Home > Comparison > Industrials > PNR vs PSN

The strategic rivalry between Pentair plc and Parsons Corporation shapes the future of the Industrials sector. Pentair operates as a capital-intensive machinery manufacturer specializing in water solutions. In contrast, Parsons delivers high-tech integrated services in defense and critical infrastructure. This head-to-head pits asset-heavy manufacturing against knowledge-driven solutions. This analysis will identify which business model offers superior risk-adjusted returns for a diversified portfolio navigating evolving industrial demands.

Table of contents

Companies Overview

Pentair plc and Parsons Corporation stand as pivotal players in the industrial machinery sector, each commanding distinct market niches.

Pentair plc: Global Water Solutions Leader

Pentair plc excels as a global provider of water solutions, generating revenue through two key segments: Consumer Solutions and Industrial & Flow Technologies. Its core products span residential and commercial pool equipment, water treatment systems, and advanced fluid treatment technologies. In 2026, Pentair sharpened its strategic focus on expanding water filtration and sustainable water management technologies worldwide.

Parsons Corporation: Defense and Infrastructure Integrator

Parsons Corporation identifies primarily as an integrated solutions provider for defense, intelligence, and critical infrastructure markets. It earns revenue through Federal Solutions and Critical Infrastructure segments, offering cybersecurity, geospatial services, missile defense, and smart city infrastructure solutions. Parsons’ 2026 strategy centers on enhancing technology services and cybersecurity platforms tailored to U.S. Department of Defense and infrastructure clients.

Strategic Collision: Similarities & Divergences

Pentair pursues a product-driven approach centered around water technology, emphasizing physical systems and filtration. Parsons adopts a service-led model focused on integrated defense and infrastructure technology solutions. Their competition converges indirectly in critical infrastructure, where water systems intersect with security and smart city frameworks. Investors face contrasting profiles: Pentair offers tangible product durability, while Parsons provides complex, high-tech service contracts with government backing.

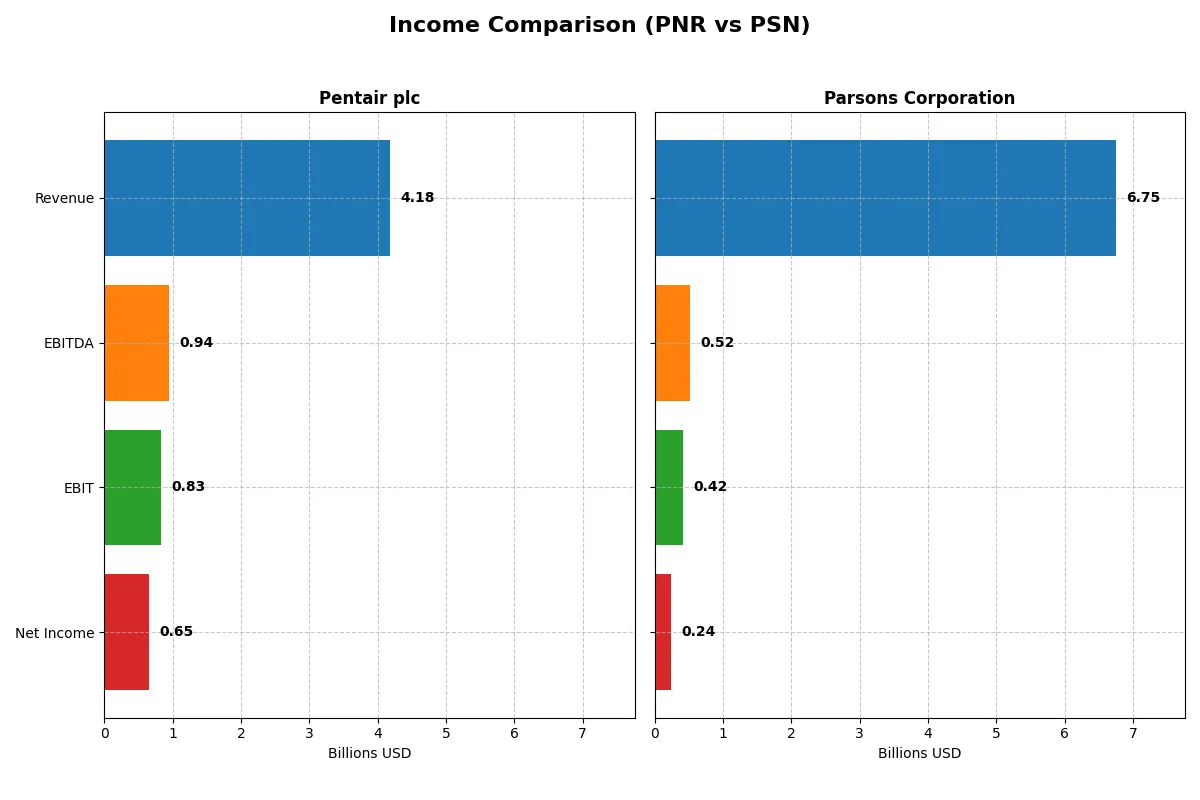

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Pentair plc (PNR) | Parsons Corporation (PSN) |

|---|---|---|

| Revenue | 4.18B | 6.75B |

| Cost of Revenue | 2.49B | 5.34B |

| Operating Expenses | 833M | 978M |

| Gross Profit | 1.69B | 1.41B |

| EBITDA | 944M | 518M |

| EBIT | 826M | 419M |

| Interest Expense | 69M | 52M |

| Net Income | 654M | 235M |

| EPS | 3.99 | 2.21 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes which company drives profitability and operational efficiency more effectively in their respective markets.

Pentair plc Analysis

Pentair’s revenue rose steadily to $4.18B in 2025, with net income climbing to $650M, reflecting consistent earnings growth. Its gross margin of 40.5% and net margin near 15.7% demonstrate robust profitability. The 2025 margin expansion and EPS growth of 5.9% reveal solid momentum and operational discipline despite modest revenue growth.

Parsons Corporation Analysis

Parsons surged revenue by 24% to $6.75B in 2024, with net income increasing sharply to $235M. Despite a lower gross margin of 20.8% and net margin of 3.5%, Parsons shows strong top-line momentum and a remarkable 49.3% EPS growth. This reflects aggressive expansion and improving profitability, although margins remain thin compared to sector norms.

Margin Strength vs. Revenue Momentum

Pentair leads in profitability with higher and improving margins, signaling operational efficiency. Parsons dominates revenue growth and EPS expansion but at lower margin levels. Investors favoring stable profit margins might prefer Pentair, while those prioritizing rapid top-line and earnings growth may find Parsons’ profile more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Pentair plc (PNR) | Parsons Corporation (PSN) |

|---|---|---|

| ROE | 16.90% | 9.73% |

| ROIC | 12.46% | 8.28% |

| P/E | 26.14 | 41.72 |

| P/B | 4.42 | 4.06 |

| Current Ratio | 1.61 | 1.29 |

| Quick Ratio | 0.95 | 1.29 |

| D/E (Debt-to-Equity) | 0.42 | 0.59 |

| Debt-to-Assets | 23.86% | 25.89% |

| Interest Coverage | 12.36 | 8.30 |

| Asset Turnover | 0.61 | 1.23 |

| Fixed Asset Turnover | 11.08 | 25.51 |

| Payout Ratio | 25.13% | 0% |

| Dividend Yield | 0.96% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths that shape investor decisions.

Pentair plc

Pentair delivers solid profitability with a 16.9% ROE and 15.66% net margin, signaling efficient operations. Its valuation, however, appears stretched with a P/E of 26.14 and P/B of 4.42. The company returns value through a modest 0.96% dividend yield, balancing shareholder rewards with steady reinvestment in R&D and growth.

Parsons Corporation

Parsons shows weaker profitability, with a 9.73% ROE and a slim 3.48% net margin, reflecting operational challenges. Its valuation is notably expensive, carrying a P/E of 41.72 and P/B around 4.06. The firm offers no dividend, focusing instead on growth and maintaining a strong balance sheet marked by a favorable WACC of 6.24%.

Premium Valuation vs. Operational Safety

Pentair provides a better balance of profitability and operational efficiency despite a stretched valuation. Parsons’ high valuation contrasts with lower returns and absent dividends, increasing risk. Investors seeking steady operational performance may favor Pentair, while growth-oriented profiles might consider Parsons’ potential.

Which one offers the Superior Shareholder Reward?

Pentair plc (PNR) pays a consistent dividend with a 0.96% yield and a modest 25% payout ratio, supported by strong free cash flow coverage near 92%. Its buyback program is steady but less intense. Parsons Corporation (PSN) pays no dividends, reinvesting cash flow into growth and acquisitions, with a strong buyback focus that supports shareholder returns. Historically in industrial sectors, dividend payers like PNR offer reliable income, but PSN’s reinvestment and buybacks target higher capital appreciation. I see PNR’s balanced yield and cash flow safety as more sustainable, but PSN’s aggressive buybacks could drive superior total returns if growth executes well. For 2026, I favor PNR for income-focused investors and PSN for growth-seekers, with PNR offering a more dependable shareholder reward overall.

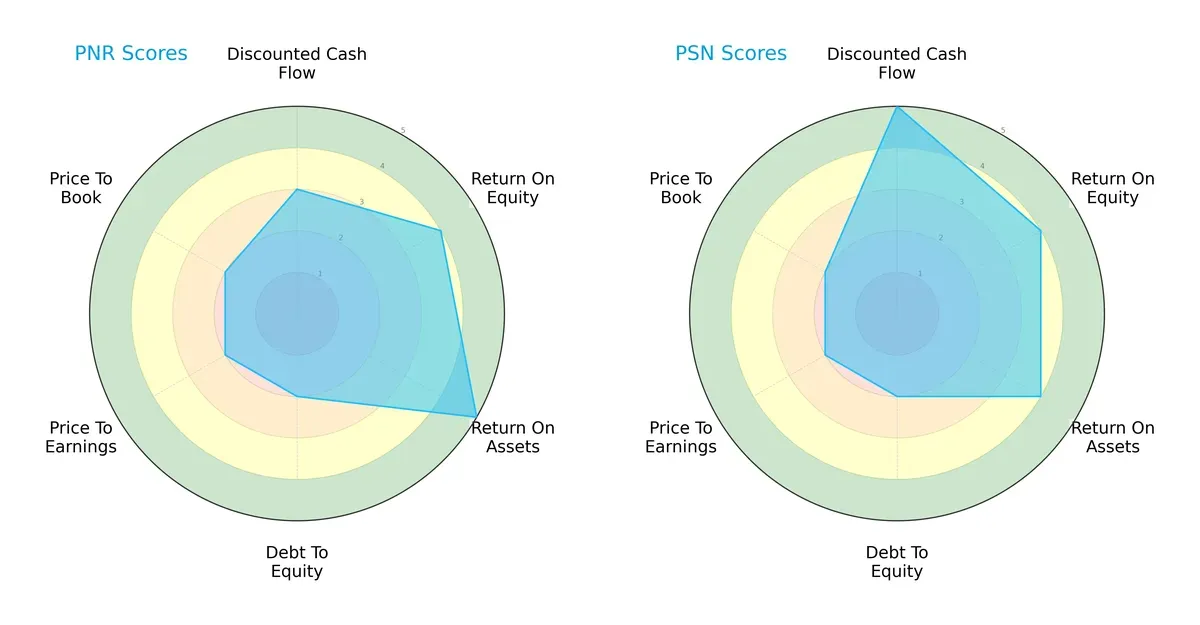

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Pentair plc and Parsons Corporation, highlighting their financial strengths and valuation nuances:

Pentair scores higher in asset efficiency (ROA 5 vs. 4) but lags Parsons in discounted cash flow (DCF 3 vs. 5). Both share identical returns on equity (ROE 4) and moderate debt profiles (Debt/Equity 2). Parsons’ strong DCF score suggests future cash flow confidence, while Pentair’s asset utilization stands out. Overall, Parsons maintains a more balanced edge through valuation and cash flow strength, whereas Pentair relies on operational efficiency.

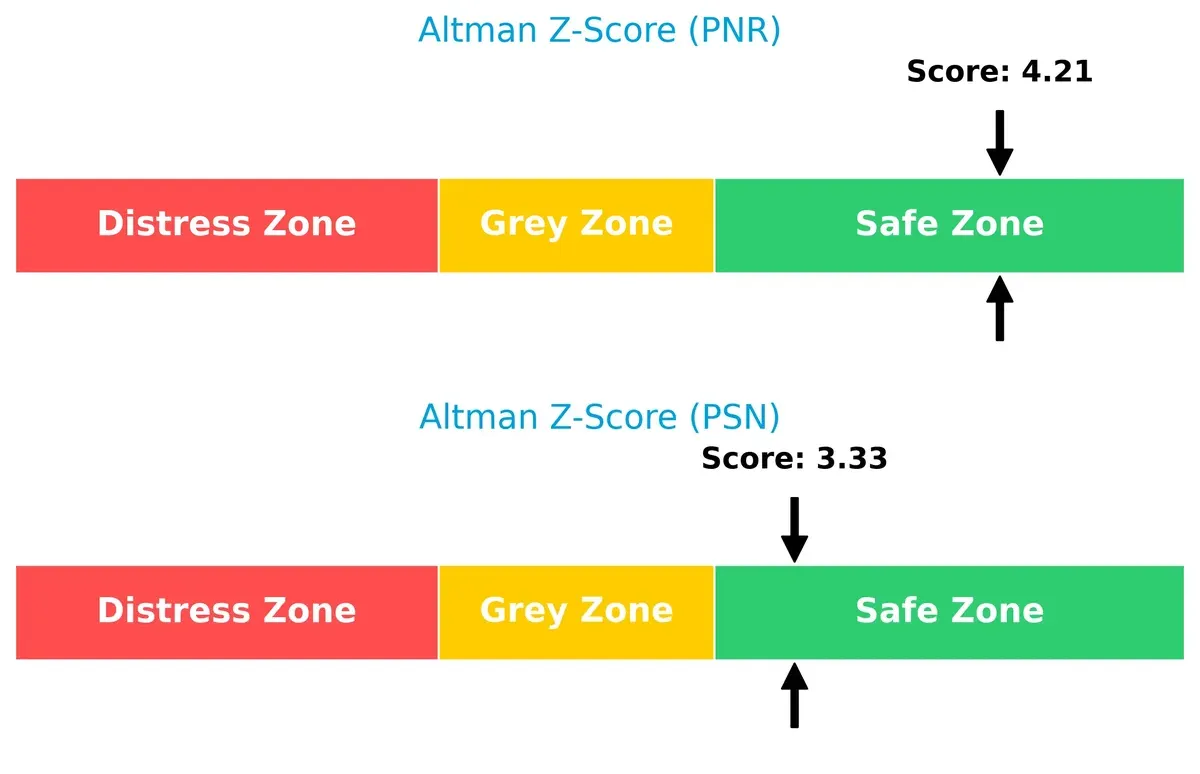

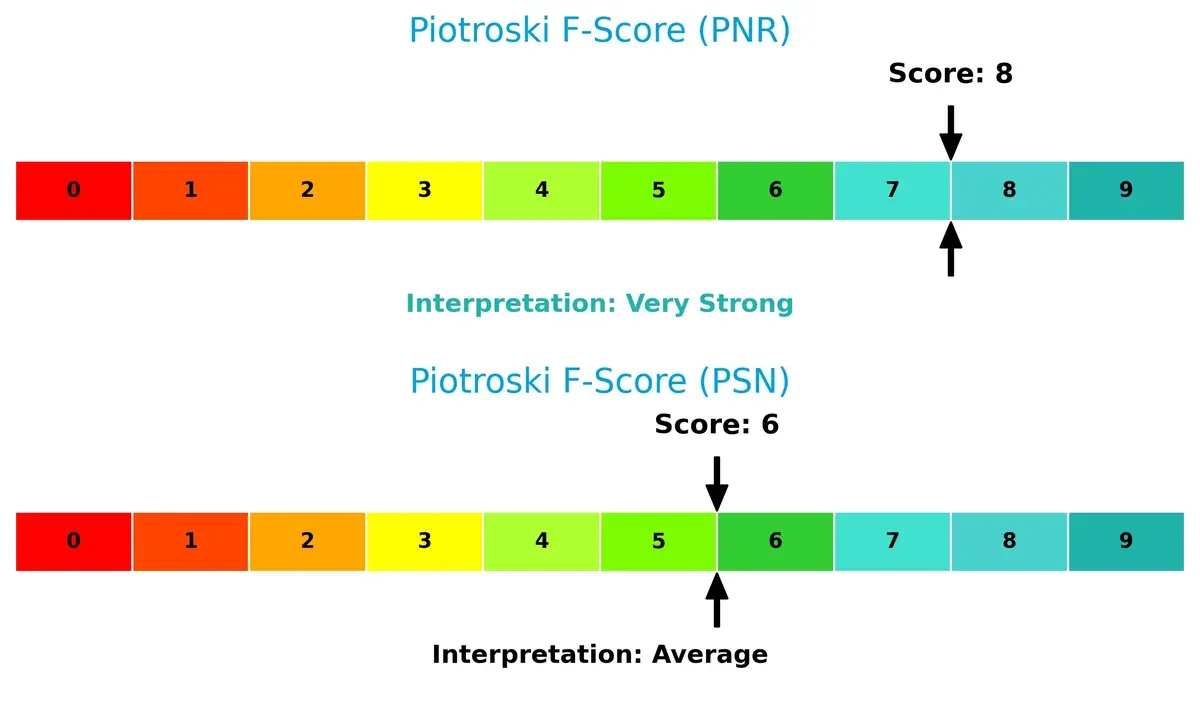

Bankruptcy Risk: Solvency Showdown

Pentair’s Altman Z-Score of 4.21 surpasses Parsons’ 3.33, signaling a stronger solvency buffer amid market volatility:

Both firms reside safely above the distress threshold, but Pentair’s higher score indicates greater resilience against economic downturns. I view this as a critical advantage in the capital-intensive industrial sector, where financial stability protects long-term value.

Financial Health: Quality of Operations

Pentair leads with a Piotroski F-Score of 8, outperforming Parsons’ 6, demonstrating more robust internal financial health:

An 8 signals Pentair’s strong profitability, liquidity, and efficiency metrics. Parsons’ average 6 raises caution on operational consistency. I consider Pentair’s higher score a sign of superior quality and lower risk within their peer group.

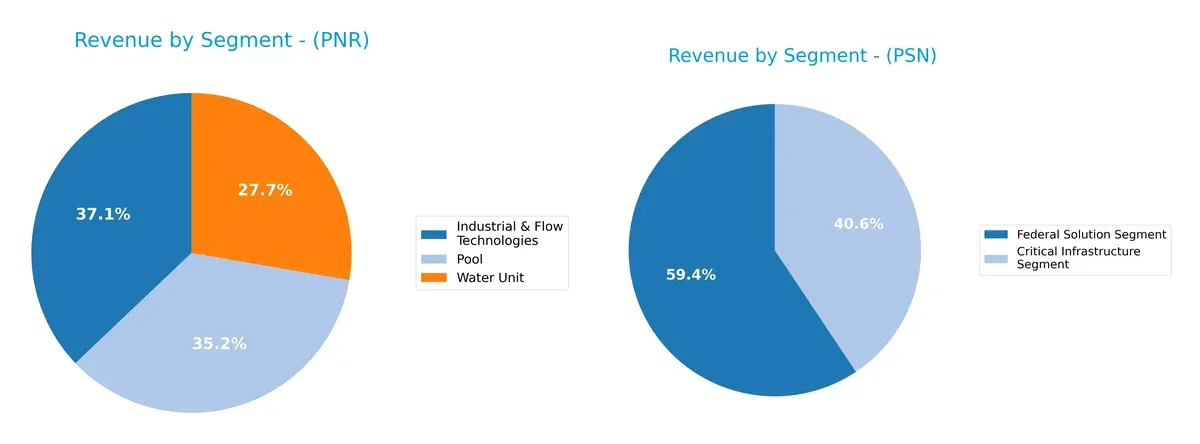

How are the two companies positioned?

This section dissects the operational DNA of Pentair and Parsons by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify the more resilient and sustainable competitive advantage in today’s market.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Pentair plc and Parsons Corporation diversify their income streams and where their primary sector bets lie:

Pentair shows a balanced mix with Industrial & Flow Technologies at 1.5B, Pool at 1.4B, and Water Unit at 1.1B, spreading risk across segments. Parsons leans heavily on Federal Solutions at 4B, dwarfs its Critical Infrastructure at 2.7B, indicating concentrated reliance on government contracts. Pentair’s diversification cushions against volatility. Parsons’ focus anchors it in infrastructure dominance but exposes it to sector-specific risks.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Pentair plc and Parsons Corporation:

Pentair plc Strengths

- Diversified product segments including Industrial & Flow Technologies and Pool

- Strong profitability with 15.66% net margin and 16.9% ROE

- Favorable financial ratios on leverage and liquidity

- Established US and developed countries presence

- Consistent asset turnover and fixed asset efficiency

Parsons Corporation Strengths

- Leading revenue from Critical Infrastructure and Federal Solution segments

- Favorable WACC and interest coverage ratios

- Strong asset turnover and fixed asset turnover metrics

- Solid liquidity with quick ratio at 1.29

- Significant North America and Middle East market presence

Pentair plc Weaknesses

- Unfavorable valuation multiples with PE at 26.14 and PB at 4.42

- Dividend yield below 1% limits income appeal

- Neutral quick ratio below 1 indicates some liquidity caution

- Moderate asset turnover limits efficiency

Parsons Corporation Weaknesses

- Low profitability with 3.48% net margin and 9.73% ROE

- High PE of 41.72 and PB of 4.06 signals overvaluation risk

- Zero dividend yield reduces shareholder income

- Higher debt-to-equity ratio at 0.59 raises leverage concerns

Pentair demonstrates robust profitability and solid financial health but faces valuation and income yield challenges. Parsons shows operational efficiency and strategic market reach but struggles with profitability and valuation risks, affecting its income and leverage profile.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting long-term profits from relentless competitive erosion. Let’s dissect how these firms defend their turf:

Pentair plc: Intangible Assets and Operational Efficiency

Pentair leverages its strong brand and proprietary water filtration technologies to sustain high ROIC near 20%. Though ROIC shows a slight decline, its margin stability supports continued value creation in mature markets.

Parsons Corporation: Innovation and Growing ROIC Momentum

Parsons builds its moat through specialized defense and infrastructure solutions, achieving rapid ROIC growth above WACC. This upward trajectory signals expanding competitive strength and opens new opportunities in cybersecurity and critical infrastructure.

Innovation-Driven Growth vs. Established Brand Efficiency

Parsons’ rising ROIC and expanding margins indicate a deeper moat fueled by innovation and market expansion. Pentair remains a solid value creator but faces pressure from declining profitability trends. Parsons appears better positioned to defend and grow market share in 2026.

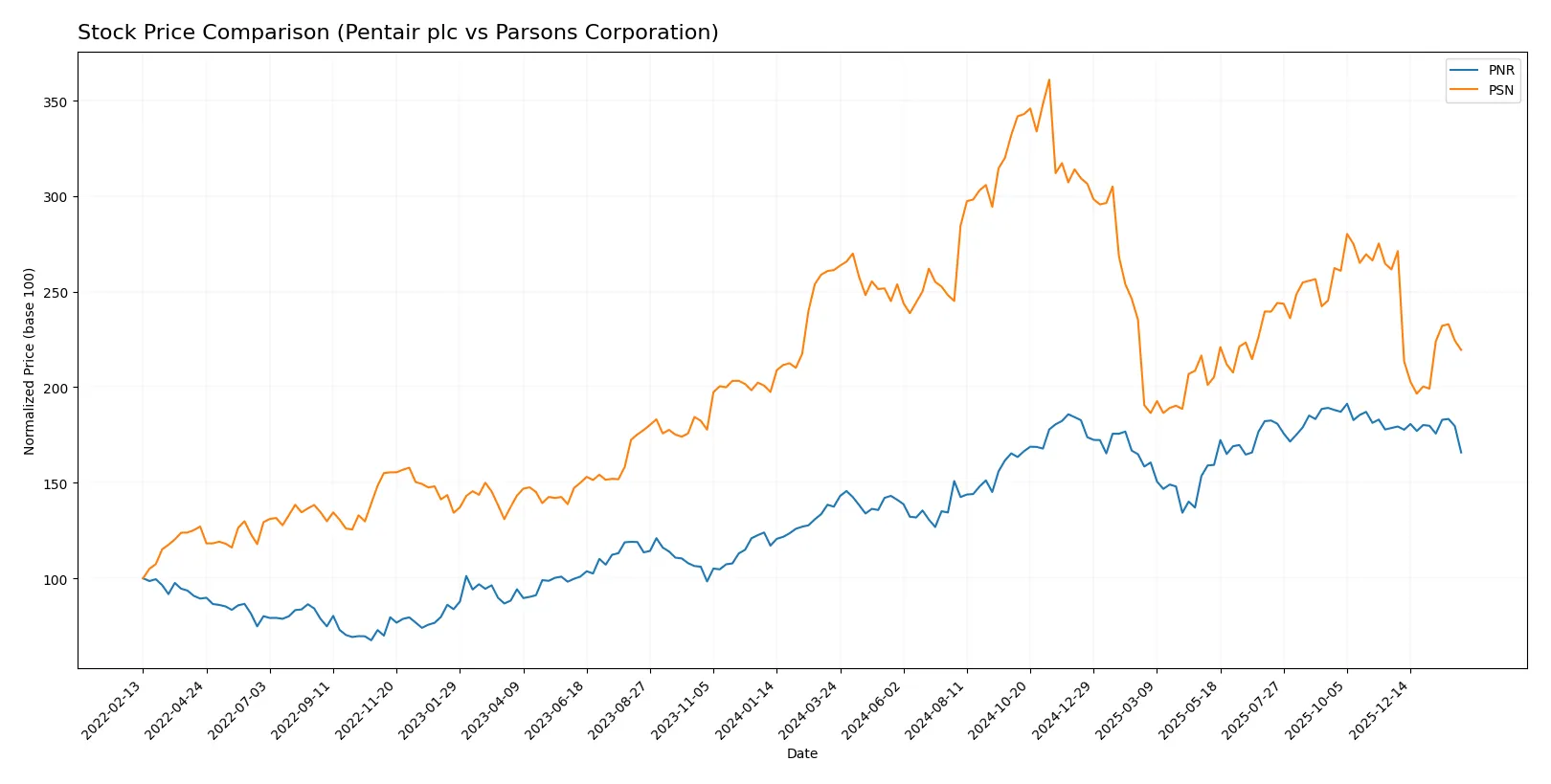

Which stock offers better returns?

Over the past 12 months, Pentair plc gained 20.65%, showing a bullish trend despite recent deceleration. Parsons Corporation declined 15.99%, reflecting a bearish trend with accelerating negative momentum.

Trend Comparison

Pentair plc’s stock rose 20.65% over the last year, marking a bullish trend with decelerating gains and a high volatility of 10.7%. The price peaked at 112.23 and bottomed at 74.39.

Parsons Corporation’s stock fell 15.99% over the same period, indicating a bearish trend with decelerating losses. Volatility was higher at 13.1%, with a high of 112.69 and a low of 58.22.

Pentair outperformed Parsons with a positive 20.65% return versus Parsons’ 15.99% decline, delivering stronger market performance overall.

Target Prices

Analysts present a cautiously optimistic consensus for Pentair plc and Parsons Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Pentair plc | 90 | 135 | 120 |

| Parsons Corporation | 78 | 104 | 86.8 |

Pentair’s target consensus at 120 suggests upside from the current 97.3 price, reflecting confidence in its water solutions niche. Parsons’ consensus near 86.8 also implies a meaningful rally potential from 68.5, driven by defense and infrastructure demand.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Pentair plc Grades

The following table summarizes recent institutional grades for Pentair plc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | maintain | Outperform | 2026-02-04 |

| Citigroup | maintain | Buy | 2026-02-04 |

| JP Morgan | maintain | Overweight | 2026-01-16 |

| Citigroup | maintain | Buy | 2026-01-12 |

| BNP Paribas Exane | downgrade | Underperform | 2026-01-07 |

| TD Cowen | downgrade | Sell | 2026-01-05 |

| Jefferies | upgrade | Buy | 2025-12-10 |

| Barclays | downgrade | Equal Weight | 2025-12-04 |

| Oppenheimer | maintain | Outperform | 2025-11-20 |

| RBC Capital | maintain | Outperform | 2025-10-22 |

Parsons Corporation Grades

The following table summarizes recent institutional grades for Parsons Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2026-01-23 |

| Keybanc | maintain | Overweight | 2026-01-20 |

| UBS | maintain | Buy | 2026-01-15 |

| Citigroup | maintain | Buy | 2026-01-13 |

| B of A Securities | maintain | Buy | 2025-12-30 |

| Stifel | maintain | Buy | 2025-12-23 |

| Jefferies | maintain | Hold | 2025-12-11 |

| TD Cowen | upgrade | Buy | 2025-12-10 |

| Truist Securities | maintain | Buy | 2025-12-08 |

| Baird | maintain | Outperform | 2025-12-08 |

Which company has the best grades?

Parsons Corporation consistently receives positive grades, with many “Buy” and “Overweight” ratings and few downgrades. Pentair plc shows a mixed picture, including recent downgrades to “Underperform” and “Sell,” which introduces more uncertainty for investors.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Pentair plc

- Operates in a diversified water solutions market with strong brand presence but faces intense industrial machinery competition.

Parsons Corporation

- Focuses on defense and critical infrastructure with niche expertise; competitive pressures from government contracts and technology innovation.

2. Capital Structure & Debt

Pentair plc

- Debt to equity ratio is low at 0.42, indicating a conservative leverage profile and strong interest coverage of 11.9x.

Parsons Corporation

- Higher leverage with debt to equity at 0.59, but still manageable; interest coverage at 8.13x suggests moderate risk.

3. Stock Volatility

Pentair plc

- Beta of 1.22 indicates above-market volatility, common in industrial machinery during economic cycles.

Parsons Corporation

- Lower beta of 0.67 reflects less stock price sensitivity to market swings, benefiting risk-averse investors.

4. Regulatory & Legal

Pentair plc

- Subject to environmental and safety regulations in water treatment; moderate legal risks typical of industrial firms.

Parsons Corporation

- Faces significant regulatory scrutiny due to defense contracts and cybersecurity operations, adding complexity and compliance costs.

5. Supply Chain & Operations

Pentair plc

- Complex global supply chain for manufacturing and distribution; vulnerable to input cost inflation and logistics disruptions.

Parsons Corporation

- Operational risks in project execution and supply chain for critical infrastructure projects; dependency on government timelines.

6. ESG & Climate Transition

Pentair plc

- Water sustainability focus supports ESG credentials but must manage energy usage and emissions in manufacturing.

Parsons Corporation

- ESG risks related to defense sector controversies and environmental impact of infrastructure projects require careful management.

7. Geopolitical Exposure

Pentair plc

- Global operations expose it to currency fluctuations and trade policy changes but less sensitive to geopolitical conflicts.

Parsons Corporation

- High exposure to U.S. defense budgets and Middle East operations introduces geopolitical risk and dependency on government policy.

Which company shows a better risk-adjusted profile?

Pentair’s strongest risk lies in market competition and supply chain complexity amid economic cycles. Parsons faces its greatest risk from regulatory and geopolitical exposure tied to defense contracting. Pentair’s conservative leverage and strong profitability offer a more balanced risk-adjusted profile. Parsons’ lower stock volatility is appealing, but its regulatory and geopolitical concentrations demand caution. Recent data show Pentair’s robust Altman Z-score of 4.21 and high Piotroski score of 8, signaling excellent financial health, while Parsons’ scores, though safe, trail behind at 3.33 and 6 respectively. This underscores my concern over Parsons’ operational and compliance risks.

Final Verdict: Which stock to choose?

Pentair plc’s superpower lies in its robust capital efficiency and consistent value creation. Its solid returns on invested capital outpace its cost of capital, signaling a durable competitive edge. A point of vigilance is its slightly declining profitability trend, warranting cautious monitoring. It fits well within an Aggressive Growth portfolio seeking steady cash generators.

Parsons Corporation offers a strategic moat through its rapidly improving return on capital and growing profitability. Its operational efficiency and strong free cash flow underpin a safer profile compared to Pentair’s more cyclical exposure. Parsons suits a GARP (Growth at a Reasonable Price) investor focused on expanding earnings with moderate risk.

If you prioritize consistent capital efficiency and proven value creation, Pentair outshines due to its stronger returns and income quality. However, if you seek accelerating growth with better stability in expanding margins, Parsons offers a superior scenario. Both command a premium but cater to distinct investor profiles with balanced risk appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Pentair plc and Parsons Corporation to enhance your investment decisions: