Home > Comparison > Technology > WDC vs PSTG

The strategic rivalry between Western Digital Corporation and Pure Storage, Inc. shapes the future of the computer hardware sector. Western Digital operates as a capital-intensive data storage manufacturer with a broad product portfolio spanning HDDs and SSDs. In contrast, Pure Storage focuses on high-margin, software-driven flash storage solutions emphasizing innovation and agility. This analysis will assess which company’s strategy delivers superior risk-adjusted returns, guiding investors toward optimal portfolio allocation.

Table of contents

Companies Overview

Western Digital Corporation and Pure Storage, Inc. stand as vital players shaping the data storage landscape in 2026.

Western Digital Corporation: Established Data Storage Powerhouse

Western Digital dominates the data storage devices market with a broad portfolio including HDDs, SSDs, and flash-based solutions. It generates revenue by selling to OEMs, distributors, and retailers worldwide. In 2026, the firm focuses strategically on enhancing its enterprise data center solutions and expanding flash memory technologies to sustain its competitive edge.

Pure Storage, Inc.: Innovator in Flash-Based Storage

Pure Storage specializes in flash-based data storage technologies emphasizing software-integrated solutions like Purity and AI-ready infrastructure. It drives revenue through direct sales and subscription services targeting enterprise workloads. The 2026 strategy prioritizes expanding cloud-native storage offerings and subscription models, aiming to disrupt traditional storage markets with flexible, software-defined platforms.

Strategic Collision: Similarities & Divergences

Both companies target the enterprise data storage sector but diverge in approach: Western Digital leans on a hardware-centric, diversified product mix, while Pure Storage bets on software-driven, subscription-based innovation. They compete mainly in the high-performance storage solutions market. Investors will note Western Digital’s scale and legacy versus Pure Storage’s agility and modern cloud-aligned growth profile.

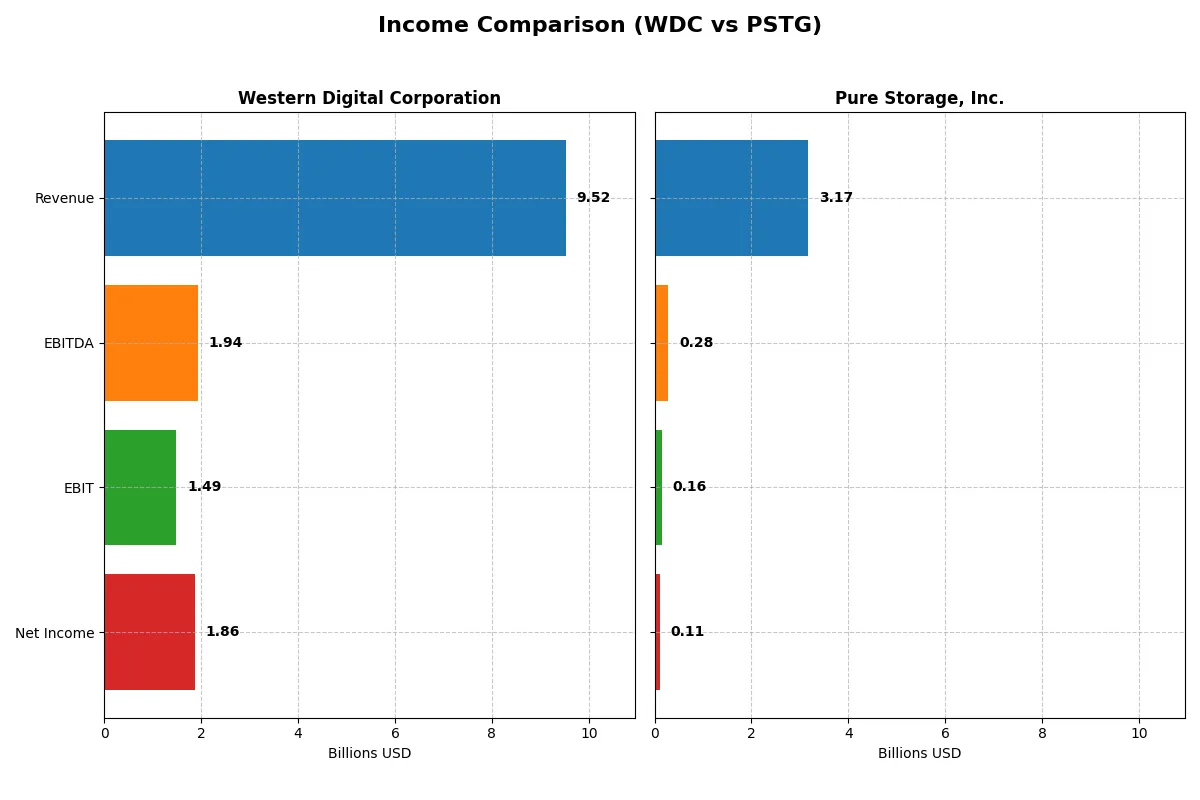

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Western Digital Corporation (WDC) | Pure Storage, Inc. (PSTG) |

|---|---|---|

| Revenue | 9.52B | 3.17B |

| Cost of Revenue | 5.83B | 955M |

| Operating Expenses | 1.36B | 2.13B |

| Gross Profit | 3.69B | 2.21B |

| EBITDA | 1.94B | 282M |

| EBIT | 1.49B | 156M |

| Interest Expense | 357M | 7.8M |

| Net Income | 1.86B | 107M |

| EPS | 5.31 | 0.33 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company converts revenue into profit more effectively, exposing the true efficiency of each corporate engine.

Western Digital Corporation Analysis

Western Digital shows a volatile revenue trajectory, plunging from 18.8B in 2022 to 6.3B in 2024 before rebounding to 9.5B in 2025. Net income follows suit, swinging from a loss of -852M in 2024 to a robust 1.86B in 2025. Margins improved sharply in 2025, with gross margin at 38.8% and net margin near 19.6%, signaling a strong operational recovery and enhanced profitability momentum.

Pure Storage, Inc. Analysis

Pure Storage steadily grows revenue from 1.7B in 2021 to 3.2B in 2025, with net income rising from a -282M loss to 107M profit over the same period. Its gross margin impresses at nearly 70%, but net margin remains slim at 3.4%, reflecting ongoing investment in growth. EBIT margin sits at a modest 4.9%, indicating cautious progress toward profitability with consistent, moderate momentum.

Margin Dominance vs. Scale Resurgence

Western Digital’s volatile but high-margin comeback contrasts with Pure Storage’s steady, scale-driven growth at lower profitability. WDC leads in net income and margin improvements, reflecting superior operational leverage. Pure Storage offers smoother revenue expansion with thinner profits. For investors, WDC’s profile suits those seeking rebound strength, while PSTG appeals to growth-focused portfolios.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Western Digital Corporation (WDC) | Pure Storage, Inc. (PSTG) |

|---|---|---|

| ROE | 35.0% | 8.2% |

| ROIC | 21.5% | 2.5% |

| P/E | 11.8 | 206.9 |

| P/B | 4.14 | 16.90 |

| Current Ratio | 1.08 | 1.61 |

| Quick Ratio | 0.84 | 1.58 |

| D/E | 0.96 | 0.22 |

| Debt-to-Assets | 36.3% | 7.1% |

| Interest Coverage | 6.54 | 10.91 |

| Asset Turnover | 0.68 | 0.80 |

| Fixed Asset Turnover | 4.06 | 5.21 |

| Payout ratio | 2.36% | 0% |

| Dividend yield | 0.20% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and signaling operational strength or weakness beyond surface-level data.

Western Digital Corporation

Western Digital delivers strong profitability with a 35% ROE and a healthy 19.55% net margin, reflecting efficient operations. The stock trades at a reasonable 11.8 P/E, indicating fair valuation. Although the price-to-book is stretched at 4.14, the company offers modest dividends, signaling balanced shareholder returns alongside stable reinvestment.

Pure Storage, Inc.

Pure Storage shows weaker profitability with an 8.17% ROE and a slim 3.37% net margin, reflecting operational challenges. Its valuation is highly stretched, with a 206.9 P/E and 16.9 price-to-book ratios. The firm pays no dividends, instead directing cash toward aggressive R&D investment, aiming for future growth despite current margin pressure.

Balanced Profitability vs. Aggressive Growth

Western Digital offers a superior balance of profitability and valuation discipline, reducing risk with consistent shareholder returns. Pure Storage appeals to growth-focused investors willing to tolerate high valuation multiples and low current profitability. The choice hinges on an investor’s tolerance for risk versus growth ambition.

Which one offers the Superior Shareholder Reward?

Western Digital Corporation (WDC) offers a modest dividend yield of 0.20% with a very low payout ratio of 2.36%, signaling capacity to sustain distributions. It complements dividends with disciplined buybacks, enhancing shareholder value. Pure Storage, Inc. (PSTG) pays no dividend and channels free cash flow into growth and R&D, reflecting its expansion phase. PSTG’s free cash flow yield is lower, and its high valuation multiples imply riskier returns. I see WDC’s balanced dividend plus buyback model as more sustainable and attractive for total shareholder return in 2026 compared to PSTG’s reinvestment-heavy strategy.

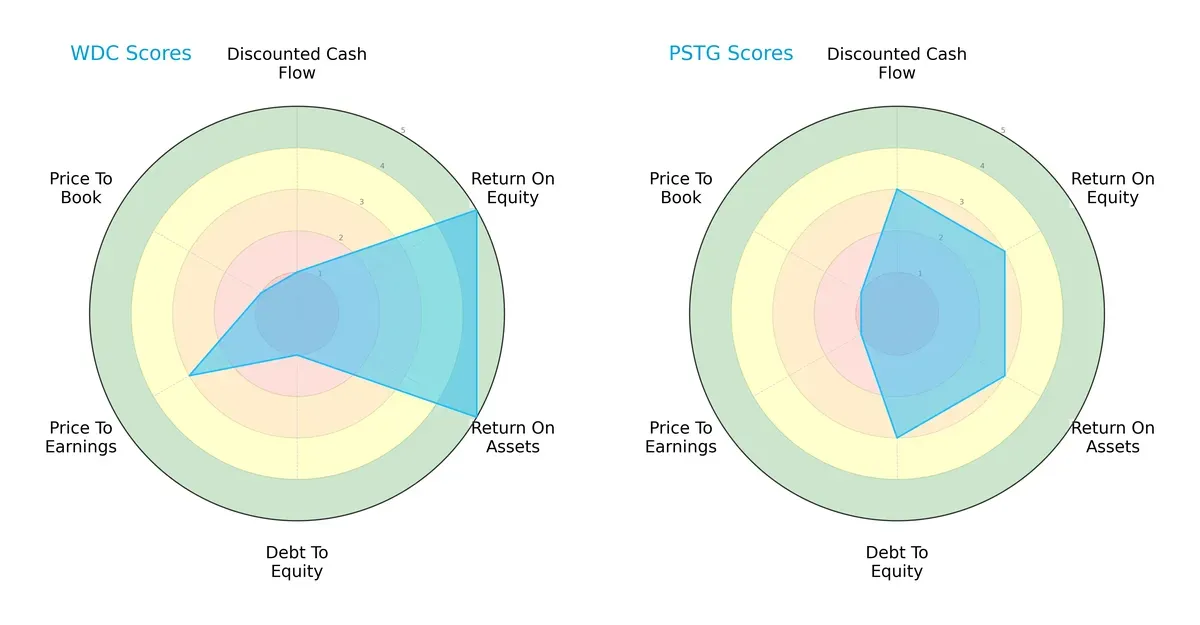

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Western Digital Corporation and Pure Storage, Inc., showing their financial strengths and weaknesses side by side:

Western Digital dominates in return on equity (5 vs. 3) and return on assets (5 vs. 3), signaling more efficient profit generation and asset use. Pure Storage holds an advantage in discounted cash flow (3 vs. 1) and debt-to-equity (3 vs. 1), reflecting better valuation and financial stability. Western Digital’s profile is unbalanced—strong operational efficiency but weak leverage and valuation scores—while Pure Storage presents a more balanced but moderate overall score set.

—

Bankruptcy Risk: Solvency Showdown

Western Digital’s Altman Z-Score of 8.96 surpasses Pure Storage’s 5.87, both safely above distress thresholds, but Western Digital shows stronger long-term solvency in this cycle:

—

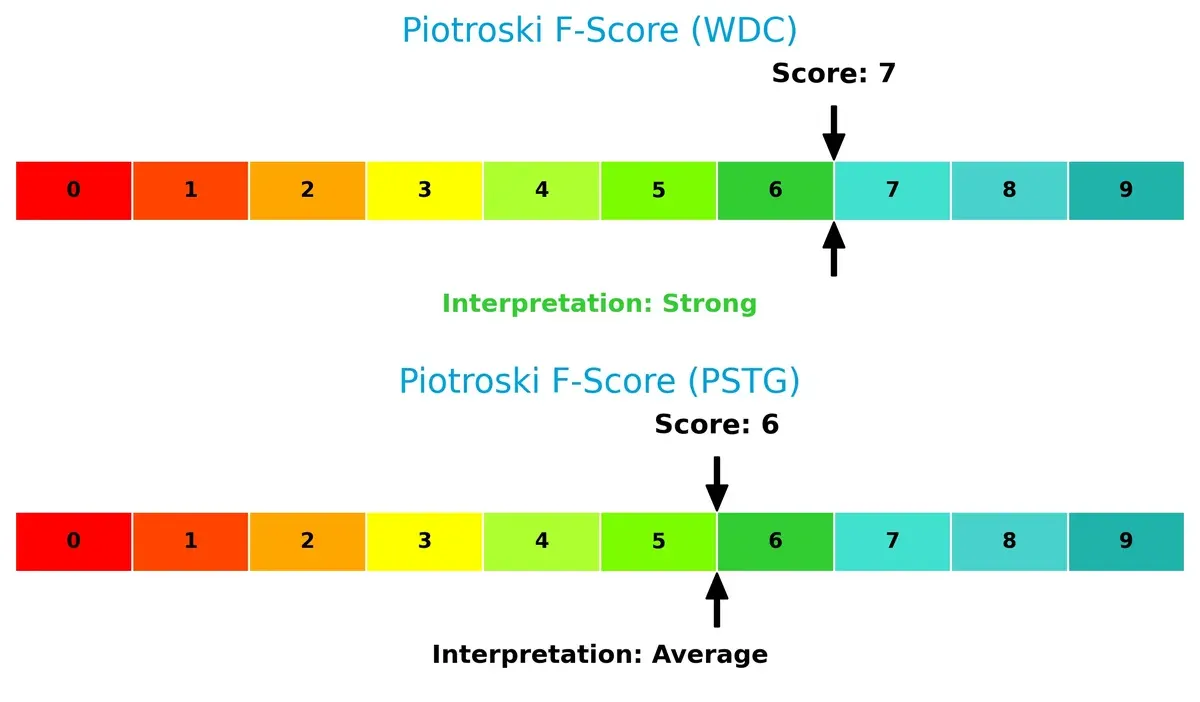

Financial Health: Quality of Operations

Western Digital’s Piotroski F-Score of 7 indicates stronger financial health compared to Pure Storage’s 6, suggesting Western Digital holds fewer red flags in profitability and efficiency metrics:

How are the two companies positioned?

This section dissects the operational DNA of WDC and PSTG by comparing revenue distribution and internal dynamics. The final goal is to confront their economic moats to reveal which model offers the most resilient, sustainable competitive advantage today.

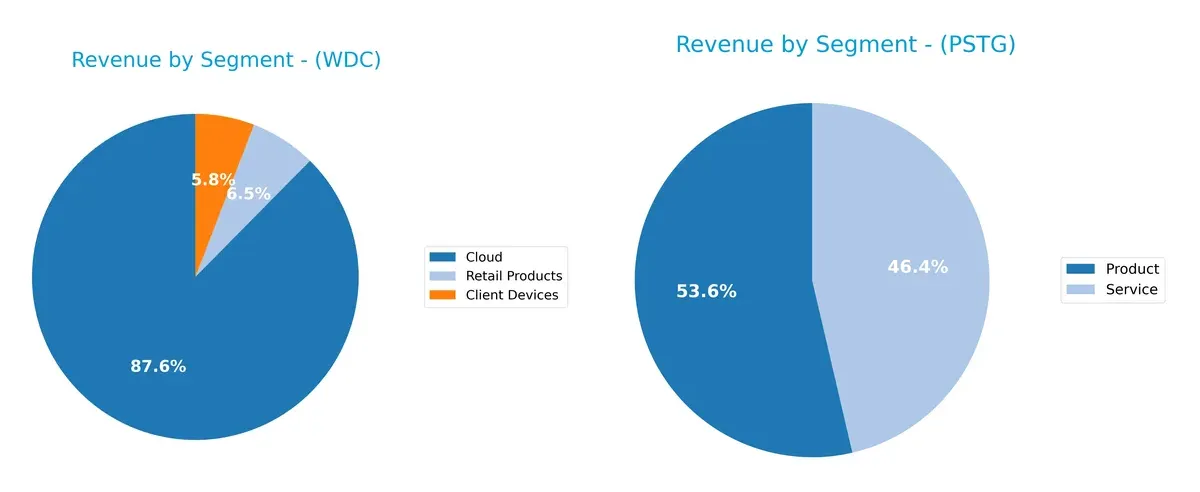

Revenue Segmentation: The Strategic Mix

This comparison dissects how Western Digital Corporation and Pure Storage, Inc. diversify their income streams and where their primary sector bets lie:

Western Digital anchors its 2025 revenue heavily on Cloud at $8.34B, with Client Devices and Retail Products trailing at $556M and $623M, respectively. This signals a pivot toward infrastructure dominance but reveals concentration risk in cloud storage. Pure Storage shows a more balanced split between Product at $1.7B and Service at $1.47B, reflecting a diversified model that leverages product sales and recurring service revenue, enhancing ecosystem lock-in.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Western Digital Corporation (WDC) and Pure Storage, Inc. (PSTG):

WDC Strengths

- Strong profitability with 19.55% net margin and 35.04% ROE

- Favorable ROIC at 21.53%, exceeding WACC

- Diversified revenue streams including Cloud and Retail products

- Established global presence with significant sales in Asia and Americas

- Efficient fixed asset turnover at 4.06

PSTG Strengths

- Solid liquidity with current ratio of 1.61 and quick ratio of 1.58

- Low leverage with debt-to-assets at 7.09% and strong interest coverage of 19.92

- Favorable fixed asset turnover at 5.21

- Balanced product and service revenue streams

- Growing US market presence with over $2.2B revenue

WDC Weaknesses

- Elevated WACC at 12.21%, reducing capital efficiency

- Unfavorable PB ratio at 4.14, indicating possible market valuation concerns

- Neutral liquidity ratios suggest potential short-term funding constraints

- Low dividend yield at 0.2% may deter income-focused investors

PSTG Weaknesses

- Low profitability with 3.37% net margin and 8.17% ROE

- ROIC at 2.45% below WACC at 9.76% signals value destruction

- High PE ratio of 206.9, implying expensive valuation

- No dividend yield and unfavorable PB ratio at 16.9

- Limited global diversification, with majority revenue from US market

Overall, WDC demonstrates robust profitability and diversified global revenues but faces challenges in capital cost and market valuation. PSTG benefits from strong liquidity and low debt yet struggles with profitability and high valuation, highlighting differing strategic priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true barrier protecting long-term profits from relentless competition erosion. Here’s the comparative moat analysis for two key players in data storage:

Western Digital Corporation: Cost Advantage and Scale Moat

Western Digital leverages scale and manufacturing efficiency, evident in its strong 38.8% gross margin and 15.6% EBIT margin. Its ROIC exceeds WACC by 9.3%, signaling robust value creation. Expansion into enterprise data center solutions deepens its moat in 2026.

Pure Storage, Inc.: Innovation-Driven Intangible Assets

Pure Storage’s moat stems from its proprietary Purity software and subscription model. Despite a high 69.8% gross margin, its EBIT margin is modest at 4.9%, with ROIC below WACC, indicating value destruction. However, growing revenues and AI-ready infrastructure hint at future moat strengthening.

Scale Efficiency vs. Software Innovation: The Moat Battle

Western Digital’s wider moat reflects superior capital efficiency and margin stability. Pure Storage’s innovation shows promise but currently lacks the profitability to match Western Digital’s entrenched position. I see Western Digital better equipped to defend market share in 2026.

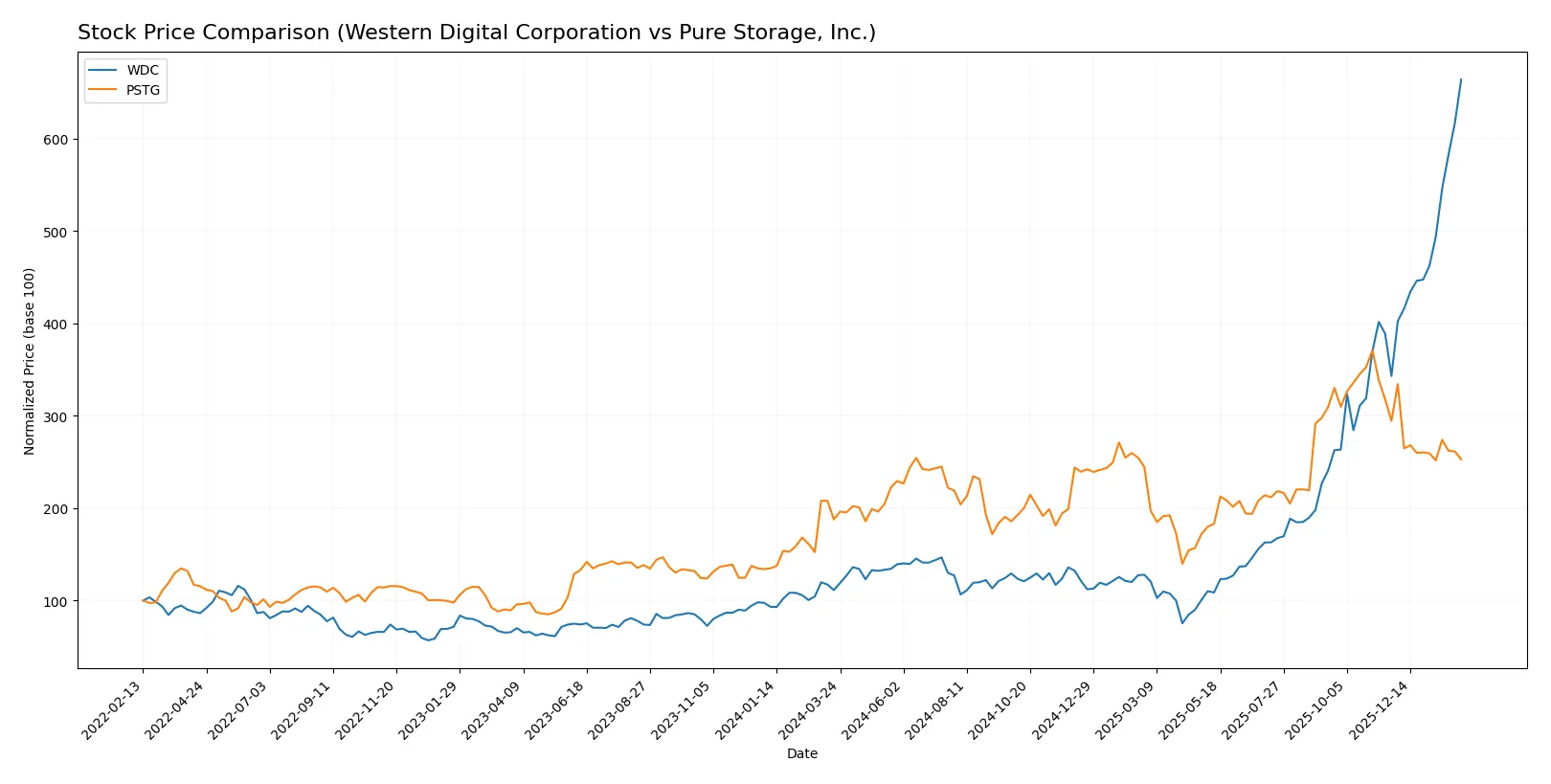

Which stock offers better returns?

The past year shows stark contrast in price dynamics: Western Digital surges with strong buyer dominance, while Pure Storage faces recent selling pressure and decelerated gains.

Trend Comparison

Western Digital’s stock rose 496.3% over 12 months, marking a bullish trend with accelerating momentum and high volatility. Its price ranged between 30.54 and 269.41.

Pure Storage gained 34.65% over the same period, maintaining a bullish but decelerating trend. Recent months show a 14.17% drop, signaling short-term weakness.

Western Digital clearly outperformed Pure Storage, delivering substantially higher market returns and sustained buyer dominance throughout the year.

Target Prices

Analysts show a bullish consensus for both Western Digital Corporation and Pure Storage, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Western Digital Corporation | 205 | 340 | 285.92 |

| Pure Storage, Inc. | 60 | 105 | 91.15 |

Western Digital’s consensus target of 286 suggests a 6% upside from today’s 269.41 price. Pure Storage’s 91 consensus implies a strong 35% gain potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Western Digital Corporation Grades

Below is a summary of recent grades from reputable institutions for Western Digital Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-02 |

| Barclays | Maintain | Overweight | 2026-02-02 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-30 |

| Wells Fargo | Maintain | Overweight | 2026-01-30 |

| Goldman Sachs | Maintain | Neutral | 2026-01-30 |

| Morgan Stanley | Maintain | Overweight | 2026-01-30 |

| TD Cowen | Maintain | Buy | 2026-01-30 |

| Wedbush | Maintain | Outperform | 2026-01-30 |

| Mizuho | Maintain | Outperform | 2026-01-27 |

| Morgan Stanley | Maintain | Overweight | 2026-01-22 |

Pure Storage, Inc. Grades

The following table presents recent institutional grades for Pure Storage, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2025-12-03 |

| Needham | Maintain | Buy | 2025-12-03 |

| Wedbush | Maintain | Outperform | 2025-12-03 |

| Susquehanna | Downgrade | Neutral | 2025-12-03 |

| UBS | Maintain | Sell | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-03 |

| Lake Street | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-11-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-17 |

Which company has the best grades?

Western Digital receives more consistent “Buy,” “Overweight,” and “Outperform” ratings from top-tier firms. Pure Storage shows mixed grades, including “Sell” and “Neutral.” This suggests stronger institutional confidence in Western Digital, which may influence investor sentiment and valuation.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Western Digital Corporation

- Faces intense competition in traditional HDD and SSD markets with established brand legacy but slower growth segments.

Pure Storage, Inc.

- Competes aggressively in cloud and flash storage with innovation edge but limited scale and higher valuation risk.

2. Capital Structure & Debt

Western Digital Corporation

- Moderate leverage (D/E ~0.96) with neutral interest coverage of 4.17 signals manageable but watchful debt risk.

Pure Storage, Inc.

- Low leverage (D/E ~0.22) and strong interest coverage of 19.92 provide financial flexibility and lower default risk.

3. Stock Volatility

Western Digital Corporation

- High beta at 1.839 indicates significant stock price volatility relative to the market.

Pure Storage, Inc.

- Lower beta of 1.273 reflects more moderate price swings amid tech sector shifts.

4. Regulatory & Legal

Western Digital Corporation

- Global operations expose WDC to complex data privacy and export regulations, increasing compliance costs.

Pure Storage, Inc.

- Emerging market presence and SaaS offerings subject PSTG to evolving cloud data and cybersecurity regulations.

5. Supply Chain & Operations

Western Digital Corporation

- Relies on semiconductor manufacturing with risk from cyclical supply shortages and geopolitical tensions.

Pure Storage, Inc.

- Leaner operations with software-centric models reduce hardware dependency but face integration and scaling challenges.

6. ESG & Climate Transition

Western Digital Corporation

- Moderate ESG initiatives; manufacturing footprint pressures sustainability goals amid rising investor scrutiny.

Pure Storage, Inc.

- Focus on software and cloud solutions offers potential ESG advantages but must address data center energy use.

7. Geopolitical Exposure

Western Digital Corporation

- Significant exposure to China and Asia-Pacific supply chains risks tariffs and export controls.

Pure Storage, Inc.

- Less manufacturing presence in geopolitically sensitive zones, lowering direct geopolitical disruption risk.

Which company shows a better risk-adjusted profile?

Western Digital’s primary risk is its high stock volatility and geopolitical supply chain exposure. Pure Storage’s biggest risk lies in its elevated valuation multiples and moderate profitability. Despite WDC’s debt concerns, its proven profitability and Altman Z-Score in the safe zone suggest greater financial stability. PSTG’s lower leverage is positive but offset by weaker margins and valuation risks. I see WDC as the better risk-adjusted choice given its robust operational efficiency and stronger earnings, balanced against manageable but watchful debt levels.

Final Verdict: Which stock to choose?

Western Digital Corporation’s superpower lies in its proven ability to generate robust returns on invested capital, signaling a durable competitive edge in storage technology. Its point of vigilance is a modest liquidity profile, which could pressure short-term flexibility. WDC suits investors with an appetite for cyclical value plays and aggressive growth.

Pure Storage, Inc. benefits from a strategic moat centered on innovative flash storage solutions and recurring revenue streams. It offers a safer balance sheet with low leverage, appealing to investors seeking stability amid growth. PSTG fits well in a GARP (Growth at a Reasonable Price) portfolio, balancing innovation with measured risk.

If you prioritize strong value creation and accelerating profitability, Western Digital outshines with a compelling margin expansion and high ROIC. However, if you seek steadier financial footing and exposure to cloud-driven growth, Pure Storage offers better stability despite its premium valuation. Both present distinctive risk-reward profiles aligned with different investor strategies.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Western Digital Corporation and Pure Storage, Inc. to enhance your investment decisions: