Investors seeking growth and stability in the packaged foods sector often weigh options between companies with strong market presence and innovation strategies. The Magnum Ice Cream Company N.V. (MICC) and Pilgrim’s Pride Corporation (PPC) both operate within consumer defensive industries but focus on distinct product lines—ice cream and poultry, respectively. This article compares their market positions and innovation approaches to help you decide which company might best enhance your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between The Magnum Ice Cream Company N.V. and Pilgrim’s Pride Corporation by providing an overview of these two companies and their main differences.

The Magnum Ice Cream Company N.V. Overview

The Magnum Ice Cream Company N.V. is a Netherlands-based firm focused on the ice cream business, operating in the Consumer Defensive sector. Founded recently with an IPO date in December 2025, it employs around 18,582 people and is listed on the NYSE. The company positions itself within the packaged foods industry, aiming to serve consumer demand for high-quality ice cream products.

Pilgrim’s Pride Corporation Overview

Pilgrim’s Pride Corporation is a well-established U.S.-based company founded in 1946, operating in the packaged foods industry within the Consumer Defensive sector. It specializes in the production, processing, marketing, and distribution of chicken and pork products globally. With 62,600 employees, it serves diverse markets including retail and foodservice under multiple brand names and is listed on NASDAQ.

Key similarities and differences

Both companies operate in the packaged foods industry under the Consumer Defensive sector, supplying food products to a broad customer base. Magnum Ice Cream focuses exclusively on ice cream products, while Pilgrim’s Pride has a diversified portfolio including fresh, frozen, and value-added chicken and pork products. Pilgrim’s Pride is significantly larger in workforce and market reach, reflecting its longer history and broader product range.

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent full fiscal year income statement figures for The Magnum Ice Cream Company N.V. and Pilgrim’s Pride Corporation, using their respective reported currencies.

| Metric | The Magnum Ice Cream Company N.V. (MICC) | Pilgrim’s Pride Corporation (PPC) |

|---|---|---|

| Market Cap | 9.3B EUR | 9.5B USD |

| Revenue | 7.95B EUR | 17.88B USD |

| EBITDA | 1.10B EUR | 2.01B USD |

| EBIT | 725M EUR | 1.57B USD |

| Net Income | 450M EUR | 1.09B USD |

| EPS | 0.74 EUR | 4.58 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

The Magnum Ice Cream Company N.V.

Over 2022-2024, Magnum Ice Cream’s revenue showed moderate growth, increasing from €7.51B to €7.95B, while net income declined from €509M to €450M. Gross margin remained favorable at 34.91%, but net margin contracted to 5.66%. In 2024, revenue growth slowed to 4.3%, with net margin and EPS both decreasing, indicating pressure on profitability despite stable operating margins.

Pilgrim’s Pride Corporation

Pilgrim’s Pride displayed strong revenue growth from $12.1B in 2020 to $17.9B in 2024, alongside a significant net income increase from $95M to $1.09B. Gross margin hovered neutrally at 12.94%, but net margin improved to 6.08%. In 2024, the company posted a remarkable rebound in profitability, with net margin and EPS growing over 200%, reflecting effective margin expansion and operational leverage.

Which one has the stronger fundamentals?

Pilgrim’s Pride exhibits stronger fundamentals, with consistent and substantial revenue and net income growth over the period, supported by favorable margin expansions. By contrast, Magnum Ice Cream’s growth is more modest, coupled with declining net income and margins. Overall, Pilgrim’s Pride’s income statement reflects more favorable trends, signaling better operational performance and profitability improvements.

Financial Ratios Comparison

This table presents the key financial ratios for The Magnum Ice Cream Company N.V. (MICC) and Pilgrim’s Pride Corporation (PPC) based on their most recent fiscal year data, facilitating a clear side-by-side evaluation.

| Ratios | The Magnum Ice Cream Company N.V. (MICC) | Pilgrim’s Pride Corporation (PPC) |

|---|---|---|

| ROE | 16.2% | 25.6% |

| ROIC | 16.4% | 14.2% |

| P/E | 19.6 | 9.9 |

| P/B | 3.18 | 2.54 |

| Current Ratio | 0.80 | 2.01 |

| Quick Ratio | 0.35 | 1.31 |

| D/E (Debt to Equity) | 0.068 | 0.82 |

| Debt-to-Assets | 3.4% | 32.5% |

| Interest Coverage | 5.18 | 9.34 |

| Asset Turnover | 1.44 | 1.68 |

| Fixed Asset Turnover | 3.37 | 5.27 |

| Payout ratio | 2.4% | 0% |

| Dividend yield | 0.12% | 0% |

Interpretation of the Ratios

The Magnum Ice Cream Company N.V.

The Magnum Ice Cream Company N.V. shows a mix of favorable and unfavorable financial ratios. Strengths include solid returns on equity (16.2%) and invested capital (16.42%), low debt levels, and strong interest coverage. However, liquidity ratios are weak with a current ratio of 0.8 and quick ratio of 0.35, indicating potential short-term solvency concerns. The company does not pay dividends, likely focusing on reinvestment or growth.

Pilgrim’s Pride Corporation

Pilgrim’s Pride Corporation demonstrates generally strong ratios, with a favorable return on equity of 25.63% and robust asset turnover metrics. Liquidity is strong, evidenced by a current ratio of 2.01 and quick ratio of 1.31, although debt levels are moderate with a debt-to-equity ratio of 0.82. The company does not distribute dividends, which may reflect reinvestment priorities or market strategy.

Which one has the best ratios?

Pilgrim’s Pride Corporation has a higher proportion of favorable ratios (64.29%) and stronger liquidity compared to Magnum Ice Cream’s 57.14% favorable ratios and weaker liquidity. While Magnum excels in low debt and return on invested capital, Pilgrim’s Pride’s balance of profitability, liquidity, and asset efficiency presents a more robust overall financial profile based on the available ratio evaluations.

Strategic Positioning

This section compares the strategic positioning of MICC and PPC, including market position, key segments, and exposure to disruption:

MICC

- Positioned in the ice cream segment with a market cap of 9.3B USD; faces typical packaged food competition.

- Focuses exclusively on ice cream products, leveraging brand strength in consumer defensive sector.

- Limited explicit exposure to technological disruption mentioned.

PPC

- Operates in packaged foods with a 9.5B USD market cap; significant presence in poultry and pork.

- Diverse product portfolio including fresh, frozen, and value-added chicken and pork products.

- No direct mention of technological disruption exposure in product or market description.

MICC vs PPC Positioning

MICC’s strategy is concentrated on the ice cream segment, providing focused brand strength but less diversification. PPC adopts a diversified approach with multiple meat products and broad geographic reach, offering varied business drivers and risk exposure.

Which has the best competitive advantage?

PPC shows a very favorable moat with growing ROIC, indicating durable competitive advantage and increasing profitability. MICC also creates value with a favorable moat but has a neutral ROIC trend, suggesting stable but less dynamic advantage.

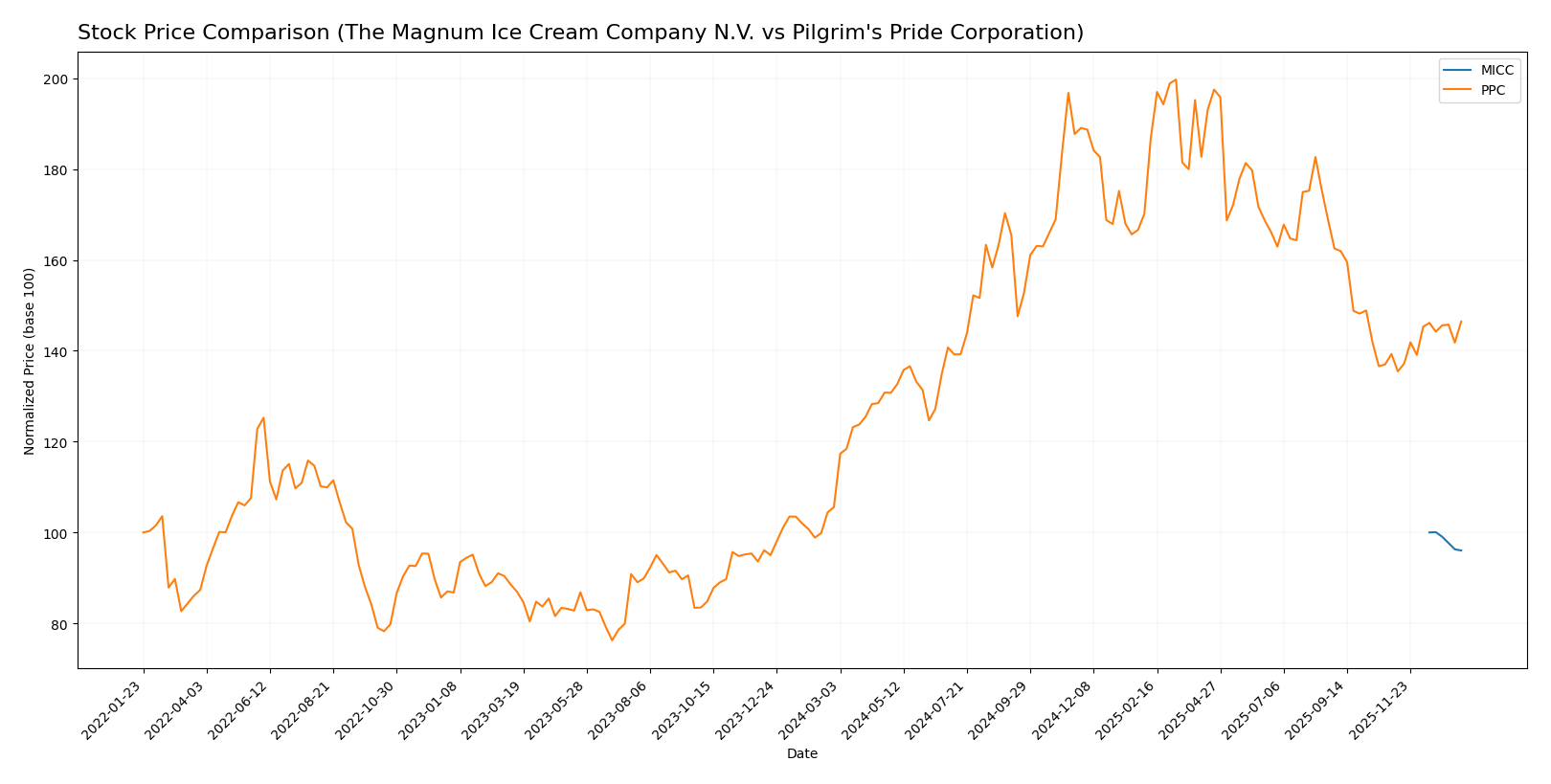

Stock Comparison

The stock price movements over the past 12 months reveal contrasting dynamics, with The Magnum Ice Cream Company N.V. showing a modest decline while Pilgrim’s Pride Corporation has experienced a significant upward trajectory, reflecting differing market sentiments and trading volumes.

Trend Analysis

The Magnum Ice Cream Company N.V. (MICC) exhibited a bearish trend with a -3.97% price change over the past 12 months, maintaining a stable acceleration and low volatility, with prices fluctuating narrowly between 15.24 and 15.88.

Pilgrim’s Pride Corporation (PPC) showed a strong bullish trend over the same period, gaining 38.73% with accelerating momentum and higher volatility, reaching a peak price of 54.62 from a low of 28.87.

Comparing both, PPC has delivered the highest market performance with a clear bullish trend, significantly outperforming MICC’s bearish trajectory over the last year.

Target Prices

Analysts present a clear target consensus for both companies, indicating defined price expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Magnum Ice Cream Company N.V. | 16 | 16 | 16 |

| Pilgrim’s Pride Corporation | 56 | 45 | 50.5 |

The Magnum Ice Cream Company’s target price of $16 slightly exceeds its current price of $15.24, suggesting modest upside potential. Pilgrim’s Pride shows a broader range, with a consensus target 26% above its current $40.05, reflecting stronger expected appreciation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for The Magnum Ice Cream Company N.V. (MICC) and Pilgrim’s Pride Corporation (PPC):

Rating Comparison

MICC Rating

- Rating: B- with a very favorable status.

- Discounted Cash Flow Score: 1, very unfavorable, indicating potential overvaluation.

- ROE Score: 5, very favorable, showing efficient profit generation from equity.

- ROA Score: 4, favorable, reflecting effective asset utilization.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

- Overall Score: 3, moderate, representing average financial standing.

PPC Rating

- Rating: A+ with a very favorable status.

- Discounted Cash Flow Score: 4, favorable, suggesting better valuation prospects.

- ROE Score: 5, very favorable, also indicating strong profitability.

- ROA Score: 5, very favorable, demonstrating superior asset efficiency.

- Debt To Equity Score: 4, favorable, implying lower financial risk.

- Overall Score: 4, favorable, indicating stronger overall financial health.

Which one is the best rated?

PPC is better rated overall, with a higher rating (A+) and superior scores in discounted cash flow, ROA, debt-to-equity, and overall financial health compared to MICC’s moderate and very unfavorable scores in key risk areas.

Scores Comparison

Here is a comparison of the available financial scores for the two companies:

MICC Scores

- Altman Z-Score: Not available

- Piotroski Score: Not available

PPC Scores

- 3.75, indicating a safe zone with low bankruptcy risk.

- 5, reflecting average financial strength.

Which company has the best scores?

Based on the provided data, only PPC has reported scores. PPC’s Altman Z-Score places it in the safe zone, and its Piotroski Score is average. MICC’s scores are not available for comparison.

Grades Comparison

The grades comparison for The Magnum Ice Cream Company N.V. and Pilgrim’s Pride Corporation is as follows:

Pilgrim’s Pride Corporation Grades

The following table summarizes recent reliable grades from notable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2025-12-09 |

| Goldman Sachs | Maintain | Neutral | 2025-10-13 |

| BMO Capital | Maintain | Market Perform | 2025-03-17 |

| Barclays | Maintain | Equal Weight | 2024-11-01 |

| BMO Capital | Maintain | Market Perform | 2024-11-01 |

| Barclays | Maintain | Equal Weight | 2024-09-09 |

| Argus Research | Maintain | Buy | 2024-08-28 |

| B of A Securities | Downgrade | Neutral | 2024-08-15 |

| BMO Capital | Downgrade | Market Perform | 2024-08-12 |

| Barclays | Maintain | Equal Weight | 2024-08-02 |

Overall, Pilgrim’s Pride Corporation’s grades show a stable trend with mostly “Equal Weight,” “Neutral,” and “Market Perform” ratings, reflecting a cautious but steady outlook from analysts.

The Magnum Ice Cream Company N.V. has no available reliable grading data.

Which company has the best grades?

Pilgrim’s Pride Corporation has received multiple reliable grades ranging mainly from “Buy” to “Hold” consensus, while The Magnum Ice Cream Company N.V. lacks any grade data. This suggests Pilgrim’s Pride’s evaluations provide clearer guidance for investors, potentially reducing uncertainty compared to the ungraded company.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for The Magnum Ice Cream Company N.V. (MICC) and Pilgrim’s Pride Corporation (PPC) based on their recent financial and competitive performance.

| Criterion | MICC | PPC |

|---|---|---|

| Diversification | Limited product segmentation; niche focus | Broad product range in poultry industry |

| Profitability | ROIC 16.4%, ROE 16.2%, net margin 5.66% | ROIC 14.2%, ROE 25.6%, net margin 6.08% |

| Innovation | Stable profitability, moderate innovation | Growing ROIC trend indicates innovation |

| Global presence | Moderate, with stable competitive advantage | Strong, supported by durable competitive advantage |

| Market Share | Stable, value-creating with favorable moat | Increasing profitability and market strength |

Key takeaways: MICC offers stable profitability with a focused product range and efficient capital use, but limited diversification and liquidity ratios are concerns. PPC demonstrates stronger growth potential with a durable competitive advantage, better liquidity, and broader market presence, making it a robust contender for investors prioritizing growth with managed risks.

Risk Analysis

The table below summarizes key risks for The Magnum Ice Cream Company N.V. (MICC) and Pilgrim’s Pride Corporation (PPC) as of 2026, focusing on their market, financial, regulatory, operational, environmental, and geopolitical exposures.

| Metric | The Magnum Ice Cream Company N.V. (MICC) | Pilgrim’s Pride Corporation (PPC) |

|---|---|---|

| Market Risk | Moderate (Beta 0, limited market volatility) | Moderate (Beta 0.445, some sensitivity to market swings) |

| Debt level | Low (Debt-to-equity 0.07, very favorable) | Moderate-High (Debt-to-equity 0.82, neutral risk) |

| Regulatory Risk | Moderate (Food industry compliance in EU) | Moderate-High (Extensive US and international food regulations) |

| Operational Risk | Moderate (Supply chain and production scale) | Moderate (Large scale operations, diverse product lines) |

| Environmental Risk | Moderate (Food packaging and sustainability pressures) | Moderate-High (Agricultural sourcing and climate impact) |

| Geopolitical Risk | Moderate (European operations, exposed to EU policies) | Moderate-High (US and international operations, subject to trade policies) |

The most impactful risks are Pilgrim’s Pride’s higher debt level and exposure to complex regulatory environments across multiple regions, which can affect financial stability. Magnum Ice Cream carries less debt but faces challenges with liquidity ratios and environmental sustainability pressure. Both companies operate in sectors sensitive to regulatory and geopolitical changes, warranting cautious monitoring.

Which Stock to Choose?

The Magnum Ice Cream Company N.V. (MICC) shows moderate revenue growth but declining profitability, with a net margin of 5.66% rated favorable in ROE and ROIC, low debt levels, and a very favorable rating despite some unfavorable liquidity ratios.

Pilgrim’s Pride Corporation (PPC) reports strong income growth, with a net margin of 6.08%, favorable financial ratios including high ROE and liquidity, moderate debt, and a very favorable overall rating supported by a durable and increasing competitive advantage.

Investors focused on growth and durability might find PPC’s improving profitability and very favorable rating appealing, while those prioritizing lower debt and stable returns could interpret MICC’s profile as more fitting, given its low leverage and favorable moat status.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Magnum Ice Cream Company N.V. and Pilgrim’s Pride Corporation to enhance your investment decisions: