Home > Comparison > Technology > STX vs RGTI

The strategic rivalry between Seagate Technology Holdings plc and Rigetti Computing, Inc. defines the current trajectory of the computer hardware industry. Seagate operates as a capital-intensive data storage giant with a broad enterprise and consumer product portfolio. Rigetti stands as a niche innovator, developing cutting-edge quantum computing systems and cloud integration. This analysis will determine which operational model offers superior risk-adjusted returns for a diversified technology portfolio.

Table of contents

Companies Overview

Seagate Technology and Rigetti Computing represent contrasting forces in the expanding computer hardware sector.

Seagate Technology Holdings plc: Data Storage Powerhouse

Seagate Technology dominates the mass storage solutions market with a comprehensive portfolio including enterprise HDDs, SSDs, and network-attached drives. Its revenue stems from OEM, distributor, and retailer sales. In 2026, Seagate focuses on its Lyve edge-to-cloud platform, emphasizing scalable storage capacity to meet growing global data demands.

Rigetti Computing, Inc.: Quantum Computing Innovator

Rigetti Computing pioneers quantum computing hardware and integrated systems. Its core business generates income by developing superconducting quantum processors and offering cloud-based quantum services. The 2026 strategy centers on expanding its Quantum Cloud Services platform, aiming to embed quantum computing into public, private, and hybrid clouds.

Strategic Collision: Similarities & Divergences

Seagate and Rigetti both innovate within computer hardware but diverge sharply: Seagate leverages a mature, mass-market storage model, while Rigetti pursues a cutting-edge, nascent quantum niche. Their primary battleground lies in enterprise technology adoption—storage versus computation. Investors face distinct profiles: Seagate blends scale and cash flow; Rigetti offers long-term growth potential amid higher risk.

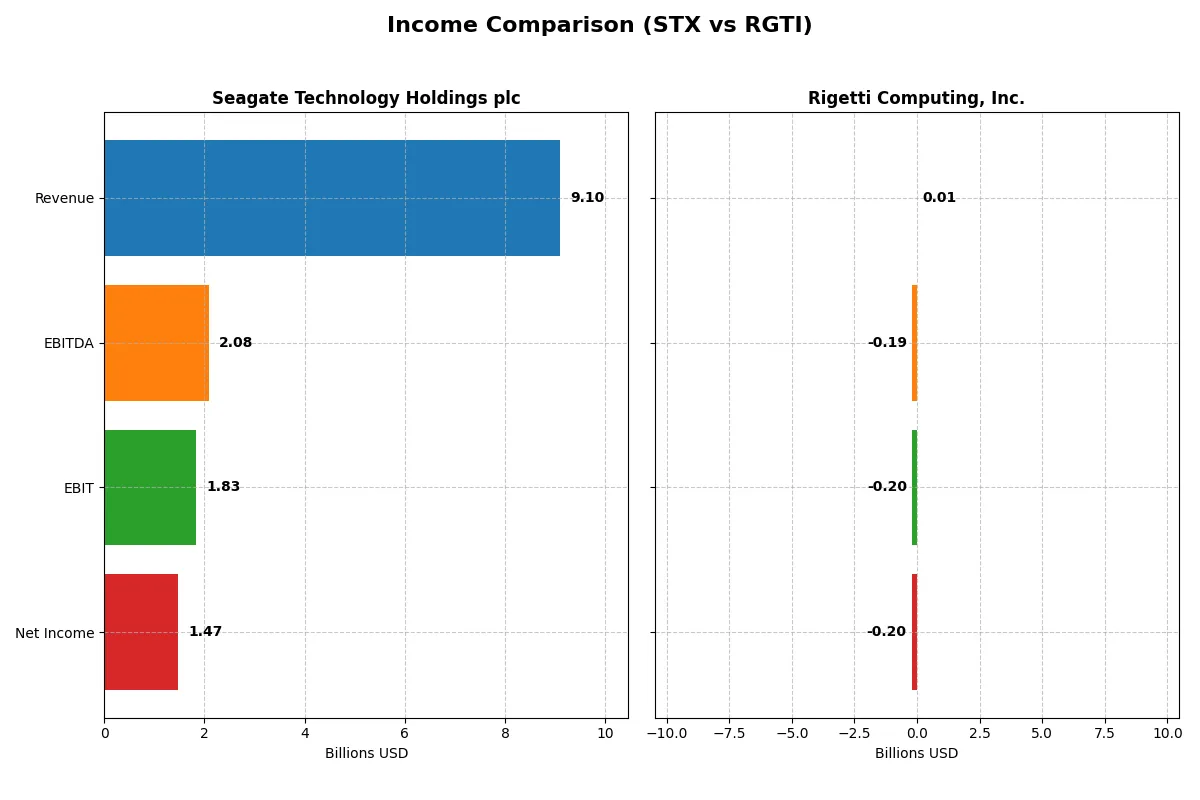

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Seagate Technology Holdings plc (STX) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| Revenue | 9.1B | 10.8M |

| Cost of Revenue | 5.9B | 5.1M |

| Operating Expenses | 1.31B | 74.2M |

| Gross Profit | 3.2B | 5.7M |

| EBITDA | 2.09B | -191M |

| EBIT | 1.83B | -198M |

| Interest Expense | 321M | 3.3M |

| Net Income | 1.47B | -201M |

| EPS | 6.93 | -1.09 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true operational efficiency and profitability dynamics of two distinct corporate engines.

Seagate Technology Holdings plc Analysis

Seagate’s revenue fluctuated over five years, peaking at 11.7B in 2022 before sliding to 6.6B in 2024 and rebounding to 9.1B in 2025. Net income turned from a loss of 529M in 2023 to a strong 1.47B in 2025. Gross margin remained robust at 35%, and net margin improved sharply to 16.2% in 2025, signaling disciplined cost control and operational momentum.

Rigetti Computing, Inc. Analysis

Rigetti’s revenue peaked at 13.1M in 2022 then declined by 10% to 10.8M in 2024. The company consistently reported net losses, worsening to -201M in 2024. Despite a favorable gross margin of 53%, negative EBIT and net margins exceeding -1800% reflect heavy operating losses and costly capital allocation. The downward trajectory in profitability highlights ongoing operational challenges.

Margin Strength vs. Growth Struggles

Seagate clearly outperforms Rigetti in profitability and margin quality, delivering positive net income and expanding margins despite revenue volatility. Rigetti’s superior gross margin fails to translate into profits due to excessive operating expenses and negative bottom-line results. For investors, Seagate’s consistent earnings and margin recovery present a fundamentally sound profile compared to Rigetti’s high-risk, loss-making position.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Seagate Technology Holdings plc (STX) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| ROE | -3.24% | -158.77% |

| ROIC | 33.76% | -24.91% |

| P/E | 20.41 | -14.02 |

| P/B | -66.19 | 22.26 |

| Current Ratio | 1.38 | 17.42 |

| Quick Ratio | 0.84 | 17.42 |

| D/E (Debt-to-Equity) | -11.86 | 0.07 |

| Debt-to-Assets | 66.97% | 3.09% |

| Interest Coverage | 5.89 | -21.05 |

| Asset Turnover | 1.13 | 0.04 |

| Fixed Asset Turnover | 5.49 | 0.20 |

| Payout ratio | 40.84% | 0% |

| Dividend yield | 2.00% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, uncovering hidden risks and operational strengths that shape investor confidence and portfolio resilience.

Seagate Technology Holdings plc

Seagate demonstrates strong operational efficiency with a favorable 16.15% net margin and an impressive 33.76% ROIC, well above its 11.21% WACC. The stock trades at a neutral P/E of 20.41, indicating fair valuation. Shareholders benefit from a solid 2.0% dividend yield, reflecting steady capital return amid consistent profitability.

Rigetti Computing, Inc.

Rigetti struggles with deeply negative profitability metrics: net margin at -1862.72% and ROIC at -24.91%, signaling operational losses and value destruction. Despite a favorable P/E due to negative earnings, the stock’s valuation appears stretched with a high 22.26 P/B ratio. No dividends are paid; capital is reinvested heavily in R&D to fuel growth.

Operational Strength vs. Growth Challenges

Seagate offers a balanced mix of profitability and shareholder returns with disciplined valuation metrics. Rigetti’s profile signals high risk with weak profitability despite growth investments. Investors seeking operational stability may favor Seagate, while those pursuing high-growth bets might consider Rigetti’s speculative profile.

Which one offers the Superior Shareholder Reward?

I see Seagate Technology Holdings plc (STX) pays a consistent dividend yielding about 2.0% with a sustainable payout ratio near 41%. Their free cash flow comfortably covers dividends, supporting steady returns. STX also engages in moderate buybacks, enhancing shareholder value. Rigetti Computing, Inc. (RGTI) pays no dividends, reinvesting heavily in R&D and growth, reflected by negative profit margins and free cash flow. RGTI’s minimal buyback activity and high cash reserves suggest a long-term growth play but with elevated risk. For 2026, I favor STX’s balanced distribution and cash flow-backed dividends as the superior total return profile.

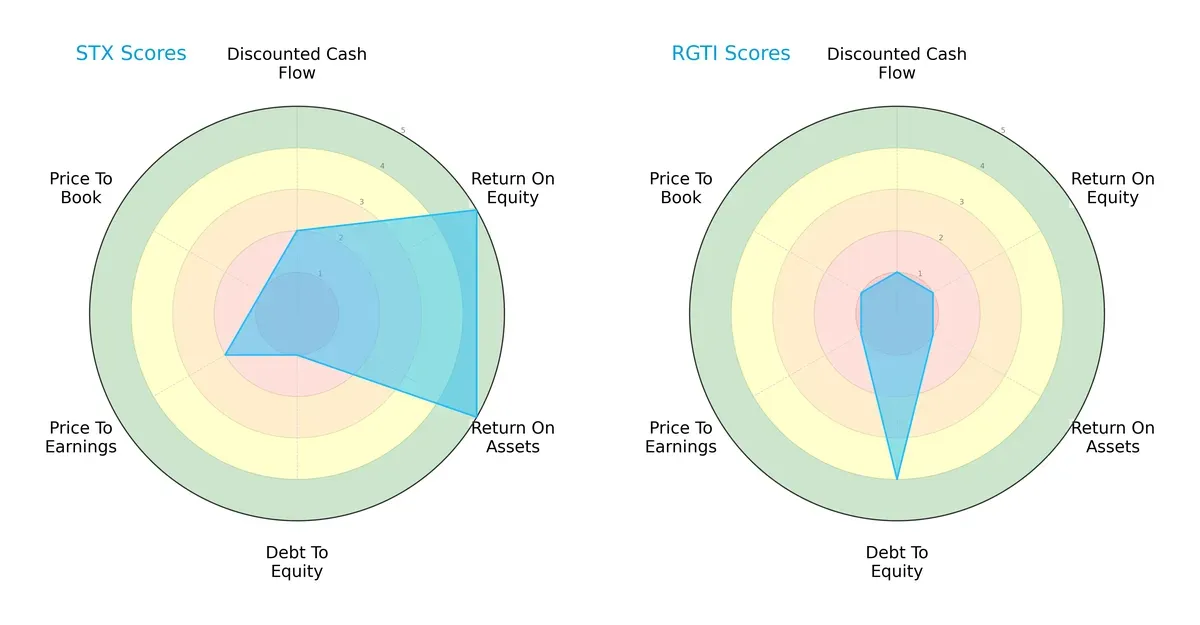

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Seagate Technology and Rigetti Computing, highlighting their core financial strengths and weaknesses:

Seagate Technology exhibits a balanced profile with strong ROE and ROA scores at 5 each, signaling efficient profit generation and asset use. However, its heavy debt burden drags its debt-to-equity score down to 1. Rigetti relies on a favorable debt position with a 4 score but suffers across profitability and valuation metrics, consistently scoring 1. Seagate’s moderate DCF and valuation scores versus Rigetti’s uniformly weak ratings confirm Seagate’s more resilient and diversified financial footing.

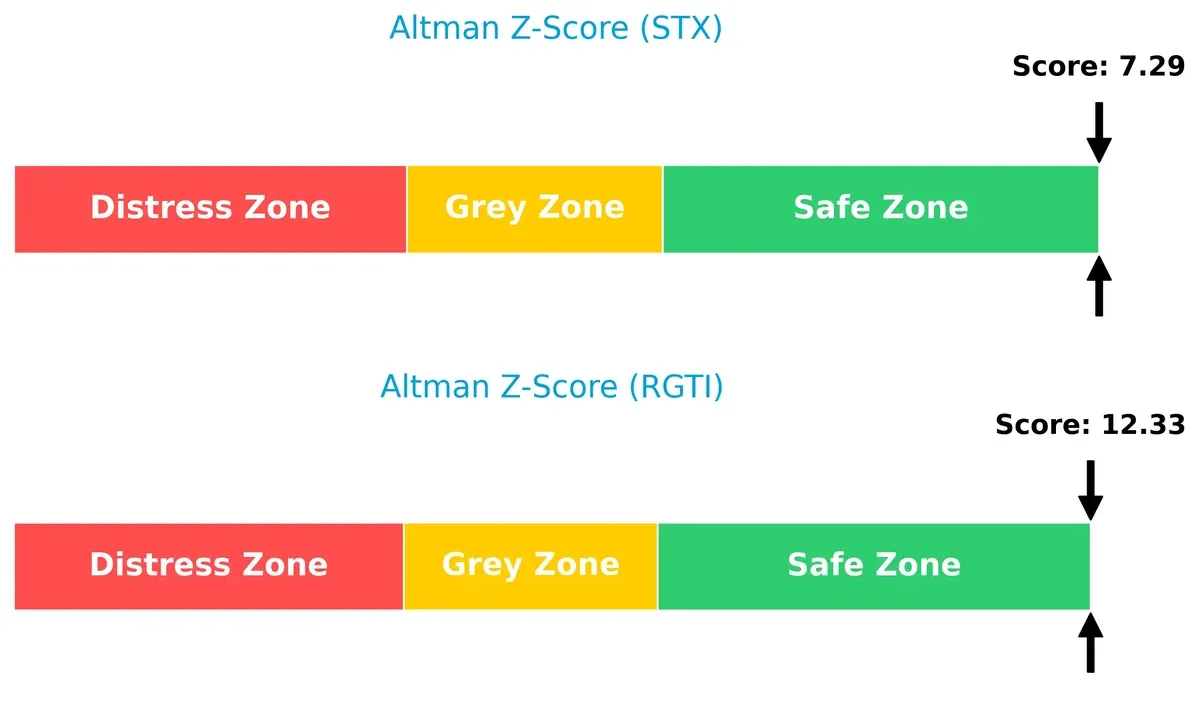

Bankruptcy Risk: Solvency Showdown

Seagate’s Altman Z-Score stands at 7.3, while Rigetti scores even higher at 12.3, both comfortably in the safe zone, indicating strong solvency and low bankruptcy risk in this cycle:

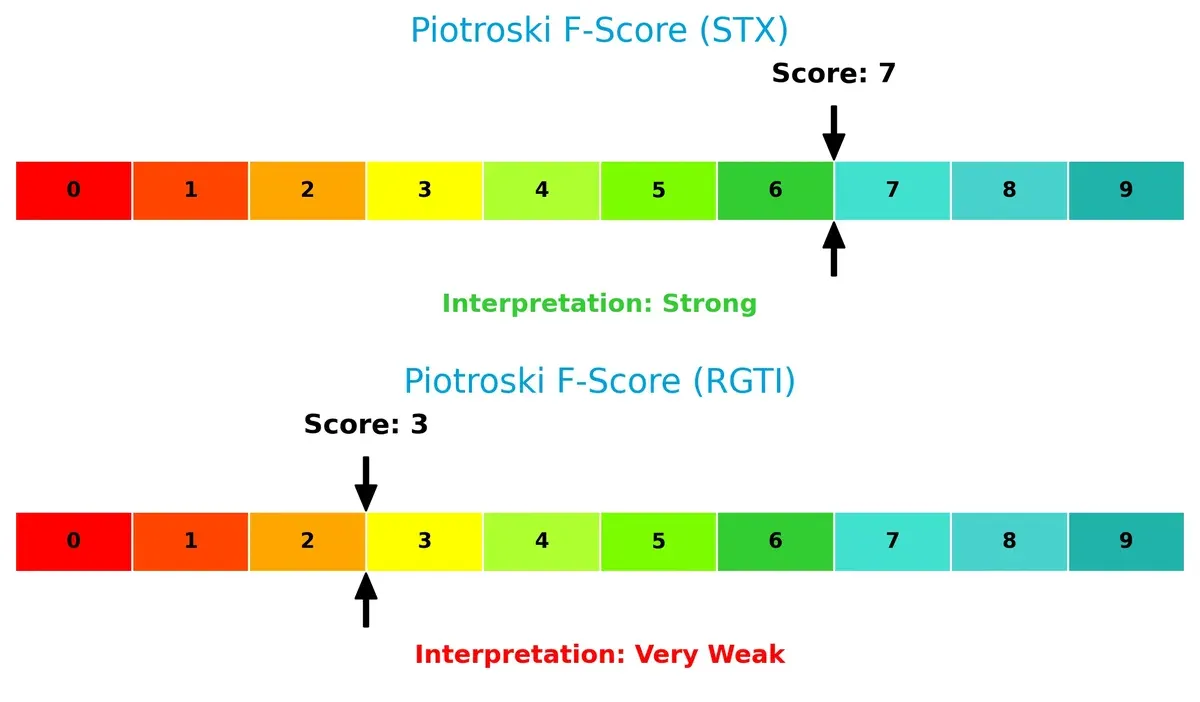

Financial Health: Quality of Operations

Seagate’s Piotroski F-Score of 7 reflects strong internal financial health, while Rigetti’s 3 raises red flags about its operational quality and financial stability:

How are the two companies positioned?

This section dissects the operational DNA of STX and RGTI by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which business model offers the most resilient competitive advantage today.

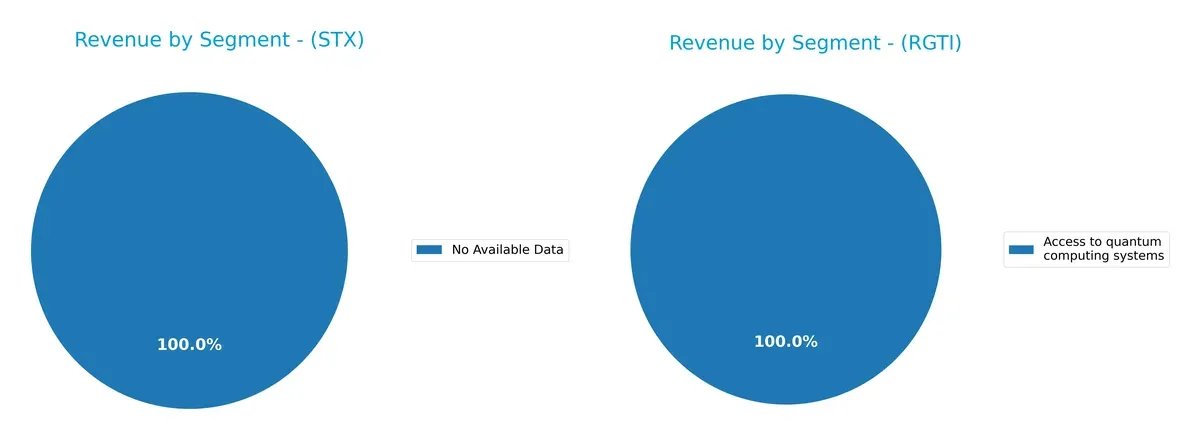

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Seagate Technology and Rigetti Computing diversify their income streams and where their primary sector bets lie:

Seagate Technology lacks available segment data, preventing a full comparison. Rigetti Computing pivots heavily on “Access to quantum computing systems,” with 3.2M in 2022, but also relies on “Collaborative research and other professional services,” which dwarfs this at 9.9M. Rigetti’s mix suggests a blend of cutting-edge infrastructure access and specialized services, but it carries concentration risk in emerging quantum technology markets.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Seagate Technology Holdings plc (STX) and Rigetti Computing, Inc. (RGTI):

STX Strengths

- Strong profitability with 16.15% net margin

- High ROIC at 33.76% surpassing WACC

- Favorable asset turnover and interest coverage

- Global presence with diversified revenues across US, Singapore, Netherlands

- Dividend yield of 2.0% supports shareholder returns

RGTI Strengths

- Favorable debt-to-equity ratio and low debt-to-assets at 3.09%

- Quick ratio strong at 17.42 indicating liquidity

- Favorable PE ratio despite losses

- Niche market in quantum computing with growing US and Europe presence

STX Weaknesses

- Negative ROE at -324.28% signals equity erosion

- High debt-to-assets ratio at 66.97% increases financial risk

- WACC above optimal at 11.21%

- Neutral liquidity ratios suggest moderate short-term risk

- Negative PB ratio unusual, complicates valuation

RGTI Weaknesses

- Large negative profitability metrics: net margin -1862.72%, ROE -158.77%, ROIC -24.91%

- Negative interest coverage at -60.75 signals inability to cover debt costs

- Low asset turnover of 0.04 limits efficiency

- No dividend yield reflects lack of cash returns

- Weak global revenue diversification, concentrated in US

Both companies exhibit clear divergences in financial health and market positioning. STX demonstrates strong profitability and a broad global footprint but carries significant leverage risks. RGTI operates in a cutting-edge sector with solid liquidity and low leverage but struggles with deep losses and limited scale. These contrasts define their strategic challenges and growth prospects.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from relentless competitive erosion in dynamic markets:

Seagate Technology Holdings plc: Cost Advantage and Scale Moat

Seagate’s moat stems from its cost advantage and scale in mass storage solutions, reflected in a strong 22.5% ROIC above WACC and stable 16% net margins. Its expansion into Lyve edge-to-cloud platforms in 2026 promises deeper integration and sustained profitability.

Rigetti Computing, Inc.: Innovation-Driven Moat with Scalability Risks

Rigetti’s moat is rooted in cutting-edge quantum computing technology, contrasting Seagate’s cost leadership. However, its negative ROIC signals value destruction despite improving trends. Commercial cloud integration offers growth, but scalability and competitive quantum advances pose risks.

Verdict: Cost Leadership vs. Quantum Innovation — Who Defends Market Share Better?

Seagate’s wider and deeper moat, driven by consistent value creation and scale economies, outmatches Rigetti’s nascent, innovation-dependent moat. Seagate is better positioned to defend market share, while Rigetti must overcome profitability hurdles to sustain its edge.

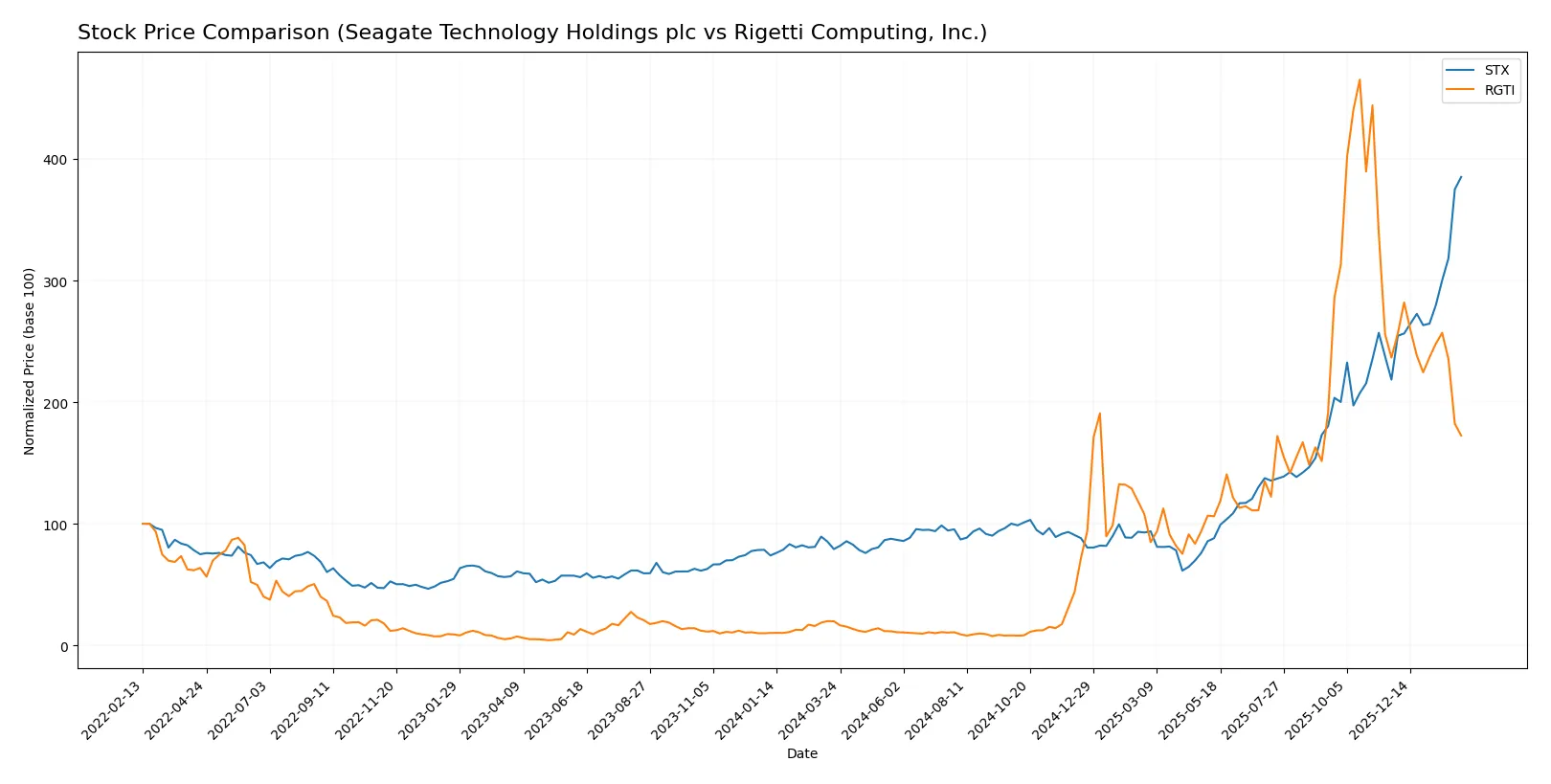

Which stock offers better returns?

Both Seagate Technology Holdings plc and Rigetti Computing, Inc. showed pronounced price movements over the past year, reflecting contrasting momentum and trading dynamics.

Trend Comparison

Seagate Technology’s stock surged 387% over the past year, showing a strong bullish trend with accelerating momentum and a high volatility level (78.67 std deviation). The price hit a peak of 418.63 and a low of 66.73.

Rigetti Computing’s stock gained 773% over the same period, also bullish but with decelerating momentum and lower volatility (11.24 std deviation). The stock fluctuated between 0.75 and 46.38 in price.

Seagate posted steady acceleration and strong buyer dominance recently, while Rigetti showed recent bearish price movement and slight seller dominance. Rigetti delivered the highest overall market performance.

Target Prices

Analysts present a bullish consensus for both Seagate Technology Holdings plc and Rigetti Computing, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Seagate Technology Holdings plc | 270 | 505 | 407.2 |

| Rigetti Computing, Inc. | 30 | 50 | 38 |

Seagate’s consensus target sits slightly below its current price of 419, suggesting modest downside risk. Rigetti’s target price implies significant upside from its 17.19 share price, highlighting growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Seagate Technology Holdings plc and Rigetti Computing, Inc.:

Seagate Technology Holdings plc Grades

This table presents the latest grades issued by reputable financial institutions for Seagate Technology Holdings plc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Maintain | Overweight | 2026-02-04 |

| Citigroup | Maintain | Buy | 2026-01-29 |

| Baird | Maintain | Outperform | 2026-01-29 |

| Rosenblatt | Maintain | Buy | 2026-01-28 |

| UBS | Maintain | Neutral | 2026-01-28 |

| Barclays | Maintain | Equal Weight | 2026-01-28 |

| Mizuho | Maintain | Outperform | 2026-01-28 |

| Goldman Sachs | Maintain | Buy | 2026-01-28 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-28 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-28 |

Rigetti Computing, Inc. Grades

This table shows recent institutional ratings for Rigetti Computing, Inc. from established grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Upgrade | Buy | 2026-01-22 |

| Rosenblatt | Maintain | Buy | 2026-01-21 |

| Wedbush | Maintain | Outperform | 2026-01-21 |

| B. Riley Securities | Maintain | Neutral | 2025-11-12 |

| Benchmark | Maintain | Buy | 2025-11-12 |

| B. Riley Securities | Downgrade | Neutral | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-08-13 |

| Needham | Maintain | Buy | 2025-08-04 |

Which company has the best grades?

Seagate Technology consistently receives “Buy” and “Outperform” grades from multiple firms, reflecting broad institutional confidence. Rigetti Computing’s ratings vary more, with recent upgrades but also neutral and downgrade actions. Investors may interpret Seagate’s steadier positive outlook as a sign of more stable institutional support.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Seagate Technology Holdings plc

- Established leader in mass storage with diversified product lines faces intense commoditization.

Rigetti Computing, Inc.

- Emerging quantum computing player with high innovation but unproven commercial scalability.

2. Capital Structure & Debt

Seagate Technology Holdings plc

- High debt-to-assets ratio (67%) signals elevated leverage risk despite solid interest coverage.

Rigetti Computing, Inc.

- Very low debt and debt-to-assets ratio (3%) indicate conservative leverage but weak capital deployment.

3. Stock Volatility

Seagate Technology Holdings plc

- Beta of 1.64 shows higher volatility than S&P 500, reflecting cyclical tech hardware exposure.

Rigetti Computing, Inc.

- Beta of 1.70 shows even higher volatility driven by speculative quantum tech market dynamics.

4. Regulatory & Legal

Seagate Technology Holdings plc

- Subject to global data storage regulations and international trade policies.

Rigetti Computing, Inc.

- Faces uncertain regulatory frameworks for quantum technology and cloud data security.

5. Supply Chain & Operations

Seagate Technology Holdings plc

- Complex global supply chain with risks from component shortages and geopolitical tensions.

Rigetti Computing, Inc.

- Smaller scale and nascent manufacturing increase operational risks and scalability challenges.

6. ESG & Climate Transition

Seagate Technology Holdings plc

- Established ESG practices but must adapt to energy-intensive data storage demands.

Rigetti Computing, Inc.

- Quantum computing’s energy profile is unclear; potential ESG benefits remain speculative.

7. Geopolitical Exposure

Seagate Technology Holdings plc

- Significant international footprint exposes it to cross-border trade disputes and tariffs.

Rigetti Computing, Inc.

- Primarily US-based, less exposed but vulnerable to national security policies on emerging tech.

Which company shows a better risk-adjusted profile?

Seagate’s biggest risk is heavy leverage amid cyclical hardware demand, tempered by strong cash flow and dividend yield. Rigetti faces existential risk from unproven business models and poor profitability, despite low debt. Seagate’s mature operations and robust Altman Z-Score (7.3) contrast with Rigetti’s weak Piotroski score (3), signaling better financial resilience. Recent data confirms Seagate’s stable asset turnover and interest coverage, while Rigetti struggles with negative margins and high volatility, underscoring a less favorable risk-adjusted profile.

Final Verdict: Which stock to choose?

Seagate Technology’s superpower lies in its efficient capital deployment that consistently generates returns well above its cost of capital. This cash machine boasts solid operational momentum and a favorable income statement, though its elevated debt level is a point of vigilance. It suits investors aiming for steady income with exposure to cyclical tech hardware.

Rigetti Computing offers a strategic moat rooted in cutting-edge quantum technology and heavy R&D investment, promising long-term growth potential. Its balance sheet shows strong liquidity and low leverage, providing a safer profile relative to Seagate. This makes it appealing for growth-at-a-reasonable-price (GARP) portfolios with a tolerance for developmental risk.

If you prioritize reliable value creation and strong profitability, Seagate outshines due to its proven moat and cash flow generation. However, if you seek to capture disruptive innovation with a focus on liquidity and lower leverage, Rigetti offers better stability despite its current losses. Both represent distinct analytical scenarios tailored to differing risk appetites and time horizons.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Seagate Technology Holdings plc and Rigetti Computing, Inc. to enhance your investment decisions: