Snowflake Inc. and Pegasystems Inc. are two influential players in the software application industry, each driving innovation in data management and customer engagement solutions. Snowflake leads with its cloud-based data platform, while Pegasystems excels in intelligent automation and digital process optimization. Their overlapping markets and distinct innovation strategies make them compelling contenders. In this article, I will help you determine which company is the more attractive investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Snowflake Inc. and Pegasystems Inc. by providing an overview of these two companies and their main differences.

Snowflake Inc. Overview

Snowflake Inc. offers a cloud-based data platform designed to consolidate data into a single source of truth, enabling business insights, data-driven applications, and data sharing. Founded in 2012 and headquartered in Bozeman, Montana, Snowflake serves various industries internationally, positioning itself as a key player in cloud data management within the technology sector.

Pegasystems Inc. Overview

Pegasystems Inc. develops and markets enterprise software applications focused on customer engagement and digital process automation through its Pega Platform and Pega Infinity. Established in 1983 and based in Waltham, Massachusetts, Pegasystems targets diverse sectors including financial services and healthcare, delivering software solutions and services globally with an emphasis on intelligent automation.

Key similarities and differences

Both Snowflake and Pegasystems operate in the software application industry within the technology sector, serving broad international markets. Snowflake specializes in cloud-based data platforms for data consolidation and analytics, while Pegasystems focuses on enterprise software that enhances customer engagement and automates business processes. Their business models differ in product scope: Snowflake emphasizes data cloud infrastructure, whereas Pegasystems centers on customer relationship management and automation software.

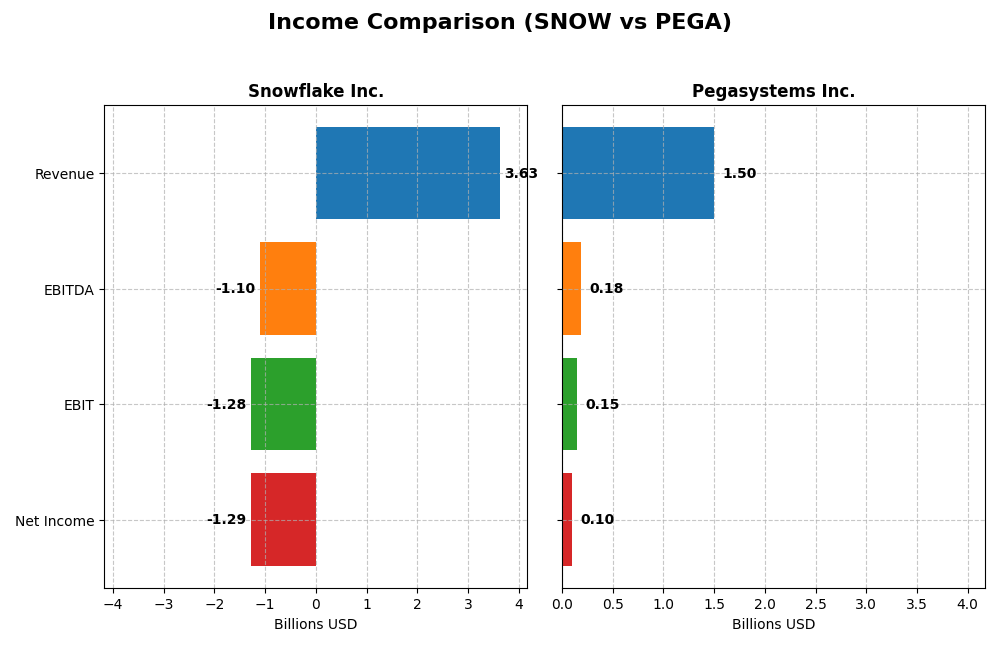

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Snowflake Inc. and Pegasystems Inc. for their most recent fiscal years.

| Metric | Snowflake Inc. (SNOW) | Pegasystems Inc. (PEGA) |

|---|---|---|

| Market Cap | 70.4B | 8.9B |

| Revenue | 3.63B | 1.50B |

| EBITDA | -1.10B | 185M |

| EBIT | -1.28B | 149M |

| Net Income | -1.29B | 99M |

| EPS | -3.86 | 0.58 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Snowflake Inc.

Snowflake Inc. experienced strong revenue growth from 2021 to 2025, with a remarkable 512.52% increase overall and 29.21% growth in the last year. However, net income remained negative and deteriorated by 138.48% over the period. Gross margins stayed favorable around 66.5%, but EBIT and net margins declined in 2025, reflecting challenges in profitability despite expanding top-line revenue.

Pegasystems Inc.

Pegasystems Inc. showed moderate revenue growth of 47.14% over 2020-2024, with a 4.51% increase in the latest year. Net income improved substantially, growing 261.62% overall and 39.97% in the last year, with a positive net margin of 6.63%. Gross margins were strong at 73.91%, and EBIT margin stabilized near 10%, indicating improved operational efficiency and profitability.

Which one has the stronger fundamentals?

Pegasystems displays stronger fundamentals, with consistent positive net income growth, healthy gross margins, and improving profitability metrics. Snowflake, while showing rapid revenue expansion and stable gross margins, continues to face significant net losses and unfavorable EBIT margins. The contrast highlights Pegasystems’ more balanced income statement stability versus Snowflake’s aggressive but loss-making growth trajectory.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Snowflake Inc. and Pegasystems Inc. based on their latest fiscal year data, providing insight into their profitability, liquidity, leverage, and valuation metrics.

| Ratios | Snowflake Inc. (2025) | Pegasystems Inc. (2024) |

|---|---|---|

| ROE | -42.9% | 16.9% |

| ROIC | -25.2% | 7.4% |

| P/E | -47.0 | 80.1 |

| P/B | 20.1 | 13.6 |

| Current Ratio | 1.75 | 1.23 |

| Quick Ratio | 1.75 | 1.23 |

| D/E (Debt-to-Equity) | 0.90 | 0.94 |

| Debt-to-Assets | 29.7% | 31.1% |

| Interest Coverage | -528.0 | 18.1 |

| Asset Turnover | 0.40 | 0.85 |

| Fixed Asset Turnover | 5.53 | 14.36 |

| Payout ratio | 0 | 10.3% |

| Dividend yield | 0% | 0.13% |

Interpretation of the Ratios

Snowflake Inc.

Snowflake’s ratios reveal a mixed picture. While current and quick ratios at 1.75 indicate solid short-term liquidity and debt to assets at 29.72% is favorable, profitability ratios such as net margin (-35.45%) and return on equity (-42.86%) are notably weak. The price-to-earnings ratio is favorable at -46.97 due to losses, but the high price-to-book ratio of 20.13 raises valuation concerns. Snowflake does not pay dividends, likely reflecting its reinvestment strategy in a growth phase.

Pegasystems Inc.

Pegasystems exhibits generally stable ratios with a 1.23 current ratio and a favorable quick ratio of 1.23, supporting liquidity. Profitability indicators like return on equity (16.94%) and interest coverage (21.87) are favorable, though the net margin at 6.63% is neutral. The valuation multiples, including a high PE of 80.12 and PB of 13.57, are unfavorable. Pegasystems pays a modest dividend with a 0.13% yield, indicating some shareholder returns but potential payout concerns.

Which one has the best ratios?

Comparing both, Pegasystems shows more favorable profitability and coverage ratios, reflecting steadier financial health. Snowflake, although strong in liquidity, struggles with significant losses and valuation metrics. Overall, Pegasystems’ ratios lean slightly favorable, whereas Snowflake’s remain slightly unfavorable, suggesting different risk and growth profiles.

Strategic Positioning

This section compares the strategic positioning of Snowflake Inc. and Pegasystems Inc., including their market position, key segments, and exposure to technological disruption:

Snowflake Inc.

- Leading cloud-based data platform provider facing intense competition in software applications.

- Focused on cloud data platform products generating $3.46B revenue (2025), with minor professional services.

- Operates in cloud data consolidation, enabling data-driven insights; must adapt continuously to cloud tech shifts.

Pegasystems Inc.

- Established enterprise software vendor with competitive pressure from diverse technology providers.

- Diversified revenue streams from cloud, consulting, maintenance, and subscription licenses totaling $1.7B.

- Provides intelligent automation and customer engagement software with a strong emphasis on digital process automation.

Snowflake Inc. vs Pegasystems Inc. Positioning

Snowflake concentrates on a cloud data platform, driven largely by product revenue, while Pegasystems offers a diversified mix of cloud, consulting, and licensing services. Snowflake’s scale in cloud data is larger, but Pegasystems benefits from broader enterprise software applications.

Which has the best competitive advantage?

Both companies are currently shedding value relative to their cost of capital, but Pegasystems shows a growing ROIC trend indicating improving profitability. Snowflake’s declining ROIC suggests worsening returns, making Pegasystems’ competitive advantage slightly stronger currently.

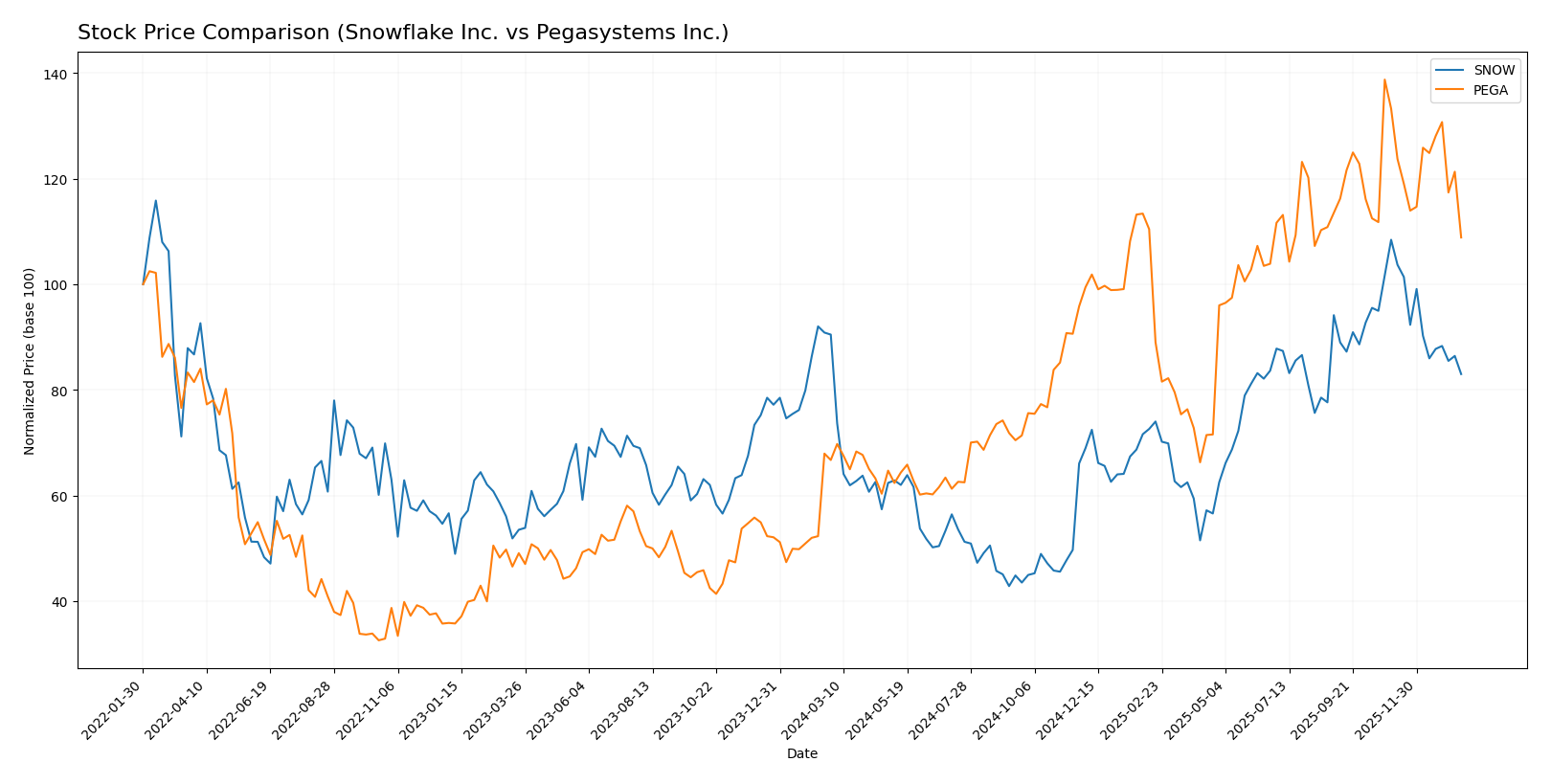

Stock Comparison

The stock price movements of Snowflake Inc. (SNOW) and Pegasystems Inc. (PEGA) over the past year reveal divergent trends, with SNOW experiencing a bearish phase marked by deceleration, while PEGA shows a bullish trend also with deceleration, reflecting contrasting trading dynamics.

Trend Analysis

Snowflake Inc. (SNOW) shows a bearish trend over the past 12 months with an overall price decline of -8.27%, accompanied by deceleration and high volatility (std deviation 42.6). The stock peaked at 274.88 and bottomed at 108.56.

Pegasystems Inc. (PEGA) demonstrated a bullish trend with a 63.18% price increase over the same period, despite deceleration. Volatility is lower at 10.77, with a high of 66.27 and a low of 28.73, indicating steady upward momentum.

Comparing both, PEGA delivered the highest market performance with a strong positive gain, while SNOW’s price trend was negative, reflecting contrasting investor sentiment and trading outcomes.

Target Prices

Analysts present a clear target price consensus for Snowflake Inc. and Pegasystems Inc., indicating growth potential above current market prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Snowflake Inc. | 325 | 237 | 281.86 |

| Pegasystems Inc. | 80 | 67 | 74 |

Snowflake’s target consensus of 281.86 suggests a significant upside from its current price of 210.38, while Pegasystems’ consensus of 74 also indicates potential growth above the present 51.99 price level.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Snowflake Inc. and Pegasystems Inc.:

Rating Comparison

Snowflake Inc. Rating

- Rating: C-, evaluated as Very Favorable overall.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation assessment.

- ROE Score: 1, considered Very Unfavorable, showing low efficiency in equity returns.

- ROA Score: 1, rated Very Unfavorable, indicating poor asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, reflecting higher financial risk.

- Overall Score: 1, Very Unfavorable, suggesting weak overall financial standing.

Pegasystems Inc. Rating

- Rating: B+, evaluated as Very Favorable overall.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation assessment.

- ROE Score: 5, considered Very Favorable, showing high efficiency in equity returns.

- ROA Score: 5, rated Very Favorable, indicating strong asset utilization.

- Debt To Equity Score: 3, Moderate, indicating a balanced financial risk profile.

- Overall Score: 3, Moderate, suggesting a stronger overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Pegasystems Inc. is better rated than Snowflake Inc. Pegasystems shows higher scores in ROE, ROA, and overall financial standing, while Snowflake scores are mostly very unfavorable except for a moderate DCF score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Snowflake Inc. and Pegasystems Inc.:

Snowflake Inc. Scores

- Altman Z-Score: 5.36, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength and value potential.

Pegasystems Inc. Scores

- Altman Z-Score: 10.31, indicating a safe financial zone with very low bankruptcy risk.

- Piotroski Score: 8, showing very strong financial health and solid investment quality.

Which company has the best scores?

Based on the provided data, Pegasystems Inc. has higher Altman Z and Piotroski scores than Snowflake Inc., indicating stronger financial health and lower bankruptcy risk. Pegasystems’ scores suggest better overall financial stability and investment potential.

Grades Comparison

Here is a comparison of the recent grades assigned to Snowflake Inc. and Pegasystems Inc. by leading grading companies:

Snowflake Inc. Grades

The following table summarizes Snowflake Inc.’s recent grades from reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Downgrade | Equal Weight | 2026-01-12 |

| Argus Research | Upgrade | Buy | 2026-01-08 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Wells Fargo | Maintain | Overweight | 2025-12-04 |

| Keybanc | Maintain | Overweight | 2025-12-04 |

| Piper Sandler | Maintain | Overweight | 2025-12-04 |

| Morgan Stanley | Maintain | Overweight | 2025-12-04 |

| Wedbush | Maintain | Outperform | 2025-12-04 |

| Deutsche Bank | Maintain | Buy | 2025-12-04 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-04 |

Snowflake’s grades generally show strong buy-side sentiment, with multiple Overweight and Buy ratings, although Barclays recently downgraded it to Equal Weight.

Pegasystems Inc. Grades

The table below presents Pegasystems Inc.’s recent grades from established grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-10-23 |

| RBC Capital | Maintain | Outperform | 2025-10-23 |

| Barclays | Maintain | Equal Weight | 2025-10-23 |

| Rosenblatt | Maintain | Buy | 2025-10-23 |

| DA Davidson | Upgrade | Buy | 2025-10-22 |

| Rosenblatt | Maintain | Buy | 2025-10-15 |

| Rosenblatt | Maintain | Buy | 2025-07-24 |

| DA Davidson | Maintain | Neutral | 2025-07-24 |

| Wedbush | Maintain | Outperform | 2025-07-24 |

Pegasystems’ grades indicate a consistent buy-side consensus with several Outperform and Buy ratings, though Barclays rates it at Equal Weight.

Which company has the best grades?

Both Snowflake Inc. and Pegasystems Inc. hold a consensus “Buy” rating, but Snowflake has a larger number of buy-side recommendations and more recent upgrades despite a recent downgrade by Barclays. This suggests Snowflake may have stronger analyst conviction, potentially influencing investor confidence more positively.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Snowflake Inc. (SNOW) and Pegasystems Inc. (PEGA) based on their latest financial and strategic data.

| Criterion | Snowflake Inc. (SNOW) | Pegasystems Inc. (PEGA) |

|---|---|---|

| Diversification | Moderate; primarily product-driven with growing revenue in products (3.46B in 2025) and some services | Well diversified across Cloud (1.13B), Subscription Licenses (398M), Maintenance, and Consulting |

| Profitability | Unfavorable; negative net margin (-35.45%) and ROIC (-25.24%) indicate value destruction | Slightly favorable; positive net margin (6.63%) and ROE (16.94%), ROIC improving at 7.4% |

| Innovation | Moderate; strong product revenue growth but declining ROIC trend signals challenges | Moderate to strong; growing ROIC trend and cloud innovation driving revenue growth |

| Global presence | Strong global cloud data platform presence | Strong global presence with diversified enterprise software solutions |

| Market Share | Growing product revenue but challenged by profitability issues | Stable with diversified revenue streams and improving profitability metrics |

Key takeaway: Snowflake shows impressive top-line growth but struggles with profitability and value creation, signaling caution for investors. Pegasystems presents a more balanced profile with improving profitability and diversified revenue, making it a comparatively safer investment option in 2026.

Risk Analysis

Below is a comparative table summarizing key risk factors for Snowflake Inc. and Pegasystems Inc. based on the most recent data available.

| Metric | Snowflake Inc. (SNOW) | Pegasystems Inc. (PEGA) |

|---|---|---|

| Market Risk | Beta 1.14 – moderate volatility | Beta 1.08 – moderate volatility |

| Debt level | Debt-to-assets 29.7% – moderate, Debt/Equity 0.9 – neutral | Debt-to-assets 31.1% – moderate, Debt/Equity 0.94 – neutral |

| Regulatory Risk | Moderate – operates in cloud data, some compliance exposure | Moderate – global software operations with regulatory demands |

| Operational Risk | High – negative margins and returns, operational efficiency concerns | Moderate – positive margins and efficiency but competitive industry |

| Environmental Risk | Low – primarily software/cloud business | Low – primarily software business |

| Geopolitical Risk | Moderate – US-based but international exposure | Moderate – US-based with global clients |

Snowflake faces the most impactful risks from operational inefficiencies and negative profitability metrics in 2025, despite a solid balance sheet and safe bankruptcy score. Pegasystems shows stronger financial health with positive returns and very strong Piotroski score, reducing operational risk but faces valuation concerns with high P/E and P/B ratios. Both companies have moderate market and geopolitical risks given their technology sectors and international operations. I advise cautious monitoring of Snowflake’s profitability improvements and Pegasystems’ valuation before investing.

Which Stock to Choose?

Snowflake Inc. (SNOW) shows strong revenue growth of 29.2% in 2025 and a favorable gross margin at 66.5%, but its profitability remains negative with a net margin of -35.45% and declining returns on equity and invested capital. Debt levels are moderate with a debt-to-assets ratio of 29.7%, while its overall financial ratios appear slightly unfavorable. The company’s rating is very favorable (C-), yet its global income statement evaluation is neutral.

Pegasystems Inc. (PEGA) presents moderate revenue growth of 4.5% in 2024 with a favorable gross margin of 73.9%. Profitability metrics are positive, including a net margin of 6.63% and return on equity of 16.94%. Debt ratios show moderate risk, and financial ratios are slightly favorable overall. PEGA holds a very favorable rating (B+) with a strong income statement and excellent financial health scores.

Considering ratings and financial evaluations, PEGA could appear more favorable for investors seeking stable profitability and improving returns, while SNOW might appeal to those focused on high growth despite weaker current profitability and financial ratios. The choice might depend on whether an investor prioritizes growth potential or financial stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Snowflake Inc. and Pegasystems Inc. to enhance your investment decisions: