PepsiCo, Inc. and Monster Beverage Corporation are two leading players in the non-alcoholic beverages industry, each with unique market approaches and innovation strategies. PepsiCo boasts a diversified portfolio spanning snacks and beverages globally, while Monster focuses on energy drinks with strong brand appeal. Their overlapping markets and growth potential make them compelling candidates for comparison. In this article, I will help you decide which company presents the most attractive investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between PepsiCo and Monster Beverage by providing an overview of these two companies and their main differences.

PepsiCo Overview

PepsiCo, Inc. is a global leader in the non-alcoholic beverages and convenient foods market, operating through seven diverse segments across multiple regions. Founded in 1898 and headquartered in Purchase, New York, the company manufactures, markets, and distributes a wide range of products including snacks, cereals, and beverages. With a workforce of 319K employees, PepsiCo serves a broad customer base through various retail and e-commerce channels.

Monster Beverage Overview

Monster Beverage Corporation focuses on the development, marketing, and distribution of energy drinks and related beverages worldwide. Headquartered in Corona, California, and founded in 1985, Monster operates three segments, offering a diverse portfolio including carbonated and non-carbonated drinks under numerous brand names. The company employs 5.5K people and sells primarily through bottlers, distributors, and direct retail channels.

Key similarities and differences

Both PepsiCo and Monster Beverage operate in the non-alcoholic beverage sector and distribute products through extensive networks including retail and e-commerce. However, PepsiCo has a more diversified product portfolio spanning snacks and beverages across global markets, while Monster Beverage specializes predominantly in energy drinks and related beverages. PepsiCo’s scale and employee base are significantly larger, reflecting its broader market presence and product variety.

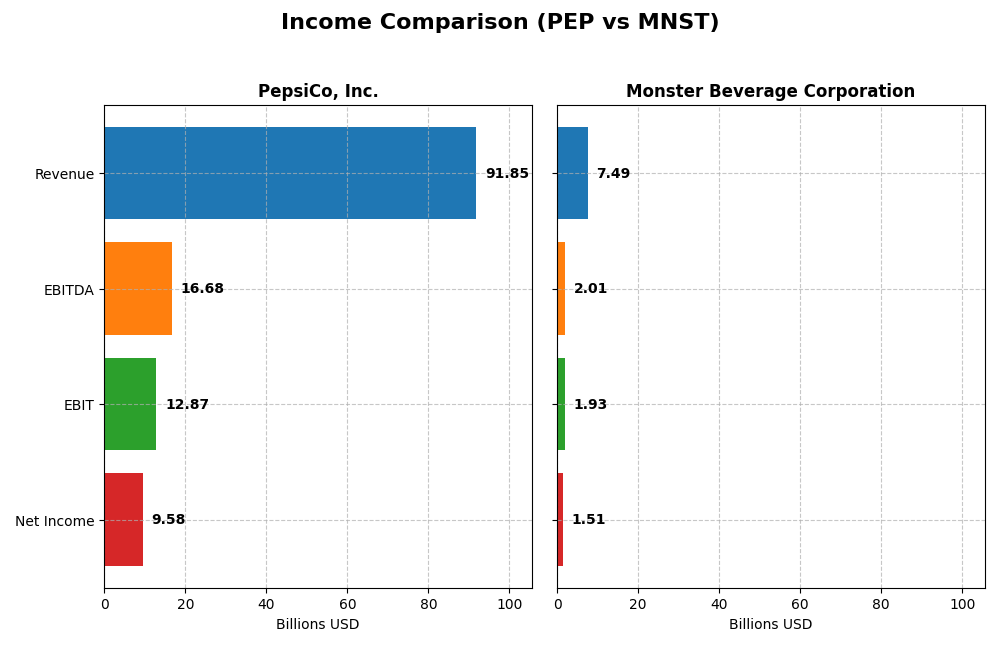

Income Statement Comparison

The table below summarizes the key income statement metrics for PepsiCo, Inc. and Monster Beverage Corporation for the fiscal year 2024, providing a direct financial comparison.

| Metric | PepsiCo, Inc. (PEP) | Monster Beverage Corporation (MNST) |

|---|---|---|

| Market Cap | 193.3B | 75.7B |

| Revenue | 91.9B | 7.5B |

| EBITDA | 16.7B | 2.0B |

| EBIT | 12.9B | 1.9B |

| Net Income | 9.6B | 1.5B |

| EPS | 6.98 | 1.50 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

PepsiCo, Inc.

PepsiCo’s revenue steadily increased from 70.4B in 2020 to 91.9B in 2024, with net income rising from 7.12B to 9.58B over the same period. Margins remained stable, with a gross margin near 54.8% and net margin around 10.4%. In 2024, revenue growth slowed to 0.42%, but net margin and EPS improved, signaling efficient cost management.

Monster Beverage Corporation

Monster’s revenue advanced from 4.6B in 2020 to 7.5B in 2024, with net income fluctuating but overall increasing from 1.41B to 1.51B. Gross margin stayed favorable at about 54%, while net margin was strong at 20.1%. The latest year showed 4.94% revenue growth but declines in EBIT and net margin, reflecting margin pressure despite solid top-line expansion.

Which one has the stronger fundamentals?

PepsiCo demonstrates consistent revenue and net income growth with stable margins and favorable net margin expansion, indicating resilience. Monster boasts higher net margins and rapid revenue growth but recent declines in profitability metrics raise concerns. Overall, PepsiCo’s steady profitability and margin stability contrast with Monster’s margin volatility, reflecting different fundamental strengths.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for PepsiCo, Inc. and Monster Beverage Corporation for the fiscal year 2024.

| Ratios | PepsiCo, Inc. (PEP) | Monster Beverage Corporation (MNST) |

|---|---|---|

| ROE | 53.1% | 25.3% |

| ROIC | 15.2% | 22.1% |

| P/E | 21.8 | 35.0 |

| P/B | 11.6 | 8.9 |

| Current Ratio | 0.82 | 3.32 |

| Quick Ratio | 0.65 | 2.65 |

| D/E (Debt-to-Equity) | 2.49 | 0.06 |

| Debt-to-Assets | 45.2% | 4.8% |

| Interest Coverage | 15.6 | 69.2 |

| Asset Turnover | 0.92 | 0.97 |

| Fixed Asset Turnover | 2.93 | 7.16 |

| Payout Ratio | 75.5% | 0% |

| Dividend Yield | 3.46% | 0% |

Interpretation of the Ratios

PepsiCo, Inc.

PepsiCo shows a mix of strong and weak ratios. It has favorable net margin (10.43%), ROE (53.09%), ROIC (15.23%), and interest coverage (14.0), indicating solid profitability and debt service capacity. However, its low current ratio (0.82), high debt-to-equity (2.49), and unfavorable price-to-book (11.57) ratios are concerns for liquidity and valuation. The company pays dividends with a 3.46% yield, supported by a stable payout, yet free cash flow coverage is tight, posing risks from high distributions and repurchases.

Monster Beverage Corporation

Monster Beverage presents stronger liquidity and operational efficiency with a high quick ratio (2.65) and fixed asset turnover (7.16). Profitability ratios like net margin (20.14%), ROIC (22.11%), and interest coverage (69.19) are favorable, but the high P/E (34.99) and P/B (8.86) ratios suggest premium valuation. The company does not pay dividends, reflecting a reinvestment strategy focused on growth and possibly R&D, supported by a low debt-to-equity (0.06) and strong free cash flow.

Which one has the best ratios?

Monster Beverage’s ratios are generally more favorable, especially regarding liquidity, operational efficiency, and capital structure, despite high valuation multiples. PepsiCo has robust profitability but faces liquidity and leverage challenges. Overall, Monster’s financial profile appears stronger, although both companies exhibit some unfavorable valuation indicators and specific risks in liquidity or cash flow management.

Strategic Positioning

This section compares the strategic positioning of PepsiCo, Inc. and Monster Beverage Corporation, including market position, key segments, and exposure to disruption:

PepsiCo, Inc.

- Large market cap of 193B with diversified global beverage and convenient foods, facing broad competitive pressure.

- Operates seven segments including snacks, beverages, and regional markets; driven by broad product portfolio and distribution networks.

- Limited explicit exposure to technological disruption mentioned; operates via direct store delivery and e-commerce.

Monster Beverage Corporation

- Market cap of 76B, focused on energy drinks with moderate competitive pressure in niche markets.

- Revenue primarily driven by Monster Energy Drinks, plus strategic and alcohol brands segments.

- No direct mention of tech disruption; focus on beverage innovation within energy and related product lines.

PepsiCo, Inc. vs Monster Beverage Corporation Positioning

PepsiCo has a diversified product and geographic portfolio, spreading risk and driving multiple revenue streams. Monster is more concentrated on energy drinks and related beverages, which may limit scope but focus its market expertise and innovation efforts.

Which has the best competitive advantage?

PepsiCo exhibits a very favorable moat with growing ROIC and durable competitive advantage, while Monster shows a slightly favorable moat with value creation but declining profitability, indicating PepsiCo holds a stronger competitive advantage currently.

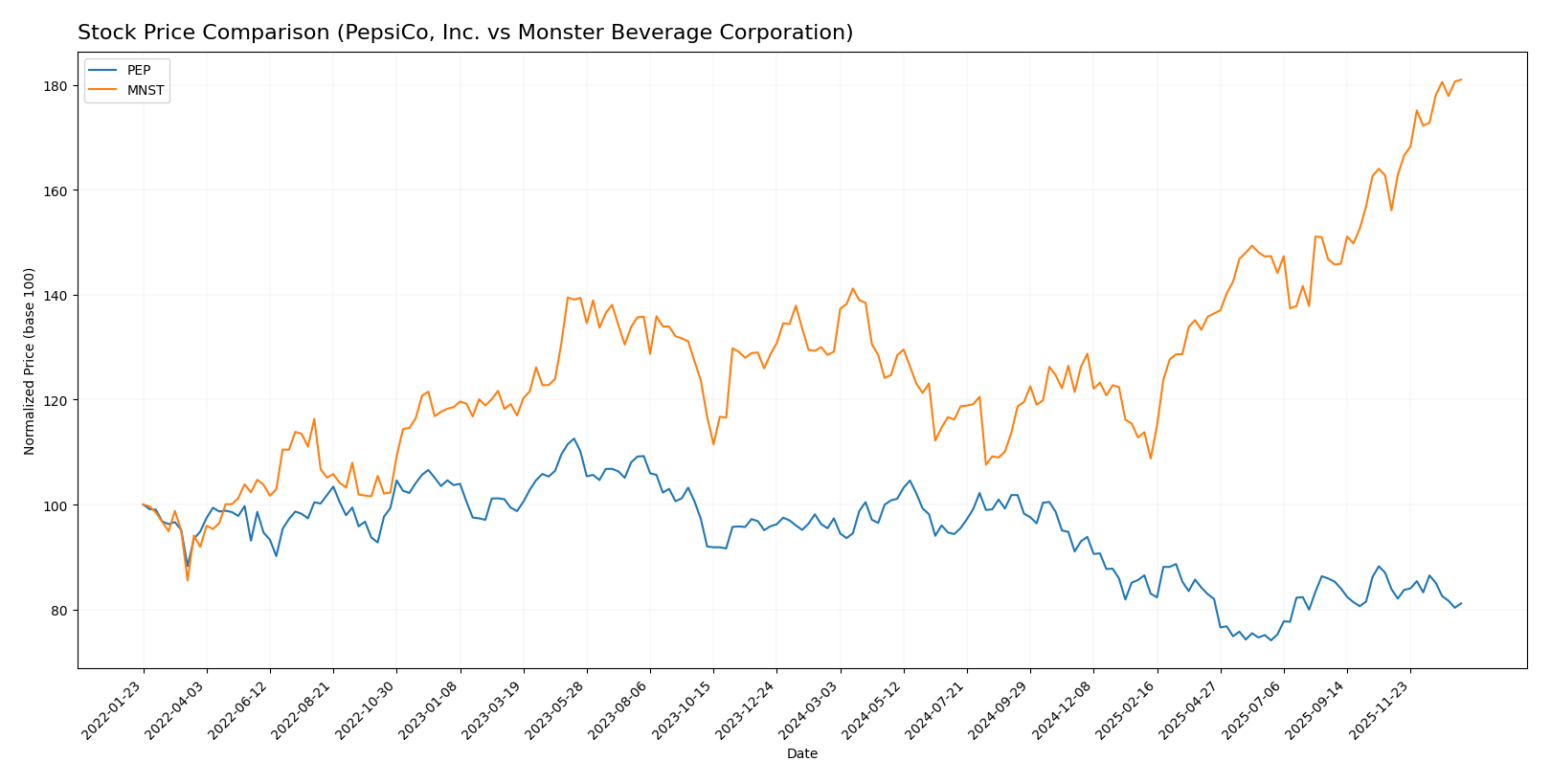

Stock Comparison

The stock price chart over the past 12 months reveals a marked divergence in performance between PepsiCo, Inc. and Monster Beverage Corporation, with PepsiCo experiencing a significant decline and Monster Beverage showing robust growth and sustained buyer dominance.

Trend Analysis

PepsiCo, Inc. saw a bearish trend over the past year with a price decrease of 16.65% and an accelerating downward momentum. The stock showed high volatility with a standard deviation of 14.7, hitting a high of 182.19 and a low of 129.07.

Monster Beverage Corporation exhibited a bullish trend with a 40.17% price increase over the same period, coupled with accelerating gains. Volatility was moderate with a standard deviation of 8.13; the stock ranged between 46.06 and 77.5.

Comparatively, Monster Beverage significantly outperformed PepsiCo over the last 12 months, delivering stronger market gains and more consistent buyer dominance in trading volumes.

Target Prices

Analysts present a positive target consensus for PepsiCo, Inc. and Monster Beverage Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| PepsiCo, Inc. | 172 | 144 | 158.33 |

| Monster Beverage Corporation | 87 | 70 | 79.44 |

The target prices suggest upside potential for both stocks compared to their current prices of 141.36 for PepsiCo and 77.5 for Monster Beverage, reflecting generally bullish analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for PepsiCo, Inc. and Monster Beverage Corporation:

Rating Comparison

PEP Rating

- Rating: B with a very favorable status.

- Discounted Cash Flow Score: 4, indicating favorable valuation.

- ROE Score: 5, very favorable efficiency in generating profit.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 3, moderate overall financial standing.

MNST Rating

- Rating: B with a very favorable status.

- Discounted Cash Flow Score: 4, indicating favorable valuation.

- ROE Score: 5, very favorable efficiency in generating profit.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Both PepsiCo and Monster Beverage share the same overall rating of B and identical scores in discounted cash flow, ROE, debt-to-equity, and overall score. Monster Beverage has a slightly higher ROA score, indicating better asset utilization.

Scores Comparison

The scores comparison between PepsiCo and Monster Beverage highlights their financial stability and strength as follows:

PepsiCo Scores

- Altman Z-Score: 3.46, indicating a safe zone.

- Piotroski Score: 6, reflecting average financial health.

Monster Beverage Scores

- Altman Z-Score: 25.33, indicating a safe zone.

- Piotroski Score: 8, reflecting very strong financial health.

Which company has the best scores?

Monster Beverage outperforms PepsiCo in both the Altman Z-Score and Piotroski Score, showing stronger financial health and a more robust position against bankruptcy risks.

Grades Comparison

Here is a comparison of recent grades and rating consensus for PepsiCo, Inc. and Monster Beverage Corporation:

PepsiCo, Inc. Grades

The following table summarizes recent grades from major grading companies for PepsiCo, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-12-17 |

| Barclays | Maintain | Equal Weight | 2025-12-11 |

| JP Morgan | Upgrade | Overweight | 2025-12-10 |

| Piper Sandler | Maintain | Overweight | 2025-12-09 |

| Piper Sandler | Maintain | Overweight | 2025-11-21 |

| Freedom Capital Markets | Downgrade | Hold | 2025-10-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-10 |

| JP Morgan | Maintain | Neutral | 2025-10-06 |

| Barclays | Maintain | Equal Weight | 2025-10-03 |

| Citigroup | Maintain | Buy | 2025-09-25 |

PepsiCo’s grades show a mix of “Buy,” “Overweight,” and “Equal Weight” ratings, with one recent downgrade to “Hold.” The consensus rating stands at “Hold,” reflecting a cautious outlook.

Monster Beverage Corporation Grades

Below is a summary of recent grades from grading companies for Monster Beverage Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-23 |

| Citigroup | Maintain | Buy | 2025-12-17 |

| Stifel | Maintain | Buy | 2025-12-12 |

| Wells Fargo | Maintain | Overweight | 2025-12-03 |

| Piper Sandler | Maintain | Overweight | 2025-12-03 |

| BMO Capital | Maintain | Market Perform | 2025-12-03 |

| RBC Capital | Maintain | Outperform | 2025-12-01 |

| Piper Sandler | Maintain | Overweight | 2025-12-01 |

Monster Beverage’s grades predominantly consist of “Buy,” “Overweight,” and “Outperform” ratings, with a single “Hold” and one “Market Perform.” The consensus rating is “Buy,” indicating a generally positive outlook.

Which company has the best grades?

Monster Beverage Corporation has received stronger and more consistently positive grades than PepsiCo, Inc., with more “Buy,” “Overweight,” and “Outperform” ratings. This suggests investors may view Monster as having higher growth potential or stronger momentum compared to PepsiCo, which shows more mixed and cautious ratings.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for PepsiCo, Inc. and Monster Beverage Corporation based on the latest available data.

| Criterion | PepsiCo, Inc. | Monster Beverage Corporation |

|---|---|---|

| Diversification | Highly diversified across beverages and snacks, reducing sector risk | Primarily focused on energy drinks with limited diversification |

| Profitability | Strong profitability with a 10.43% net margin and ROIC of 15.23% | Higher net margin at 20.14% and ROIC of 22.11%, but declining trend |

| Innovation | Continuous product innovation and brand extensions | Innovation focused on energy drinks and strategic brand expansions |

| Global presence | Extensive global footprint with widespread market penetration | More concentrated global presence, mostly in North America and select regions |

| Market Share | Large market share in beverages and snacks worldwide | Leading position in energy drinks, but narrower market segment |

PepsiCo’s diversified portfolio and strong global footprint provide stability, while Monster excels in profitability within its niche but faces risks due to lower diversification and a declining ROIC trend. Investors should weigh diversification versus focused high-margin growth when choosing between them.

Risk Analysis

Below is a comparative table outlining key risks for PepsiCo, Inc. (PEP) and Monster Beverage Corporation (MNST) based on 2024 financial data and recent company profiles.

| Metric | PepsiCo, Inc. (PEP) | Monster Beverage Corporation (MNST) |

|---|---|---|

| Market Risk | Moderate (Beta 0.42) | Moderate (Beta 0.46) |

| Debt Level | High (D/E 2.49, Debt-to-Assets 45%) | Very Low (D/E 0.06, Debt-to-Assets 5%) |

| Regulatory Risk | Moderate (Global operations with diverse regulations) | Moderate (U.S. focused but growing internationally) |

| Operational Risk | Medium (Large scale, complex supply chain) | Low (Smaller scale, more focused product line) |

| Environmental Risk | Elevated (Food and beverage packaging, sustainability pressures) | Moderate (Beverage production, energy drink scrutiny) |

| Geopolitical Risk | Moderate (Global footprint, emerging markets exposure) | Low to Moderate (Primarily North America, some international growth) |

PepsiCo faces its most impactful risks from elevated debt levels and environmental sustainability pressures, amplified by its global scale. Monster Beverage’s key risks are more contained, with minimal debt and strong financial health, but it is vulnerable to regulatory scrutiny on energy drinks. Both exhibit moderate market risk consistent with their sector.

Which Stock to Choose?

PepsiCo, Inc. (PEP) shows a favorable income statement with steady revenue and net income growth over 2020-2024. Its financial ratios are slightly favorable, with strong return on equity (53.1%) but some concerns on liquidity and debt levels. The company holds a very favorable rating and demonstrates a very favorable moat with growing ROIC above WACC.

Monster Beverage Corporation (MNST) presents a favorable income profile, although recent net margin and EPS growth show unfavorable trends. It has a favorable financial ratios profile marked by low debt and strong returns on invested capital, but its moat rating is only slightly favorable due to declining ROIC. Ratings are very favorable, supported by strong scores in profitability and financial stability.

Investors seeking durable competitive advantage and stable profitability might find PepsiCo’s profile more aligned with risk-averse or quality investing strategies. Conversely, those focused on growth and higher recent stock price momentum could see Monster Beverage as a potential option, despite its declining profitability trend. Overall, the choice might depend on the investor’s tolerance for risk and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of PepsiCo, Inc. and Monster Beverage Corporation to enhance your investment decisions: