In the fast-evolving technology landscape, Shopify Inc. (SHOP) and Snowflake Inc. (SNOW) stand out as leaders in software applications, each innovating distinct yet overlapping markets. Shopify revolutionizes commerce platforms for merchants worldwide, while Snowflake transforms data management with its cloud-based solutions. Comparing these two giants reveals contrasting growth strategies and market potentials. Join me as we explore which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Shopify and Snowflake by providing an overview of these two companies and their main differences.

Shopify Overview

Shopify Inc. is a commerce company headquartered in Ottawa, Canada, offering a comprehensive platform that enables merchants to display, manage, market, and sell products across multiple channels such as web, mobile, physical stores, and social media. Its services include inventory management, payment processing, order fulfillment, and merchant solutions like financing and shipping. Shopify operates globally with 8,100 employees and a market cap of 205.7B USD.

Snowflake Overview

Snowflake Inc., based in Bozeman, Montana, provides a cloud-based data platform known as Data Cloud that consolidates data to enable business insights, data-driven applications, and data sharing. Its platform serves organizations of varying sizes across industries in the US and internationally. Snowflake employs 7,834 people and has a market cap of 72.1B USD, positioning itself strongly in the cloud data sector.

Key similarities and differences

Both Shopify and Snowflake operate in the technology sector, focusing on software applications but serving different core needs: Shopify in e-commerce commerce infrastructure and Snowflake in cloud data management. Shopify’s model centers on enabling merchants with sales and operational tools, while Snowflake provides data consolidation and analytics capabilities. Market caps and employee counts differ significantly, with Shopify being larger and more retail-focused and Snowflake specializing in data platforms.

Income Statement Comparison

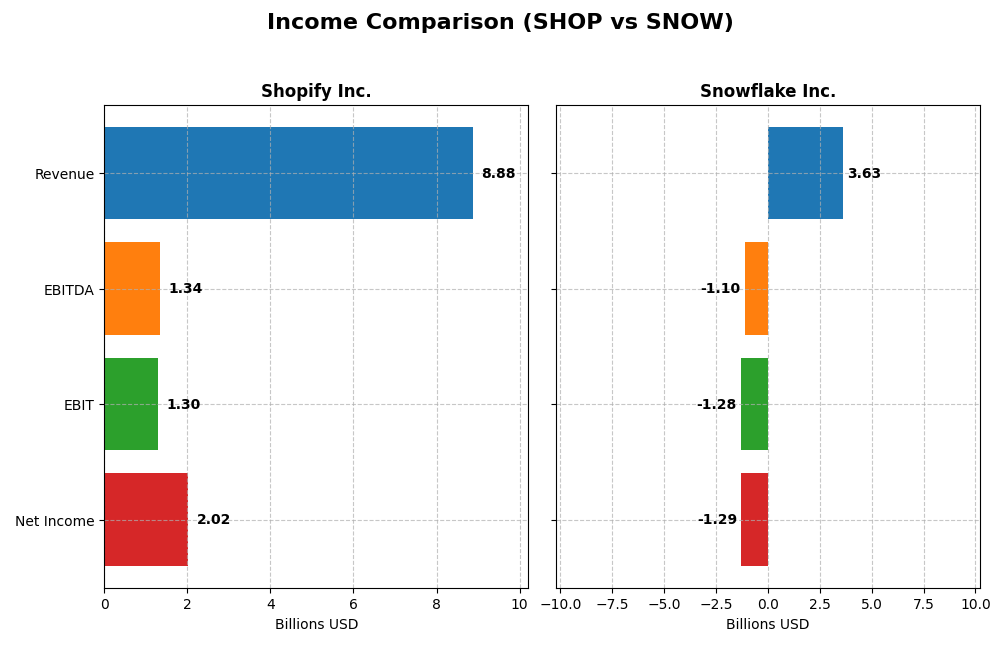

Below is a side-by-side comparison of key income statement metrics for Shopify Inc. and Snowflake Inc. for their most recent fiscal years.

| Metric | Shopify Inc. (SHOP) | Snowflake Inc. (SNOW) |

|---|---|---|

| Market Cap | 206B | 72B |

| Revenue | 8.88B | 3.63B |

| EBITDA | 1.34B | -1.10B |

| EBIT | 1.30B | -1.28B |

| Net Income | 2.02B | -1.29B |

| EPS | 1.56 | -3.86 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Shopify Inc.

Shopify’s revenue rose significantly from 2.93B in 2020 to 8.88B in 2024, with net income improving impressively from 320M to 2.02B. Margins strengthened notably, achieving a gross margin of 50.36% and a net margin of 22.74% in 2024. The latest year showed robust growth with EBIT and net margin surging, reflecting operational efficiency and profitability gains.

Snowflake Inc.

Snowflake’s revenue expanded substantially from 592M in 2021 to 3.63B in 2025, but it remained unprofitable with net losses widening to -1.29B in 2025. Despite a strong gross margin of 66.5%, the EBIT margin stayed negative at -35.36%. The 2025 results showed revenue growth but declines in EBIT and net margin, indicating ongoing challenges in controlling operating expenses.

Which one has the stronger fundamentals?

Shopify demonstrates stronger fundamentals with consistent profitability, positive margin trends, and substantial income growth over the period. Snowflake shows impressive top-line expansion but struggles with persistent losses and negative operating margins. Shopify’s favorable income statement metrics contrast with Snowflake’s mixed results, indicating a more solid income foundation for Shopify.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Shopify Inc. and Snowflake Inc. as of their latest fiscal years, offering a snapshot of key performance and financial health metrics.

| Ratios | Shopify Inc. (2024) | Snowflake Inc. (2025) |

|---|---|---|

| ROE | 17.47% | -42.86% |

| ROIC | 7.55% | -25.24% |

| P/E | 68.18 | -46.97 |

| P/B | 11.91 | 20.13 |

| Current Ratio | 3.71 | 1.75 |

| Quick Ratio | 3.70 | 1.75 |

| D/E | 0.097 | 0.895 |

| Debt-to-Assets | 8.09% | 29.72% |

| Interest Coverage | 0 | -527.73 |

| Asset Turnover | 0.64 | 0.40 |

| Fixed Asset Turnover | 63.43 | 5.53 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Shopify Inc.

Shopify exhibits several strong ratios such as a favorable net margin of 22.74% and ROE of 17.47%, though its valuation metrics like PE (68.18) and PB (11.91) are high and considered unfavorable. The liquidity ratios show mixed signals with a high current ratio (3.71, unfavorable) but a strong quick ratio (3.7, favorable). Shopify does not pay dividends, reflecting a reinvestment strategy to sustain growth rather than returning cash to shareholders.

Snowflake Inc.

Snowflake shows weak profitability ratios, including a net margin of -35.45% and ROE of -42.86%, both unfavorable. Its liquidity is reasonable with a current ratio of 1.75 (favorable), but the interest coverage ratio is deeply negative, signaling financial stress. Snowflake also does not pay dividends, likely due to ongoing investments in R&D and expansion in a high growth phase, prioritizing long-term value creation over shareholder payouts.

Which one has the best ratios?

Shopify’s ratios are overall more favorable, with half of its key metrics rated positively and a slightly favorable global opinion. Snowflake’s ratios are predominantly unfavorable, especially in profitability and coverage metrics, leading to a slightly unfavorable assessment. Thus, Shopify currently presents stronger financial ratio metrics compared to Snowflake.

Strategic Positioning

This section compares the strategic positioning of Shopify Inc. and Snowflake Inc., focusing on market position, key segments, and exposure to technological disruption:

Shopify Inc.

- Leading commerce platform with strong multi-channel presence, facing intense competitive pressure in e-commerce software.

- Key segments include merchant solutions and subscription services, driven by commerce platform services and merchant solutions.

- Exposure to disruption through evolving e-commerce technologies and digital payment solutions in retail environments.

Snowflake Inc.

- Cloud-based data platform provider with growing presence, competing in a competitive data cloud market.

- Revenue mainly from product sales and professional services, focused on data consolidation and analytics.

- Faces technological disruption risks from rapid innovation in cloud computing and data management platforms.

Shopify Inc. vs Snowflake Inc. Positioning

Shopify’s strategy is diversified across commerce services and merchant solutions, leveraging multi-channel sales. Snowflake concentrates on cloud data platforms and analytics, focusing on data-driven insights. Shopify’s broader scope offers varied revenue streams, while Snowflake’s focus targets specialized data needs.

Which has the best competitive advantage?

Both companies are currently shedding value, but Shopify shows a slightly unfavorable moat with growing ROIC, while Snowflake faces a very unfavorable moat with declining ROIC and profitability, suggesting Shopify maintains a relatively stronger competitive advantage.

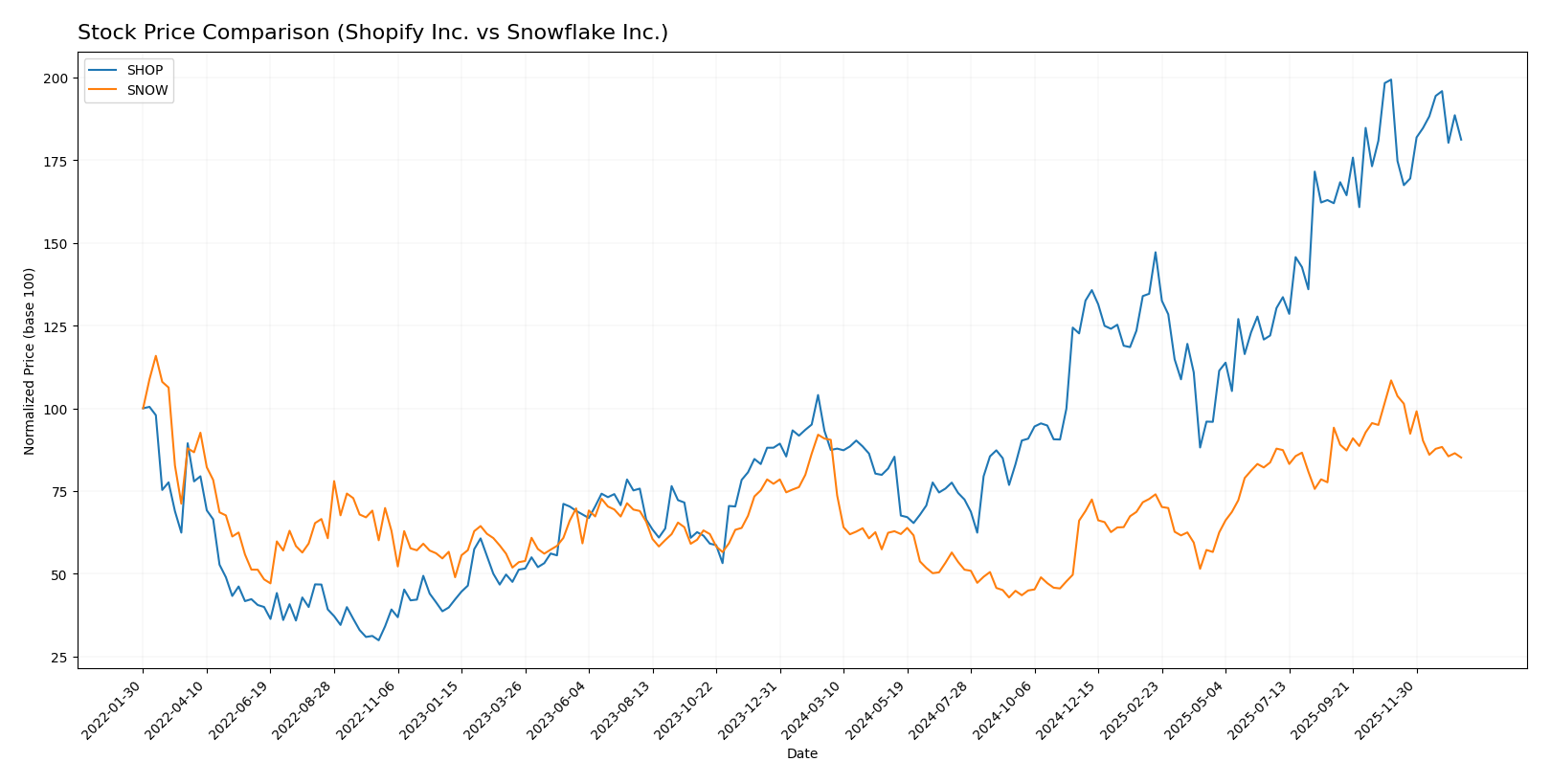

Stock Comparison

The stock price movements of Shopify Inc. and Snowflake Inc. over the past year reveal contrasting trends, with Shopify showing strong gains and Snowflake experiencing declines amid shifting trading volumes and buyer-seller dynamics.

Trend Analysis

Shopify Inc. posted a bullish trend over the past 12 months with a 107.29% price increase, despite a recent 9.1% pullback and decelerating momentum. The stock showed notable volatility with a 33.71 std deviation.

Snowflake Inc. experienced a bearish trend with a 5.91% price decline over the past year, accelerating downward recently with a 21.5% drop and higher volatility at a 42.65 std deviation.

Comparing performances, Shopify significantly outperformed Snowflake, delivering the highest market gains while Snowflake faced sustained downward pressure.

Target Prices

The consensus target prices from verified analysts show promising upside potential for both Shopify Inc. and Snowflake Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Shopify Inc. | 200 | 140 | 186.24 |

| Snowflake Inc. | 325 | 237 | 281.86 |

Analysts expect Shopify’s target consensus (186.24 USD) to be well above its current price (~158 USD), indicating potential growth. Snowflake’s consensus target (281.86 USD) also suggests significant upside compared to its current price (~215 USD).

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Shopify Inc. and Snowflake Inc.:

Rating Comparison

Shopify Inc. Rating

- Rating: B, considered Very Favorable

- Discounted Cash Flow Score: 2, Moderate

- ROE Score: 4, Favorable

- ROA Score: 5, Very Favorable

- Debt To Equity Score: 3, Moderate

- Overall Score: 3, Moderate

Snowflake Inc. Rating

- Rating: C-, considered Very Favorable

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 1, Very Unfavorable

Which one is the best rated?

Based strictly on the provided data, Shopify holds a higher overall rating (B vs. C-) and better financial scores across ROE, ROA, and debt-to-equity metrics. Snowflake scores lower overall, indicating a less favorable assessment.

Scores Comparison

The scores comparison between Shopify Inc. and Snowflake Inc. based on their Altman Z-Score and Piotroski Score is as follows:

Shopify Scores

- Altman Z-Score: 50.42, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

Snowflake Scores

- Altman Z-Score: 5.36, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

Which company has the best scores?

Shopify shows a significantly higher Altman Z-Score than Snowflake, both in the safe zone, while Shopify’s Piotroski Score is also higher, indicating relatively stronger financial stability based on the provided data.

Grades Comparison

Here is a comparison of the latest grades assigned to Shopify Inc. and Snowflake Inc.:

Shopify Inc. Grades

The following table summarizes recent grades assigned by recognized grading companies to Shopify Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Scotiabank | Upgrade | Sector Outperform | 2026-01-08 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2025-12-17 |

| Truist Securities | Maintain | Hold | 2025-11-05 |

| CIBC | Maintain | Outperform | 2025-11-05 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-05 |

| DA Davidson | Maintain | Buy | 2025-11-05 |

| Scotiabank | Maintain | Sector Perform | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

Shopify’s grades show a mix of buy and outperform ratings, with some recent upgrades and downgrades indicating a moderately positive but cautious outlook.

Snowflake Inc. Grades

Below is a summary of recent grades awarded to Snowflake Inc. by established grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Downgrade | Equal Weight | 2026-01-12 |

| Argus Research | Upgrade | Buy | 2026-01-08 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Wells Fargo | Maintain | Overweight | 2025-12-04 |

| Keybanc | Maintain | Overweight | 2025-12-04 |

| Piper Sandler | Maintain | Overweight | 2025-12-04 |

| Morgan Stanley | Maintain | Overweight | 2025-12-04 |

| Wedbush | Maintain | Outperform | 2025-12-04 |

| Deutsche Bank | Maintain | Buy | 2025-12-04 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-04 |

Snowflake’s grades predominantly reflect buy and overweight recommendations, with a single recent downgrade to equal weight, indicating generally favorable analyst sentiment.

Which company has the best grades?

Both Shopify Inc. and Snowflake Inc. hold a consensus “Buy” rating supported by multiple buy and outperform grades. Snowflake shows a slightly stronger concentration of overweight and buy ratings, suggesting a marginally more optimistic analyst view. This could imply different risk-return profiles for investors assessing these stocks.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Shopify Inc. and Snowflake Inc. based on the most recent financial and operational data.

| Criterion | Shopify Inc. (SHOP) | Snowflake Inc. (SNOW) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from Merchant and Subscription Solutions | Moderate: Revenue primarily from Product sales with some Professional Services |

| Profitability | Positive net margin at 22.7%, ROE 17.5%, but ROIC below WACC indicating value destruction | Negative net margin (-35.5%), negative ROE and ROIC, indicating significant losses and value destruction |

| Innovation | Growing ROIC trend suggests improving profitability and operational efficiency | Declining ROIC trend signals worsening profitability and operational challenges |

| Global presence | Strong e-commerce platform with broad international reach | Cloud data platform with global clients but faces stiff competition |

| Market Share | Significant in e-commerce solutions, expanding merchant base | Growing cloud data market share but struggling with profitability |

Key takeaways: Shopify demonstrates improving profitability and operational efficiency despite currently destroying value, supported by strong market presence. Snowflake faces greater challenges with declining profitability and value destruction, highlighting higher investment risk.

Risk Analysis

Below is a comparative table outlining key risks for Shopify Inc. (SHOP) and Snowflake Inc. (SNOW) based on the most recent fiscal data.

| Metric | Shopify Inc. (SHOP) | Snowflake Inc. (SNOW) |

|---|---|---|

| Market Risk | High beta (2.84) indicates volatility | Moderate beta (1.14) suggests moderate volatility |

| Debt level | Low debt-to-equity (0.1), low debt-to-assets (8.1%) | Higher debt-to-equity (0.9), moderate debt-to-assets (29.7%) |

| Regulatory Risk | Moderate, operates globally with compliance needs | Moderate, US-based with international exposure |

| Operational Risk | Platform complexity with global merchant services | Cloud infrastructure dependency and innovation pace |

| Environmental Risk | Moderate, limited direct impact | Moderate, data center energy use concerns |

| Geopolitical Risk | Exposure across multiple regions including emerging markets | Primarily US-based but expanding internationally |

Shopify’s most impactful risks stem from its high market volatility and premium valuation, despite strong financial health and low debt. Snowflake faces greater financial instability with significant losses and higher leverage, increasing bankruptcy risk. Operational risks are notable for both due to their reliance on technology platforms and evolving regulatory environments.

Which Stock to Choose?

Shopify Inc. (SHOP) shows a favorable income evolution with 25.78% revenue growth in 2024 and strong profitability metrics, including a 22.74% net margin and 17.47% ROE. Its debt levels are low, supported by a favorable debt-to-equity ratio, and the overall rating is very favorable with a “B” grade.

Snowflake Inc. (SNOW) records mixed income results with 29.21% revenue growth but negative profitability, including a -35.45% net margin and -42.86% ROE. Debt ratios are moderate to high, and the rating is less supportive, with a “C-” grade, reflecting financial challenges and negative returns.

For investors focused on growth, Shopify’s slightly favorable financial ratios and improving profitability might appear more attractive, while those tolerant of risk and seeking potentially undervalued opportunities might view Snowflake’s profile as a speculative play despite weaker financial health.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Shopify Inc. and Snowflake Inc. to enhance your investment decisions: