In the dynamic world of technology, Rubrik, Inc. and Wix.com Ltd. stand out as innovators in software infrastructure, each addressing critical business needs. Rubrik focuses on data security and cloud protection, while Wix empowers users with creative website development tools and business automation. Their market overlap and innovation strategies make them compelling peers to compare. Join me as we explore which company offers the best investment potential in 2026.

Table of contents

Companies Overview

I will begin the comparison between Rubrik and Wix.com by providing an overview of these two companies and their main differences.

Rubrik Overview

Rubrik, Inc. specializes in data security solutions, offering enterprise, cloud, and SaaS data protection, along with cyber recovery and threat analytics. Founded in 2013 and based in Palo Alto, California, Rubrik serves diverse sectors including finance, healthcare, and technology. The company is positioned as a key player in software infrastructure with a market cap of 13.4B USD and employs around 3,200 people.

Wix.com Overview

Wix.com Ltd. is a cloud platform enabling website and web application creation through drag-and-drop tools and AI-powered features. Founded in 2006 in Tel Aviv, Israel, Wix serves millions globally with products like Wix Editor and Wix Payments. It operates in software infrastructure with a market cap of 4.5B USD and employs approximately 4,400 staff, focusing on ease of use and business growth solutions.

Key similarities and differences

Both Rubrik and Wix operate in the technology sector under software infrastructure but target distinct markets. Rubrik focuses on data security and protection solutions primarily for enterprises, while Wix targets individuals and businesses needing website creation tools. Rubrik’s business emphasizes data resilience and cybersecurity, whereas Wix centers on digital presence and e-commerce facilitation. Their geographic bases and user demographics also differ significantly.

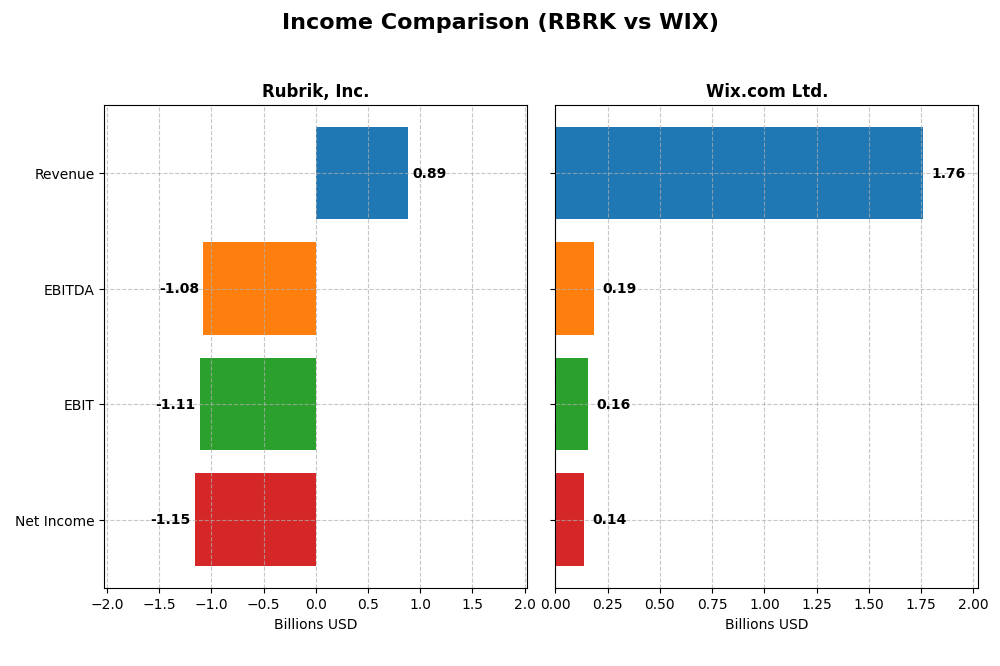

Income Statement Comparison

The table below compares key financial metrics from the most recent fiscal year for Rubrik, Inc. and Wix.com Ltd., highlighting their revenue, profitability, and earnings per share.

| Metric | Rubrik, Inc. (RBRK) | Wix.com Ltd. (WIX) |

|---|---|---|

| Market Cap | 13.4B | 4.46B |

| Revenue | 887M | 1.76B |

| EBITDA | -1.08B | 186M |

| EBIT | -1.11B | 155M |

| Net Income | -1.15B | 138M |

| EPS | -7.48 | 2.49 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Rubrik, Inc.

Rubrik’s revenue grew significantly from $388M in 2021 to $887M in 2025, a 129% increase over five years. However, net income remained deeply negative, worsening from -$213M to -$1.15B, reflecting persistent losses. Despite a strong gross margin of 70%, the company’s EBIT and net margins are severely negative, with deteriorating profitability in 2025 as losses expanded sharply.

Wix.com Ltd.

Wix exhibited steady revenue growth from $984M in 2020 to $1.76B in 2024, a 79% rise in five years. Net income improved markedly from a -$167M loss to a positive $138M in 2024, signaling a successful turnaround. Margins improved with a gross margin near 68% and a positive net margin of 7.9% in 2024, supported by expanding operating profits and EPS growth.

Which one has the stronger fundamentals?

Wix displays stronger fundamentals with consistent revenue growth, positive net income, and improving margins, reflecting operational efficiency and profitability gains. Conversely, Rubrik shows rapid revenue growth but large and increasing net losses with unfavorable EBIT and net margins, indicating ongoing challenges in achieving profitability despite its market expansion.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Rubrik, Inc. (RBRK) and Wix.com Ltd. (WIX) based on their most recent fiscal year data.

| Ratios | Rubrik, Inc. (2025) | Wix.com Ltd. (2024) |

|---|---|---|

| ROE | 2.09% | -1.76% |

| ROIC | -2.35% | 9.13% |

| P/E | -9.79 | 86.21 |

| P/B | -20.42 | -151.35 |

| Current Ratio | 1.13 | 0.84 |

| Quick Ratio | 1.13 | 0.84 |

| D/E (Debt-to-Equity) | -0.63 | -12.31 |

| Debt-to-Assets | 24.65% | 50.70% |

| Interest Coverage | -27.49 | 25.92 |

| Asset Turnover | 0.62 | 0.92 |

| Fixed Asset Turnover | 16.67 | 3.33 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Rubrik, Inc.

Rubrik shows a favorable overall ratio profile with 57.14% of ratios positive, including a strong ROE of 208.55% and a solid fixed asset turnover of 16.67. However, concerns remain due to a negative net margin of -130.26% and weak interest coverage at -26.84. The current ratio is neutral at 1.13. Rubrik does not pay dividends, likely reflecting reinvestment in growth and R&D given its early IPO in 2024.

Wix.com Ltd.

Wix presents a mixed ratio picture with 28.57% favorable ratios but 35.71% unfavorable, notably a negative ROE of -175.57% and a concerning debt-to-assets ratio of 50.7%. The net margin is neutral at 7.86%, and interest coverage is strong at 40.14. Current ratio is weak at 0.84. Wix also does not pay dividends, consistent with its focus on innovation and market expansion.

Which one has the best ratios?

Rubrik’s ratios lean more favorable overall, with strong asset efficiency and equity returns, despite some profitability challenges. Wix’s ratios reveal more weaknesses, especially in leverage and returns, though interest coverage is robust. Based on the balance of positive and negative ratios, Rubrik exhibits a relatively stronger financial ratio profile than Wix.

Strategic Positioning

This section compares the strategic positioning of Rubrik, Inc. and Wix.com Ltd., focusing on market position, key segments, and exposure to technological disruption:

Rubrik, Inc.

- Positioned in data security with global enterprise clients; faces competitive pressure in software infrastructure.

- Key segments include subscription-based data protection and cyber recovery across multiple industries including finance and healthcare.

- Exposure to technological disruption involves evolving cybersecurity threats and cloud data protection innovations.

Wix.com Ltd.

- Operates cloud-based website development platform with broad international reach and competitive digital services.

- Key segments are creative subscriptions and business solutions targeting website creation and online business tools.

- Faces disruption from rapid changes in web technologies and AI-driven online business tools.

Rubrik, Inc. vs Wix.com Ltd. Positioning

Rubrik’s strategy is focused and specialized on data security solutions across diverse industries, while Wix operates a more diversified platform targeting website creation and online business automation. Rubrik’s industry concentration contrasts with Wix’s broader product ecosystem.

Which has the best competitive advantage?

Both companies currently shed value relative to their cost of capital, but Wix shows improving profitability trends, indicating a slightly stronger position in sustaining competitive advantage compared to Rubrik’s declining profitability.

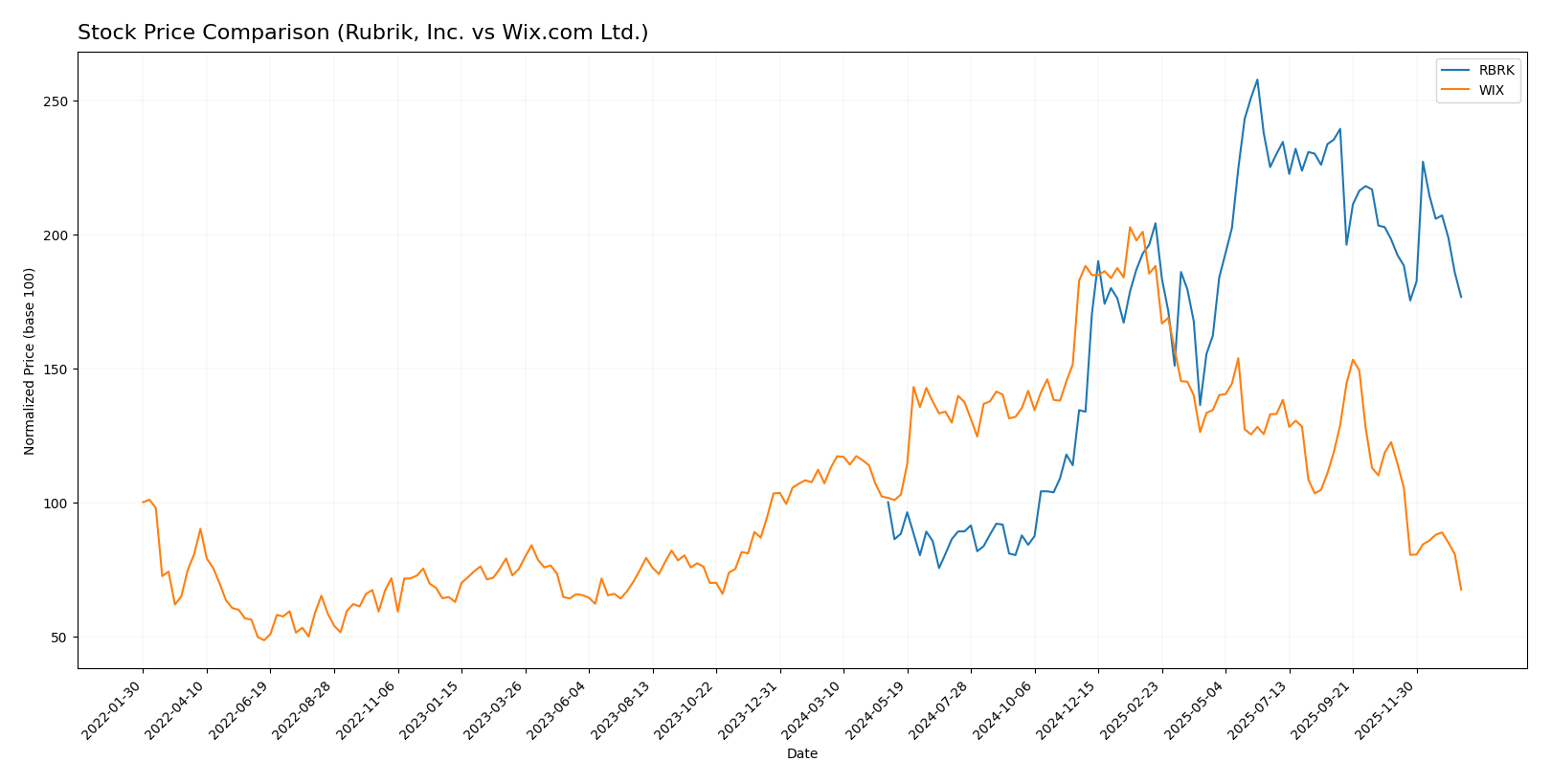

Stock Comparison

The stock price chart highlights significant price movements and contrasting trading dynamics for Rubrik, Inc. (RBRK) and Wix.com Ltd. (WIX) over the past 12 months, reflecting divergent market sentiments and volume trends.

Trend Analysis

Rubrik, Inc. (RBRK) exhibited a strong bullish trend over the past year, with a 76.58% price increase despite a recent deceleration and a 10.85% decline in the last two and a half months.

Wix.com Ltd. (WIX) showed a bearish trend over the past year, with a 40.28% price decline and accelerating negative momentum, including a 44.92% drop in the recent period.

Rubrik outperformed Wix considerably, delivering the highest market performance with a strong positive trend compared to Wix’s sustained decline.

Target Prices

The current analyst consensus indicates notable upside potential for both Rubrik, Inc. and Wix.com Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rubrik, Inc. | 113 | 105 | 109.33 |

| Wix.com Ltd. | 210 | 70 | 160.27 |

Analysts expect Rubrik’s stock price to rise significantly from its current 67.1 USD toward a consensus target of 109.33 USD, while Wix.com shows a wider range but also strong upside from 80.16 USD to an average target near 160.27 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Rubrik, Inc. and Wix.com Ltd.:

Rating Comparison

RBRK Rating

- Rating: Both companies hold a “C” rating with very favorable status.

- Discounted Cash Flow Score: RBRK has a very unfavorable score of 1.

- ROE Score: RBRK shows a very favorable score of 5, indicating strong profit generation from equity.

- ROA Score: RBRK has a very unfavorable score of 1, showing poor asset utilization.

- Debt To Equity Score: Both companies have a very unfavorable score of 1, suggesting higher financial risk.

- Overall Score: Both companies have a moderate overall score of 2.

WIX Rating

- Rating: Both companies hold a “C” rating with very favorable status.

- Discounted Cash Flow Score: WIX scores a moderate 3, indicating better cash flow valuation.

- ROE Score: WIX has a very unfavorable score of 1, reflecting weaker efficiency in generating profit from equity.

- ROA Score: WIX shows a favorable score of 4, indicating better asset utilization.

- Debt To Equity Score: Both companies have a very unfavorable score of 1, suggesting higher financial risk.

- Overall Score: Both companies have a moderate overall score of 2.

Which one is the best rated?

Based on the provided data, both RBRK and WIX share the same overall rating and score. RBRK excels in return on equity, while WIX performs better on discounted cash flow and return on assets, resulting in a balanced comparative profile.

Scores Comparison

Here is a comparison of the financial health scores for Rubrik, Inc. and Wix.com Ltd.:

Rubrik, Inc. Scores

- Altman Z-Score: 1.41, indicating distress zone risk

- Piotroski Score: 4, representing average financial strength

Wix.com Ltd. Scores

- Altman Z-Score: 1.83, indicating moderate bankruptcy risk in grey zone

- Piotroski Score: 6, representing average financial strength

Which company has the best scores?

Wix.com Ltd. has a higher Altman Z-Score of 1.83 compared to Rubrik’s 1.41, placing Wix in the grey zone versus Rubrik’s distress zone. Wix also has a better Piotroski Score of 6 versus Rubrik’s 4, indicating relatively stronger financial health.

Grades Comparison

Here is the comparison of recent grades and ratings for Rubrik, Inc. and Wix.com Ltd.:

Rubrik, Inc. Grades

The following table shows recent grades from established grading companies for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

Rubrik, Inc. maintains a generally positive outlook with most grades at Overweight, Buy, or Outperform, including one recent upgrade.

Wix.com Ltd. Grades

The following table presents recent grades from recognized grading firms for Wix.com Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| Wells Fargo | Maintain | Overweight | 2025-12-19 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Overweight | 2025-11-20 |

| Barclays | Maintain | Overweight | 2025-11-20 |

| Citizens | Maintain | Market Outperform | 2025-11-20 |

| Citigroup | Maintain | Buy | 2025-11-20 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-20 |

| Needham | Maintain | Buy | 2025-11-20 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-20 |

Wix.com Ltd. shows consistent positive ratings predominantly at Overweight or better, with no downgrades reported.

Which company has the best grades?

Both Rubrik, Inc. and Wix.com Ltd. have strong buy-side support, but Wix.com Ltd. features a larger number of Overweight and Outperform ratings with some sector-specific outperformance. This broader positive consensus might offer investors a wider base of confidence signals compared to Rubrik’s solid but slightly narrower rating profile.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Rubrik, Inc. and Wix.com Ltd. based on their most recent financial and operational data.

| Criterion | Rubrik, Inc. (RBRK) | Wix.com Ltd. (WIX) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from subscriptions (828.7M USD) with smaller segments in maintenance and other services | Strong: Balanced revenue from Creative Subscription (1.26B USD) and Business Solutions (496M USD) |

| Profitability | Weak: Negative net margin (-130.26%), ROIC very unfavorable (-234.85%), shedding value | Moderate: Positive net margin (7.86%), ROIC neutral (9.13%), but still slightly unfavorable overall |

| Innovation | Moderate: High fixed asset turnover (16.67) suggests efficient use of assets | Moderate: Good fixed asset turnover (3.33), ongoing innovation in creative and business platform services |

| Global presence | Limited data, but focused on subscription-based cloud solutions | Established global platform with broad user base and service offerings worldwide |

| Market Share | Niche player in data management and backup services | Larger market presence in website creation and business solutions |

Key takeaways: Rubrik shows significant challenges in profitability and value creation despite efficient asset use, indicating risk for investors. Wix, while facing some financial pressures, demonstrates growing profitability trends and diversified revenue streams, making it a comparatively more stable investment option at present.

Risk Analysis

Below is a table summarizing key risks for Rubrik, Inc. (RBRK) and Wix.com Ltd. (WIX) based on the most recent data available in 2026:

| Metric | Rubrik, Inc. (RBRK) | Wix.com Ltd. (WIX) |

|---|---|---|

| Market Risk | Low beta (0.28) indicates lower sensitivity to market swings | High beta (1.42) suggests higher volatility and market sensitivity |

| Debt level | Moderate debt-to-assets at 24.65%, favorable debt-to-equity ratio | Higher debt-to-assets at 50.7%, unfavorable debt-to-equity ratio |

| Regulatory Risk | US-based with sector-specific compliance; moderate risk | Israel-based, subject to international regulation; moderate risk |

| Operational Risk | Negative net margin and interest coverage imply operational challenges | Positive net margin but low current ratio may constrain operations |

| Environmental Risk | Minimal direct exposure due to software focus | Similar minimal direct environmental impact |

| Geopolitical Risk | Primarily US exposure, moderate geopolitical risk | International presence increases exposure to geopolitical tensions |

Rubrik faces operational and financial distress risks, reflected in a low Altman Z-score (1.41, distress zone) despite strong ROE, indicating profitability is not yet stable. Wix shows moderate financial risk (Altman Z-score 1.83, grey zone) with high market volatility and significant leverage, which may impact stability under adverse conditions. Investors should weigh these operational and financial risks carefully against growth potential.

Which Stock to Choose?

Rubrik, Inc. (RBRK) has shown strong revenue growth of 41.19% in the past year but faces unfavorable net margin and declining profitability. Its financial ratios are mostly favorable, with a positive ROE of 208.55% and a healthy debt profile, though some ratios like interest coverage remain weak. The company’s rating is very favorable despite mixed score evaluations and a very unfavorable economic moat indicating value destruction.

Wix.com Ltd. (WIX) demonstrates steady income growth of 12.74% with a favorable gross margin and net margin. The financial ratios reveal a mixed picture with some favorable metrics like interest coverage but unfavorable debt levels and ROE. Its rating is very favorable, supported by average Piotroski and a grey zone Altman Z-score, though the economic moat is slightly unfavorable, signaling improving but still challenged profitability.

For investors, Rubrik might appear attractive for those focused on growth potential given its strong revenue increase and favorable rating, while Wix could be more suitable for those valuing steady income and improving profitability despite some financial risks. The choice could depend on the investor’s risk tolerance and strategy preferences, as both companies present distinct profiles with different strengths and weaknesses.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Rubrik, Inc. and Wix.com Ltd. to enhance your investment decisions: