Home > Comparison > Technology > PSTG vs SMCI

The strategic rivalry between Pure Storage, Inc. and Super Micro Computer, Inc. shapes the technology hardware landscape. Pure Storage excels as a specialized data storage innovator, while Super Micro Computer focuses on modular, high-performance server and storage solutions. This contrast highlights a battle between niche software-driven growth and broad-based hardware integration. This analysis will reveal which strategy offers superior risk-adjusted returns for diversified portfolios navigating the evolving tech sector.

Table of contents

Companies Overview

Pure Storage and Super Micro Computer stand as pivotal players in the competitive computer hardware landscape.

Pure Storage, Inc.: Data Storage Innovator

Pure Storage leads in enterprise-class data storage solutions, generating revenue primarily from high-performance FlashArray and FlashBlade products. Its strategic focus in 2026 centers on expanding subscription services like Pure as-a-Service and cloud-native Kubernetes data management, enhancing flexibility and scalability for modern workloads. The company leverages its proprietary Purity software to maintain a competitive edge in data reduction and protection.

Super Micro Computer, Inc.: Modular Server Specialist

Super Micro Computer excels in high-performance server and storage solutions with modular, open architecture designs. It drives revenue through comprehensive server systems, including blade servers and management software tailored for AI, 5G, and edge computing markets. In 2026, Super Micro emphasizes expanding its software management suite and strengthening integration services to capture enterprise and cloud data center demand.

Strategic Collision: Similarities & Divergences

Both firms compete fiercely in the hardware sector but pursue distinct philosophies. Pure Storage prioritizes a closed ecosystem with subscription-based services, while Super Micro champions an open, modular infrastructure. Their main battlefield lies in data storage and server efficiency for enterprise clients. Investors face contrasting profiles: Pure Storage with a software-driven recurring revenue model versus Super Micro’s hardware-centric, scalable system integration approach.

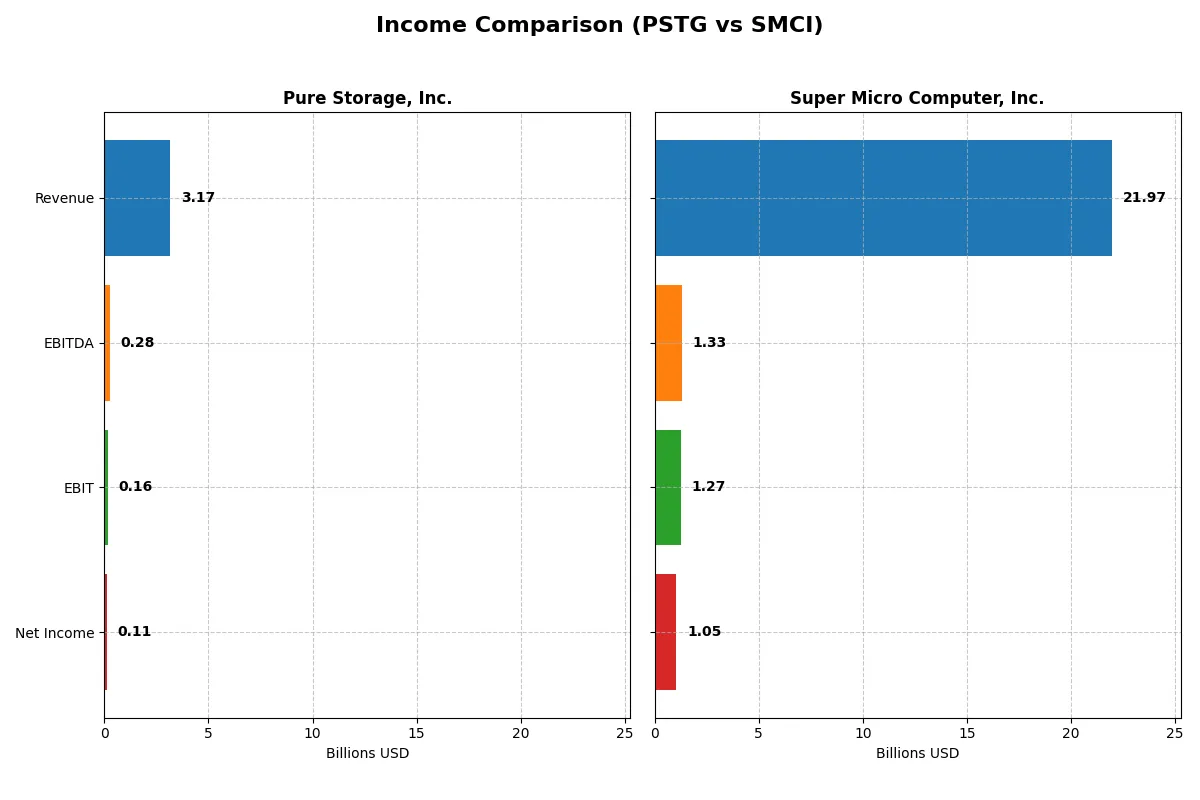

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Pure Storage, Inc. (PSTG) | Super Micro Computer, Inc. (SMCI) |

|---|---|---|

| Revenue | 3.17B | 21.97B |

| Cost of Revenue | 955M | 19.54B |

| Operating Expenses | 2.13B | 1.18B |

| Gross Profit | 2.21B | 2.43B |

| EBITDA | 282M | 1.33B |

| EBIT | 156M | 1.27B |

| Interest Expense | 7.8M | 59.6M |

| Net Income | 107M | 1.05B |

| EPS | 0.33 | 1.77 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and growth dynamics of each company’s corporate engine over recent years.

Pure Storage, Inc. Analysis

Pure Storage’s revenue increased steadily from 1.68B in 2021 to 3.17B in 2025, nearly doubling in five years. Its gross margin remains robust at nearly 70%, signaling strong cost control on core operations. The net income turned positive in 2023 and surged to 107M in 2025, reflecting improving operational efficiency and margin expansion.

Super Micro Computer, Inc. Analysis

Super Micro Computer’s revenue exploded from 3.56B in 2021 to 21.97B in 2025, showcasing aggressive top-line growth. However, its gross margin is a modest 11%, indicating tight cost pressures. Despite this, net income jumped to 1.05B in 2025, supported by solid operating income and disciplined expense management, though net margin slightly declined year-over-year.

Margin Strength vs. Scale Dominance

Pure Storage delivers superior margin health, with a strong gross margin and rising net income, reflecting operational leverage and margin expansion. Super Micro dominates revenue scale with explosive sales growth but operates with slimmer margins. For investors prioritizing profitability and margin resilience, Pure Storage’s profile appears more attractive; those focused on rapid scale might lean toward Super Micro.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Pure Storage, Inc. (PSTG) | Super Micro Computer, Inc. (SMCI) |

|---|---|---|

| ROE | 8.2% | 16.6% |

| ROIC | 2.5% | 9.3% |

| P/E | 207 | 28 |

| P/B | 16.9 | 4.6 |

| Current Ratio | 1.61 | 5.25 |

| Quick Ratio | 1.58 | 3.25 |

| D/E (Debt to Equity) | 0.22 | 0.76 |

| Debt-to-Assets | 7.1% | 34.1% |

| Interest Coverage | 10.9 | 21.0 |

| Asset Turnover | 0.80 | 1.57 |

| Fixed Asset Turnover | 5.21 | 27.53 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, exposing hidden risks and operational strengths that guide investors through complex financial landscapes.

Pure Storage, Inc.

Pure Storage shows modest profitability with an ROE of 8.17% and a net margin of 3.37%, which are both flagged as unfavorable. Its valuation is stretched, with a P/E of 207 and a P/B of 16.9, reflecting high market expectations. The company pays no dividends, instead reinvesting heavily in R&D (25.4% of revenue) to fuel growth.

Super Micro Computer, Inc.

Super Micro posts a stronger ROE at 16.64% and a better net margin of 4.77%, though the latter remains unfavorable. Its valuation is more reasonable with a P/E of 27.7 and a P/B of 4.62, indicating less price pressure. Like Pure Storage, it offers no dividends but balances shareholder returns with operational efficiency and solid asset turnover.

Premium Valuation vs. Operational Safety

Pure Storage’s valuation is significantly stretched, paired with weaker profitability metrics. Super Micro delivers a better equity return and more balanced valuation. Investors seeking growth with operational resilience may prefer Super Micro’s profile, while those tolerating high valuation risk might consider Pure Storage’s innovation focus.

Which one offers the Superior Shareholder Reward?

I observe that neither Pure Storage (PSTG) nor Super Micro Computer (SMCI) pays dividends, focusing instead on reinvestment and buybacks. PSTG posts zero dividend yield and payout ratio, emphasizing innovation with free cash flow at 1.6B and modest buyback activity. SMCI also pays no dividend but shows stronger free cash flow at 2.58B and a more aggressive buyback stance, supported by a solid operating margin of 5.7% versus PSTG’s 2.7%. SMCI’s capital efficiency and higher cash ratio (2.2 vs. 0.45) signal more sustainable shareholder returns. Given these factors, I judge SMCI offers the more attractive total return profile in 2026.

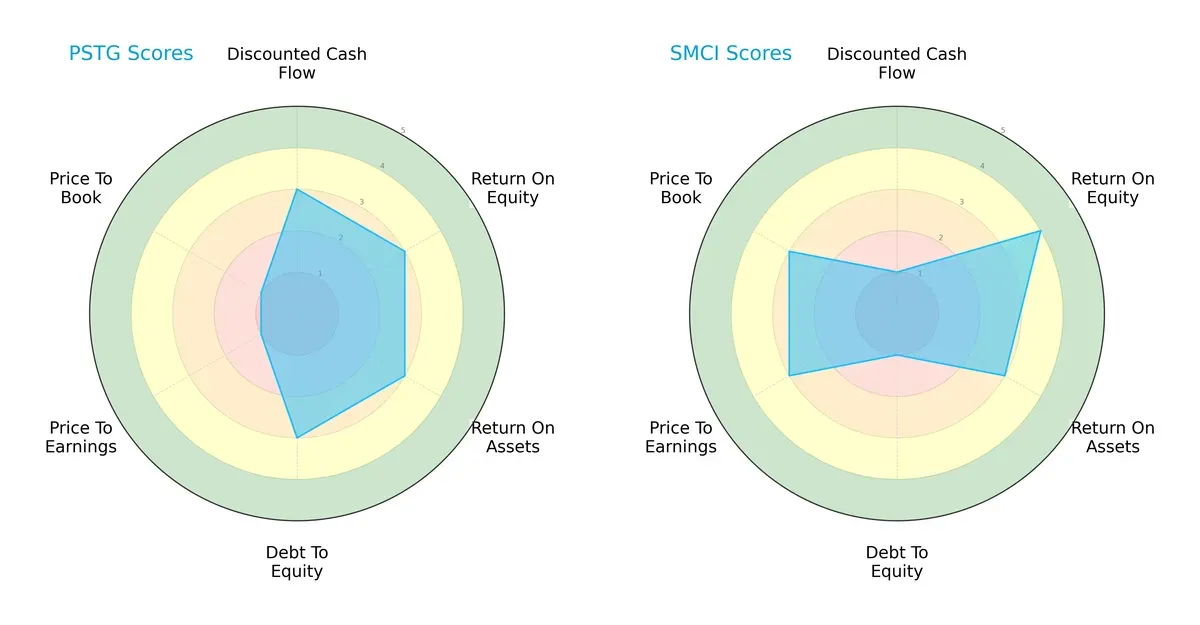

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Pure Storage, Inc. and Super Micro Computer, Inc., highlighting their financial strengths and valuation challenges:

Pure Storage shows a balanced operational profile, with moderate scores in DCF, ROE, ROA, and Debt/Equity. However, it struggles with valuation, scoring very unfavorable on P/E and P/B. Super Micro Computer excels in ROE and valuation metrics but faces financial risk due to poor Debt/Equity and DCF scores. Pure Storage offers a steadier, more consistent foundation, while Super Micro Computer relies heavily on profitability and market valuation edges.

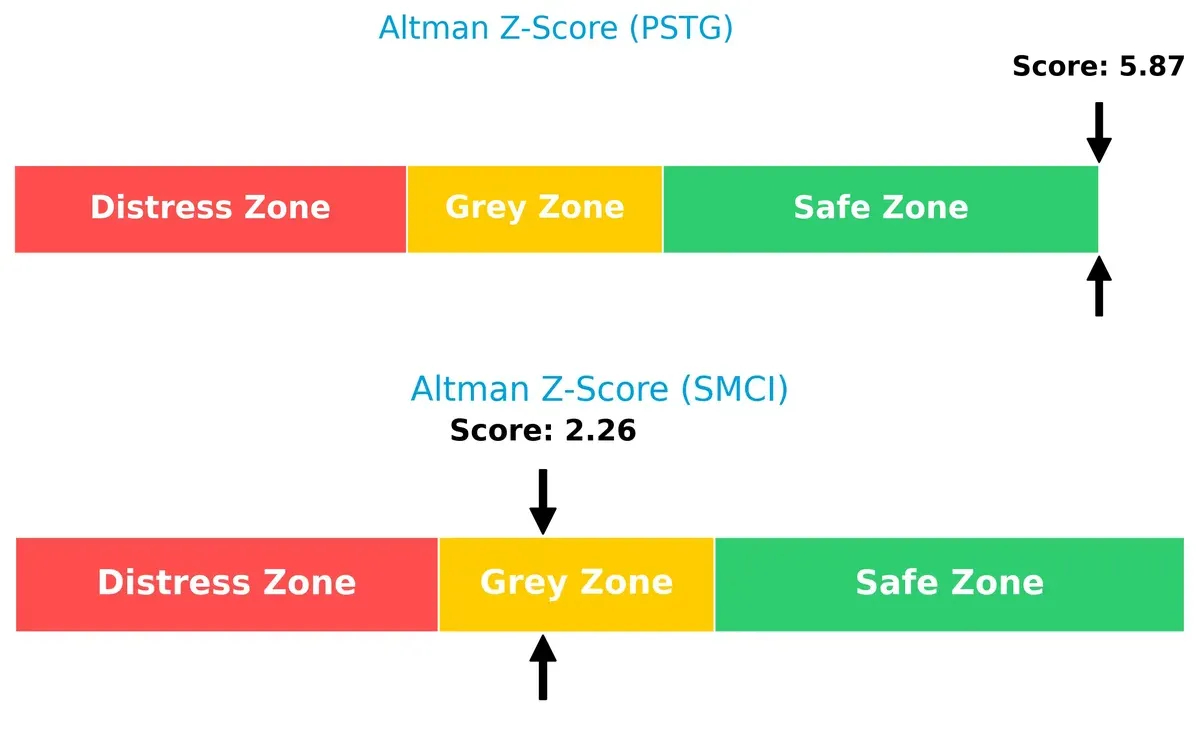

Bankruptcy Risk: Solvency Showdown

Pure Storage’s Altman Z-Score of 5.87 places it comfortably in the safe zone, signaling strong long-term solvency. Super Micro Computer’s 2.26 score lands in the grey zone, indicating moderate bankruptcy risk under current market pressures:

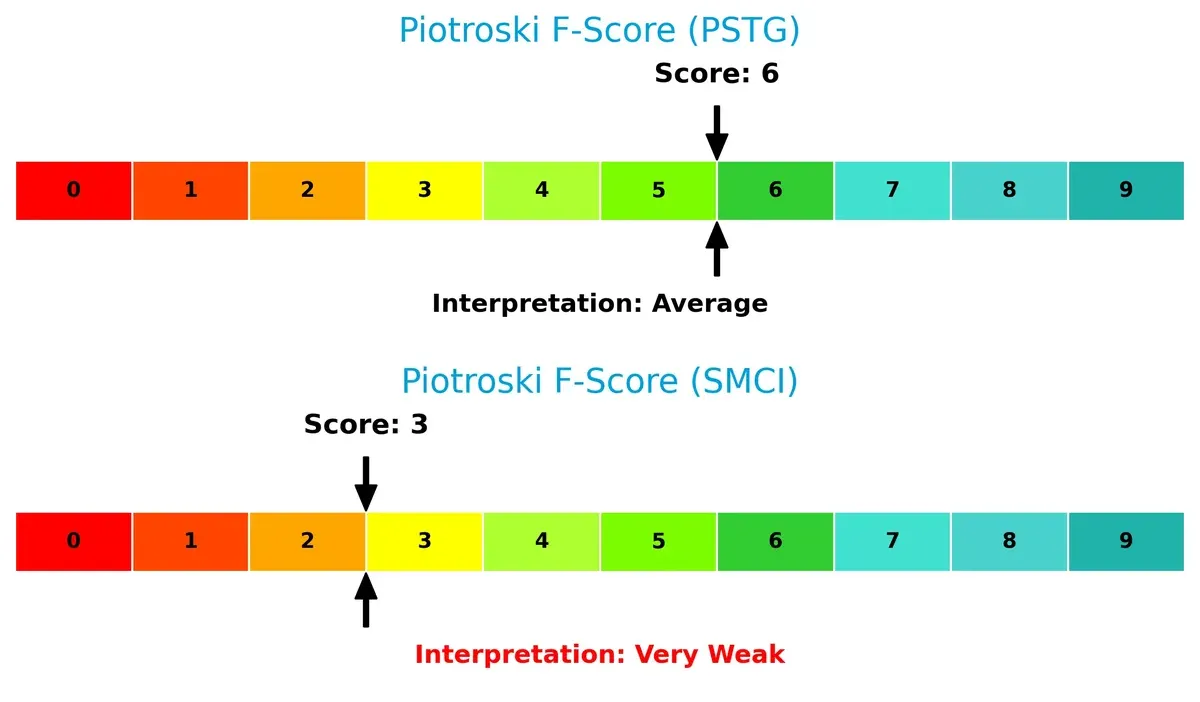

Financial Health: Quality of Operations

Pure Storage’s Piotroski F-Score of 6 suggests average financial health with no immediate red flags. Super Micro Computer’s low score of 3 signals weak internal metrics and operational concerns, posing higher risk to investors:

How are the two companies positioned?

This section dissects the operational DNA of Pure Storage and Super Micro by comparing their revenue distribution and internal strengths and weaknesses. The objective is to confront their economic moats to identify which model offers a more resilient, sustainable competitive advantage today.

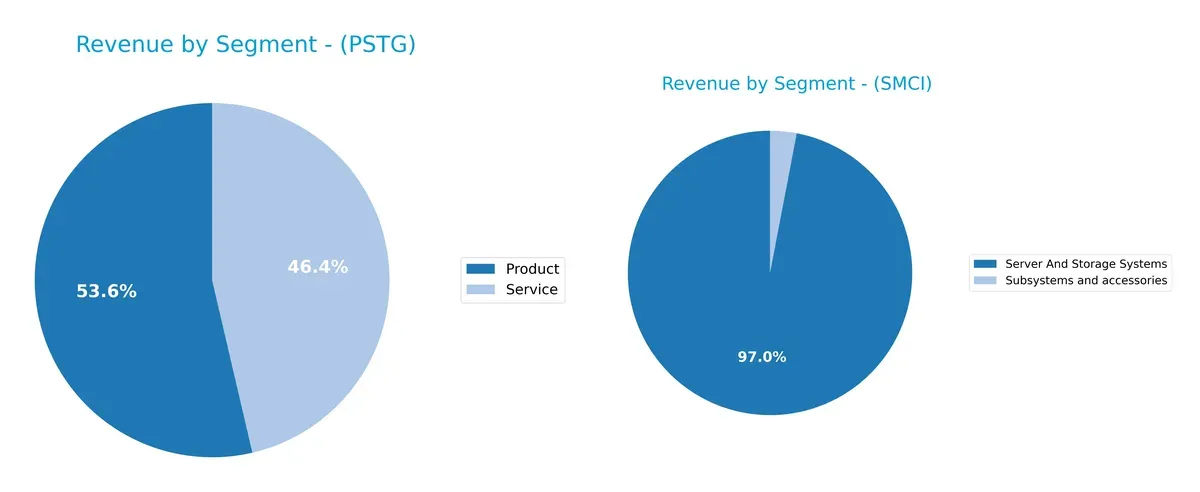

Revenue Segmentation: The Strategic Mix

This comparison dissects how Pure Storage, Inc. and Super Micro Computer, Inc. diversify their income streams and where their primary sector bets lie:

Pure Storage balances its revenue between Product ($1.7B) and Service ($1.5B) segments, showing a well-rounded portfolio. Super Micro Computer leans heavily on Server and Storage Systems ($21.3B), dwarfing its Subsystems and Accessories ($660M) revenue. PSTG’s diversified mix reduces concentration risk and builds ecosystem lock-in, while SMCI’s reliance on a dominant segment signals infrastructure dominance but raises vulnerability to market shifts.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Pure Storage, Inc. and Super Micro Computer, Inc.:

Pure Storage Strengths

- Balanced revenue split between product (1.7B) and service (1.5B) segments

- Favorable liquidity ratios with current ratio at 1.61 and quick ratio at 1.58

- Low leverage with debt-to-assets at 7.1%

- Strong fixed asset turnover at 5.21

Super Micro Computer Strengths

- Large scale product revenue with 21.3B from server and storage systems

- Favorable asset turnover at 1.57 and fixed asset turnover at 27.53

- Strong interest coverage at 21.34

- Robust global presence across US, Asia (5.5B), and Europe (2.7B)

Pure Storage Weaknesses

- Unfavorable profitability with net margin at 3.37% and ROE at 8.17% below cost of capital

- High valuation multiples with PE of 206.9 and PB of 16.9

- No dividend yield

- Moderate asset turnover at 0.8

Super Micro Computer Weaknesses

- Unfavorable net margin at 4.77% despite favorable ROE

- Elevated valuation with PE at 27.74 and PB at 4.62

- Weak current ratio at 5.25 considered unfavorable due to possible working capital inefficiencies

- No dividend yield

Overall, Pure Storage shows strengths in liquidity and low leverage but struggles with profitability and valuation. Super Micro exhibits scale advantages and efficient asset use but faces margin pressure and valuation risks. Both companies maintain neutral overall financial health, requiring careful monitoring of profitability and capital efficiency.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting long-term profits from relentless competitive erosion. Let’s compare two tech hardware firms’ moats:

Pure Storage, Inc.: Innovation-Driven Software Moat

Pure Storage leverages intangible assets through its proprietary Purity software, driving high gross margins near 70%. Despite ROIC below WACC, improving profitability and subscription growth hint at moat deepening in 2026.

Super Micro Computer, Inc.: Modular Cost Advantage Moat

Super Micro’s cost advantage stems from modular, open architecture servers, enabling rapid revenue growth and operational leverage. Its lower gross margin contrasts with Pure Storage’s, but steady ROIC growth supports a resilient competitive position.

Innovation Edge vs. Cost Leadership: The Moat Showdown

Both firms destroy value as ROIC trails WACC, yet each shows ROIC improvement. Pure Storage’s software moat offers deeper profit stability, while Super Micro’s cost focus fuels volume growth. I see Pure Storage better poised to defend market share long term.

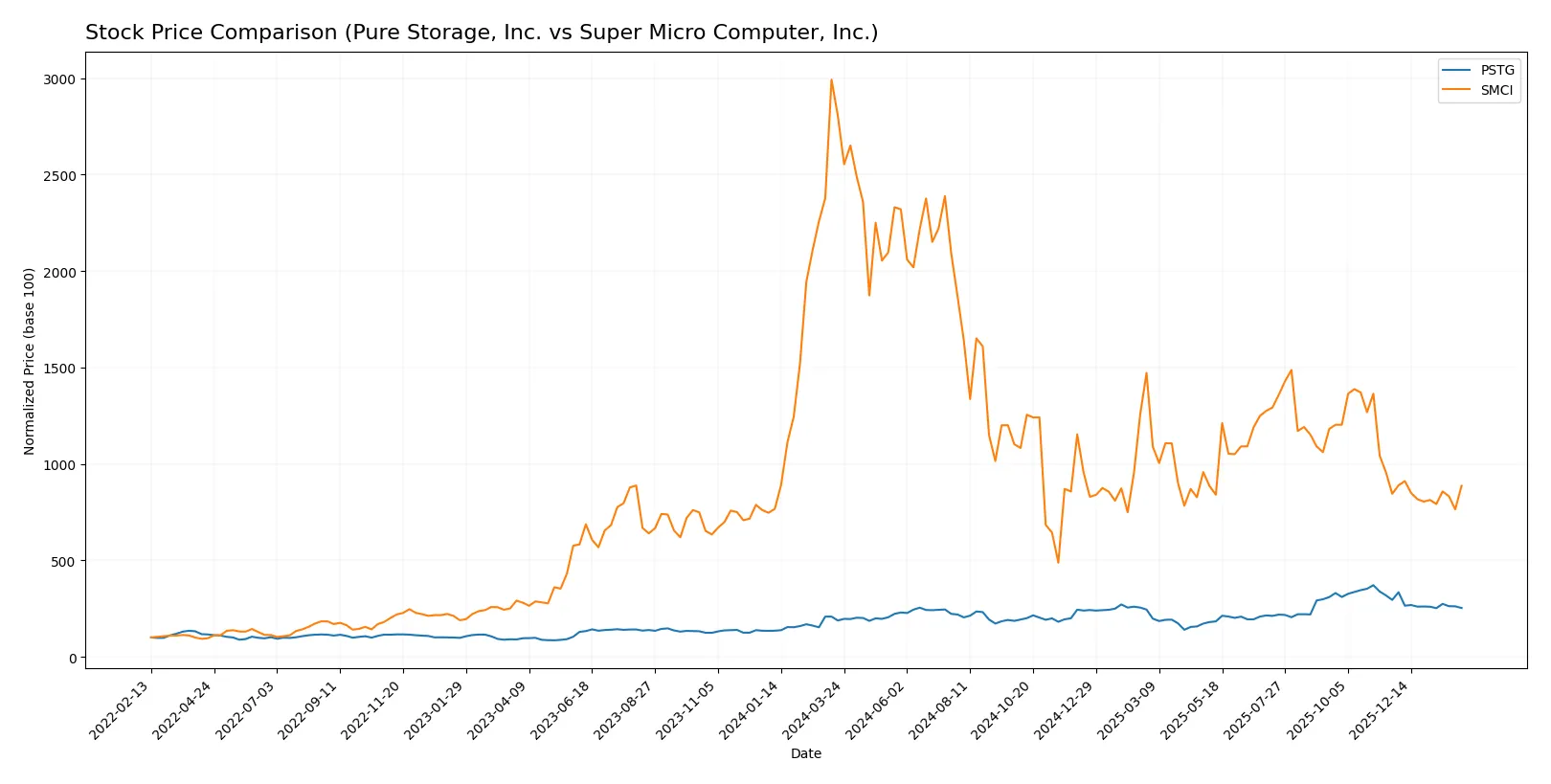

Which stock offers better returns?

The past year shows starkly divergent price trajectories for Pure Storage, Inc. and Super Micro Computer, Inc., with Pure Storage posting strong gains while Super Micro Computer suffers substantial losses.

Trend Comparison

Pure Storage, Inc. gained 34.65% over the past 12 months, marking a bullish trend despite decelerating momentum lately. It reached a high of 98.7 and a low of 37.18.

Super Micro Computer, Inc. dropped 68.41% over the last year, confirming a bearish trend with accelerating decline. The stock ranged between 18.58 and 106.88.

Pure Storage, Inc. outperformed Super Micro Computer, Inc. by a wide margin, delivering the highest market returns in this 12-month period.

Target Prices

Analysts set clear target price ranges for Pure Storage, Inc. and Super Micro Computer, Inc., signaling distinct upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Pure Storage, Inc. | 60 | 105 | 91.15 |

| Super Micro Computer, Inc. | 26 | 64 | 47.13 |

The consensus target for Pure Storage at 91.15 implies a 35% upside versus its current 67.24 price. Super Micro’s 47.13 target suggests a 40% gain above 33.76, reflecting bullish analyst sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Pure Storage, Inc. Grades

The following table summarizes recent grades from established grading firms for Pure Storage, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2025-12-03 |

| Needham | Maintain | Buy | 2025-12-03 |

| Wedbush | Maintain | Outperform | 2025-12-03 |

| Susquehanna | Downgrade | Neutral | 2025-12-03 |

| UBS | Maintain | Sell | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-03 |

| Lake Street | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-11-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-17 |

Super Micro Computer, Inc. Grades

Below is a summary of recent established grading firm actions on Super Micro Computer, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2024-10-02 |

| Loop Capital | Maintain | Buy | 2024-09-23 |

| JP Morgan | Downgrade | Neutral | 2024-09-06 |

| Barclays | Downgrade | Equal Weight | 2024-09-04 |

| Barclays | Maintain | Overweight | 2024-08-28 |

| Wells Fargo | Maintain | Equal Weight | 2024-08-28 |

| CFRA | Downgrade | Hold | 2024-08-28 |

| Goldman Sachs | Maintain | Neutral | 2024-08-08 |

| Wells Fargo | Maintain | Equal Weight | 2024-08-07 |

| Rosenblatt | Maintain | Buy | 2024-08-07 |

Which company has the best grades?

Pure Storage, Inc. holds a stronger consensus of Buy and Outperform ratings, while Super Micro Computer, Inc. shows more downgrades and Neutral ratings. This difference may influence investor sentiment and portfolio positioning.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Pure Storage, Inc. (PSTG)

- Faces intense competition with a high P/E of 207 indicating possible overvaluation risk.

Super Micro Computer, Inc. (SMCI)

- Operates in a competitive market but has a more reasonable P/E of 28, suggesting better valuation discipline.

2. Capital Structure & Debt

Pure Storage, Inc. (PSTG)

- Low debt-to-equity ratio (0.22) signals conservative leverage and financial stability.

Super Micro Computer, Inc. (SMCI)

- Higher debt-to-equity (0.76) increases financial risk and interest burden.

3. Stock Volatility

Pure Storage, Inc. (PSTG)

- Beta at 1.27 indicates moderate volatility relative to the market.

Super Micro Computer, Inc. (SMCI)

- Beta at 1.52 indicates higher stock price sensitivity and risk.

4. Regulatory & Legal

Pure Storage, Inc. (PSTG)

- No elevated regulatory risks reported; typical industry compliance challenges.

Super Micro Computer, Inc. (SMCI)

- Similar regulatory environment with exposure to international standards and compliance costs.

5. Supply Chain & Operations

Pure Storage, Inc. (PSTG)

- Benefits from integrated software and hardware offerings but vulnerable to component shortages.

Super Micro Computer, Inc. (SMCI)

- Faces operational complexity due to modular product lines and global manufacturing footprint.

6. ESG & Climate Transition

Pure Storage, Inc. (PSTG)

- Increasing pressure to improve ESG scores; energy-efficient products align with climate goals.

Super Micro Computer, Inc. (SMCI)

- ESG improvements needed; higher emissions likely due to manufacturing scale and diversity.

7. Geopolitical Exposure

Pure Storage, Inc. (PSTG)

- US-based with moderate international sales; geopolitical tensions pose export risks.

Super Micro Computer, Inc. (SMCI)

- Greater international exposure heightens vulnerability to trade disputes and tariffs.

Which company shows a better risk-adjusted profile?

Pure Storage’s greatest risk stems from its stretched valuation and modest profitability, raising concerns over its growth sustainability. Super Micro faces elevated financial leverage and geopolitical risks but benefits from stronger ROE and operational efficiency. Overall, Pure Storage presents a safer balance sheet and lower debt burden, offering a more stable risk-adjusted profile despite valuation concerns. The sharply higher P/E of Pure Storage alerts me to potential downside volatility amid market corrections.

Final Verdict: Which stock to choose?

Pure Storage, Inc. (PSTG) excels as an innovation engine with rapid profit growth and operational efficiency as its superpower. Its high valuation multiples and modest current profitability remain points of vigilance. PSTG suits investors seeking aggressive growth in a dynamic tech environment.

Super Micro Computer, Inc. (SMCI) commands a strategic moat through its asset efficiency and robust return on equity. Its balance sheet presents stronger liquidity, offering comparatively better financial stability than PSTG. SMCI fits well within GARP portfolios targeting steady growth with risk mitigation.

If you prioritize rapid expansion and are comfortable with valuation risk, PSTG is the compelling choice due to its accelerating profitability and innovation focus. However, if you seek a blend of solid profitability and financial resilience, SMCI offers better stability and a more balanced growth profile. Both companies are value destroyers relative to capital costs, so careful monitoring of profitability trends is essential.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Pure Storage, Inc. and Super Micro Computer, Inc. to enhance your investment decisions: