In the fast-evolving software application industry, PTC Inc. and SoundHound AI, Inc. stand out with distinct yet overlapping innovation strategies. PTC focuses on digital transformation and product lifecycle solutions, while SoundHound pioneers conversational AI platforms. Both companies address the technology sector with promising growth potential, making them compelling candidates for investment. This article will help you decide which company offers the most attractive opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between PTC Inc. and SoundHound AI by providing an overview of these two companies and their main differences.

PTC Inc. Overview

PTC Inc. is a software and services company headquartered in Boston, Massachusetts, operating primarily in the Americas, Europe, and Asia Pacific. It offers a comprehensive portfolio of digital transformation tools including the ThingWorx platform, Vuforia augmented reality, and Onshape SaaS product development. Its solutions focus on enabling enterprises to innovate and accelerate time to value in product design, lifecycle management, and service parts management.

SoundHound AI Overview

SoundHound AI, based in Santa Clara, California, develops a voice artificial intelligence platform designed to enhance conversational experiences across industries. Its flagship Houndify platform provides tools like automatic speech recognition, natural language understanding, and text-to-speech to help brands build customized voice assistants. The company focuses on embedding voice solutions to improve customer interaction quality.

Key similarities and differences

Both PTC and SoundHound AI operate in the software application industry within the technology sector in the US, but they serve distinct niches. PTC emphasizes digital transformation and product lifecycle management with software and services for enterprises, while SoundHound AI specializes in voice AI platforms for conversational interfaces. PTC has a larger market capitalization and workforce compared to SoundHound AI, reflecting their different scales and business focuses.

Income Statement Comparison

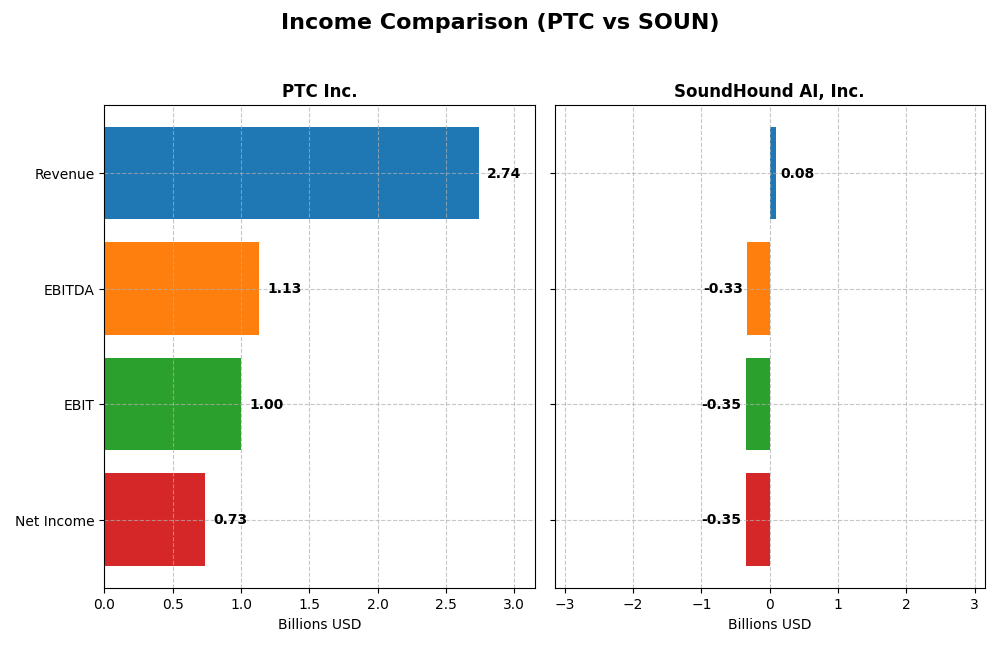

Below is a side-by-side comparison of key income statement metrics for PTC Inc. and SoundHound AI, Inc. for their most recent fiscal years.

| Metric | PTC Inc. (2025) | SoundHound AI, Inc. (2024) |

|---|---|---|

| Market Cap | 19.9B | 4.7B |

| Revenue | 2.74B | 85M |

| EBITDA | 1.13B | -329M |

| EBIT | 997M | -348M |

| Net Income | 734M | -351M |

| EPS | 6.18 | -1.04 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

PTC Inc.

PTC Inc. showed consistent revenue growth from 2021 to 2025, reaching $2.74B in 2025, with net income rising to $734M. Margins remained strong and stable, with a gross margin of 83.76% and a net margin of 26.8% in 2025. The latest year highlighted robust growth, with a 19.18% revenue increase and a 96.79% rise in EPS, reflecting improved profitability.

SoundHound AI, Inc.

SoundHound AI experienced rapid revenue growth, jumping 84.62% in 2024 to $85M, yet it remained unprofitable with a net loss of $351M. Gross margin was favorable at 48.86%, but EBIT and net margins were significantly negative, reflecting high operating expenses and interest costs. The latest year showed widening losses despite revenue gains, indicating ongoing challenges in cost control.

Which one has the stronger fundamentals?

PTC Inc. demonstrates stronger fundamentals with favorable profitability metrics, stable and growing margins, and positive net income trends. In contrast, SoundHound AI, despite high revenue growth, suffers from persistent net losses and unfavorable margins, resulting in a weaker overall income statement profile. PTC’s financial stability and margin strength position it ahead in fundamental quality.

Financial Ratios Comparison

The table below compares key financial ratios for PTC Inc. and SoundHound AI, Inc. based on their most recent fiscal year data, offering insight into profitability, liquidity, leverage, and market valuation.

| Ratios | PTC Inc. (2025 FY) | SoundHound AI, Inc. (2024 FY) |

|---|---|---|

| ROE | 19.18% | -191.99% |

| ROIC | 14.43% | -68.13% |

| P/E | 33.19 | -19.15 |

| P/B | 6.37 | 36.76 |

| Current Ratio | 1.12 | 3.77 |

| Quick Ratio | 1.12 | 3.77 |

| D/E (Debt-to-Equity) | 0.36 | 0.02 |

| Debt-to-Assets | 20.70% | 0.79% |

| Interest Coverage | 12.76 | -28.05 |

| Asset Turnover | 0.41 | 0.15 |

| Fixed Asset Turnover | 15.58 | 14.28 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

PTC Inc.

PTC shows a generally favorable financial profile with strong net margin (26.8%), return on equity (19.18%), and return on invested capital (14.43%). However, its high price-to-earnings (33.19) and price-to-book (6.37) ratios are less attractive. The company does not pay dividends, reflecting a reinvestment strategy rather than shareholder payouts.

SoundHound AI, Inc.

SoundHound’s ratios reveal significant challenges, including highly negative net margin (-414.06%), return on equity (-191.99%), and return on invested capital (-68.13%). Despite a low debt-to-equity ratio (0.02), its high price-to-book (36.76) and negative interest coverage indicate financial stress. No dividends are paid, consistent with ongoing investment in growth and development.

Which one has the best ratios?

PTC exhibits a more balanced and favorable ratio set, with positive profitability and moderate leverage metrics, contrasting with SoundHound’s predominantly unfavorable and negative performance ratios. Overall, PTC’s financial ratios suggest a stronger position compared to SoundHound’s current financial challenges.

Strategic Positioning

This section compares the strategic positioning of PTC and SoundHound AI, including market position, key segments, and exposure to technological disruption:

PTC

- Established software leader with $19.9B market cap, moderate beta, facing typical sector competition.

- Diverse software portfolio: CAD, PLM, IoT platforms, licensing, cloud services, and consulting.

- Exposure through software innovation in AR, digital transformation, and SaaS product development.

SoundHound AI

- Smaller player with $4.7B market cap, high beta, operating in a competitive AI voice platform market.

- Focused on voice AI solutions, including speech recognition and conversational platforms.

- Dependent on AI advancements with products centered on voice-enabled conversational experiences.

PTC vs SoundHound AI Positioning

PTC shows a diversified business with multiple software segments and service offerings, supporting stable revenue streams. SoundHound AI concentrates on voice AI technology, which may offer growth but also higher volatility and competitive risk.

Which has the best competitive advantage?

PTC demonstrates a very favorable moat with growing ROIC above WACC, indicating durable competitive advantage. SoundHound AI has a slightly unfavorable moat, shedding value despite improving profitability, reflecting a weaker competitive position.

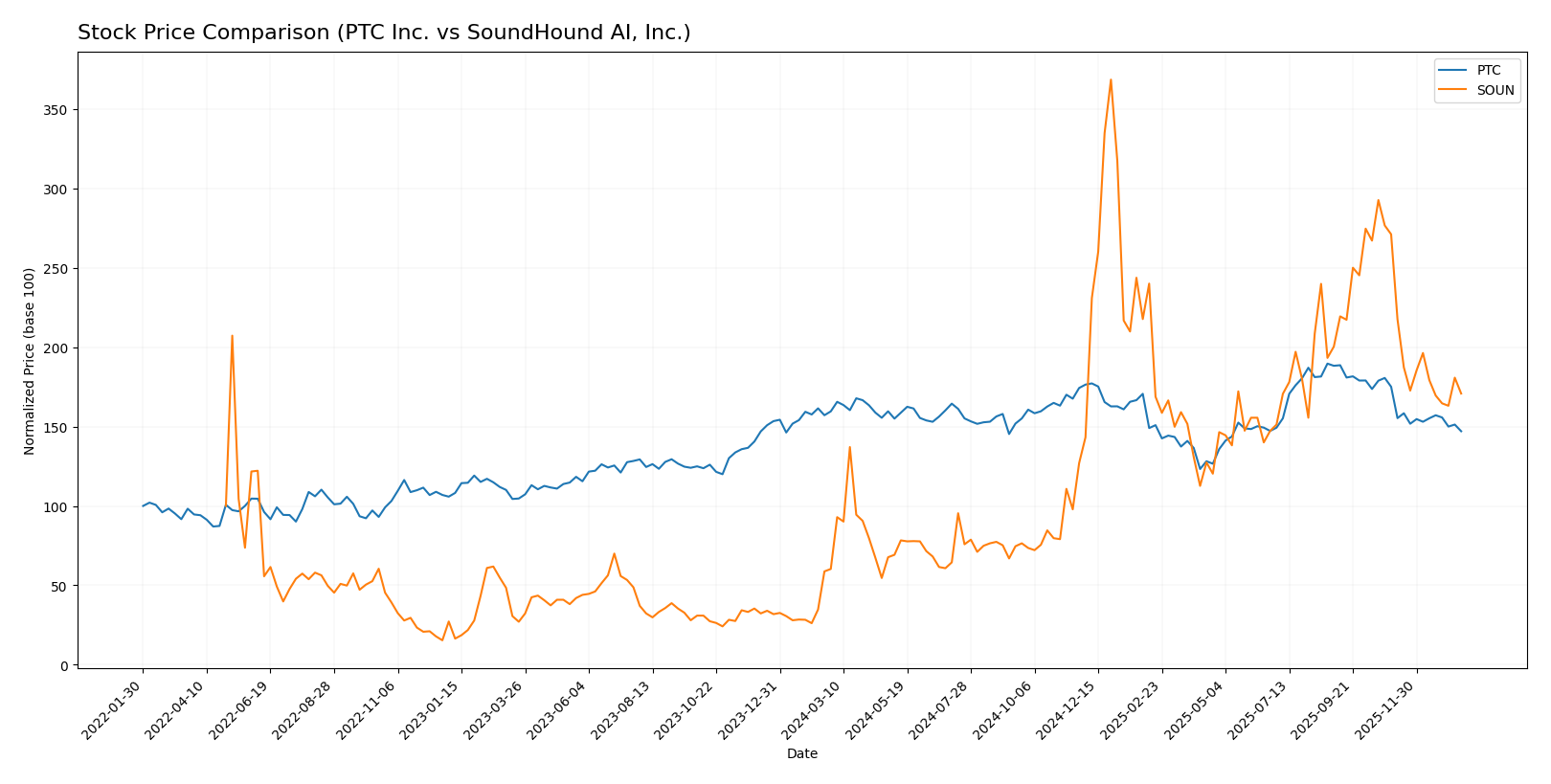

Stock Comparison

The stock price movements over the past 12 months reveal contrasting dynamics, with PTC Inc. showing a bearish trend marked by a deceleration in decline, while SoundHound AI, Inc. experienced a strong bullish run despite recent downward pressure.

Trend Analysis

PTC Inc.’s stock exhibited a bearish trend over the past year with a -7.84% price change, accompanied by deceleration in the decline and high volatility (std deviation 15.47). Recent months intensified the drop (-16.01%).

SoundHound AI, Inc. recorded a bullish trend with a significant 183.16% gain over the year, though the acceleration slowed. Recent trading shows a sharp pullback of -37.0%, with lower volatility (std deviation 4.66).

Comparing both, SoundHound AI outperformed PTC with the highest overall market performance, despite both stocks facing recent downward pressure.

Target Prices

The current target price consensus from verified analysts shows promising upside potential for both PTC Inc. and SoundHound AI, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| PTC Inc. | 255 | 120 | 213.25 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

Analysts expect PTC’s stock to rise significantly above its current price of $166.75, reflecting strong confidence. SoundHound’s consensus target also suggests moderate growth potential from its current $11.10 level.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for PTC Inc. and SoundHound AI, Inc.:

Rating Comparison

PTC Rating

- Rating: B+, indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 4, a favorable valuation metric.

- ROE Score: 4, showing efficient profit generation from equity.

- ROA Score: 5, demonstrating very favorable asset utilization.

- Debt To Equity Score: 2, a moderate financial risk level.

- Overall Score: 3, representing a moderate overall rating.

SOUN Rating

- Rating: C-, reflecting a very unfavorable overall evaluation.

- Discounted Cash Flow Score: 1, a very unfavorable valuation metric.

- ROE Score: 1, indicating very unfavorable profit generation.

- ROA Score: 1, with very unfavorable asset utilization.

- Debt To Equity Score: 4, a favorable financial risk position.

- Overall Score: 1, indicating a very unfavorable overall rating.

Which one is the best rated?

Based strictly on the data, PTC has superior ratings across most financial scores, including cash flow, ROE, and ROA, compared to SoundHound AI, which only scores favorably on debt to equity. This makes PTC the better rated company.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

PTC Scores

- Altman Z-Score: 5.67, indicating a safe zone and low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

SoundHound Scores

- Altman Z-Score: 6.62, indicating a safe zone and low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial health.

Which company has the best scores?

Based on the provided scores, SoundHound has a slightly higher Altman Z-Score, suggesting a marginally lower bankruptcy risk. However, PTC shows a much stronger Piotroski Score, indicating better overall financial strength.

Grades Comparison

Here is a comparison of the latest grades assigned to PTC Inc. and SoundHound AI, Inc. by recognized grading firms:

PTC Inc. Grades

This table summarizes recent grades from established grading companies for PTC Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-10-30 |

| Oppenheimer | Maintain | Outperform | 2025-07-31 |

| Rosenblatt | Maintain | Buy | 2025-07-31 |

| Barclays | Maintain | Overweight | 2025-07-31 |

| Stifel | Maintain | Buy | 2025-07-31 |

| Keybanc | Maintain | Overweight | 2025-07-31 |

| RBC Capital | Maintain | Outperform | 2025-07-31 |

| Piper Sandler | Maintain | Neutral | 2025-07-31 |

Overall, PTC Inc. maintains a consensus leaning toward a Buy rating, with multiple firms consistently affirming positive grades and no recent downgrades.

SoundHound AI, Inc. Grades

The following table lists recent grades from reputable grading firms for SoundHound AI, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI shows a generally positive rating trend, with upgrades and multiple Buy and Outperform ratings reinforcing a bullish outlook.

Which company has the best grades?

Both companies hold a consensus Buy rating, but PTC Inc. has a higher volume of Buy and Outperform grades from large firms, indicating stronger analyst confidence. This may reflect greater perceived stability or growth potential, impacting investor sentiment accordingly.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for PTC Inc. and SoundHound AI, Inc., based on the most recent financial and market data.

| Criterion | PTC Inc. | SoundHound AI, Inc. |

|---|---|---|

| Diversification | Strong diversification with License, Technology Service, and Support & Cloud Services generating over $2.9B combined in 2025 | Limited diversification, mainly Hosted Services, Licensing, and Professional Services totaling approx. $85M in 2024 |

| Profitability | Highly profitable: 26.8% net margin, 19.18% ROE, 14.43% ROIC as of 2025 | Negative profitability: -414% net margin, -192% ROE, and -68% ROIC as of 2024 |

| Innovation | Consistent growth in ROIC (+42.4%) indicates effective innovation and value creation | ROIC increasing (+57.2%) but still negative, showing early-stage innovation with improving but weak profitability |

| Global presence | Strong global footprint with durable competitive advantage and growing profitability | Smaller scale with less global reach, still building market presence and competitiveness |

| Market Share | Significant market share in CAD and PLM software markets, supported by recurring revenues | Emerging player in AI voice tech, with small market share and volatile financials |

Key takeaways: PTC Inc. exhibits strong profitability, diversification, and a durable competitive advantage, making it a stable value creator. SoundHound AI shows promising innovation growth but suffers from poor profitability and a limited market footprint, implying higher investment risk.

Risk Analysis

Below is a comparative table summarizing key risks for PTC Inc. and SoundHound AI, Inc. based on the most recent data available for 2025 and 2024 respectively.

| Metric | PTC Inc. | SoundHound AI, Inc. |

|---|---|---|

| Market Risk | Moderate (Beta ~1.01) | High (Beta ~2.88) |

| Debt level | Low (D/E ~0.36, Debt/Assets 20.7%) | Very Low (D/E ~0.02, Debt/Assets <1%) |

| Regulatory Risk | Moderate (Tech sector compliance) | Moderate (Emerging AI regulations) |

| Operational Risk | Moderate (Global operations complexity) | High (Smaller scale, growth phase) |

| Environmental Risk | Low (Software company with minimal footprint) | Low (Software-focused, limited impact) |

| Geopolitical Risk | Moderate (Global presence in Americas, Europe, Asia) | Low (Primarily US-focused) |

In synthesis, SoundHound AI carries higher market and operational risks due to its smaller size, growth volatility, and high beta, despite very low leverage. PTC shows moderate financial and geopolitical risks but benefits from strong financial health and diversified global presence. Investors should weigh SoundHound’s high volatility and weak profitability against PTC’s stable but moderately priced profile.

Which Stock to Choose?

PTC Inc. shows favorable income evolution with strong revenue and net income growth, supported by robust profitability margins. Its financial ratios are mostly favorable, including a solid ROE of 19.18% and manageable debt levels. The company maintains a very favorable moat with growing ROIC above WACC and holds a strong B+ rating.

SoundHound AI, Inc. exhibits rapid revenue growth but suffers from significant net losses and negative profitability ratios. Its financial ratios are predominantly unfavorable, with negative ROE and ROIC, despite a very low debt ratio. The company’s moat status is slightly unfavorable due to value destruction, reflected in a weak C- rating.

For investors prioritizing stability and strong profitability, PTC might appear more favorable given its durable competitive advantage and solid financial health, whereas those focused on high-growth potential but willing to accept higher risk could see SoundHound’s rapid revenue expansion as a signal. Each profile could interpret the data differently depending on risk tolerance and investment goals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of PTC Inc. and SoundHound AI, Inc. to enhance your investment decisions: