In the fast-evolving semiconductor industry, choosing the right company to invest in requires careful analysis of innovation, market position, and growth potential. Qnity Electronics, Inc. and SkyWater Technology, Inc. both operate in semiconductor manufacturing but differ in scale and specialization. This comparison will explore their strategies and market dynamics to help you decide which company presents the most compelling investment opportunity. Let’s dive in to uncover the best fit for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Qnity Electronics, Inc. and SkyWater Technology, Inc. by providing an overview of these two companies and their main differences.

Qnity Electronics, Inc. Overview

Qnity Electronics, Inc. specializes in electronic solutions and materials for semiconductor chip manufacturing and advanced electronic materials. The company, headquartered in Wilmington, Delaware, operates in the semiconductor industry and is listed on the NYSE with a market cap of $19.5B. It rebranded in April 2025 and focuses on innovative materials that support chip production processes.

SkyWater Technology, Inc. Overview

SkyWater Technology, Inc. provides semiconductor development and manufacturing services, including engineering and process development. Based in Bloomington, Minnesota, it serves diverse sectors like aerospace, automotive, and bio-health. Listed on NASDAQ, SkyWater has a market cap of $1.5B and employs about 700 people, emphasizing customized semiconductor solutions for analog, mixed-signal, and rad-hard integrated circuits.

Key similarities and differences

Both companies operate in the semiconductor sector but differ significantly in scale and focus. Qnity is primarily a materials provider for chip manufacturing, while SkyWater integrates semiconductor development with manufacturing services across multiple industries. Qnity’s market cap is substantially larger, and it trades on the NYSE, whereas SkyWater is smaller, trades on NASDAQ, and offers more end-to-end services including engineering collaboration with clients.

Income Statement Comparison

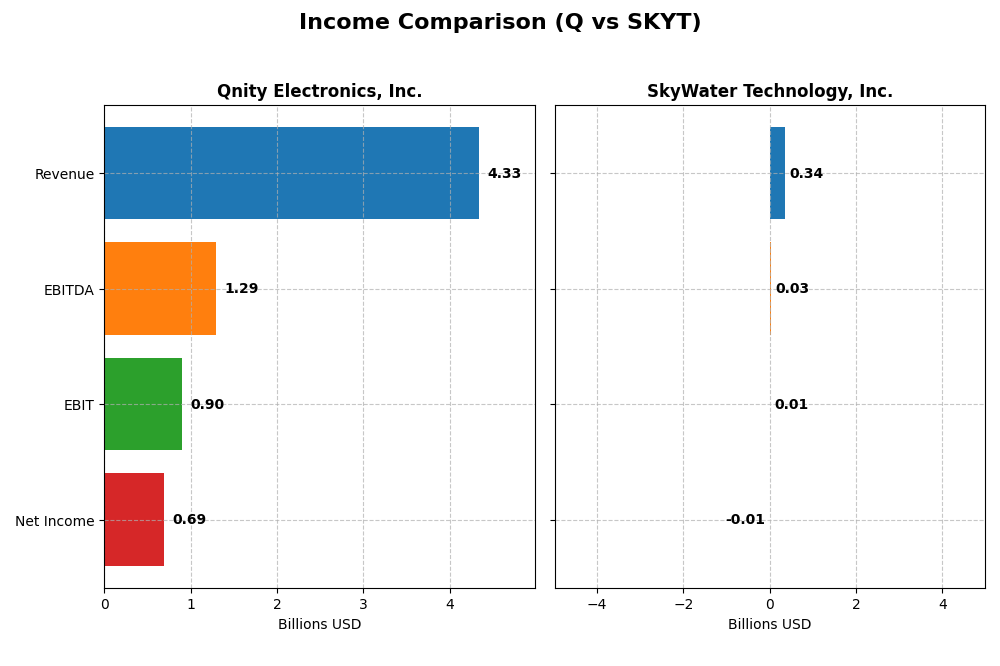

This table compares the key income statement metrics for Qnity Electronics, Inc. and SkyWater Technology, Inc. for the fiscal year 2024.

| Metric | Qnity Electronics, Inc. | SkyWater Technology, Inc. |

|---|---|---|

| Market Cap | 19.5B | 1.54B |

| Revenue | 4.34B | 342M |

| EBITDA | 1.29B | 25.3M |

| EBIT | 898M | 6.56M |

| Net Income | 693M | -6.79M |

| EPS | 3.31 | -0.14 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Qnity Electronics, Inc.

Qnity Electronics experienced a revenue decline of 8.8% over 2022-2024 but showed a 7.4% revenue increase in 2024 alone. Net income fell 10.5% overall but surged 36.7% in 2024, reflecting improved profitability. Margins are generally favorable, with a 46.1% gross margin and a nearly 16% net margin in 2024, indicating margin stability and operational efficiency gains in the latest year.

SkyWater Technology, Inc.

SkyWater Technology demonstrated strong growth, with revenue rising 144% overall and 19.4% in 2024. Net income also improved by 67% over the period, with an 81.5% net margin growth in 2024, although the net margin remained slightly negative at -2%. Margins are improving, supported by a favorable 20.3% gross margin and a positive trend in EBIT margin, reflecting operational progress despite ongoing losses.

Which one has the stronger fundamentals?

Qnity Electronics exhibits solid margin profiles and recent net income growth, though with declining revenues over the longer term. SkyWater Technology shows robust top-line and bottom-line growth with improving margins but still posts a negative net margin. Based on these factors, Qnity’s stable margins contrast with SkyWater’s growth trajectory, highlighting differing fundamental strengths and risk exposures.

Financial Ratios Comparison

The table below presents the key financial ratios for Qnity Electronics, Inc. and SkyWater Technology, Inc. for the fiscal year 2024, offering a snapshot of their financial health and operational efficiency.

| Ratios | Qnity Electronics, Inc. (Q) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | 6.51% | -11.79% |

| ROIC | 5.92% | 3.40% |

| P/E | 28.8 | -100.26 |

| P/B | 1.88 | 11.82 |

| Current Ratio | 1.77 | 0.86 |

| Quick Ratio | 1.06 | 0.76 |

| D/E | 0.018 | 1.33 |

| Debt-to-Assets | 1.56% | 24.46% |

| Interest Coverage | 3.03 | 0.74 |

| Asset Turnover | 0.35 | 1.09 |

| Fixed Asset Turnover | 2.59 | 2.07 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Qnity Electronics, Inc.

Qnity Electronics shows a mix of favorable and unfavorable financial ratios, with a strong net margin at 15.99% and a healthy current ratio of 1.77. However, return on equity at 6.51% and price-to-earnings ratio of 28.8 are less favorable, suggesting moderate profitability and valuation concerns. The company pays a small dividend, but with zero dividend yield, indicating limited returns from dividends.

SkyWater Technology, Inc.

SkyWater Technology exhibits predominantly unfavorable ratios, including a negative net margin of -1.98% and a weak return on equity at -11.79%. Its current ratio of 0.86 signals liquidity concerns, while high debt-to-equity ratio of 1.33 raises financial risk. The company does not pay dividends, likely reflecting ongoing losses and a focus on reinvestment and growth.

Which one has the best ratios?

Qnity Electronics presents a better overall ratio profile, with more favorable metrics and stronger liquidity compared to SkyWater Technology. SkyWater’s high debt levels, negative profitability ratios, and poor liquidity contribute to its unfavorable evaluation, making Qnity the stronger performer on a ratio basis.

Strategic Positioning

This section compares the strategic positioning of Qnity Electronics, Inc. and SkyWater Technology, Inc. in terms of Market position, Key segments, and Exposure to technological disruption:

Qnity Electronics, Inc.

- Large market cap of 19.5B USD in semiconductors, stable position with low beta (0).

- Focused on electronic solutions and materials for semiconductor chip manufacturing.

- No explicit data on exposure to technological disruption available.

SkyWater Technology, Inc.

- Smaller market cap of 1.5B USD, higher volatility with beta of 3.5 in semiconductors.

- Diverse segments including advanced technology services and wafer services.

- Provides engineering and process development, co-creating technologies with customers.

Qnity Electronics, Inc. vs SkyWater Technology, Inc. Positioning

Qnity is concentrated on electronic materials for chip manufacturing, leveraging a large market cap and stable market presence. SkyWater operates more diversified services including manufacturing and engineering, but with smaller scale and higher market volatility.

Which has the best competitive advantage?

Qnity holds a neutral moat with stable profitability but no clear advantage, while SkyWater shows slightly unfavorable moat status with value destruction despite improving profitability. Neither company currently demonstrates a strong competitive advantage.

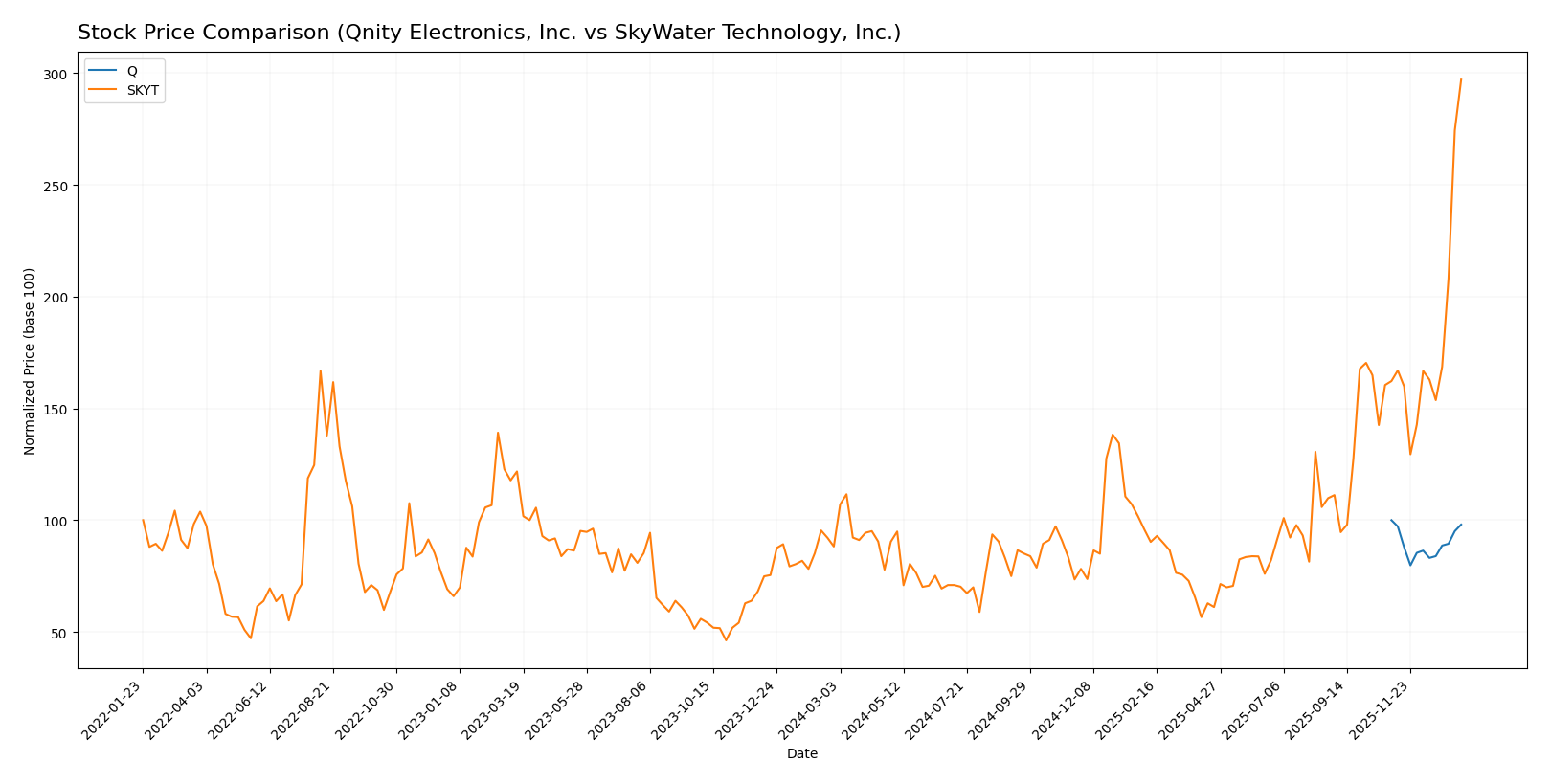

Stock Comparison

The stock prices of Qnity Electronics, Inc. and SkyWater Technology, Inc. have exhibited contrasting dynamics over the past 12 months, with SkyWater showing significant upward momentum while Qnity maintained a relatively stable but slightly declining trend.

Trend Analysis

Qnity Electronics, Inc. experienced a slight bearish trend with a -1.98% price change over the past year, marked by stable acceleration and a price range between 75.8 and 95.0. Volatility was moderate at a 5.94 standard deviation.

SkyWater Technology, Inc. demonstrated a strong bullish trend with a 236.8% price increase over the same period, showing acceleration in momentum and a price range from 6.1 to 32.03. Volatility was somewhat lower, with a 4.41 standard deviation.

Comparing the two, SkyWater Technology delivered the highest market performance with a robust bullish trend, while Qnity Electronics showed a near-neutral to slightly bearish trend.

Target Prices

Analyst consensus provides clear target price ranges indicating expected upside potential for these semiconductor firms.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Qnity Electronics, Inc. | 117 | 92 | 105.89 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Qnity Electronics’ consensus target of 105.89 suggests about a 14% upside from the current 93.12 price, while SkyWater’s target at 25 is well below its current 32.03, indicating mixed analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Qnity Electronics, Inc. (Q) and SkyWater Technology, Inc. (SKYT):

Rating Comparison

Q Rating

- Rating: B+, considered Very Favorable

- Discounted Cash Flow Score: 4, Favorable assessment indicating positive cash flow outlooks

- Return on Equity Score: 3, Moderate efficiency in generating profit from shareholders’ equity

- Return on Assets Score: 4, Favorable utilization of assets to generate earnings

- Debt To Equity Score: 3, Moderate financial risk with balanced debt levels

- Overall Score: 3, Moderate overall financial standing

SKYT Rating

- Rating: B+, considered Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable, suggesting concerns about future cash flows

- Return on Equity Score: 5, Very Favorable, demonstrating strong profitability from equity

- Return on Assets Score: 5, Very Favorable, showing excellent asset utilization

- Debt To Equity Score: 1, Very Unfavorable, indicating high financial risk due to debt

- Overall Score: 3, Moderate overall financial standing

Which one is the best rated?

Both Q and SKYT share the same overall rating of B+ and moderate overall score of 3. However, SKYT excels in return on equity and assets but shows significant financial risk with a poor debt-to-equity score. Q maintains a more balanced financial risk profile with moderately favorable cash flow and asset utilization scores.

Scores Comparison

Here is a comparison of the financial scores for Qnity Electronics, Inc. and SkyWater Technology, Inc.:

Q Scores

- Altman Z-Score: Not available

- Piotroski Score: Not available

SKYT Scores

- Altman Z-Score: 2.20, indicating a grey zone of financial risk.

- Piotroski Score: 5, categorized as average financial strength.

Which company has the best scores?

Only SkyWater Technology, Inc. has available scores, showing moderate financial health with a grey zone Altman Z-Score and an average Piotroski Score. Qnity Electronics has no scores provided for comparison.

Grades Comparison

Here is the comparison of recent grades and ratings for Qnity Electronics, Inc. and SkyWater Technology, Inc.:

Qnity Electronics, Inc. Grades

The table below shows the latest grades from reputable grading companies for Qnity Electronics, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2025-11-25 |

| Mizuho | Maintain | Outperform | 2025-11-20 |

Qnity Electronics has consistently maintained an “Outperform” rating from leading analysts, indicating stable positive sentiment.

SkyWater Technology, Inc. Grades

The table below shows the latest grades from reputable grading companies for SkyWater Technology, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology has a strong consensus of “Buy” with multiple reaffirmations over the past years, reflecting sustained analyst confidence.

Which company has the best grades?

SkyWater Technology, Inc. has received a larger number of “Buy” and “Overweight” ratings compared to Qnity Electronics’ consistent “Outperform” grades. This broader analyst support may translate into higher investor interest and perceived growth potential.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Qnity Electronics, Inc. (Q) and SkyWater Technology, Inc. (SKYT) based on the most recent financial and strategic data.

| Criterion | Qnity Electronics, Inc. (Q) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Limited product range; focused market | More diversified with advanced tech and wafer services |

| Profitability | Positive net margin (16%), stable ROIC | Negative net margin (-2%), improving ROIC trend |

| Innovation | Neutral ROIC trend; stable but no strong moat | Growing ROIC suggests improving innovation impact |

| Global presence | Moderate, stable operations | Expanding with growing service segments |

| Market Share | Stable but no clear competitive moat | Slightly unfavorable moat but increasing market traction |

Key takeaways: Qnity Electronics shows stable profitability and financial health with a slightly favorable outlook, but lacks a strong competitive moat. SkyWater Technology faces profitability challenges but is improving its returns and expanding its service offerings, indicating potential growth if risks are managed carefully.

Risk Analysis

Below is a comparative risk overview for Qnity Electronics, Inc. (Q) and SkyWater Technology, Inc. (SKYT) based on the most recent 2024 data and market conditions in 2026.

| Metric | Qnity Electronics, Inc. (Q) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Low beta (0), stable price range indicates lower volatility | High beta (3.487), highly volatile stock price |

| Debt level | Very low debt-to-equity (0.02), strong balance sheet | High debt-to-equity (1.33), financial risk elevated |

| Regulatory Risk | Moderate, operates in US semiconductor industry with evolving tech regulations | Moderate to high, defense and aerospace exposure increases regulatory scrutiny |

| Operational Risk | Moderate, relatively new post-IPO (2025) but stable financial metrics | Higher, negative net margin and profitability signal operational challenges |

| Environmental Risk | Low, no significant exposures reported | Moderate, manufacturing operations with potential environmental compliance costs |

| Geopolitical Risk | Moderate, US-based but global semiconductor supply chain exposure | Higher, serves aerospace and defense sectors sensitive to geopolitical tensions |

In synthesis, SkyWater Technology faces higher market and financial risks, including debt burden and operational inefficiencies, amplified by geopolitical sensitivities. Qnity Electronics benefits from financial stability and lower volatility but as a recent IPO, it carries typical growth phase uncertainties. Investors should weigh SkyWater’s growth potential against its elevated risks, while Qnity offers more cautious exposure in semiconductors.

Which Stock to Choose?

Qnity Electronics, Inc. shows a stable income with favorable margins and profitability, low debt levels, and a slightly favorable financial ratio profile. Its ROIC is neutral compared to WACC, indicating no clear competitive advantage, while its rating is very favorable with a B+ score.

SkyWater Technology, Inc. displays improving income growth and profitability trends but remains unprofitable overall with high debt and unfavorable financial ratios. Its ROIC is slightly unfavorable despite a growing trend, and it holds a very favorable B+ rating with mixed score evaluations.

Investors seeking stability and consistent profitability may find Qnity Electronics more aligned with their profile, while those open to higher risk and potential growth might view SkyWater Technology’s improving income and ROIC trend as a positive signal. Both stocks’ ratings and financial metrics suggest different risk-return dynamics depending on investment objectives.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Qnity Electronics, Inc. and SkyWater Technology, Inc. to enhance your investment decisions: