In the fast-evolving technology sector, Pure Storage, Inc. (PSTG) and Rigetti Computing, Inc. (RGTI) represent two distinct yet overlapping frontiers of innovation within computer hardware. Pure Storage focuses on advanced data storage solutions, while Rigetti pioneers quantum computing systems. Comparing these companies reveals contrasting growth paths and technological strategies. Join me as we explore which company holds the most promise for investors seeking cutting-edge opportunities.

Table of contents

Companies Overview

I will begin the comparison between Pure Storage and Rigetti Computing by providing an overview of these two companies and their main differences.

Pure Storage Overview

Pure Storage, Inc. specializes in data storage technologies and services, offering enterprise-class data solutions such as data reduction, protection, and encryption. Its product range includes FlashArray and FlashBlade for various data workloads, alongside hybrid infrastructure platforms and cloud-native solutions. Founded in 2009 and headquartered in Santa Clara, California, Pure Storage serves a broad market with a workforce of around 6,000 employees.

Rigetti Computing Overview

Rigetti Computing, Inc. develops quantum computers and the superconducting processors that power them, integrating its machines into cloud platforms via Quantum Cloud Services. Founded in 2013 and based in Berkeley, California, the company focuses on advancing quantum computing technology. It operates with a significantly smaller team of approximately 137 employees compared to traditional hardware firms.

Key similarities and differences

Both companies operate in the technology sector under the computer hardware industry, but they target fundamentally different markets. Pure Storage focuses on classical data storage solutions for enterprises, while Rigetti Computing pioneers quantum computing systems. Pure Storage’s scale, with a market cap above 24B and thousands of employees, contrasts with Rigetti’s emerging quantum niche and smaller market cap near 8B with a lean workforce.

Income Statement Comparison

The table below compares the key income statement metrics of Pure Storage, Inc. and Rigetti Computing, Inc. for their most recent fiscal years, providing a snapshot of their financial performance.

| Metric | Pure Storage, Inc. (PSTG) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| Market Cap | 24.7B | 8.1B |

| Revenue | 3.17B | 10.8M |

| EBITDA | 282M | -191M |

| EBIT | 156M | -198M |

| Net Income | 107M | -201M |

| EPS | 0.33 | -1.09 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Pure Storage, Inc.

Pure Storage’s revenue increased steadily from $1.68B in 2021 to $3.17B in 2025, with net income turning positive after 2022 and reaching $107M in 2025. Gross margin remained strong at nearly 70%, while EBIT and net margins were stable but modest. The recent year showed favorable growth of nearly 12% in revenue and more than 55% in net margin, indicating improving profitability.

Rigetti Computing, Inc.

Rigetti’s revenue rose from $5.5M in 2020 to $10.8M in 2024, but net income remained deeply negative, with a loss of $201M in 2024. Gross margin was favorable at 52.8%, but EBIT and net margins were severely negative, reflecting high costs and interest expenses. The latest year saw a 10% revenue decline and worsening margins, signaling operational challenges and deteriorating profitability.

Which one has the stronger fundamentals?

Pure Storage presents stronger fundamentals with consistent revenue and net income growth, favorable gross margin, and stable profitability metrics. Rigetti shows revenue growth over the longer term but suffers from sustained losses, negative margins, and unfavorable expense ratios. Overall, Pure Storage’s income statement metrics reflect a healthier and more improving financial position compared to Rigetti.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Pure Storage, Inc. (PSTG) and Rigetti Computing, Inc. (RGTI) for fiscal year 2025 and 2024 respectively, facilitating a straightforward comparison of their financial profiles.

| Ratios | Pure Storage, Inc. (2025) | Rigetti Computing, Inc. (2024) |

|---|---|---|

| ROE | 8.17% | -158.77% |

| ROIC | 2.45% | -24.91% |

| P/E | 206.9 | -14.02 |

| P/B | 16.90 | 22.26 |

| Current Ratio | 1.61 | 17.42 |

| Quick Ratio | 1.58 | 17.42 |

| D/E | 0.22 | 0.07 |

| Debt-to-Assets | 7.09% | 3.09% |

| Interest Coverage | 10.91 | -21.05 |

| Asset Turnover | 0.80 | 0.04 |

| Fixed Asset Turnover | 5.21 | 0.20 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Pure Storage, Inc.

Pure Storage shows a mixed ratio profile with favorable liquidity ratios (current ratio 1.61, quick ratio 1.58) and low debt levels, indicating solid short-term financial health and manageable leverage. However, profitability metrics such as net margin (3.37%), ROE (8.17%), and ROIC (2.45%) are weak, raising concerns about efficiency and returns. The company pays no dividends, consistent with reinvestment in growth and innovation, reflecting its focus on R&D and expansion.

Rigetti Computing, Inc.

Rigetti’s ratios reveal significant weaknesses, including deeply negative profitability measures (net margin -1862.72%, ROE -158.77%, ROIC -24.91%) and poor operational efficiency, with very low asset turnover and negative interest coverage. While it maintains low debt ratios, its extremely high current ratio (17.42) may indicate idle cash or inefficient asset use. Like Pure Storage, Rigetti does not distribute dividends, likely due to ongoing investment and development in its quantum computing platform.

Which one has the best ratios?

Comparing both, Pure Storage exhibits a more balanced financial profile with several favorable ratios in liquidity and leverage, though profitability remains a challenge. Rigetti’s financials are more strained, with predominantly unfavorable ratios and negative returns, reflecting its early-stage, high-risk nature. Overall, Pure Storage holds a relatively stronger ratio position than Rigetti.

Strategic Positioning

This section compares the strategic positioning of Pure Storage, Inc. and Rigetti Computing, Inc. in terms of market position, key segments, and exposure to technological disruption:

Pure Storage, Inc.

- Established player in computer hardware with $24.7B market cap and moderate competitive pressure.

- Focused on data storage technologies with products and services generating over $3.1B revenue in 2025.

- Operates in a mature storage market with incremental innovations; moderate exposure to technological disruption.

Rigetti Computing, Inc.

- Smaller market cap $8.1B, niche player in quantum computing systems, facing high competitive pressure.

- Specializes in quantum computing hardware and cloud services, with modest revenue from access and research services.

- High exposure to technological disruption due to emerging quantum computing technology and cloud integration.

Pure Storage, Inc. vs Rigetti Computing, Inc. Positioning

Pure Storage pursues a diversified approach, combining hardware and services in established data storage markets with steady growth. Rigetti focuses on a concentrated quantum computing niche, with smaller scale and emerging technologies, implying higher risk and innovation potential.

Which has the best competitive advantage?

Both companies currently shed value despite growing profitability, resulting in a slightly unfavorable moat status. Pure Storage’s larger scale and diversified offerings contrast with Rigetti’s specialized focus, reflecting different competitive dynamics rather than a clear advantage.

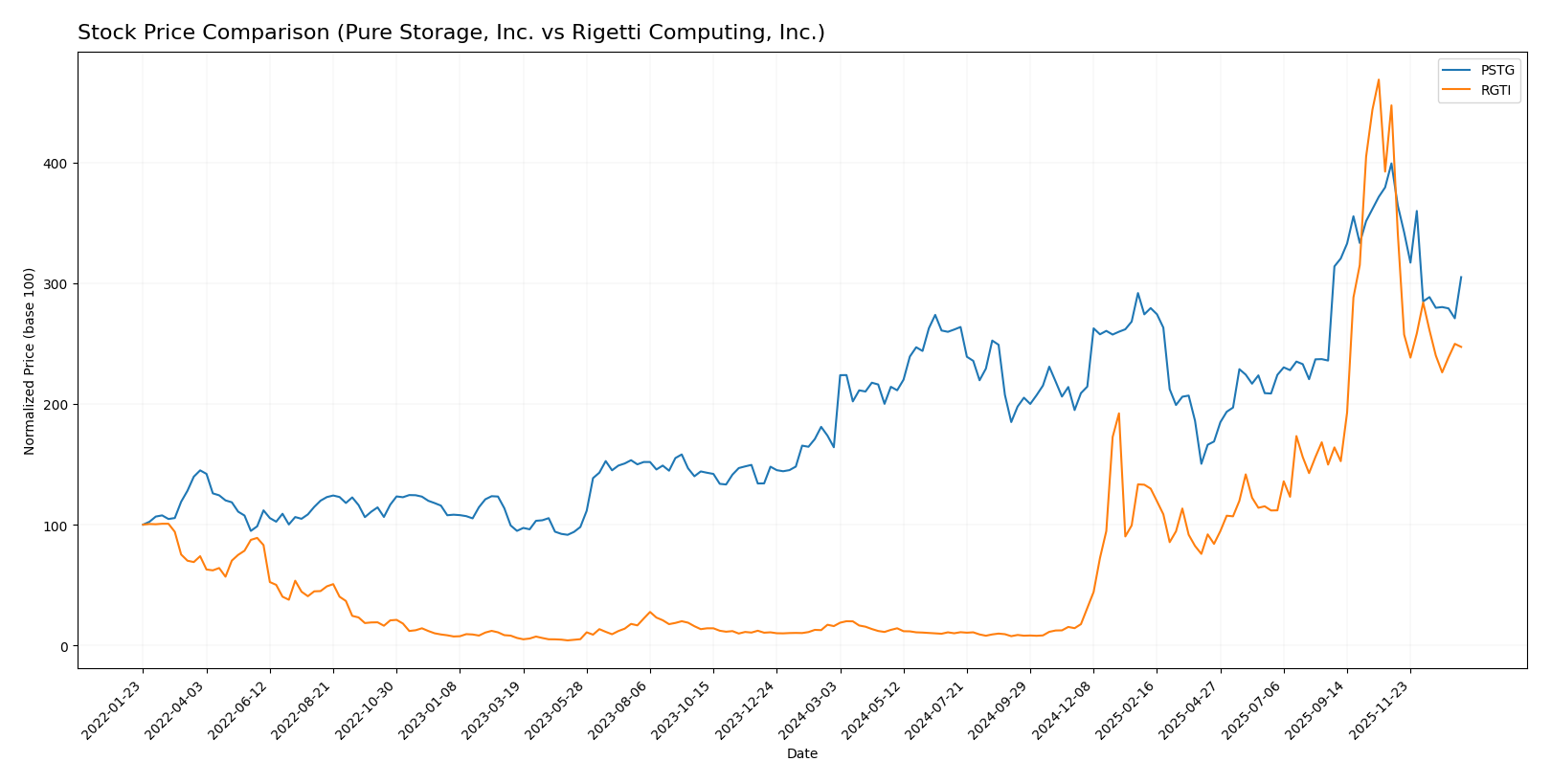

Stock Comparison

The past year saw significant bullish trends for both Pure Storage, Inc. (PSTG) and Rigetti Computing, Inc. (RGTI), with notable deceleration in momentum and recent downward corrections affecting their trading dynamics.

Trend Analysis

Pure Storage, Inc. exhibited a strong bullish trend over the past 12 months with an 85.88% price increase, though recent weeks show a 23.6% decline, signaling a short-term bearish correction amid decelerating growth.

Rigetti Computing, Inc. demonstrated an exceptional bullish rally with a 1448.73% gain over one year, yet experienced a sharper recent pullback of 44.73%, reflecting a pronounced deceleration phase with sustained volatility.

Comparing the two, Rigetti Computing, Inc. delivered the highest market performance over the past year, outperforming Pure Storage, Inc. by a wide margin despite both facing recent downward price adjustments.

Target Prices

Analysts provide a clear consensus on target prices for Pure Storage, Inc. and Rigetti Computing, Inc., indicating varied upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Pure Storage, Inc. | 105 | 60 | 91.15 |

| Rigetti Computing, Inc. | 50 | 18 | 35.83 |

The consensus target price for Pure Storage at 91.15 suggests a moderate upside from its current price of 75.41. Rigetti Computing’s consensus target of 35.83 indicates a significant potential increase compared to its current price of 24.47.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Pure Storage, Inc. and Rigetti Computing, Inc.:

Rating Comparison

Pure Storage, Inc. Rating

- Rating: B-, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 3, indicating a Moderate status.

- ROE Score: 3, showing a Moderate level of efficiency.

- ROA Score: 3, reflecting Moderate asset utilization.

- Debt To Equity Score: 3, considered Moderate financial risk.

- Overall Score: 2, rated as Moderate overall.

Rigetti Computing, Inc. Rating

- Rating: C, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 1, indicating a Very Unfavorable status.

- ROE Score: 1, indicating a Very Unfavorable level.

- ROA Score: 1, reflecting Very Unfavorable asset utilization.

- Debt To Equity Score: 4, considered Favorable financial risk.

- Overall Score: 2, rated as Moderate overall.

Which one is the best rated?

Pure Storage holds a higher rating grade (B-) compared to Rigetti’s (C), with stronger scores in discounted cash flow, ROE, and ROA, while Rigetti has a better debt to equity score; overall, both share a Moderate overall score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Pure Storage, Inc. and Rigetti Computing, Inc.:

PSTG Scores

- Altman Z-Score: 5.91, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength and investment quality.

RGTI Scores

- Altman Z-Score: 101.71, indicating a safe financial zone with very low bankruptcy risk.

- Piotroski Score: 2, indicating very weak financial strength and investment quality.

Which company has the best scores?

Rigetti Computing shows a much higher Altman Z-Score, suggesting stronger bankruptcy safety, but Pure Storage has a notably higher Piotroski Score, indicating better overall financial health. The scores differ significantly in their financial strength signals.

Grades Comparison

Here is a comparison of recent stock grades from recognized grading companies for Pure Storage, Inc. and Rigetti Computing, Inc.:

Pure Storage, Inc. Grades

The following table summarizes Pure Storage’s latest grades from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Sell | 2025-12-03 |

| Barclays | Maintain | Equal Weight | 2025-12-03 |

| Needham | Maintain | Buy | 2025-12-03 |

| Susquehanna | Downgrade | Neutral | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Wedbush | Maintain | Outperform | 2025-12-03 |

| Lake Street | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-11-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-17 |

Pure Storage’s grades show a balanced mix of Buy, Overweight, and Hold ratings with a single Sell, reflecting a generally positive but cautious sentiment.

Rigetti Computing, Inc. Grades

The following table presents Rigetti Computing’s recent grades from reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Neutral | 2025-11-12 |

| Benchmark | Maintain | Buy | 2025-11-12 |

| B. Riley Securities | Downgrade | Neutral | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-08-13 |

| Needham | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

| Benchmark | Maintain | Buy | 2025-05-15 |

| Needham | Maintain | Buy | 2025-05-14 |

Rigetti’s grades predominantly show Buy ratings with a few Neutral, indicating an overall positive outlook with some recent caution.

Which company has the best grades?

Both companies have an overall Buy consensus, but Pure Storage exhibits a wider range of ratings including Sell and Neutral, while Rigetti shows a stronger concentration of Buy ratings with fewer downgrades. This suggests Rigetti’s grades may indicate a slightly more consistent positive sentiment, potentially influencing investor confidence differently.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Pure Storage, Inc. (PSTG) and Rigetti Computing, Inc. (RGTI) based on the most recent financial and operational data.

| Criterion | Pure Storage, Inc. (PSTG) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| Diversification | Moderate: Balanced revenue from products ($1.7B) and services ($1.47B) in 2025 | Low: Revenue mainly from quantum computing access and research services |

| Profitability | Low profitability: ROIC 2.45%, Net margin 3.37%, shedding value but improving | Very low profitability: Negative ROIC (-24.91%), Net margin deep negative (-1862.72%) |

| Innovation | Strong in storage tech with ongoing ROIC growth | Highly innovative in quantum computing but struggling financially |

| Global presence | Established global footprint with significant product sales | Emerging player with limited global reach |

| Market Share | Significant in data storage market but challenged by competitors | Niche quantum computing market, very small share |

Key takeaways: Pure Storage shows a more balanced business model with improving profitability, but still faces challenges in value creation. Rigetti exhibits strong innovation in a cutting-edge field but suffers from severe financial losses and limited diversification. Investors should weigh growth potential against financial risks carefully.

Risk Analysis

Below is a comparative table of key risks for Pure Storage, Inc. (PSTG) and Rigetti Computing, Inc. (RGTI) based on their latest available data from 2024-2025.

| Metric | Pure Storage, Inc. (PSTG) | Rigetti Computing, Inc. (RGTI) |

|---|---|---|

| Market Risk | Moderate beta 1.26, tech sector volatility | High beta 1.71, emerging quantum tech market volatility |

| Debt level | Low leverage (D/E 0.22), strong interest coverage | Very low leverage (D/E 0.07), but negative interest coverage |

| Regulatory Risk | Moderate, typical for US tech firms | Elevated, quantum computing subject to evolving export controls |

| Operational Risk | Moderate, 6K employees, mature product lines | High, early-stage company with 137 employees and complex tech |

| Environmental Risk | Low, primarily data center energy use | Low but emerging quantum tech energy demands could rise |

| Geopolitical Risk | Moderate, US-based with international sales | High, sensitive quantum tech amid US-China tensions |

In synthesis, Rigetti faces higher operational, market, and geopolitical risks due to its early-stage status and sensitive quantum computing technology exposed to export controls and international tensions. Pure Storage’s risks are more moderate, with solid financial stability but still exposed to typical tech sector fluctuations. Investors should weigh Rigetti’s high growth potential against its significant risk profile.

Which Stock to Choose?

Pure Storage, Inc. (PSTG) shows a favorable income evolution with strong revenue and net income growth over 2021-2025. Its financial ratios reveal a balanced profile with several favorable metrics, moderate profitability, low debt, and a very favorable B- rating.

Rigetti Computing, Inc. (RGTI) experiences unfavorable income trends, marked by negative margins and declining profitability. Its financial ratios are mostly unfavorable, despite low debt levels and a very favorable C rating, reflecting significant operational challenges.

Investors seeking growth potential might find PSTG appealing due to its improving profitability and solid financial stability, whereas those with a tolerance for higher risk and a focus on innovation could interpret RGTI’s profile as a speculative opportunity amid ongoing value destruction.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Pure Storage, Inc. and Rigetti Computing, Inc. to enhance your investment decisions: