Home > Comparison > Energy > PSX vs VLO

The strategic rivalry between Phillips 66 and Valero Energy defines the trajectory of the energy refining sector. Phillips 66 operates a diversified model spanning midstream logistics, chemicals, refining, and marketing. Valero focuses on refining, renewable diesel, and ethanol production with extensive downstream distribution. This analysis examines their contrasting operational scopes to identify which company presents a superior risk-adjusted investment opportunity for a diversified portfolio in 2026.

Table of contents

Companies Overview

Phillips 66 and Valero Energy Corporation stand as two heavyweight contenders in the US refining and marketing sector.

Phillips 66: Integrated Energy Manufacturer and Logistics Leader

Phillips 66 commands a diversified energy portfolio through Midstream, Chemicals, Refining, and Marketing segments. Its core revenue derives from refining crude oil into petroleum products and chemical manufacturing. In 2026, it sharpened its focus on expanding midstream logistics and specialty chemicals to enhance cash flow stability amid volatile crude prices.

Valero Energy Corporation: Refining and Renewable Fuels Powerhouse

Valero operates a broad refining network with 15 refineries and a strong footprint in renewable diesel and ethanol production. It generates revenue primarily from gasoline, diesel, jet fuel, and biofuel sales across North America and Europe. The firm’s 2026 strategy emphasizes renewable fuel capacity growth and supply chain integration to capture evolving energy demand.

Strategic Collision: Similarities & Divergences

Both companies share a refining-centric business model but diverge in diversification strategies—Phillips 66 leans on chemicals and midstream assets, Valero on renewables and ethanol. Their battle for market share centers on refining throughput and renewable fuel production. Each presents distinct risk-return profiles shaped by their asset mix and exposure to energy transition dynamics.

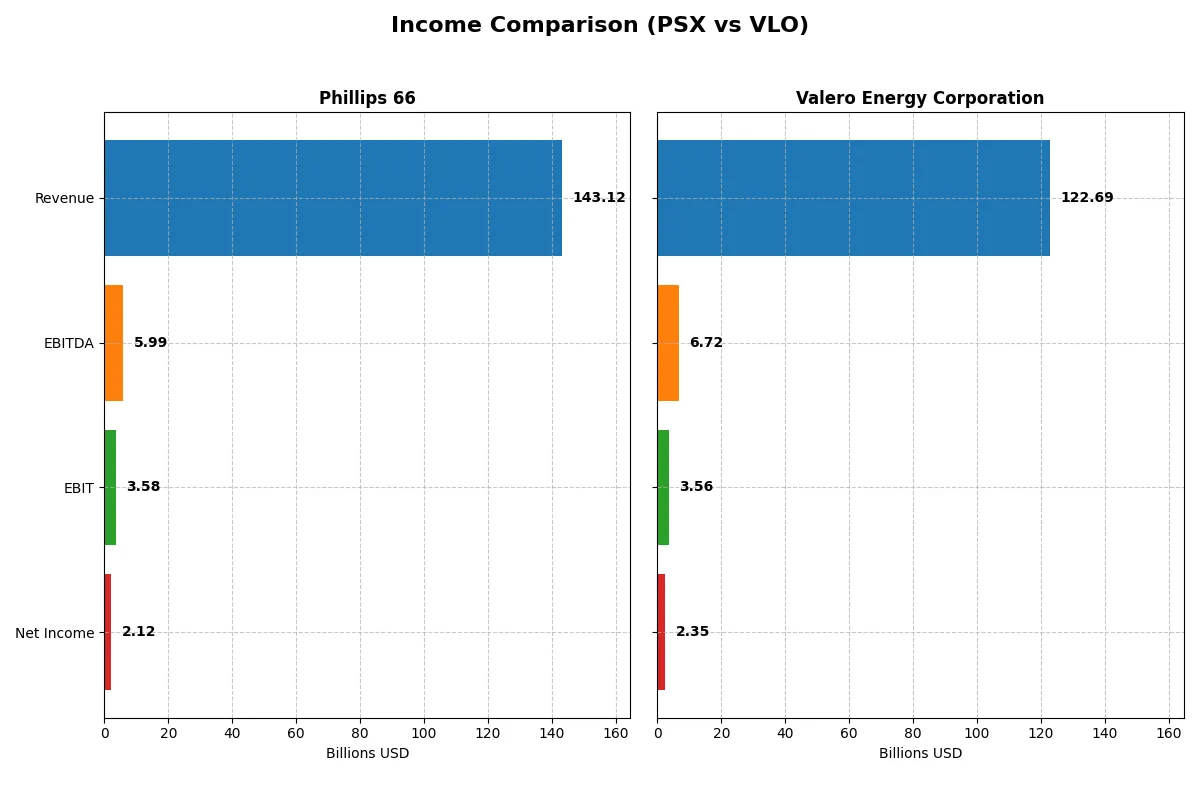

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Phillips 66 (PSX) | Valero Energy Corporation (VLO) |

|---|---|---|

| Revenue | 143.1B | 129.9B |

| Cost of Revenue | 138.3B | 125.1B |

| Operating Expenses | 2.54B | 1.01B |

| Gross Profit | 4.86B | 4.76B |

| EBITDA | 6.0B | 7.03B |

| EBIT | 3.58B | 4.25B |

| Interest Expense | 907M | 556M |

| Net Income | 2.12B | 2.76B |

| EPS | 5.01 | 8.58 |

| Fiscal Year | 2024 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes each company’s true operational efficiency and profit-generation prowess over recent years.

Phillips 66 Analysis

Phillips 66’s revenue peaked at 170B in 2022 but declined to 143B by 2024, reflecting a 2.8% drop in the latest year. Net income followed a similar downward trend, falling from 11B in 2022 to 2.1B in 2024. Gross and net margins contracted sharply in 2024, signaling weakening profitability and operational efficiency. Despite revenue growth of 125% over five years, recent margin erosion highlights pressure on cost management.

Valero Energy Corporation Analysis

Valero recorded revenues of 123B in 2025, down 5.5% from 2024, with net income sliding to 2.3B from 2.8B. However, gross margin improved by 12.8% last year, supporting a healthier 1.9% net margin versus Phillips 66’s 1.5%. Valero’s overall revenue growth was modest at 7.6% over five years, but it delivered a robust 152% net income increase and a 233% EPS surge, reflecting solid bottom-line momentum despite recent setbacks.

Margin Discipline vs. Resilient Growth

Phillips 66 boasts stronger long-term revenue growth but suffers steep recent margin declines that undermine current profitability. Valero, while growing more modestly in sales, maintains superior margin stability and EPS growth. For investors prioritizing margin resilience and earnings momentum, Valero’s profile appears more attractive amid industry volatility.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Phillips 66 (PSX) | Valero Energy Corp. (VLO) |

|---|---|---|

| ROE | 7.7% (2024) | 11.3% (2024) |

| ROIC | 3.2% (2024) | 6.7% (2024) |

| P/E | 22.6 (2024) | 14.3 (2024) |

| P/B | 1.75 (2024) | 1.61 (2024) |

| Current Ratio | 1.19 (2024) | 1.53 (2024) |

| Quick Ratio | 0.92 (2024) | 1.03 (2024) |

| D/E | 0.73 (2024) | 0.47 (2024) |

| Debt-to-Assets | 27.6% (2024) | 19.2% (2024) |

| Interest Coverage | 2.56 (2024) | 6.75 (2024) |

| Asset Turnover | 1.97 (2024) | 2.16 (2024) |

| Fixed Asset Turnover | 4.06 (2024) | 4.27 (2024) |

| Payout ratio | 89% (2024) | 50% (2024) |

| Dividend yield | 3.93% (2024) | 3.51% (2024) |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing underlying risks and operational strengths that raw figures alone cannot reveal.

Phillips 66

Phillips 66 posts a modest ROE of 7.7% and a low net margin of 1.48%, signaling subdued profitability. Valuation metrics like a P/E of 22.6 and P/B of 1.75 classify the stock as fairly valued. It offers a 3.9% dividend yield, rewarding shareholders amid moderate reinvestment in R&D.

Valero Energy Corporation

Valero shows a higher ROE at 9.9% and a slightly better net margin of 1.91%, reflecting more efficient profit generation. The stock trades at a neutral P/E of 21.4 and P/B of 2.12, neither cheap nor expensive. Valero yields 2.78% in dividends, balancing shareholder returns with moderate leverage risks.

Balanced Valuation Meets Operational Prudence

Phillips 66 offers a more conservative financial profile with balanced leverage and a higher dividend yield. Valero delivers stronger profitability but carries higher debt and working capital risks. Investors seeking stability may favor Phillips 66, while those pursuing growth might lean toward Valero’s efficiency.

Which one offers the Superior Shareholder Reward?

I compare Phillips 66 (PSX) and Valero Energy (VLO) on dividends, payout ratios, and buybacks to find the superior shareholder reward in 2026.

Phillips 66 yields 3.9% with a high 89% payout ratio but covers dividends and capex 1.12x, showing tight free cash flow. It pairs this with steady buybacks, sustaining returns. Valero yields 2.8% with a 59% payout ratio, more conservative yet supported by a strong free cash flow margin and a robust buyback program. Historically, Phillips 66’s aggressive payout risks sustainability in cyclical downturns, while Valero’s balanced distribution and capital allocation better weather volatility. I judge Valero offers a more attractive and sustainable total return profile for 2026 investors.

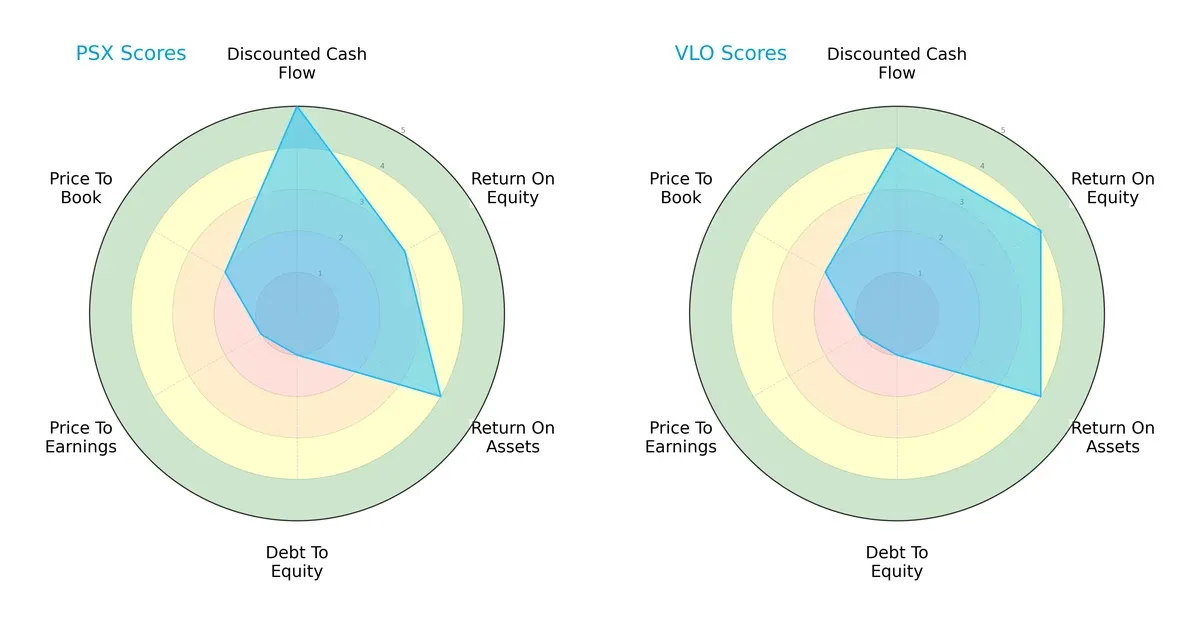

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Phillips 66 and Valero Energy Corporation, highlighting their strategic strengths and weaknesses:

I observe that Phillips 66 excels in discounted cash flow with a top score of 5, indicating strong future cash generation. Valero leads slightly in return on equity (4 vs. 3) and matches Phillips 66 in return on assets (4 each), reflecting efficient asset use. Both firms show very unfavorable debt-to-equity and price-to-earnings scores, signaling high leverage and potentially overvalued shares. Phillips 66’s profile is less balanced, relying on cash flow strength, while Valero displays a more consistent performance across profitability metrics.

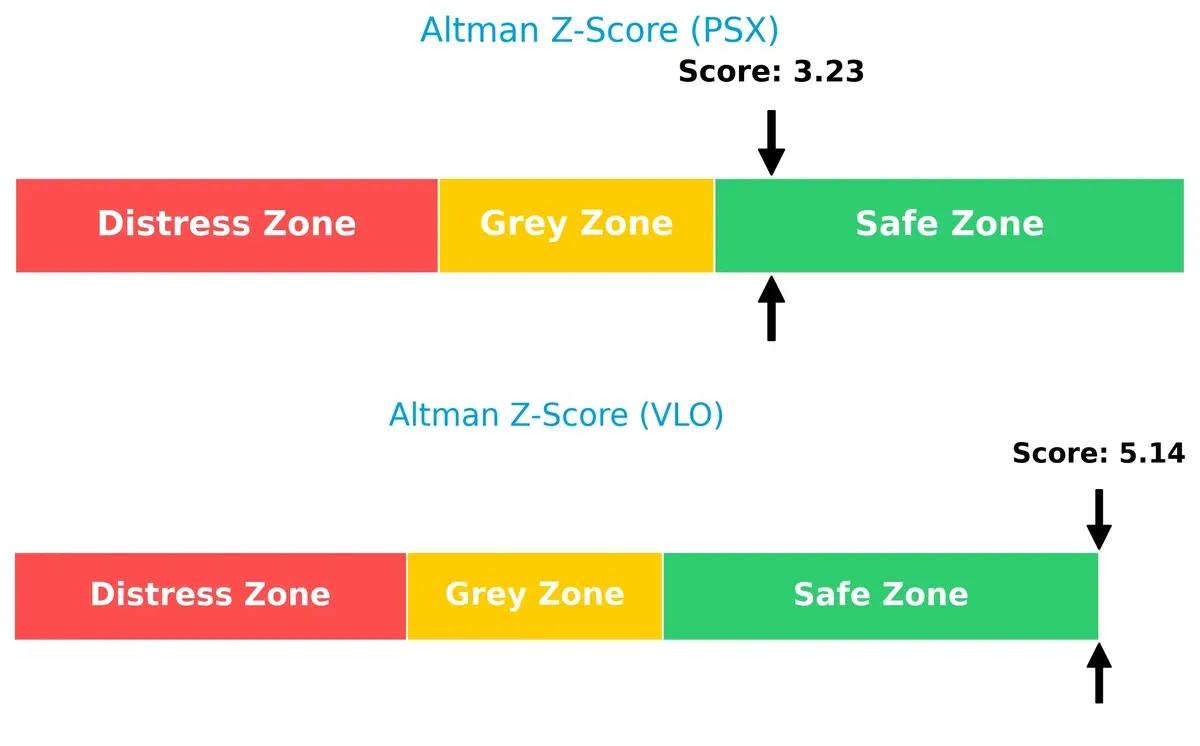

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap favors Valero (5.14) over Phillips 66 (3.23), signaling a superior solvency position for Valero:

Valero’s higher score places it comfortably in the safe zone, indicating robust financial health and low bankruptcy risk. Phillips 66 also sits in the safe zone but closer to the grey area, suggesting slightly higher vulnerability in economic downturns.

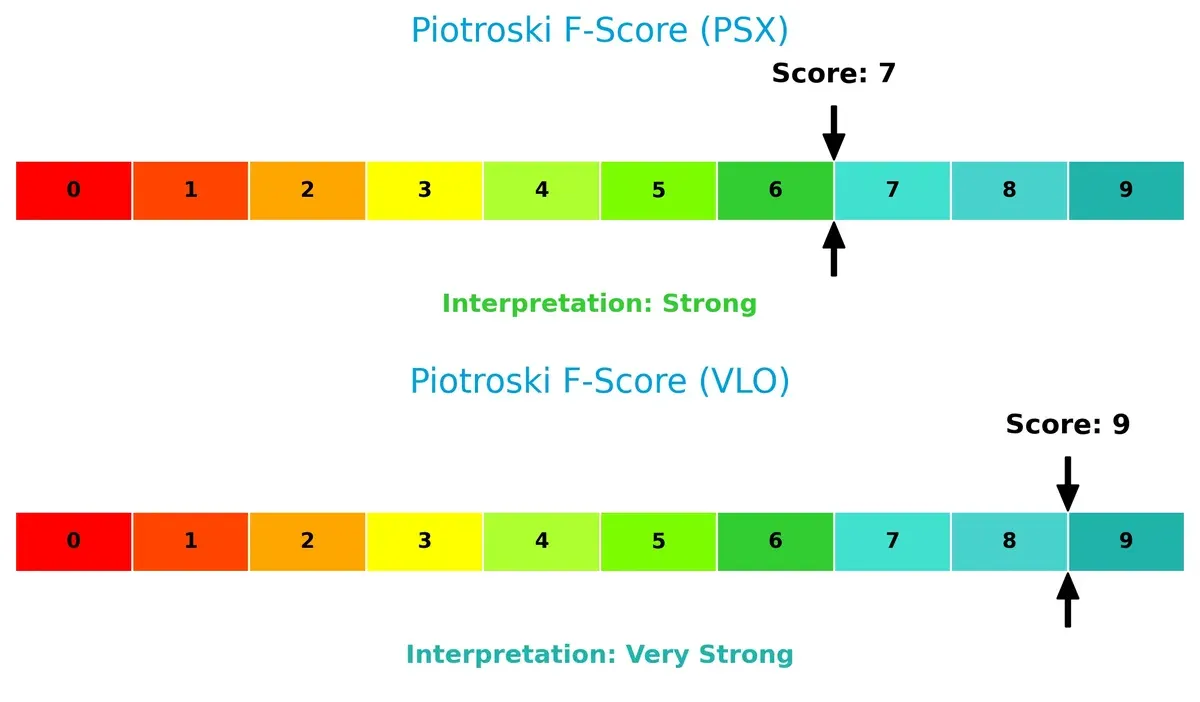

Financial Health: Quality of Operations

Valero’s Piotroski F-Score of 9 outperforms Phillips 66’s 7, reflecting peak financial health and operational quality:

Valero scores very strong, demonstrating superior profitability, liquidity, and efficiency metrics. Phillips 66 remains strong but shows modest red flags in internal controls and operational consistency compared to Valero’s pristine score. This difference may influence investor confidence in stability and growth potential.

How are the two companies positioned?

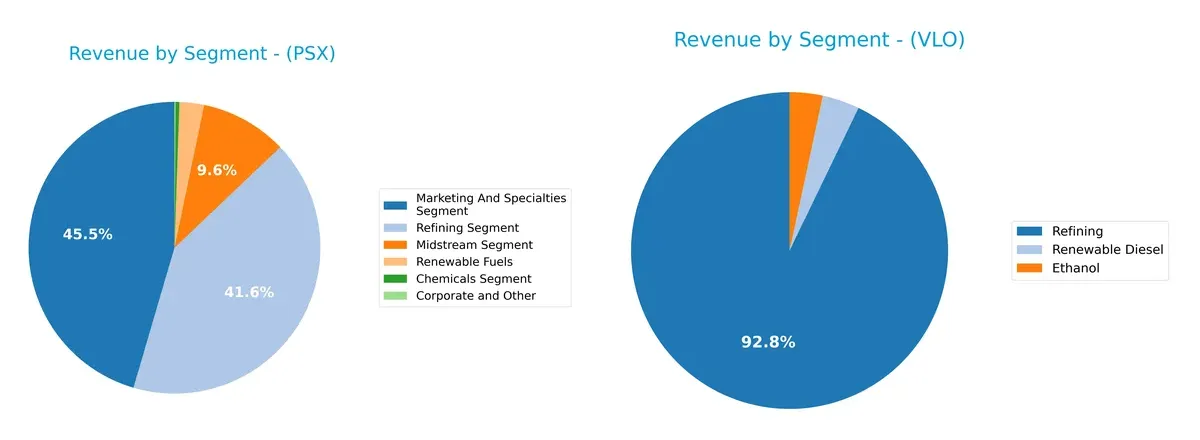

This section dissects the operational DNA of Phillips 66 and Valero by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This comparison dissects how Phillips 66 and Valero Energy diversify their income streams and where their primary sector bets lie:

Phillips 66 balances revenue across Marketing & Specialties ($92.8B), Refining ($85B), and Midstream ($19.7B), signaling a diversified portfolio that mitigates concentration risk. Valero Energy leans heavily on Refining ($123.9B), which dwarfs its Ethanol ($4.5B) and Renewable Diesel ($5.1B) segments. Valero’s reliance on refining anchors its strategy to infrastructure dominance but exposes it to commodity price swings more than Phillips 66’s broader ecosystem.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Phillips 66 and Valero Energy Corporation:

Phillips 66 Strengths

- Diversified segments including Marketing, Midstream, Refining, Chemicals, and Renewables

- Strong asset turnover metrics

- Favorable debt-to-assets ratio at 27.64%

- Dividend yield of 3.93% supports income generation

Valero Strengths

- Strong refining revenue with $124B in 2024

- Favorable quick ratio and interest coverage ratio

- Dividend yield of 2.78%

- Higher net margin and ROE than Phillips 66

Phillips 66 Weaknesses

- Low profitability ratios: net margin 1.48%, ROE 7.72%, ROIC 3.19% below WACC

- Neutral liquidity ratios but quick ratio below 1

- Market concentration in the US at $113B revenue

Valero Weaknesses

- High leverage with debt-to-assets near 70% and D/E at 1.44

- Unfavorable current ratio at 3.47

- Zero fixed asset turnover reported

- Unfavorable net margin at 1.91% despite higher ROE

Phillips 66’s strengths lie in diversified operations and conservative leverage. Valero excels in refining scale and liquidity but carries higher financial risk. Each company’s profile suggests differing strategic priorities in risk and operational focus.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion. Let’s dissect how Phillips 66 and Valero Energy defend their turf:

Phillips 66: Logistics and Chemical Integration Moat

Phillips 66 leverages a complex midstream and chemicals network that creates high operational switching costs. Its slightly unfavorable ROIC versus WACC signals value destruction, but improving profitability hints at moat strengthening. Expansion into specialty chemicals could deepen its advantage in 2026.

Valero Energy Corporation: Refining Scale and Brand Moat

Valero’s competitive edge stems from its large refining footprint and multi-brand distribution channels, which generate efficient capital use and stable margins. Its ROIC comfortably exceeds WACC, showing value creation and a robust moat. Growth in renewable diesel production may extend its market leadership.

Refining Scale vs. Integrated Logistics: Who Holds the Deeper Moat?

Valero’s positive ROIC spread and consistent value creation grant it a wider moat than Phillips 66, which struggles with capital inefficiency despite growth. Valero is better positioned to defend market share amid evolving energy demands.

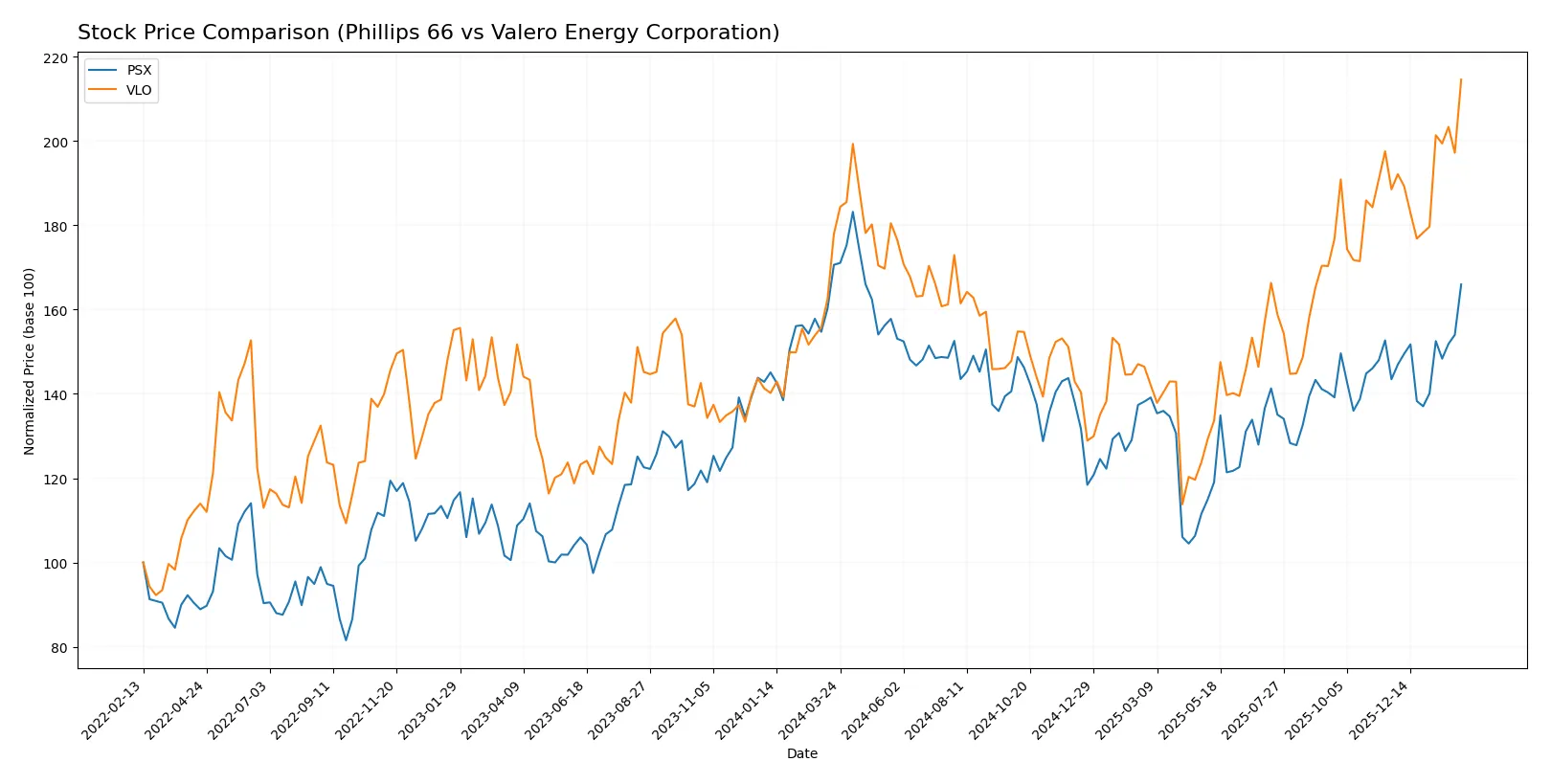

Which stock offers better returns?

Over the past year, Phillips 66 and Valero Energy exhibited contrasting price trajectories, with Valero showing sustained gains while Phillips 66 faced a notable decline before recent recovery.

Trend Comparison

Phillips 66’s stock declined 2.73% over the last 12 months, marking a bearish trend with accelerating downside and a wide price range from 97.38 to 170.75. Recently, it gained 15.68%, indicating a short-term rebound.

Valero Energy’s stock rose 20.59% over the past year, sustaining a bullish trend with acceleration and a broader volatility range between 104.69 and 197.41. Recent gains of 13.81% confirm positive momentum.

Valero outperformed Phillips 66 in market returns over the last 12 months, delivering stronger overall gains despite Phillips 66’s recent price acceleration.

Target Prices

Analysts present a confident target price consensus for Phillips 66 and Valero Energy Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Phillips 66 | 140 | 162 | 149.88 |

| Valero Energy Corporation | 162 | 220 | 190.22 |

The target consensus for Phillips 66 sits slightly below its current price of $154.69, suggesting modest upside or consolidation. Valero’s consensus target of $190.22 aligns closely with its current price of $197.41, indicating a balanced risk-reward outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a comparison of recent institutional grades for Phillips 66 and Valero Energy Corporation:

Phillips 66 Grades

The table below shows recent grades from major institutions for Phillips 66:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-14 |

| JP Morgan | Maintain | Overweight | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Piper Sandler | Maintain | Neutral | 2026-01-12 |

| Mizuho | Maintain | Neutral | 2026-01-12 |

| Piper Sandler | Maintain | Neutral | 2026-01-08 |

| Freedom Capital Markets | Downgrade | Sell | 2026-01-06 |

| Mizuho | Maintain | Neutral | 2025-12-12 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| Barclays | Maintain | Equal Weight | 2025-11-17 |

Valero Energy Corporation Grades

Below are recent institutional grades for Valero Energy Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-30 |

| Piper Sandler | Maintain | Overweight | 2026-01-30 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-27 |

| JP Morgan | Maintain | Overweight | 2026-01-08 |

| Piper Sandler | Maintain | Overweight | 2026-01-08 |

| Mizuho | Downgrade | Neutral | 2025-12-12 |

| B of A Securities | Downgrade | Neutral | 2025-12-11 |

| Barclays | Maintain | Overweight | 2025-11-17 |

| Piper Sandler | Maintain | Overweight | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-11-10 |

Which company has the best grades?

Valero Energy Corporation generally holds more favorable grades, with multiple “Overweight” ratings. Phillips 66 mostly receives “Neutral” or “Equal Weight” grades, with one recent downgrade to “Sell.” This contrast may influence investors seeking stronger institutional support.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Phillips 66

- Faces stiff competition in refining and chemicals with moderate net margin of 1.48%.

Valero Energy Corporation

- Competes on scale with larger refining capacity and stronger net margin of 1.91%.

2. Capital Structure & Debt

Phillips 66

- Maintains moderate leverage with debt-to-assets at 27.64%, interest coverage 3.95x.

Valero Energy Corporation

- Higher leverage with debt-to-assets near 70% and stronger interest coverage at 6.4x, raising financial risk.

3. Stock Volatility

Phillips 66

- Beta of 0.87 indicates moderate stock volatility relative to market.

Valero Energy Corporation

- Lower beta of 0.72 signals less stock price volatility and more stability.

4. Regulatory & Legal

Phillips 66

- Subject to US and European environmental and safety regulations impacting refining and chemicals.

Valero Energy Corporation

- Faces regulatory risks in multiple jurisdictions including US, Canada, and UK with ethanol and renewable diesel segments.

5. Supply Chain & Operations

Phillips 66

- Complex midstream and chemicals logistics expose it to supply chain disruptions.

Valero Energy Corporation

- Large refining and renewable assets create operational complexity but diversified product mix.

6. ESG & Climate Transition

Phillips 66

- Transition risks from fossil fuel exposure, but diversified with chemicals and midstream.

Valero Energy Corporation

- Faces challenges in shifting towards renewables despite ethanol and renewable diesel segments.

7. Geopolitical Exposure

Phillips 66

- US and Europe-focused operations with moderate geopolitical risk exposure.

Valero Energy Corporation

- Broader international footprint increases geopolitical risk but also market diversification.

Which company shows a better risk-adjusted profile?

Phillips 66’s main risk lies in moderate profitability and regulatory pressures in chemicals and refining. Valero’s greatest concern is its high leverage and associated financial risk. I see Phillips 66 as having a slightly better risk-adjusted profile, supported by a safer debt-to-assets ratio and balanced operational segments. Valero’s higher debt-to-assets near 70% and lower Altman Z-Score safety margin raise red flags despite stronger profitability and Piotroski scores.

Final Verdict: Which stock to choose?

Phillips 66’s superpower lies in its improving profitability trajectory despite current value erosion. Its modest financial leverage and solid cash flow efficiency appeal to investors who tolerate cyclical dips. However, the company’s value destruction compared to its cost of capital is a point of vigilance. It fits portfolios aiming for aggressive growth with patience for turnaround.

Valero Energy stands out with a clear strategic moat, evidenced by a ROIC exceeding its WACC, signaling sustainable value creation. Its strong balance sheet and very robust financial scores offer better stability compared to Phillips 66. Valero suits investors who prefer GARP—Growth at a Reasonable Price—with a focus on durable competitive advantages.

If you prioritize turnaround potential and accelerating profitability, Phillips 66 is the compelling choice due to its improving operating returns. However, if you seek stability and a proven economic moat, Valero offers better stability and a sustainable competitive edge, commanding a premium valuation. Both require careful risk consideration in a volatile energy sector.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Phillips 66 and Valero Energy Corporation to enhance your investment decisions: