Home > Comparison > Technology > SMCI vs RGTI

The strategic rivalry between Super Micro Computer, Inc. and Rigetti Computing, Inc. shapes the future of the computer hardware industry. Super Micro delivers modular, high-performance server solutions, while Rigetti pioneers quantum computing with integrated systems. This clash represents a contest between established infrastructure leadership and cutting-edge technological innovation. This analysis aims to identify which company’s trajectory offers the superior risk-adjusted return potential for investors seeking diversification in the evolving technology sector.

Table of contents

Companies Overview

Super Micro Computer and Rigetti Computing define innovation within the evolving technology hardware market.

Super Micro Computer, Inc.: Modular Server Solutions Pioneer

Super Micro Computer dominates the high-performance server and storage solutions market with modular, open architecture products. It generates revenue through sales of servers, storage, networking devices, and management software. In 2026, the company focuses strategically on expanding its footprint in enterprise data centers, cloud computing, AI, 5G, and edge computing, leveraging its broad product portfolio and service integration.

Rigetti Computing, Inc.: Quantum Computing Innovator

Rigetti Computing operates as an integrated systems company specializing in quantum computers and superconducting processors. Its revenue engine centers on developing quantum machines and deploying them via its Quantum Cloud Services platform. In 2026, Rigetti sharpens its focus on integrating quantum computing into public, private, and hybrid cloud environments, highlighting its ambition to commercialize next-generation computing technologies.

Strategic Collision: Similarities & Divergences

Both firms compete within the computer hardware sector but diverge sharply in approach. Super Micro emphasizes modular, open architecture servers targeting traditional and emerging tech markets. Rigetti pursues a closed ecosystem focused on quantum hardware and cloud integration. Their battleground is the future of data processing—classical vs. quantum computing. Investors face distinct risk profiles: Super Micro offers scale and diversification; Rigetti bets on pioneering quantum innovation.

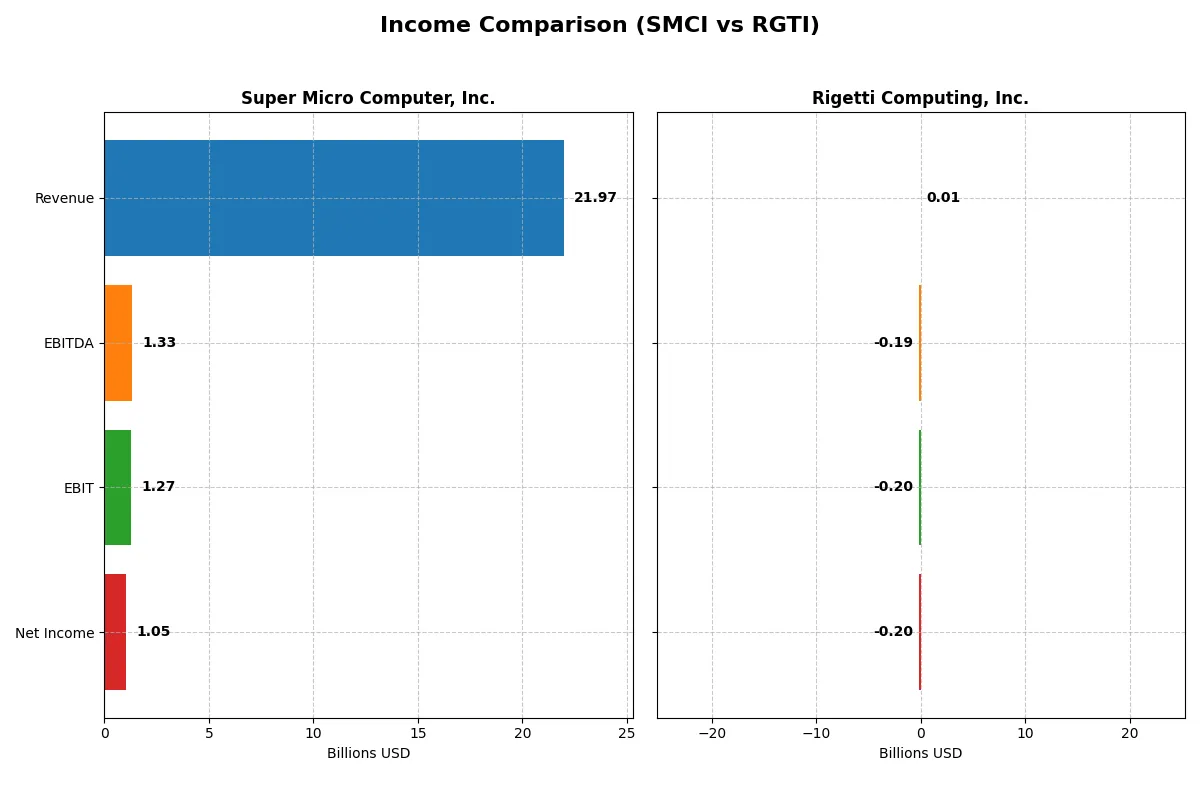

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Super Micro Computer, Inc. (SMCI) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| Revenue | 21.97B | 10.79M |

| Cost of Revenue | 19.54B | 5.09M |

| Operating Expenses | 1.18B | 74.21M |

| Gross Profit | 2.43B | 5.70M |

| EBITDA | 1.33B | -190.83M |

| EBIT | 1.27B | -197.73M |

| Interest Expense | 59.57M | 3.26M |

| Net Income | 1.05B | -201.00M |

| EPS | 1.77 | -1.09 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs its business more efficiently and profitably over recent years.

Super Micro Computer, Inc. Analysis

Super Micro Computer, Inc. shows a strong revenue climb from 3.6B in 2021 to 22B in 2025, with net income rising from 112M to 1.05B. Its gross margin remains steady around 11%, while net margin holds near 4.8%. Despite a slight dip in net margin growth last year, the firm demonstrates solid momentum and operational efficiency.

Rigetti Computing, Inc. Analysis

Rigetti Computing, Inc. reports revenue peaking at 13M in 2022 before declining to 11M in 2024, with persistent net losses widening to -201M. Gross margin impresses at over 50%, but EBIT and net margins plunge deeply negative due to high operating expenses and interest costs. The company struggles to convert revenue into profits, showing deteriorating profitability.

Margin Stability vs. Loss Expansion

Super Micro Computer clearly outperforms Rigetti with sustained revenue growth and positive net income, backed by stable margins and improving operating results. Rigetti’s high gross margin masks severe operating losses and weak capital structure. Investors seeking reliable earnings should favor the consistent profit profile of Super Micro Computer over Rigetti’s high-risk, loss-heavy model.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Super Micro Computer, Inc. (SMCI) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| ROE | 16.6% | -158.8% |

| ROIC | 9.3% | -24.9% |

| P/E | 27.7 | -14.0 |

| P/B | 4.62 | 22.26 |

| Current Ratio | 5.25 | 17.42 |

| Quick Ratio | 3.25 | 17.42 |

| D/E | 0.76 | 0.07 |

| Debt-to-Assets | 34.1% | 3.1% |

| Interest Coverage | 21.0 | -21.0 |

| Asset Turnover | 1.57 | 0.04 |

| Fixed Asset Turnover | 27.53 | 0.20 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and operational strengths that raw numbers alone cannot reveal.

Super Micro Computer, Inc.

Super Micro shows solid profitability with a 16.6% ROE and a moderate 4.77% net margin. The stock trades at a relatively stretched P/E of 27.7 and a high P/B of 4.62, signaling premium valuation. It does not pay dividends, instead reinvesting in R&D at nearly 3% of revenue to fuel growth.

Rigetti Computing, Inc.

Rigetti’s financial health reflects severe challenges with deeply negative profitability metrics: ROE at -158.8% and net margin at -1862.7%. Its valuation is extreme, with an EV/Sales ratio over 255, and a high P/B of 22.3, marking it as very expensive. The company does not return capital to shareholders, heavily spending on R&D exceeding 460% of revenue, aiming for future growth.

Premium Valuation vs. Operational Safety

Super Micro balances operational efficiency and moderate risk with a premium valuation but positive returns. Rigetti carries high risk with deeply negative profitability and stretched multiples. Investors seeking stability may prefer Super Micro’s profile, while those pursuing speculative growth might consider Rigetti’s aggressive reinvestment stance.

Which one offers the Superior Shareholder Reward?

Super Micro Computer, Inc. (SMCI) and Rigetti Computing, Inc. (RGTI) both forgo dividends, focusing on reinvestment and buybacks. SMCI yields no dividends but delivers solid free cash flow (2.58/share in 2025) and sustains active buybacks, supporting shareholder value. RGTI operates at steep losses with negative margins and free cash flow, relying heavily on cash reserves for growth, with minimal buyback activity. SMCI’s distribution model balances growth and capital return sustainably. I conclude SMCI offers a superior total return profile in 2026, given its healthier cash flow and disciplined capital allocation.

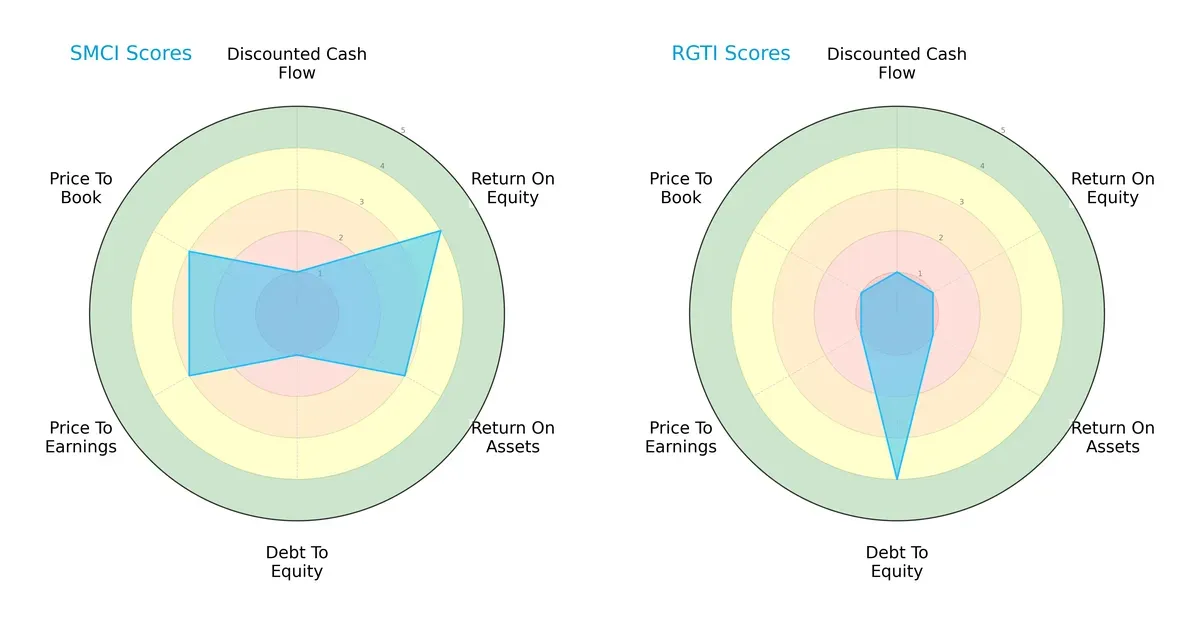

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Super Micro Computer, Inc. and Rigetti Computing, Inc., highlighting their strategic positioning and financial balance:

Super Micro Computer, Inc. shows a more balanced profile with favorable ROE (4) and moderate ROA (3) scores, though it struggles with high debt (Debt/Equity score of 1) and weak DCF (1). Rigetti Computing, Inc. relies heavily on a strong balance sheet (Debt/Equity 4) but suffers very unfavorable scores in profitability metrics (ROE 1, ROA 1) and valuation (P/E 1, P/B 1). Super Micro’s diversified strengths contrast with Rigetti’s concentrated edge in financial leverage.

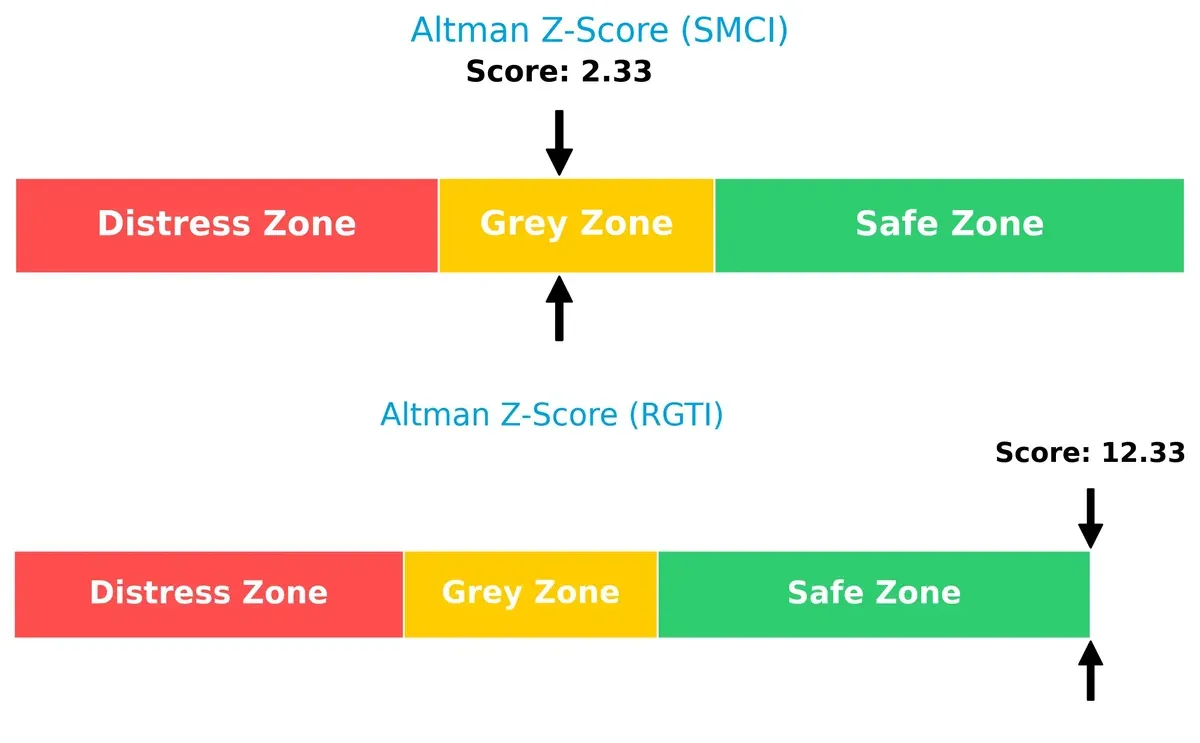

Bankruptcy Risk: Solvency Showdown

Super Micro Computer’s Altman Z-Score sits in the grey zone at 2.33, indicating moderate bankruptcy risk, while Rigetti Computing scores a robust 12.33, firmly in the safe zone. This gap suggests Rigetti holds a significant solvency advantage in today’s volatile market:

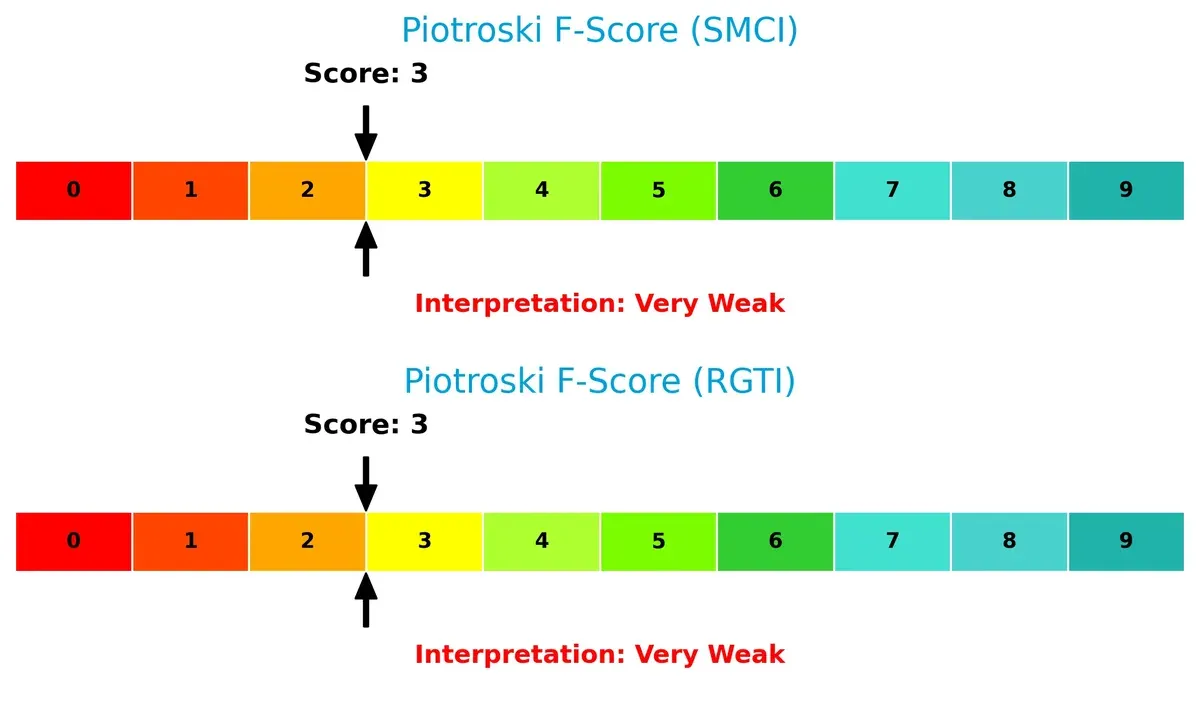

Financial Health: Quality of Operations

Both firms register a Piotroski F-Score of 3, signaling very weak financial health and potential red flags in operational quality. Neither company currently demonstrates peak financial strength, warranting caution for investors:

How are the two companies positioned?

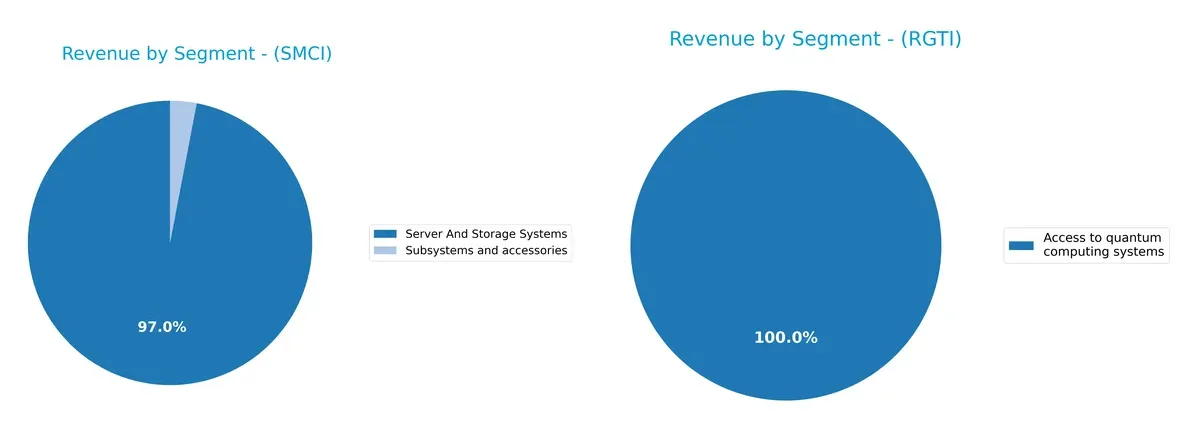

This section dissects the operational DNA of SMCI and RGTI by comparing their revenue distribution by segment and internal dynamics, including strengths and weaknesses. The final objective is to confront their economic moats to identify which business model offers the most resilient, sustainable competitive advantage in today’s market landscape.

Revenue Segmentation: The Strategic Mix

This comparison dissects how Super Micro Computer, Inc. and Rigetti Computing, Inc. diversify their income streams and where their primary sector bets lie:

Super Micro Computer, Inc. anchors its revenue on Server And Storage Systems with $21.3B in 2025, dwarfing its $660M accessories segment. This concentration shows infrastructure dominance but raises some concentration risk. Rigetti Computing, Inc. relies primarily on Access to Quantum Computing Systems with modest revenue under $3.2M, supplemented by collaborative research services. Rigetti’s mix remains narrow, reflecting its early-stage, specialized quantum ecosystem pivot.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Super Micro Computer, Inc. (SMCI) and Rigetti Computing, Inc. (RGTI):

SMCI Strengths

- Strong U.S. market presence with 13B revenue

- Rapid growth in Server and Storage Systems segment

- Favorable ROE at 16.64%

- High interest coverage at 21.34

- Good asset turnover ratios

- Favorable quick ratio and low debt-to-assets

RGTI Strengths

- Favorable price-to-earnings (PE) ratio despite losses

- Very low debt-to-equity at 0.07

- Strong quick ratio at 17.42

- Low debt-to-assets at 3.09

- Presence in the U.S. market with 11M revenue

- Focused innovation in quantum computing access

SMCI Weaknesses

- Unfavorable net margin at 4.77%

- Overvalued price-to-book (PB) at 4.62

- High current ratio at 5.25 may indicate inefficient asset use

- No dividend yield

- Neutral ROIC below WACC at 9.26% vs. 9.62%

- Moderate debt level at 0.76 debt-to-equity

RGTI Weaknesses

- Deeply negative net margin of -1862.72%

- Negative ROE at -158.77% and ROIC at -24.91%

- Unfavorable WACC at 11.94%

- Poor interest coverage at -60.75

- Very low asset turnover and fixed asset turnover

- Overvalued PB ratio at 22.26

- No dividend yield

SMCI demonstrates solid profitability and operational efficiency with a broad product base and strong U.S. footprint. RGTI faces significant profitability and efficiency challenges but benefits from low leverage and a focused innovation niche. Both companies show distinct strategic implications in balancing growth with financial discipline.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only barrier protecting long-term profits from relentless competition erosion. Let’s analyze the moats of Super Micro Computer and Rigetti Computing:

Super Micro Computer, Inc.: Cost Advantage with Expanding Scale

I see Super Micro’s moat rooted in cost advantage through modular, open architecture servers. Its stable gross margin near 11% and growing revenue reflect operational efficiency. Expansion into AI and edge computing markets could widen this moat in 2026.

Rigetti Computing, Inc.: Innovation-Driven Intangible Assets

Rigetti’s moat relies on cutting-edge quantum computing technology, an intangible asset. Despite current heavy losses and negative margins, its rising ROIC trend signals improving capital efficiency. Success in quantum cloud services could disrupt hardware norms soon.

The Moat Verdict: Cost Efficiency vs. Quantum Innovation

Super Micro holds a deeper moat through tangible cost advantages and steady margins. Rigetti’s moat is narrow but promises growth if quantum breakthroughs scale commercially. Super Micro is better positioned today to defend market share amid competition.

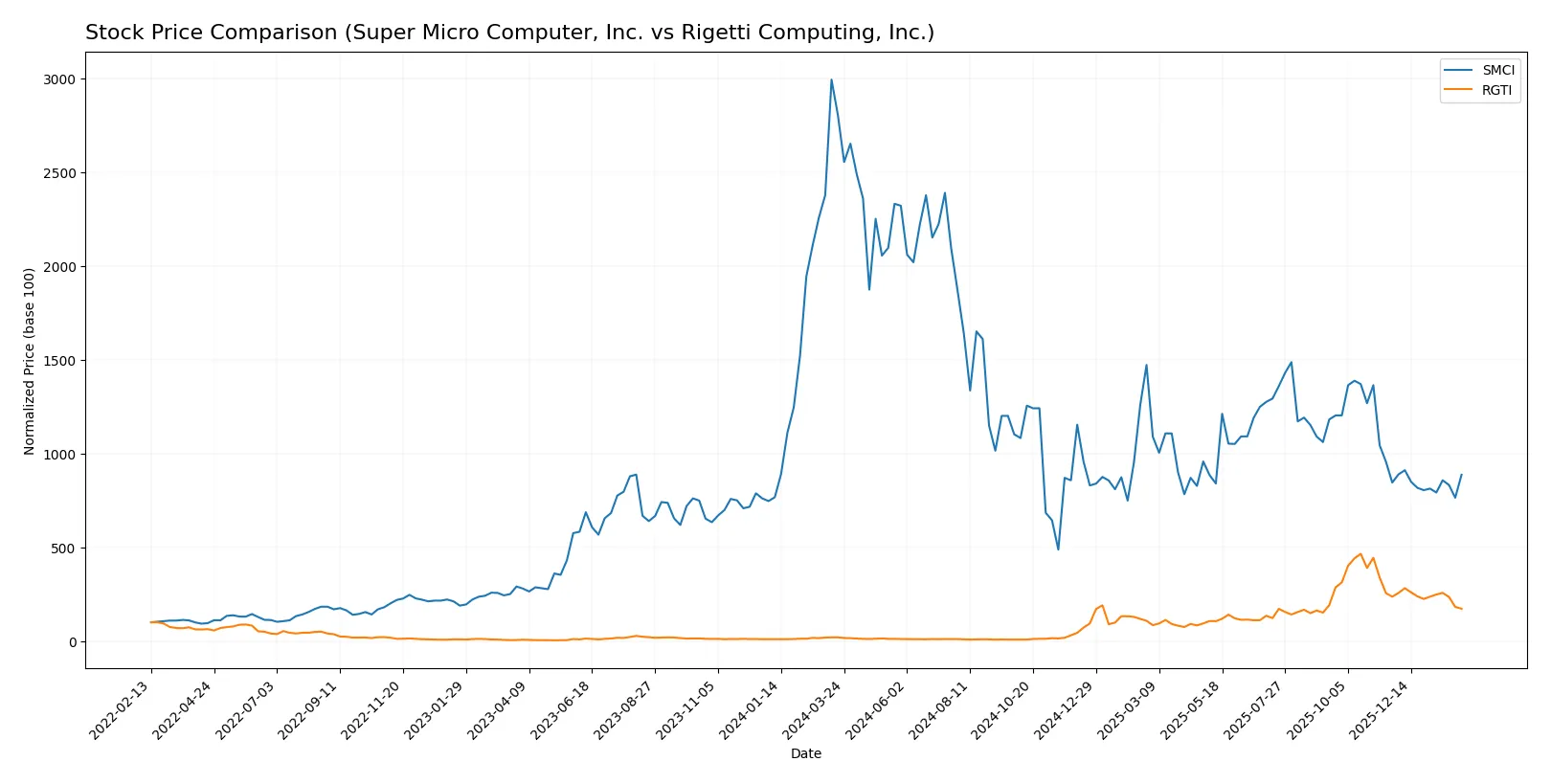

Which stock offers better returns?

The past year saw Super Micro Computer’s shares plunge sharply, while Rigetti Computing’s stock soared before retreating recently. Trading volumes and buyer dominance shifted, reflecting contrasting investor sentiment.

Trend Comparison

Super Micro Computer, Inc. shows a bearish trend over the past 12 months with a -68.41% price decline and accelerating downward momentum, hitting a low of 18.58 from a 106.88 peak. Rigetti Computing, Inc. exhibits a bullish trend over the same period with a 772.59% gain but recent deceleration and a -27.13% drop in the last two months. Rigetti clearly outperformed Super Micro in market returns despite recent weakness, delivering the highest overall price appreciation.

Target Prices

Analysts present a moderately optimistic outlook, with target consensus prices well above current levels.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Super Micro Computer, Inc. | 26 | 64 | 47.13 |

| Rigetti Computing, Inc. | 30 | 50 | 38 |

Super Micro Computer’s consensus target of 47.13 implies a 40% upside from its 33.76 price. Rigetti’s 38 target suggests more than 100% potential gain from 17.19, reflecting high growth expectations but also elevated risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Institutional grades for Super Micro Computer, Inc. and Rigetti Computing, Inc. illustrate recent analyst sentiment:

Super Micro Computer, Inc. Grades

Below is a summary of recent grades issued by reputable analysts for Super Micro Computer, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2024-10-02 |

| Loop Capital | Maintain | Buy | 2024-09-23 |

| JP Morgan | Downgrade | Neutral | 2024-09-06 |

| Barclays | Downgrade | Equal Weight | 2024-09-04 |

| Barclays | Maintain | Overweight | 2024-08-28 |

| Wells Fargo | Maintain | Equal Weight | 2024-08-28 |

| CFRA | Downgrade | Hold | 2024-08-28 |

| Goldman Sachs | Maintain | Neutral | 2024-08-08 |

| Wells Fargo | Maintain | Equal Weight | 2024-08-07 |

| Rosenblatt | Maintain | Buy | 2024-08-07 |

Rigetti Computing, Inc. Grades

The following table shows recent grades from recognized grading firms for Rigetti Computing, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Upgrade | Buy | 2026-01-22 |

| Rosenblatt | Maintain | Buy | 2026-01-21 |

| Wedbush | Maintain | Outperform | 2026-01-21 |

| B. Riley Securities | Maintain | Neutral | 2025-11-12 |

| Benchmark | Maintain | Buy | 2025-11-12 |

| B. Riley Securities | Downgrade | Neutral | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-08-13 |

| Needham | Maintain | Buy | 2025-08-04 |

Which company has the best grades?

Rigetti Computing, Inc. has received consistently bullish grades, including multiple Buy and Outperform ratings. Super Micro Computer, Inc. shows more mixed sentiment with recent downgrades. Investors may view Rigetti’s stronger grades as an indicator of higher confidence from analysts.

Risks specific to each company

The following categories pinpoint the critical pressure points and systemic threats facing Super Micro Computer, Inc. and Rigetti Computing, Inc. in the 2026 market environment:

1. Market & Competition

Super Micro Computer, Inc.

- Competes in mature computer hardware with established rivals; steady but intense competition.

Rigetti Computing, Inc.

- Faces nascent quantum computing competition; technology uncertainty adds market risk.

2. Capital Structure & Debt

Super Micro Computer, Inc.

- Moderate debt-to-assets ratio (34%), manageable interest coverage (21.3x), balanced leverage.

Rigetti Computing, Inc.

- Very low debt (3.1%), minimal leverage, but negative interest coverage signals operational losses.

3. Stock Volatility

Super Micro Computer, Inc.

- Beta 1.52 indicates above-market volatility but within tech sector norms.

Rigetti Computing, Inc.

- Higher beta 1.70 indicates more pronounced price swings and greater risk.

4. Regulatory & Legal

Super Micro Computer, Inc.

- Subject to standard hardware industry regulations, limited legal risk.

Rigetti Computing, Inc.

- Emerging quantum tech may face evolving regulations and IP challenges.

5. Supply Chain & Operations

Super Micro Computer, Inc.

- Global supply chain exposure but diversified; operational scale supports resilience.

Rigetti Computing, Inc.

- Small scale (137 employees) makes supply chain sensitive to disruptions.

6. ESG & Climate Transition

Super Micro Computer, Inc.

- No explicit ESG scores; typical tech industry pressures to improve sustainability.

Rigetti Computing, Inc.

- Early-stage company with limited ESG disclosure; transition risks unclear.

7. Geopolitical Exposure

Super Micro Computer, Inc.

- Operates internationally; exposed to trade tensions and tariffs.

Rigetti Computing, Inc.

- Primarily US-based but quantum tech subject to export controls and geopolitical restrictions.

Which company shows a better risk-adjusted profile?

Super Micro Computer, Inc. faces competitive and geopolitical risks typical of a mature hardware company but benefits from stable capital structure and operational scale. Rigetti Computing, Inc. confronts extreme financial strain, technological uncertainty, and higher volatility. Its low leverage masks poor profitability and cash burn. The most impactful risk for Super Micro is market competition squeezing margins. For Rigetti, it is catastrophic negative profitability and operational losses. Super Micro’s moderate Altman Z-Score (2.33, grey zone) contrasts with Rigetti’s safe zone score (12.33) but poor profitability and Piotroski scores signal caution. Overall, Super Micro Computer shows a better risk-adjusted profile due to financial stability and scale despite competitive pressures.

Final Verdict: Which stock to choose?

Super Micro Computer, Inc. (SMCI) is a cash machine with a proven ability to efficiently convert invested capital into shareholder returns. Its growing profitability amid a challenging macro environment highlights operational resilience. A point of vigilance remains its elevated valuation multiples and liquidity ratios, which may signal increased risk. SMCI suits an aggressive growth portfolio willing to tolerate cyclical swings.

Rigetti Computing, Inc. (RGTI) offers a strategic moat rooted in pioneering quantum computing and substantial R&D investment. Its fortress-like balance sheet with minimal debt provides relative safety compared to SMCI’s leverage profile. However, persistent operating losses and negative returns on invested capital temper near-term optimism. RGTI fits a GARP (Growth at a Reasonable Price) portfolio focused on long-term innovation potential with higher risk tolerance.

If you prioritize robust cash generation and improving profitability, SMCI is the compelling choice due to its operational efficiency and income growth. However, if you seek frontier technology exposure with better capital structure stability, RGTI offers superior risk management despite ongoing value erosion. Both stocks present analytical scenarios aligned with distinct investor profiles and risk appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Super Micro Computer, Inc. and Rigetti Computing, Inc. to enhance your investment decisions: