In the dynamic world of technology, Shopify Inc. and PTC Inc. stand out as leaders in software applications, each driving innovation in distinct yet overlapping market segments. Shopify excels in commerce platforms empowering merchants globally, while PTC focuses on digital transformation and product lifecycle solutions. This comparison will explore their strategies, growth potential, and market presence to help you decide which company presents the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Shopify and PTC by providing an overview of these two companies and their main differences.

Shopify Overview

Shopify Inc. is a commerce company headquartered in Ottawa, Canada, offering a comprehensive platform that enables merchants to display, manage, market, and sell products across multiple channels including web, mobile, social media, and physical stores. The company supports merchants with inventory management, payment processing, order fulfillment, analytics, and financing. With a market cap of 205B USD and 8,100 employees, Shopify operates globally in the technology sector.

PTC Overview

PTC Inc., based in Boston, Massachusetts, is a software and services company specializing in digital transformation solutions. Its offerings include platforms for augmented reality, product lifecycle management, computer-aided design, and application lifecycle management, serving enterprises worldwide. PTC has a market cap of approximately 20B USD and employs 7,512 people, focusing on scalable, innovative software products and professional services in the technology industry.

Key similarities and differences

Both Shopify and PTC operate in the software application industry and serve global markets with technology-driven solutions. Shopify focuses on commerce platforms enabling merchants to sell and manage products across various sales channels, while PTC emphasizes digital transformation and product development software. Shopify’s business model centers on enabling commerce operations, whereas PTC provides specialized enterprise software for design, collaboration, and lifecycle management. Their market caps and employee sizes differ significantly, reflecting distinct scale and focus areas.

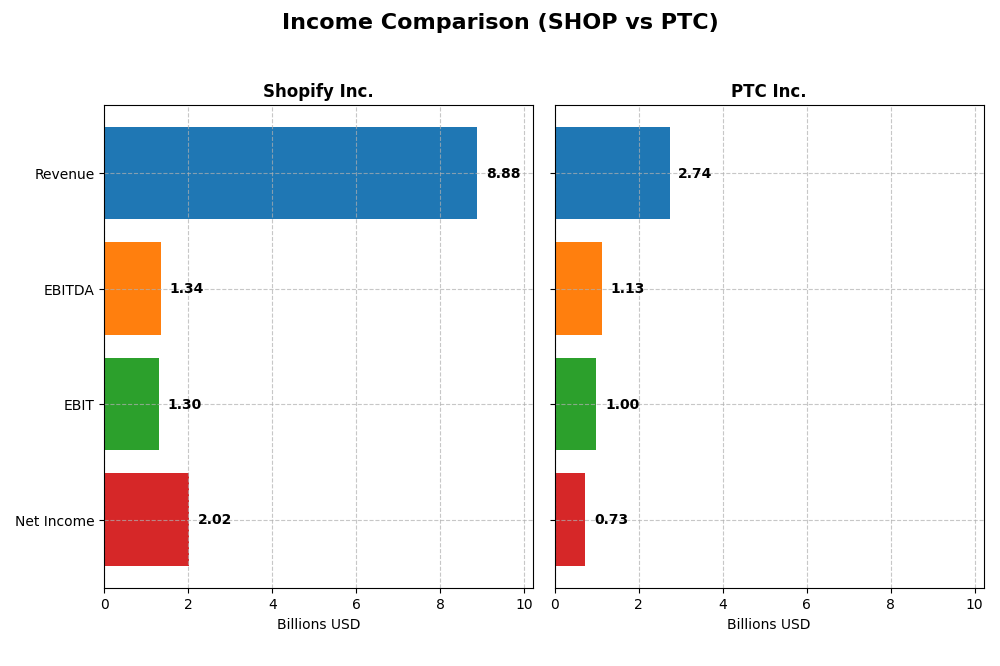

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Shopify Inc. and PTC Inc. for their most recent fiscal years, providing a snapshot of their financial performance.

| Metric | Shopify Inc. (2024) | PTC Inc. (2025) |

|---|---|---|

| Market Cap | 205B | 19.9B |

| Revenue | 8.88B | 2.74B |

| EBITDA | 1.34B | 1.13B |

| EBIT | 1.30B | 997M |

| Net Income | 2.02B | 734M |

| EPS | 1.56 | 6.18 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Shopify Inc.

Shopify’s revenue rose sharply from $2.9B in 2020 to $8.9B in 2024, reflecting a strong growth trajectory. Net income showed significant volatility but surged to $2.0B in 2024 after a steep loss in 2022. Margins improved substantially, with the gross margin at 50.36% and net margin reaching 22.74% in 2024, indicating enhanced profitability and operational efficiency.

PTC Inc.

PTC exhibited steady revenue growth from $1.8B in 2021 to $2.7B in 2025, with net income increasing from $477M to $734M over the same period. The company maintained high margins, including an 83.76% gross margin and a 26.8% net margin in 2025. Recent growth rates slowed compared to Shopify but remained favorable, with positive improvements in profitability metrics.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement fundamentals, with Shopify showing exceptional revenue and net income growth and improving margins after prior losses. PTC maintains consistently high margins and steady growth but with less dramatic changes. Shopify’s rapid expansion contrasts with PTC’s stable performance, highlighting different growth dynamics and risk profiles.

Financial Ratios Comparison

The table below compares key financial ratios for Shopify Inc. (SHOP) and PTC Inc. (PTC) based on their most recent fiscal year data, providing insights into profitability, liquidity, leverage, and efficiency.

| Ratios | Shopify Inc. (2024) | PTC Inc. (2025) |

|---|---|---|

| ROE | 17.47% | 19.18% |

| ROIC | 7.55% | 14.43% |

| P/E | 68.18 | 33.19 |

| P/B | 11.91 | 6.37 |

| Current Ratio | 3.71 | 1.12 |

| Quick Ratio | 3.70 | 1.12 |

| D/E | 0.097 | 0.358 |

| Debt-to-Assets | 8.09% | 20.70% |

| Interest Coverage | 0 | 12.76 |

| Asset Turnover | 0.64 | 0.41 |

| Fixed Asset Turnover | 63.43 | 15.58 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Shopify Inc.

Shopify exhibits a mix of strong and weak ratios, with favorable net margin at 22.74% and return on equity at 17.47%. However, its high price-to-earnings ratio of 68.18 and elevated price-to-book of 11.91 indicate overvaluation concerns. The company does not pay dividends, reflecting a reinvestment strategy common in high-growth phases, without share buyback programs reported.

PTC Inc.

PTC shows generally stronger profitability ratios, with net margin at 26.8%, ROE at 19.18%, and a favorable return on invested capital at 14.43%. Despite unfavorable valuation multiples like a PE of 33.19 and PB of 6.37, its liquidity and debt coverage remain solid. PTC also does not pay dividends, likely prioritizing growth and R&D investments over shareholder payouts.

Which one has the best ratios?

PTC holds a slight edge with 57.14% favorable ratios compared to Shopify’s 50%, alongside stronger returns on capital and better interest coverage. Shopify’s higher leverage and valuation multiples present some caution. Both companies refrain from dividends, focusing on reinvestment, but PTC’s overall balance of profitability and financial health is more favorable.

Strategic Positioning

This section compares the strategic positioning of Shopify Inc. and PTC Inc., including market position, key segments, and exposure to technological disruption:

Shopify Inc.

- Leading global commerce platform with broad competitive pressure in e-commerce software.

- Key segments include Merchant Solutions and Subscription Solutions driving growth and revenue.

- Exposed to disruption in commerce technology but benefits from scalable platform and services.

PTC Inc.

- Mid-sized software provider with moderate competitive pressure in product lifecycle management.

- Focuses on software products and professional services, including PLM, CAD, and AR solutions.

- Faces disruption risks in digital transformation solutions but offers innovative AR and SaaS tools.

Shopify Inc. vs PTC Inc. Positioning

Shopify’s approach is concentrated on commerce platforms with global reach, emphasizing merchant and subscription solutions. PTC adopts a diversified software product and service model focused on industrial digital transformation, including AR and PLM. Shopify leverages scale, while PTC emphasizes innovation in specialized software.

Which has the best competitive advantage?

PTC shows a very favorable moat with ROIC above WACC and growing profitability, indicating a durable competitive advantage. Shopify’s moat is slightly unfavorable with value destruction despite improving ROIC, signaling weaker competitive sustainability.

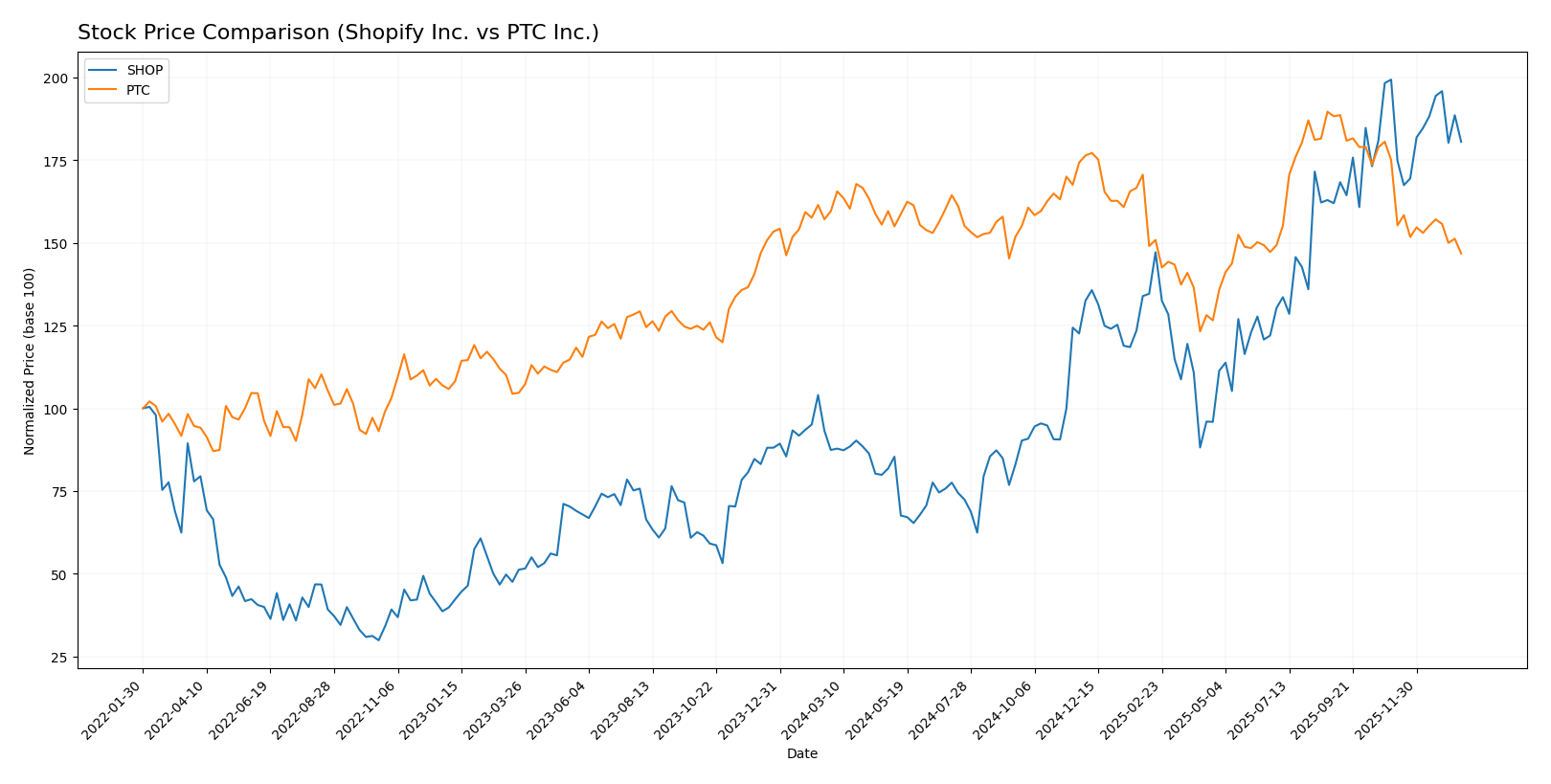

Stock Comparison

The stock price chart over the past 12 months highlights Shopify Inc.’s significant 106.53% gain with decelerating momentum, contrasted by PTC Inc.’s 8.0% decline and easing bearish trend, reflecting differing investor sentiment and market dynamics.

Trend Analysis

Shopify Inc.’s stock exhibited a strong bullish trend over the past year, rising 106.53% with decelerating acceleration and a volatility measure of 33.71. Its highest and lowest prices were 173.86 and 54.43, respectively.

PTC Inc.’s stock showed a bearish trend with an 8.0% decline over the same period, also decelerating. The stock ranged between 215.05 at its peak and 139.77 at its low, with a volatility of 15.47.

Comparatively, Shopify delivered the highest market performance with a robust positive gain, while PTC faced a moderate decline, underlining divergent trajectories in stock returns.

Target Prices

The current analyst consensus indicates optimistic target prices for both Shopify Inc. and PTC Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Shopify Inc. | 200 | 140 | 186.24 |

| PTC Inc. | 255 | 120 | 213.25 |

Analysts expect Shopify’s price to rise from 157.52 to near 186.24, suggesting moderate upside potential. PTC’s consensus target of 213.25 also implies significant growth above its current 166.57 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Shopify Inc. and PTC Inc.:

Rating Comparison

Shopify Inc. Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: 3, moderate status.

- Return on Equity Score: 4, favorable status.

- Return on Assets Score: 5, very favorable status.

- Debt To Equity Score: 3, moderate status.

- Overall Score: 3, moderate status.

PTC Inc. Rating

- Rating: B+, considered very favorable overall.

- Discounted Cash Flow Score: 4, favorable status.

- Return on Equity Score: 4, favorable status.

- Return on Assets Score: 5, very favorable status.

- Debt To Equity Score: 2, moderate status.

- Overall Score: 3, moderate status.

Which one is the best rated?

Based strictly on the provided data, PTC holds a slightly better rating of B+ compared to Shopify’s B. PTC also scores higher in discounted cash flow and has a lower debt-to-equity score, indicating a marginally stronger financial rating overall.

Scores Comparison

Here is a comparison of the financial scores for Shopify Inc. and PTC Inc.:

Shopify Inc. Scores

- Altman Z-Score: 50.42, indicating a safe financial zone.

- Piotroski Score: 6, reflecting average financial strength.

PTC Inc. Scores

- Altman Z-Score: 5.67, also indicating a safe financial zone.

- Piotroski Score: 8, reflecting very strong financial strength.

Which company has the best scores?

PTC has a lower Altman Z-Score but still in the safe zone, and a higher Piotroski Score indicating very strong financial health. Shopify has a much higher Z-Score but a lower Piotroski Score, showing average strength.

Grades Comparison

Here is a detailed comparison of recent grades assigned to Shopify Inc. and PTC Inc.:

Shopify Inc. Grades

The following table summarizes recent grades and rating changes from recognized grading companies for Shopify Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Scotiabank | Upgrade | Sector Outperform | 2026-01-08 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2025-12-17 |

| Truist Securities | Maintain | Hold | 2025-11-05 |

| CIBC | Maintain | Outperform | 2025-11-05 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-05 |

| DA Davidson | Maintain | Buy | 2025-11-05 |

| Scotiabank | Maintain | Sector Perform | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

Shopify’s grades show a mix of “Buy,” “Outperform,” and “Hold” ratings with a recent upgrade by Scotiabank and a downgrade by Wolfe Research, indicating some divergence in analyst views.

PTC Inc. Grades

The following table presents recent grades and rating stabilities from recognized grading companies for PTC Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-10-30 |

| Oppenheimer | Maintain | Outperform | 2025-07-31 |

| Rosenblatt | Maintain | Buy | 2025-07-31 |

| Barclays | Maintain | Overweight | 2025-07-31 |

| Stifel | Maintain | Buy | 2025-07-31 |

| Keybanc | Maintain | Overweight | 2025-07-31 |

| RBC Capital | Maintain | Outperform | 2025-07-31 |

| Piper Sandler | Maintain | Neutral | 2025-07-31 |

PTC’s grades consistently show “Buy,” “Outperform,” and “Overweight” ratings with no recent changes, reflecting stable analyst confidence.

Which company has the best grades?

Both Shopify Inc. and PTC Inc. hold a consensus “Buy” rating, but PTC exhibits more stable and consistently positive grades without recent downgrades. This steadiness may signal lower analyst uncertainty, potentially appealing to investors seeking more predictable outlooks, while Shopify’s recent mixed actions suggest some variability in market sentiment.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Shopify Inc. (SHOP) and PTC Inc. (PTC) based on the latest financial and strategic data.

| Criterion | Shopify Inc. (SHOP) | PTC Inc. (PTC) |

|---|---|---|

| Diversification | Moderate: Focused on e-commerce platforms and merchant solutions, growing subscription services | High: Diverse revenue streams from licenses, technology services, and cloud support |

| Profitability | Mixed: Net margin 22.7%, ROIC 7.55% (neutral), but WACC high at 17.1% indicating value destruction | Strong: Net margin 26.8%, ROIC 14.4%, WACC moderate at 8.3%, creating consistent value |

| Innovation | Growing ROIC trend suggests improving efficiency; heavy investment in platform enhancements | Sustained innovation with durable competitive advantage and growing ROIC |

| Global presence | Strong, with a broad merchant base worldwide but facing intense competition | Well-established global footprint in industrial software and services |

| Market Share | Significant in e-commerce platform market, but faces pressure from competitors | Leading position in CAD and IoT software markets with expanding cloud services |

Key takeaways: PTC shows a more favorable financial and competitive position with higher profitability, diversification, and a durable moat. Shopify displays growth potential with improving profitability but currently struggles with cost efficiency and value creation. Investors should weigh Shopify’s growth prospects against its current value challenges, while PTC offers a more stable investment profile.

Risk Analysis

The following table summarizes key risk factors for Shopify Inc. and PTC Inc. based on their most recent financial and market data in 2026:

| Metric | Shopify Inc. (SHOP) | PTC Inc. (PTC) |

|---|---|---|

| Market Risk | High beta (2.84), volatile price range (69.84-182.19 USD) | Moderate beta (1.01), stable price range (133.38-219.69 USD) |

| Debt level | Very low debt-to-equity (0.10), low debt-to-assets (8.09%) | Moderate debt-to-equity (0.36), moderate debt-to-assets (20.7%) |

| Regulatory Risk | Moderate, operates globally with exposure to multi-jurisdiction rules | Moderate, US-based but global operations with complex software regulations |

| Operational Risk | Platform reliance on e-commerce trends and merchant success | Dependency on innovation in industrial and product lifecycle software |

| Environmental Risk | Low direct impact, mostly software-based operations | Low direct impact, focus on digital transformation solutions |

| Geopolitical Risk | Exposure to global markets including emerging economies | Exposure to Americas, Europe, Asia Pacific with some geopolitical uncertainties |

In summary, Shopify presents higher market risk due to its elevated beta and valuation multiples, though it maintains a conservative debt profile. PTC shows moderate financial leverage but benefits from a strong Piotroski score and safer Altman Z-Score. Market volatility and regulatory compliance remain the most impactful risks for both, requiring cautious monitoring.

Which Stock to Choose?

Shopify Inc. (SHOP) shows a strong income evolution with a 25.78% revenue growth in 2024 and favorable profitability metrics such as a 22.74% net margin and 17.47% ROE. Its debt levels are low, supported by a favorable debt-to-equity ratio, and the company holds a very favorable rating of B with a slightly favorable financial ratios evaluation. However, its ROIC is below WACC, indicating slight value destruction despite growing profitability.

PTC Inc. (PTC) exhibits solid revenue growth of 19.18% in 2025, with favorable profitability highlighted by a 26.8% net margin and 19.18% ROE. The company carries moderate debt but maintains a very favorable rating of B+ and a favorable financial ratios profile. Importantly, PTC’s ROIC exceeds its WACC, signifying value creation and a durable competitive advantage with increasing profitability.

For investors prioritizing value creation and a durable economic moat, PTC’s favorable ROIC relative to WACC and strong profitability might appear more attractive. Conversely, those focused on rapid income growth and improving profitability could find Shopify’s dynamic income evolution and solid ratings relevant, despite its slight value erosion. Ultimately, the choice could depend on the investor’s risk tolerance and preference for growth versus stable value creation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Shopify Inc. and PTC Inc. to enhance your investment decisions: