In today’s fast-evolving technology landscape, monday.com Ltd. and Perfect Corp. stand out as innovative players in the software application industry. monday.com focuses on cloud-based work management solutions, while Perfect Corp. leads in AI-driven beauty and fashion tech. Despite different niches, both compete through cutting-edge innovation and expanding global reach. This article will help investors determine which company presents the most compelling opportunity for their portfolio.

Table of contents

Companies Overview

I will begin the comparison between monday.com Ltd. and Perfect Corp. by providing an overview of these two companies and their main differences.

monday.com Ltd. Overview

monday.com Ltd. develops cloud-based software applications globally, offering Work OS, a visual work operating system for creating customizable work management tools. Serving various sectors including marketing, CRM, and project management, monday.com focuses on providing modular solutions to organizations, educational institutions, and government units. Founded in 2012 and headquartered in Tel Aviv, it is a well-established player in the software application industry.

Perfect Corp. Overview

Perfect Corp. specializes in SaaS AI and augmented reality solutions for beauty and fashion tech, delivering virtual try-on and AI-powered analysis tools. Its product suite includes makeup, hairstyle, and accessory virtual try-ons, alongside AI features for personalized recommendations. Founded in 2015 and based in New Taipei City, Perfect Corp. serves a niche market within the software application sector, leveraging cutting-edge technology to enhance customer experiences.

Key similarities and differences

Both companies operate within the software application industry, focusing on innovative technology solutions. monday.com Ltd. targets broad organizational work management needs with a cloud-based platform, while Perfect Corp. concentrates on AI and AR applications specific to beauty and fashion. monday.com is significantly larger in market cap and employee count, reflecting its wider market scope, whereas Perfect Corp. maintains a specialized, tech-driven niche with a smaller scale.

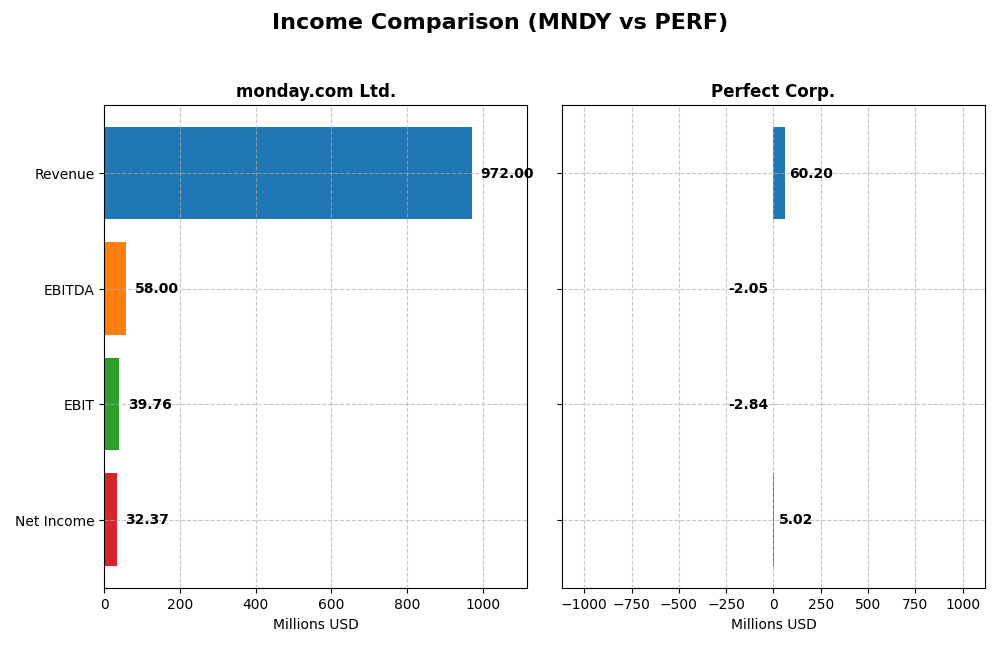

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for monday.com Ltd. (MNDY) and Perfect Corp. (PERF) for the fiscal year 2024.

| Metric | monday.com Ltd. (MNDY) | Perfect Corp. (PERF) |

|---|---|---|

| Market Cap | 6.53B | 179M |

| Revenue | 972M | 60.2M |

| EBITDA | 58.0M | -2.05M |

| EBIT | 39.8M | -2.84M |

| Net Income | 32.4M | 5.02M |

| EPS | 0.65 | 0.05 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

monday.com Ltd.

monday.com Ltd. demonstrated strong revenue growth from 2020 to 2024, increasing from $161M to $972M, with net income turning positive at $32M in 2024 after losses in prior years. Gross margins remained high and favorable at 89.33%, while net margin improved to a neutral 3.33%. The latest fiscal year showed significant margin and profitability improvements, reflecting robust operational leverage.

Perfect Corp.

Perfect Corp. also exhibited revenue growth, rising from $29.9M in 2020 to $60.2M in 2024, with net income recovering to $5M in 2024 after earlier losses. Gross margin stayed favorable at 77.98%, but EBIT margin remained unfavorable at -4.72%. The most recent year saw slower EBIT growth and a decline in net margin despite positive net income and steady revenue expansion.

Which one has the stronger fundamentals?

monday.com Ltd. shows stronger fundamentals, with higher gross margins, positive EBIT, and net income growth rates that are both faster and more consistent. Perfect Corp.’s margins are less favorable, especially EBIT, and its recent negative EBIT growth contrasts with monday.com’s significant profitability improvements. Both companies display favorable overall income statement trends, but monday.com’s metrics stand out more positively.

Financial Ratios Comparison

The table below presents the key financial ratios for monday.com Ltd. (MNDY) and Perfect Corp. (PERF) based on their most recent fiscal year data from 2024.

| Ratios | monday.com Ltd. (MNDY) | Perfect Corp. (PERF) |

|---|---|---|

| ROE | 3.14% | 3.42% |

| ROIC | -1.73% | -2.10% |

| P/E | 363 | 56.6 |

| P/B | 11.41 | 1.93 |

| Current Ratio | 2.66 | 5.52 |

| Quick Ratio | 2.66 | 5.52 |

| D/E | 0.10 | 0.0035 |

| Debt-to-Assets | 6.29% | 0.28% |

| Interest Coverage | 0 | -449 |

| Asset Turnover | 0.58 | 0.33 |

| Fixed Asset Turnover | 7.13 | 57.94 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

monday.com Ltd.

monday.com Ltd. shows a mixed ratio profile with strong liquidity evidenced by a current ratio of 2.66 and low debt levels, while profitability ratios like net margin (3.33%) and return on equity (3.14%) are weak and unfavorable. The company does not pay dividends, which may reflect reinvestment in growth and R&D, consistent with its high expenditure in development and stock-based compensation.

Perfect Corp.

Perfect Corp. has a slightly unfavorable ratio profile, with a favorable weighted average cost of capital at 5.96% and no debt, but weak profitability ratios including a low return on equity (3.42%) and negative return on invested capital (-2.1%). It also does not pay dividends, likely due to a focus on growth and technology investment, without share buyback programs reported.

Which one has the best ratios?

monday.com Ltd. presents a more balanced liquidity and leverage position with favorable debt coverage and asset turnover, but struggles with profitability and valuation metrics. Perfect Corp. has lower debt and cost of capital but weaker asset efficiency and profitability, making its overall ratios slightly less favorable compared to monday.com Ltd.

Strategic Positioning

This section compares the strategic positioning of monday.com Ltd. and Perfect Corp. regarding Market position, Key segments, and Exposure to technological disruption:

monday.com Ltd.

- Established NASDAQ-listed software application provider with global presence and competitive pressure in cloud work OS markets.

- Focuses on modular cloud-based work management tools serving organizations, educational, government, and diverse business units.

- Operates in software application sector with standard technological disruption risks typical for cloud-based enterprise tools.

Perfect Corp.

- NYSE-listed AI and AR SaaS provider specializing in beauty and fashion tech solutions with niche market focus.

- Offers AI-powered virtual try-on and beauty tech applications driving engagement in fashion and cosmetics industries.

- Faces technological disruption from rapid advances in AI and AR within consumer beauty and fashion tech markets.

monday.com Ltd. vs Perfect Corp. Positioning

monday.com Ltd. pursues a diversified approach with broad organizational clients and modular software, while Perfect Corp. concentrates on AI/AR beauty tech niche. monday.com benefits from scale and variety; Perfect leverages specialized innovation but with narrower market reach.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOAT status due to ROIC below WACC, despite growing profitability trends. Neither currently demonstrates a strong competitive advantage based on efficient capital use from 2020 to 2024.

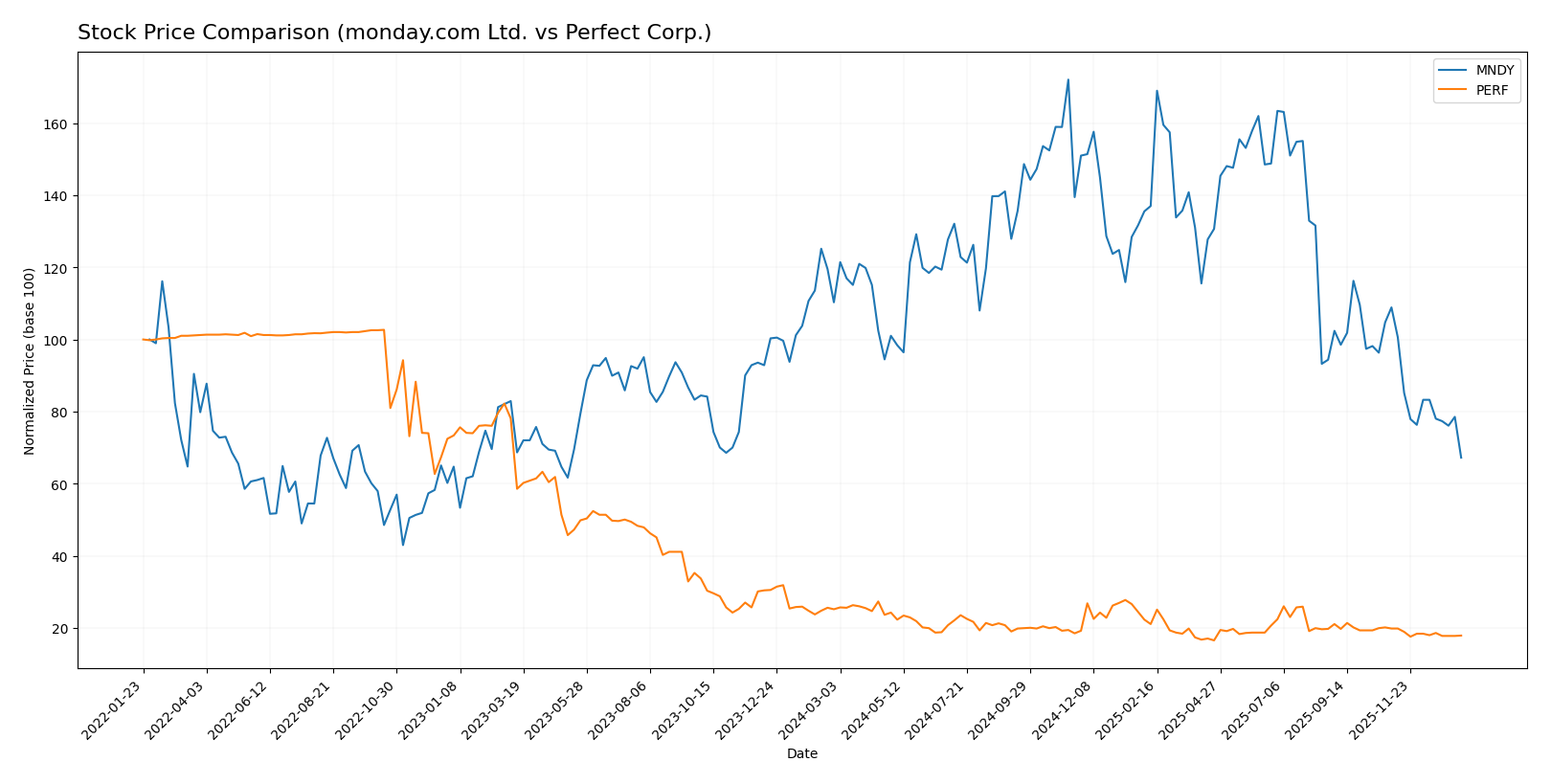

Stock Comparison

The stock prices of monday.com Ltd. (MNDY) and Perfect Corp. (PERF) have both exhibited bearish trends over the past 12 months, with notable declines and decelerating momentum in their trading dynamics.

Trend Analysis

Monday.com Ltd. (MNDY) experienced a -39.06% price change over the past year, indicating a bearish trend with deceleration. The stock showed high volatility with a standard deviation of 47.32, hitting a peak of 324.31 and a low of 126.7.

Perfect Corp. (PERF) recorded a -28.98% price change over the same period, also bearish with deceleration. Its volatility was much lower, with a standard deviation of 0.27, and prices ranged from 2.7 to 1.61.

Comparing both stocks, monday.com Ltd. showed a larger decline and higher volatility, making Perfect Corp. the less negative performer in terms of market price movement during this period.

Target Prices

The current analyst consensus shows promising upside potential for monday.com Ltd. and a stable outlook for Perfect Corp.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| monday.com Ltd. | 330 | 194 | 264.42 |

| Perfect Corp. | 7 | 7 | 7 |

Analysts expect monday.com Ltd.’s stock price to more than double from the current 126.7 USD, indicating strong growth prospects. Perfect Corp.’s target consensus at 7 USD suggests a significant potential increase from its current 1.74 USD price, reflecting optimism despite lower market capitalization.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial grades for monday.com Ltd. and Perfect Corp.:

Rating Comparison

monday.com Ltd. Rating

- Rating: B-, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a favorable valuation based on future cash flows.

- ROE Score: 3, a moderate level of efficiency in generating profit from equity.

- ROA Score: 3, moderate effectiveness in asset utilization.

- Debt To Equity Score: 3, moderate financial risk from debt levels.

- Overall Score: 3, reflecting a moderate overall financial standing.

Perfect Corp. Rating

- Rating: A-, also regarded as very favorable.

- Discounted Cash Flow Score: 5, showing a very favorable valuation outlook.

- ROE Score: 2, moderate but slightly lower efficiency in profit generation.

- ROA Score: 3, moderate effectiveness in asset utilization.

- Debt To Equity Score: 4, favorable financial stability with lower risk.

- Overall Score: 4, indicating a favorable overall financial condition.

Which one is the best rated?

Based strictly on the provided data, Perfect Corp. holds a better rating overall with an A- and higher scores in discounted cash flow, debt to equity, and overall score. monday.com Ltd. has moderate scores and a lower B- rating.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for monday.com Ltd. and Perfect Corp.:

monday.com Ltd. Scores

- Altman Z-Score: 6.33, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, showing average financial strength.

Perfect Corp. Scores

- Altman Z-Score: 1.31, in distress zone indicating high bankruptcy risk.

- Piotroski Score: 6, showing average financial strength.

Which company has the best scores?

Based on the provided data, monday.com Ltd. has a significantly stronger Altman Z-Score, placing it in the safe zone. Both companies show average Piotroski Scores, but Perfect Corp. has a slightly higher score. Overall, monday.com Ltd. shows better financial stability according to these scores.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to monday.com Ltd. and Perfect Corp.:

monday.com Ltd. Grades

The table below summarizes the latest grades from recognized financial institutions for monday.com Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-01-15 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-23 |

| Tigress Financial | Maintain | Buy | 2025-12-11 |

| Baird | Maintain | Outperform | 2025-11-11 |

| Wells Fargo | Maintain | Overweight | 2025-11-11 |

| DA Davidson | Maintain | Buy | 2025-11-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-11 |

| Piper Sandler | Maintain | Overweight | 2025-11-11 |

All recent grades for monday.com Ltd. consistently indicate a positive outlook, predominantly Buy and Overweight ratings with no downgrades.

Perfect Corp. Grades

The table below summarizes the latest grades from recognized financial institutions for Perfect Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2024-02-29 |

| Goldman Sachs | Maintain | Neutral | 2023-10-26 |

| Piper Sandler | Maintain | Neutral | 2023-10-25 |

| Piper Sandler | Maintain | Neutral | 2023-07-26 |

| Piper Sandler | Maintain | Neutral | 2023-07-25 |

| Piper Sandler | Maintain | Neutral | 2023-04-27 |

| Oppenheimer | Downgrade | Perform | 2023-04-20 |

| Oppenheimer | Downgrade | Perform | 2023-04-19 |

| Oppenheimer | Downgrade | Perform | 2023-04-18 |

| Piper Sandler | Maintain | Neutral | 2023-03-08 |

Grades for Perfect Corp. show a stable but cautious stance, mainly Neutral ratings with a downgrade from Outperform to Perform by Oppenheimer in early 2023.

Which company has the best grades?

monday.com Ltd. has received consistently stronger grades, with numerous Buy, Outperform, and Overweight recommendations compared to Perfect Corp.’s Neutral and downgraded Perform ratings. This divergence may imply a more optimistic market perception and confidence in monday.com Ltd.’s prospects by analysts.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of monday.com Ltd. (MNDY) and Perfect Corp. (PERF) based on their diversification, profitability, innovation, global presence, and market share using the most recent data.

| Criterion | monday.com Ltd. (MNDY) | Perfect Corp. (PERF) |

|---|---|---|

| Diversification | Moderate, focused on project management tools | Moderate, specialized in beauty tech solutions |

| Profitability | Low net margin (3.33%), ROIC negative (-1.73%), value-destroying but improving | Moderate net margin (8.34%), negative ROIC (-2.1%), also value-destroying but improving |

| Innovation | Strong innovation with growing ROIC trend (+99.6%) | Solid innovation with ROIC growth (+45.8%) |

| Global presence | Growing international footprint, good asset turnover (7.13) | Expanding global reach, very high fixed asset turnover (57.94) |

| Market Share | High valuation multiples (PE 363), indicating market optimism but risk | Lower valuation multiples (PE 57), more reasonable but still elevated |

In summary, both companies exhibit improving profitability trends despite currently destroying value, signaling potential turnaround opportunities. monday.com shows stronger innovation and balance sheet health, while Perfect Corp. benefits from a lower valuation and niche specialization. Investors should weigh these factors carefully with risk management in mind.

Risk Analysis

Below is a comparison of key risks for monday.com Ltd. (MNDY) and Perfect Corp. (PERF) based on their most recent financial and operational data from 2024.

| Metric | monday.com Ltd. (MNDY) | Perfect Corp. (PERF) |

|---|---|---|

| Market Risk | Moderate (Beta 1.255) | Low (Beta 0.454) |

| Debt level | Low (D/E 0.1, Debt to Assets 6.29%) | Very Low (D/E 0.0, Debt to Assets 0.28%) |

| Regulatory Risk | Moderate (Israeli & global software regulations) | Moderate (Taiwanese & global tech regulations) |

| Operational Risk | Moderate (Scaling SaaS platform) | Moderate (AI/AR tech innovation risks) |

| Environmental Risk | Low (Software industry) | Low (Software industry) |

| Geopolitical Risk | Moderate (Israel regional tensions) | Moderate (Taiwan-China tensions) |

The most impactful risks include monday.com’s elevated market volatility and high valuation multiples, increasing exposure to market corrections. Perfect Corp.’s distress zone Altman Z-Score signals financial fragility despite low debt, highlighting operational and profitability challenges. Geopolitical tensions in their respective regions remain a shared concern for both companies.

Which Stock to Choose?

monday.com Ltd. (MNDY) shows a strong income growth with a 33.21% revenue increase in 2024 and favorable gross margin at 89.33%. Financial ratios are mixed, with favorable liquidity and low debt but unfavorable profitability and valuation metrics. The company’s rating is very favorable overall, supported by a moderate financial health score and a safe Altman Z-Score.

Perfect Corp. (PERF) also demonstrates favorable income growth, though at a slower 12.52% revenue growth in 2024, with a lower gross margin of 77.98%. Its financial ratios reveal some weaknesses in profitability and asset turnover, with a slightly unfavorable global ratio opinion. However, PERF holds a stronger rating of A- and a distress-zone Altman Z-Score indicating financial risk.

Considering the ratings and financial evaluations, MNDY’s strong income growth and stable financial health might appeal to investors seeking growth with moderate risk. Conversely, PERF’s higher rating but financial distress signals could be more aligned with investors tolerating higher risk and valuing potential turnaround opportunities. The choice could depend on the investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of monday.com Ltd. and Perfect Corp. to enhance your investment decisions: