Investors seeking exposure to the dynamic semiconductor sector often weigh the merits of Silicon Laboratories Inc. (SLAB) and SkyWater Technology, Inc. (SKYT). Both companies operate within the semiconductors industry, yet they differ in business models—SLAB is fabless, focusing on analog and mixed-signal solutions, while SKYT specializes in semiconductor manufacturing services. This article will analyze their market positions, innovation strategies, and growth prospects to help you identify the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Silicon Laboratories Inc. and SkyWater Technology, Inc. by providing an overview of these two companies and their main differences.

Silicon Laboratories Inc. Overview

Silicon Laboratories Inc. is a fabless semiconductor company headquartered in Austin, Texas. It focuses on providing analog-intensive mixed-signal solutions, including wireless microcontrollers and sensor products. Its technology serves a broad range of Internet of Things (IoT) applications such as connected home, industrial automation, and medical instrumentation, positioning it as a key player in semiconductor innovation since its founding in 1996.

SkyWater Technology, Inc. Overview

SkyWater Technology, Inc., based in Bloomington, Minnesota, specializes in semiconductor development and manufacturing services. Established in 2017, it offers engineering and process support to co-develop technologies and manufactures silicon-based analog, mixed-signal, and rad-hard integrated circuits. SkyWater serves diverse industries, including aerospace, automotive, bio-health, and IoT, emphasizing its role as a foundry and technology partner.

Key similarities and differences

Both companies operate in the semiconductor industry and serve IoT-related markets, yet their business models differ notably. Silicon Labs is fabless, focusing on designing and selling semiconductor products, whereas SkyWater combines development services with semiconductor manufacturing. Silicon Labs has a larger market cap of approximately 5B USD and more employees, while SkyWater is smaller with a market cap around 1.5B USD and concentrates on manufacturing services.

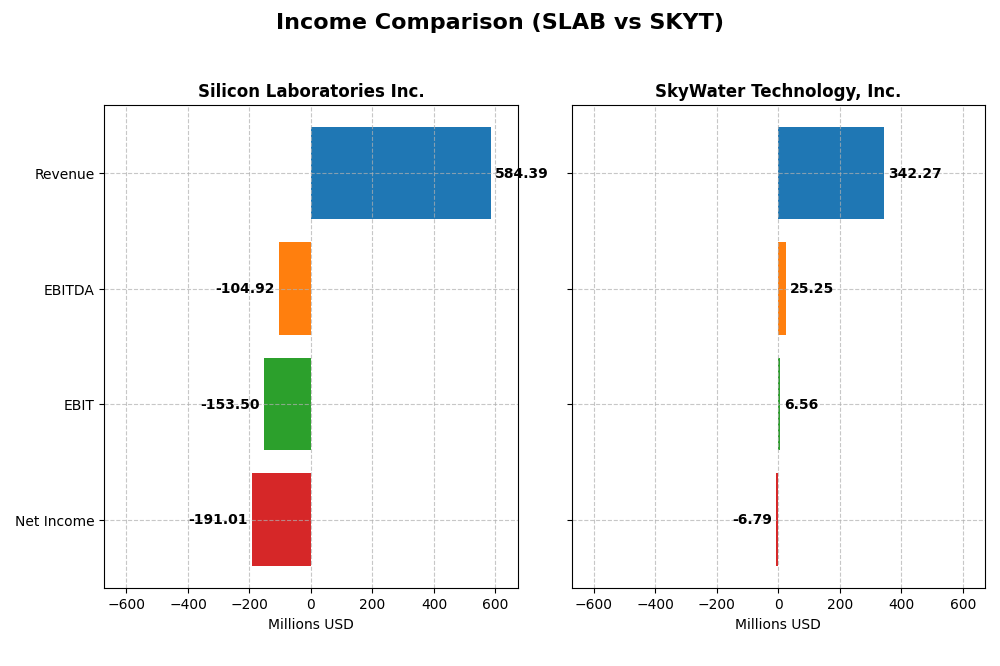

Income Statement Comparison

The table below compares the key income statement metrics of Silicon Laboratories Inc. and SkyWater Technology, Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Silicon Laboratories Inc. (SLAB) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Cap | 5.0B | 1.5B |

| Revenue | 584M | 342M |

| EBITDA | -105M | 25M |

| EBIT | -154M | 7M |

| Net Income | -191M | -7M |

| EPS | -5.93 | -0.14 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Silicon Laboratories Inc.

Silicon Laboratories Inc. showed a modest overall revenue growth of 14.38% from 2020 to 2024, but experienced significant net income decline over the same period. Gross margins remained relatively stable and favorable at 53.42%, though EBIT and net margins deteriorated sharply, reaching -26.27% and -32.69% respectively. The 2024 fiscal year saw a 25.29% revenue drop and a steep net income loss, reflecting worsening profitability.

SkyWater Technology, Inc.

SkyWater Technology, Inc. demonstrated strong revenue growth of 143.72% over 2020-2024, with net income improving by 67.05%. Its gross margin stood at a lower but favorable 20.34%, while EBIT margin was neutral at 1.92%, and net margin slightly negative at -1.98%. The latest year featured a 19.39% revenue increase and significant improvements in EBIT and net margin, signaling enhanced operational efficiency.

Which one has the stronger fundamentals?

SkyWater Technology exhibits stronger fundamentals with broad favorable trends across revenue, net income, and margin growth, supported by stable gross margins and improving EBIT. Silicon Laboratories’ fundamentals are weaker, marked by declining profitability and unfavorable margin trends despite stable gross margins. Overall, SkyWater’s growth and margin improvements outweigh Silicon Laboratories’ financial struggles.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Silicon Laboratories Inc. (SLAB) and SkyWater Technology, Inc. (SKYT) for the fiscal year 2024.

| Ratios | Silicon Laboratories Inc. (SLAB) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | -17.7% | -11.8% |

| ROIC | -14.7% | 3.4% |

| P/E | -21.5 | -100.3 |

| P/B | 3.81 | 11.82 |

| Current Ratio | 6.15 | 0.86 |

| Quick Ratio | 5.07 | 0.76 |

| D/E | 0.014 | 1.33 |

| Debt-to-Assets | 1.3% | 24.5% |

| Interest Coverage | -126.3 | 0.74 |

| Asset Turnover | 0.48 | 1.09 |

| Fixed Asset Turnover | 4.42 | 2.07 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Silicon Laboratories Inc.

Silicon Laboratories exhibits mostly unfavorable ratios, including a negative net margin of -32.69% and a return on equity of -17.69%, indicating profitability and efficiency challenges. Its strong quick ratio (5.07) and low debt-to-equity (0.01) reflect solid liquidity and conservative leverage. The company does not pay dividends, likely due to ongoing reinvestment and a focus on R&D, as suggested by its high research-to-revenue ratio.

SkyWater Technology, Inc.

SkyWater’s ratios reveal significant weaknesses: a negative net margin of -1.98% and a return on equity of -11.79%, alongside a low current ratio of 0.86, indicating liquidity concerns. Debt levels are relatively high with a debt-to-equity ratio of 1.33. SkyWater also does not distribute dividends, possibly because it is in a growth or reinvestment phase, as indicated by negative earnings and prioritization of capital expenditures.

Which one has the best ratios?

Both companies face unfavorable financial ratios, but Silicon Laboratories has a higher proportion of favorable metrics (35.71% vs. 21.43%) and stronger liquidity indicators. Conversely, SkyWater struggles more with leverage and liquidity, despite slightly better asset turnover. Overall, Silicon Laboratories presents a marginally stronger ratio profile in 2024.

Strategic Positioning

This section compares the strategic positioning of Silicon Laboratories Inc. (SLAB) and SkyWater Technology, Inc. (SKYT) regarding market position, key segments, and exposure to technological disruption:

Silicon Laboratories Inc.

- Larger market cap of 5B with moderate beta of 1.545, facing typical semiconductor industry pressure.

- Focused on analog-intensive mixed-signal products for IoT, industrial automation, smart metering, and consumer electronics.

- Fabless semiconductor model with product innovation in wireless microcontrollers and sensors, moderately exposed to tech disruption.

SkyWater Technology, Inc.

- Smaller market cap of 1.5B with higher beta of 3.487, indicating higher volatility and competitive pressure.

- Provides semiconductor development and manufacturing services across computation, aerospace, automotive, and bio-health sectors.

- Engages in co-creation of technologies and wafer manufacturing, exposed to disruption via advanced technology service demands.

Silicon Laboratories Inc. vs SkyWater Technology, Inc. Positioning

SLAB adopts a diversified product approach targeting IoT and industrial markets, offering scale advantages. SKYT concentrates on semiconductor manufacturing and engineering services, exposing it to niche industrial sectors but with potentially higher operational risks.

Which has the best competitive advantage?

Both companies are currently shedding value relative to their cost of capital. SLAB shows declining profitability, while SKYT’s profitability is improving, suggesting SKYT has a slightly more favorable position in sustaining competitive advantage.

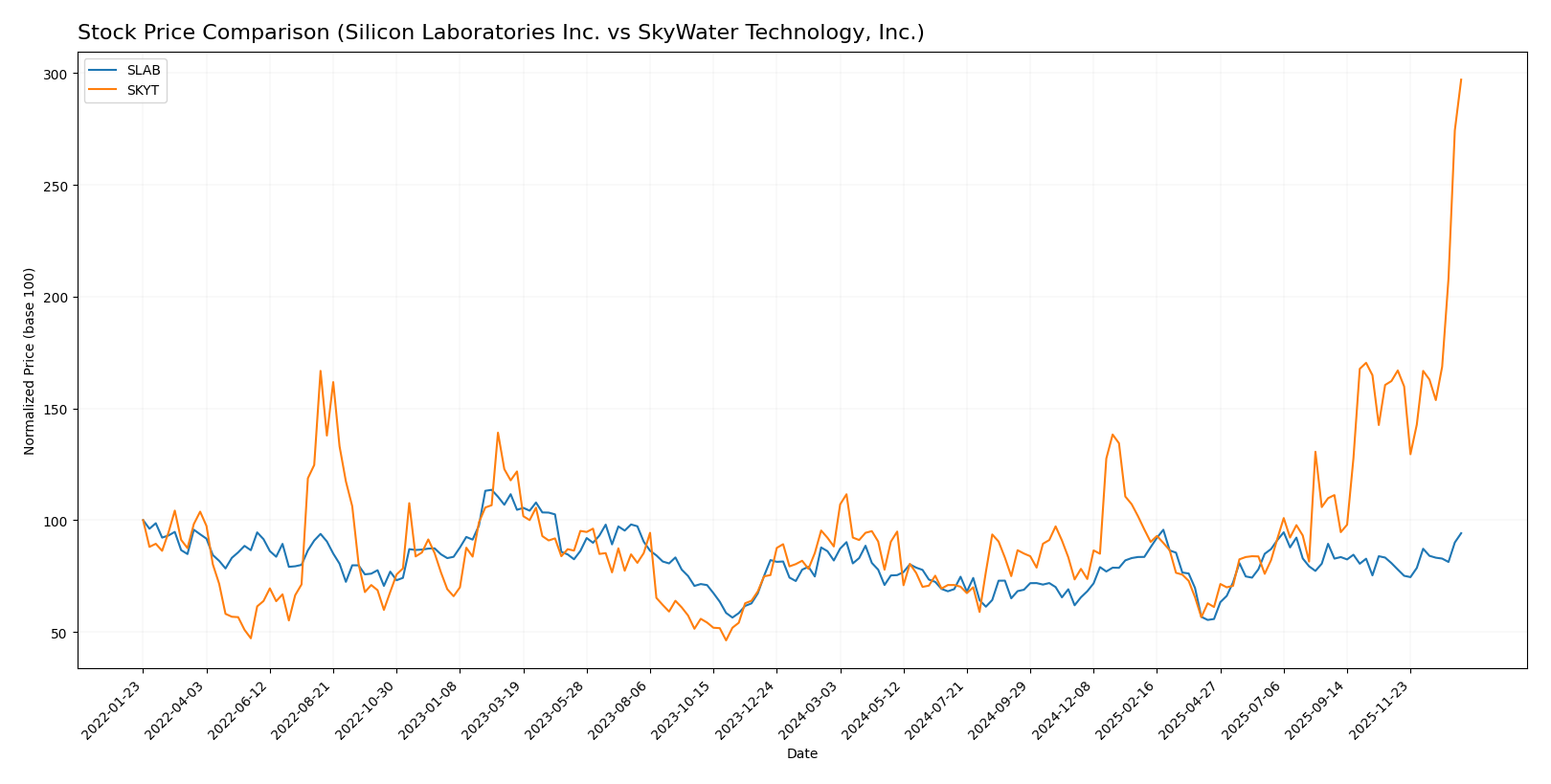

Stock Comparison

The stock price movements over the past 12 months reveal significant bullish trends for both Silicon Laboratories Inc. and SkyWater Technology, Inc., with notable acceleration and differing volatility levels shaping their trading dynamics.

Trend Analysis

Silicon Laboratories Inc. (SLAB) shows a bullish trend with a 14.91% price increase over the past year, marked by acceleration and a high volatility level (std deviation 14.15), reaching a peak price of 155.33.

SkyWater Technology, Inc. (SKYT) exhibits a strong bullish trend with a 236.8% increase over the same period, also accelerating but with lower volatility (std deviation 4.41), hitting a high of 32.03 during the year.

Comparing the two, SkyWater Technology delivered the highest market performance with a substantially larger price gain, indicating stronger upward momentum than Silicon Laboratories in the last 12 months.

Target Prices

The current analyst consensus suggests mixed but clear target price expectations for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Silicon Laboratories Inc. | 165 | 130 | 151.67 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Analysts see Silicon Laboratories trading close to its consensus target of 151.67 USD, near the current price of 152.82 USD. SkyWater Technology’s consensus target is significantly below its current price of 32.03 USD, indicating potential downside risk.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Silicon Laboratories Inc. (SLAB) and SkyWater Technology, Inc. (SKYT):

Rating Comparison

SLAB Rating

- Rating: C-, assessed as Very Favorable overall rating.

- Discounted Cash Flow Score: 2, indicating Moderate status.

- ROE Score: 1, marked Very Unfavorable for equity efficiency.

- ROA Score: 1, marked Very Unfavorable for asset utilization.

- Debt To Equity Score: 1, Very Unfavorable financial risk.

- Overall Score: 1, indicating Very Unfavorable overall health.

SKYT Rating

- Rating: B+, assessed as Very Favorable overall rating.

- Discounted Cash Flow Score: 1, indicating Very Unfavorable.

- ROE Score: 5, marked Very Favorable for equity efficiency.

- ROA Score: 5, marked Very Favorable for asset utilization.

- Debt To Equity Score: 1, Very Unfavorable financial risk.

- Overall Score: 3, indicating Moderate overall health.

Which one is the best rated?

SKYT holds a higher overall rating (B+) and better scores in ROE and ROA, showing stronger profitability and asset use compared to SLAB’s C- rating and uniformly low scores. However, both show similarly weak debt-to-equity scores.

Scores Comparison

The comparison of Silicon Laboratories Inc. and SkyWater Technology, Inc. scores is as follows:

SLAB Scores

- Altman Z-Score: 18.02, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

SKYT Scores

- Altman Z-Score: 2.20, placing the company in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 5, also reflecting average financial strength.

Which company has the best scores?

Silicon Laboratories Inc. has a significantly higher Altman Z-Score, indicating stronger financial stability, while both companies have similar average Piotroski Scores. SLAB shows a safer position regarding bankruptcy risk based on the provided data.

Grades Comparison

Here is the comparison of recent grades from reputable institutions for Silicon Laboratories Inc. and SkyWater Technology, Inc.:

Silicon Laboratories Inc. Grades

The following table summarizes recent grades and actions from leading grading companies for Silicon Laboratories Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

| Susquehanna | Maintain | Neutral | 2025-08-06 |

| Barclays | Maintain | Equal Weight | 2025-08-05 |

| Susquehanna | Maintain | Neutral | 2025-07-22 |

| Stifel | Maintain | Buy | 2025-07-18 |

| Keybanc | Maintain | Overweight | 2025-07-08 |

| Benchmark | Maintain | Buy | 2025-05-27 |

| Benchmark | Maintain | Buy | 2025-05-14 |

| Susquehanna | Maintain | Neutral | 2025-05-14 |

| Needham | Maintain | Buy | 2025-05-14 |

Silicon Laboratories Inc. shows a mixed but generally positive pattern, with multiple “Buy” and “Overweight” ratings alongside “Neutral” and “Equal Weight” grades.

SkyWater Technology, Inc. Grades

The following table provides recent grades and actions from credible grading firms for SkyWater Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology, Inc. consistently receives “Buy” and “Overweight” grades, indicating a strong positive consensus from analysts.

Which company has the best grades?

SkyWater Technology, Inc. has received more consistently positive grades with repeated “Buy” and “Overweight” ratings compared to Silicon Laboratories Inc., which has a more mixed grade profile. This suggests stronger analyst confidence in SkyWater, which may impact investor sentiment and portfolio positioning.

Strengths and Weaknesses

Below is a comparative overview of Silicon Laboratories Inc. (SLAB) and SkyWater Technology, Inc. (SKYT) highlighting their key strengths and weaknesses based on recent financial and operational data.

| Criterion | Silicon Laboratories Inc. (SLAB) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Moderate; revenue mainly from Industrial & Commercial sectors with prior IoT and Infrastructure exposure. | Moderate; focused on Advanced Technology Services and Wafer Services with some service pricing variety. |

| Profitability | Weak; negative net margin (-32.7%) and ROIC (-14.7%) showing value destruction. | Weak; negative net margin (-2%) and low positive ROIC (3.4%) but still below WACC, value shedding. |

| Innovation | Low; declining ROIC trend (-185%), indicating challenges in sustaining competitive advantage. | Moderate; improving ROIC trend (+171%) suggests improving profitability potential. |

| Global presence | Established but concentrated; lacks clear global expansion signals. | Smaller scale, likely niche presence focused on specialized technology services. |

| Market Share | Facing pressure; declining profitability and asset turnover (0.48) indicate operational inefficiencies. | Niche market player with improving asset turnover (1.09), but overall financial health is fragile. |

In summary, both companies exhibit financial challenges with negative profitability metrics; however, SkyWater shows signs of improving operational efficiency and ROIC trends, whereas Silicon Laboratories faces declining returns and value destruction. Caution and close monitoring of future performance are advised before investing.

Risk Analysis

Below is a comparative risk assessment table for Silicon Laboratories Inc. (SLAB) and SkyWater Technology, Inc. (SKYT) based on the latest 2024 data:

| Metric | Silicon Laboratories Inc. (SLAB) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Beta 1.55 — moderate volatility | Beta 3.49 — high volatility |

| Debt Level | Very low (Debt/Equity 0.01) | High (Debt/Equity 1.33) |

| Regulatory Risk | Moderate due to semiconductor industry compliance | Moderate, with aerospace/defense exposure |

| Operational Risk | Medium — broad product range, fabless model | Higher — manufacturing complexity and smaller scale |

| Environmental Risk | Low | Moderate due to manufacturing processes |

| Geopolitical Risk | Moderate — international sales exposure | Moderate — supply chain and defense sector sensitivity |

The most impactful and likely risks are market volatility for SkyWater given its high beta and significant debt load, which heightens financial risk. Silicon Laboratories shows strong financial stability with minimal debt but faces operational risks tied to innovation demands. Recent financial indicators reveal SLAB’s robust Altman Z-score placing it safely above bankruptcy risk, while SKYT’s score falls in a grey zone, signaling caution. Investors should weigh these factors carefully, prioritizing risk management given the semiconductor sector’s cyclical nature and geopolitical sensitivities.

Which Stock to Choose?

Silicon Laboratories Inc. (SLAB) shows a declining income trend with unfavorable profitability and financial ratios. Its ROIC is below WACC, indicating value destruction, and the company holds a very unfavorable overall rating despite a strong current ratio and low debt levels.

SkyWater Technology, Inc. (SKYT) exhibits favorable income growth and improving profitability metrics, though it carries higher leverage and weaker liquidity ratios. Its ROIC remains below WACC but is trending upward, with a slightly unfavorable moat and a very favorable rating reflecting improving financial health.

Investors prioritizing growth potential and improving profitability might view SkyWater’s upward ROIC trend and favorable income growth as more attractive, while those favoring a stronger balance sheet and lower debt could perceive Silicon Laboratories’ financial stability differently. The choice could depend on the investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Silicon Laboratories Inc. and SkyWater Technology, Inc. to enhance your investment decisions: