Quantum computing stands at the forefront of technological innovation, promising to revolutionize industries with unprecedented processing power. Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT) both operate in the computer hardware sector, targeting quantum solutions but with distinct approaches—Rigetti focuses on integrated quantum systems, while Quantum Computing, Inc. emphasizes quantum software and application acceleration. In this article, I will analyze these companies to help you determine which presents the most compelling investment opportunity in this cutting-edge market.

Table of contents

Companies Overview

I will begin the comparison between Rigetti Computing, Inc. and Quantum Computing, Inc. by providing an overview of these two companies and their main differences.

Rigetti Computing, Inc. Overview

Rigetti Computing, Inc. is an integrated systems company specializing in building quantum computers and superconducting quantum processors. Founded in 2013 and based in Berkeley, California, Rigetti integrates its machines into public, private, or hybrid clouds through its Quantum Cloud Services platform. It operates within the computer hardware industry and has a market cap of approximately 7.8B USD.

Quantum Computing, Inc. Overview

Quantum Computing, Inc., founded in 2018 and headquartered in Leesburg, Virginia, focuses on software tools and applications for quantum computers. The company offers Qatalyst, a quantum application accelerator, and supports multiple quantum processing units such as DWave, Rigetti, and IonQ. It serves commercial and government clients and has a market cap near 1.5B USD in the computer hardware sector.

Key similarities and differences

Both Rigetti and Quantum Computing operate in the computer hardware industry and focus on quantum computing technologies. Rigetti emphasizes hardware development and integrated quantum systems, while Quantum Computing concentrates on software applications and quantum processing unit integration. Rigetti’s market cap is significantly larger, reflecting different scales and business models, with Rigetti focusing on cloud quantum services and Quantum Computing on software acceleration for quantum-ready applications.

Income Statement Comparison

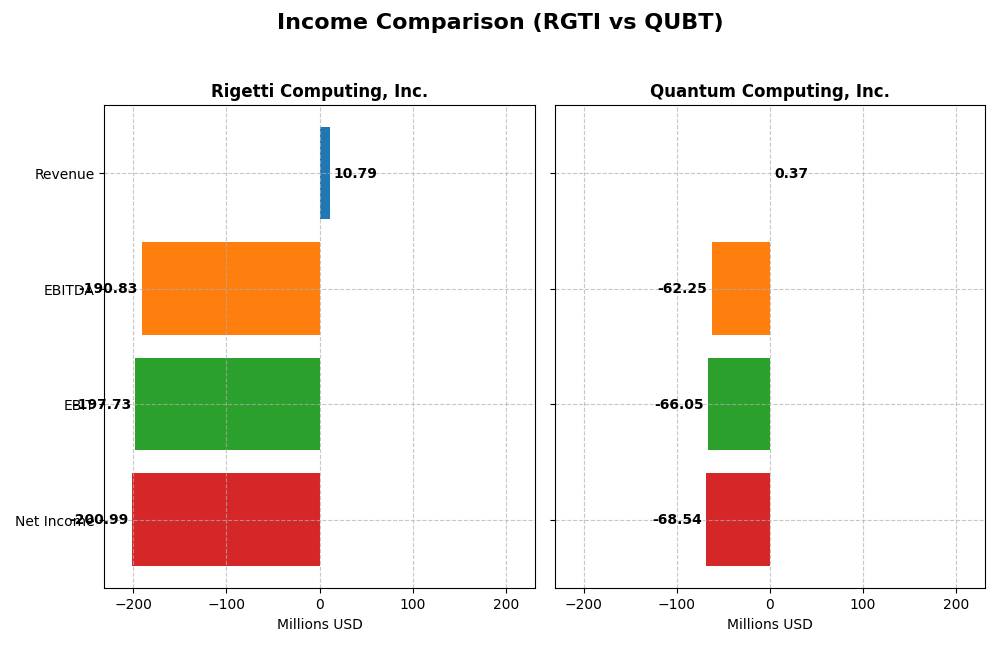

The table below presents a side-by-side comparison of key income statement metrics for Rigetti Computing, Inc. and Quantum Computing, Inc. for the fiscal year 2024.

| Metric | Rigetti Computing, Inc. (RGTI) | Quantum Computing, Inc. (QUBT) |

|---|---|---|

| Market Cap | 7.79B | 1.50B |

| Revenue | 10.79M | 373K |

| EBITDA | -190.83M | -62.25M |

| EBIT | -197.73M | -66.05M |

| Net Income | -201.00M | -68.54M |

| EPS | -1.09 | -0.73 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Rigetti Computing, Inc.

Rigetti’s revenue increased by 95% overall from 2020 to 2024, though it declined by 10% in the last year. Gross margins remain favorable at 52.8%, but net margins are deeply negative at -1862.7%. The 2024 net income worsened significantly to -$201M, reflecting higher operating expenses and a steep decline in profitability despite stable gross margins.

Quantum Computing, Inc.

Quantum Computing’s revenue remained nearly flat over the period with a slight 4% rise in 2024. Gross profit stayed negative, with gross margin at -988.2%, indicating high costs relative to sales. Net income declined further to -$68.5M in 2024, with margins persistently unfavorable. The company showed a small improvement in EPS growth but overall profitability remains weak.

Which one has the stronger fundamentals?

Both companies report unfavorable overall income statement evaluations with high negative margins and net losses. Rigetti shows stronger revenue growth and better gross margins but suffers from worsening net income and operating losses. Quantum Computing has less pronounced revenue growth and more negative margins, though it shows slight EPS improvement. Neither demonstrates strong fundamental profitability.

Financial Ratios Comparison

The following table presents a selection of key financial ratios for Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT) based on their most recent fiscal year data from 2024.

| Ratios | Rigetti Computing, Inc. (RGTI) | Quantum Computing, Inc. (QUBT) |

|---|---|---|

| ROE | -159% | -64% |

| ROIC | -25% | -17% |

| P/E | -14.0 | -22.7 |

| P/B | 22.3 | 14.5 |

| Current Ratio | 17.4 | 17.4 |

| Quick Ratio | 17.4 | 17.4 |

| D/E (Debt to Equity) | 0.07 | 0.01 |

| Debt-to-Assets | 3.1% | 0.8% |

| Interest Coverage | -21.0 | -10.4 |

| Asset Turnover | 0.04 | 0.0024 |

| Fixed Asset Turnover | 0.20 | 0.038 |

| Payout ratio | 0 | -0.31% |

| Dividend yield | 0% | 0.014% |

Interpretation of the Ratios

Rigetti Computing, Inc.

Rigetti Computing’s ratios reveal challenges, with a highly negative net margin (-1862.72%) and return on equity (-158.77%), indicating significant unprofitability and weak returns. The company’s debt levels are low and favorably managed, but poor asset turnover and interest coverage raise concerns about operational efficiency. Rigetti does not pay dividends, reflecting its focus on reinvestment and growth in the quantum computing sector.

Quantum Computing, Inc.

Quantum Computing exhibits weak profitability metrics, including an extremely negative net margin (-18375.87%) and negative returns on equity (-63.89%) and invested capital (-17.41%). Despite a strong liquidity position and low debt ratios, asset turnover remains minimal. The company also does not distribute dividends, likely prioritizing R&D and strategic development over shareholder payouts amid ongoing expansion.

Which one has the best ratios?

Both Rigetti Computing and Quantum Computing display predominantly unfavorable financial ratios, with only about 29% of metrics rated favorable. Each maintains strong liquidity and low leverage, yet both suffer from poor profitability and operational efficiency. Given these similarities, neither company clearly outperforms the other on ratio analysis alone for the fiscal year 2024.

Strategic Positioning

This section compares the strategic positioning of Rigetti Computing, Inc. and Quantum Computing, Inc., including market position, key segments, and exposure to technological disruption:

Rigetti Computing, Inc.

- Larger market cap of 7.8B with moderate competitive pressure in quantum hardware.

- Focus on building quantum hardware and cloud integration with quantum processors.

- Direct involvement in quantum hardware manufacturing limits disruption threats.

Quantum Computing, Inc.

- Smaller market cap of 1.5B, higher beta indicating greater volatility.

- Concentrated on software tools and applications for quantum computers.

- Exposure through software enabling quantum-ready applications across platforms.

Rigetti Computing, Inc. vs Quantum Computing, Inc. Positioning

Rigetti’s approach is hardware-focused and integrated with cloud services, offering a broader product scope, while Quantum Computing concentrates on software solutions for quantum applications, showing a more specialized but narrower market focus.

Which has the best competitive advantage?

Both companies are currently shedding value as their ROIC is below WACC, but each shows growing ROIC trends, suggesting improving profitability. Neither currently exhibits a strong competitive moat based on provided MOAT evaluations.

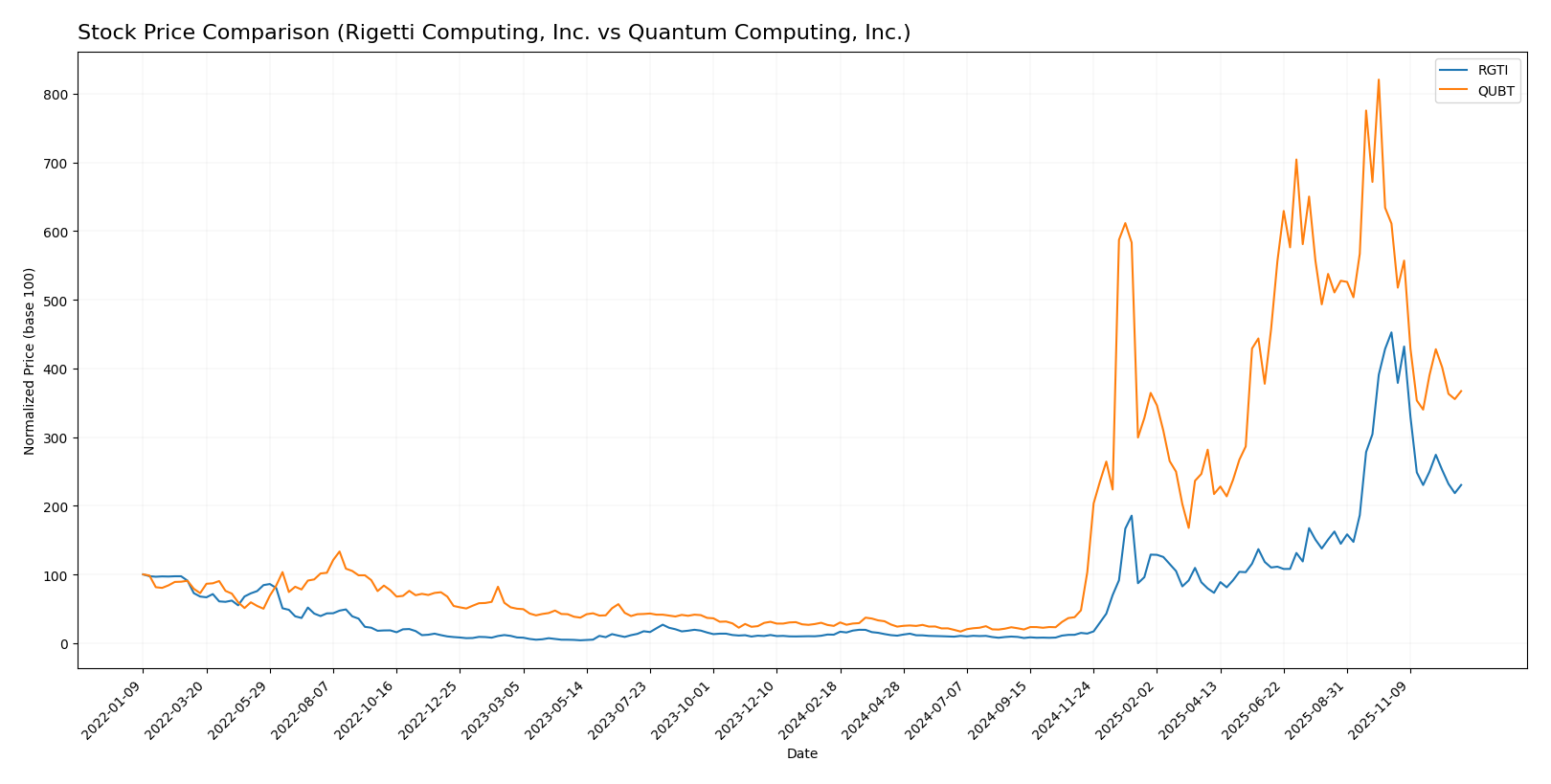

Stock Comparison

The stock price movements of Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT) over the past 12 months reveal strong bullish trends overall, with recent significant pullbacks indicating shifting trading dynamics.

Trend Analysis

Rigetti Computing, Inc. (RGTI) exhibited a bullish trend with a 1788.0% price increase over the past year, though recent months show a 49.12% decline, signaling a deceleration phase with elevated volatility (std dev 11.14).

Quantum Computing, Inc. (QUBT) also showed a bullish trend with a 1369.18% gain year-on-year, followed by a 39.93% pullback recently, reflecting deceleration and lower volatility (std dev 6.96) compared to RGTI.

Comparing both, RGTI delivered the highest market performance over the year despite recent sharper declines, while QUBT posted a strong but less pronounced price appreciation.

Target Prices

The target price consensus for Rigetti Computing, Inc. and Quantum Computing, Inc. reflects cautious optimism among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rigetti Computing, Inc. | 50 | 18 | 35.83 |

| Quantum Computing, Inc. | 40 | 10 | 19.5 |

Analysts expect Rigetti’s stock to trade significantly above its current price of $23.6, signaling potential upside. Quantum Computing’s consensus target at $19.5 also suggests room for growth from its current $11.01 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Rigetti Computing, Inc. and Quantum Computing, Inc.:

Rating Comparison

RGTI Rating

- Rating: C, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 1, indicating Very Unfavorable valuation.

- ROE Score: 1, showing very unfavorable profit efficiency.

- ROA Score: 1, reflecting very unfavorable asset utilization.

- Debt To Equity Score: 4, favorable financial leverage.

- Overall Score: 2, moderate overall financial standing.

QUBT Rating

- Rating: C+, also considered Very Favorable by analysts.

- Discounted Cash Flow Score: 2, moderate valuation level.

- ROE Score: 1, equally very unfavorable profit efficiency.

- ROA Score: 1, similarly very unfavorable asset utilization.

- Debt To Equity Score: 5, very favorable financial leverage.

- Overall Score: 2, also moderate overall financial standing.

Which one is the best rated?

Quantum Computing, Inc. holds a slightly better rating with a C+ compared to Rigetti’s C. It also has a more favorable Debt To Equity and Discounted Cash Flow score, although both share similar low ROE and ROA scores and moderate overall ratings.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Rigetti Computing, Inc. and Quantum Computing, Inc.:

RGTI Scores

- Altman Z-Score: 101.7, indicating a safe zone rating.

- Piotroski Score: 2, classified as very weak financial health.

QUBT Scores

- Altman Z-Score: 50.2, also indicating a safe zone.

- Piotroski Score: 4, classified as average financial health.

Which company has the best scores?

Both companies are in the safe zone according to the Altman Z-Score, but QUBT has a stronger Piotroski Score at 4 (average) versus RGTI’s 2 (very weak). Thus, QUBT shows comparatively better financial strength based on the provided data.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Rigetti Computing, Inc. and Quantum Computing, Inc.:

Rigetti Computing, Inc. Grades

The table below shows recent grades from reputable grading companies for Rigetti Computing, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Neutral | 2025-11-12 |

| Benchmark | Maintain | Buy | 2025-11-12 |

| B. Riley Securities | Downgrade | Neutral | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-08-13 |

| Needham | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

| Benchmark | Maintain | Buy | 2025-05-15 |

| Needham | Maintain | Buy | 2025-05-14 |

Rigetti Computing shows mostly consistent Buy ratings with a recent neutral downgrade by B. Riley Securities, indicating mixed but generally positive sentiment.

Quantum Computing, Inc. Grades

Below are recent grades from established grading firms for Quantum Computing, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Ascendiant Capital | Maintain | Buy | 2025-12-22 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-12-18 |

| Lake Street | Maintain | Buy | 2025-11-17 |

| Ascendiant Capital | Maintain | Buy | 2025-10-03 |

| Ascendiant Capital | Maintain | Buy | 2025-06-06 |

| Ascendiant Capital | Maintain | Buy | 2025-04-28 |

| Ascendiant Capital | Maintain | Buy | 2024-11-13 |

| Ascendiant Capital | Maintain | Buy | 2023-11-24 |

Quantum Computing, Inc. maintains predominantly Buy ratings with a single recent Neutral from Cantor Fitzgerald, reflecting steady positive analyst confidence.

Which company has the best grades?

Quantum Computing, Inc. has received a more consistently positive set of Buy grades compared to Rigetti Computing, Inc., which shows some recent neutral downgrades. Investors might interpret stronger analyst support for Quantum Computing as an indicator of greater confidence in its prospects.

Strengths and Weaknesses

Below is a comparison of Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT) based on key financial and strategic criteria.

| Criterion | Rigetti Computing, Inc. (RGTI) | Quantum Computing, Inc. (QUBT) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from quantum computing access and research services, with declining recent sales | Low: Revenue concentrated in services with minimal diversification |

| Profitability | Unfavorable: Negative net margin (-1863%) and declining ROIC (-24.9%), but showing ROIC growth trend | Unfavorable: Extremely negative net margin (-18,376%) and negative ROIC (-17.4%), though ROIC trend is improving |

| Innovation | Strong: Active in quantum computing systems access and R&D collaborations | Moderate: Primarily focused on services, limited product innovation evident |

| Global presence | Modest: Focused on niche quantum computing markets, some global collaborations | Limited: Smaller scale with less market reach |

| Market Share | Small but growing in the quantum computing niche | Very small with minimal market penetration |

Key takeaways: Both RGTI and QUBT are early-stage quantum computing companies facing significant profitability challenges and value destruction. However, they both exhibit improving ROIC trends, indicating potential for future profitability if operational efficiencies and market expansion improve. Investors should weigh high risk against potential innovation-driven growth.

Risk Analysis

Below is a comparative table summarizing key risks for Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT) based on the most recent 2024 data:

| Metric | Rigetti Computing, Inc. (RGTI) | Quantum Computing, Inc. (QUBT) |

|---|---|---|

| Market Risk | High beta at 1.69 indicating elevated sensitivity to market fluctuations | Very high beta at 3.80, implying extreme market volatility |

| Debt level | Low debt-to-equity ratio (~0.07), low debt-to-assets (3.1%) | Even lower debt levels; debt-to-equity around 0.01, debt-to-assets <1% |

| Regulatory Risk | Moderate, operating in emerging quantum tech with evolving regulations | Moderate, similar exposure to quantum computing regulations and government contracts |

| Operational Risk | High due to negative profitability (net margin -1863%), weak asset turnover and unfavorable ROE/ROIC | Very high operational risk with even larger losses (net margin -18376%), zero asset turnover |

| Environmental Risk | Low; technology sector with limited direct environmental impact | Low; similar sector and environmental footprint |

| Geopolitical Risk | Moderate, U.S.-based with exposure to international supply chains and tech export controls | Moderate, U.S.-based, potentially sensitive to government policy shifts affecting contracts |

In synthesis, both companies face significant operational risks marked by extreme negative margins and poor returns on equity and assets. Market risk is also notable, especially for Quantum Computing, Inc. with its very high beta, suggesting vulnerability to market swings. Debt levels are low for both firms, which is favorable for financial stability. Regulatory and geopolitical risks remain moderate, typical for cutting-edge tech firms in the quantum computing space. Investors should focus on operational turnaround and market volatility as the primary risk factors.

Which Stock to Choose?

Rigetti Computing, Inc. (RGTI) shows unfavorable income evolution with a -10.14% revenue decline in 2024 and negative profitability ratios, including a net margin of -1862.72%. Its financial ratios are mostly unfavorable, though debt levels remain low, and the company holds a moderate overall rating of C with a very favorable rating status.

Quantum Computing, Inc. (QUBT) exhibits a mixed income evolution with a slight 4.19% revenue growth but heavily negative profitability metrics, including a net margin of -18375.87%. Its financial ratios are largely unfavorable, despite very low debt levels, and it holds a moderate overall rating of C+ with a very favorable rating status.

For investors, the choice might depend on risk tolerance and investment strategy: growth-oriented investors could find potential in Quantum Computing’s slight revenue growth and improving ROIC trend, while risk-averse or quality-focused investors may view Rigetti’s stronger rating and higher market capitalization as more appealing despite current profitability challenges. Both companies currently display unfavorable financial ratios and income statements but show signs of improving profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Rigetti Computing, Inc. and Quantum Computing, Inc. to enhance your investment decisions: