Home > Comparison > Healthcare > RMD vs WST

The strategic rivalry between ResMed Inc. and West Pharmaceutical Services defines the current trajectory of the healthcare instruments sector. ResMed focuses on integrated medical devices and cloud-based software for respiratory care, while West excels in advanced drug containment and delivery systems. This clash highlights growth through digital integration versus specialized manufacturing. This analysis aims to identify which company offers superior risk-adjusted returns for a diversified portfolio in a competitive healthcare landscape.

Table of contents

Companies Overview

ResMed Inc. and West Pharmaceutical Services, Inc. stand as pivotal players in the medical instruments and supplies sector.

ResMed Inc.: Leader in Respiratory Care and Digital Health

ResMed dominates the sleep and respiratory care market by developing medical devices and cloud-based software. Its revenue engine centers on solutions for respiratory disorders, including ventilation devices and compliance monitoring software. In 2026, ResMed strategically emphasizes expanding its cloud-connected healthcare platforms to enhance patient outcomes and provider efficiency worldwide.

West Pharmaceutical Services, Inc.: Innovator in Drug Delivery Systems

West Pharmaceutical Services leads in designing and manufacturing containment and delivery systems for injectable drugs. Its core revenue comes from proprietary stoppers, seals, and self-injection devices, combined with contract manufacturing for pharmaceutical clients. The company’s 2026 focus lies in advancing integrated drug delivery technologies to meet evolving pharmaceutical industry demands globally.

Strategic Collision: Similarities & Divergences

Both firms excel in healthcare innovation but diverge in focus: ResMed pursues a software-integrated care approach, while West centers on physical drug delivery components. They compete indirectly through healthcare providers’ ecosystem influence, targeting improved patient treatment. ResMed offers a digital health growth profile; West provides a manufacturing-driven innovation trajectory, reflecting distinct risk and opportunity landscapes.

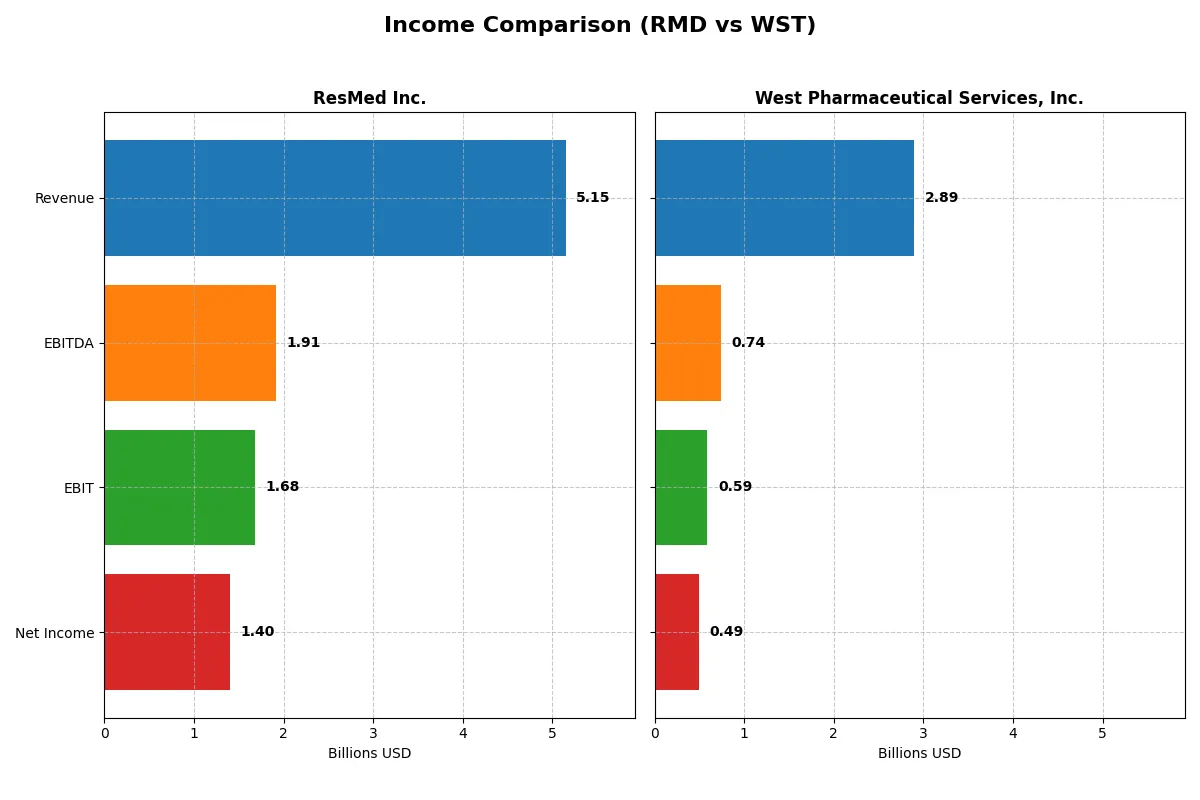

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | ResMed Inc. (RMD) | West Pharmaceutical Services, Inc. (WST) |

|---|---|---|

| Revenue | 5.15B | 2.89B |

| Cost of Revenue | 2.09B | 1.89B |

| Operating Expenses | 1.37B | 408M |

| Gross Profit | 3.05B | 1.00B |

| EBITDA | 1.91B | 744M |

| EBIT | 1.68B | 588M |

| Interest Expense | 13M | 2.9M |

| Net Income | 1.40B | 493M |

| EPS | 9.55 | 6.75 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison uncovers which company drives superior efficiency and profitability in their core operations.

ResMed Inc. Analysis

ResMed’s revenue climbed steadily from 3.2B in 2021 to 5.1B in 2025, with net income surging from 475M to 1.4B. Gross and net margins hold strong at 59.36% and 27.22%, respectively, reflecting robust cost control. The 2025 results highlight significant momentum, with EBIT growth hitting 28% and EPS up 37%, signaling exceptional operational leverage.

West Pharmaceutical Services, Inc. Analysis

West’s revenue expanded from 2.1B in 2020 to nearly 2.9B in 2024, but the latest year shows a slight revenue decline (-2%). Net income rose overall to 493M in 2024, though down from 593M in 2023. Gross margin rests at a healthy 34.65%, but net margin at 17.03% and a 15% EPS drop in 2024 reveal pressure on profitability and efficiency in the recent year.

Verdict: Efficiency Surge vs. Margin Stability

ResMed outpaces West with superior top-line growth and a robust margin expansion, delivering nearly double the net income at a higher margin. West shows respectable growth but faces recent setbacks in revenue and net income momentum. For investors, ResMed’s profile offers a sharper trajectory of profitability and operational efficiency.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | ResMed Inc. (RMD) | West Pharmaceutical Services, Inc. (WST) |

|---|---|---|

| ROE | 23.5% | 18.4% |

| ROIC | 19.6% | 15.7% |

| P/E | 27.0 | 48.5 |

| P/B | 6.34 | 8.91 |

| Current Ratio | 3.44 | 2.79 |

| Quick Ratio | 2.53 | 2.11 |

| D/E (Debt-to-Equity) | 0.14 | 0.11 |

| Debt-to-Assets | 10.4% | 8.4% |

| Interest Coverage | 134 | 205 |

| Asset Turnover | 0.63 | 0.79 |

| Fixed Asset Turnover | 7.16 | 1.72 |

| Payout ratio | 22.2% | 12.0% |

| Dividend yield | 0.82% | 0.25% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing underlying risks and operational strengths that raw numbers often conceal.

ResMed Inc.

ResMed delivers strong profitability with a 23.47% ROE and a 27.22% net margin, signaling operational excellence. Its valuation feels stretched at a 27.02 P/E and 6.34 P/B, reflecting premium pricing. Shareholders see modest dividends at 0.82%, while the company reinvests heavily in R&D to fuel growth and innovation.

West Pharmaceutical Services, Inc.

West posts a solid but lower 18.37% ROE and a 17.03% net margin, showing efficiency but less dominance than ResMed. Its valuation appears significantly stretched with a 48.53 P/E and 8.91 P/B ratios. Dividends are minimal at 0.25%, with capital largely directed toward steady operational improvements and moderate growth.

Premium Valuation vs. Operational Safety

ResMed offers a better blend of profitability and capital returns despite a high valuation. West trades at a higher premium with less robust margins. Investors favoring operational strength may lean toward ResMed, while those seeking steady growth at a premium might consider West’s profile.

Which one offers the Superior Shareholder Reward?

I see ResMed (RMD) offers a 0.82% dividend yield with a sustainable 22% payout ratio backed by strong free cash flow of 11.3/share. Its buybacks are less intense but consistent. West Pharmaceutical (WST) pays a low 0.25% yield with a 12% payout ratio and weaker free cash flow conversion at 3.8/share, but runs modest buybacks. RMD’s higher yield, solid FCF coverage, and balanced buyback strategy deliver a more attractive total return profile for 2026 investors.

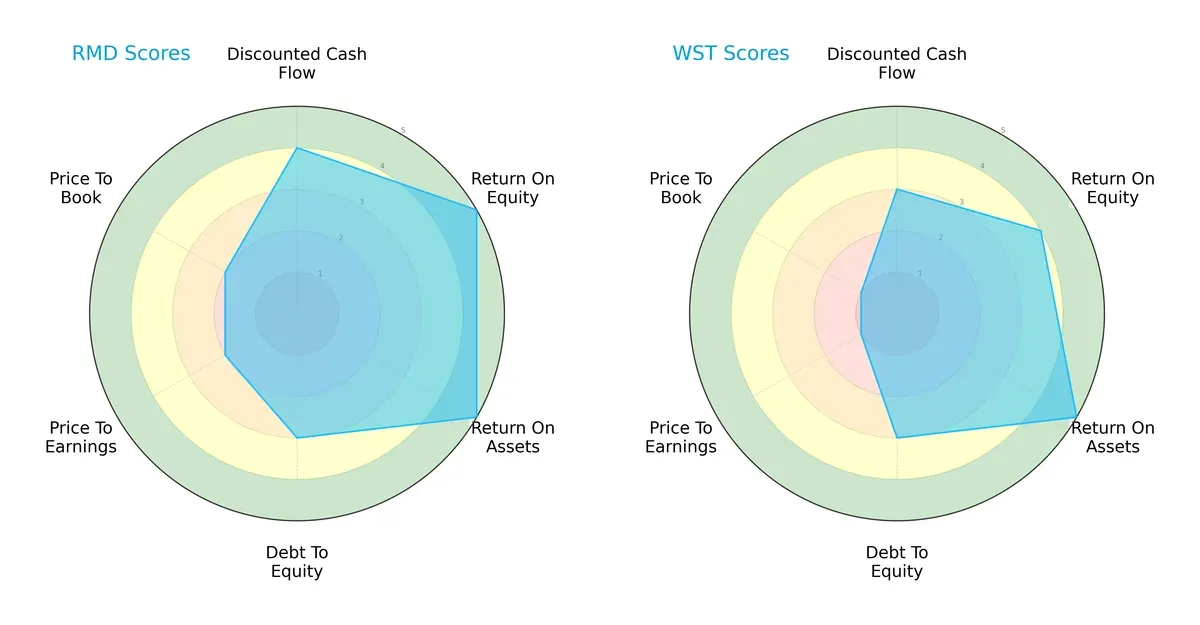

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of ResMed Inc. and West Pharmaceutical Services, Inc., highlighting their financial strengths and valuation nuances:

ResMed leads with a more balanced profile, excelling in ROE (5) and ROA (5), and showing a stronger DCF score (4) compared to West’s moderate 3. Both share moderate debt-to-equity scores (3), but ResMed’s valuation metrics (PE/PB scores at 2) are less stretched than West’s very unfavorable low scores (1). West leans on asset efficiency but suffers from valuation pressure, while ResMed offers a sturdier blend of profitability and valuation discipline.

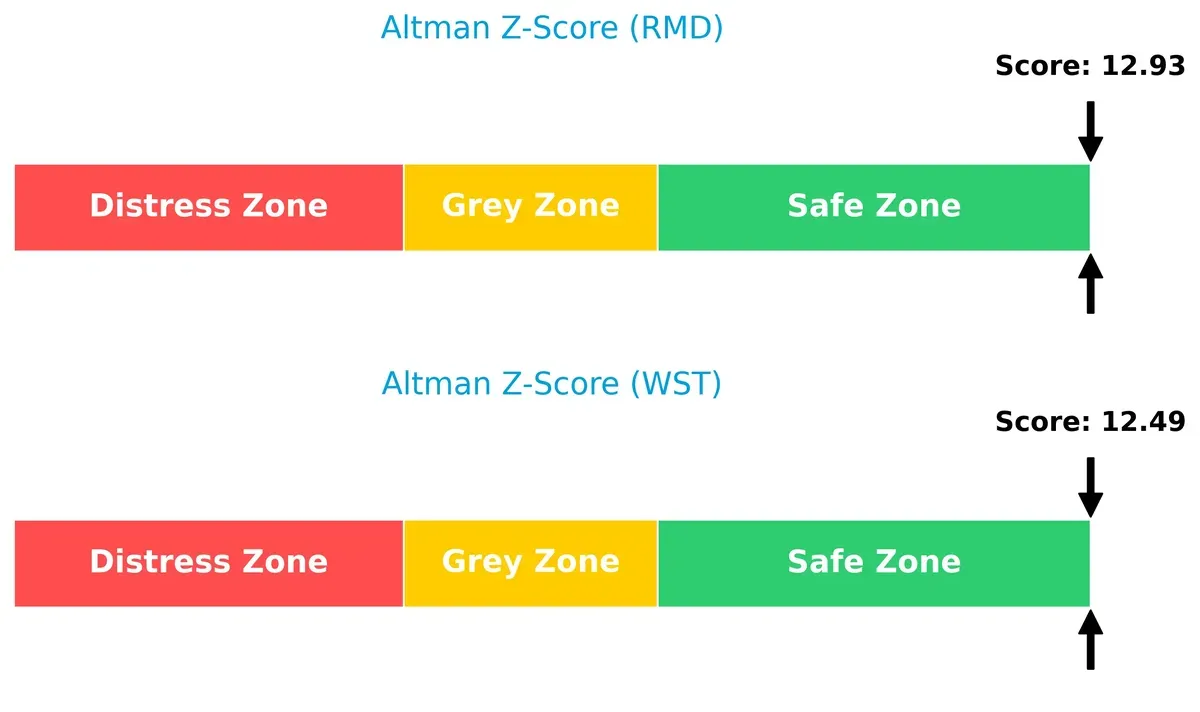

Bankruptcy Risk: Solvency Showdown

ResMed’s Altman Z-Score of 12.93 slightly edges out West’s 12.49, both firmly in the safe zone, signaling robust solvency and minimal bankruptcy risk amid current economic cycles:

Financial Health: Quality of Operations

ResMed’s Piotroski F-Score of 7 indicates strong financial health, surpassing West’s 6, which is average. This suggests ResMed maintains better internal financial metrics with fewer red flags:

How are the two companies positioned?

This section dissects the operational DNA of ResMed and West Pharmaceutical by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and reveal which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

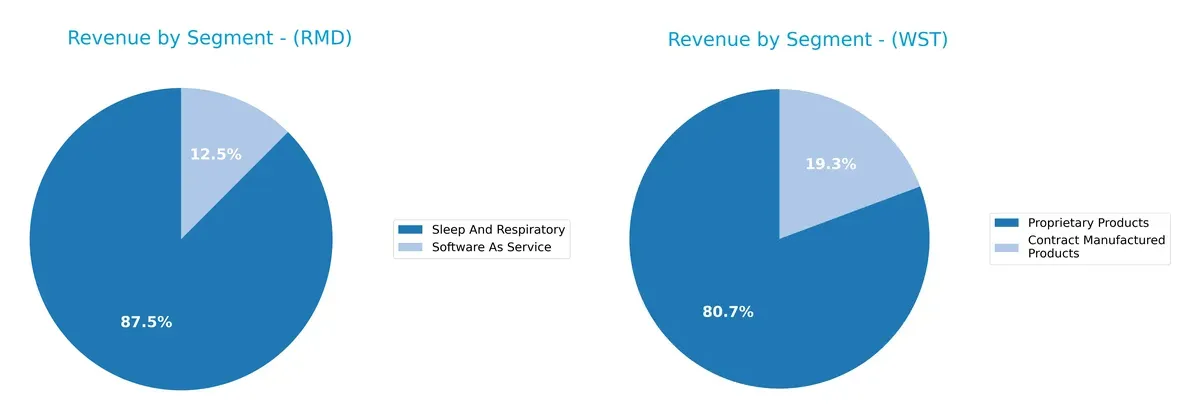

This visual comparison dissects how ResMed Inc. and West Pharmaceutical Services, Inc. diversify their income streams and where their primary sector bets lie:

ResMed anchors revenue heavily in Sleep And Respiratory at $4.1B, with Software As Service adding $584M, showing moderate diversification. West Pharmaceutical relies mainly on Proprietary Products at $2.3B, dwarfing Contract Manufactured Products at $559M. ResMed’s focus suggests ecosystem lock-in through medical devices and software, while West Pharmaceutical’s concentration in proprietary products signals infrastructure dominance but raises concentration risk.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of ResMed Inc. and West Pharmaceutical Services, Inc.:

ResMed Inc. Strengths

- High profitability with 27.22% net margin

- Strong returns: 23.47% ROE and 19.56% ROIC

- Low debt levels with 0.14 debt-to-equity

- Robust interest coverage at 133.05

- Diversified products in Sleep, Respiratory, and SaaS segments

- Significant global revenue, especially U.S. market dominance

West Pharmaceutical Services Strengths

- Solid profitability with 17.03% net margin

- Good returns: 18.37% ROE and 15.69% ROIC

- Very strong interest coverage at 202.9

- Low leverage with 0.11 debt-to-equity

- Diversified products across proprietary and contract manufacturing

- Broad geographic exposure including strong U.S. and European markets

ResMed Inc. Weaknesses

- Elevated valuation ratios: PE 27.02 and PB 6.34

- Unfavorable current ratio at 3.44 despite strong quick ratio

- Low dividend yield of 0.82%

- Moderate asset turnover at 0.63 limits operational efficiency

West Pharmaceutical Services Weaknesses

- High valuation with PE of 48.53 and PB 8.91

- Lower dividend yield of 0.25%

- Neutral weighted average cost of capital at 9.34%

- Moderate asset and fixed asset turnovers at 0.79 and 1.72 respectively

Both companies demonstrate favorable profitability and conservative debt management, but face valuation concerns. ResMed’s strengths lie in higher profitability and broader product diversification, while West excels in interest coverage and geographic breadth. Each must address valuation and operational efficiency in their strategic focus.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competition and market disruption. Let’s dissect the competitive edges of these healthcare firms:

ResMed Inc.: Innovation-Driven Switching Costs

ResMed dominates through integrated medical devices and cloud software, creating high switching costs. Its 11.7% ROIC delta above WACC signals strong value creation. New digital health solutions could deepen this moat in 2026.

West Pharmaceutical Services, Inc.: Specialized Product Expertise

West leverages proprietary drug delivery components and manufacturing scale. Its 6.3% ROIC premium shows value creation but lags ResMed’s margin strength. Expansion into biologics packaging offers growth but faces tougher competition.

Moat Magnitude: Switching Costs vs. Specialized Expertise

ResMed’s wider moat outpaces West’s due to higher ROIC and a faster growth trajectory. ResMed is better positioned to defend market share amid evolving healthcare demands and digital integration.

Which stock offers better returns?

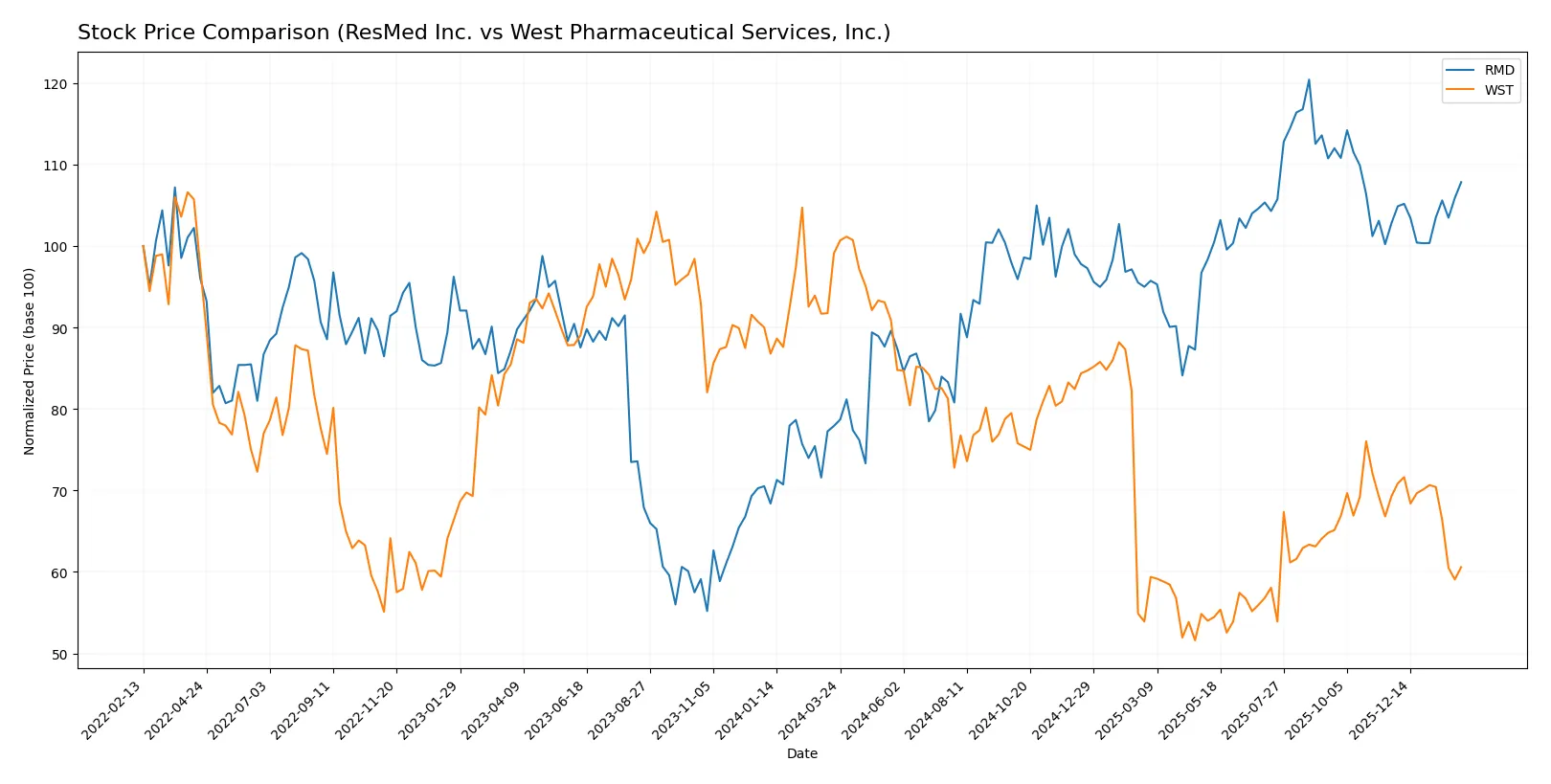

Over the past year, ResMed Inc. surged 38.4%, showing strong gains despite decelerating momentum, while West Pharmaceutical Services, Inc. declined 38.8%, reflecting sustained selling pressure and weakening trend dynamics.

Trend Comparison

ResMed Inc. posts a bullish trend with a 38.4% price increase over 12 months, slowing momentum, a 24.56 volatility, and a high near 294. Buyer dominance strengthens recently.

West Pharmaceutical Services, Inc. exhibits a bearish 38.8% decline over the same period, decelerating losses, higher 51.58 volatility, and a recent 12.55% drop with neutral buyer activity.

ResMed outperforms West Pharmaceutical significantly, delivering robust gains versus a steep drop, marking it the stronger market performer over the past year.

Target Prices

Analysts show a clear bullish consensus for both ResMed Inc. and West Pharmaceutical Services, indicating upside potential from current prices.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| ResMed Inc. (RMD) | 265 | 345 | 295.88 |

| West Pharmaceutical Services, Inc. (WST) | 285 | 355 | 323.5 |

ResMed’s consensus target of 295.88 suggests roughly 12.5% upside from 263.03 current price. West Pharma’s 323.5 target implies almost 36.5% potential gain from 237.05.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a comparison of recent institutional grades for ResMed Inc. and West Pharmaceutical Services, Inc.:

ResMed Inc. Grades

The table below summarizes recent grades assigned to ResMed Inc. by reputable institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-02 |

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| Piper Sandler | Maintain | Neutral | 2026-01-30 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-30 |

| Stifel | Maintain | Hold | 2026-01-30 |

West Pharmaceutical Services, Inc. Grades

The following table presents the latest grades for West Pharmaceutical Services, Inc. from respected grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2026-02-03 |

| Barclays | Maintain | Equal Weight | 2025-10-27 |

| UBS | Maintain | Buy | 2025-10-24 |

| Keybanc | Maintain | Overweight | 2025-10-24 |

Which company has the best grades?

West Pharmaceutical Services, Inc. has consistently received higher grades such as Outperform and Buy from multiple firms. ResMed Inc.’s grades range from Buy to Hold, indicating a more mixed outlook. Investors may interpret West’s stronger consensus as higher institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

ResMed Inc.

- Strong position in sleep and respiratory care with growing cloud-based software segment. Faces pressure from new entrants and evolving healthcare tech.

West Pharmaceutical Services, Inc.

- Focuses on injectable drug delivery systems with innovation in containment solutions. Faces intense competition and pricing pressure in pharma packaging.

2. Capital Structure & Debt

ResMed Inc.

- Low debt-to-equity ratio (0.14) and strong interest coverage (133x) indicate conservative leverage and financial stability.

West Pharmaceutical Services, Inc.

- Also maintains low leverage (debt-to-equity 0.11) with excellent interest coverage (203x), supporting resilience amid market shifts.

3. Stock Volatility

ResMed Inc.

- Beta of 0.88 signals lower volatility than the market, appealing for risk-averse investors.

West Pharmaceutical Services, Inc.

- Higher beta of 1.19 suggests greater volatility and sensitivity to market swings, increasing risk exposure.

4. Regulatory & Legal

ResMed Inc.

- Operates globally with exposure to healthcare regulations and compliance risks in multiple jurisdictions.

West Pharmaceutical Services, Inc.

- Faces stringent regulatory scrutiny in pharmaceutical packaging and drug delivery device approvals worldwide.

5. Supply Chain & Operations

ResMed Inc.

- Complex global supply chain for medical devices and software. Vulnerable to component shortages and logistic disruptions.

West Pharmaceutical Services, Inc.

- Supply chain spans specialized materials for drug containment, sensitive to raw material price fluctuations and manufacturing bottlenecks.

6. ESG & Climate Transition

ResMed Inc.

- Increasing focus on sustainable healthcare solutions and reducing carbon footprint in manufacturing.

West Pharmaceutical Services, Inc.

- Emphasizes environmentally friendly packaging innovations but faces challenges transitioning polymer materials to greener alternatives.

7. Geopolitical Exposure

ResMed Inc.

- Broad global footprint with risks from trade tensions, tariffs, and pandemic-related disruptions.

West Pharmaceutical Services, Inc.

- Global operations expose it to geopolitical instability, especially in emerging markets and regulatory regimes.

Which company shows a better risk-adjusted profile?

ResMed’s strongest risk is market competition amid rapid tech evolution. West’s highest risk lies in stock volatility and regulatory demands. ResMed’s lower beta and superior capital structure offer a more attractive risk-adjusted profile. Its recent surge in cloud-based software adoption underscores competitive advantage and adaptability, mitigating market threats more effectively than West.

Final Verdict: Which stock to choose?

ResMed Inc. (RMD) stands out with its superpower of generating exceptional returns on invested capital, well above its cost of capital. This cash-generating machine boasts strong profitability and operational efficiency. A point of vigilance remains its relatively high valuation multiples, which could temper near-term upside. It suits aggressive growth portfolios willing to pay for quality.

West Pharmaceutical Services, Inc. (WST) impresses with a durable strategic moat rooted in specialized pharmaceutical components and recurring revenue streams. Its financial stability appears stronger relative to ResMed, reflected in conservative leverage and solid liquidity. WST fits portfolios targeting growth at a reasonable price, balancing growth potential and safety.

If you prioritize high return on capital and rapid earnings growth, ResMed outshines with superior profitability and value creation dynamics. However, if you seek better stability and a stronger margin of safety, West Pharmaceutical offers a compelling profile with a steadier cash conversion and conservative balance sheet. Both present viable analytical scenarios depending on your risk appetite and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of ResMed Inc. and West Pharmaceutical Services, Inc. to enhance your investment decisions: