In the dynamic world of technology, Rubrik, Inc. and StoneCo Ltd. stand out as influential players in the software infrastructure sector. Rubrik focuses on comprehensive data security solutions, while StoneCo excels in financial technology for electronic commerce, particularly in Brazil. Their shared emphasis on innovation and market penetration invites a detailed comparison. Join me as we explore which company offers the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Rubrik and StoneCo by providing an overview of these two companies and their main differences.

Rubrik Overview

Rubrik, Inc. focuses on delivering data security solutions globally, targeting enterprise and SaaS data protection, cloud data, and unstructured data. The company also provides data threat analytics and cyber recovery services. Established in 2013 and based in Palo Alto, California, Rubrik serves multiple sectors including financial, healthcare, retail, and technology, positioning itself as a key player in software infrastructure.

StoneCo Overview

StoneCo Ltd. offers financial technology solutions primarily in Brazil, enabling electronic commerce across in-store, online, and mobile channels. The company supports about 1.77M clients, mainly small and medium businesses, through proprietary Stone Hubs and a diverse sales force. Founded in 2000 and headquartered in the Cayman Islands, StoneCo operates as a subsidiary of HR Holdings, focusing on merchant services and integrated payment solutions.

Key similarities and differences

Both companies operate within the technology sector and specialize in software infrastructure, but their core focuses diverge: Rubrik centers on data security and protection services globally, while StoneCo emphasizes fintech solutions for commerce in Brazil. Rubrik targets a broad range of industries worldwide, whereas StoneCo concentrates on local merchant services and payment technology. Their market caps reflect different scales, with Rubrik at 13.4B USD and StoneCo at 3.9B USD.

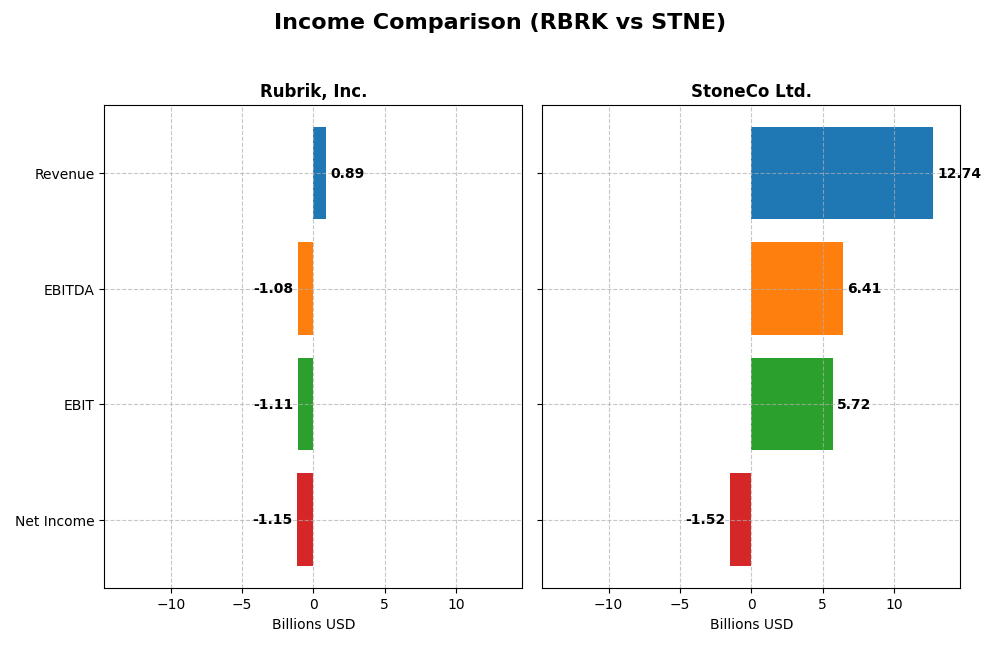

Income Statement Comparison

The following table compares the key income statement metrics for Rubrik, Inc. and StoneCo Ltd. for their most recent fiscal years, highlighting differences in scale and profitability.

| Metric | Rubrik, Inc. (RBRK) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Cap | 13.4B USD | 3.9B USD |

| Revenue | 887M USD | 12.7B BRL |

| EBITDA | -1.08B USD | 6.41B BRL |

| EBIT | -1.11B USD | 5.72B BRL |

| Net Income | -1.15B USD | -1.52B BRL |

| EPS | -7.48 USD | -5.02 BRL |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Rubrik, Inc.

Rubrik’s revenue rose significantly from $388M in 2021 to $887M in 2025, reflecting strong top-line growth of 129% over five years. However, net income remained negative and worsened to -$1.15B in 2025, with net margins deepening to -130%. Despite a favorable gross margin of 70%, operating and net margins deteriorated, indicating rising costs and operational challenges in the latest year.

StoneCo Ltd.

StoneCo’s revenue expanded steadily from BRL 3.17B in 2020 to BRL 12.74B in 2024, representing a robust growth of 302%. Gross and EBIT margins remained strong and favorable at 73.4% and 44.9% respectively, though net income slipped into negative territory at -BRL 1.52B in 2024. The company showed solid operating profitability but faced net margin pressure likely due to financing costs or other expenses.

Which one has the stronger fundamentals?

StoneCo exhibits stronger fundamentals with consistent revenue growth, healthy gross and EBIT margins, and a globally favorable income statement evaluation. Rubrik, despite solid revenue gains, shows persistent and expanding net losses with unfavorable margins overall. StoneCo’s operational profitability contrasts with Rubrik’s deepening negative net margins, suggesting StoneCo’s financial structure is comparatively more robust.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Rubrik, Inc. and StoneCo Ltd., providing a clear snapshot of their operational efficiency, profitability, liquidity, and leverage as of their latest fiscal year.

| Ratios | Rubrik, Inc. (2025) | StoneCo Ltd. (2024) |

|---|---|---|

| ROE | 2.09% | -12.87% |

| ROIC | -2.35% | 22.41% |

| P/E | -9.79 | -9.84 |

| P/B | -20.42 | 1.27 |

| Current Ratio | 1.13 | 1.37 |

| Quick Ratio | 1.13 | 1.37 |

| D/E | -0.63 | 1.10 |

| Debt-to-Assets | 24.65% | 23.53% |

| Interest Coverage | -27.49 | 5.57 |

| Asset Turnover | 0.62 | 0.23 |

| Fixed Asset Turnover | 16.67 | 6.95 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Rubrik, Inc.

Rubrik’s ratios show a mix of strengths and weaknesses. While return on equity is very strong at 208.55% and leverage ratios are favorable with a debt-to-equity of -0.63, the company faces challenges with a highly negative net margin of -130.26% and poor return on invested capital at -234.85%. Its current ratio is neutral at 1.13, indicating adequate short-term liquidity. Rubrik does not pay dividends, likely reflecting its growth phase and reinvestment strategy.

StoneCo Ltd.

StoneCo’s ratios are mixed with some positive signs but notable concerns. It has a favorable return on invested capital of 22.41% and a decent interest coverage ratio of 5.41, yet it suffers from a negative net margin of -11.89% and a negative return on equity at -12.87%. The company’s leverage is high with a debt-to-equity of 1.1, which is unfavorable. StoneCo also does not pay dividends, consistent with its reinvestment in operations and growth focus.

Which one has the best ratios?

Rubrik holds a slight edge with 57.14% of ratios favorable compared to StoneCo’s 50%, supported by stronger profitability metrics like ROE and better leverage ratios. However, Rubrik’s extreme negative margins and return on capital highlight risks. StoneCo’s higher debt and weaker profitability weigh against it despite some operational strengths. Overall, Rubrik’s ratios are assessed as favorable, and StoneCo’s as slightly favorable.

Strategic Positioning

This section compares the strategic positioning of Rubrik, Inc. and StoneCo Ltd. regarding market position, key segments, and exposure to technological disruption:

Rubrik, Inc.

- Market position and competitive pressure

- Key segments and business drivers

- Exposure to technological disruption

StoneCo Ltd.

- MarketCap 13.4B, low beta 0.28, operates globally in data security.

- Revenue mainly from subscriptions (829M), plus maintenance and services.

- Provides enterprise and cloud data protection, cyber recovery solutions.

Rubrik, Inc. vs StoneCo Ltd. Positioning

Rubrik has a diversified global technology footprint focused on data security subscriptions, while StoneCo concentrates on Brazilian fintech for SMBs with a strong client base. Rubrik’s approach favors recurring revenue; StoneCo emphasizes localized fintech innovation.

Which has the best competitive advantage?

StoneCo shows a very favorable moat with growing ROIC and value creation, indicating durable competitive advantage. Rubrik’s very unfavorable moat status with declining ROIC reflects value destruction and weaker competitive positioning.

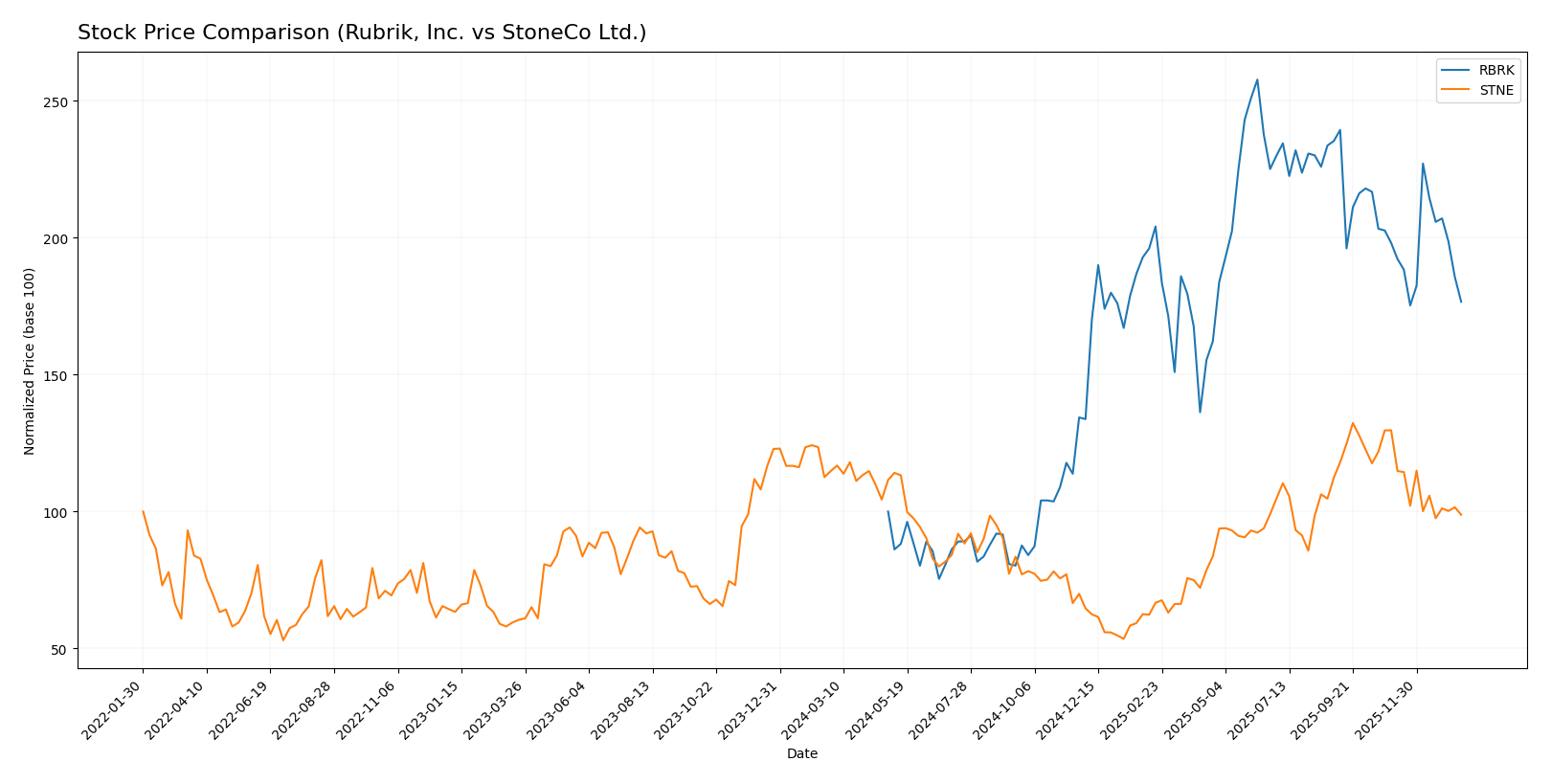

Stock Comparison

The stock price movements of Rubrik, Inc. (RBRK) and StoneCo Ltd. (STNE) over the past 12 months reveal contrasting trading dynamics, with Rubrik showing a strong upward trajectory while StoneCo experiences a decline amid increasing trading volumes.

Trend Analysis

Rubrik, Inc. (RBRK) demonstrated a bullish trend over the past year, with a 76.58% price increase, though recent months show a deceleration and a -10.85% decline, indicating a short-term pullback. StoneCo Ltd. (STNE) experienced a bearish trend with a -13.9% price change over the last year and a more pronounced recent decline of -23.78%, both showing deceleration. Comparing both stocks, Rubrik delivered the highest market performance with significant positive growth, while StoneCo underperformed with substantial losses.

Target Prices

The consensus target prices indicate promising upside potential for both Rubrik, Inc. and StoneCo Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rubrik, Inc. | 113 | 105 | 109.33 |

| StoneCo Ltd. | 20 | 20 | 20 |

Analysts expect Rubrik’s price to rise significantly above its current $67.1, while StoneCo’s consensus target of $20 suggests a notable premium over its current $14.49 share price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Rubrik, Inc. and StoneCo Ltd.:

Rating Comparison

Rubrik, Inc. Rating

- Rating: C, regarded as Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable

- ROE Score: 5, Very Favorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 2, Moderate

StoneCo Ltd. Rating

- Rating: C, regarded as Very Favorable

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 2, Moderate

Which one is the best rated?

Both companies share the same overall rating of C and an identical overall score of 2, categorized as moderate. Rubrik scores higher on ROE, while StoneCo shows a better discounted cash flow score.

Scores Comparison

Here is a comparison of the financial health scores for Rubrik, Inc. and StoneCo Ltd.:

RBRK Scores

- Altman Z-Score: 1.41, indicating financial distress risk.

- Piotroski Score: 4, reflecting average financial strength.

STNE Scores

- Altman Z-Score: 1.02, indicating financial distress risk.

- Piotroski Score: 5, reflecting average financial strength.

Which company has the best scores?

Based on the provided data, StoneCo Ltd. has slightly lower Altman Z-Score and a higher Piotroski Score compared to Rubrik, indicating a marginally better financial condition.

Grades Comparison

Here is a comparison of the latest grades assigned to Rubrik, Inc. and StoneCo Ltd. by recognized grading companies:

Rubrik, Inc. Grades

The table below summarizes recent grades from leading financial institutions for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

Rubrik, Inc. shows a strong buy and outperform trend with multiple upgrades and maintained positive ratings across reputable firms.

StoneCo Ltd. Grades

The following table presents recent grades for StoneCo Ltd. from well-known financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Buy | 2025-10-14 |

| B of A Securities | Maintain | Buy | 2025-09-09 |

| UBS | Maintain | Buy | 2025-08-29 |

| JP Morgan | Maintain | Overweight | 2025-07-16 |

| Barclays | Maintain | Equal Weight | 2025-05-12 |

| Barclays | Maintain | Equal Weight | 2025-04-23 |

| Citigroup | Upgrade | Buy | 2025-04-22 |

| Barclays | Maintain | Equal Weight | 2025-03-21 |

| Morgan Stanley | Maintain | Underweight | 2025-03-21 |

| Goldman Sachs | Maintain | Buy | 2025-02-06 |

StoneCo Ltd. presents a mixed rating picture with several buy and overweight ratings but also equal weight and underweight opinions.

Which company has the best grades?

Rubrik, Inc. has received more uniformly positive grades, predominantly “Buy” and “Outperform,” indicating stronger analyst confidence compared to StoneCo Ltd., which has a broader range of opinions including holds and underweights. This disparity may influence investors’ perception of growth potential and risk profiles.

Strengths and Weaknesses

Below is a comparative overview of Rubrik, Inc. (RBRK) and StoneCo Ltd. (STNE) based on key investment criteria as of 2026.

| Criterion | Rubrik, Inc. (RBRK) | StoneCo Ltd. (STNE) |

|---|---|---|

| Diversification | Moderate, mainly subscription-based revenue (828.7M USD in 2025) | Moderate, focused on fintech services, less diversified |

| Profitability | Unfavorable net margin (-130.26%), negative ROIC (-234.85%) indicating value destruction | Slightly unfavorable net margin (-11.89%), positive ROIC (22.41%) showing value creation |

| Innovation | Strong product offerings with high fixed asset turnover (16.67) indicating efficient use of assets | Moderate innovation, supported by positive PE and PB ratios, but lower asset turnover (0.23) |

| Global presence | Expanding but still limited global footprint | Established presence in Latin America with solid growth potential |

| Market Share | Facing challenges with declining ROIC and profitability | Growing ROIC trend (+371%), suggesting increasing market share and competitive advantage |

Rubrik struggles with profitability and value creation despite a strong subscription revenue base, signaling caution. StoneCo shows a more favorable economic moat and improving profitability, though it faces margin pressures and higher leverage risks. Investors should weigh growth potential against financial stability carefully.

Risk Analysis

Below is a comparative table highlighting key risks for Rubrik, Inc. (RBRK) and StoneCo Ltd. (STNE) based on the most recent data from 2025 and 2024 respectively.

| Metric | Rubrik, Inc. (RBRK) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Risk | Low beta (0.28) indicates low volatility; but tech sector cyclicality remains | High beta (1.84) implies high volatility; exposure to Brazilian market instability |

| Debt level | Favorable debt-to-assets (24.65%) and negative debt-to-equity (-0.63) suggest manageable debt | Debt-to-assets (23.53%) favorable, but debt-to-equity (1.1) is high, indicating higher leverage risk |

| Regulatory Risk | Moderate; US and global data security laws evolving rapidly | High; Brazilian fintech regulations and geopolitical tensions may affect operations |

| Operational Risk | Moderate; rapid tech changes and cybersecurity threats | Moderate to high; dependency on local infrastructure and payment ecosystems |

| Environmental Risk | Low; primarily software business with limited direct environmental impact | Low; fintech sector with minimal environmental footprint |

| Geopolitical Risk | Low; primarily US-based but global client base | High; exposure to Latin America’s political and economic fluctuations |

In summary, StoneCo faces more pronounced market, regulatory, and geopolitical risks due to its high volatility and exposure to Brazil’s unstable environment. Rubrik’s biggest concerns are operational risks from evolving cybersecurity threats, though its low beta and strong balance sheet mitigate market and debt risks. Both companies show financial distress signals, but StoneCo’s higher debt and geopolitical exposure present greater investment risk.

Which Stock to Choose?

Rubrik, Inc. (RBRK) shows strong revenue growth of 41.2% over the past year but suffers from unfavorable net margin and declining profitability metrics. Its financial ratios are mostly favorable, with a strong ROE of 208.6%, low debt, and a favorable WACC of 5.34%, yet it has a very unfavorable MOAT rating due to negative ROIC compared to WACC. The company’s rating is very favorable overall, despite weaknesses in discounted cash flow and leverage scores.

StoneCo Ltd. (STNE) presents moderate revenue growth of 12.1%, positive EBIT margin, and a favorable MOAT with ROIC exceeding WACC by 11.7%, showing value creation and improving profitability. Its financial ratios are slightly favorable, supported by adequate liquidity and interest coverage, though it carries higher debt and mixed returns. The rating is very favorable, with moderate discounted cash flow and price-to-book scores but weaker profitability indicators.

Investors favoring growth opportunities might find Rubrik’s rapid revenue expansion and strong ROE appealing despite its negative profitability trends and value destruction signals. Conversely, those prioritizing value creation and improving returns could see StoneCo’s positive MOAT and steady income growth as more aligned with a quality or value investing approach. Each profile may interpret the data differently based on risk tolerance and investment goals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Rubrik, Inc. and StoneCo Ltd. to enhance your investment decisions: