Home > Comparison > Technology > PLTR vs RBRK

The strategic rivalry between Palantir Technologies Inc. and Rubrik, Inc. shapes the future of the software infrastructure sector. Palantir operates as a data analytics powerhouse, serving government and commercial clients with complex, intelligence-driven platforms. In contrast, Rubrik specializes in data security and cloud protection, targeting diverse industries with scalable solutions. This analysis examines which company’s business model offers superior risk-adjusted returns for a diversified portfolio navigating evolving technology demands.

Table of contents

Companies Overview

Palantir Technologies and Rubrik, Inc. are key players shaping the software infrastructure market in 2026.

Palantir Technologies Inc.: Data-Driven Intelligence Pioneer

Palantir dominates as a software platform provider focused on intelligence and operational data integration. Its revenue stems from Palantir Gotham and Foundry, which enable governments and enterprises to analyze complex datasets. In 2026, Palantir emphasizes AI integration and cloud-agnostic deployment, advancing its strategic position in data orchestration and decision intelligence.

Rubrik, Inc.: Cybersecurity and Data Protection Specialist

Rubrik leads in enterprise data security solutions, covering backup, threat analytics, and cyber recovery across industries. Its core revenue comes from SaaS and cloud data protection services. In 2026, Rubrik prioritizes enhancing cyber resilience and automating data threat detection, reinforcing its foothold in safeguarding unstructured and hybrid cloud environments.

Strategic Collision: Similarities & Divergences

Both firms operate in software infrastructure but differ fundamentally. Palantir offers a closed ecosystem for data analytics and AI-driven insights, while Rubrik delivers an open security framework emphasizing data protection. They compete primarily in enterprise data management, with Palantir focusing on intelligence augmentation and Rubrik on cyber defense. Their investment profiles reflect these contrasts: Palantir bets on AI-driven growth, Rubrik on cybersecurity resilience.

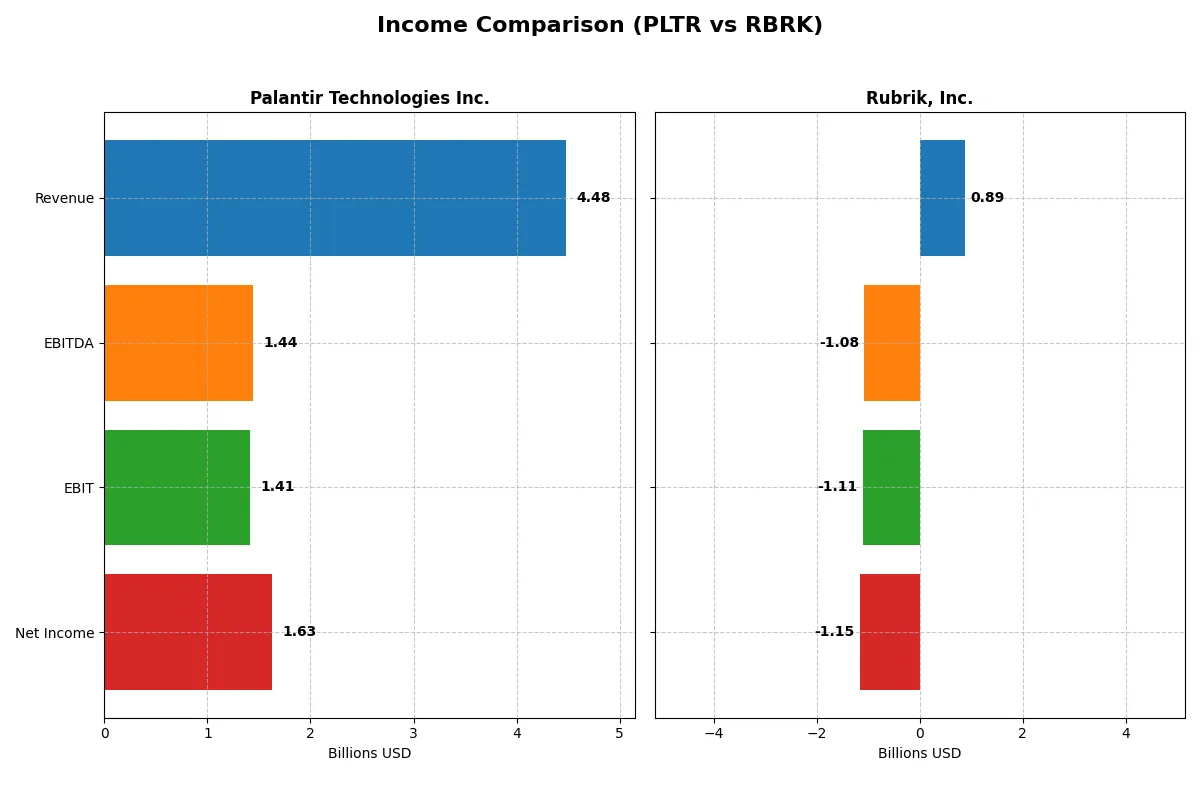

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Palantir Technologies Inc. (PLTR) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Revenue | 4.48B | 886.5M |

| Cost of Revenue | 789.2M | 265.7M |

| Operating Expenses | 2.27B | 1.75B |

| Gross Profit | 3.69B | 620.8M |

| EBITDA | 1.44B | -1.08B |

| EBIT | 1.41B | -1.11B |

| Interest Expense | 0 | 41.3M |

| Net Income | 1.63B | -1.15B |

| EPS | 0.69 | -7.48 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates more efficiently and generates superior profitability in a competitive tech landscape.

Palantir Technologies Inc. Analysis

Palantir’s revenue surged from 1.54B in 2021 to 4.48B in 2025, reflecting robust growth momentum. Net income improved dramatically from a loss of 520M in 2021 to a gain of 1.63B in 2025. Its gross margin stands strong at 82.4%, and net margin reached a healthy 36.3%, signaling efficient cost management and scaling profitability in the latest fiscal year.

Rubrik, Inc. Analysis

Rubrik’s revenue climbed steadily from 388M in 2021 to 887M in 2025, showing solid top-line expansion. However, it remains unprofitable with a net loss widening to 1.15B in 2025. Despite a respectable gross margin of 70%, the net margin is deeply negative at -130.3%, reflecting high operating expenses and poor bottom-line efficiency in the most recent year.

Verdict: Profitability Surge vs. Persistent Losses

Palantir clearly outperforms Rubrik by converting fast revenue growth into substantial profits and strong margins. Rubrik’s steep net losses and negative margins contrast sharply with Palantir’s improving earnings quality. Investors seeking a company with demonstrated income statement strength and margin power should find Palantir’s profile more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Palantir Technologies Inc. (PLTR) | Rubrik, Inc. (RBRK) |

|---|---|---|

| ROE | 22.0% | 208.6% |

| ROIC | 17.9% | -234.8% |

| P/E | 259.2 | -9.8 |

| P/B | 57.0 | -20.4 |

| Current Ratio | 7.11 | 1.13 |

| Quick Ratio | 7.11 | 1.13 |

| D/E | 0.03 | -0.63 |

| Debt-to-Assets | 2.58% | 24.7% |

| Interest Coverage | 0 | -27.5 |

| Asset Turnover | 0.50 | 0.62 |

| Fixed Asset Turnover | 17.8 | 16.7 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and operational strengths essential for investment decisions.

Palantir Technologies Inc.

Palantir shows strong profitability with a 22% ROE and a robust 36.3% net margin, reflecting operational efficiency. However, its valuation appears stretched, with a P/E of 259 and a P/B of 57, signaling expensive stock pricing. Palantir returns no dividends, instead channeling capital into R&D and growth initiatives.

Rubrik, Inc.

Rubrik posts an extraordinary 208.6% ROE despite a negative net margin of -130%, indicating volatile profitability. The stock valuation remains attractive with a negative P/E and P/B, though interest coverage is weak. Rubrik does not pay dividends and faces reinvestment challenges, focusing heavily on R&D but with negative returns on invested capital.

Premium Valuation vs. Operational Volatility

Palantir delivers a balanced mix of solid returns and strategic reinvestment but at a premium price. Rubrik’s metrics reveal high profitability on equity but significant operational risk and valuation anomalies. Investors seeking growth with operational stability might favor Palantir’s profile, while risk-tolerant investors may consider Rubrik’s volatile upside potential.

Which one offers the Superior Shareholder Reward?

Palantir Technologies Inc. (PLTR) and Rubrik, Inc. (RBRK) both avoid dividends, focusing on reinvestment for growth. PLTR boasts strong free cash flow (0.89/share in 2025) and a robust buyback capacity backed by a hefty current ratio (7.1). RBRK shows weak cash flow (0.20/share) and minimal buyback potential, with a fragile current ratio (1.13). PLTR’s capital allocation favors sustained shareholder value through disciplined cash flow reinvestment and buybacks. RBRK’s negative profitability and leverage undermine distribution sustainability. I conclude PLTR offers a superior total return profile for 2026 investors.

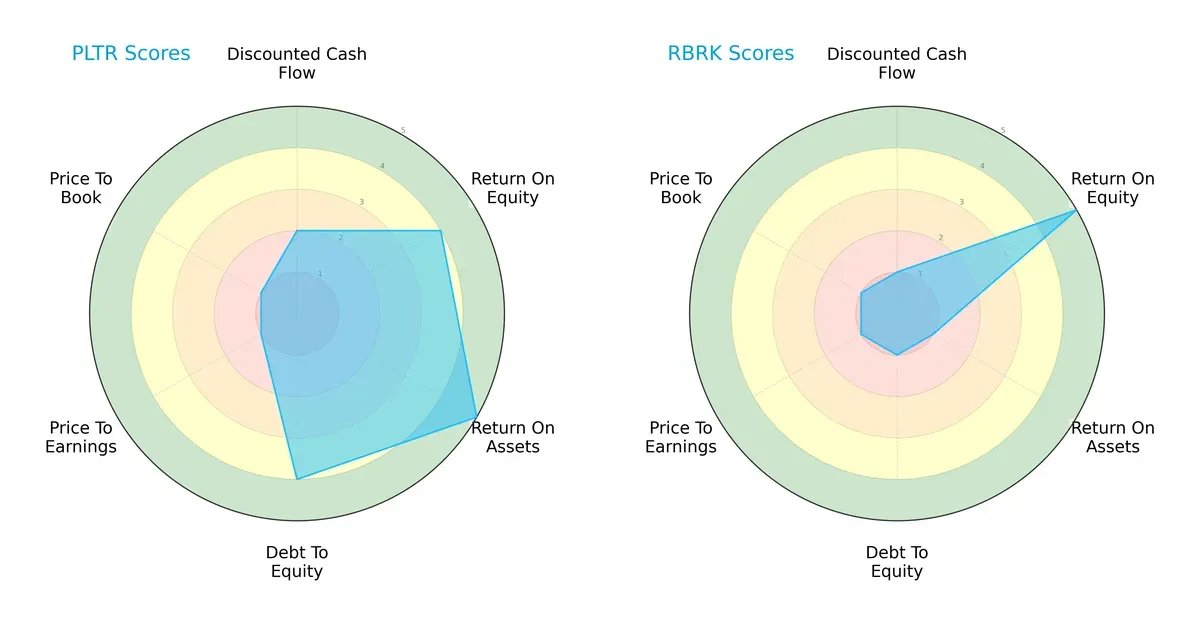

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Palantir Technologies Inc. and Rubrik, Inc., highlighting their distinctive financial strengths and vulnerabilities:

Palantir presents a more balanced profile with strong ROA (5) and solid debt-to-equity (4), indicating efficient asset use and financial stability. Rubrik excels in ROE (5) but struggles with asset returns (1) and leverage (1), relying heavily on equity efficiency. Both firms share weak valuation scores (PE and PB at 1), signaling possible overvaluation risks.

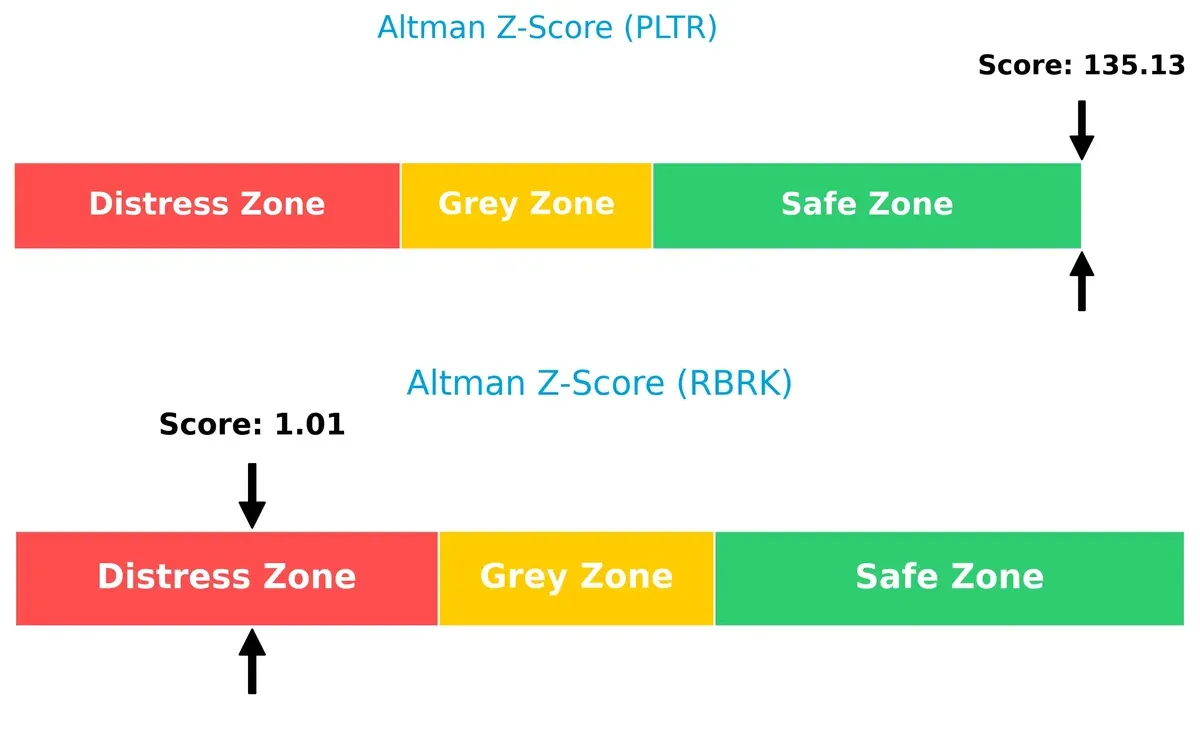

Bankruptcy Risk: Solvency Showdown

Palantir’s Altman Z-Score of 135 places it firmly in the safe zone, while Rubrik’s score near 1 signals distress, implying significantly higher long-term bankruptcy risk for Rubrik in this cycle:

Financial Health: Quality of Operations

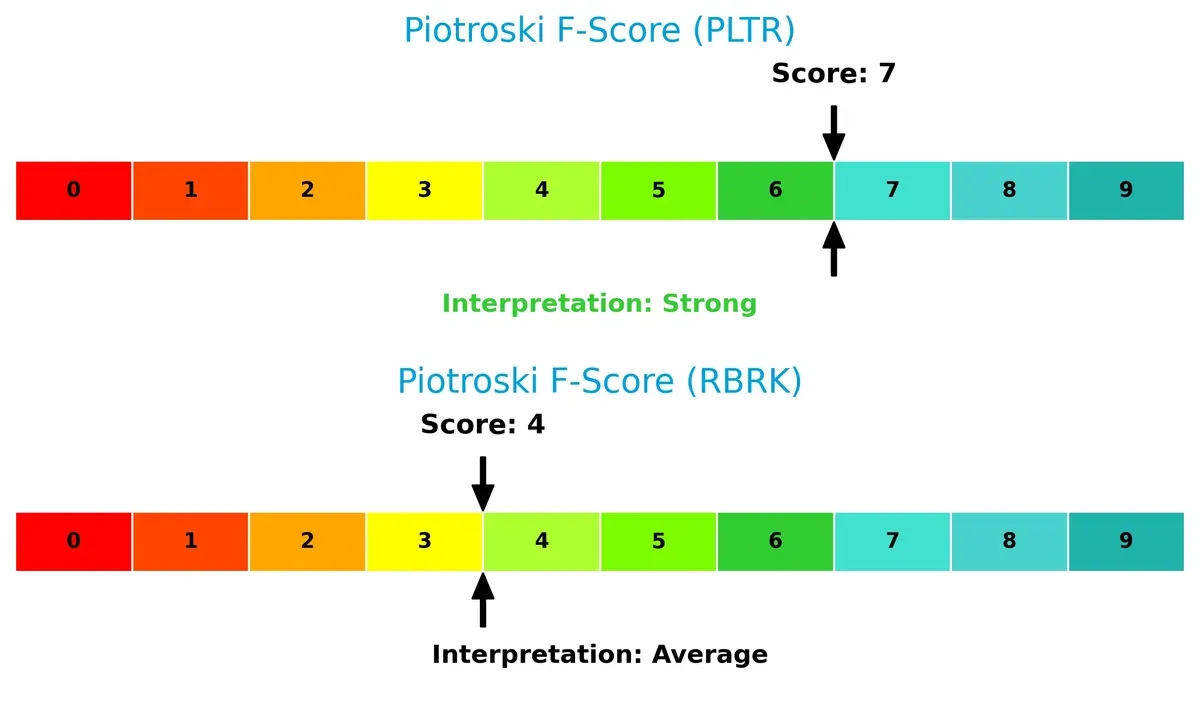

Palantir’s Piotroski F-Score of 7 shows strong financial health, reflecting efficient operations and solid fundamentals. Rubrik’s score of 4 indicates average health with potential red flags in internal metrics compared to Palantir:

How are the two companies positioned?

This section dissects Palantir and Rubrik’s operational DNA by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable competitive edge today.

Revenue Segmentation: The Strategic Mix

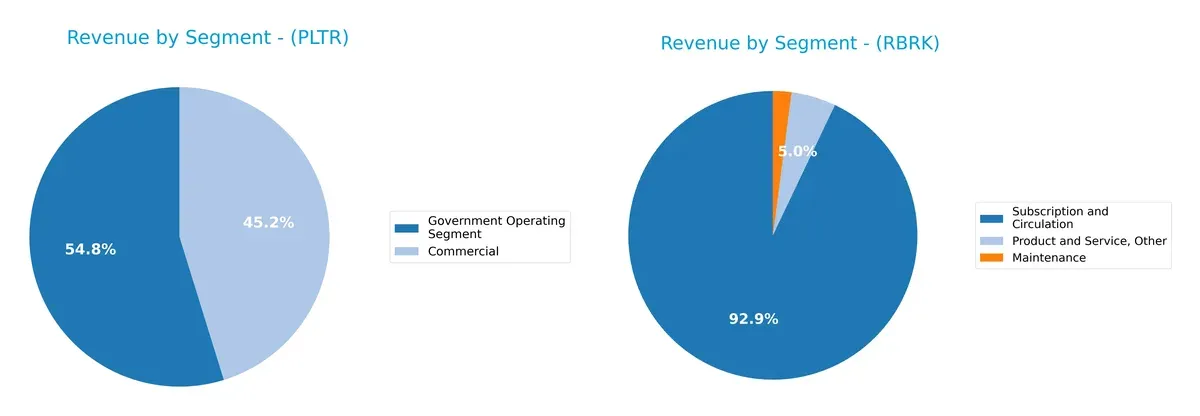

The following visual comparison dissects how Palantir Technologies Inc. and Rubrik, Inc. diversify their income streams and where their primary sector bets lie:

Palantir anchors its revenue in two key segments: Government Operating Segment at $1.57B and Commercial at $1.30B in 2024, showing a balanced yet government-tilted mix. Rubrik relies heavily on Subscription and Circulation with $829M, dwarfing Maintenance ($18M) and Product and Service ($45M). Palantir’s dual-segment focus mitigates concentration risk, while Rubrik pivots on subscription dominance, exposing it to ecosystem lock-in and recurring revenue strength.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Palantir Technologies Inc. and Rubrik, Inc. based on key financial and operational criteria:

Palantir Strengths

- Strong net margin at 36.31%

- High ROE at 22%

- Favorable ROIC of 17.95% above WACC

- Low debt ratios with 0.03 DE

- Significant government and commercial revenue diversification

- Broad global presence including US, UK, and Rest of World

Rubrik Strengths

- Favorable ROE at 208.55%

- Low WACC at 5.6% supports cheaper capital

- Diverse revenue by subscription, maintenance, and products

- Geographic revenue spread across Americas, Asia Pacific, and EMEA

- Favorable debt-to-assets at 24.65%

- Positive fixed asset turnover at 16.67

Palantir Weaknesses

- High P/E at 259.19 indicating overvaluation risk

- Elevated P/B at 57.02 suggests rich valuation

- Unfavorable WACC at 11.79% raises capital costs

- Current ratio at 7.11 flagged as unfavorable liquidity

- Zero dividend yield

- Moderate asset turnover at 0.5

Rubrik Weaknesses

- Negative net margin of -130.26% signals unprofitability

- Negative ROIC at -234.85% below WACC

- Negative P/E and P/B ratios complicate valuation

- Interest coverage negative at -26.84 indicating risk

- Current ratio neutral at 1.13

- Zero dividend yield

Palantir demonstrates robust profitability and strong capital structure but faces valuation and liquidity concerns. Rubrik shows mixed financial health with strong equity returns but suffers from unprofitability and coverage risks. Both companies maintain diversified revenues and global footprints, shaping distinct strategic challenges ahead.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion in technology sectors:

Palantir Technologies Inc.: Intangible Assets and High-Value Data Analytics

Palantir’s moat stems from proprietary software platforms and deep government ties, driving a 6% ROIC premium over WACC and stable, high margins near 36%. Their expanding AI capabilities in 2026 should deepen this moat by reinforcing switching costs and data integration barriers.

Rubrik, Inc.: Emerging Cost Advantage in Data Security

Rubrik relies on cloud-native data protection solutions, carving a cost advantage in a competitive market. However, it suffers a severe negative ROIC trend and net losses, contrasting sharply with Palantir’s profitability. Growth in cloud security demand offers opportunities but also intense pressure to scale profitably.

Moat Strength Showdown: Proprietary Data Platforms vs. Cost-Driven Cloud Security

Palantir possesses a wider and deeper moat, demonstrated by a very favorable ROIC trend and strong income metrics. Rubrik’s value destruction and shrinking profitability highlight a fragile competitive position. Palantir is better equipped to defend market share through innovation and entrenched data assets.

Which stock offers better returns?

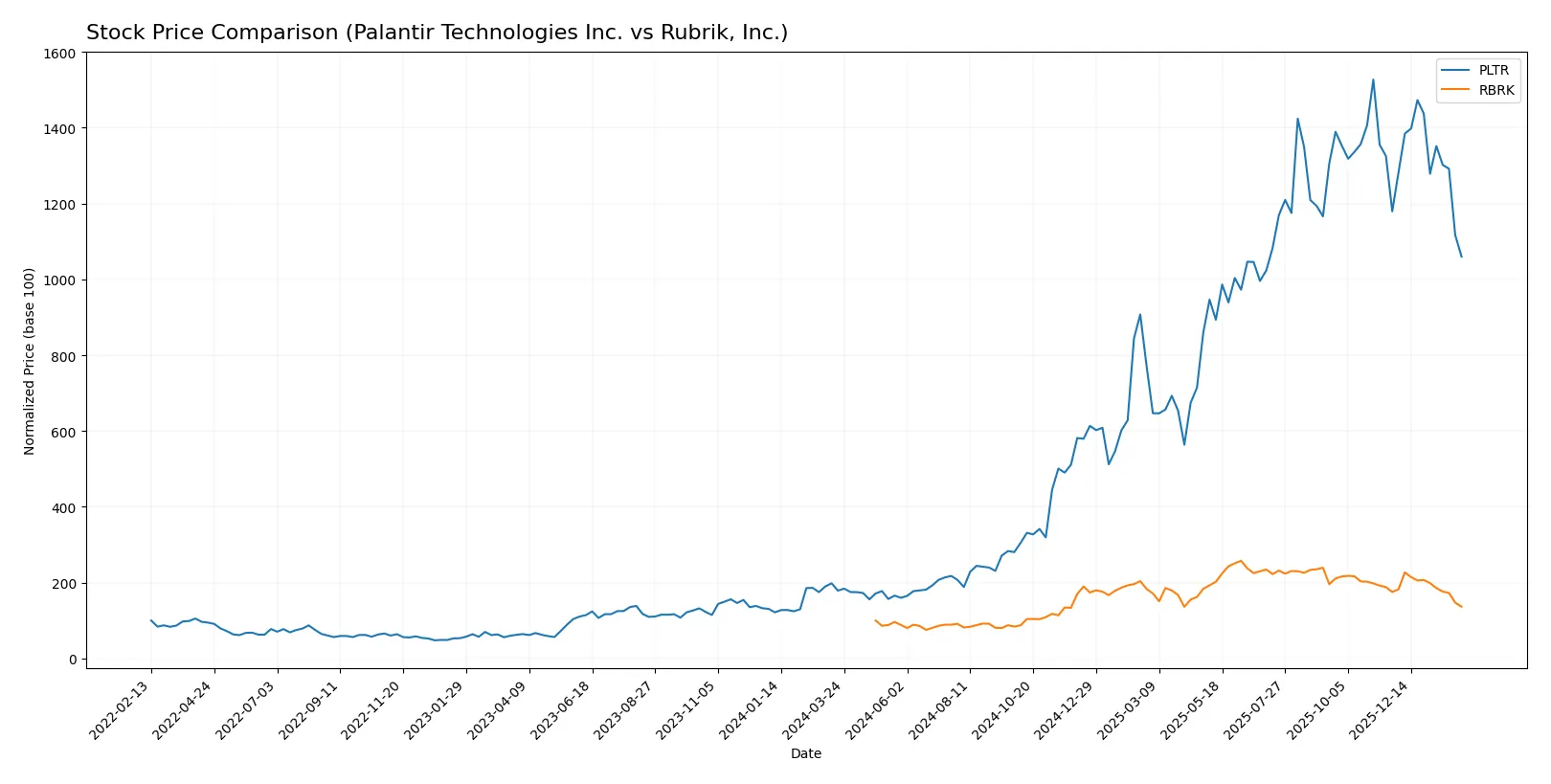

The past year reveals divergent trajectories for Palantir Technologies Inc. and Rubrik, Inc., with Palantir showing extraordinary gains but recent pullbacks, while Rubrik posts moderate growth amid seller dominance in trading.

Trend Comparison

Palantir’s stock surged 492.46% over the past 12 months, marking a strong bullish trend despite decelerating momentum and a recent 10.13% decline since November 2025.

Rubrik gained 36.42% over the same period, also bullish but slowing. Its recent trend worsened with a 22.15% drop and clear seller dominance in volume.

Palantir outperformed Rubrik substantially in market returns, despite recent softness. Palantir’s volatility and volume dynamics contrast with Rubrik’s more modest but weakening performance.

Target Prices

Analysts maintain a positive outlook with solid target consensus for both Palantir Technologies and Rubrik, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Palantir Technologies Inc. | 180 | 230 | 198.8 |

| Rubrik, Inc. | 105 | 113 | 109.33 |

The target consensus for Palantir sits nearly 44% above its current price of 138.26, signaling strong upside potential. Rubrik’s consensus target more than doubles its current price of 51.68, reflecting aggressive growth expectations despite its recent IPO.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Palantir Technologies Inc. Grades

The following table shows recent grades from leading financial institutions for Palantir Technologies Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-03 |

| UBS | Maintain | Neutral | 2026-02-03 |

| DA Davidson | Maintain | Neutral | 2026-02-03 |

| Citigroup | Upgrade | Buy | 2026-01-12 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| Piper Sandler | Maintain | Overweight | 2025-11-04 |

| Goldman Sachs | Maintain | Neutral | 2025-11-04 |

| Baird | Maintain | Neutral | 2025-11-04 |

| B of A Securities | Maintain | Buy | 2025-11-04 |

| UBS | Maintain | Neutral | 2025-11-04 |

Rubrik, Inc. Grades

The table below summarizes the latest institutional grades for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

Which company has the best grades?

Rubrik, Inc. holds stronger consensus grades, with multiple “Outperform” and “Overweight” ratings, compared to Palantir’s mix of “Buy,” “Neutral,” and “Equal Weight.” This suggests greater institutional confidence in Rubrik’s near-term prospects, potentially attracting more investor interest.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Palantir Technologies Inc.

- Dominates niche intelligence and data analytics software with strong government ties, but faces intense competition from big tech.

Rubrik, Inc.

- Competes in a crowded data security market, struggling to differentiate against established cybersecurity firms and cloud providers.

2. Capital Structure & Debt

Palantir Technologies Inc.

- Extremely low debt (D/E 0.03) and strong interest coverage reduce financial risk; conservative capital structure.

Rubrik, Inc.

- Higher debt levels (Debt to Assets 24.65%) and negative interest coverage indicate elevated financial leverage and credit risk.

3. Stock Volatility

Palantir Technologies Inc.

- Beta of 1.69 signals above-market volatility; share price has wide trading range and recent sharp declines.

Rubrik, Inc.

- Beta of 0.32 shows low volatility, but limited liquidity and recent price weakness reflect market uncertainty.

4. Regulatory & Legal

Palantir Technologies Inc.

- Faces scrutiny due to government contracts and data privacy concerns, increasing regulatory risk.

Rubrik, Inc.

- Operates under evolving cybersecurity regulations; risks stem from potential compliance failures and data breaches.

5. Supply Chain & Operations

Palantir Technologies Inc.

- Software-centric model minimizes physical supply chain risks; operational complexity lies in continuous software deployment.

Rubrik, Inc.

- Relies heavily on cloud infrastructure and third-party vendors, exposing it to supply disruptions and service outages.

6. ESG & Climate Transition

Palantir Technologies Inc.

- Limited ESG disclosure; data privacy and ethical AI use remain key concerns impacting reputation.

Rubrik, Inc.

- Focus on data security aligns with social governance, but carbon footprint and sustainability efforts are underdeveloped.

7. Geopolitical Exposure

Palantir Technologies Inc.

- Significant exposure to US and allied government contracts, vulnerable to geopolitical tensions and export controls.

Rubrik, Inc.

- Primarily serves commercial sectors with global clients; moderate geopolitical risk but sensitive to trade policy shifts.

Which company shows a better risk-adjusted profile?

Palantir’s dominant market position and pristine balance sheet offer a stronger risk buffer, but regulatory and geopolitical risks remain significant. Rubrik’s financial leverage and operational dependencies heighten its risk, despite lower volatility. Palantir’s recent strong profitability and Altman Z-Score confirm better resilience under pressure.

Final Verdict: Which stock to choose?

Palantir Technologies Inc. (PLTR) excels as a cash-generating powerhouse with a robust moat demonstrated by its consistently growing ROIC well above WACC. Its main point of vigilance is a sky-high valuation, which might pressure returns if growth slows. PLTR suits investors seeking aggressive growth with a tolerance for premium pricing.

Rubrik, Inc. (RBRK) offers a strategic moat rooted in niche enterprise data management, but its financials reveal value erosion and declining profitability. Relative to Palantir, Rubrik presents a more uncertain safety profile. It may appeal to risk-tolerant investors targeting speculative GARP opportunities with patience for a turnaround.

If you prioritize sustainable value creation and proven capital efficiency, Palantir outshines Rubrik thanks to its strong economic moat and solid income growth. However, if you seek potential undervalued growth with a speculative edge, Rubrik offers a riskier but possibly rewarding scenario. Each fits a distinct investor avatar demanding careful risk calibration.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palantir Technologies Inc. and Rubrik, Inc. to enhance your investment decisions: