Home > Comparison > Consumer Defensive > KHC vs PPC

The strategic rivalry between The Kraft Heinz Company and Pilgrim’s Pride Corporation shapes the packaged foods sector’s competitive landscape. Kraft Heinz operates as a diversified food and beverage manufacturer with a broad product portfolio, while Pilgrim’s Pride focuses on poultry and meat processing with extensive foodservice reach. This analysis explores their contrasting operational models and growth strategies to identify which company offers superior risk-adjusted returns for a balanced investment portfolio.

Table of contents

Companies Overview

The Kraft Heinz Company and Pilgrim’s Pride Corporation stand as major players in the global packaged foods industry.

The Kraft Heinz Company: Iconic Food & Beverage Giant

The Kraft Heinz Company dominates the packaged foods sector with a broad portfolio including condiments, dairy, and meals. Its core revenue stems from manufacturing and marketing diverse food products across North America and internationally. In 2026, the firm focuses on expanding e-commerce channels and innovating healthier snack options to sustain its competitive edge.

Pilgrim’s Pride Corporation: Leading Poultry & Pork Producer

Pilgrim’s Pride commands the fresh and processed poultry and pork markets, supplying retailers and foodservice operators worldwide. Its primary income arises from producing value-added chicken and pork products under multiple brands. The 2026 strategy centers on scaling export distribution and enhancing product variety to meet global demand shifts.

Strategic Collision: Similarities & Divergences

Both companies anchor their revenue in packaged foods but diverge in approach: Kraft Heinz emphasizes a diversified product portfolio and consumer convenience, while Pilgrim’s Pride prioritizes volume-driven fresh meat production. Their battle unfolds mainly in retail and foodservice channels. Investors face distinct profiles—Kraft Heinz offers brand depth and innovation, Pilgrim’s Pride delivers volume scale and export growth.

Income Statement Comparison

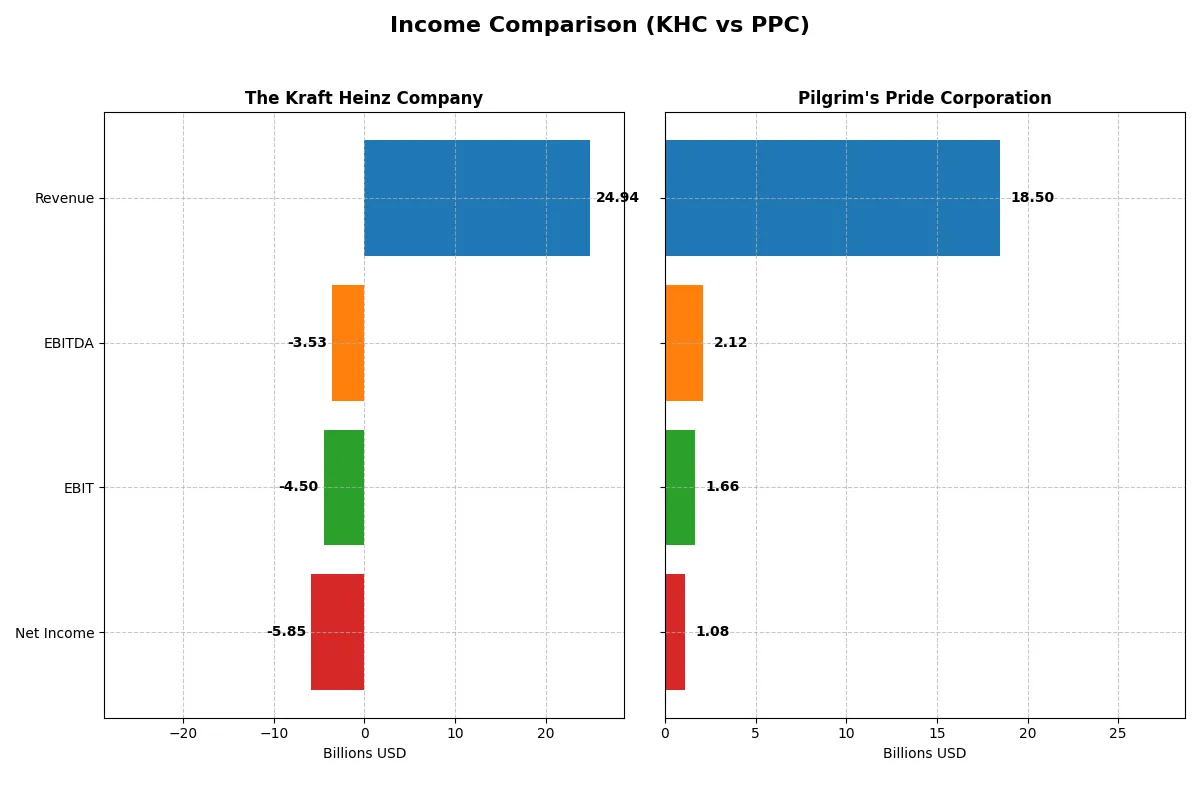

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | The Kraft Heinz Company (KHC) | Pilgrim’s Pride Corporation (PPC) |

|---|---|---|

| Revenue | 24.9B | 18.5B |

| Cost of Revenue | 16.6B | 16.1B |

| Operating Expenses | 12.9B | 745M |

| Gross Profit | 8.3B | 2.4B |

| EBITDA | -3.5B | 2.1B |

| EBIT | -4.5B | 1.7B |

| Interest Expense | 947M | 161M |

| Net Income | -5.8B | 1.1B |

| EPS | -4.93 | 4.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes which company runs a more efficient and profitable business engine through recent financial performance.

The Kraft Heinz Company Analysis

Kraft Heinz’s revenue declined 3.5% in 2025 to $24.9B, with net income plunging to a -$5.8B loss. Despite a solid gross margin near 33%, operating and net margins turned sharply negative, reflecting deteriorating profitability. The steep drop in EBIT and net income signals operational and financial stress in the latest year.

Pilgrim’s Pride Corporation Analysis

Pilgrim’s Pride grew revenue by 3.5% to $18.5B in 2025, pushing net income higher to $1.08B. Margins remain modest but positive, with a gross margin of 12.7% and net margin near 5.9%. Operating income and EBIT expanded, demonstrating improving efficiency and stable momentum over the year.

Margin Power vs. Revenue Scale

Pilgrim’s Pride outperforms Kraft Heinz on profitability and margin stability despite smaller revenue. Kraft Heinz’s significant losses and margin erosion undermine its scale advantage. For investors, Pilgrim’s Pride presents a more attractive profile, combining growth and healthy earnings efficiency.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | The Kraft Heinz Company (KHC) | Pilgrim’s Pride Corporation (PPC) |

|---|---|---|

| ROE | -14.0% | 29.4% |

| ROIC | -6.4% | 15.6% |

| P/E | -4.9 | 8.7 |

| P/B | 0.69 | 2.57 |

| Current Ratio | 1.15 | 1.47 |

| Quick Ratio | 0.79 | 0.76 |

| D/E | 0.46 | 0.05 |

| Debt-to-Assets | 23.6% | 1.9% |

| Interest Coverage | -4.9 | 10.0 |

| Asset Turnover | 0.30 | 1.79 |

| Fixed Asset Turnover | 3.41 | 4.88 |

| Payout ratio | -32.5% | 184.3% |

| Dividend yield | 6.6% | 21.1% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and operational strengths essential for sound investment decisions.

The Kraft Heinz Company

KHC posts negative core profitability with a -14.03% ROE and -23.44% net margin, signaling operational struggles. Its valuation appears attractive, featuring a favorable P/E of -4.9 and a low P/B at 0.69, suggesting undervaluation. The company delivers a neutral 6.63% dividend yield, balancing shareholder returns amid reinvestment challenges.

Pilgrim’s Pride Corporation

PPC demonstrates robust profitability with a 29.41% ROE and 5.85% net margin, reflecting operational efficiency. The stock trades at a reasonable P/E of 8.73 and a neutral P/B of 2.57, indicating fair valuation. PPC offers a neutral 21.12% dividend yield, signaling strong shareholder returns supported by solid free cash flow generation.

Operational Strength vs. Valuation Appeal

PPC delivers superior profitability and operational efficiency with a favorable valuation, while KHC shows valuation appeal but suffers from weak returns. Investors seeking growth and stable returns may prefer PPC’s profile; those focused on potential undervaluation might consider KHC’s riskier stance.

Which one offers the Superior Shareholder Reward?

I see Kraft Heinz (KHC) and Pilgrim’s Pride (PPC) adopt contrasting distribution strategies. KHC yields 6.63% with a payout ratio near -32%, indicating a strained dividend sustainability amid recent losses. PPC delivers a striking 21.1% yield but with an unsustainable payout ratio above 180%, signaling heavy dividend reliance despite zero recent payouts in some years. KHC balances moderate buybacks and dividends, supported by free cash flow coverage of 82%, while PPC shows aggressive buybacks fueled by strong free cash flow but lacks dividends consistency. Historically, KHC’s disciplined payout and buyback blend ensures steadier long-term value. I favor KHC for a more reliable total return profile in 2026, given PPC’s payout volatility and elevated financial leverage risks.

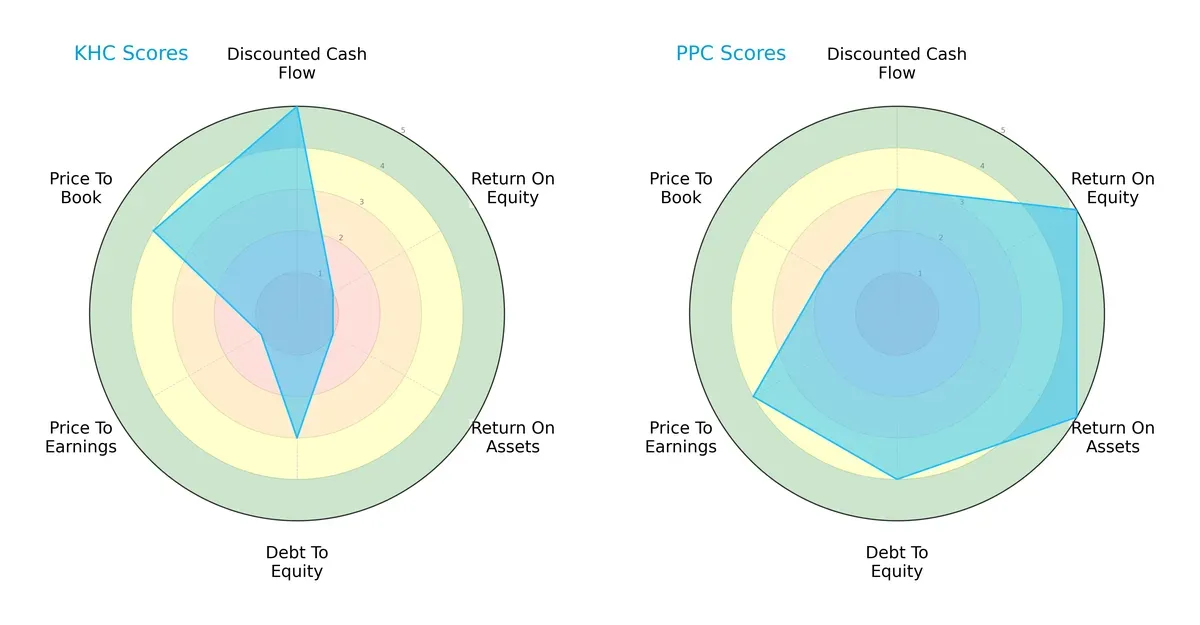

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their financial strengths and valuation nuances:

Pilgrim’s Pride (PPC) exhibits a more balanced profile with strong ROE (5) and ROA (5) scores, and favorable debt management (4). Kraft Heinz (KHC) relies heavily on its discounted cash flow advantage (5) but shows weak profitability metrics (ROE 1, ROA 1) and poor valuation (P/E 1). PPC’s valuation scores (P/E 4, P/B 2) suggest moderate premium pricing compared to KHC’s mixed valuation signals.

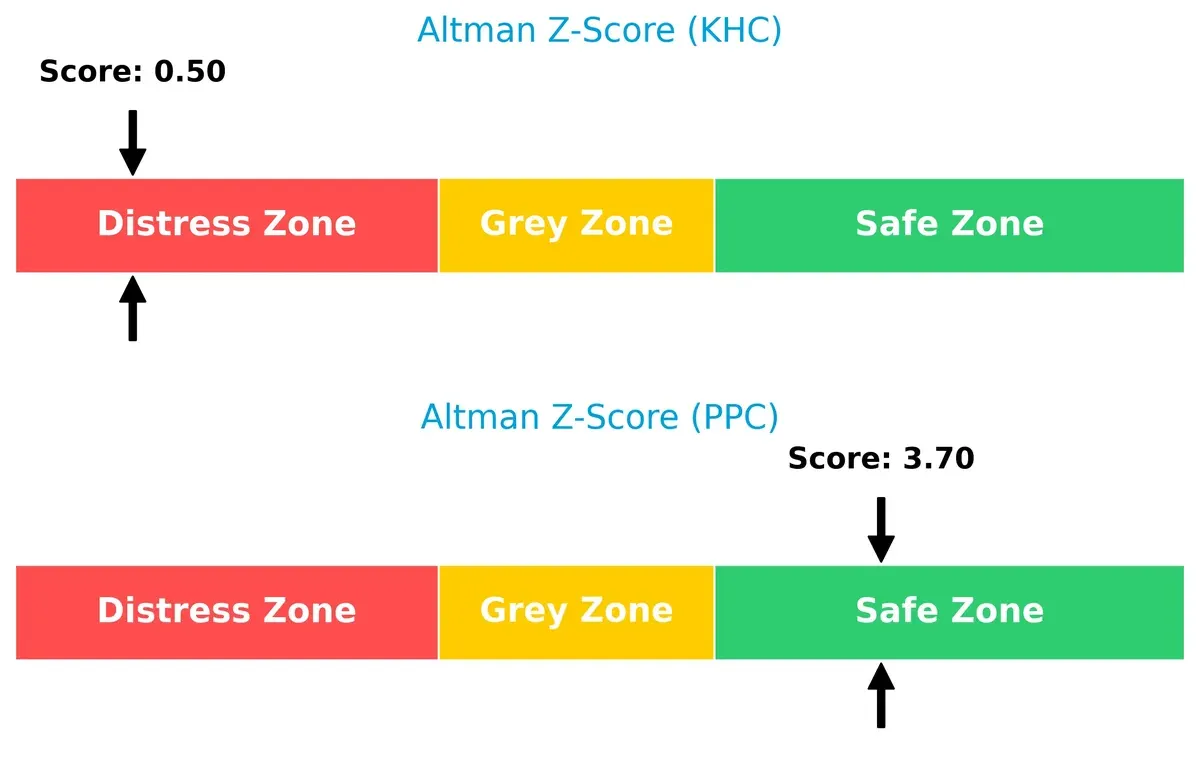

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score delta signals sharply divergent bankruptcy risks:

KHC’s low score (0.5, distress zone) flags severe financial distress and elevated bankruptcy risk. PPC’s strong 3.7 score places it safely above distress thresholds, indicating superior solvency and resilience in this cycle.

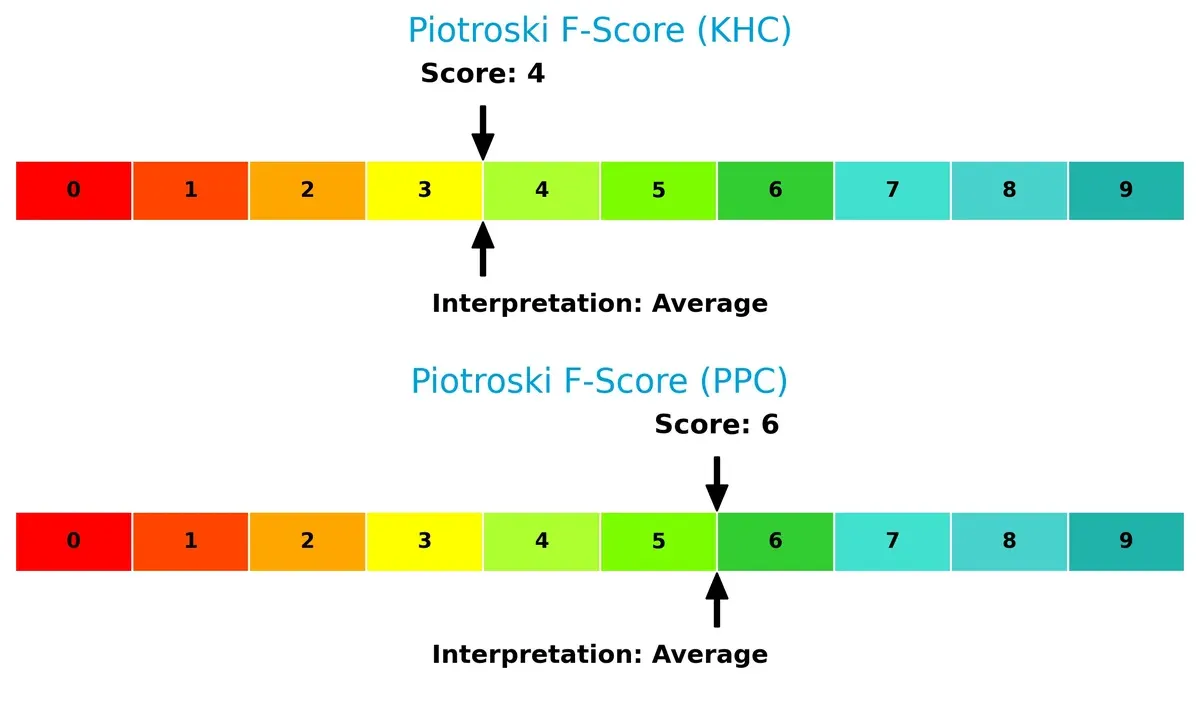

Financial Health: Quality of Operations

The Piotroski F-Score comparison highlights operational quality differences:

PPC’s score of 6 indicates solid financial health and efficient operations. KHC’s 4 points to average health with potential red flags in profitability or liquidity. PPC’s stronger internal metrics improve its attractiveness as a value investment.

How are the two companies positioned?

This section dissects the operational DNA of KHC and PPC by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which model offers the most resilient competitive advantage today.

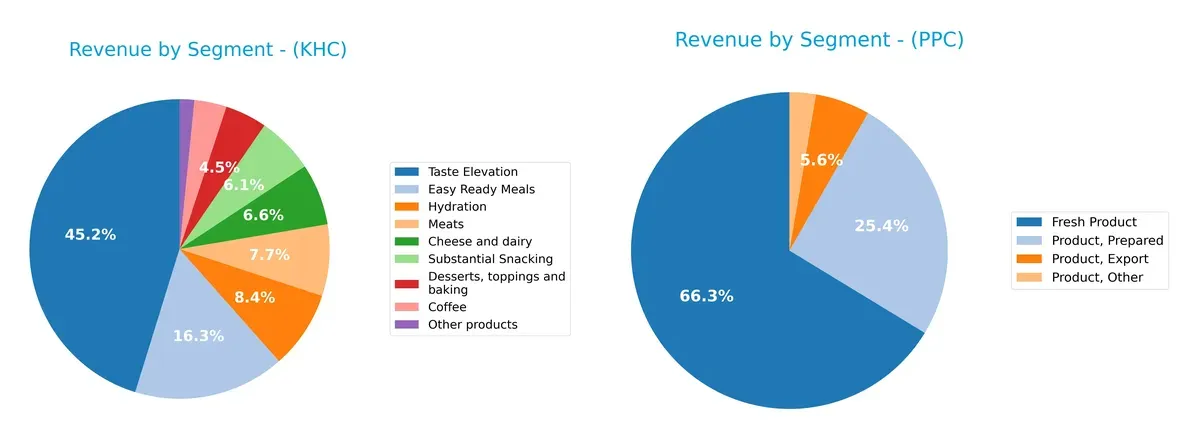

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how The Kraft Heinz Company and Pilgrim’s Pride Corporation diversify their income streams and reveals each firm’s core sector focus:

Kraft Heinz displays a broad portfolio with Taste Elevation anchoring at $11.3B, alongside diversified segments like Easy Ready Meals ($4.1B) and Hydration ($2.1B). Pilgrim’s Pride heavily pivots on Fresh Product, which dwarfs other streams at $12.3B, showing concentration risk. Kraft Heinz’s mix suggests ecosystem lock-in and innovation breadth, while Pilgrim’s Pride’s reliance on a dominant segment signals exposure to market fluctuations in fresh meats.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of The Kraft Heinz Company (KHC) and Pilgrim’s Pride Corporation (PPC):

KHC Strengths

- Diverse product segments including Cheese, Coffee, and Meals

- Significant US revenue base of 16.8B

- Favorable low debt-to-assets ratio at 23.61%

- Strong fixed asset turnover at 3.41x

PPC Strengths

- High profitability with 29.41% ROE and 15.61% ROIC

- Favorable interest coverage of 10.31x

- Broad geographic presence including US, Europe, and Mexico

- Robust asset turnover at 1.79x and fixed asset turnover at 4.88x

KHC Weaknesses

- Negative net margin of -23.44% and ROE of -14.03%

- Unfavorable quick ratio at 0.79

- Negative interest coverage at -4.75x

- Asset turnover weak at 0.3x

PPC Weaknesses

- Unfavorable quick ratio at 0.76

- PB ratio of 2.57 indicates some valuation risk

- Net margin moderate at 5.85%

- Exposure to currency and regional risks in multiple international markets

KHC’s diversified product and geographic footprint contrasts with its profitability challenges and liquidity concerns. PPC shows stronger profitability and capital efficiency but faces valuation and liquidity risks. These factors shape each company’s strategic priorities in managing growth and financial health.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competition erosion. Here’s how these two food giants stack up:

The Kraft Heinz Company: Intangible Assets Moat

KHC’s moat stems from powerful brand recognition and extensive distribution. However, declining ROIC and negative margin trends signal weakening competitive leverage in 2026.

Pilgrim’s Pride Corporation: Cost Advantage Moat

PPC leverages efficient operations and scale, delivering consistent ROIC growth and positive margin expansion. Its expanding international footprint deepens this cost-based moat.

Brand Equity vs. Operational Efficiency: The Moat Showdown

PPC exhibits a wider, more sustainable moat with growing profitability and value creation. KHC’s shrinking returns suggest it struggles to defend market share effectively in today’s market.

Which stock offers better returns?

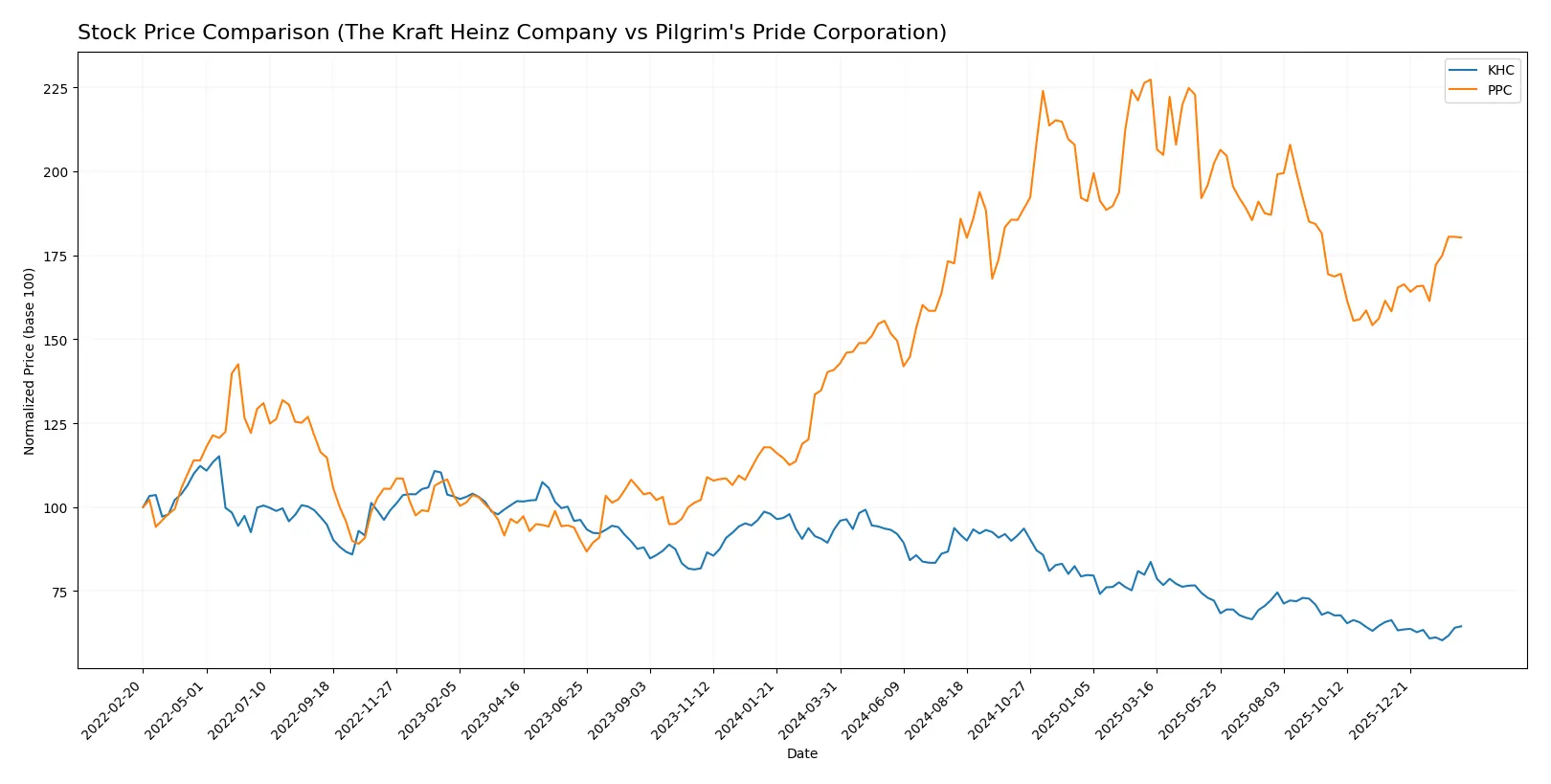

The past year reveals starkly contrasting trajectories: The Kraft Heinz Company’s shares fell sharply, while Pilgrim’s Pride Corporation surged with growing momentum.

Trend Comparison

The Kraft Heinz Company’s stock dropped 30.82% over the past 12 months, marking a bearish trend with accelerating declines and a notable high of 38.16 and a low near 23.2.

Pilgrim’s Pride Corporation’s shares rose 27.98% in the same period, reflecting a bullish trend with accelerating gains, hitting a peak at 54.62 and a low of 33.85.

Pilgrim’s Pride outperformed The Kraft Heinz Company, delivering the highest market returns with positive price momentum and stronger recent gains.

Target Prices

Analysts present a clear consensus with moderate upside potential for both Kraft Heinz and Pilgrim’s Pride.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| The Kraft Heinz Company | 23 | 28 | 25.11 |

| Pilgrim’s Pride Corporation | 45 | 56 | 50.5 |

Kraft Heinz’s consensus target of 25.11 slightly exceeds its current price of 24.8, implying modest appreciation. Pilgrim’s Pride shows stronger analyst optimism, with a 50.5 consensus well above its 43.32 market price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The Kraft Heinz Company Grades

The table below summarizes recent institutional grades for The Kraft Heinz Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Equal Weight | 2026-02-13 |

| JP Morgan | downgrade | Underweight | 2026-02-12 |

| Jefferies | maintain | Hold | 2026-01-21 |

| JP Morgan | maintain | Neutral | 2026-01-21 |

| Morgan Stanley | downgrade | Underweight | 2026-01-16 |

| UBS | maintain | Neutral | 2026-01-14 |

| Piper Sandler | maintain | Neutral | 2025-12-15 |

| Barclays | maintain | Equal Weight | 2025-10-31 |

| Wells Fargo | maintain | Equal Weight | 2025-10-30 |

| UBS | maintain | Neutral | 2025-10-30 |

Pilgrim’s Pride Corporation Grades

The table below summarizes recent institutional grades for Pilgrim’s Pride Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | maintain | Market Perform | 2026-02-13 |

| Barclays | maintain | Equal Weight | 2025-12-09 |

| Goldman Sachs | maintain | Neutral | 2025-10-13 |

| BMO Capital | maintain | Market Perform | 2025-03-17 |

| BMO Capital | maintain | Market Perform | 2024-11-01 |

| Barclays | maintain | Equal Weight | 2024-11-01 |

| Barclays | maintain | Equal Weight | 2024-09-09 |

| Argus Research | maintain | Buy | 2024-08-28 |

| B of A Securities | downgrade | Neutral | 2024-08-15 |

| BMO Capital | downgrade | Market Perform | 2024-08-12 |

Which company has the best grades?

Pilgrim’s Pride holds a slightly stronger rating profile, including a Buy and consistent Market Perform grades. Kraft Heinz shows multiple downgrades to Underweight and Hold. This may influence investors toward Pilgrim’s Pride for relatively better analyst sentiment.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

The Kraft Heinz Company

- Faces shrinking margins amid changing consumer preferences and rising competition in packaged foods.

Pilgrim’s Pride Corporation

- Benefits from diversified product lines and strong market presence in poultry, mitigating competitive threats.

2. Capital Structure & Debt

The Kraft Heinz Company

- Moderate debt-to-equity ratio at 0.46 but weak interest coverage raises financial risk concerns.

Pilgrim’s Pride Corporation

- Very low debt-to-equity of 0.05 and strong interest coverage of 10.31 signal solid financial health.

3. Stock Volatility

The Kraft Heinz Company

- Extremely low beta of 0.047 indicates low stock volatility but limits upside potential.

Pilgrim’s Pride Corporation

- Higher beta of 0.426 suggests more price volatility, reflecting sensitivity to market shifts.

4. Regulatory & Legal

The Kraft Heinz Company

- Subject to food safety and labeling regulations with potential liabilities.

Pilgrim’s Pride Corporation

- Faces regulatory scrutiny related to meat processing and export compliance across multiple regions.

5. Supply Chain & Operations

The Kraft Heinz Company

- Complexity in sourcing diverse ingredients globally increases supply chain risks.

Pilgrim’s Pride Corporation

- Supply chain exposed to livestock feed costs and disease outbreaks, impacting operational stability.

6. ESG & Climate Transition

The Kraft Heinz Company

- Pressure to enhance sustainability practices amid growing consumer and investor ESG demands.

Pilgrim’s Pride Corporation

- Faces challenges reducing carbon footprint in meat production but benefits from parent company’s ESG initiatives.

7. Geopolitical Exposure

The Kraft Heinz Company

- Global footprint exposes it to trade tensions and tariff risks.

Pilgrim’s Pride Corporation

- International operations in volatile regions increase geopolitical risk, particularly in export markets.

Which company shows a better risk-adjusted profile?

Pilgrim’s Pride faces lower financial and operational risks, with robust debt metrics and safer Altman Z-score in 2026. Kraft Heinz struggles with profitability and liquidity, reflected in its distress-zone bankruptcy risk. Pilgrim’s Pride’s stronger capital structure and market agility deliver a superior risk-adjusted profile. The Kraft Heinz Company’s negative net margin and weak interest coverage highlight its vulnerability amid rising costs and competitive pressure.

Final Verdict: Which stock to choose?

The Kraft Heinz Company’s superpower lies in its substantial brand equity and dividend yield, appealing to income-focused investors. However, its declining profitability and cash flow volatility remain points of vigilance. It best suits portfolios seeking value turnaround potential with a tolerance for operational challenges.

Pilgrim’s Pride Corporation benefits from a robust moat anchored in efficient capital allocation and growing returns on invested capital. Its financial stability and improving profitability offer a safer profile compared to Kraft Heinz. This stock fits well within Growth at a Reasonable Price (GARP) portfolios aiming for steady expansion.

If you prioritize income and brand legacy, Kraft Heinz presents a compelling case despite its current struggles. However, if you seek growth with stronger financial health and a durable competitive advantage, Pilgrim’s Pride outshines with better stability and value creation prospects. Each appeals to distinct investor profiles navigating today’s market.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Kraft Heinz Company and Pilgrim’s Pride Corporation to enhance your investment decisions: