In the fast-evolving world of cybersecurity and data protection, Palo Alto Networks, Inc. (PANW) and Rubrik, Inc. (RBRK) stand out as key players. Both operate in the software infrastructure industry, offering innovative solutions to safeguard enterprise data and networks. Comparing their market presence, innovation strategies, and growth potential helps investors identify which company offers the most promising opportunity. Let’s explore which stock deserves a place in your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Palo Alto Networks and Rubrik by providing an overview of these two companies and their main differences.

Palo Alto Networks Overview

Palo Alto Networks, Inc. specializes in cybersecurity solutions, offering firewall appliances, security management, and subscription services for threat prevention and device protection. The company targets medium to large enterprises, service providers, and government entities across various industries. Headquartered in Santa Clara, California, Palo Alto Networks holds a significant position in the software infrastructure market with a market cap of 128B USD.

Rubrik Overview

Rubrik, Inc. provides data security solutions including enterprise and cloud data protection, threat analytics, and cyber recovery. Serving diverse sectors such as financial, retail, healthcare, and technology, Rubrik focuses on safeguarding unstructured and SaaS data. Based in Palo Alto, California, the company has a smaller footprint with 3,200 employees and a market cap of 13B USD, reflecting its recent IPO in 2024.

Key similarities and differences

Both companies operate in the software infrastructure industry with a focus on cybersecurity and data protection. Palo Alto Networks offers broader cybersecurity services including firewall and cloud security, while Rubrik concentrates on data-centric security solutions and cyber recovery. Palo Alto Networks is more established and larger in scale, whereas Rubrik is a younger company with a narrower specialization and smaller market capitalization.

Income Statement Comparison

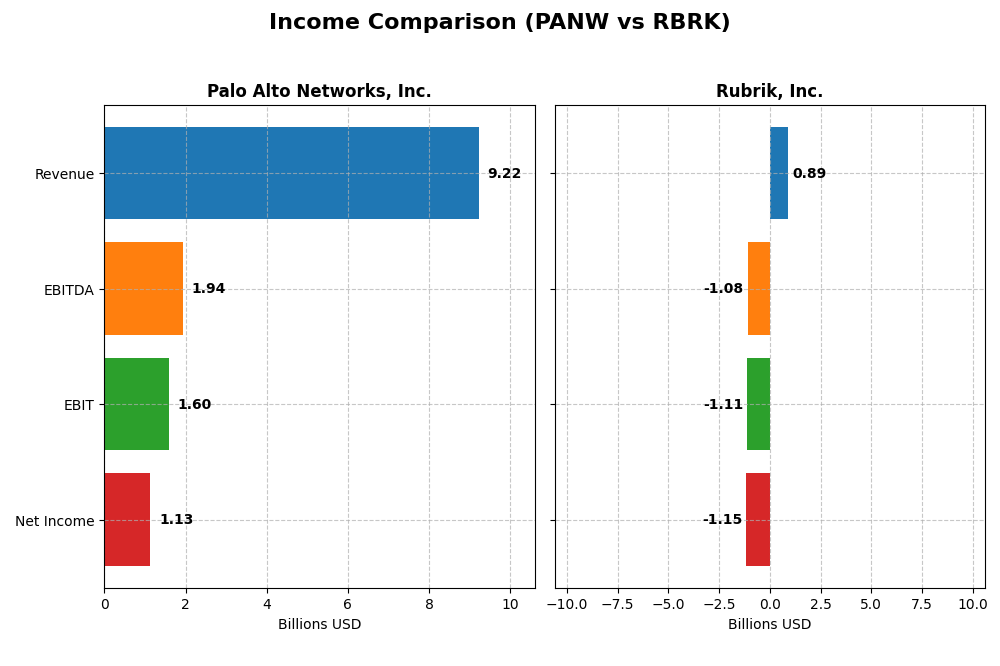

The table below compares key income statement metrics for Palo Alto Networks, Inc. and Rubrik, Inc. for their most recent fiscal year, highlighting scale and profitability differences.

| Metric | Palo Alto Networks, Inc. | Rubrik, Inc. |

|---|---|---|

| Market Cap | 128.4B | 13.4B |

| Revenue | 9.22B | 887M |

| EBITDA | 1.94B | -1.08B |

| EBIT | 1.60B | -1.11B |

| Net Income | 1.13B | -1.15B |

| EPS | 1.71 | -7.48 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Palo Alto Networks, Inc.

Palo Alto Networks demonstrated consistent revenue growth from 4.26B in 2021 to 9.22B in 2025, with net income swinging from a loss of 498.9M to a profit of 1.13B. Margins improved overall, with a gross margin of 73.41% and an EBIT margin of 17.32% in 2025. However, net margin and EPS declined in the latest year despite solid revenue and EBIT growth.

Rubrik, Inc.

Rubrik’s revenue increased steadily from 388M in 2021 to 887M in 2025, but it remained unprofitable with net losses widening to -1.15B in 2025. The gross margin was favorable at 70.02%, but negative EBIT (-124.89%) and net margins (-130.26%) reflect ongoing operational challenges. Recent year growth in revenue and gross profit contrasts with worsening net income and EPS.

Which one has the stronger fundamentals?

Palo Alto Networks exhibits stronger fundamentals, with favorable margins, positive net income growth, and overall profitability despite recent margin pressures. Rubrik shows revenue growth but sustained heavy losses and unfavorable EBIT and net margins, indicating weaker financial health. The contrast highlights Palo Alto’s more robust income statement performance over the period.

Financial Ratios Comparison

This table presents the latest available key financial ratios for Palo Alto Networks, Inc. and Rubrik, Inc., providing a side-by-side view for fiscal year 2025.

| Ratios | Palo Alto Networks, Inc. (PANW) | Rubrik, Inc. (RBRK) |

|---|---|---|

| ROE | 14.5% | 208.6% |

| ROIC | 5.7% | -234.8% |

| P/E | 101.4 | -9.8 |

| P/B | 14.7 | -20.4 |

| Current Ratio | 0.89 | 1.13 |

| Quick Ratio | 0.89 | 1.13 |

| D/E (Debt-to-Equity) | 0.04 | -0.63 |

| Debt-to-Assets | 1.4% | 24.7% |

| Interest Coverage | 414.3 | -27.5 |

| Asset Turnover | 0.39 | 0.62 |

| Fixed Asset Turnover | 12.6 | 16.7 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Palo Alto Networks, Inc.

Palo Alto Networks shows a mix of strengths and weaknesses in its financial ratios. Key positives include a favorable net margin of 12.3%, strong interest coverage at 532.53, and low debt levels, indicating solid financial health. However, challenges arise with a high PE ratio of 101.43 and a low current ratio of 0.89, which may signal valuation concerns and liquidity risks. The company does not pay dividends, likely focusing on reinvestment for growth.

Rubrik, Inc.

Rubrik presents a more mixed profile with favorable return on equity at 208.55% and solid asset turnover, yet it suffers from a deeply negative net margin of -130.26% and poor interest coverage at -26.84, indicating profitability and solvency issues. Its dividend yield is zero, consistent with its unprofitable status and probable reinvestment strategy in this growth phase. The company’s overall ratios lean toward favorable despite some significant risks.

Which one has the best ratios?

Rubrik’s ratios are generally more favorable in percentage terms, especially regarding return on equity and valuation metrics, despite its unprofitability and negative margins. Palo Alto Networks offers stronger profitability and liquidity fundamentals but faces valuation and operational efficiency challenges. The choice between them depends on weighing growth potential against financial stability and risk exposure.

Strategic Positioning

This section compares the strategic positioning of Palo Alto Networks and Rubrik, including market position, key segments, and exposure to disruption:

Palo Alto Networks

- Leading cybersecurity provider with significant market cap and moderate competitive pressure.

- Focused on cybersecurity infrastructure with products, subscriptions, and support driving revenue.

- Exposed to evolving cybersecurity threats and cloud security innovation demands.

Rubrik

- Smaller market cap with lower beta, facing competitive pressure in data security.

- Concentrates on data protection and cyber recovery with subscription-based revenue.

- Faces disruption risk from advancing data threat analytics and cloud data protection.

Palo Alto Networks vs Rubrik Positioning

Palo Alto Networks has a diversified cybersecurity portfolio with multiple revenue streams, offering broad market coverage. Rubrik is more concentrated on data security and recovery, implying narrower focus but specialization. Palo Alto’s larger scale contrasts with Rubrik’s emerging positioning.

Which has the best competitive advantage?

Based on MOAT evaluation, Palo Alto Networks shows slightly unfavorable but improving profitability, while Rubrik faces very unfavorable and declining returns. Palo Alto’s trend suggests a stronger potential competitive advantage despite current value shedding.

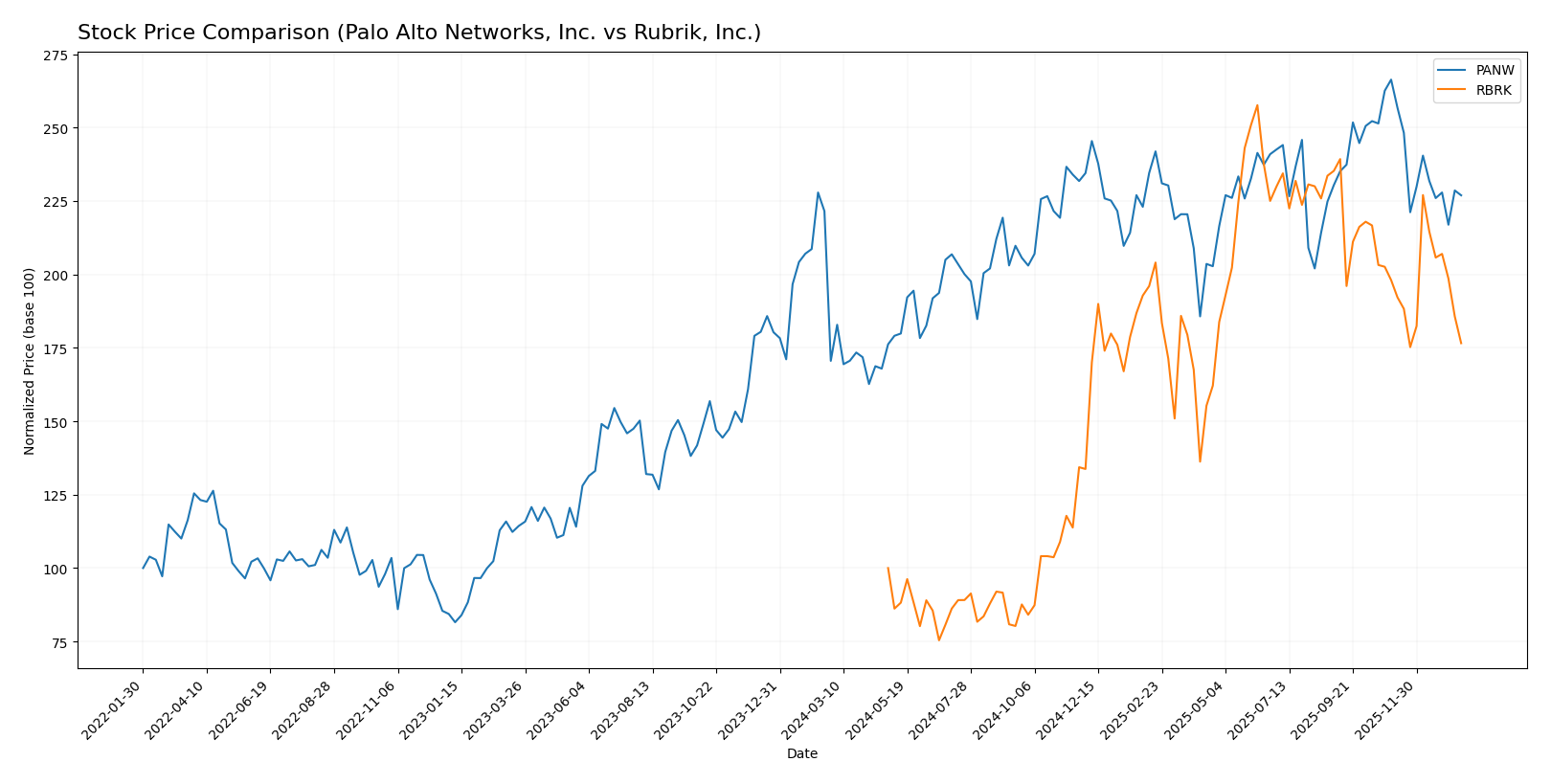

Stock Comparison

The stock price chart reveals significant bullish trends for both Palo Alto Networks and Rubrik over the past 12 months, with recent downward corrections and shifting trading dynamics.

Trend Analysis

Palo Alto Networks, Inc. (PANW) showed a 33.05% price increase over the past year, indicating a bullish trend with deceleration. The stock fluctuated between 134.51 and 220.24, with recent weeks marked by a -14.79% decline.

Rubrik, Inc. (RBRK) experienced a stronger bullish trend, rising 76.58% over 12 months but also slowing down. Its price ranged from 28.65 to 97.91, with a recent moderate drop of -10.85%.

Comparing trends, Rubrik outperformed Palo Alto Networks in overall market gains despite both showing recent declines, confirming RBRK as the higher-performing stock over the analyzed period.

Target Prices

The consensus target prices for Palo Alto Networks, Inc. and Rubrik, Inc. reflect varied analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palo Alto Networks, Inc. | 265 | 157 | 231.07 |

| Rubrik, Inc. | 113 | 105 | 109.33 |

Analysts see Palo Alto Networks’ stock potentially rising significantly above its current price of $187.66, while Rubrik’s consensus target price of $109.33 is well above its current $67.10, indicating positive growth expectations for both.

Analyst Opinions Comparison

This section compares the analysts’ ratings and financial scores for Palo Alto Networks, Inc. and Rubrik, Inc.:

Rating Comparison

PANW Rating

- Rating: B, categorized as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation outlook.

- ROE Score: 4, showing Favorable efficiency in generating profit from equity.

- ROA Score: 3, a Moderate efficiency in using assets to generate earnings.

- Debt To Equity Score: 4, Favorable, indicating lower financial risk.

- Overall Score: 3, rated as Moderate overall financial standing.

RBRK Rating

- Rating: C, also classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 1, signaling a Very Unfavorable valuation.

- ROE Score: 5, the highest score, reflecting Very Favorable profit generation.

- ROA Score: 1, a Very Unfavorable use of assets.

- Debt To Equity Score: 1, Very Unfavorable, implying higher financial risk.

- Overall Score: 2, also rated Moderate but lower than PANW.

Which one is the best rated?

Based strictly on the provided data, PANW holds a higher overall score and better discounted cash flow and debt to equity scores, while RBRK excels in return on equity. Overall, PANW is better rated due to a stronger balance of financial metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

Palo Alto Networks Scores

- Altman Z-Score: 5.95, indicating a safe zone and financial stability.

- Piotroski Score: 6, representing average financial strength.

Rubrik Scores

- Altman Z-Score: 1.41, indicating distress zone and risk of bankruptcy.

- Piotroski Score: 4, representing average financial strength.

Which company has the best scores?

Palo Alto Networks shows a significantly stronger Altman Z-Score in the safe zone, while Rubrik’s score signals financial distress. Both have average Piotroski Scores, but Palo Alto Networks has the more favorable overall financial stability.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Palo Alto Networks, Inc. and Rubrik, Inc.:

Palo Alto Networks, Inc. Grades

The following table summarizes recent grades and actions from reputable grading firms for Palo Alto Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Guggenheim | Upgrade | Neutral | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-18 |

| Goldman Sachs | Maintain | Buy | 2025-11-21 |

| HSBC | Downgrade | Reduce | 2025-11-21 |

| Needham | Maintain | Buy | 2025-11-20 |

| WestPark Capital | Maintain | Hold | 2025-11-20 |

| Bernstein | Maintain | Outperform | 2025-11-20 |

| DA Davidson | Maintain | Buy | 2025-11-20 |

Palo Alto Networks maintains predominantly positive grades with multiple “Buy” and “Overweight” ratings, despite one recent downgrade to “Reduce.”

Rubrik, Inc. Grades

The following table outlines recent grades and actions from credible grading companies for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

Rubrik shows a consistent and strong positive grade trend, with upgrades and multiple “Outperform” and “Buy” ratings.

Which company has the best grades?

Rubrik, Inc. has received consistently strong grades with several upgrades and a majority of “Outperform” and “Buy” ratings, indicating robust analyst confidence. Palo Alto Networks, Inc. also holds a positive consensus but includes a recent downgrade, suggesting slightly more mixed sentiment. Investors might interpret Rubrik’s stronger grades as a signal of higher analyst optimism compared to Palo Alto Networks.

Strengths and Weaknesses

The table below compares key strengths and weaknesses of Palo Alto Networks, Inc. (PANW) and Rubrik, Inc. (RBRK) based on recent financial and operational data.

| Criterion | Palo Alto Networks, Inc. (PANW) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Diversification | Strong product and subscription mix, $6.2B revenue in 2025 with balanced segments | Revenue heavily reliant on subscription ($828M in 2025), less diversified product portfolio |

| Profitability | Positive net margin (12.3%), growing ROIC but still slightly unfavorable moat | Negative net margin (-130.26%), declining ROIC, very unfavorable moat status |

| Innovation | High fixed asset turnover (12.56), indicating efficient use of assets in innovation | Higher fixed asset turnover (16.67), but profitability issues limit innovation impact |

| Global presence | Established global footprint with steady revenue growth | Smaller scale, less global reach compared to PANW |

| Market Share | Leading position in cybersecurity with strong subscription growth | Emerging player with niche focus, limited market share |

Key takeaways: Palo Alto Networks shows stronger diversification and profitability with improving returns despite a slightly unfavorable moat. Rubrik struggles with profitability and declining returns, though it maintains favorable asset efficiency. Investors should weigh growth potential against the risk of value destruction.

Risk Analysis

Below is a comparison table detailing key risk metrics for Palo Alto Networks, Inc. (PANW) and Rubrik, Inc. (RBRK) for the year 2025:

| Metric | Palo Alto Networks, Inc. (PANW) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Market Risk | Beta 0.75 (moderate volatility) | Beta 0.28 (low volatility) |

| Debt level | Low debt-to-equity 0.04 (favorable) | Negative debt/equity ratio, moderate debt-to-assets 24.65% (favorable) |

| Regulatory Risk | Moderate – operates in cybersecurity with evolving compliance demands | Moderate – data security sector with regulatory scrutiny |

| Operational Risk | Moderate – large scale, complex product offerings | Higher – younger company, rapid growth challenges |

| Environmental Risk | Low – primarily software industry | Low – primarily software industry |

| Geopolitical Risk | Moderate – global customer base, exposure to geopolitical tensions | Moderate – US based with global clients, sensitive to trade policies |

Overall, Palo Alto Networks shows a lower financial risk profile with a strong balance sheet and a safe Altman Z-Score, while Rubrik’s distress zone Altman Z-Score signals higher bankruptcy risk despite favorable ROE. Market risk is manageable for both, but Rubrik faces more operational and financial uncertainties, making Palo Alto Networks comparatively more stable for cautious investors.

Which Stock to Choose?

Palo Alto Networks, Inc. (PANW) shows favorable income growth with a 14.87% revenue increase in 2025 and a strong net margin of 12.3%. Financial ratios are slightly favorable overall, with low debt and high interest coverage, though valuation metrics like P/E and P/B appear unfavorable. The company’s profitability is improving despite a slightly unfavorable moat rating, indicating value destruction but growing returns.

Rubrik, Inc. (RBRK) reports strong revenue growth of 41.19% in 2025 but suffers from negative net margin and EBIT margin, reflecting unprofitable operations. Its financial ratios are generally favorable, driven by a high ROE and low leverage, yet it faces challenges with negative interest coverage and a very unfavorable moat due to declining profitability. The company’s financial health is weaker, with key valuation metrics favorable but operational losses significant.

Considering ratings and the overall evaluation of income and financial ratios, PANW might appear more suitable for investors seeking stable profitability and improving financial health, while RBRK could be seen as an option for those with a higher risk tolerance aiming for growth despite current profitability issues. The choice may depend on whether an investor prioritizes financial stability and positive income trends or is willing to accept volatility for potential upside.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palo Alto Networks, Inc. and Rubrik, Inc. to enhance your investment decisions: