In the fast-evolving world of cloud security and data protection, Zscaler, Inc. and Rubrik, Inc. stand out as key players driving innovation. Both companies operate in the Software – Infrastructure sector, targeting enterprise clients with advanced security solutions. Their overlapping markets and strategic focus on safeguarding digital assets make them natural competitors. In this article, I will analyze these companies to identify which offers the best investment potential for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Zscaler and Rubrik by providing an overview of these two companies and their main differences.

Zscaler Overview

Zscaler, Inc. is a cloud security company headquartered in San Jose, California. It offers solutions such as Zscaler Internet Access and Zscaler Private Access to secure access for users, servers, and IoT devices to external and internal applications. The company also provides digital experience measurement and workload segmentation to prevent data breaches. Founded in 2007, Zscaler operates globally across multiple industries including technology, healthcare, and finance.

Rubrik Overview

Rubrik, Inc., based in Palo Alto, California, delivers data security solutions encompassing enterprise, cloud, and SaaS data protection. Its offerings include data threat analytics, security posture, and cyber recovery services. Founded in 2013, Rubrik serves a diverse client base across sectors such as financial services, retail, healthcare, and public organizations. The company emphasizes safeguarding unstructured data and enhancing cyber resilience worldwide.

Key similarities and differences

Both Zscaler and Rubrik operate in the software infrastructure industry with a focus on cybersecurity, serving a wide range of sectors. Zscaler specializes in cloud access security and digital experience monitoring, while Rubrik concentrates on data protection and cyber recovery. Zscaler has a larger workforce and market capitalization compared to Rubrik, reflecting different scales and stages of growth within the technology security landscape.

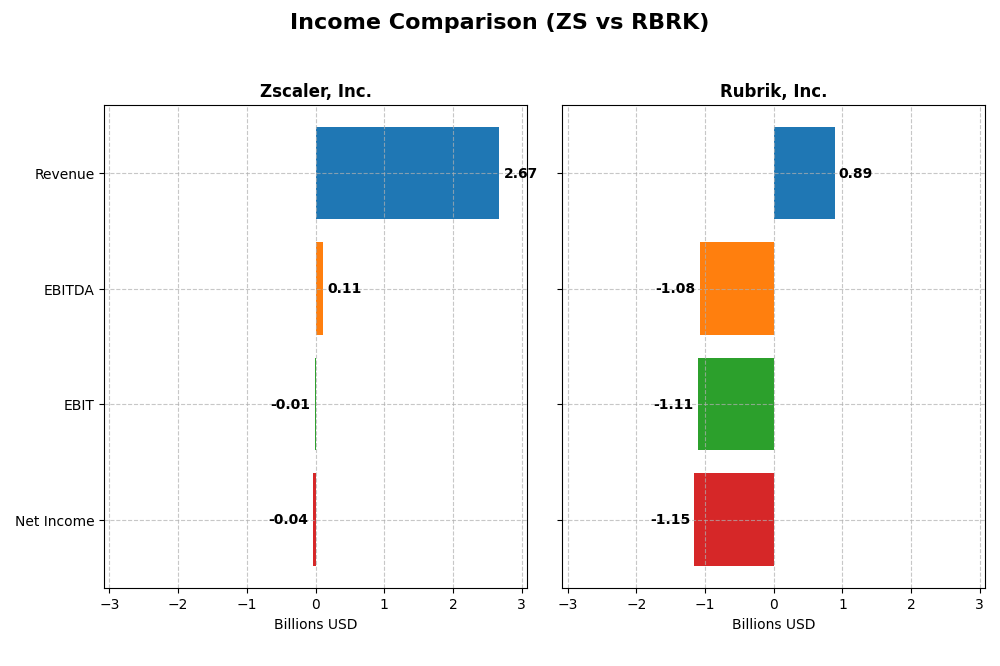

Income Statement Comparison

The table below presents a side-by-side comparison of the latest fiscal year income statement metrics for Zscaler, Inc. and Rubrik, Inc., highlighting key financial figures to aid in analysis.

| Metric | Zscaler, Inc. (ZS) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Market Cap | 34.1B | 13.4B |

| Revenue | 2.67B | 886.5M |

| EBITDA | 112.4M | -1.08B |

| EBIT | -8.8M | -1.11B |

| Net Income | -41.5M | -1.15B |

| EPS | -0.27 | -7.48 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Zscaler, Inc.

Zscaler’s revenue rose sharply from $673M in 2021 to $2.67B in 2025, reflecting a strong growth trajectory. Despite persistent net losses, net income improved significantly, with a narrowing net margin of -1.55% in 2025. Gross margin remained robust at 76.87%, and the company showed favorable growth in revenue, EBIT, and EPS in the most recent year.

Rubrik, Inc.

Rubrik’s revenue increased from $388M in 2021 to $887M in 2025, indicating solid top-line growth. However, net losses widened considerably, with a net margin of -130.26% in 2025. While gross margin stood at a favorable 70.02%, operating expenses grew faster than revenue, leading to unfavorable EBIT and EPS trends over the latest year and overall period.

Which one has the stronger fundamentals?

Zscaler demonstrates stronger fundamentals with consistent revenue growth, improving net income, and a high gross margin. Its income statement shows mostly favorable trends, including margin improvements and positive EPS growth. In contrast, Rubrik, despite revenue gains, exhibits significant profitability challenges, with widening losses and unfavorable margin trajectories, reflecting weaker income statement fundamentals.

Financial Ratios Comparison

The table below compares key financial ratios for Zscaler, Inc. and Rubrik, Inc. based on their most recent fiscal year data, providing an overview of profitability, liquidity, leverage, and market valuation metrics.

| Ratios | Zscaler, Inc. (ZS) | Rubrik, Inc. (RBRK) |

|---|---|---|

| ROE | -2.31% | 208.55% |

| ROIC | -3.18% | -234.85% |

| P/E | -1063 | -9.79 |

| P/B | 24.51 | -20.42 |

| Current Ratio | 2.01 | 1.13 |

| Quick Ratio | 2.01 | 1.13 |

| D/E (Debt to Equity) | 1.00 | -0.63 |

| Debt-to-Assets | 27.98% | 24.65% |

| Interest Coverage | -13.49 | -27.49 |

| Asset Turnover | 0.42 | 0.62 |

| Fixed Asset Turnover | 4.22 | 16.67 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Zscaler, Inc.

Zscaler shows a mixed ratio profile with 35.7% favorable and 50% unfavorable ratios, leading to a slightly unfavorable overall view. Strengths include a solid current and quick ratio around 2.0, and a low debt-to-assets ratio at 28%. However, negative net margin, return on equity (-2.31%), and poor interest coverage present concerns. The company does not pay dividends, likely reflecting its focus on reinvestment and growth.

Rubrik, Inc.

Rubrik presents a more favorable ratio set with 57.1% favorable and 28.6% unfavorable metrics. It benefits from a strong return on equity of 208.55% and a low weighted average cost of capital at 5.34%. Liquidity is moderate with a current ratio of 1.13. Despite negative net margin and interest coverage, the firm does not pay dividends, consistent with a reinvestment or growth phase strategy.

Which one has the best ratios?

Rubrik offers a more favorable ratios profile compared to Zscaler, with higher returns on equity and better capital cost metrics. Zscaler’s liquidity is stronger, but its negative profitability and coverage ratios weigh more heavily. Overall, Rubrik’s ratios indicate a stronger position despite some risks, while Zscaler’s metrics suggest caution.

Strategic Positioning

This section compares the strategic positioning of Zscaler, Inc. and Rubrik, Inc., including Market position, Key segments, and Exposure to technological disruption:

Zscaler, Inc.

- Leading cloud security company with a market cap of 34B, facing competitive pressure in software infrastructure.

- Focused on cloud security solutions including SaaS access, workload segmentation, and digital experience.

- Exposure includes evolving cloud security technologies and risks related to SaaS and cloud infrastructure.

Rubrik, Inc.

- Mid-sized data security firm with a 13B market cap, operating under competitive software infrastructure.

- Concentrates on enterprise and cloud data protection, threat analytics, and cyber recovery.

- Faces disruption risks in data protection technologies and cyber threat analytics innovation.

Zscaler, Inc. vs Rubrik, Inc. Positioning

Zscaler has a more diversified approach with cloud security and workload segmentation across many industries, benefiting from scale. Rubrik concentrates on data protection and cyber recovery, with a narrower product scope and smaller scale, which may impact competitive resilience.

Which has the best competitive advantage?

Both companies are currently shedding value, but Zscaler shows a growing ROIC trend indicating improving profitability, while Rubrik’s declining ROIC trend signals weakening competitive advantage, classifying Zscaler’s moat as slightly unfavorable versus Rubrik’s very unfavorable status.

Stock Comparison

The stock price movements of Zscaler, Inc. and Rubrik, Inc. over the past year reveal contrasting trends, with Zscaler experiencing a notable bearish phase and Rubrik showing strong bullish momentum, despite recent deceleration.

Trend Analysis

Zscaler, Inc. showed a bearish trend over the past 12 months with a price decline of 9.03%, marked by deceleration and high volatility indicated by a 47.11 standard deviation. The stock peaked at 331.14 and bottomed at 156.78.

Rubrik, Inc. experienced a bullish trend over the same period, with a 76.58% price increase and deceleration in momentum. Its volatility was lower, with a standard deviation of 21.4, and prices ranged from 28.65 to 97.91.

Comparing both stocks, Rubrik delivered the highest market performance with a strong positive gain, outperforming Zscaler’s negative price movement over the past year.

Target Prices

Analysts present a clear target consensus for both Zscaler, Inc. and Rubrik, Inc., indicating potential upside from current prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Zscaler, Inc. | 360 | 260 | 311.41 |

| Rubrik, Inc. | 113 | 105 | 109.33 |

The target consensus for Zscaler, Inc. at 311.41 suggests a significant upside versus its current price of 213.98 USD. Rubrik, Inc.’s consensus target of 109.33 also indicates a strong growth potential from its current price of 67.1 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Zscaler, Inc. and Rubrik, Inc.:

Rating Comparison

ZS Rating

- Rating: C- indicating a very favorable overall assessment.

- Discounted Cash Flow Score: 4, favorable, suggesting undervaluation potential.

- ROE Score: 1, very unfavorable, reflecting low efficiency in equity use.

- ROA Score: 1, very unfavorable, indicating poor asset utilization.

- Debt To Equity Score: 1, very unfavorable, suggesting higher financial risk.

- Overall Score: 1, very unfavorable summary of financial health.

RBRK Rating

- Rating: C indicating a very favorable overall assessment.

- Discounted Cash Flow Score: 1, very unfavorable, indicating possible overvaluation.

- ROE Score: 5, very favorable, showing strong profit generation from equity.

- ROA Score: 1, very unfavorable, indicating poor asset utilization.

- Debt To Equity Score: 1, very unfavorable, suggesting higher financial risk.

- Overall Score: 2, moderate summary of financial health.

Which one is the best rated?

Rubrik holds a higher overall score (2 vs. 1) and a stronger ROE score (5 vs. 1) compared to Zscaler. However, Zscaler has a more favorable discounted cash flow score (4 vs. 1). Overall, Rubrik is better rated based on the provided data.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Zscaler and Rubrik:

ZS Scores

- Altman Z-Score: 4.89, safe zone indicating low bankruptcy risk.

- Piotroski Score: 3, very weak financial strength.

RBRK Scores

- Altman Z-Score: 1.41, distress zone indicating high bankruptcy risk.

- Piotroski Score: 4, average financial strength.

Which company has the best scores?

ZS shows a much stronger Altman Z-Score, indicating better financial stability, while RBRK has a slightly better Piotroski Score but remains average. Overall, ZS is safer financially based on these scores.

Grades Comparison

The following tables summarize the recent grades from reputable financial institutions for Zscaler, Inc. and Rubrik, Inc.:

Zscaler, Inc. Grades

This table shows recent grades from well-known analysts for Zscaler, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Mizuho | Upgrade | Outperform | 2025-12-16 |

| Bernstein | Downgrade | Market Perform | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-12-01 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| BTIG | Maintain | Buy | 2025-11-26 |

Overall, Zscaler’s grades show a stable to positive trend with more buy and outperform ratings, despite a single downgrade.

Rubrik, Inc. Grades

This table presents recent grades from reputable firms for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

Rubrik’s grades consistently reflect positive outlooks, with multiple upgrades and no downgrades, highlighting strong analyst confidence.

Which company has the best grades?

Rubrik, Inc. has received consistently high grades with multiple outperform and buy ratings and no downgrades, indicating stronger analyst confidence than Zscaler, Inc., which shows a mix of buy, outperform, and some neutral ratings with one downgrade. For investors, Rubrik’s grades suggest a comparatively more robust consensus on future performance.

Strengths and Weaknesses

Here is a comparison of key strengths and weaknesses for Zscaler, Inc. and Rubrik, Inc. based on the most recent financial and operational data:

| Criterion | Zscaler, Inc. (ZS) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Diversification | Moderate, primarily cloud security | Moderate, focused on data management and backup |

| Profitability | Negative net margin (-1.55%), ROIC -3.18%, value destroying but improving | Strong ROE (208.55%) but negative net margin (-130.26%), ROIC very negative (-234.85%) and declining |

| Innovation | High innovation in cloud security platforms | Innovation in data protection and backup ecosystems |

| Global presence | Significant global footprint in cybersecurity | Growing presence, less extensive globally |

| Market Share | Leader in cloud security market segment | Niche player in data backup and management |

Key takeaways: Zscaler shows improving profitability trends but still operates at a loss, while Rubrik faces severe profitability challenges despite strong ROE. Zscaler’s broader global presence and focus on cloud security may offer more stability, whereas Rubrik’s niche focus requires monitoring due to declining returns and value destruction.

Risk Analysis

Below is a comparative table highlighting key risks for Zscaler, Inc. (ZS) and Rubrik, Inc. (RBRK) based on the most recent financial and operational data from 2025.

| Metric | Zscaler, Inc. (ZS) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Market Risk | Moderate (Beta 1.02) | Low (Beta 0.28) |

| Debt Level | Moderate (Debt/Assets 28%) | Moderate (Debt/Assets 25%) |

| Regulatory Risk | Moderate (Cloud security sector) | Moderate (Data security sector) |

| Operational Risk | Moderate (7,348 employees, global operations) | Moderate (3,200 employees, expanding) |

| Environmental Risk | Low (Tech sector, minimal footprint) | Low (Tech sector, minimal footprint) |

| Geopolitical Risk | Moderate (US-based, global clients) | Moderate (US-based, global clients) |

In synthesis, the most impactful risks are market volatility and operational challenges due to rapid growth and competitive pressure in cloud security. Zscaler’s higher beta indicates greater sensitivity to market swings, while Rubrik faces distress signals with a low Altman Z-Score, highlighting potential financial instability despite its favorable ROE. Investors should weigh these factors carefully in risk management strategies.

Which Stock to Choose?

Zscaler, Inc. (ZS) shows strong income growth with a 297% revenue increase over 2021-2025 and an overall favorable income statement. However, profitability ratios such as ROE and net margin remain negative, debt levels are moderate, and financial ratios are slightly unfavorable, indicating some operational challenges despite a growing ROIC trend.

Rubrik, Inc. (RBRK) has experienced revenue growth of 129% over the same period but faces significant profitability issues with negative net margin and declining ROIC. Its financial ratios are more favorable overall, supported by a strong ROE score, though it remains in financial distress with weak liquidity and worsening profitability metrics.

For investors prioritizing growth and improving profitability trends, Zscaler’s favorable income evolution and growing ROIC might appear more attractive, whereas those valuing stronger financial ratios and potentially higher ROE could view Rubrik as more suitable despite its financial distress and declining profitability. The choice could depend on whether the investor is more risk-tolerant with a focus on growth or prefers financial stability with a moderate risk profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Zscaler, Inc. and Rubrik, Inc. to enhance your investment decisions: