Home > Comparison > Healthcare > RMD vs COO

The strategic rivalry between ResMed Inc. and The Cooper Companies defines leadership in the healthcare instruments sector. ResMed focuses on integrated medical devices and cloud-based software for respiratory care, while Cooper blends contact lens innovation with family health solutions. This contrast frames a battle between technology-driven growth and diversified medical product exposure. This analysis aims to identify which path offers superior risk-adjusted returns for a balanced, long-term portfolio.

Table of contents

Companies Overview

ResMed Inc. and The Cooper Companies, Inc. hold key roles in the medical instruments sector, shaping healthcare innovation globally.

ResMed Inc.: Leader in Respiratory and Sleep Solutions

ResMed Inc. dominates the respiratory care market by developing and marketing devices and cloud-based software for sleep apnea and respiratory disorders. Its revenue relies heavily on device sales and SaaS platforms like AirView for remote patient monitoring. In 2026, ResMed focuses strategically on expanding its cloud-based healthcare software and enhancing patient compliance tools worldwide.

The Cooper Companies, Inc.: Diverse Vision and Women’s Health Innovator

The Cooper Companies, Inc. stands out in contact lenses and women’s health medical devices. It generates revenue through CooperVision’s corrective lenses and CooperSurgical’s fertility and surgical products. Its 2026 strategy emphasizes broadening its fertility and genomics offerings, alongside maintaining strong global distribution in vision care across multiple regions.

Strategic Collision: Similarities & Divergences

Both companies operate in healthcare but diverge sharply: ResMed integrates cloud software with medical devices, while Cooper relies on diversified product segments with a physical goods focus. Their primary battleground is global healthcare innovation and distribution networks. Investors face contrasting profiles: ResMed’s tech-driven, recurring revenue model versus Cooper’s product-diversified, cyclical exposure.

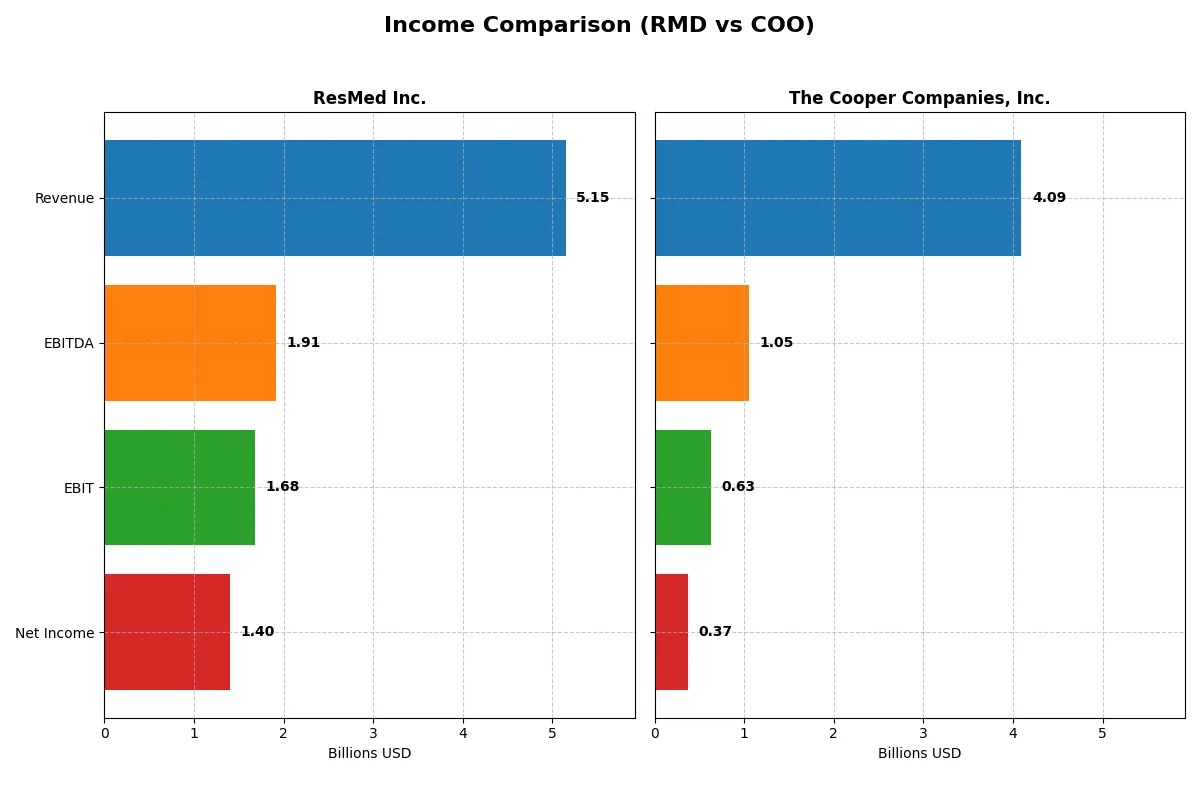

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | ResMed Inc. (RMD) | The Cooper Companies, Inc. (COO) |

|---|---|---|

| Revenue | 5.15B | 4.09B |

| Cost of Revenue | 2.09B | 1.61B |

| Operating Expenses | 1.37B | 1.80B |

| Gross Profit | 3.05B | 2.48B |

| EBITDA | 1.91B | 1.05B |

| EBIT | 1.68B | 630M |

| Interest Expense | 12.6M | 100M |

| Net Income | 1.40B | 375M |

| EPS | 9.55 | 1.87 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine through recent financial performance.

ResMed Inc. Analysis

ResMed’s revenue rose steadily from 3.2B in 2021 to 5.1B in 2025, with net income surging from 475M to 1.4B. Its gross margin remains robust at 59.4%, while net margin expanded to 27.2% in 2025, showing strong profitability. The company accelerated earnings growth last year, reflecting excellent operational momentum and cost control.

The Cooper Companies, Inc. Analysis

Cooper’s revenue grew from 2.9B in 2021 to 4.1B in 2025, but net income declined sharply from 2.9B (not adjusted) to 375M, with net margin at a modest 9.2%. Gross margin held firm near 60.7%, yet EBIT and net income shrank last year, signaling weakening operational efficiency and margin pressure amid rising expenses.

Margin Strength vs. Earnings Momentum

ResMed outperforms with superior margin expansion and profit growth, nearly doubling net income over five years. Cooper shows respectable revenue growth but suffers from declining profitability and margin erosion. ResMed’s profile appeals more to investors prioritizing sustainable earnings and operational efficiency.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | ResMed Inc. (RMD) | The Cooper Companies, Inc. (COO) |

|---|---|---|

| ROE | 23.5% | 4.6% |

| ROIC | 19.6% | 4.0% |

| P/E | 27.0 | 37.3 |

| P/B | 6.34 | 1.70 |

| Current Ratio | 3.44 | 1.89 |

| Quick Ratio | 2.53 | 1.13 |

| D/E (Debt/Equity) | 0.14 | 0.34 |

| Debt-to-Assets | 10.4% | 22.5% |

| Interest Coverage | 134 | 6.83 |

| Asset Turnover | 0.63 | 0.33 |

| Fixed Asset Turnover | 7.16 | 1.97 |

| Payout Ratio | 22.2% | 0% |

| Dividend Yield | 0.82% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and operational strengths essential for informed investing decisions.

ResMed Inc.

ResMed displays robust profitability with a 23.47% ROE and a strong 27.22% net margin, signaling operational efficiency. Its valuation appears stretched, with a P/E of 27.02 and P/B of 6.34. Shareholders gain modest dividends (0.82% yield), while capital allocation favors R&D, supporting sustained growth.

The Cooper Companies, Inc.

Cooper’s profitability lags with a 4.55% ROE and a modest 9.16% net margin, indicating operational challenges. The stock trades at a higher P/E of 37.3 but a reasonable P/B of 1.7, reflecting mixed valuation signals. It pays no dividend, focusing reinvestment on growth initiatives to improve returns.

Premium Valuation vs. Operational Safety

ResMed offers superior profitability and a balanced capital structure despite a higher valuation multiple. Cooper presents more valuation risk with weaker returns and no dividends. Investors seeking operational strength may prefer ResMed, while those targeting growth reinvestment might consider Cooper’s profile.

Which one offers the Superior Shareholder Reward?

I see ResMed Inc. (RMD) offers a more balanced and sustainable shareholder reward through consistent dividends and robust buybacks. Its 0.82% dividend yield is backed by a low 22% payout ratio and nearly 95% free cash flow coverage. ResMed maintains steady buyback activity, enhancing total returns. In contrast, The Cooper Companies, Inc. (COO) pays almost no dividends, prioritizing reinvestment with a weaker free cash flow conversion (54%) and less aggressive buybacks. While COO’s growth focus appeals, RMD’s disciplined capital allocation and reliable shareholder distributions provide a superior total return profile in 2026.

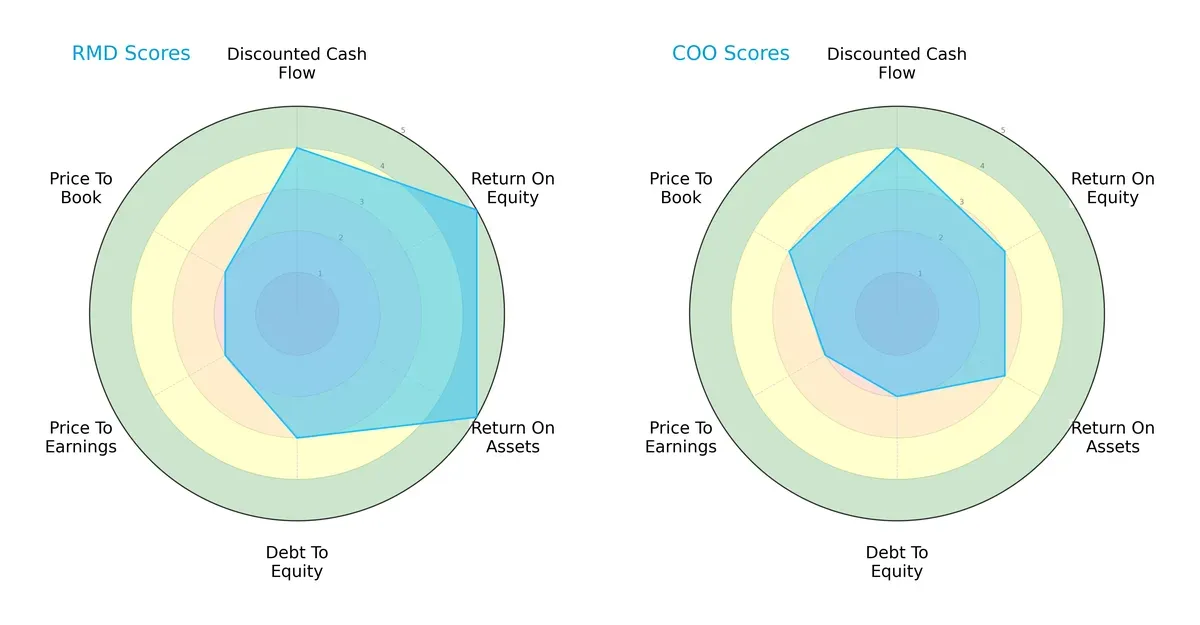

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of ResMed Inc. and The Cooper Companies, Inc.:

ResMed shows a more balanced profile with top scores in ROE (5) and ROA (5), signaling operational efficiency. It carries moderate debt risk (3) but suffers from weaker valuation metrics (P/E and P/B scores of 2). Cooper Companies relies more on discounted cash flow strength (4) but lags in profitability (ROE and ROA at 3) and carries slightly higher financial risk (debt-to-equity score of 2). ResMed’s diversified strengths suggest a durable moat, while Cooper leans on valuation appeal.

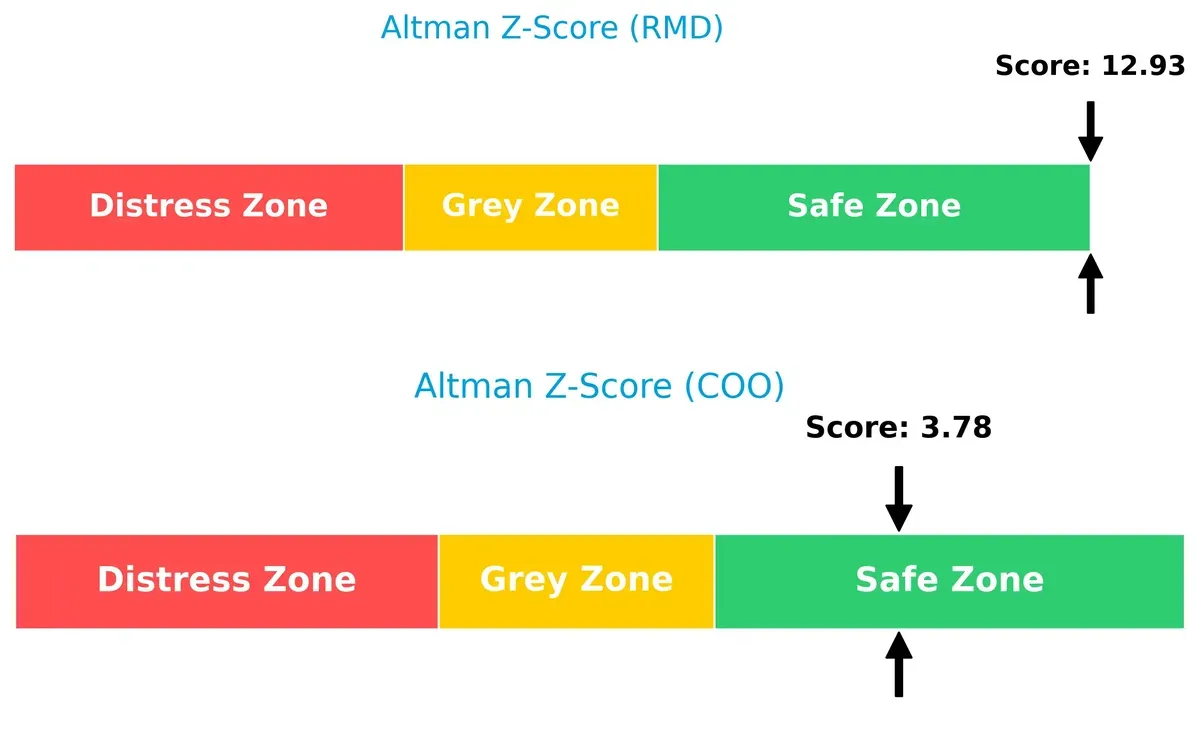

Bankruptcy Risk: Solvency Showdown

ResMed’s Altman Z-Score of 12.9 vastly surpasses Cooper’s 3.8, placing both in the safe zone but highlighting ResMed’s superior financial fortress. This gap implies ResMed can better withstand economic downturns and credit shocks:

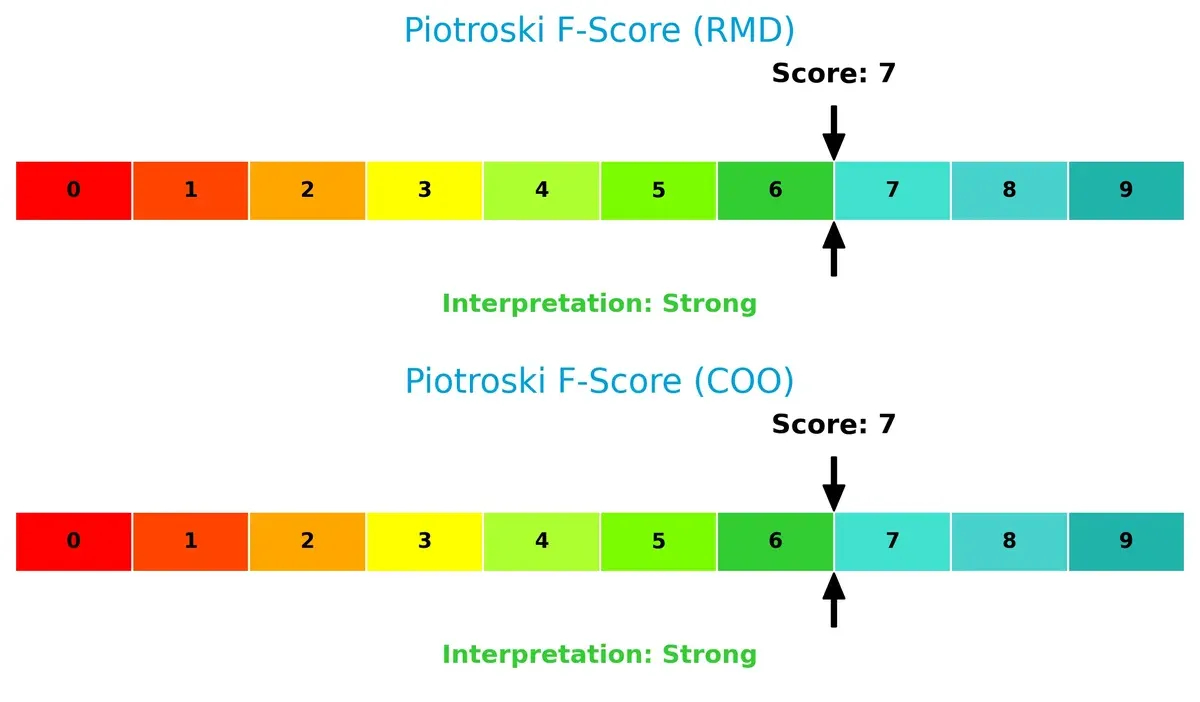

Financial Health: Quality of Operations

Both companies score 7 on the Piotroski F-Score, indicating strong financial health. Neither shows red flags in profitability, leverage, or liquidity metrics, reflecting solid internal financial management:

How are the two companies positioned?

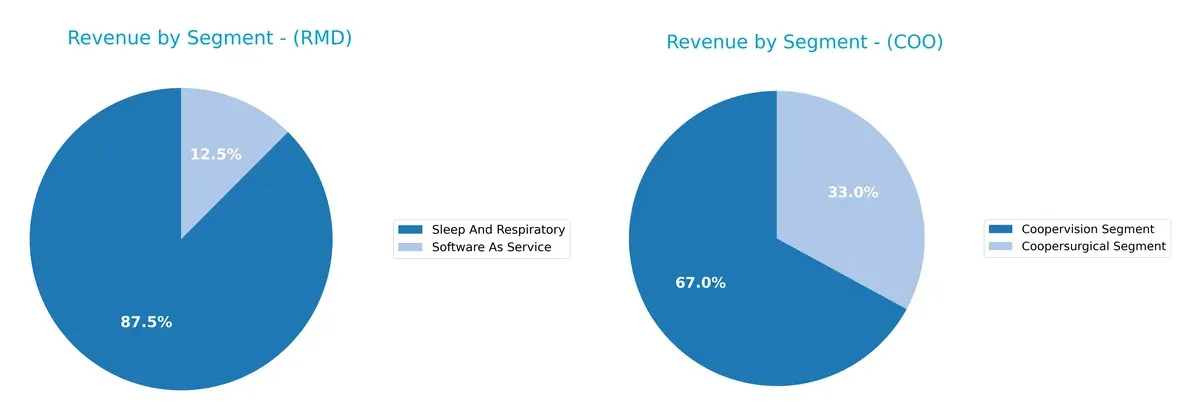

This section dissects ResMed and Cooper’s operational DNA by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and reveal which model delivers the most resilient, sustainable advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how ResMed Inc. and The Cooper Companies, Inc. diversify their income streams and where their primary sector bets lie:

ResMed anchors revenue in Sleep And Respiratory, generating $4.1B in 2024, with Software as a Service adding $584M. Cooper Companies relies heavily on Coopervision at $2.6B, dwarfing Coopersurgical’s $1.29B. ResMed shows a more concentrated focus on respiratory health, signaling strong ecosystem lock-in. Cooper’s split between surgical and vision segments offers moderate diversification but leans on vision infrastructure dominance, exposing some concentration risk.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of ResMed Inc. and The Cooper Companies, Inc.:

ResMed Inc. Strengths

- Strong profitability with 27.22% net margin

- High ROE at 23.47% and ROIC at 19.56%

- Low debt to assets at 10.42%

- High interest coverage ratio at 133.05

- Solid diversification in Sleep & Respiratory and SaaS segments

- Global revenue base with significant US market exposure

The Cooper Companies Strengths

- Favorable capital structure with reasonable debt to assets at 22.46%

- Positive interest coverage ratio of 6.3

- Good liquidity ratios with current ratio 1.89 and quick ratio 1.13

- Diverse revenue streams from Coopersurgical and Coopervision segments

- Strong presence in US and Europe markets

- Neutral to favorable valuation metrics with PB at 1.7

ResMed Inc. Weaknesses

- High PE ratio of 27.02 may indicate overvaluation

- Elevated PB ratio at 6.34 signals expensive stock

- Unusually high current ratio of 3.44 could imply inefficient asset use

- Low dividend yield at 0.82%

- Asset turnover neutral at 0.63

The Cooper Companies Weaknesses

- Low profitability with 9.16% net margin

- Weak ROE of 4.55% and ROIC of 3.98% below cost of capital

- High PE ratio at 37.3 suggests overvaluation

- Low asset turnover at 0.33 limits operational efficiency

- Zero dividend yield

Overall, ResMed demonstrates robust profitability and financial strength but faces valuation and asset utilization concerns. Cooper Companies shows moderate financial health with diversified revenues but struggles with profitability and efficiency metrics. These factors will influence each company’s strategic priorities going forward.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting long-term profits from relentless competition erosion. Let’s dissect the moats of two healthcare giants:

ResMed Inc.: Innovation-Driven Switching Costs

ResMed’s moat stems from high switching costs tied to its integrated medical devices and cloud-based software. Its strong ROIC of 11.7% above WACC confirms durable value creation. Expansion into remote patient monitoring deepens this moat in 2026.

The Cooper Companies, Inc.: Product Diversification with Cost Pressures

Cooper relies on a diversified product portfolio across vision and women’s health but suffers from declining ROIC and value destruction. Its weaker margin profile contrasts ResMed’s stability. Future growth hinges on revitalizing product innovation and operational efficiency.

Verdict: Integrated Software Ecosystem vs. Diversified Product Line

ResMed’s deeply entrenched switching costs and growing ROIC create a wider, more durable moat than Cooper’s fragmented and weakening competitive position. ResMed is better equipped to defend and expand its market share through innovation-led customer lock-in.

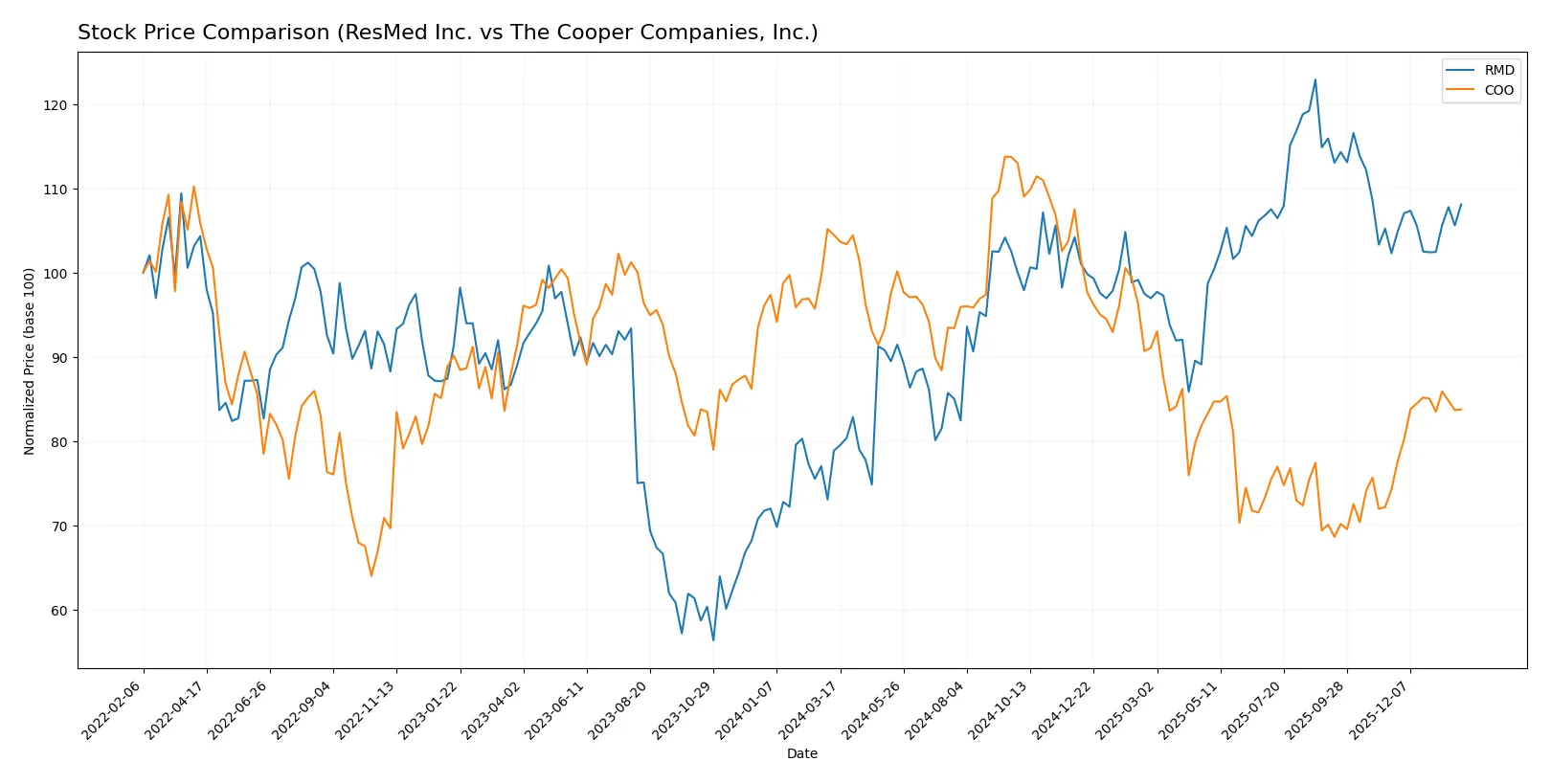

Which stock offers better returns?

Over the past year, ResMed Inc. rallied significantly, while The Cooper Companies, Inc. experienced notable declines despite recent recovery signs.

Trend Comparison

ResMed Inc. posted a strong 37.08% gain over 12 months, marking a bullish trend with decelerating momentum and a high volatility of 24.93%. The stock peaked at 293.73 and bottomed at 178.85.

The Cooper Companies, Inc. fell 19.83% over the same period, reflecting a bearish trend with accelerating downside pressure. Volatility measured 12.34%, with prices ranging from 66.68 to 110.53.

ResMed delivered superior market performance with sustained gains. Cooper showed a weak yearly trend but recent price action suggests a recovery attempt.

Target Prices

Analysts set a constructive target price consensus for both ResMed Inc. and The Cooper Companies, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| ResMed Inc. | 265 | 345 | 295.88 |

| The Cooper Companies, Inc. | 73 | 100 | 91.75 |

The consensus targets for ResMed and Cooper Companies exceed their current prices of $258.31 and $81.38 respectively, indicating upside potential based on analyst expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the latest institutional grades for ResMed Inc. and The Cooper Companies, Inc.:

ResMed Inc. Grades

The table below summarizes recent grades from reputable analysts for ResMed Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-30 |

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| Stifel | Maintain | Hold | 2026-01-30 |

| Piper Sandler | Maintain | Neutral | 2026-01-30 |

| Stifel | Maintain | Hold | 2025-12-18 |

| Baird | Downgrade | Neutral | 2025-12-16 |

| Baird | Maintain | Outperform | 2025-11-03 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

The Cooper Companies, Inc. Grades

Below are recent institutional grades for The Cooper Companies, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-26 |

| Citigroup | Maintain | Neutral | 2025-12-08 |

| Goldman Sachs | Maintain | Sell | 2025-12-08 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-08 |

| Mizuho | Maintain | Outperform | 2025-12-05 |

| Stifel | Maintain | Buy | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| Needham | Maintain | Buy | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

Which company has the best grades?

The Cooper Companies, Inc. consistently receives higher grades, including multiple Buy and Outperform ratings. ResMed Inc. has a more mixed profile with several Hold and Neutral grades. Investors may interpret Cooper’s stronger grades as a signal of greater institutional confidence.

Risks specific to each company

In the complex 2026 market landscape, these categories pinpoint the critical pressure points and systemic threats facing ResMed Inc. and The Cooper Companies, Inc.:

1. Market & Competition

ResMed Inc.

- Operates in a competitive medical device market with strong innovation in sleep and respiratory care.

The Cooper Companies, Inc.

- Faces intense competition in contact lenses and women’s health; slower asset turnover signals operational challenges.

2. Capital Structure & Debt

ResMed Inc.

- Maintains low debt-to-equity (0.14) and strong interest coverage (133x), indicating conservative leverage.

The Cooper Companies, Inc.

- Higher debt-to-equity (0.34) and lower interest coverage (6.3x) increase financial risk relative to ResMed.

3. Stock Volatility

ResMed Inc.

- Beta of 0.876 suggests below-market volatility, appealing for risk-averse investors.

The Cooper Companies, Inc.

- Beta of 1.029 indicates market-level volatility, exposing investors to typical sector swings.

4. Regulatory & Legal

ResMed Inc.

- Subject to healthcare device regulations globally, but diversified product lines mitigate regulatory shocks.

The Cooper Companies, Inc.

- Compliance in surgical and fertility products carries regulatory complexity and potential for litigation risk.

5. Supply Chain & Operations

ResMed Inc.

- Robust global distribution in 140 countries supports resilience; asset turnover (0.63) is neutral but efficient fixed assets turnover.

The Cooper Companies, Inc.

- Lower asset turnover (0.33) suggests operational inefficiency, which could strain supply chain responsiveness.

6. ESG & Climate Transition

ResMed Inc.

- Increasing focus on software-driven care aligns with sustainable healthcare trends.

The Cooper Companies, Inc.

- Exposure to surgical and fertility markets may face ESG scrutiny, requiring proactive climate transition strategies.

7. Geopolitical Exposure

ResMed Inc.

- Operations in 140 countries diversify geopolitical risk significantly.

The Cooper Companies, Inc.

- Global footprint in diverse markets, but supply chain vulnerabilities could amplify geopolitical tensions.

Which company shows a better risk-adjusted profile?

ResMed’s most impactful risk lies in market competition and valuation pressures, given its high P/E and P/B ratios. Cooper’s key risk centers on operational inefficiency and weaker profitability metrics. ResMed’s conservative debt load, superior profitability (ROIC 19.56% vs. 3.98%), and stronger financial scores deliver a superior risk-adjusted profile. Its Altman Z-Score of 12.9 confirms financial safety, contrasting with Cooper’s lower 3.78. ResMed’s higher fixed asset turnover (7.16) signals better capital utilization, justifying my preference for its balance of growth and prudence.

Final Verdict: Which stock to choose?

ResMed Inc. (RMD) stands out with its superpower of delivering consistent value creation through a durable competitive moat and a steadily growing ROIC well above its cost of capital. Its key point of vigilance is a relatively elevated price-to-book ratio, which could temper near-term valuation appeal. This company fits well in an Aggressive Growth portfolio seeking robust profitability and capital efficiency.

The Cooper Companies, Inc. (COO) offers a strategic moat centered on niche market presence and solid income quality, supported by a stable balance sheet and manageable debt levels. It appears safer than RMD in terms of liquidity ratios but struggles with declining profitability metrics and value destruction signals. COO could suit a GARP (Growth at a Reasonable Price) investor willing to accept moderate growth with defensive financial traits.

If you prioritize sustained value creation and superior capital efficiency, RMD is the compelling choice due to its durable moat and strong income growth. However, if you seek relative stability with moderate risk and prefer a company that might recover profitability over time, COO offers better defensive characteristics despite its current challenges. Each scenario demands careful risk assessment aligned with your investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of ResMed Inc. and The Cooper Companies, Inc. to enhance your investment decisions: