In today’s dynamic tech landscape, Unity Software Inc. and Perfect Corp. stand out for their innovative application software solutions. Unity leads in interactive real-time 3D content platforms, while Perfect focuses on AI-driven augmented reality for beauty and fashion. Both companies operate at the intersection of creativity and technology, making them intriguing contenders for investors. This article will help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Unity Software Inc. and Perfect Corp. by providing an overview of these two companies and their main differences.

Unity Software Inc. Overview

Unity Software Inc. develops and operates an interactive real-time 3D content platform. Its mission is to provide software solutions that enable the creation, operation, and monetization of interactive 2D and 3D content across multiple devices, including mobile phones, PCs, consoles, and AR/VR devices. Founded in 2004 and headquartered in San Francisco, Unity serves a global customer base of developers, artists, and designers.

Perfect Corp. Overview

Perfect Corp. offers SaaS solutions specializing in artificial intelligence and augmented reality for beauty and fashion tech. Its product suite includes virtual try-on applications and AI-powered analysis tools for makeup, hair, nails, and accessories. Established in 2015 and based in New Taipei City, Taiwan, Perfect Corp. focuses on enhancing digital experiences in the beauty industry through innovative AR and AI technologies.

Key similarities and differences

Both Unity and Perfect operate in the software application industry with a focus on AR and AI technologies. Unity’s business model targets a broad range of content creators across multiple platforms and device types, while Perfect Corp. concentrates on niche beauty and fashion tech solutions powered by AI and AR. Unity is a much larger company by market capitalization and employee count, reflecting its broader market reach compared to Perfect’s specialized product offerings.

Income Statement Comparison

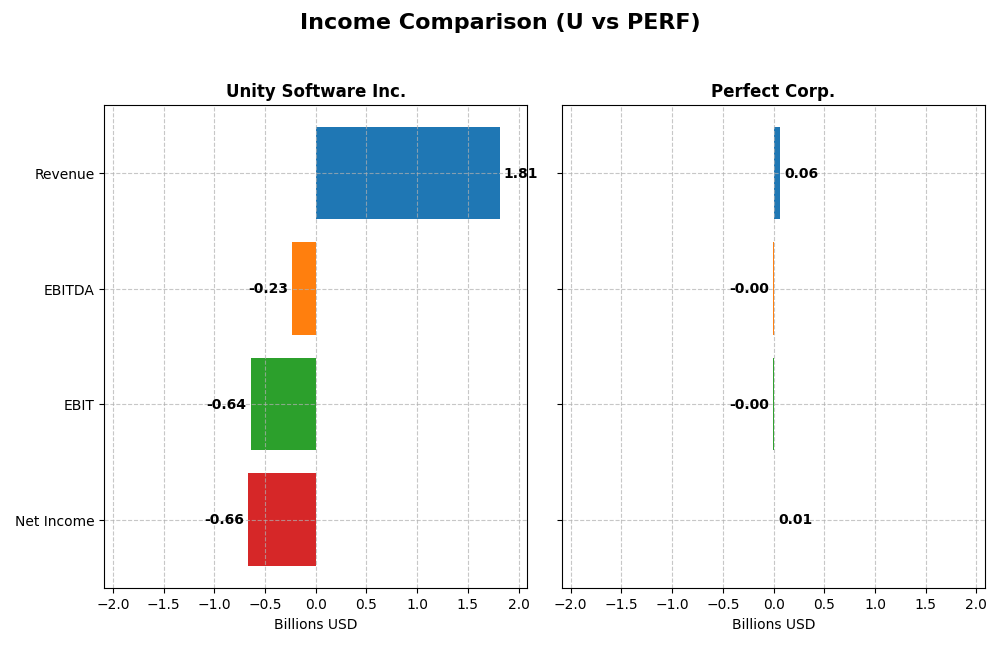

The table below presents a side-by-side comparison of key income statement metrics for Unity Software Inc. and Perfect Corp. for the fiscal year 2024.

| Metric | Unity Software Inc. | Perfect Corp. |

|---|---|---|

| Market Cap | 17.5B | 179M |

| Revenue | 1.81B | 60.2M |

| EBITDA | -235M | -2.05M |

| EBIT | -644M | -2.84M |

| Net Income | -664M | 5.02M |

| EPS | -1.68 | 0.05 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Unity Software Inc.

Unity’s revenue increased significantly from 2020 to 2023, peaking at $2.19B before declining 17.1% in 2024 to $1.81B. Net income remained negative throughout, though losses narrowed from -$919M in 2022 to -$664M in 2024. Gross margin remained strong at 73.48%, but unfavorable EBIT and net margins reflect ongoing profitability challenges despite improved EPS growth of 22.22% in the latest year.

Perfect Corp.

Perfect Corp. demonstrated steady revenue growth, rising from $29.9M in 2020 to $60.2M in 2024, a favorable 12.5% increase over the last year. Net income turned positive in recent years, reaching $5M in 2024 with an 8.34% net margin. Gross margin is robust at nearly 78%, though EBIT margin declined recently. Overall, Perfect shows consistent margin improvements and substantial EPS growth of 8.93% in the last fiscal year.

Which one has the stronger fundamentals?

Perfect Corp. exhibits stronger fundamentals with consistent revenue and net income growth, favorable margins, and a positive net margin in 2024. Unity, despite higher revenue scale and gross margin, continues to report significant losses and negative net margins. The global income statement evaluation favors Perfect’s financial health, while Unity’s remains challenged by profitability issues and declining recent revenue.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Unity Software Inc. (U) and Perfect Corp. (PERF) based on their most recent fiscal year data from 2024.

| Ratios | Unity Software Inc. (U) | Perfect Corp. (PERF) |

|---|---|---|

| ROE | -20.8% | 3.42% |

| ROIC | -12.8% | -2.10% |

| P/E | -13.4 | 56.6 |

| P/B | 2.79 | 1.93 |

| Current Ratio | 2.50 | 5.52 |

| Quick Ratio | 2.50 | 5.52 |

| D/E | 0.74 | 0.0035 |

| Debt-to-Assets | 35.0% | 0.28% |

| Interest Coverage | -32.1 | -449 |

| Asset Turnover | 0.27 | 0.33 |

| Fixed Asset Turnover | 18.35 | 57.94 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Unity Software Inc.

Unity Software shows a mixed financial profile with a strong current and quick ratio of 2.5, indicating good short-term liquidity, yet it faces challenges such as an unfavorable return on equity at -20.81% and a negative net margin of -36.63%. The company pays no dividends, reflecting either reinvestment priorities or a growth phase, with no dividend yield or payout risks evident.

Perfect Corp.

Perfect Corp. exhibits moderate financial health with a very high current ratio of 5.52 and a favorable debt-to-equity ratio of 0, suggesting minimal leverage. However, it has an unfavorable interest coverage ratio and a negative return on invested capital of -2.1%. Like Unity, Perfect Corp. does not pay dividends, likely focusing on growth and operational reinvestment over shareholder distributions.

Which one has the best ratios?

Both companies face significant unfavorable ratios, including negative returns and interest coverage issues, impacting profitability and risk profiles. Perfect Corp. benefits from stronger liquidity and no debt, while Unity shows better asset turnover but more leverage. Overall, each has distinct strengths and weaknesses, resulting in a similarly cautious outlook on their financial ratios.

Strategic Positioning

This section compares the strategic positioning of Unity Software Inc. and Perfect Corp., focusing on market position, key segments, and exposure to technological disruption:

Unity Software Inc.

- Large market cap at $17.5B, faces competitive pressure in interactive real-time 3D software.

- Key segments include Create Solutions and Operate Solutions, driving revenue through 2D/3D content creation and monetization.

- Operates in a rapidly evolving tech space with potential disruption from emerging AR/VR technologies.

Perfect Corp.

- Small market cap at $179M, operates in niche AR/AI beauty and fashion tech market.

- Focuses on SaaS AI and AR solutions for virtual try-on and beauty tech applications.

- Strong focus on AI and AR innovations, positioning for disruption in beauty and fashion tech sectors.

Unity Software Inc. vs Perfect Corp. Positioning

Unity offers a diversified platform across multiple devices and user segments, leveraging broad interactive content creation. Perfect Corp. concentrates on AI-driven beauty and fashion tech, targeting specific consumer applications with fewer employees and smaller scale.

Which has the best competitive advantage?

Both companies are shedding value relative to their cost of capital. Unity’s declining ROIC signals worsening profitability, while Perfect Corp. shows improving ROIC despite still being below WACC, indicating a slightly more favorable competitive position.

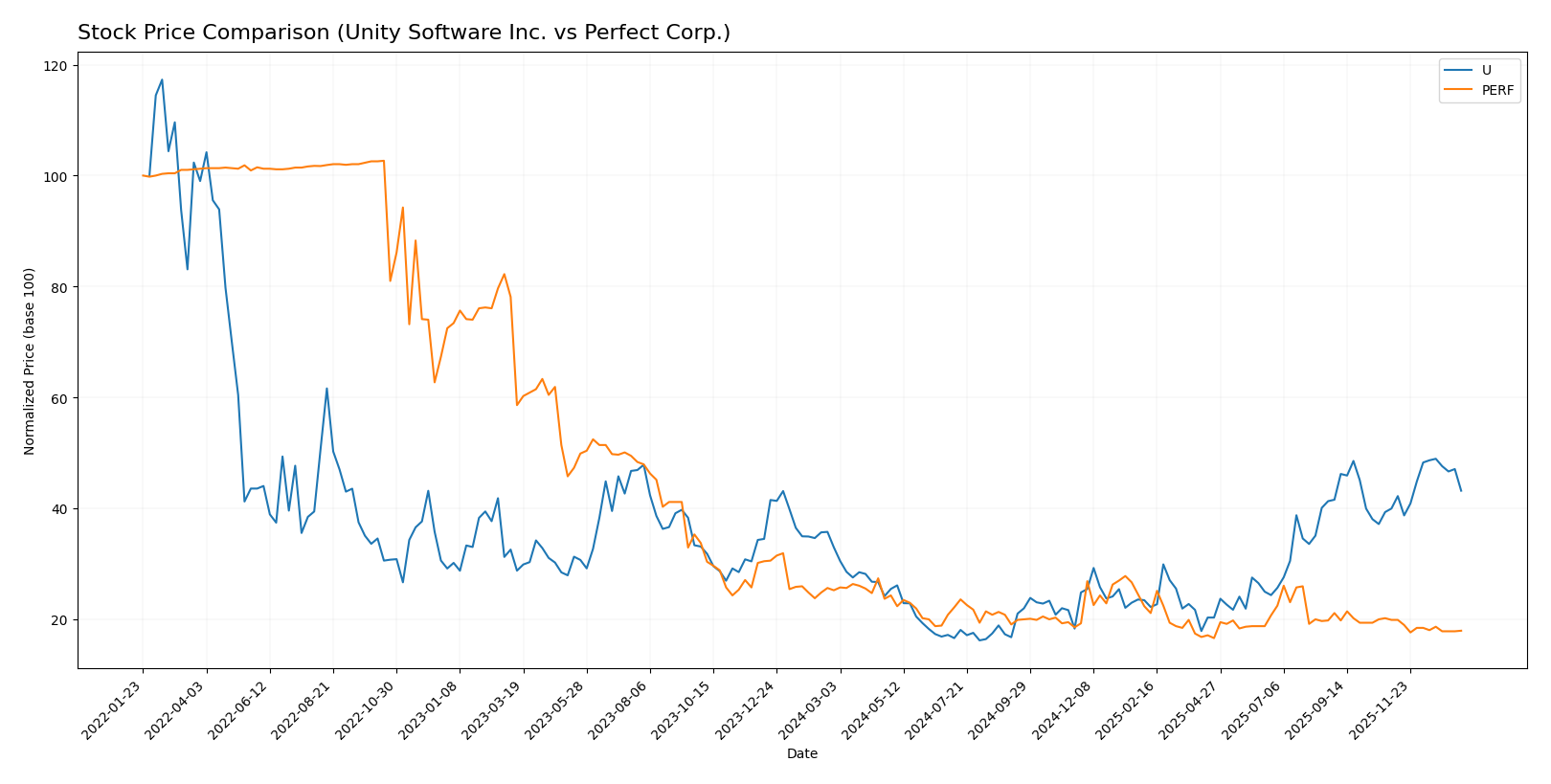

Stock Comparison

The stock price movements of Unity Software Inc. and Perfect Corp. over the past 12 months reveal contrasting trends, with Unity showing strong gains and increasing buyer dominance, while Perfect experiences declines and seller dominance.

Trend Analysis

Unity Software Inc. exhibits a bullish trend with a 31.0% price increase over the past year, marked by accelerating growth and notable volatility (9.04 std deviation). The stock reached a high of 46.42 and a low of 15.32.

Perfect Corp. shows a bearish trend, falling 28.98% over the same period, with decelerating decline and low volatility (0.27 std deviation). Its price ranged between 1.61 and 2.7 during this time.

Comparing the two, Unity Software Inc. delivered the highest market performance with significant upward momentum, while Perfect Corp. underperformed with a sustained downtrend.

Target Prices

The current analyst consensus shows a range of expectations for these technology software companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Unity Software Inc. | 60 | 39 | 50.98 |

| Perfect Corp. | 7 | 7 | 7 |

Analysts expect Unity Software’s price to rise significantly above its current 40.95 USD, indicating upside potential. Perfect Corp.’s consensus target of 7 USD is far above its current 1.74 USD, signaling strong growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Unity Software Inc. and Perfect Corp.:

Rating Comparison

U Rating

- Rating: D+, considered very unfavorable overall by analysts.

- Discounted Cash Flow Score: 1, very unfavorable, indicating weak cash flow projections.

- ROE Score: 1, very unfavorable, showing low efficiency in generating profit from equity.

- ROA Score: 1, very unfavorable, reflecting poor asset utilization for earnings.

- Debt To Equity Score: 1, very unfavorable, implying high financial risk.

- Overall Score: 1, very unfavorable, reflecting weak financial standing.

PERF Rating

- Rating: A-, rated very favorable overall by analysts.

- Discounted Cash Flow Score: 5, very favorable, signaling strong future cash flow prospects.

- ROE Score: 2, moderate, indicating average efficiency in equity profit generation.

- ROA Score: 3, moderate, showing reasonable asset utilization effectiveness.

- Debt To Equity Score: 4, favorable, indicating a stronger balance sheet and lower financial risk.

- Overall Score: 4, favorable, indicating solid financial health.

Which one is the best rated?

Based strictly on the provided data, Perfect Corp. is clearly better rated than Unity Software Inc., with higher scores across all key financial metrics and a superior overall rating.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Unity Software Inc. and Perfect Corp.:

Unity Software Inc. Scores

- Altman Z-Score: 2.93, grey zone indicating moderate risk of bankruptcy.

- Piotroski Score: 4, average financial strength.

Perfect Corp. Scores

- Altman Z-Score: 1.31, distress zone indicating high bankruptcy risk.

- Piotroski Score: 6, average financial strength.

Which company has the best scores?

Unity Software Inc. has a higher Altman Z-Score, placing it in the grey zone, while Perfect Corp. is in the distress zone. Perfect Corp. has a higher Piotroski Score, but both are in the average category.

Grades Comparison

Here is a comparison of the latest reliable grades for Unity Software Inc. and Perfect Corp.:

Unity Software Inc. Grades

The table below shows recent grades from recognized grading companies for Unity Software Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-13 |

| Goldman Sachs | Maintain | Neutral | 2026-01-13 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Piper Sandler | Upgrade | Overweight | 2025-12-11 |

| BTIG | Upgrade | Buy | 2025-12-11 |

| Wells Fargo | Upgrade | Overweight | 2025-12-05 |

| Arete Research | Upgrade | Buy | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-11-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

Overall, Unity Software Inc. shows a positive trend with multiple upgrades and a consensus rating of Buy, indicating favorable analyst sentiment.

Perfect Corp. Grades

The table below shows recent grades from recognized grading companies for Perfect Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2024-02-29 |

| Goldman Sachs | Maintain | Neutral | 2023-10-26 |

| Piper Sandler | Maintain | Neutral | 2023-10-25 |

| Piper Sandler | Maintain | Neutral | 2023-07-26 |

| Piper Sandler | Maintain | Neutral | 2023-07-25 |

| Piper Sandler | Maintain | Neutral | 2023-04-27 |

| Oppenheimer | Downgrade | Perform | 2023-04-20 |

| Oppenheimer | Downgrade | Perform | 2023-04-19 |

| Oppenheimer | Downgrade | Perform | 2023-04-18 |

| Piper Sandler | Maintain | Neutral | 2023-03-08 |

Perfect Corp. has consistently received Neutral ratings with a recent downgrade from Outperform to Perform by Oppenheimer, reflecting a stable but cautious analyst outlook and a consensus rating of Hold.

Which company has the best grades?

Unity Software Inc. has received significantly more positive grades, including multiple Buy and Overweight ratings, compared to Perfect Corp.’s Neutral and Perform grades. This contrast may influence investors seeking stronger analyst conviction or momentum in their portfolios.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Unity Software Inc. (U) and Perfect Corp. (PERF) based on the most recent data available.

| Criterion | Unity Software Inc. (U) | Perfect Corp. (PERF) |

|---|---|---|

| Diversification | Moderate: Revenue from Create and Operate Solutions, with some strategic partnerships | Limited data on product diversification; focused on core business |

| Profitability | Weak: Negative net margin (-36.63%), negative ROIC (-12.78%), declining profitability | Weak but improving: Slightly positive net margin (8.34%), negative ROIC (-2.1%) but growing trend |

| Innovation | Moderate: High fixed asset turnover (18.35) suggests efficient asset use for innovation | Strong: Very high fixed asset turnover (57.94), indicating efficient innovation and asset use |

| Global presence | Strong: Large and diversified revenue streams, global client base | Moderate: Smaller scale, less global diversification evident |

| Market Share | Moderate: Competing in a large gaming and software market but losing value | Moderate: Niche market leadership with improving profitability trend |

Key takeaways: Unity Software shows challenges in profitability and value creation despite a strong global presence and diversified revenue. Perfect Corp. is still shedding value but improving profitability and demonstrates efficient asset use, suggesting potential for growth. Both companies exhibit risks that require cautious investment consideration.

Risk Analysis

Below is a comparison of key risks for Unity Software Inc. (U) and Perfect Corp. (PERF) based on the most recent data from 2024–2026:

| Metric | Unity Software Inc. (U) | Perfect Corp. (PERF) |

|---|---|---|

| Market Risk | High beta (2.05) indicates significant price volatility and sensitivity to market swings. | Low beta (0.45) suggests lower volatility and market sensitivity. |

| Debt Level | Moderate debt-to-equity ratio (~0.74) with neutral risk; interest coverage is negative, indicating difficulty servicing debt. | Virtually no debt (debt-to-equity ~0), very low financial risk from leverage. |

| Regulatory Risk | Moderate, operating globally including US and EU with potential compliance challenges in tech regulation. | Moderate, based in Taiwan, facing evolving technology and data privacy regulations regionally. |

| Operational Risk | Unfavorable profitability metrics (negative net margin, ROE, ROIC) imply operational inefficiencies and risk to earnings. | Mixed metrics with modest profitability but negative ROIC; operational risks include scaling AI/AR tech. |

| Environmental Risk | Moderate, typical for software firms with limited direct environmental impact but growing stakeholder scrutiny. | Moderate, similar industry context with increasing demand for sustainable tech practices. |

| Geopolitical Risk | Exposure to US-China tensions and global supply chain disruptions affecting international sales. | Higher geopolitical risk due to Taiwan-China relations and reliance on Asian markets. |

The most impactful risks for Unity Software are its high market volatility and operational inefficiencies reflected by negative profitability and poor interest coverage. Perfect Corp. faces lower market risk and no leverage risk but has elevated geopolitical uncertainty due to its location and a distressed Altman Z-score indicating financial vulnerability. Caution is advised especially for Unity on profitability and debt servicing, and for Perfect on geopolitical and financial distress risks.

Which Stock to Choose?

Unity Software Inc. shows declining revenue with a 17.1% drop in 2024 and generally unfavorable profitability ratios, including a -36.63% net margin and -20.81% ROE. Debt levels are moderate, and the rating is very unfavorable overall, with a “D+” score. The company is shedding value, with a very unfavorable moat rating and declining profitability.

Perfect Corp. reports revenue growth of 12.52% in 2024 and a positive net margin of 8.34%, though ROE and ROIC remain slightly unfavorable. The company has low debt, a strong current ratio, and a favorable overall rating of “A-“. Despite shedding value, its profitability trend is improving, reflected in a slightly unfavorable moat rating.

Investors seeking growth might find Perfect Corp.’s improving income and stronger rating more appealing, while those with a higher risk tolerance might interpret Unity Software’s metrics as indicating potential turnaround opportunities despite its unfavorable financials and declining moat.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Unity Software Inc. and Perfect Corp. to enhance your investment decisions: