Home > Comparison > Real Estate > SBAC vs WY

The strategic rivalry between SBA Communications Corporation and Weyerhaeuser Company shapes the Real Estate specialty REIT sector’s future. SBA operates as a capital-light wireless infrastructure provider, leasing antenna space across the Americas and Africa. Weyerhaeuser contrasts as a capital-intensive timberland owner and wood products manufacturer with a sustainability focus. This analysis evaluates which model delivers superior risk-adjusted returns amid evolving sector dynamics, guiding investors toward the optimal portfolio allocation.

Table of contents

Companies Overview

SBA Communications and Weyerhaeuser stand as pivotal players in the specialty REIT sector, shaping distinct market niches in 2026.

SBA Communications Corporation: Leading Wireless Infrastructure REIT

SBA Communications dominates the wireless infrastructure market across the Americas and South Africa. Its core revenue derives from leasing antenna space on multi-tenant communication sites under long-term contracts. In 2026, SBA’s strategic focus remains on expanding site leasing and development services, reinforcing its competitive position as a critical enabler of wireless connectivity.

Weyerhaeuser Company: Timberland and Wood Products Giant

Weyerhaeuser is one of the largest private timberland owners globally, managing about 11 million acres sustainably. It generates revenue through timberland management and manufacturing wood products in North America. The company’s 2026 strategy emphasizes sustainable forestry and wood products manufacturing, aligning with its reputation for environmental stewardship and operational scale.

Strategic Collision: Similarities & Divergences

Both companies operate as specialty REITs, but their business philosophies diverge sharply—SBA leverages a high-tech wireless infrastructure model, while Weyerhaeuser focuses on natural resource management. Their primary battleground is capital allocation in asset-heavy industries. SBA’s growth hinges on technological infrastructure expansion; Weyerhaeuser depends on sustainable resource utilization. This sets distinct risk profiles and investment dynamics for investors.

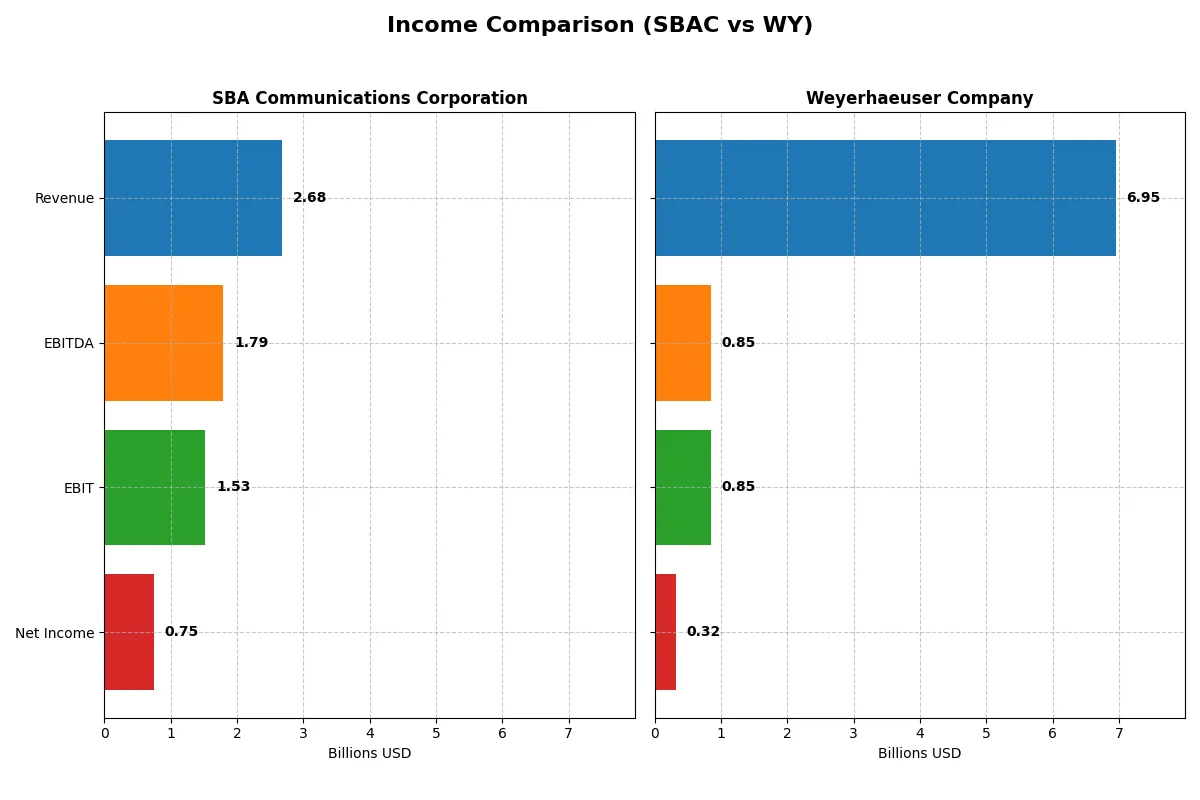

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | SBA Communications Corporation (SBAC) | Weyerhaeuser Company (WY) |

|---|---|---|

| Revenue | 2.68B | 7.12B |

| Cost of Revenue | 608M | 5.81B |

| Operating Expenses | 636M | 628M |

| Gross Profit | 2.07B | 1.31B |

| EBITDA | 1.79B | 1.20B |

| EBIT | 1.53B | 696M |

| Interest Expense | 0 | 269M |

| Net Income | 750M | 396M |

| EPS | 6.96 | 0.54 |

| Fiscal Year | 2024 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison unveils which company converts revenue into profitable growth most efficiently in recent years.

SBA Communications Corporation Analysis

SBA Communications shows steady revenue growth from 2.08B in 2020 to 2.68B in 2024, with net income surging from 24M to 750M. Its gross margin remains robust near 77%, while net margin climbs to 28%, signaling strong profitability. The 2024 surge in EBIT (+42%) and net income (+51%) highlights accelerating operational efficiency.

Weyerhaeuser Company Analysis

Weyerhaeuser’s revenue declined from 10.2B in 2021 to 6.95B in 2025, with net income falling sharply from 2.6B to 324M. Gross margin weakens to 15%, and net margin retreats to under 5%, reflecting margin pressure. Despite a 23% EBIT rebound in 2025, overall profitability and growth trends remain negative, indicating challenges in cost control and market conditions.

Profitability Strength vs. Revenue Contraction

SBA Communications clearly dominates on margin strength and consistent earnings growth, while Weyerhaeuser struggles with shrinking revenue and compressed margins. SBA offers a superior profit engine with expanding net margins, appealing to investors prioritizing operational efficiency. Weyerhaeuser’s profile suits those focused on cyclical recovery potential amid current headwinds.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | SBA Communications Corporation (SBAC) | Weyerhaeuser Company (WY) |

|---|---|---|

| ROE | -14.67% (2024) | 3.44% (2025) |

| ROIC | 12.57% (2024) | 2.93% (2025) |

| P/E | 29.37 (2024) | 52.88 (2025) |

| P/B | -4.31 (2024) | 1.82 (2025) |

| Current Ratio | 1.10 (2024) | 1.29 (2025) |

| Quick Ratio | 1.10 (2024) | 1.29 (2025) |

| D/E | -3.08 (2024) | 0.59 (2025) |

| Debt-to-Assets | 138% (2024) | 34% (2025) |

| Interest Coverage | 0 (2024) | 0 (2025) |

| Asset Turnover | 0.23 (2024) | 0.42 (2025) |

| Fixed Asset Turnover | 0.42 (2024) | 2.50 (2025) |

| Payout ratio | 56.59% (2024) | 187.04% (2025) |

| Dividend yield | 1.93% (2024) | 3.54% (2025) |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational strengths that shape long-term investor outcomes.

SBA Communications Corporation

SBA shows solid net margins at 27.97% and a ROIC of 12.57%, signaling operational efficiency above its 5.69% WACC. However, its negative ROE (-14.67%) and high P/E of 29.37 suggest stretched valuation. Dividend yield stands modest at 1.93%, with reinvestment likely focused on growth given zero R&D expenses.

Weyerhaeuser Company

Weyerhaeuser posts weaker profitability with a 4.69% net margin and ROIC of 2.93%, both trailing its WACC of 7.73%. The P/E ratio is elevated at 52.88, indicating an expensive stock relative to earnings. It offers a healthier 3.54% dividend yield, returning more cash to shareholders despite lower operational returns.

Premium Valuation vs. Operational Safety

SBA balances higher operational efficiency with a stretched valuation, while Weyerhaeuser trades at a premium despite weaker returns. Investors prioritizing operational strength may prefer SBA; those valuing income and stability might lean toward Weyerhaeuser’s dividend profile.

Which one offers the Superior Shareholder Reward?

I observe that SBA Communications (SBAC) offers a moderate 1.93% dividend yield with a sustainable 57% payout ratio and robust free cash flow of 10.2/share fueling buybacks. Weyerhaeuser (WY) pays a higher 3.34% yield but with payout ratios exceeding 100%, signaling dividend risk. WY’s buybacks are minimal, reflecting less aggressive capital return. SBAC’s balanced dividend and buyback mix better supports long-term value creation. Thus, I conclude SBAC delivers a superior total shareholder reward in 2026.

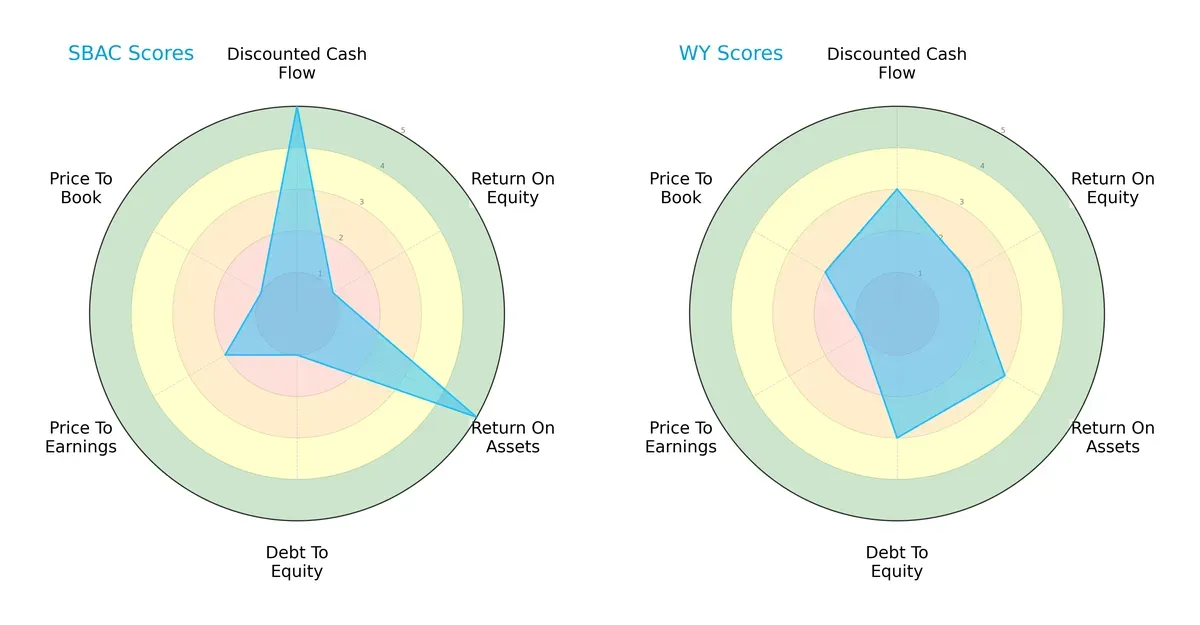

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of SBA Communications Corporation and Weyerhaeuser Company, highlighting their financial strengths and vulnerabilities:

SBAC excels in discounted cash flow (5) and return on assets (5), signaling strong cash generation and asset efficiency but suffers from weak equity returns (1) and a risky capital structure (debt-to-equity score of 1). WY shows moderate scores across the board with a more balanced debt profile (3) but struggles with valuation metrics, especially P/E (1). SBAC relies on a cash flow edge, while WY maintains steadier financial leverage.

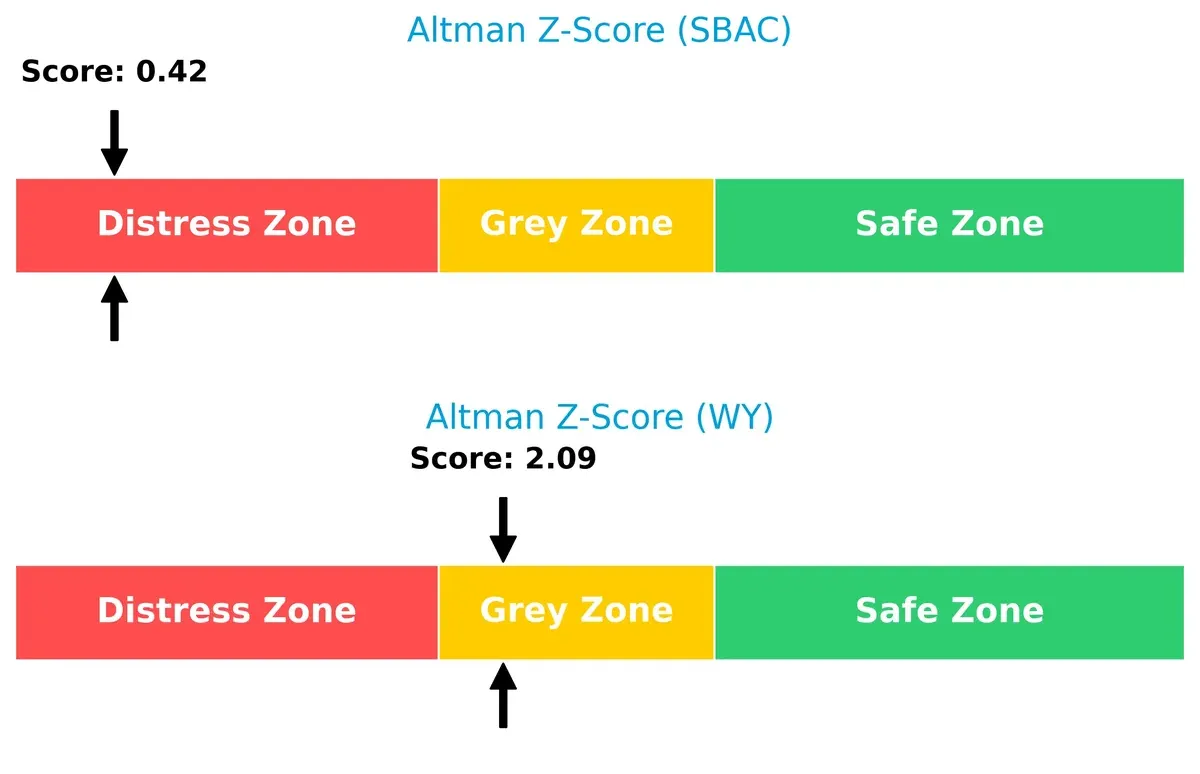

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score difference shows WY (2.09) in the grey zone, indicating moderate bankruptcy risk. SBAC (0.42) falls deep in distress territory, signaling urgent solvency concerns in this cycle:

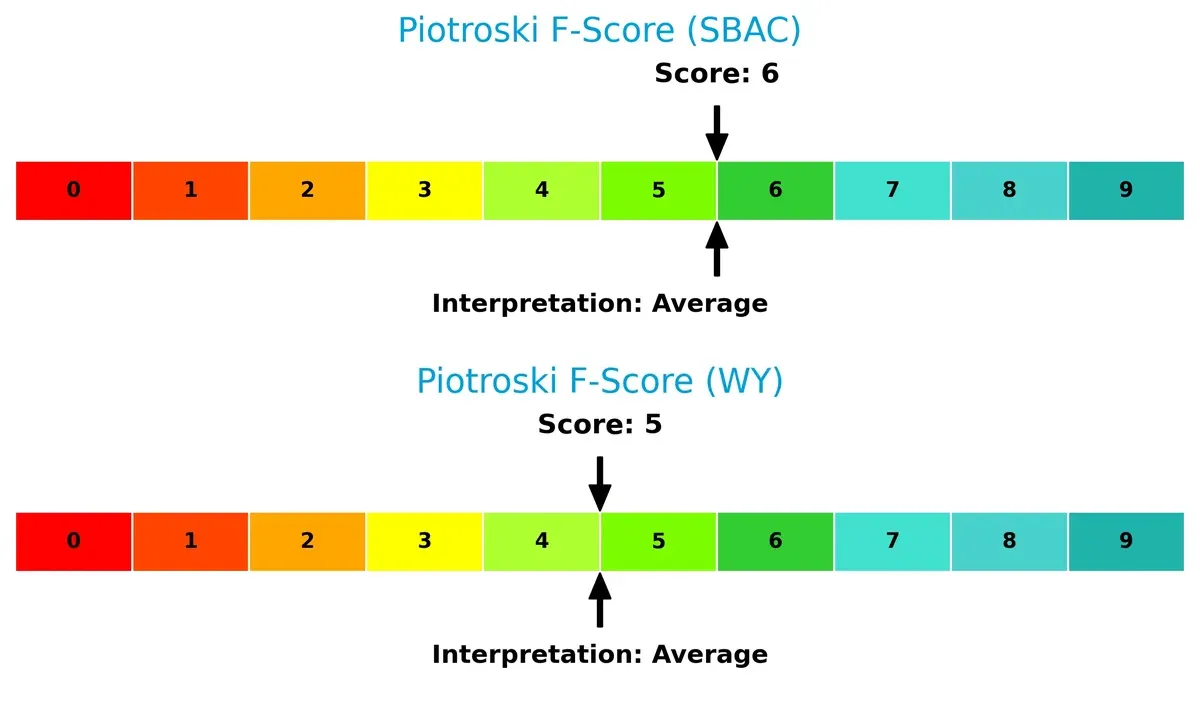

Financial Health: Quality of Operations

Both firms score similarly on financial health with Piotroski F-Scores of 6 (SBAC) and 5 (WY), reflecting average operational quality. Neither displays critical red flags, but SBAC holds a slight edge in internal financial metrics:

How are the two companies positioned?

This section dissects the operational DNA of SBAC and WY by comparing revenue distribution and internal dynamics—strengths and weaknesses. The goal is to confront their economic moats to identify which model offers the most resilient, sustainable advantage today.

Revenue Segmentation: The Strategic Mix

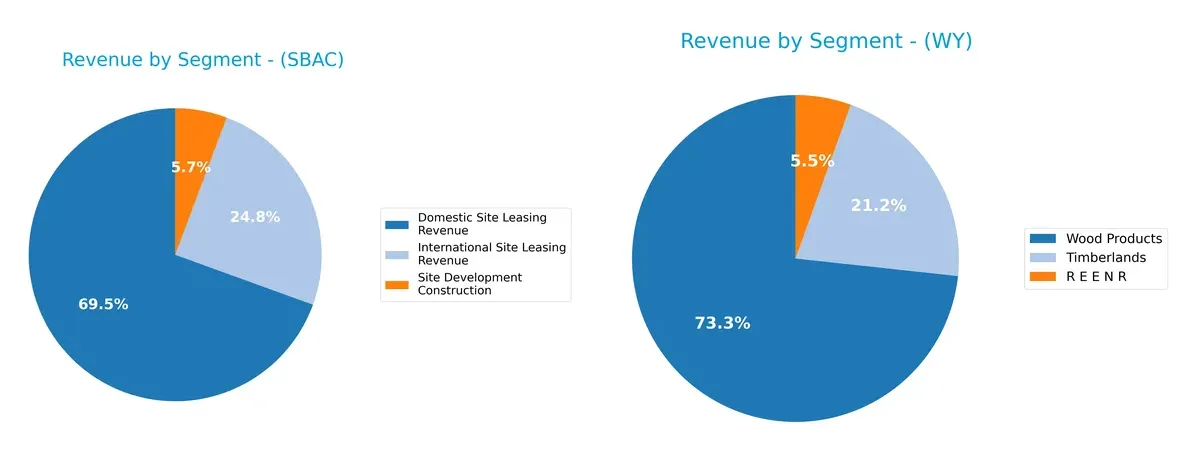

The following visual comparison dissects how SBA Communications Corporation and Weyerhaeuser Company diversify their income streams and where their primary sector bets lie:

SBA Communications leans heavily on Domestic Site Leasing, generating $1.86B in 2024, with International Leasing and Site Development trailing. This concentration anchors SBA’s ecosystem lock-in in wireless infrastructure. Weyerhaeuser displays a broader spread, with Wood Products dominating at $5.22B, but Timberlands and R E E N R add meaningful diversification. Weyerhaeuser’s mix mitigates risk but depends on cyclical wood product demand, unlike SBA’s infrastructure resilience.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of SBA Communications Corporation (SBAC) and Weyerhaeuser Company (WY):

SBAC Strengths

- Strong net margin of 27.97%

- ROIC at 12.57% exceeds WACC of 5.69% indicating value creation

- Favorable quick ratio and low debt-to-equity

- Diverse revenue from domestic and international site leasing

- Positive interest coverage ratio

WY Strengths

- Diversified revenue across Timberlands, Wood Products, and R E E N R segments

- Favorable WACC at 7.73%

- Dividend yield of 3.54%

- Neutral current and quick ratios imply liquidity balance

- Geographic diversification with significant US and international sales

SBAC Weaknesses

- Negative ROE at -14.67%, a red flag for shareholder returns

- High debt-to-assets at 138%, signaling financial risk

- Unfavorable asset and fixed asset turnover ratios indicate inefficiency

- High P/E ratio at 29.37 may suggest overvaluation

WY Weaknesses

- Low net margin of 4.69%

- ROE and ROIC below cost of capital, indicating poor profitability

- Unfavorable asset turnover

- High P/E ratio of 52.88 raises valuation concerns

- Neutral to unfavorable interest coverage ratio

SBAC’s strengths lie in operational profitability and capital efficiency but face financial leverage risks. WY shows revenue diversification and stable liquidity but struggles with profitability and efficiency. These contrasts highlight different strategic priorities and risk profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competition erosion. Let’s examine these moats closely:

SBA Communications Corporation: Network Effects and Infrastructure Scale

SBA’s moat stems from its vast wireless tower network, creating high switching costs for tenants. Its 6.9% ROIC premium over WACC confirms efficient capital use and margin stability. Expansion into emerging 5G markets in 2026 could deepen this advantage.

Weyerhaeuser Company: Natural Resource Ownership

Weyerhaeuser’s moat relies on its 11M acres of timberlands, offering a cost advantage through sustainable resource control. However, a negative 4.8% ROIC gap versus WACC signals value destruction. Market volatility and declining margins threaten its competitive position in 2026.

Network Scale vs. Resource Control: Who Holds the Stronger Moat?

SBA’s growing ROIC premium highlights a wider, more durable moat compared to Weyerhaeuser’s shrinking returns and value loss. SBA is clearly better positioned to defend and grow its market share through innovation and scale.

Which stock offers better returns?

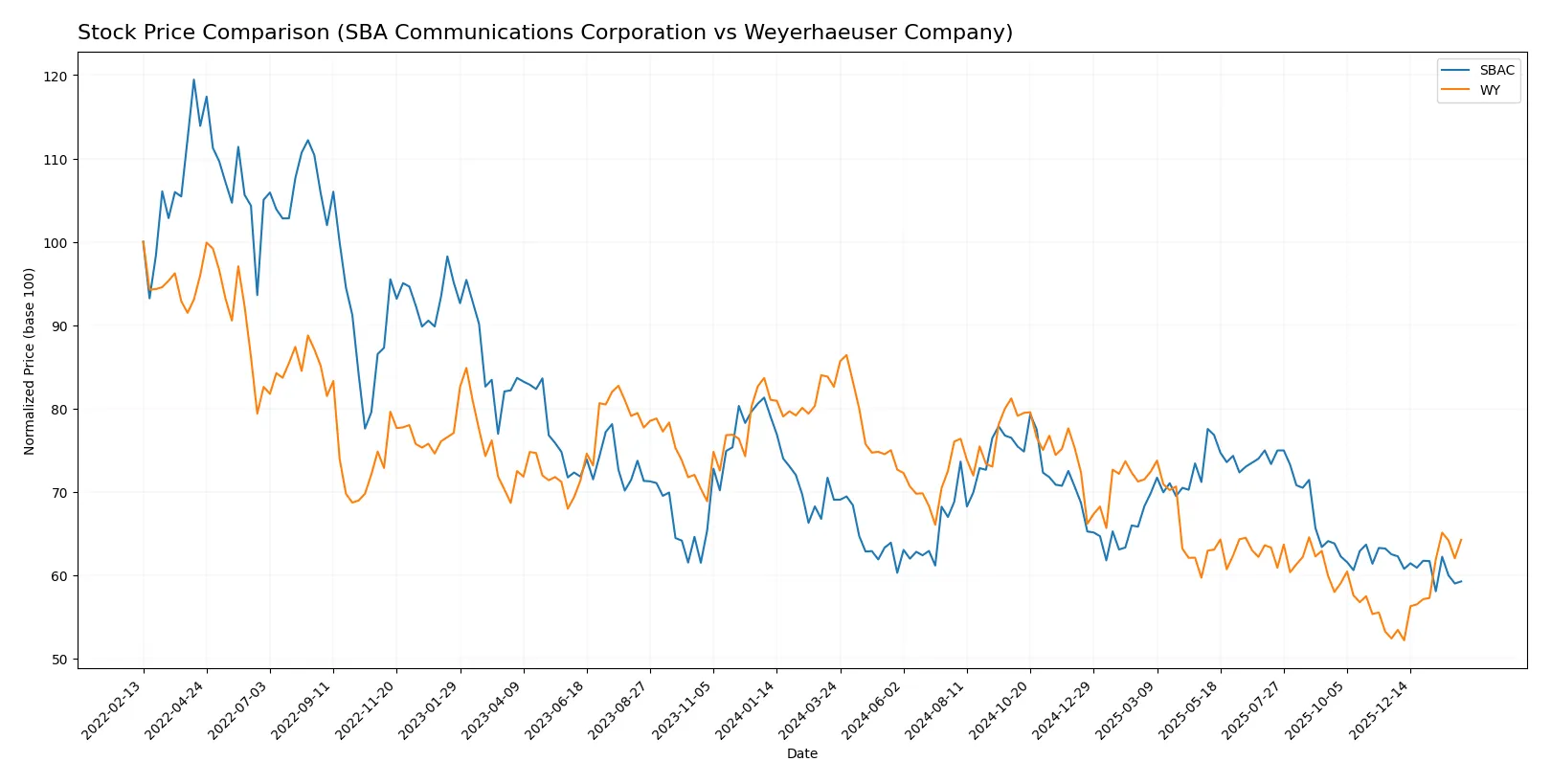

The past year shows contrasting price dynamics for SBA Communications and Weyerhaeuser, with both stocks experiencing significant shifts and distinct trading volumes.

Trend Comparison

SBA Communications (SBAC) displays a bearish trend over the past 12 months, with a -14.21% decline and decelerating price movement, hitting a high of 247.47 and a low of 181.2.

Weyerhaeuser (WY) also shows a bearish overall trend, down -22.23% over 12 months, but with accelerating downward momentum. Notably, it rebounded recently with a 22.59% gain since November 2025.

WY’s recent bullish recovery contrasts with SBAC’s continued bearish trend, resulting in WY delivering a stronger market performance in the latest months despite larger annual declines.

Target Prices

Analyst consensus projects solid upside potential for both SBA Communications Corporation and Weyerhaeuser Company.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| SBA Communications Corporation | 205 | 280 | 238.43 |

| Weyerhaeuser Company | 28 | 33 | 30.2 |

SBA Communications’ target consensus sits roughly 29% above its current price of $184.87, signaling strong growth expectations. Weyerhaeuser’s consensus target exceeds its $26.7 price by about 13%, reflecting moderate optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the latest institutional grades for SBA Communications Corporation and Weyerhaeuser Company:

SBA Communications Corporation Grades

The table below shows recent grades issued by major financial institutions for SBA Communications Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-20 |

| Scotiabank | Maintain | Sector Perform | 2026-01-14 |

| JP Morgan | Maintain | Neutral | 2026-01-12 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-16 |

| Barclays | Maintain | Overweight | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-17 |

| RBC Capital | Maintain | Outperform | 2025-11-10 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| BMO Capital | Maintain | Market Perform | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

Weyerhaeuser Company Grades

Below is the latest grading data from key analysts for Weyerhaeuser Company.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2026-02-02 |

| DA Davidson | Maintain | Buy | 2026-02-02 |

| Citigroup | Maintain | Buy | 2026-01-14 |

| Truist Securities | Maintain | Hold | 2026-01-06 |

| CIBC | Maintain | Outperform | 2025-12-12 |

| B of A Securities | Downgrade | Neutral | 2025-11-17 |

| JP Morgan | Maintain | Overweight | 2025-11-14 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| RBC Capital | Maintain | Outperform | 2025-11-03 |

| DA Davidson | Maintain | Buy | 2025-11-03 |

Which company has the best grades?

SBA Communications holds predominantly positive grades, including multiple Buy and Outperform ratings. Weyerhaeuser has a mix of Buy and Hold grades, with one recent downgrade. SBA’s stronger consensus may attract investors seeking higher conviction.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

SBA Communications Corporation

- Dominates wireless infrastructure with strong multi-tenant leases but faces sector tech shifts.

Weyerhaeuser Company

- Largest timberland owner with sustainable management but exposed to cyclical wood product demand.

2. Capital Structure & Debt

SBA Communications Corporation

- High debt-to-assets ratio (138%) signals elevated leverage risk despite strong interest coverage.

Weyerhaeuser Company

- Moderate leverage (33.5% debt-to-assets) with stable interest coverage reflects balanced capital structure.

3. Stock Volatility

SBA Communications Corporation

- Beta of 0.87 indicates below-market volatility, appealing for risk-averse investors.

Weyerhaeuser Company

- Beta slightly above 1.0 (1.033) shows sensitivity to market swings, increasing risk exposure.

4. Regulatory & Legal

SBA Communications Corporation

- Subject to telecommunications regulations and zoning laws impacting lease expansions.

Weyerhaeuser Company

- Faces stringent forestry regulations and sustainability compliance, increasing operational constraints.

5. Supply Chain & Operations

SBA Communications Corporation

- Relies on site development and leasing; operational risks include construction delays and tenant churn.

Weyerhaeuser Company

- Supply chain exposed to raw material availability and fluctuations in wood product manufacturing.

6. ESG & Climate Transition

SBA Communications Corporation

- Limited direct climate impact but increasing pressure to support green telecom infrastructure.

Weyerhaeuser Company

- High ESG focus with sustainable forestry; climate transition integral but vulnerable to extreme weather.

7. Geopolitical Exposure

SBA Communications Corporation

- Operations span Americas and South Africa, exposing it to diverse geopolitical risks and currency fluctuations.

Weyerhaeuser Company

- Primarily North American exposure limits geopolitical risk but ties to cross-border timber licenses add complexity.

Which company shows a better risk-adjusted profile?

SBA Communications’ most impactful risk is its excessive leverage, heightening financial distress potential despite operational strengths. Weyerhaeuser’s key vulnerability lies in market cyclicality and weaker profitability metrics. SBA’s lower beta and strong interest coverage favor a better risk-adjusted profile, though its Altman Z-Score signals distress. Weyerhaeuser’s more moderate leverage and grey zone Z-Score suggest caution but less immediate financial risk. Recent data highlight SBA’s extreme debt-to-assets ratio at 138%, justifying concern over solvency despite its market position.

Final Verdict: Which stock to choose?

SBA Communications Corporation’s superpower lies in its robust value creation and growing profitability, signaling a sustainable competitive advantage. However, its elevated leverage and volatile price action warrant vigilance. This stock suits aggressive growth portfolios that can weather financial complexity for outsized returns.

Weyerhaeuser Company’s moat is its tangible asset base and steady cash flow, offering a defensive profile compared to SBA’s higher risk. Though its profitability lags, WY provides relative stability and a dividend cushion. It fits well in GARP portfolios seeking moderate growth with income stability.

If you prioritize aggressive growth and value creation, SBA Communications outshines with its expanding moat and operational efficiency despite balance sheet risks. However, if you seek better stability and income, Weyerhaeuser offers a safer harbor with tangible assets and dividend yield, albeit with slower growth prospects.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of SBA Communications Corporation and Weyerhaeuser Company to enhance your investment decisions: