmark | maintain | Hold | 2026-02-04 |

| Keybanc | maintain | Overweight | 2026-02-04 |

| JP Morgan | maintain | Neutral | 2026-02-04 |

| Morgan Stanley | maintain | Equal Weight | 2026-02-02 |

| B. Riley Securities | maintain | Neutral | 2026-01-26 |

| Mizuho | maintain | Neutral | 2026-01-26 |

| Susquehanna | maintain | Neutral | 2026-01-22 |

| UBS | maintain | Neutral | 2026-01-20 |

Silicon Laboratories Inc. Grades

Below is a table showing recent institutional grades for Silicon Laboratories Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | downgrade | Hold | 2026-02-04 |

| Keybanc | downgrade | Sector Weight | 2026-02-04 |

| Needham | downgrade | Hold | 2026-02-04 |

| Susquehanna | maintain | Neutral | 2025-08-06 |

| Morgan Stanley | maintain | Equal Weight | 2025-08-06 |

| Barclays | maintain | Equal Weight | 2025-08-05 |

| Susquehanna | maintain | Neutral | 2025-07-22 |

| Stifel | maintain | Buy | 2025-07-18 |

| Keybanc | maintain | Overweight | 2025-07-08 |

| Benchmark | maintain | Buy | 2025-05-27 |

Which company has the best grades?

Skyworks Solutions, Inc. maintains mostly Neutral to Hold grades with some Overweight ratings. Silicon Laboratories Inc. has recently faced downgrades from Buy to Hold or Sector Weight. Thus, Skyworks holds a slightly stronger and more consistent grade profile, which may imply greater current institutional confidence.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Skyworks Solutions, Inc. (SWKS)

- Established semiconductor player with diversified product portfolio in multiple end markets.

Silicon Laboratories Inc. (SLAB)

- Fabless semiconductor firm focused on analog mixed-signal and IoT markets, facing intense niche competition.

2. Capital Structure & Debt

Skyworks Solutions, Inc. (SWKS)

- Low debt-to-equity ratio (0.21) and strong interest coverage (20.44) reflect financial stability.

Silicon Laboratories Inc. (SLAB)

- Reported zero debt, but financial ratios indicate liquidity concerns and operational losses.

3. Stock Volatility

Skyworks Solutions, Inc. (SWKS)

- Beta of 1.32 suggests moderate market sensitivity; trading range is stable (48-91 USD).

Silicon Laboratories Inc. (SLAB)

- Higher beta at 1.56 indicates elevated volatility; stock experienced 48.9% price surge recently.

4. Regulatory & Legal

Skyworks Solutions, Inc. (SWKS)

- Global footprint exposes it to complex semiconductor export controls and IP regulations.

Silicon Laboratories Inc. (SLAB)

- Also exposed internationally, with risks from evolving IoT device compliance and data privacy laws.

5. Supply Chain & Operations

Skyworks Solutions, Inc. (SWKS)

- Vertically integrated manufacturing helps control supply risks amid semiconductor shortages.

Silicon Laboratories Inc. (SLAB)

- Fabless model relies heavily on foundries, increasing vulnerability to supply chain disruptions.

6. ESG & Climate Transition

Skyworks Solutions, Inc. (SWKS)

- Larger scale allows for substantial ESG initiatives; pressure to reduce carbon footprint globally.

Silicon Laboratories Inc. (SLAB)

- Smaller scale with limited disclosures; climate transition risks may impair investor appeal.

7. Geopolitical Exposure

Skyworks Solutions, Inc. (SWKS)

- Significant exposure to China and Asia-Pacific heightens risk from US-China tech tensions.

Silicon Laboratories Inc. (SLAB)

- Also exposed to China but to a lesser extent; benefits from US-centric operations in Texas.

Which company shows a better risk-adjusted profile?

Skyworks faces its greatest risk in geopolitical tensions given its extensive global operations. Silicon Labs’ main risk is its weak financial health and operational losses. Skyworks’ strong balance sheet and stable cash flow provide a superior risk-adjusted profile. Silicon Labs’ high volatility and negative profitability raise red flags despite recent stock gains.

Final Verdict: Which stock to choose?

Skyworks Solutions excels as a cash-generating powerhouse with robust balance sheet metrics, making it a reliable dividend payer. Its point of vigilance lies in declining profitability and a shrinking economic moat, suggesting cautious monitoring. This stock suits portfolios targeting steady income with moderate growth exposure.

Silicon Laboratories offers a strategic moat through its aggressive R&D investment and accelerating revenue growth, positioning it well in innovation-driven markets. While its financial stability remains less proven, it presents a growth profile with higher volatility. SLAB fits portfolios seeking Growth at a Reasonable Price with a tolerance for operational risks.

If you prioritize capital preservation and income reliability, Skyworks outshines due to its strong financial stability and cash flow quality. However, if you seek rapid growth and can accept higher risk, Silicon Laboratories offers superior growth momentum and innovation potential. Both scenarios require vigilant risk management given their contrasting fundamentals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Skyworks Solutions, Inc. and Silicon Laboratories Inc. to enhance your investment decisions: