In the dynamic world of software applications, Salesforce, Inc. and SoundHound AI, Inc. stand out with distinct yet overlapping ambitions. Salesforce leads in customer relationship management with a vast platform connecting businesses globally, while SoundHound AI pioneers voice AI technology that enhances conversational experiences. Both companies innovate within the technology sector, making their comparison essential for investors seeking growth and innovation. Let’s explore which stock holds the most promise for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Salesforce, Inc. and SoundHound AI, Inc. by providing an overview of these two companies and their main differences.

Salesforce Overview

Salesforce, Inc. specializes in customer relationship management (CRM) technology, aiming to connect companies and customers globally through its Customer 360 platform. It offers a broad range of services including sales automation, personalized customer service, marketing, commerce, analytics with Tableau, and integration via MuleSoft. Founded in 1999 and headquartered in San Francisco, Salesforce serves diverse industries with a workforce of 76K employees.

SoundHound Overview

SoundHound AI, Inc. develops an independent voice AI platform designed to help businesses create conversational voice assistants. Its flagship product, the Houndify platform, provides tools like speech recognition, natural language understanding, and embedded voice solutions. The company, founded recently and based in Santa Clara, California, focuses on enhancing customer interactions through voice technology with 842 employees.

Key similarities and differences

Both companies operate within the software application industry and focus on enhancing customer experience through technology. Salesforce offers a comprehensive CRM ecosystem targeting various business functions and industries, whereas SoundHound AI concentrates on voice AI platforms to enable conversational experiences. Their market caps differ significantly, with Salesforce at 219B and SoundHound AI at 4.8B, reflecting their scale and maturity.

Income Statement Comparison

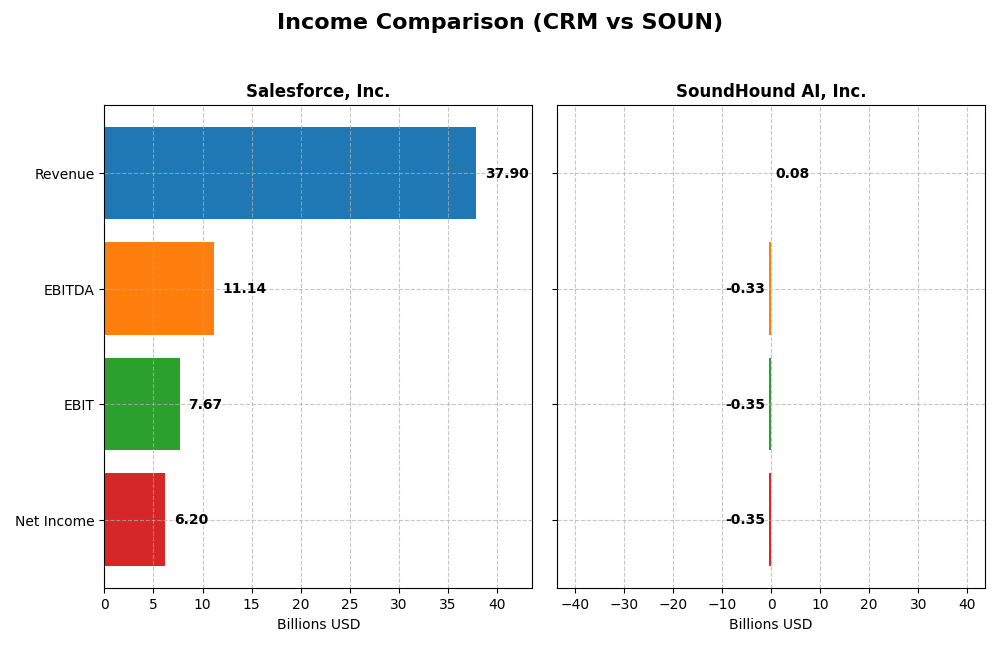

This table presents a side-by-side comparison of the key financial metrics from the latest fiscal year for Salesforce, Inc. and SoundHound AI, Inc.

| Metric | Salesforce, Inc. | SoundHound AI, Inc. |

|---|---|---|

| Market Cap | 219B | 4.8B |

| Revenue | 37.9B | 85M |

| EBITDA | 11.1B | -329M |

| EBIT | 7.7B | -348M |

| Net Income | 6.2B | -351M |

| EPS | 6.44 | -1.04 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Salesforce, Inc.

Salesforce showed consistent revenue growth from $21.3B in 2021 to $37.9B in 2025, with net income rising from $4.07B to $6.2B over the same period. Margins remained strong, with a gross margin above 77% and a net margin of 16.35% in 2025. The latest year exhibited solid earnings growth and improved operating efficiency, reinforcing its profitability.

SoundHound AI, Inc.

SoundHound’s revenue expanded rapidly from $13M in 2020 to $85M in 2024, though it remains unprofitable with a net loss of $351M in 2024. Gross margin was favorable at nearly 49%, but EBIT and net margins were deeply negative, reflecting high expenses. The most recent year saw revenue growth slow, while losses widened, indicating ongoing challenges managing costs.

Which one has the stronger fundamentals?

Salesforce demonstrates stronger fundamentals with sustained revenue and net income growth, favorable margins, and efficient cost management. SoundHound shows impressive top-line expansion but struggles with persistent losses and unfavorable profitability metrics. Salesforce’s consistent profitability outweighs SoundHound’s growth potential in terms of financial stability and income statement strength.

Financial Ratios Comparison

Below is a comparative overview of key financial ratios for Salesforce, Inc. (CRM) and SoundHound AI, Inc. (SOUN) based on their most recent fiscal year data.

| Ratios | Salesforce, Inc. (CRM) FY 2025 | SoundHound AI, Inc. (SOUN) FY 2024 |

|---|---|---|

| ROE | 10.1% | -191.9% |

| ROIC | 7.95% | -68.1% |

| P/E | 53.0 | -19.1 |

| P/B | 5.37 | 36.8 |

| Current Ratio | 1.06 | 3.77 |

| Quick Ratio | 1.06 | 3.77 |

| D/E (Debt-to-Equity) | 0.19 | 0.02 |

| Debt-to-Assets | 11.1% | 0.79% |

| Interest Coverage | 26.5 | -28.1 |

| Asset Turnover | 0.37 | 0.15 |

| Fixed Asset Turnover | 7.03 | 14.3 |

| Payout Ratio | 24.8% | 0% |

| Dividend Yield | 0.47% | 0% |

Interpretation of the Ratios

Salesforce, Inc.

Salesforce shows a mix of strong and weak ratios; its net margin is favorable at 16.35% while the price-to-earnings and price-to-book ratios are unfavorable, indicating potential overvaluation. Liquidity and leverage ratios are generally positive, with a debt-to-equity of 0.19 and interest coverage of 28.18. The company pays dividends with a low yield of 0.47%, reflecting cautious shareholder returns.

SoundHound AI, Inc.

SoundHound AI’s financial ratios are predominantly unfavorable, with deeply negative net margin (-414.06%) and return on equity (-191.99%), indicating significant losses. While the debt ratio is low and quick ratio favorable at 3.77, poor interest coverage and asset turnover raise concerns. The company does not pay dividends, likely due to ongoing losses and focus on growth and R&D.

Which one has the best ratios?

Salesforce presents a slightly favorable overall ratio profile, balancing profitability and liquidity despite some valuation concerns. In contrast, SoundHound AI’s ratios are largely unfavorable, reflecting its early-stage status and financial challenges. Therefore, Salesforce demonstrates stronger financial stability and performance metrics based on the given data.

Strategic Positioning

This section compares the strategic positioning of Salesforce and SoundHound AI regarding market position, key segments, and exposure to technological disruption:

Salesforce, Inc.

- Large market cap of $219B with established industry presence; faces typical competitive pressure in software applications.

- Diverse revenue streams: Sales Cloud, Service Cloud, Marketing, Commerce, Integration, Analytics, and professional services.

- Operates in established CRM and analytics software; disruption risk present but mitigated by diversified offerings and platform integration.

SoundHound AI, Inc.

- Smaller market cap of $4.8B; operates in emerging voice AI with higher beta indicating greater volatility.

- Focused on voice AI platform with hosted services, licensing, and professional services as main revenue drivers.

- Positioned in conversational AI, a rapidly evolving tech area with high disruption potential and innovation dependency.

Salesforce, Inc. vs SoundHound AI, Inc. Positioning

Salesforce maintains a diversified business model across multiple cloud and service segments, offering stability but exposure to broader competition. SoundHound AI concentrates on voice AI, which may offer high growth but entails higher risk due to narrower focus and emerging market challenges.

Which has the best competitive advantage?

Both companies are currently shedding value as their ROIC is below WACC, though both show improving ROIC trends. Salesforce’s larger scale and diversified segments provide a more stable, albeit slightly unfavorable, moat compared to SoundHound AI’s higher volatility and narrower focus.

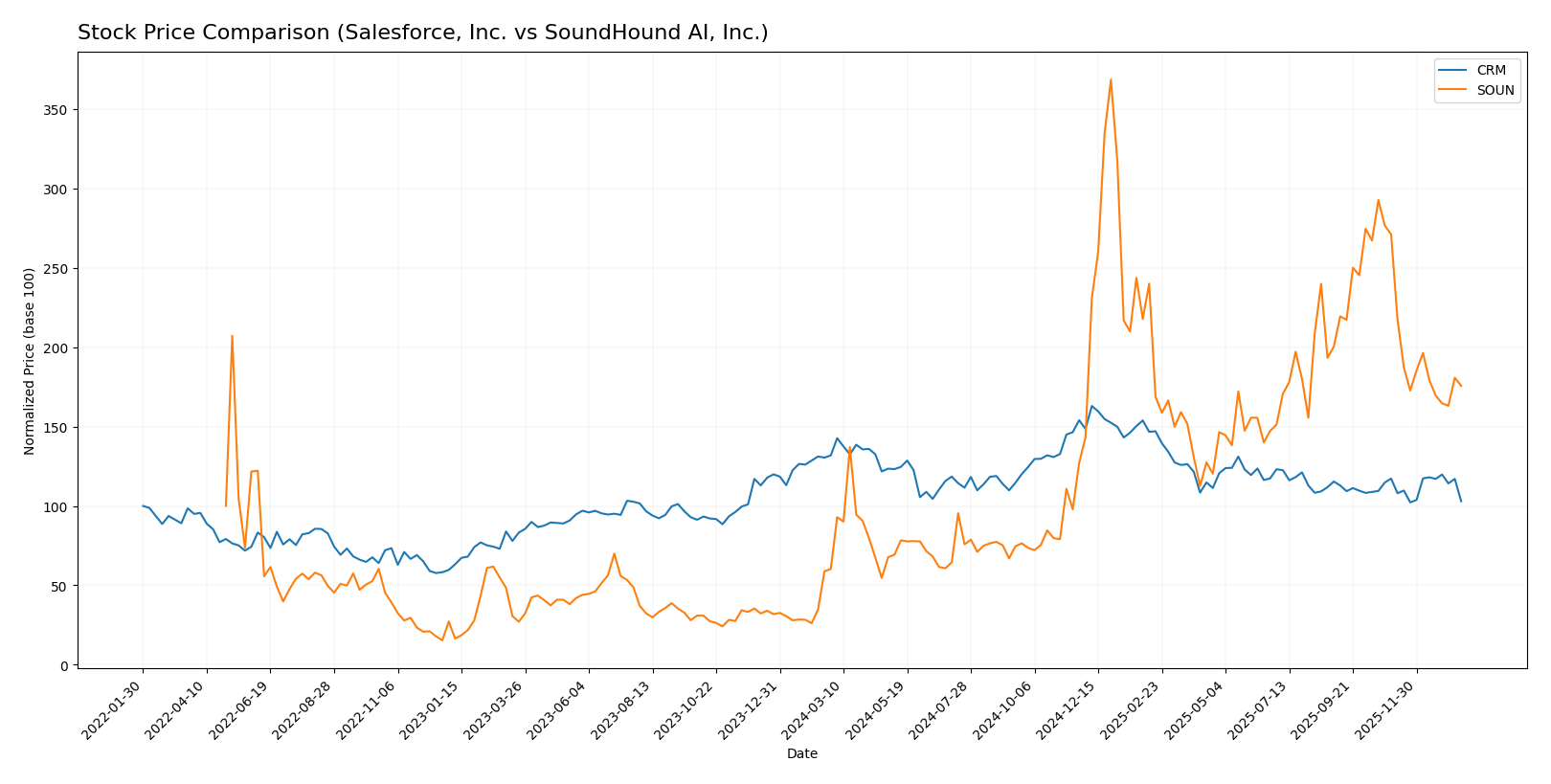

Stock Comparison

The stock price dynamics over the past year reveal contrasting trajectories, with Salesforce, Inc. (CRM) experiencing a pronounced decline while SoundHound AI, Inc. (SOUN) shows substantial growth, albeit with recent volatility and shifts in trading dominance.

Trend Analysis

Salesforce, Inc. (CRM) exhibited a bearish trend over the past 12 months with a price decrease of 21.86%, showing acceleration in the decline and a high volatility level indicated by a 31.79 standard deviation. The stock’s highest and lowest prices were 361.99 and 227.11 respectively.

SoundHound AI, Inc. (SOUN) demonstrated a bullish trend over the same period with a 191.2% price increase, though the trend showed deceleration and much lower volatility at 4.66 standard deviation. The stock’s price fluctuated between 3.55 and 23.95.

Comparing both, SoundHound AI delivered the highest market performance over the past year, significantly outperforming Salesforce despite recent downward pressure and seller dominance in the latest period.

Target Prices

The current analyst consensus on target prices reflects moderate optimism for both Salesforce, Inc. and SoundHound AI, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Salesforce, Inc. | 400 | 250 | 324.17 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

Analysts expect Salesforce’s stock to appreciate from its current price of $229.05 toward the $324 consensus, indicating upside potential. SoundHound AI’s target suggests a modest increase from its current $11.41 price, reflecting cautious optimism.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Salesforce, Inc. and SoundHound AI, Inc.:

Rating Comparison

Salesforce, Inc. Rating

- Rating: B+ indicating a very favorable status.

- Discounted Cash Flow Score: 4, considered favorable.

- ROE Score: 4, showing favorable profitability efficiency.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 3, moderate financial risk.

- Overall Score: 3, moderate overall financial standing.

SoundHound AI, Inc. Rating

- Rating: C- with a very unfavorable overall status.

- Discounted Cash Flow Score: 1, considered very unfavorable.

- ROE Score: 1, very unfavorable profitability efficiency.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 4, favorable financial risk profile.

- Overall Score: 1, very unfavorable overall financial standing.

Which one is the best rated?

Based on the provided data, Salesforce, Inc. is better rated overall, with higher scores in discounted cash flow, ROE, and ROA, despite a moderate debt-to-equity score. SoundHound AI shows weakness in most categories except debt-to-equity.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Salesforce, Inc. and SoundHound AI, Inc.:

Salesforce Scores

- Altman Z-Score: 5.26, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health.

SoundHound AI Scores

- Altman Z-Score: 6.62, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 3, indicating very weak financial health.

Which company has the best scores?

Both companies have Altman Z-Scores in the safe zone, but Salesforce’s Piotroski Score is notably higher at 7, indicating stronger financial health compared to SoundHound AI’s score of 3.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Salesforce, Inc. and SoundHound AI, Inc.:

Salesforce, Inc. Grades

This table summarizes recent grades from reputable financial institutions for Salesforce, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-09 |

| Citigroup | Maintain | Neutral | 2025-12-08 |

| DA Davidson | Maintain | Neutral | 2025-12-05 |

| Citizens | Maintain | Market Outperform | 2025-12-04 |

| Deutsche Bank | Maintain | Buy | 2025-12-04 |

| Wedbush | Maintain | Outperform | 2025-12-04 |

| Northland Capital Markets | Maintain | Market Perform | 2025-12-04 |

| Canaccord Genuity | Maintain | Buy | 2025-12-04 |

Salesforce’s grades show a consistent pattern of positive outlooks, predominantly “Overweight,” “Buy,” and “Outperform,” indicating confidence from multiple firms.

SoundHound AI, Inc. Grades

The following table lists recent grades from recognized grading companies for SoundHound AI, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI’s grades range from “Neutral” to “Buy” and “Outperform,” with some recent upgrades, reflecting a moderately optimistic sentiment.

Which company has the best grades?

Salesforce, Inc. has received more numerous and consistently stronger grades, including multiple “Overweight” and “Buy” ratings from major firms, suggesting stronger analyst conviction. SoundHound AI, Inc. has a mix of “Neutral” and “Buy” ratings with fewer upgrades. This disparity could influence investors’ perception of relative stability and growth potential.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Salesforce, Inc. (CRM) and SoundHound AI, Inc. (SOUN) based on recent financial and operational data.

| Criterion | Salesforce, Inc. (CRM) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | Highly diversified product segments generating multi-billion revenues across cloud services | Limited product diversification with smaller revenue segments mainly in hosted services and licensing |

| Profitability | Positive net margin (16.35%), growing ROIC but still slightly unfavorable vs WACC | Negative net margin (-414%), negative ROIC, company is shedding value but improving profitability trend |

| Innovation | Strong focus on cloud innovation and analytics, consistent revenue growth in Integration and Analytics segment | Emerging AI voice tech, innovation potential but currently low profitability and high losses |

| Global presence | Extensive global footprint in cloud and enterprise software markets | Smaller scale, less global reach compared to CRM |

| Market Share | Leading CRM software provider with significant market share in multiple cloud segments | Early stage in competitive AI voice market with limited market share |

Key takeaways: Salesforce shows strong diversification, solid profitability, and global presence despite value shedding, while SoundHound, although innovative, struggles with profitability and scale, indicating higher investment risk but potential growth upside.

Risk Analysis

Below is a comparative table highlighting key risk factors for Salesforce, Inc. (CRM) and SoundHound AI, Inc. (SOUN) based on their most recent financial and operational data.

| Metric | Salesforce, Inc. (CRM) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Risk | Moderate (Beta 1.27) | High (Beta 2.88) |

| Debt level | Low (D/E 0.19) | Very Low (D/E 0.02) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate (Large scale, complex operations) | High (Smaller scale, emerging tech) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate (Global presence) | Moderate (US-based, tech sector) |

Salesforce faces moderate market and operational risks due to its large scale and complex global operations, but enjoys low debt levels and solid financial health. SoundHound AI exhibits higher market and operational risks, amplified by its higher stock volatility and weaker profitability, despite very low debt. The most impactful risk for investors is SoundHound’s operational and financial instability, while Salesforce’s risks are more balanced but require monitoring in a competitive tech landscape.

Which Stock to Choose?

Salesforce, Inc. (CRM) shows a favorable income evolution with strong revenue and net income growth over 2021-2025. Its financial ratios are slightly favorable overall, featuring good profitability, low debt levels, and a solid rating of B+ with a moderate overall score. However, its economic moat is slightly unfavorable as ROIC is below WACC despite improving trends.

SoundHound AI, Inc. (SOUN) displays an unfavorable income evolution marked by significant net losses and negative profitability ratios, despite rapid revenue growth. Its financial ratios are largely unfavorable, with some favorable liquidity and leverage metrics. The rating stands at C- with a very unfavorable overall score, and the economic moat is also slightly unfavorable with ROIC well below WACC but improving.

For investors focused on stability and profitability, Salesforce’s solid rating and favorable income metrics might appear more attractive, whereas risk-tolerant investors interested in high growth potential could interpret SoundHound’s rapid revenue expansion and improving ROIC trend as a speculative opportunity. The choice could be seen as dependent on the investor’s risk profile and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Salesforce, Inc. and SoundHound AI, Inc. to enhance your investment decisions: