In the fast-evolving software application industry, PTC Inc. and Unity Software Inc. stand out as innovative leaders reshaping digital experiences. PTC specializes in industrial digital transformation and augmented reality, while Unity excels in real-time 3D content creation across multiple platforms. Both companies address overlapping markets with distinct strategies, making their comparison essential for investors seeking growth and innovation. Join me as we analyze which company presents the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between PTC Inc. and Unity Software Inc. by providing an overview of these two companies and their main differences.

PTC Inc. Overview

PTC Inc. is a technology company specializing in software and services across the Americas, Europe, and Asia Pacific. It focuses on digital transformation with solutions like ThingWorx for enterprise innovation, Vuforia for augmented reality, and Onshape for product development. PTC also offers lifecycle management software and consulting services, emphasizing scalable, collaborative, and analytics-driven tools for product design and management.

Unity Software Inc. Overview

Unity Software Inc. delivers an interactive real-time 3D content platform, enabling users to create and monetize 2D and 3D content across multiple devices including mobile, PC, consoles, and AR/VR systems. It serves creators like developers, artists, and designers through direct sales and distribution globally. Founded in 2004 and headquartered in San Francisco, Unity is positioned as a leader in real-time content creation technology.

Key similarities and differences

Both companies operate in the software application industry, focusing on innovative technology platforms that support digital content and product development. PTC emphasizes enterprise digital transformation and product lifecycle management, while Unity specializes in real-time interactive 3D content creation for diverse media and devices. Their business models share a technology-driven approach but differ in target markets and primary applications, with PTC oriented toward industrial and professional services and Unity toward creative and entertainment sectors.

Income Statement Comparison

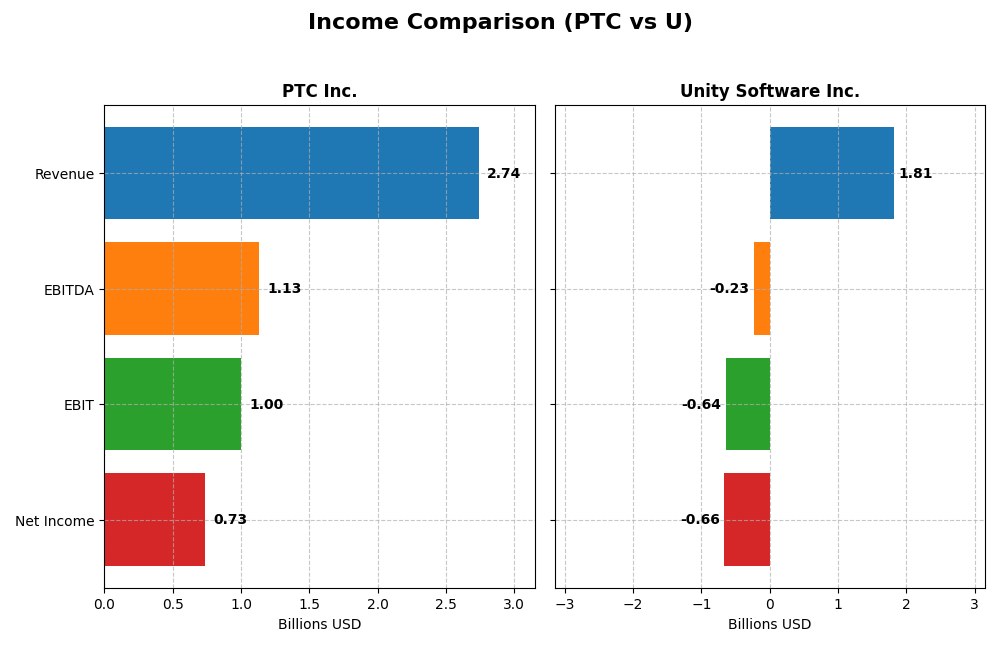

The table below provides a side-by-side comparison of key income statement metrics for PTC Inc. and Unity Software Inc. for their most recent fiscal years.

| Metric | PTC Inc. | Unity Software Inc. |

|---|---|---|

| Market Cap | 19.9B | 17.5B |

| Revenue | 2.74B | 1.81B |

| EBITDA | 1.13B | -235M |

| EBIT | 997M | -644M |

| Net Income | 734M | -664M |

| EPS | 6.18 | -1.68 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

PTC Inc.

From 2021 to 2025, PTC Inc. showed consistent revenue growth, reaching $2.74B in 2025, with net income rising to $734M. Margins remained strong and stable, with a gross margin of 83.76% and net margin of 26.8% in the latest year. The 2025 fiscal year saw significant growth in revenue (19.18%) and net income (96.79%), indicating improved profitability and operational efficiency.

Unity Software Inc.

Unity Software experienced growth in revenue from $772M in 2020 to $1.81B in 2024 but reported net losses, with a net income of -$664M in 2024. Gross margin was favorable at 73.48%, but EBIT and net margins were negative, reflecting ongoing operational challenges. The latest year showed a 17.1% decline in revenue and modest improvements in EBIT and EPS, signaling some operational recovery despite losses.

Which one has the stronger fundamentals?

PTC Inc. demonstrates stronger fundamentals with sustained revenue and net income growth, favorable margins, and positive earnings trends. In contrast, Unity Software, despite solid revenue expansion, shows persistent net losses and unfavorable profitability metrics. PTC’s consistent profitability and margin improvements contrast with Unity’s ongoing operational deficits and margin pressures.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for PTC Inc. and Unity Software Inc. based on their most recent fiscal year data.

| Ratios | PTC Inc. (2025) | Unity Software Inc. (2024) |

|---|---|---|

| ROE | 19.18% | -20.81% |

| ROIC | 14.43% | -12.78% |

| P/E | 33.19 | -13.40 |

| P/B | 6.37 | 2.79 |

| Current Ratio | 1.12 | 2.50 |

| Quick Ratio | 1.12 | 2.50 |

| D/E (Debt-to-Equity) | 0.36 | 0.74 |

| Debt-to-Assets | 20.70% | 34.94% |

| Interest Coverage | 12.76 | -32.08 |

| Asset Turnover | 0.41 | 0.27 |

| Fixed Asset Turnover | 15.58 | 18.35 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

PTC Inc.

PTC Inc. shows a generally favorable financial profile with strong net margin (26.8%), ROE (19.18%), and ROIC (14.43%), indicating efficient profitability and capital use. However, valuation ratios like PE (33.19) and PB (6.37) appear high, suggesting potential overvaluation risks. The company does not pay dividends, possibly reinvesting earnings to fuel growth and innovation.

Unity Software Inc.

Unity Software Inc. faces challenges with negative net margin (-36.63%), ROE (-20.81%), and ROIC (-12.78%), reflecting ongoing losses and inefficient capital use. It holds a favorable PE ratio (-13.4) due to negative earnings but struggles with interest coverage (-27.34). Unity also does not pay dividends, likely prioritizing reinvestment in R&D and expansion during its growth phase.

Which one has the best ratios?

PTC Inc. has a more favorable overall ratio profile, with a majority of strong profitability and solvency metrics, despite some valuation concerns. Unity Software’s ratios are mostly unfavorable, reflecting financial strain and negative returns. Based on these evaluations, PTC’s ratios present a stronger and more stable financial condition compared to Unity’s.

Strategic Positioning

This section compares the strategic positioning of PTC Inc. and Unity Software Inc., including their market position, key segments, and exposure to technological disruption:

PTC Inc.

- Established software company with $19.9B market cap, moderate beta, NASDAQ-listed

- Diverse segments: License, Technology Services, Support and Cloud Services driving growth

- Operates digital transformation, AR, CAD, and PLM software with scalable platforms

Unity Software Inc.

- Interactive 3D platform leader, $17.5B market cap, higher beta, NYSE-listed

- Focused on Create and Operate Solutions for 2D/3D content creation and monetization

- Platform supports mobile, PC, consoles, AR/VR devices, targeting content creators

PTC vs Unity Positioning

PTC offers a diversified portfolio across software licenses and cloud services, benefiting from broader enterprise adoption. Unity concentrates on interactive 3D content platforms, focusing on real-time creation and monetization, which exposes it to niche market fluctuations.

Which has the best competitive advantage?

PTC demonstrates a very favorable moat with growing ROIC exceeding WACC, indicating durable competitive advantage and value creation. Unity shows a very unfavorable moat with declining ROIC below WACC, reflecting value destruction and weaker competitive positioning.

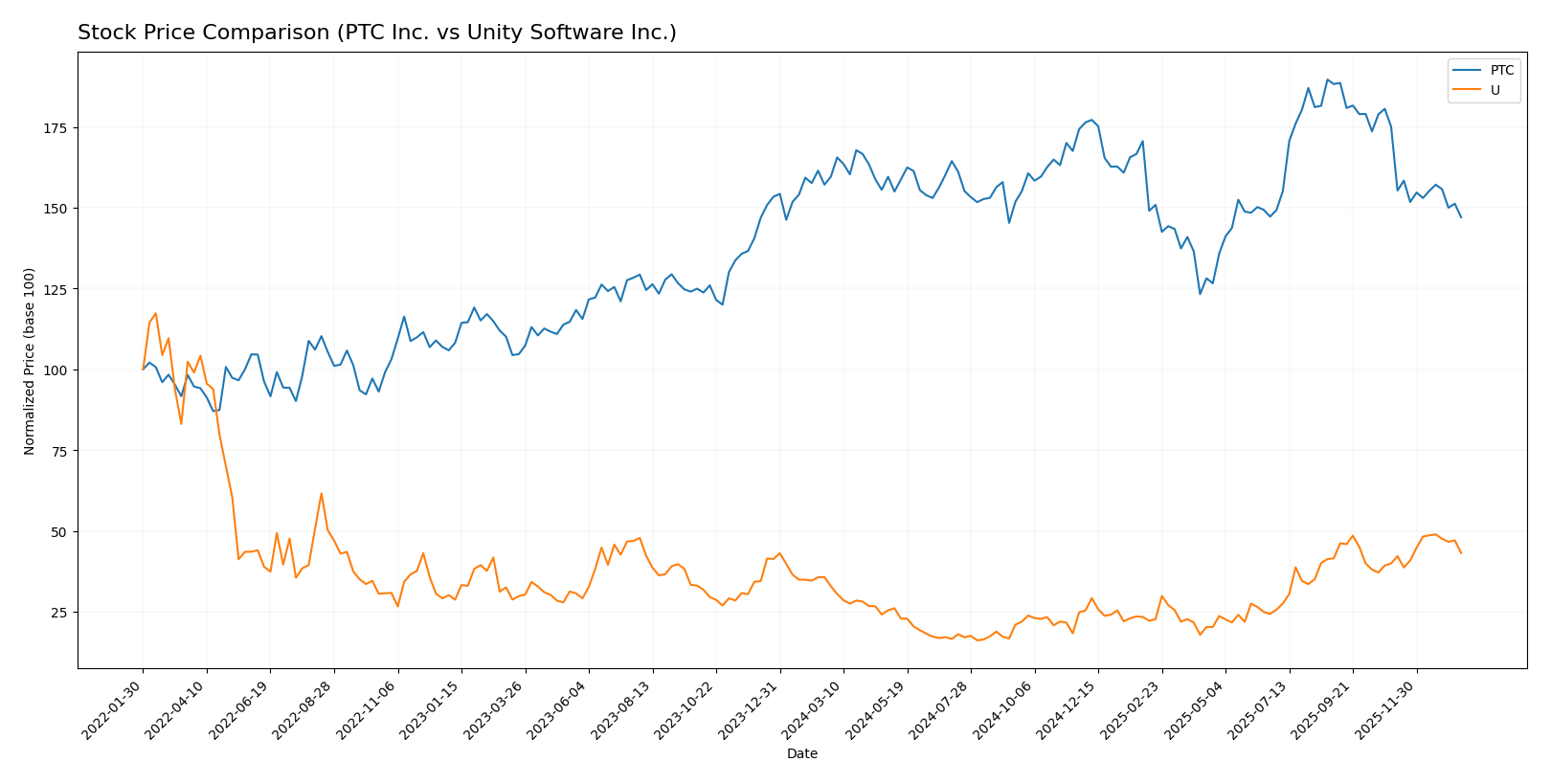

Stock Comparison

The stock price movements of PTC Inc. and Unity Software Inc. over the past 12 months reveal contrasting dynamics, with PTC showing a declining trend and Unity exhibiting strong upward momentum.

Trend Analysis

PTC Inc.’s stock price declined by 7.84% over the past year, indicating a bearish trend with deceleration. The price ranged between 139.77 and 215.05, with a high volatility level evidenced by a 15.47 standard deviation. Recent months show an accelerated decline of 16.01%.

Unity Software Inc.’s stock price increased by 31.0% over the past year, reflecting a bullish trend with accelerating momentum. The price fluctuated between 15.32 and 46.42, with moderate volatility at 9.04 standard deviation. The recent trend remains positive with an 8.05% gain and strong buyer dominance.

Comparing both stocks, Unity Software Inc. delivered the highest market performance with a 31.0% increase, significantly outperforming PTC Inc.’s 7.84% loss over the analyzed period.

Target Prices

Analysts present a clear consensus on target prices for PTC Inc. and Unity Software Inc., reflecting optimistic outlooks.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| PTC Inc. | 255 | 120 | 213.25 |

| Unity Software Inc. | 60 | 39 | 50.98 |

The consensus target prices for PTC Inc. and Unity Software Inc. suggest potential upside from their current prices of $166.75 and $40.95, indicating analyst confidence in growth prospects.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for PTC Inc. and Unity Software Inc.:

Rating Comparison

PTC Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a favorable valuation outlook.

- ROE Score: 4, showing efficient profit generation from equity.

- ROA Score: 5, reflecting very effective asset utilization.

- Debt To Equity Score: 2, showing moderate financial risk with some debt.

- Overall Score: 3, representing a moderate overall financial standing.

Unity Rating

- Rating: D+, considered very unfavorable by analysts.

- Discounted Cash Flow Score: 1, signaling a very unfavorable valuation outlook.

- ROE Score: 1, indicating very unfavorable equity profit generation.

- ROA Score: 1, reflecting very unfavorable asset utilization.

- Debt To Equity Score: 1, indicating very unfavorable financial risk.

- Overall Score: 1, representing a very unfavorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, PTC is better rated overall with a B+ rating and higher scores across all key financial metrics compared to Unity’s D+ rating and consistently lower scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

PTC Scores

- Altman Z-Score: 5.67, in the safe zone, low bankruptcy risk

- Piotroski Score: 8, very strong financial health

Unity Scores

- Altman Z-Score: 2.93, in the grey zone, moderate bankruptcy risk

- Piotroski Score: 4, average financial strength

Which company has the best scores?

PTC shows stronger financial health with a safe zone Altman Z-Score and a very strong Piotroski Score. Unity’s scores indicate moderate risk and average strength, positioning PTC ahead based on the provided data.

Grades Comparison

Here is a detailed comparison of the recent grades awarded to PTC Inc. and Unity Software Inc.:

PTC Inc. Grades

This table shows recent grades and actions from reputable grading companies for PTC Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | maintain | Neutral | 2025-11-07 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-10-30 |

| Oppenheimer | maintain | Outperform | 2025-07-31 |

| Rosenblatt | maintain | Buy | 2025-07-31 |

| Barclays | maintain | Overweight | 2025-07-31 |

| Stifel | maintain | Buy | 2025-07-31 |

| Keybanc | maintain | Overweight | 2025-07-31 |

| RBC Capital | maintain | Outperform | 2025-07-31 |

| Piper Sandler | maintain | Neutral | 2025-07-31 |

PTC Inc. has mostly maintained positive grades such as Buy, Outperform, and Overweight, with a few Neutral ratings, indicating a stable and generally favorable outlook.

Unity Software Inc. Grades

Below are recent grades and actions from verified grading companies for Unity Software Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Overweight | 2026-01-13 |

| Goldman Sachs | maintain | Neutral | 2026-01-13 |

| Wells Fargo | maintain | Overweight | 2026-01-08 |

| Jefferies | maintain | Buy | 2026-01-05 |

| Piper Sandler | upgrade | Overweight | 2025-12-11 |

| BTIG | upgrade | Buy | 2025-12-11 |

| Wells Fargo | upgrade | Overweight | 2025-12-05 |

| Arete Research | upgrade | Buy | 2025-12-01 |

| Citigroup | maintain | Buy | 2025-11-11 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

Unity Software shows a positive trend with multiple upgrades to Buy and Overweight ratings, indicating growing confidence by analysts.

Which company has the best grades?

Both PTC Inc. and Unity Software Inc. hold a consensus Buy rating, but Unity Software displays a more recent and consistent upgrade trend toward Overweight and Buy grades. This could signal stronger analyst conviction and potential for positive investor sentiment compared to PTC’s steady but less dynamic grade profile.

Strengths and Weaknesses

Below is a comparison table outlining the key strengths and weaknesses of PTC Inc. and Unity Software Inc. based on their latest financial and operational data.

| Criterion | PTC Inc. | Unity Software Inc. |

|---|---|---|

| Diversification | Strong revenue streams from License, Technology Services, and Support & Cloud Services, showing balanced product segments. | Revenue concentrated in Create and Operate Solutions, with less diversification across product types. |

| Profitability | High net margin (26.8%), positive ROIC (14.43%), and favorable ROE (19.18%), indicating solid profitability. | Negative net margin (-36.63%), negative ROIC (-12.78%), reflecting ongoing operating losses and unprofitable status. |

| Innovation | Demonstrates durable competitive advantage with growing ROIC, suggesting successful innovation and efficiency improvements. | Declining ROIC and value destruction indicate challenges in sustaining innovation and profitability. |

| Global presence | Well-established global footprint with consistent revenue growth across multiple service lines. | Expanding but still developing global presence, focused mainly on digital and software solutions. |

| Market Share | Established player with strong market positioning in industrial software solutions. | Emerging competitor in real-time 3D content creation, still fighting for market share and profitability. |

In summary, PTC Inc. exhibits strong profitability, diversification, and a durable competitive moat, making it a more stable investment. Unity Software struggles with profitability and value creation, signaling higher risk despite its innovative product focus.

Risk Analysis

Below is a comparison of key risks for PTC Inc. and Unity Software Inc. based on the most recent data from 2025 and 2024 respectively:

| Metric | PTC Inc. | Unity Software Inc. |

|---|---|---|

| Market Risk | Moderate (Beta ~1.01) | High (Beta ~2.05) |

| Debt level | Low (D/E 0.36, favorable) | Moderate-High (D/E 0.74, neutral) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Low (Strong financial scores) | High (Negative margins, losses) |

| Environmental Risk | Moderate | Moderate |

| Geopolitical Risk | Moderate (Global operations) | Moderate (Global operations) |

PTC Inc. shows a favorable financial profile with low debt and stable operations, making operational and debt risks less concerning. Unity Software faces higher market and operational risks due to volatility, consistent losses, and a borderline Altman Z-Score, indicating moderate financial distress risk. Investors should weigh Unity’s growth potential against its elevated risk profile carefully.

Which Stock to Choose?

PTC Inc. has shown a favorable income evolution with strong revenue and net income growth over 2021-2025. Its financial ratios reveal solid profitability, moderate debt levels, and a very favorable rating of B+, indicating reliable financial health and efficient capital use.

Unity Software Inc. presents an unfavorable income statement characterized by negative net margins and declining profitability over 2020-2024. Its financial ratios are mostly unfavorable or neutral, reflecting financial strain and a very unfavorable rating of D+, suggesting ongoing challenges in value creation.

Considering ratings and overall financial evaluations, PTC might appear more suitable for risk-averse or quality-focused investors due to its durable competitive advantage and stable profitability, while Unity may appeal to risk-tolerant investors attracted by recent bullish price trends and growth potential despite current weaknesses.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of PTC Inc. and Unity Software Inc. to enhance your investment decisions: