Home > Comparison > Healthcare > WAT vs DGX

The strategic rivalry between Waters Corporation and Quest Diagnostics defines the current trajectory of the healthcare diagnostics sector. Waters, a specialty measurement company, focuses on high-performance instrumentation and analytical solutions. Quest Diagnostics operates as a broad diagnostic testing and information services provider with a vast operational footprint. This analysis will assess which business model delivers superior risk-adjusted returns for a diversified portfolio amid evolving sector dynamics.

Table of contents

Companies Overview

Waters Corporation and Quest Diagnostics Incorporated both hold pivotal roles in the medical diagnostics and research sector.

Waters Corporation: Specialty Measurement Innovator

Waters Corporation commands the specialty measurement market through high and ultra-performance liquid chromatography and mass spectrometry systems. Its core revenue stems from selling and servicing analytical instruments and consumables primarily used in pharmaceutical development and environmental testing. In 2026, Waters emphasizes advancing its workflow solutions and software integration to enhance laboratory efficiency globally.

Quest Diagnostics Incorporated: Diagnostic Testing Leader

Quest Diagnostics Incorporated leads in diagnostic testing and information services, offering routine and advanced clinical testing across various healthcare channels. Its revenue engine relies on a broad network of labs, patient centers, and healthcare professionals delivering diagnostic insights. In 2026, Quest focuses strategically on expanding its IT solutions to support healthcare providers and payers with robust data management.

Strategic Collision: Similarities & Divergences

Both firms operate in healthcare diagnostics but diverge in approach—Waters delivers specialized analytical instruments, while Quest provides comprehensive diagnostic services and IT. Their primary battleground lies in serving healthcare providers’ evolving needs for precision and data integration. Waters presents a capital-intensive, technology-driven profile; Quest offers a service-heavy, network-centric investment opportunity.

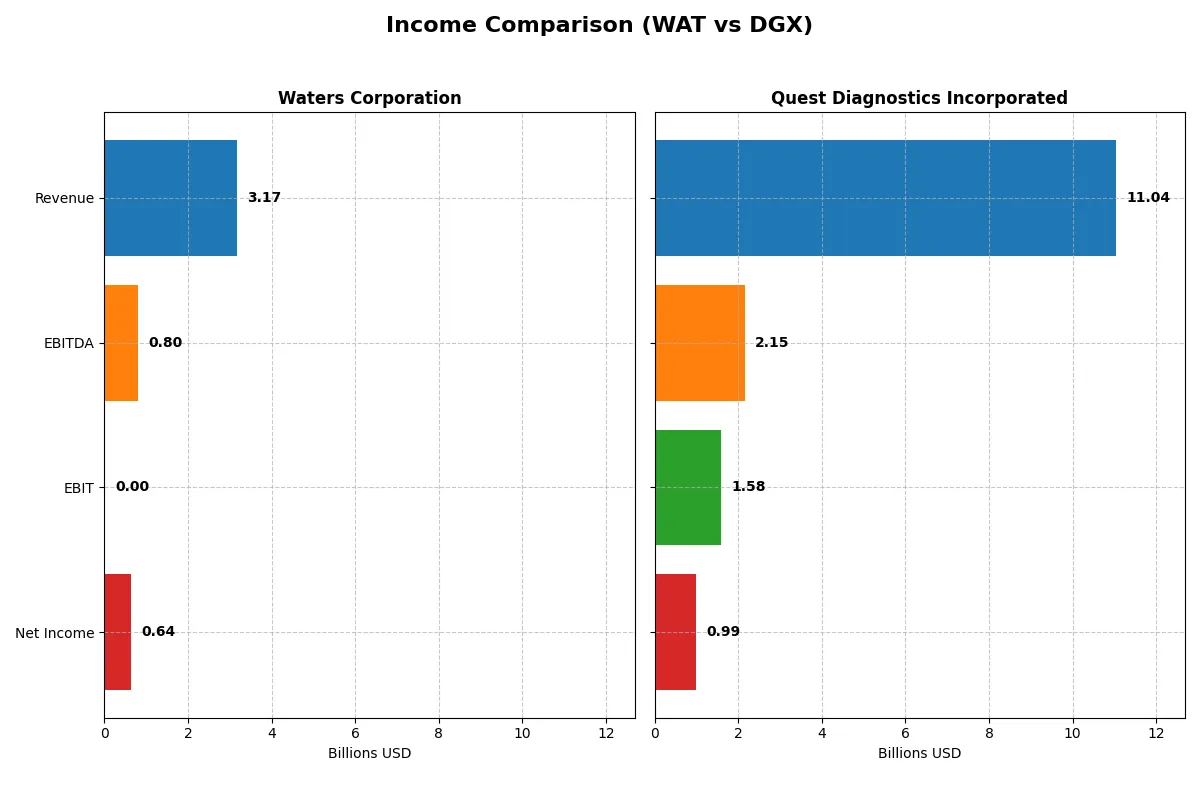

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Waters Corporation (WAT) | Quest Diagnostics Incorporated (DGX) |

|---|---|---|

| Revenue | 3.17B | 11.04B |

| Cost of Revenue | 1.29B | 7.51B |

| Operating Expenses | 1.03B | 1.92B |

| Gross Profit | 1.88B | 3.52B |

| EBITDA | 803M | 2.15B |

| EBIT | — | 1.58B |

| Interest Expense | 51M | 264M |

| Net Income | 643M | 992M |

| EPS | 10.8 | 8.87 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company delivers superior operational efficiency and profit generation under current market conditions.

Waters Corporation Analysis

Waters Corporation’s revenue rose modestly to $3.17B in 2025, with net income slightly increasing to $643M. Its gross margin remains robust at 59.3%, signaling strong core profitability. However, the EBIT margin dropped sharply to zero, indicating operating income challenges despite steady net margin at 20.3%. Efficiency has weakened recently, reflecting margin pressure.

Quest Diagnostics Incorporated Analysis

Quest Diagnostics reported a stronger revenue gain to $11.04B in 2025, with net income climbing to $992M. Gross margin stands at 31.9%, lower than Waters but stable. EBIT margin improved to 14.3%, evidencing operational leverage. Net margin at 9.0% improved slightly, highlighting sustained momentum and disciplined cost control in a competitive environment.

Margin Strength vs. Revenue Scale

Quest Diagnostics outperforms in revenue growth and operating efficiency, with rising EBIT and stable net margins. Waters boasts higher gross and net margins but faces EBIT decline and margin compression. For investors, Quest offers growth with improving operational leverage, while Waters reflects a premium margin profile under pressure. The choice hinges on preference for scale-driven efficiency or margin resilience.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Waters Corporation (WAT) | Quest Diagnostics Inc. (DGX) |

|---|---|---|

| ROE | 34.88% (2024) | 13.84% (2025) |

| ROIC | 18.43% (2024) | 8.43% (2025) |

| P/E | 34.51 (2024) | 19.42 (2025) |

| P/B | 12.04 (2024) | 2.69 (2025) |

| Current Ratio | 2.11 (2024) | 1.04 (2025) |

| Quick Ratio | 1.51 (2024) | 0.96 (2025) |

| D/E | 0.93 (2024) | 0.96 (2025) |

| Debt-to-Assets | 37.38% (2024) | 42.64% (2025) |

| Interest Coverage | 9.21 (2024) | 6.07 (2025) |

| Asset Turnover | 0.65 (2024) | 0.68 (2025) |

| Fixed Asset Turnover | 4.08 (2024) | 3.86 (2025) |

| Payout ratio | 0% (2024) | 35.58% (2025) |

| Dividend yield | 0% (2024) | 1.83% (2025) |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, unveiling hidden risks and operational excellence beneath surface numbers.

Waters Corporation

Waters Corporation shows a strong net margin of 20.3%, signaling profitability, but its zero ROE and ROIC raise concerns about capital efficiency. The stock trades at a stretched P/E of 35.17, implying high valuation risk. Waters lacks dividends, instead investing heavily in R&D at 6.18% of revenue, targeting future growth.

Quest Diagnostics Incorporated

Quest Diagnostics posts a moderate net margin of 8.99% and a neutral ROE of 13.84%, reflecting steady but unspectacular returns. Its P/E of 19.42 suggests a fair valuation relative to earnings. The company maintains a 1.83% dividend yield, balancing shareholder returns with prudent capital allocation and solid interest coverage of 5.99.

Premium Valuation vs. Operational Stability

Waters commands a premium valuation yet struggles with inefficient capital returns. Quest Diagnostics offers a balanced profile with steady profitability and shareholder dividends. Investors seeking stability and moderate growth may prefer Quest, while those tolerating valuation risk might watch Waters’ innovation-driven strategy.

Which one offers the Superior Shareholder Reward?

Waters Corporation (WAT) reinvests all free cash flow, fueling robust R&D and growth, with no dividends or buybacks. Quest Diagnostics (DGX) pays a steady ~1.9% dividend yield with a 35-38% payout, supported by solid FCF. DGX also conducts moderate buybacks, enhancing total shareholder return. I find DGX’s balanced dividend and buyback approach more sustainable and rewarding in 2026, given WAT’s zero distributions despite strong cash flow. DGX offers a superior total return profile for income and growth-focused investors this year.

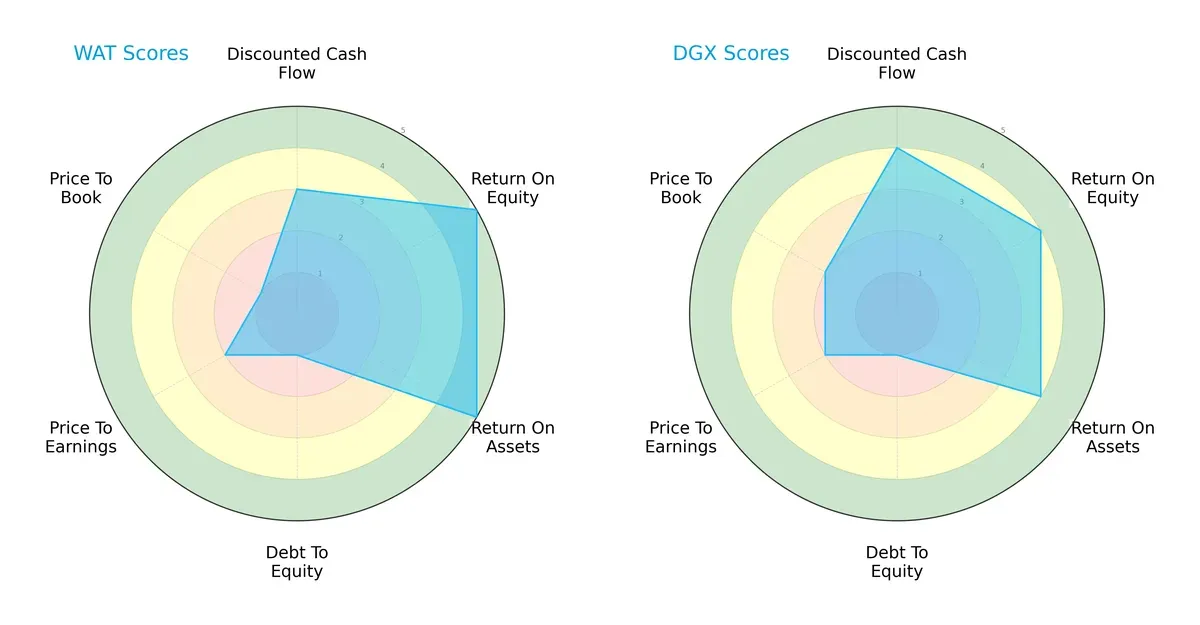

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Waters Corporation and Quest Diagnostics Incorporated, highlighting their core financial strengths and weaknesses:

Waters Corporation shows superior returns with top ROE and ROA scores (5 each), outperforming Quest Diagnostics’ solid but lower 4s in both. Quest Diagnostics leads slightly on discounted cash flow (4 vs. 3), suggesting better valuation prospects. Both exhibit weak debt management (score 1), signaling elevated leverage risks. Waters falls short on valuation metrics (P/E 2, P/B 1) compared to Quest Diagnostics’ slightly better P/B score, illustrating a more polarized profile versus Quest’s balanced approach.

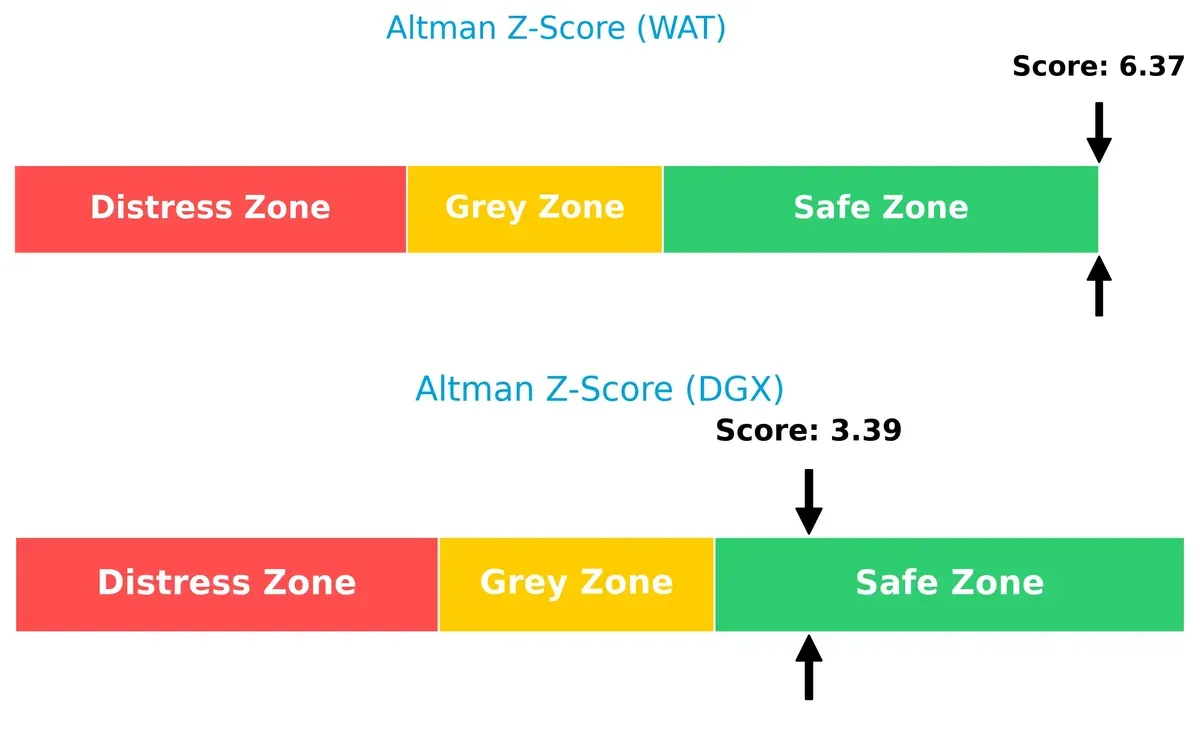

Bankruptcy Risk: Solvency Showdown

Waters Corporation’s Altman Z-Score of 6.37 far exceeds Quest Diagnostics’ 3.39, both in the safe zone, indicating Waters has a stronger buffer against financial distress in this cycle:

Financial Health: Quality of Operations

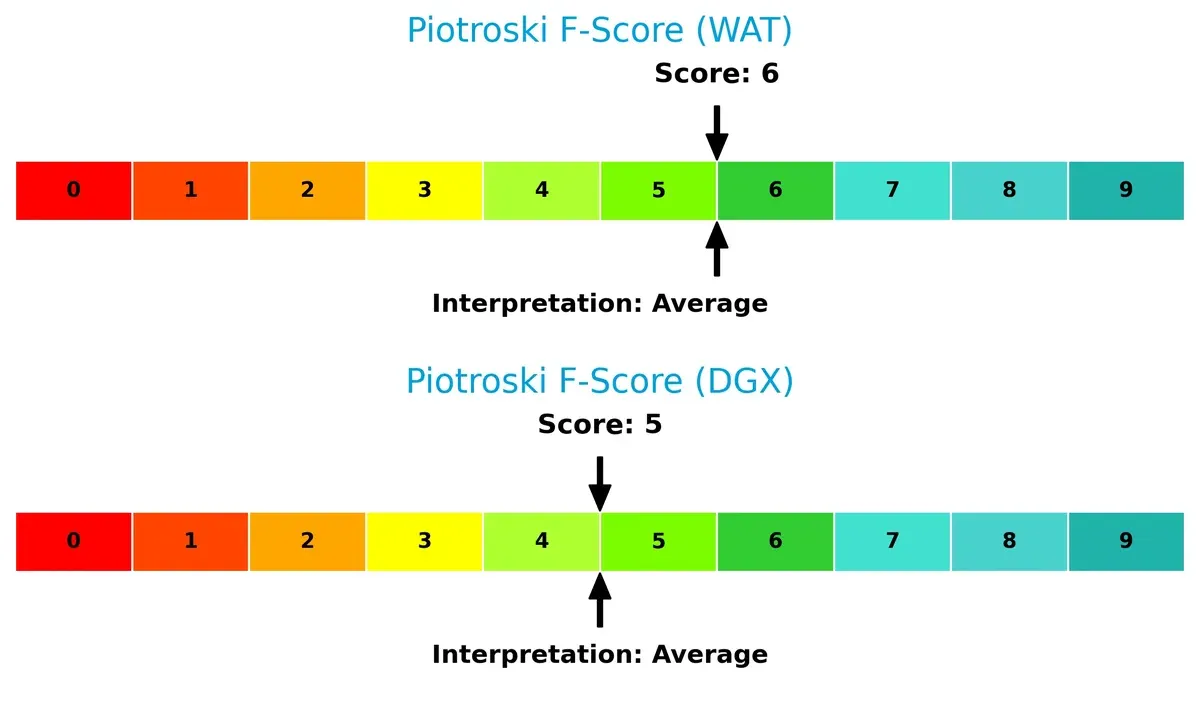

Both companies score in the average range on the Piotroski F-Score, with Waters at 6 and Quest Diagnostics at 5, suggesting comparable operational quality but no clear standout. Neither displays urgent red flags, but Waters holds a slight edge in internal financial health:

How are the two companies positioned?

This section dissects the operational DNA of Waters Corporation and Quest Diagnostics by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and determine which model delivers a more resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

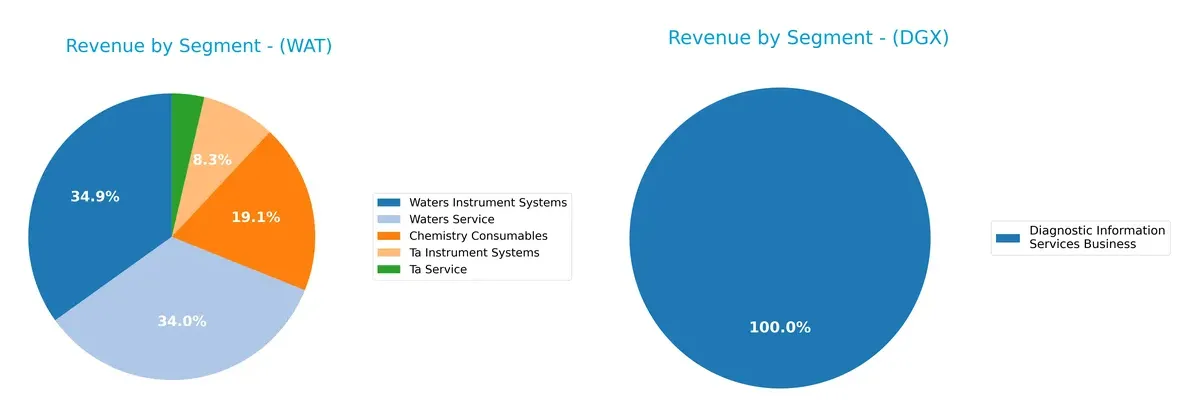

This visual comparison dissects how Waters Corporation and Quest Diagnostics diversify their income streams and where their primary sector bets lie:

Waters Corporation shows a balanced mix between Waters Instrument Systems ($1.03B) and Waters Service ($1.01B), supplemented by Chemistry Consumables ($565M) and smaller TA segments. Quest Diagnostics relies heavily on its Diagnostic Information Services Business, generating $9.61B alone, dwarfing all other revenue. Waters’ diversified segments reduce concentration risk, while Quest’s dominance signals infrastructure scale but high dependence on one business line.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Waters Corporation and Quest Diagnostics Incorporated:

Waters Corporation Strengths

- Diverse product lines including instrument systems and consumables

- Strong global presence across Americas, Asia Pacific, Europe

- High net margin at 20.3%

- Favorable debt-to-assets ratio

- Solid market share in analytical instruments

Quest Diagnostics Incorporated Strengths

- Large revenue base from diagnostic information services

- Favorable weighted average cost of capital (5.89%)

- Strong interest coverage ratio (5.99)

- Favorable fixed asset turnover (3.86)

- Neutral but stable profitability metrics

- Focused market presence with diagnostic specialization

Waters Corporation Weaknesses

- Unfavorable return on equity and invested capital at 0%

- Unfavorable liquidity ratios (current and quick ratios at 0)

- Negative interest coverage value

- High price-to-earnings ratio (35.17)

- Unfavorable asset turnover metrics

- No dividend yield

Quest Diagnostics Incorporated Weaknesses

- Neutral profitability ratios with net margin below 9%

- Higher debt-to-assets ratio (42.64%)

- Lower asset turnover (0.68)

- Moderate price-to-book ratio (2.69)

- Limited diversification outside diagnostic services

- No reported global geographic segmentation

Waters shows strength in diversification and global reach but struggles with profitability and liquidity. Quest demonstrates financial stability and efficiency but has less diversification and faces moderate profitability challenges. Both companies’ strategic focus reflects these financial profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competition erosion. Let’s dissect how these moats play out in 2026 for two healthcare firms:

Waters Corporation: Intangible Assets Powerhouse

Waters leverages proprietary chromatography and mass spectrometry technology, fueling stable gross margins near 60%. However, declining ROIC and EBIT margin pressure warn of rising competition. New product innovation will be critical to defend its niche.

Quest Diagnostics Incorporated: Scale and Network Effects

Quest capitalizes on a vast diagnostic network and brand recognition, driving solid EBIT margins above 14%. Although ROIC shows a slight decline, its efficient capital use sustains value creation. Expanding advanced testing services could deepen its ecosystem moat.

Innovation Edge vs. Network Scale: The Moat Showdown

Quest Diagnostics holds a wider moat through scale and consistent profitability despite a modest ROIC decline. Waters’ intangible asset moat is potent but vulnerable without reinvigorated growth. Quest is better positioned to defend and expand market share in 2026.

Which stock offers better returns?

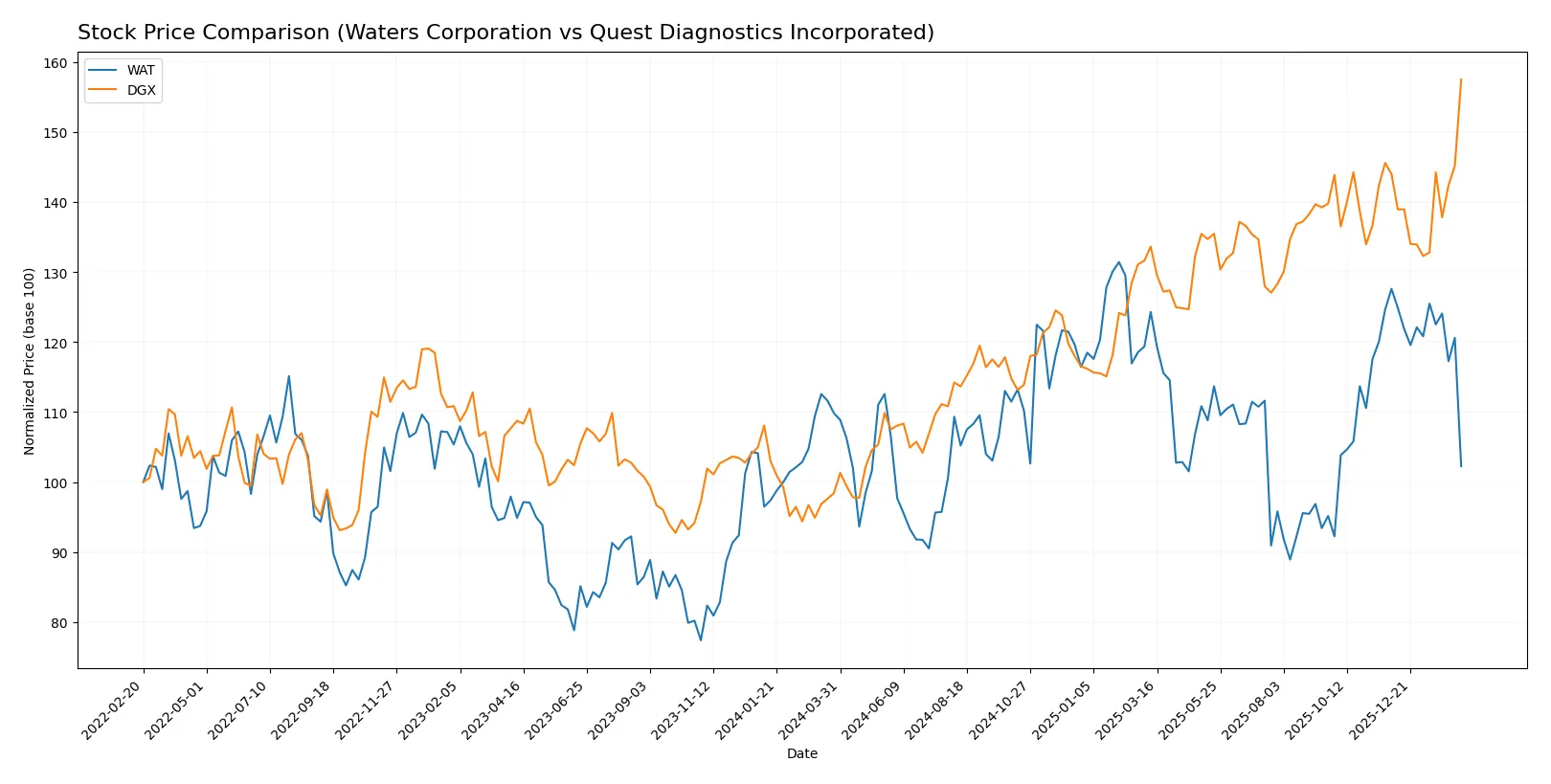

The past year revealed contrasting price dynamics: Waters Corporation declined steadily, while Quest Diagnostics Incorporated showed strong gains with accelerating momentum.

Trend Comparison

Waters Corporation’s stock fell 6.89% over the past year, marking a bearish trend with decelerating losses. It experienced a high volatility of 34.12 and a recent sharper decline of 19.84%.

Quest Diagnostics Incorporated’s stock rose 59.99% over the same period, displaying a bullish trend with acceleration. Volatility stood lower at 17.46, with a recent 9.35% gain confirming positive momentum.

Quest Diagnostics outperformed Waters Corporation by a wide margin, delivering the highest market returns and sustained upward momentum throughout the year.

Target Prices

Analysts show a bullish outlook with solid upside potential for both Waters Corporation and Quest Diagnostics.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Waters Corporation | 363 | 480 | 410.13 |

| Quest Diagnostics Incorporated | 200 | 235 | 215.1 |

The consensus targets exceed current prices by 27% for Waters and 4% for Quest Diagnostics, signaling moderate to strong expected appreciation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Waters Corporation Grades

Below is a summary of recent institutional grades for Waters Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-02-11 |

| UBS | Maintain | Neutral | 2026-02-10 |

| B of A Securities | Maintain | Neutral | 2026-02-10 |

| Guggenheim | Maintain | Buy | 2026-02-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Wolfe Research | Upgrade | Outperform | 2025-12-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| JP Morgan | Maintain | Neutral | 2025-10-09 |

| Deutsche Bank | Maintain | Hold | 2025-08-05 |

Quest Diagnostics Incorporated Grades

The following table lists recent grades from institutions for Quest Diagnostics Incorporated:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-02-12 |

| Jefferies | Maintain | Buy | 2026-02-11 |

| Barclays | Maintain | Overweight | 2026-02-11 |

| UBS | Maintain | Neutral | 2026-02-11 |

| Truist Securities | Maintain | Hold | 2026-02-11 |

| Evercore ISI Group | Maintain | In Line | 2026-02-11 |

| Citigroup | Maintain | Neutral | 2026-02-10 |

| Piper Sandler | Maintain | Neutral | 2025-10-27 |

| Barclays | Maintain | Equal Weight | 2025-10-22 |

| Truist Securities | Maintain | Hold | 2025-10-22 |

Which company has the best grades?

Quest Diagnostics holds stronger recent grades, including multiple Outperform, Buy, and Overweight ratings. Waters Corporation mainly receives Neutral and Equal Weight grades, with one Outperform upgrade. Investors might view Quest’s higher ratings as a sign of more optimistic institutional outlooks.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Waters Corporation

- Operates in specialized analytical instruments with intense innovation pressure.

Quest Diagnostics Incorporated

- Faces broad diagnostic services competition and pricing pressure from healthcare providers.

2. Capital Structure & Debt

Waters Corporation

- Strong balance sheet with low debt metrics; favorable leverage profile.

Quest Diagnostics Incorporated

- Moderate debt levels; neutral debt-to-assets ratio but strong interest coverage.

3. Stock Volatility

Waters Corporation

- Higher beta (1.18) implies more sensitivity to market swings.

Quest Diagnostics Incorporated

- Lower beta (0.68) suggests more stable stock price behavior.

4. Regulatory & Legal

Waters Corporation

- Subject to stringent FDA and environmental regulations impacting product approvals.

Quest Diagnostics Incorporated

- Heavily regulated clinical testing environment with potential legal liabilities.

5. Supply Chain & Operations

Waters Corporation

- Relies on complex manufacturing and global supply chains, vulnerable to disruptions.

Quest Diagnostics Incorporated

- Extensive lab and service network requires stable logistics and staffing.

6. ESG & Climate Transition

Waters Corporation

- Pressure to reduce environmental footprint of manufacturing and product lifecycle.

Quest Diagnostics Incorporated

- Focus on sustainable healthcare delivery and data privacy risks.

7. Geopolitical Exposure

Waters Corporation

- Global sales expose it to trade tensions and currency risks.

Quest Diagnostics Incorporated

- Primarily US-based operations but some international exposure to geopolitical shifts.

Which company shows a better risk-adjusted profile?

Waters Corporation’s key risk is its high stock volatility and operational complexity amid innovation demands. Quest Diagnostics faces regulatory and competitive pressure but benefits from steadier cash flow and lower volatility. Quest’s lower beta and solid interest coverage signify a more balanced risk-adjusted profile. The recent market data reveals Waters’s beta at 1.18 versus Quest’s 0.68, underscoring Quest’s relative stability amid sector headwinds.

Final Verdict: Which stock to choose?

Waters Corporation’s superpower lies in its robust operational efficiency and strong cash generation capabilities. However, its declining profitability trends and signs of capital inefficiency warrant close attention. It suits investors seeking aggressive growth with a tolerance for volatility and cyclical risks.

Quest Diagnostics boasts a strategic moat through its steady recurring revenues and improving cash flow quality. Its financial ratios suggest better stability and a more balanced risk profile compared to Waters. This company fits well in portfolios targeting growth at a reasonable price with moderate risk tolerance.

If you prioritize dynamic growth backed by operational excellence, Waters Corporation is the compelling choice due to its cash generation prowess despite some profitability headwinds. However, if you seek steadier income and a slightly safer harbor, Quest Diagnostics offers better stability and a more consistent financial footing. Both present distinct analytical scenarios for discerning investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Waters Corporation and Quest Diagnostics Incorporated to enhance your investment decisions: