Quantum technology is rapidly transforming the tech landscape, and two companies, Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ), are at the forefront of this revolution. Rigetti focuses on building quantum computers and processors, while Arqit specializes in quantum cybersecurity solutions leveraging satellite and cloud platforms. This article compares their market positions and innovation strategies to help you decide which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Rigetti Computing and Arqit Quantum by providing an overview of these two companies and their main differences.

Rigetti Computing Overview

Rigetti Computing, Inc. is an integrated systems company focused on building quantum computers and superconducting quantum processors. Founded in 2013 and based in Berkeley, California, Rigetti integrates its machines into public, private, or hybrid clouds via its Quantum Cloud Services platform. It operates in the computer hardware industry with a market cap of approximately 7.8B USD.

Arqit Quantum Overview

Arqit Quantum Inc. is a UK-based cybersecurity company specializing in quantum encryption through satellite and terrestrial platforms. Its QuantumCloud service enables devices to create encryption keys via a lightweight software agent. Founded in London, Arqit operates in the software infrastructure sector and has a market cap near 384M USD.

Key similarities and differences

Both companies operate within the technology sector and focus on quantum-related technologies, though Rigetti develops quantum hardware and computing systems, while Arqit provides quantum cybersecurity software solutions. Rigetti is substantially larger in market capitalization and employee count, reflecting its hardware-intensive business, whereas Arqit’s emphasis on software infrastructure results in a smaller scale and different market positioning.

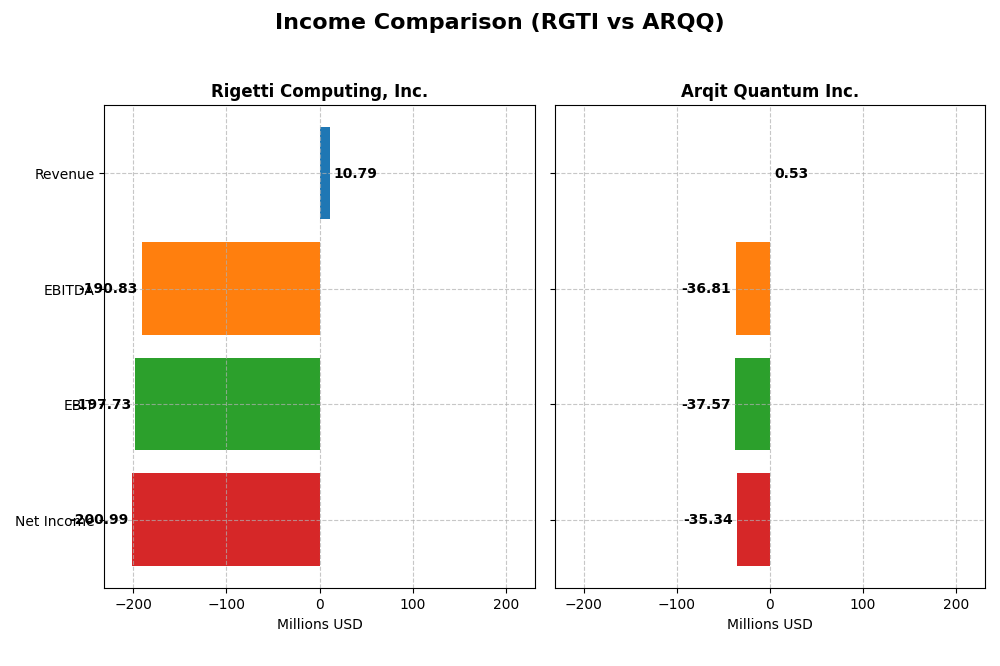

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent fiscal year income statement metrics for Rigetti Computing, Inc. and Arqit Quantum Inc., reflecting their financial performance.

| Metric | Rigetti Computing, Inc. (RGTI) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Cap | 7.79B | 384M |

| Revenue | 10.8M | 530K |

| EBITDA | -191.0M | -36.8M |

| EBIT | -197.7M | -37.6M |

| Net Income | -201.0M | -35.3M |

| EPS | -1.09 | -2.56 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Rigetti Computing, Inc.

Rigetti Computing’s revenue showed a 94.67% increase over 2020-2024 but declined 10.14% in the latest year to $10.8M. Gross margin remained favorable at 52.8%, yet net margin stayed deeply negative at -1862.72%. The 2024 results revealed worsening profitability with net income dropping sharply to -$201M and EPS down 91.23%, signaling deteriorating margins and losses.

Arqit Quantum Inc.

Arqit Quantum’s revenue surged 1006.24% over 2021-2025, with an 80.89% rise in the most recent year reaching $530K. Despite this growth, gross margin was negative at -43.4%, and net margin remained unfavorable at -6668.49%. The 2025 performance showed improved net margin growth of 64.2% and EPS growth of 76.27%, reflecting some operational progress amid ongoing losses.

Which one has the stronger fundamentals?

Arqit Quantum presents a more favorable overall income statement profile with strong revenue and net income growth, alongside improving margins and EPS. Rigetti shows solid revenue growth but suffers from persistent, steep net losses and deteriorating profitability metrics. Therefore, Arqit’s fundamentals appear stronger based on income trends, albeit both face significant challenges.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ) based on their most recent fiscal year data.

| Ratios | Rigetti Computing, Inc. (2024) | Arqit Quantum Inc. (2025) |

|---|---|---|

| ROE | -158.8% | -129.8% |

| ROIC | -24.9% | -127.5% |

| P/E | -14.0 | -15.1 |

| P/B | 22.3 | 19.6 |

| Current Ratio | 17.4 | 2.69 |

| Quick Ratio | 17.4 | 2.69 |

| D/E (Debt-to-Equity) | 0.07 | 0.03 |

| Debt-to-Assets | 3.1% | 1.7% |

| Interest Coverage | -21.0 | -802.9 |

| Asset Turnover | 0.038 | 0.012 |

| Fixed Asset Turnover | 0.205 | 0.736 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Rigetti Computing, Inc.

Rigetti’s financial ratios reveal significant weaknesses, with unfavorable net margin (-1862.72%) and return on equity (-158.77%), indicating poor profitability and efficiency. Despite a very high current ratio (17.42) suggesting liquidity, it is flagged unfavorable, possibly due to excess idle assets. The company does not pay dividends, reflecting its reinvestment strategy and growth phase in the quantum computing sector.

Arqit Quantum Inc.

Arqit’s ratios also show challenges, such as a steep negative net margin (-6668.49%) and return on equity (-129.77%), highlighting profitability issues. However, liquidity ratios like current and quick ratios (both 2.69) are favorable, indicating reasonable short-term financial health. The absence of dividends aligns with its focus on R&D and expansion, prioritizing investment over shareholder payouts.

Which one has the best ratios?

Both companies exhibit predominantly unfavorable financial ratios, reflecting their early-stage, high-investment profiles. Arqit Quantum shows a slightly higher proportion of favorable ratios (35.71%) compared to Rigetti (28.57%), particularly in liquidity and leverage metrics, but both face significant profitability and operational challenges as of their latest fiscal years.

Strategic Positioning

This section compares the strategic positioning of Rigetti Computing, Inc. and Arqit Quantum Inc., including market position, key segments, and exposure to technological disruption:

Rigetti Computing, Inc.

- Market position and competitive pressure

- Key segments and business drivers

- Exposure to technological disruption

Arqit Quantum Inc.

- Larger market cap of 7.8B USD; moderate competitive pressure in quantum hardware.

- Focuses on quantum computers and superconducting processors; revenue mainly from cloud quantum computing access.

- Operates in quantum hardware sector, integrating systems into public and hybrid clouds, vulnerable to fast tech changes.

Rigetti Computing, Inc. vs Arqit Quantum Inc. Positioning

Rigetti is diversified in integrated quantum hardware and cloud services, with revenue streams visible; Arqit concentrates on quantum cybersecurity software with no reported revenue breakdown. Rigetti’s larger scale contrasts with Arqit’s specialized yet smaller market presence.

Which has the best competitive advantage?

Both companies are currently shedding value despite growing ROIC trends, indicating slight unfavorable moats. Rigetti’s larger market cap and diverse product integration may offer a marginally stronger competitive advantage than Arqit’s smaller, software-focused model.

Stock Comparison

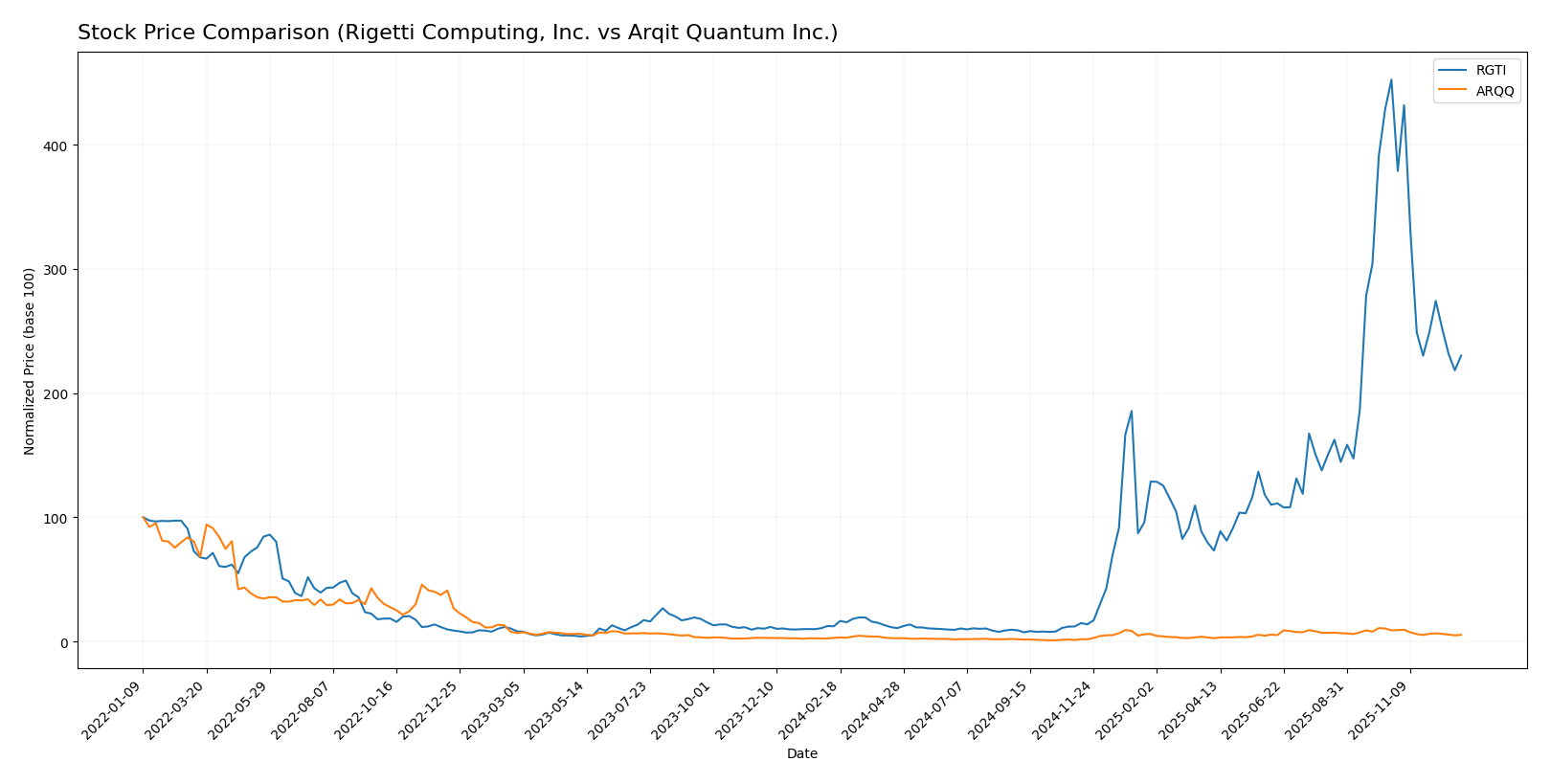

The stock price chart highlights significant bullish gains for both Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ) over the past 12 months, with recent periods showing notable downward corrections and changes in buyer-seller dynamics.

Trend Analysis

Rigetti Computing, Inc. (RGTI) exhibited a strong bullish trend over the past 12 months with a 1788.0% price increase, though recent data show a 49.12% decline, indicating a deceleration in momentum and a shift to a slightly seller-dominant phase.

Arqit Quantum Inc. (ARQQ) also showed a bullish trend with an 85.21% rise over the last year, but faced a 40.85% drop recently, reflecting deceleration and seller dominance in trading activity.

Comparing both stocks, RGTI delivered significantly higher market performance over the 12-month span, despite recent declines, outperforming ARQQ in overall price appreciation.

Target Prices

The current analyst consensus provides optimistic target prices for Rigetti Computing, Inc. and Arqit Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rigetti Computing, Inc. | 50 | 18 | 35.83 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

Analysts expect Rigetti’s price to rise significantly from $23.6, with a consensus near $35.83, while Arqit shows a firm consensus target well above its current $24.54 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Rigetti Computing, Inc. and Arqit Quantum Inc.:

Rating Comparison

RGTI Rating

- Rating: C, evaluated as Very Favorable.

- Discounted Cash Flow Score: 1, marked Very Unfavorable.

- ROE Score: 1, marked Very Unfavorable.

- ROA Score: 1, marked Very Unfavorable.

- Debt To Equity Score: 4, marked Favorable.

- Overall Score: 2, marked Moderate.

ARQQ Rating

- Rating: C, evaluated as Very Favorable.

- Discounted Cash Flow Score: 2, marked Moderate.

- ROE Score: 1, marked Very Unfavorable.

- ROA Score: 1, marked Very Unfavorable.

- Debt To Equity Score: 4, marked Favorable.

- Overall Score: 2, marked Moderate.

Which one is the best rated?

Both RGTI and ARQQ share the same overall rating of C and overall score of 2, rated as Moderate. ARQQ has a slightly better discounted cash flow score, but all other scores are identical, indicating comparable analyst ratings.

Scores Comparison

The comparison of Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ) scores is as follows:

RGTI Scores

- Altman Z-Score: 101.7, safe zone, indicating very low bankruptcy risk.

- Piotroski Score: 2, very weak financial strength rating.

ARQQ Scores

- Altman Z-Score: -1.46, distress zone, indicating high bankruptcy risk.

- Piotroski Score: 2, very weak financial strength rating.

Which company has the best scores?

RGTI shows a significantly stronger Altman Z-Score, placing it in the safe zone, while ARQQ is in financial distress. Both have equally low Piotroski Scores, indicating weak financial strength.

Grades Comparison

Here is a comparison of recent grades assigned by reputable grading companies for the two companies:

Rigetti Computing, Inc. Grades

This table shows recent grades and rating actions from well-known grading firms for Rigetti Computing, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Neutral | 2025-11-12 |

| Benchmark | Maintain | Buy | 2025-11-12 |

| B. Riley Securities | Downgrade | Neutral | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-08-13 |

| Needham | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

| Benchmark | Maintain | Buy | 2025-05-15 |

| Needham | Maintain | Buy | 2025-05-14 |

The overall trend for Rigetti shows predominantly Buy ratings with a recent slight downgrade by B. Riley Securities to Neutral, indicating some cautious sentiment.

Arqit Quantum Inc. Grades

Below are the consistent grades and rating actions from a reputable grading company for Arqit Quantum Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Arqit Quantum exhibits a stable and consistent Buy rating from the same grading company over multiple years, reflecting steady positive analyst sentiment.

Which company has the best grades?

Arqit Quantum has consistently received Buy ratings without downgrades, while Rigetti Computing shows mostly Buy ratings but with some recent cautious Neutral grades. Investors might interpret Arqit’s stable Buy grades as stronger confidence compared to Rigetti’s mixed signals.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ) based on their recent financial and market performance:

| Criterion | Rigetti Computing, Inc. (RGTI) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from quantum computing access and research services | Low: Limited product/service diversification reported |

| Profitability | Unfavorable: Negative net margin and ROIC, though ROIC trend is improving | Unfavorable: Deeply negative margins and ROIC, but slight ROIC growth |

| Innovation | Strong: Focus on quantum computing systems access and collaborative research | Strong: Focus on advanced quantum encryption technologies |

| Global presence | Moderate: Expanding quantum computing access but limited global footprint | Moderate: Emerging presence in quantum encryption markets |

| Market Share | Small but growing niche player in quantum computing services | Small niche player in quantum encryption domain |

Key takeaways: Both companies operate in emerging quantum technology sectors with strong innovation but currently face significant profitability challenges. RGTI shows improving capital efficiency, while ARQQ has slightly higher financial stability ratios but remains unprofitable. Investors should weigh growth potential against current value destruction risk.

Risk Analysis

Below is a comparative table of key risk factors for Rigetti Computing, Inc. (RGTI) and Arqit Quantum Inc. (ARQQ) based on the most recent financial and operational data:

| Metric | Rigetti Computing, Inc. (RGTI) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Risk | High beta (1.69) implies elevated volatility | Very high beta (2.38), more volatile |

| Debt Level | Low debt-to-equity (0.07), low leverage | Very low debt-to-equity (0.03), minimal leverage |

| Regulatory Risk | Moderate, US tech sector regulations apply | Moderate, UK cybersecurity regulations apply |

| Operational Risk | Small workforce (137), early-stage quantum tech challenges | Smaller team (82), reliance on emerging quantum encryption tech |

| Environmental Risk | Low, primarily software and hardware development | Low, software-driven with satellite infrastructure |

| Geopolitical Risk | Moderate, US-China tech tensions could impact | Higher, UK-based with potential Brexit and international data security issues |

In summary, both companies face significant operational risks due to their early-stage quantum technology focus. Market risk is higher for Arqit given its greater volatility. Arqit is also more exposed to geopolitical uncertainties due to its UK base and cybersecurity focus. Rigetti benefits from stronger financial stability with low debt and a favorable Altman Z-Score, while Arqit shows distress signals, elevating its financial risk. Investors should weigh these factors carefully, prioritizing risk management given the nascent and volatile nature of the quantum sector.

Which Stock to Choose?

Rigetti Computing, Inc. (RGTI) shows a declining income profile with unfavorable net margin and profitability ratios, though it maintains low debt levels and a strong quick ratio. Its overall rating is moderate with mixed financial health signals.

Arqit Quantum Inc. (ARQQ) exhibits strong revenue growth and an improving income statement, despite unfavorable profitability ratios and low asset returns. It carries low debt and a moderate overall rating, but scores poorly on value metrics.

Investors prioritizing growth and improving profitability might find ARQQ’s favorable income trends and rating more attractive, while those focused on financial stability and lower leverage could view RGTI’s debt profile and quick ratio as a potential advantage.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Rigetti Computing, Inc. and Arqit Quantum Inc. to enhance your investment decisions: