In the fast-evolving cybersecurity landscape, Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD) stand out as two industry leaders driving innovation in software infrastructure. Both companies compete fiercely in delivering advanced security solutions, targeting overlapping markets with distinct approaches to cloud and endpoint protection. This article will explore their strengths and strategies to help you decide which is the more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Palo Alto Networks and CrowdStrike by providing an overview of these two companies and their main differences.

Palo Alto Networks Overview

Palo Alto Networks, Inc. is a leading cybersecurity company focused on delivering comprehensive solutions including firewall appliances, software, and cloud security services. Headquartered in Santa Clara, California, it serves medium to large enterprises, service providers, and government entities globally. With a market cap of approximately 120B USD and over 15,700 employees, it emphasizes threat prevention, security analytics, and consulting services.

CrowdStrike Overview

CrowdStrike Holdings, Inc. specializes in cloud-delivered cybersecurity protection for endpoints, cloud workloads, identity, and data. Based in Austin, Texas, CrowdStrike operates primarily through subscription sales of its Falcon platform and related cloud modules. The company has a market cap near 113B USD and employs around 10,100 people, focusing on threat intelligence, managed security, and Zero Trust identity protection worldwide.

Key similarities and differences

Both Palo Alto Networks and CrowdStrike operate in the Software – Infrastructure sector, providing cybersecurity solutions with a global footprint. While Palo Alto Networks offers a broad range of hardware and software products alongside professional services, CrowdStrike emphasizes cloud-native, subscription-based endpoint and cloud workload protection. Their business models differ in product delivery, with Palo Alto combining physical and virtual appliances and CrowdStrike relying on a cloud-first platform approach.

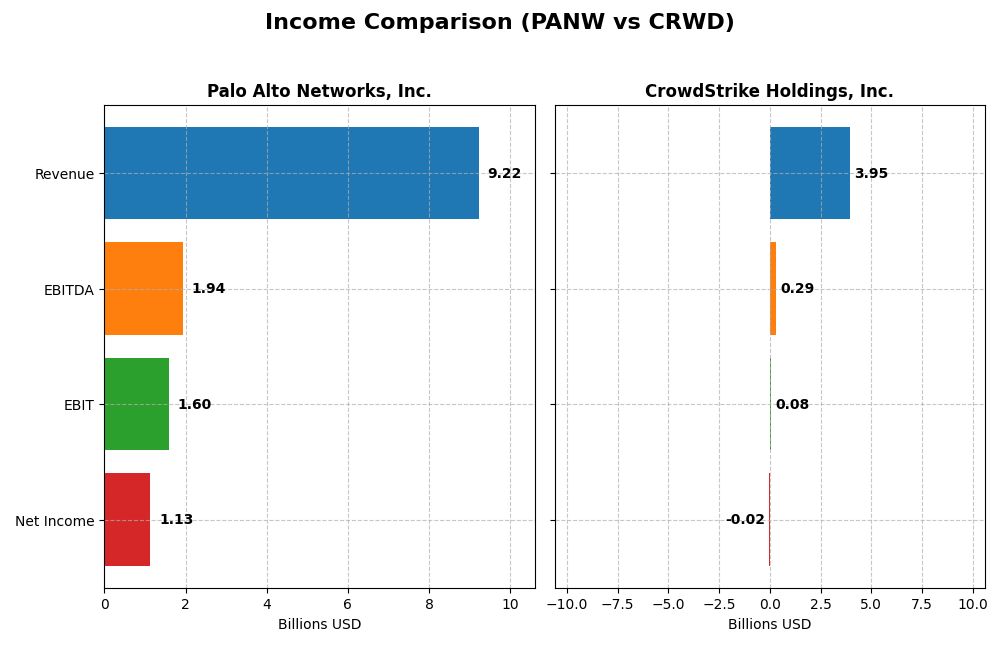

Income Statement Comparison

The table below presents a side-by-side comparison of the latest full fiscal year income statement metrics for Palo Alto Networks, Inc. and CrowdStrike Holdings, Inc.

| Metric | Palo Alto Networks, Inc. | CrowdStrike Holdings, Inc. |

|---|---|---|

| Market Cap | 120B | 113B |

| Revenue | 9.22B | 3.95B |

| EBITDA | 1.94B | 295M |

| EBIT | 1.60B | 81M |

| Net Income | 1.13B | -19M |

| EPS | 1.71 | -0.0787 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Palo Alto Networks, Inc.

Palo Alto Networks showed consistent revenue growth from 4.3B in 2021 to 9.2B in 2025, with net income rising markedly over the period. Margins improved overall, with a strong gross margin of 73.41% and EBIT margin of 17.32% in 2025. However, net margin and EPS declined in the most recent year despite revenue growth, indicating some margin pressure.

CrowdStrike Holdings, Inc.

CrowdStrike’s revenue grew sharply from 874M in 2021 to nearly 4B in 2025, reflecting rapid expansion. Gross margin remained stable at around 75%, but EBIT margin was low at 2.04% and net margin negative at -0.49% in 2025. Recent operating expenses outpaced revenue growth, leading to declines in EBIT, net margin, and EPS last year.

Which one has the stronger fundamentals?

Palo Alto Networks demonstrates stronger profitability with higher and more stable margins, supported by solid net income growth and favorable margin trends despite recent net margin dips. CrowdStrike shows impressive top-line growth but struggles with profitability and margin pressure. Overall, Palo Alto’s fundamentals appear more robust based on income statement metrics.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD) based on their most recent fiscal year data.

| Ratios | Palo Alto Networks, Inc. (2025) | CrowdStrike Holdings, Inc. (2025) |

|---|---|---|

| ROE | 14.5% | -0.6% |

| ROIC | 5.7% | 0.7% |

| P/E | 101.4 | -5055.7 |

| P/B | 14.7 | 29.7 |

| Current Ratio | 0.89 | 1.67 |

| Quick Ratio | 0.89 | 1.67 |

| D/E (Debt-to-Equity) | 0.04 | 0.24 |

| Debt-to-Assets | 1.4% | 9.1% |

| Interest Coverage | 414.3 | -4.58 |

| Asset Turnover | 0.39 | 0.45 |

| Fixed Asset Turnover | 12.56 | 4.76 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Palo Alto Networks, Inc.

Palo Alto Networks shows a mix of strong and weak financial ratios, with favorable net margin (12.3%) and low debt metrics indicating sound financial stability. However, high price-to-earnings (PE) and price-to-book (PB) ratios, along with a low current ratio (0.89), suggest valuation concerns and liquidity constraints. The company does not pay dividends, reflecting a reinvestment strategy focused on growth and innovation.

CrowdStrike Holdings, Inc.

CrowdStrike’s ratios reveal weaknesses, including negative net margin (-0.49%), return on equity (-0.59%), and return on invested capital (0.7%), which indicate operational challenges. Favorable liquidity ratios (current and quick ratio at 1.67) and manageable debt levels support its financial health. The absence of dividends aligns with its likely reinvestment in R&D and expansion during a high growth phase.

Which one has the best ratios?

Palo Alto Networks displays a slightly more favorable ratio profile overall, balancing profitability and financial stability despite valuation and liquidity concerns. CrowdStrike’s financials reflect greater operational struggles but stronger liquidity and debt management. Both companies do not pay dividends, emphasizing growth over shareholder returns at this stage.

Strategic Positioning

This section compares the strategic positioning of Palo Alto Networks and CrowdStrike, focusing on Market position, Key segments, and Exposure to technological disruption:

Palo Alto Networks

- Leading cybersecurity provider with diverse enterprise and government clients facing moderate competitive pressure.

- Revenue driven by subscriptions, products, and support across firewalls, cloud security, and threat intelligence.

- Exposure includes cloud security evolution and integration of SaaS security and threat intelligence services.

CrowdStrike

- Rapidly growing cloud security firm focusing on endpoint and cloud workload protection amid intense competition.

- Mainly subscription-based revenue from the Falcon platform and professional services focused on cloud-delivered protection.

- Significant exposure to cloud-native security and Zero Trust identity protection technologies.

Palo Alto Networks vs CrowdStrike Positioning

Palo Alto Networks has a more diversified portfolio across multiple cybersecurity solutions and customer segments, while CrowdStrike concentrates on cloud-delivered endpoint and identity protection. Diversification offers broader market reach; concentration may enable focused innovation.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOAT evaluations, shedding value but with growing ROIC trends. Palo Alto Networks’ smaller ROIC gap to WACC suggests a relatively stronger competitive advantage compared to CrowdStrike’s wider value destruction.

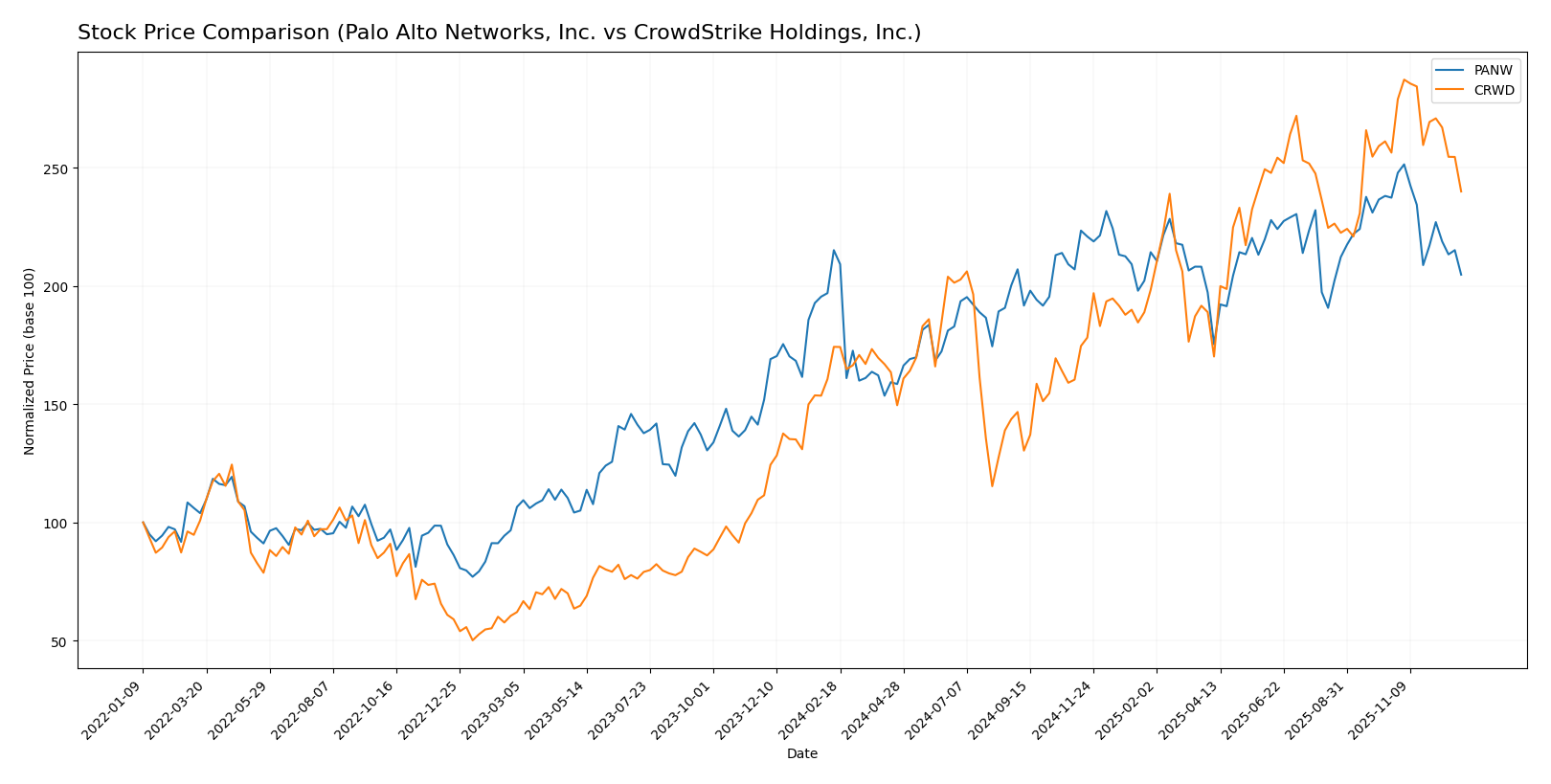

Stock Comparison

The stock price movements of Palo Alto Networks, Inc. and CrowdStrike Holdings, Inc. over the past 12 months reveal contrasting trends, with notable shifts in momentum and trading volumes reflecting changing market dynamics.

Trend Analysis

Palo Alto Networks, Inc. experienced a bearish trend over the past year, with a price decline of 4.82% and deceleration in the downward movement. The stock showed high volatility, with prices ranging from 134.51 to 220.24.

CrowdStrike Holdings, Inc. demonstrated a bullish trend over the same period, gaining 37.72%, though with deceleration in growth. The stock exhibited significant volatility, with prices fluctuating between 217.89 and 543.01.

Comparing both, CrowdStrike delivered the highest market performance with a strong positive return, while Palo Alto Networks recorded a moderate loss over the analyzed period.

Target Prices

Analysts present a bullish consensus on Palo Alto Networks and CrowdStrike, signaling potential upside from current prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palo Alto Networks, Inc. | 250 | 157 | 231.07 |

| CrowdStrike Holdings, Inc. | 706 | 353 | 548.07 |

The target consensus for Palo Alto Networks is significantly above its current price of 179.37, indicating strong analyst confidence. CrowdStrike’s consensus target also exceeds its current price of 453.58, reflecting positive growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Palo Alto Networks, Inc. and CrowdStrike Holdings, Inc.:

Rating Comparison

Palo Alto Networks, Inc. Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable DCF.

- ROE Score: 4, showing efficient profit generation.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 4, favorable financial stability.

- Overall Score: 3, moderate overall financial standing.

CrowdStrike Holdings, Inc. Rating

- Rating: C, also considered very favorable.

- Discounted Cash Flow Score: 4, also favorable DCF.

- ROE Score: 1, indicating very unfavorable efficiency.

- ROA Score: 1, very unfavorable asset use.

- Debt To Equity Score: 3, moderate financial risk.

- Overall Score: 2, moderate but lower than PANW.

Which one is the best rated?

Palo Alto Networks holds a higher rating (B vs. C) and scores better across ROE, ROA, debt-to-equity, and overall financial standing compared to CrowdStrike. Both have favorable discounted cash flow scores, but PANW appears stronger overall based on the provided data.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for Palo Alto Networks and CrowdStrike:

Palo Alto Networks Scores

- Altman Z-Score: 5.77, indicating a safe financial zone

- Piotroski Score: 6, assessed as average financial strength

CrowdStrike Scores

- Altman Z-Score: 13.54, indicating a safe financial zone

- Piotroski Score: 4, assessed as average financial strength

Which company has the best scores?

Based strictly on the provided data, CrowdStrike has a higher Altman Z-Score, signaling stronger financial stability, while Palo Alto Networks has a higher Piotroski Score, indicating better financial strength. Both companies fall into safe zones with average Piotroski scores.

Grades Comparison

The following tables present recent grades from reputable financial institutions for Palo Alto Networks, Inc. and CrowdStrike Holdings, Inc.:

Palo Alto Networks, Inc. Grades

This table shows the latest grades and actions by well-known grading companies for Palo Alto Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Overweight | 2025-12-18 |

| HSBC | downgrade | Reduce | 2025-11-21 |

| Goldman Sachs | maintain | Buy | 2025-11-21 |

| Rosenblatt | maintain | Buy | 2025-11-20 |

| Piper Sandler | maintain | Overweight | 2025-11-20 |

| Bernstein | maintain | Outperform | 2025-11-20 |

| WestPark Capital | maintain | Hold | 2025-11-20 |

| Wedbush | maintain | Outperform | 2025-11-20 |

| BTIG | maintain | Buy | 2025-11-20 |

| Oppenheimer | maintain | Outperform | 2025-11-20 |

Overall, grades for Palo Alto Networks mostly indicate positive sentiment with multiple “Buy,” “Outperform,” and “Overweight” ratings, although one downgrade to “Reduce” from HSBC was noted.

CrowdStrike Holdings, Inc. Grades

This table summarizes recent grades and actions by recognized grading firms for CrowdStrike Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-12-18 |

| Stephens & Co. | maintain | Overweight | 2025-12-18 |

| Freedom Capital Markets | upgrade | Buy | 2025-12-11 |

| Goldman Sachs | maintain | Buy | 2025-12-04 |

| Citigroup | maintain | Buy | 2025-12-04 |

| Cantor Fitzgerald | maintain | Overweight | 2025-12-03 |

| Macquarie | maintain | Neutral | 2025-12-03 |

| DA Davidson | maintain | Buy | 2025-12-03 |

| Citizens | maintain | Market Outperform | 2025-12-03 |

| Scotiabank | maintain | Sector Outperform | 2025-12-03 |

CrowdStrike Holdings has predominantly positive grades including several “Buy,” “Overweight,” and “Outperform” ratings, with no downgrades reported.

Which company has the best grades?

Both companies have received predominantly favorable grades. Palo Alto Networks shows strong “Buy” and “Outperform” ratings but also one downgrade, whereas CrowdStrike’s ratings are consistently positive with multiple “Buy” and “Overweight” grades and no downgrades. This suggests a slightly more stable positive outlook for CrowdStrike, which could influence investor confidence differently.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD) based on the latest available data.

| Criterion | Palo Alto Networks, Inc. (PANW) | CrowdStrike Holdings, Inc. (CRWD) |

|---|---|---|

| Diversification | Strong product mix with $1.8B in products and $4.97B in subscriptions, plus $2.45B in support (2025) | Revenue primarily from subscription ($3.76B) and professional services ($192M), less diversified |

| Profitability | Net margin 12.3%, ROIC 5.67%, but ROIC below WACC (7.44%), slightly unfavorable moat due to value shedding but improving profitability | Negative net margin (-0.49%), low ROIC (0.7%) below WACC (8.86%), also shedding value but with growing ROIC |

| Innovation | High fixed asset turnover (12.56) indicating efficient asset use, strong focus on subscription growth | Moderate fixed asset turnover (4.76), innovation-driven but profitability challenges remain |

| Global presence | Large and growing global subscription base, strong support services | Rapid subscription growth, expanding professional services, but smaller scale than PANW |

| Market Share | Established leader in network security with growing recurring revenues | Strong contender in endpoint security, rapidly expanding but currently less profitable |

In summary, both companies exhibit growing profitability trends, but currently operate below their cost of capital, indicating value destruction. Palo Alto Networks shows stronger diversification and profitability metrics, while CrowdStrike focuses on rapid subscription growth and innovation but faces profitability challenges. Investors should weigh growth potential against current value creation risks.

Risk Analysis

Below is a comparative overview of key risks facing Palo Alto Networks, Inc. (PANW) and CrowdStrike Holdings, Inc. (CRWD) based on their latest financial and operational profiles in 2025.

| Metric | Palo Alto Networks, Inc. (PANW) | CrowdStrike Holdings, Inc. (CRWD) |

|---|---|---|

| Market Risk | Moderate (Beta 0.79, stable tech sector) | Higher (Beta 1.09, more volatile growth) |

| Debt Level | Low (Debt-to-Equity 0.04, favorable) | Moderate (Debt-to-Equity 0.24, manageable) |

| Regulatory Risk | Moderate (Cybersecurity compliance requirements) | Moderate (Cloud security regulations) |

| Operational Risk | Moderate (Complex product suite, scale) | Moderate (Rapid growth operational challenges) |

| Environmental Risk | Low (Primarily software business) | Low (Primarily software business) |

| Geopolitical Risk | Moderate (Global enterprise exposure) | Moderate (International customer base) |

The most impactful risks are market volatility for CrowdStrike due to its higher beta and negative profitability, and Palo Alto Networks’ high valuation multiples (P/E and P/B unfavorable) that could pressure stock price if growth slows. Both companies face moderate regulatory and geopolitical risks given their global cybersecurity roles. Debt levels are low to moderate, supporting financial stability.

Which Stock to Choose?

Palo Alto Networks, Inc. (PANW) has shown strong revenue growth of 14.87% in 2025 and favorable profitability metrics, including a 12.3% net margin. Its financial ratios are slightly favorable, with low debt levels and high interest coverage, though valuation multiples appear stretched. Despite a slightly unfavorable moat rating due to ROIC below WACC, PANW’s growing profitability suggests improving value creation.

CrowdStrike Holdings, Inc. (CRWD) delivered higher revenue growth at 29.39% in 2025 but negative net margin and returns, leading to a neutral financial ratios evaluation. The company maintains solid liquidity and moderate debt, yet its ROIC remains below WACC, reflecting value destruction despite increasing profitability. CRWD’s overall rating is very favorable but tempered by weak profitability scores.

Investors prioritizing growth and willing to accept valuation premiums might find CRWD’s strong revenue momentum appealing, while those emphasizing profitability and financial stability could view PANW’s improving margins and solid credit metrics as more favorable. The choice may hinge on the tolerance for risk and preference for either growth potential or quality fundamentals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palo Alto Networks, Inc. and CrowdStrike Holdings, Inc. to enhance your investment decisions: