In today’s fast-evolving tech landscape, Rubrik, Inc. and Veritone, Inc. stand out as pioneers in software infrastructure with distinct yet overlapping market focuses. Rubrik excels in data security and cloud protection, while Veritone leads in artificial intelligence-driven data analytics. Comparing these innovators reveals insights into their growth strategies and market potential. Join me as we explore which company offers the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Rubrik and Veritone by providing an overview of these two companies and their main differences.

Rubrik Overview

Rubrik, Inc. specializes in data security solutions, offering enterprise, cloud, and SaaS data protection, along with cyber recovery and threat analytics. Founded in 2013 and based in Palo Alto, California, Rubrik serves diverse sectors including financial, retail, healthcare, and technology. With a market cap of $13.4B and 3,200 employees, it positions itself as a key player in software infrastructure focused on data security.

Veritone Overview

Veritone, Inc. develops AI computing solutions via its aiWARE platform, which processes vast structured and unstructured data to extract insights using machine learning and cognitive technologies. Headquartered in Denver, Colorado, Veritone serves media, government, legal, and energy sectors. Founded in 2014, it has a market cap of $225M and employs 469 people, operating within the software infrastructure industry.

Key similarities and differences

Both companies operate in the technology sector under software infrastructure, focusing on data-related solutions. Rubrik emphasizes data security and protection across multiple industries, while Veritone specializes in AI-powered analytics and cognitive computing primarily for media and government verticals. Rubrik’s significantly larger market cap and workforce contrast with Veritone’s niche AI platform and smaller scale, reflecting differing market focuses and business models.

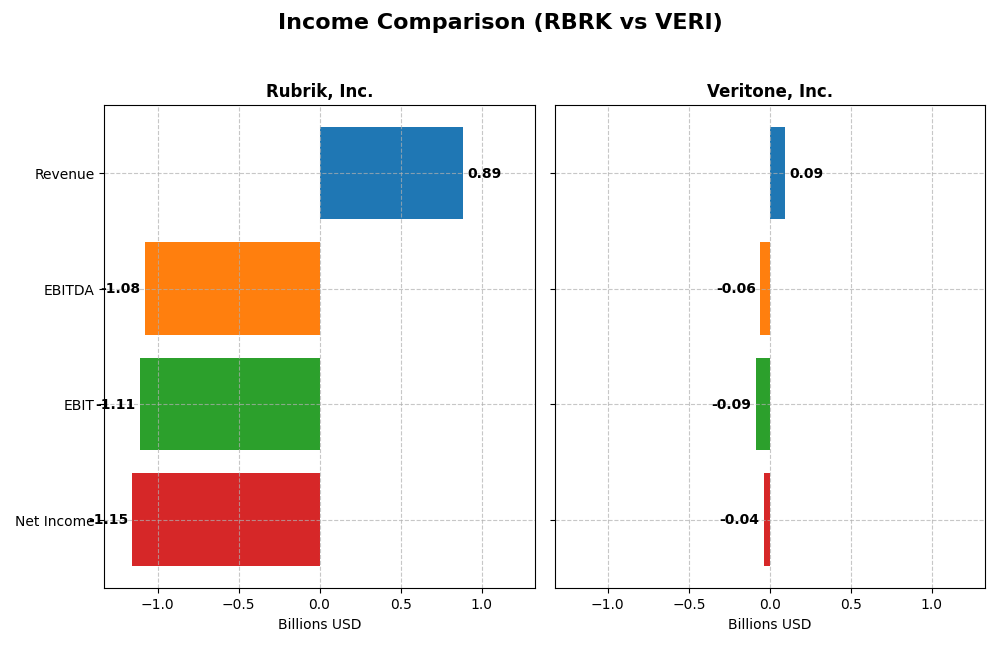

Income Statement Comparison

Below is a side-by-side comparison of the latest fiscal year income statement figures for Rubrik, Inc. and Veritone, Inc., providing a snapshot of their financial performance.

| Metric | Rubrik, Inc. (RBRK) | Veritone, Inc. (VERI) |

|---|---|---|

| Market Cap | 13.4B | 225M |

| Revenue | 887M | 93M |

| EBITDA | -1.08B | -59M |

| EBIT | -1.11B | -88M |

| Net Income | -1.15B | -37M |

| EPS | -7.48 | -0.98 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Rubrik, Inc.

Rubrik’s revenue showed strong growth from 2021 to 2025, increasing by 128.64%, but net income declined sharply, with a negative trend of -441.95% over the period. Gross margin remained favorable at 70.02%, yet operating and net margins stayed deeply negative. In 2025, revenue surged 41.19%, but net losses widened significantly, reflecting deteriorating profitability despite top-line expansion.

Veritone, Inc.

Veritone experienced a 60.53% revenue growth from 2020 to 2024, with net income improving by 21.91% overall. Gross margins were consistently favorable at around 70.58%, though EBIT and net margins remained negative. The latest year showed a revenue decline of 7.35%, yet net margin and EPS improved, signaling some operational efficiencies amid softening sales.

Which one has the stronger fundamentals?

Veritone demonstrates relatively stronger fundamentals with favorable overall income statement evaluations at 57.14%, including positive net income and margin growth over the period. Rubrik, despite higher revenue growth, exhibits a more unfavorable profile, with 64.29% unfavorable metrics and worsening net losses, indicating ongoing challenges in converting revenue into profit.

Financial Ratios Comparison

The table below presents the most recent available financial ratios for Rubrik, Inc. and Veritone, Inc. as of fiscal year 2025 and 2024 respectively.

| Ratios | Rubrik, Inc. (2025) | Veritone, Inc. (2024) |

|---|---|---|

| ROE | 2.09% | -2.78% |

| ROIC | -2.35% | -0.58% |

| P/E | -9.79 | -3.34 |

| P/B | -20.42 | 9.27 |

| Current Ratio | 1.13 | 0.97 |

| Quick Ratio | 1.13 | 0.97 |

| D/E (Debt to Equity) | -0.63 | 8.91 |

| Debt-to-Assets | 24.65% | 60.54% |

| Interest Coverage | -27.49 | -7.31 |

| Asset Turnover | 0.62 | 0.47 |

| Fixed Asset Turnover | 16.67 | 8.51 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Rubrik, Inc.

Rubrik shows a mixed ratio profile with 57% favorable and 29% unfavorable metrics. Strengths include high return on equity at 208.55% and favorable debt levels with a debt-to-equity ratio of -0.63 and debt-to-assets at 24.65%. Concerns arise from negative net margin (-130.26%) and poor interest coverage (-26.84). The company does not pay dividends, reflecting a focus on reinvestment or growth rather than shareholder payouts.

Veritone, Inc.

Veritone’s ratios are largely unfavorable, with 79% negative indicators and just 14% favorable. The company struggles with negative returns, including a -277.91% ROE and -40.36% net margin. Leverage is high, with a debt-to-equity ratio of 8.91 and debt-to-assets at 60.54%. It also does not pay dividends, likely prioritizing reinvestment and managing negative profitability.

Which one has the best ratios?

Comparing the two, Rubrik’s ratios are significantly more favorable, showing better returns and healthier leverage despite some profitability issues. Veritone exhibits a predominantly negative ratio landscape with high debt and weak profitability. Therefore, Rubrik currently has the stronger ratio profile based on the available financial data.

Strategic Positioning

This section compares the strategic positioning of Rubrik, Inc. and Veritone, Inc. including Market position, Key segments, and disruption:

Rubrik, Inc.

- Large market cap of 13.4B with low beta, indicating stable market position and moderate competitive pressure.

- Focuses on data security solutions with key drivers in enterprise, cloud, SaaS data protection across diverse sectors.

- Operates in established software infrastructure with moderate exposure to AI but primarily focused on data security technologies.

Veritone, Inc.

- Small market cap of 225M with high beta, showing volatile market position and intense competitive pressure.

- Specializes in AI computing with revenues from AI platform, media advertising, and managed services in multiple verticals.

- High exposure to AI-driven technological disruption through its aiWARE platform and related cognitive AI services.

Rubrik, Inc. vs Veritone, Inc. Positioning

Rubrik pursues a diversified approach targeting data security across broad industries, offering stable revenues but facing value destruction. Veritone concentrates on AI and advertising tech, with smaller scale and higher volatility, also facing profitability challenges.

Which has the best competitive advantage?

Both companies show very unfavorable MOAT evaluations with declining ROIC below WACC, indicating neither currently sustains a competitive advantage or creates shareholder value based on recent capital efficiency metrics.

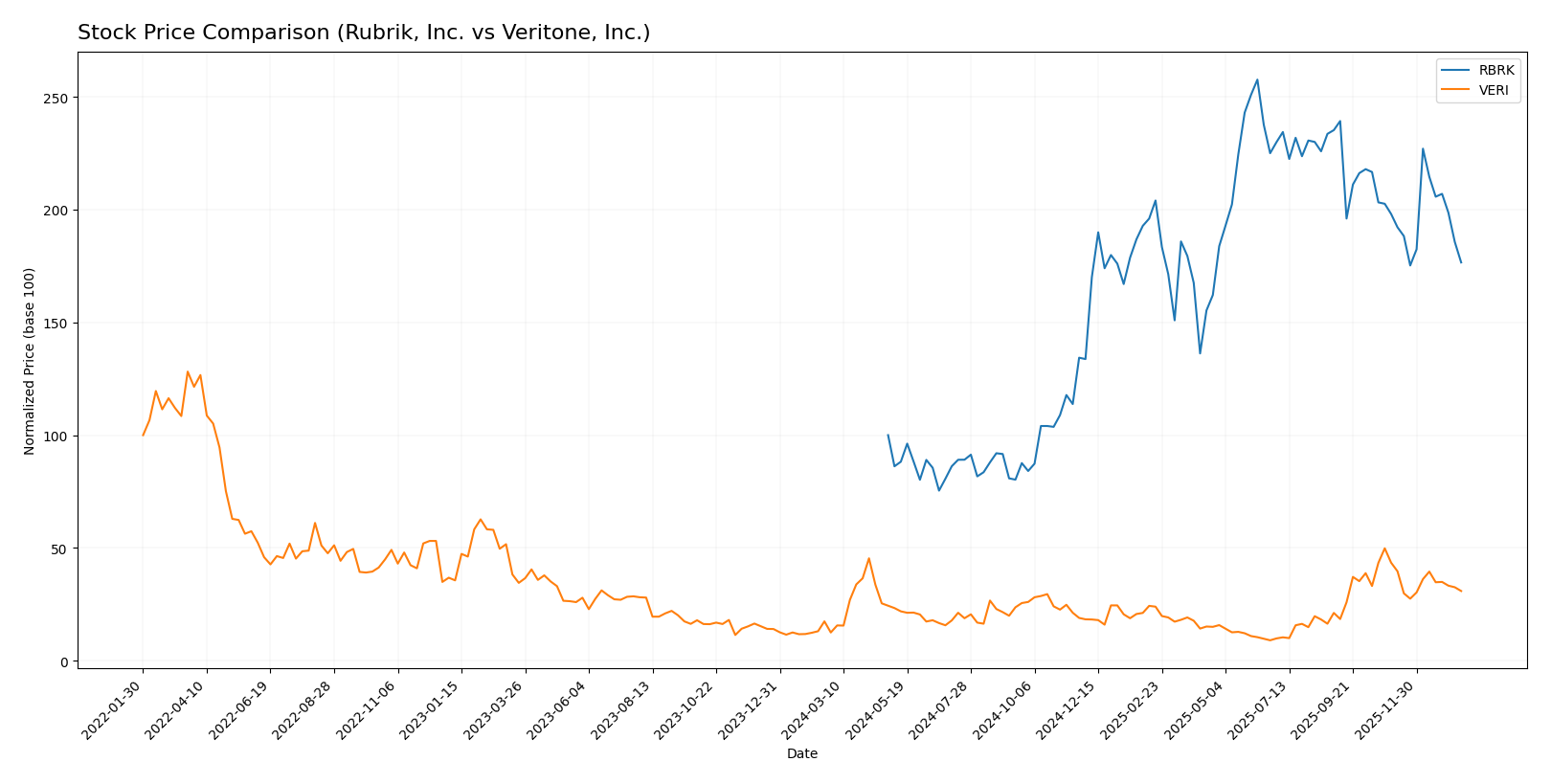

Stock Comparison

The stock price movements of Rubrik, Inc. (RBRK) and Veritone, Inc. (VERI) over the past 12 months reveal significant bullish trends with notable deceleration and recent downward pressure on both equities.

Trend Analysis

Rubrik, Inc. (RBRK) exhibited a strong bullish trend over the past year with a 76.58% price increase, though the trend showed deceleration. Recent weeks indicate a mild bearish correction of -10.85%.

Veritone, Inc. (VERI) posted an even more pronounced bullish trend with a 147.22% rise in stock price over 12 months, also decelerating recently and experiencing a sharper recent decline of -28.91%.

Comparing both, Veritone outperformed Rubrik in total price appreciation despite both stocks showing recent short-term bearish corrections and decelerating momentum.

Target Prices

The analyst consensus indicates promising upside potential for both Rubrik, Inc. and Veritone, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rubrik, Inc. | 113 | 105 | 109.33 |

| Veritone, Inc. | 10 | 9 | 9.5 |

Rubrik’s target consensus of 109.33 suggests a substantial premium over its current price of 67.1 USD, while Veritone’s 9.5 target consensus implies more than doubling from its current 4.45 USD, reflecting optimistic analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Rubrik, Inc. and Veritone, Inc.:

Rating Comparison

Rubrik, Inc. Rating

- Rating: C, considered very favorable by analysts.

- Discounted Cash Flow Score: 1, indicating very unfavorable valuation.

- ROE Score: 5, reflecting very favorable profit generation from equity.

- ROA Score: 1, showing very unfavorable asset utilization.

- Debt To Equity Score: 1, indicating very unfavorable financial risk.

- Overall Score: 2, considered moderate overall financial standing.

Veritone, Inc. Rating

- Rating: C, also considered very favorable by analysts.

- Discounted Cash Flow Score: 5, indicating very favorable valuation.

- ROE Score: 1, reflecting very unfavorable profit generation from equity.

- ROA Score: 1, showing very unfavorable asset utilization.

- Debt To Equity Score: 1, indicating very unfavorable financial risk.

- Overall Score: 2, considered moderate overall financial standing.

Which one is the best rated?

Both companies share the same rating of C and an overall score of 2, classified as moderate. Rubrik stands out with a very favorable ROE score, while Veritone leads significantly in discounted cash flow valuation.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

Rubrik, Inc. Scores

- Altman Z-Score: 1.41, in distress zone, high bankruptcy risk

- Piotroski Score: 4, average financial strength

Veritone, Inc. Scores

- Altman Z-Score: -0.07, in distress zone, very high bankruptcy risk

- Piotroski Score: 3, very weak financial strength

Which company has the best scores?

Rubrik’s Altman Z-Score is slightly higher but both are in the distress zone. Rubrik also has a better Piotroski Score indicating relatively stronger financial health compared to Veritone.

Grades Comparison

Here is a comparison of recent grades assigned to Rubrik, Inc. and Veritone, Inc.:

Rubrik, Inc. Grades

The following table shows recent grades awarded by reputable grading companies for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

Rubrik’s grades consistently reflect positive outlooks with multiple “Buy,” “Overweight,” and “Outperform” ratings, including a recent upgrade to “Outperform.”

Veritone, Inc. Grades

The following table shows recent grades awarded by reputable grading companies for Veritone, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| D. Boral Capital | Maintain | Buy | 2025-12-09 |

| D. Boral Capital | Maintain | Buy | 2025-12-04 |

| Needham | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-11-07 |

| D. Boral Capital | Maintain | Buy | 2025-10-28 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-20 |

| D. Boral Capital | Maintain | Buy | 2025-10-15 |

| D. Boral Capital | Maintain | Buy | 2025-09-24 |

| D. Boral Capital | Maintain | Buy | 2025-09-09 |

Veritone’s grades show a stable consensus of “Buy” ratings, predominantly from D. Boral Capital and other firms, with no downgrades recorded.

Which company has the best grades?

Rubrik, Inc. has received a broader range of positive grades, including multiple “Outperform” and “Overweight” ratings and a recent upgrade, whereas Veritone, Inc. has consistently maintained “Buy” ratings. This suggests Rubrik’s outlook might be viewed with slightly more optimism by analysts, potentially affecting investor sentiment differently.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Rubrik, Inc. (RBRK) and Veritone, Inc. (VERI) based on the most recent financial and operational data.

| Criterion | Rubrik, Inc. (RBRK) | Veritone, Inc. (VERI) |

|---|---|---|

| Diversification | High reliance on Subscription (828.7M USD), moderate in other services | More diversified revenue streams including License, Managed Services, Software Products |

| Profitability | Negative net margin (-130.26%), but strong ROE (208.55%) | Negative net margin (-40.36%) and negative ROE (-277.91%) |

| Innovation | Moderate asset turnover (0.62), high fixed asset turnover (16.67) | Lower asset turnover (0.47), moderate fixed asset turnover (8.51) |

| Global presence | No explicit data, but subscription model suggests strong recurring global clients | Varied products and services indicate potential broader market reach |

| Market Share | Large subscription revenue suggests solid market foothold | Smaller revenues with less favorable financial ratios suggest weaker market position |

Key takeaways: Rubrik shows strong recurring revenue and efficient capital use despite current value destruction, while Veritone struggles with profitability and financial health. Both companies face challenges with declining ROIC, signaling caution for investors.

Risk Analysis

Below is a summary table comparing key risks for Rubrik, Inc. (RBRK) and Veritone, Inc. (VERI) based on the most recent financial and operational data available for 2025 and 2024 respectively:

| Metric | Rubrik, Inc. (RBRK) | Veritone, Inc. (VERI) |

|---|---|---|

| Market Risk | Low beta (0.28) indicates lower volatility vs. market | High beta (2.05) signals high volatility and market sensitivity |

| Debt level | Moderate debt to assets (24.65%), favorable debt/equity ratio (-0.63) | High debt to assets (60.54%), unfavorable debt/equity ratio (8.91) |

| Regulatory Risk | Moderate, typical for software/security sector | Moderate, AI industry faces evolving regulations |

| Operational Risk | Medium, with average liquidity (current ratio 1.13) and some profitability issues | Higher due to weaker liquidity (current ratio 0.97) and operational inefficiencies |

| Environmental Risk | Low, standard technology sector exposure | Low, technology sector with minimal direct environmental impact |

| Geopolitical Risk | Moderate, global operations but primarily US-based | Moderate, US and UK presence with AI tech exposure |

In synthesis, Veritone presents higher market and financial risks, notably due to its high volatility, significant debt levels, and weak profitability metrics. Rubrik, despite some profitability challenges and a distress zone Altman Z-Score, shows stronger financial stability and lower market risk. Investors should carefully weigh Veritone’s operational and financial vulnerabilities against its potential growth in AI, while Rubrik’s risks include operational profitability and moderate leverage.

Which Stock to Choose?

Rubrik, Inc. (RBRK) showed strong revenue growth of 41.2% in 2025 with a favorable gross margin of 70.0%, yet suffered from negative net margins and declining profitability. Its financial ratios are globally favorable at 57%, with a strong ROE of 208.6%, low debt levels, and a moderate current ratio of 1.13. However, the company is shedding value as its ROIC is significantly below WACC, reflecting deteriorating capital efficiency.

Veritone, Inc. (VERI) experienced a 7.4% revenue decline in 2024 but improved net margin growth and EPS by over 30%. Its global income statement evaluation is favorable at 57%, though financial ratios remain very unfavorable at nearly 79% negative, with high debt, weak ROE, and a current ratio below 1. The company also shows value destruction with ROIC below WACC, indicating weakening profitability.

Investors seeking growth might find Rubrik’s strong revenue expansion and favorable financial ratios suggestive of potential upside, despite its value erosion and negative margins. Conversely, those prioritizing recent improvements in profitability metrics but accepting higher financial risk could consider Veritone’s profile, though its financial stability appears weaker. Both companies currently indicate value destruction, underscoring the importance of cautious evaluation relative to investor risk tolerance and strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Rubrik, Inc. and Veritone, Inc. to enhance your investment decisions: