In the dynamic world of technology, Unity Software Inc. and PagerDuty, Inc. stand out as innovators shaping the software application landscape. Unity excels in real-time 3D content creation across multiple platforms, while PagerDuty leads in digital operations management powered by machine learning. Both companies share market overlap and a focus on cutting-edge solutions. This article will help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Unity Software Inc. and PagerDuty, Inc. by providing an overview of these two companies and their main differences.

Unity Software Inc. Overview

Unity Software Inc. develops and manages an interactive real-time 3D content platform aimed at creators of 2D and 3D content across mobile, PC, console, and AR/VR devices. Founded in 2004 and headquartered in San Francisco, Unity serves developers, artists, and engineers with software solutions to create, run, and monetize real-time interactive content globally. The company is positioned as a leader in application software with a market cap of $17.5B.

PagerDuty, Inc. Overview

PagerDuty, Inc. operates a digital operations management platform that uses machine learning to analyze data from software-enabled systems, helping businesses detect and predict issues. Founded in 2009 and also based in San Francisco, PagerDuty serves industries including technology, telecom, retail, and financial services. It is a smaller player in the software application sector with a market cap of approximately $1B.

Key similarities and differences

Both Unity and PagerDuty operate in the software application industry and are headquartered in San Francisco, focusing on technology-driven solutions. Unity targets content creation and monetization for interactive media, while PagerDuty specializes in operational data analytics and incident management. Unity is significantly larger by market cap and employee count, reflecting different scale and market reach compared to PagerDuty’s more niche digital operations platform.

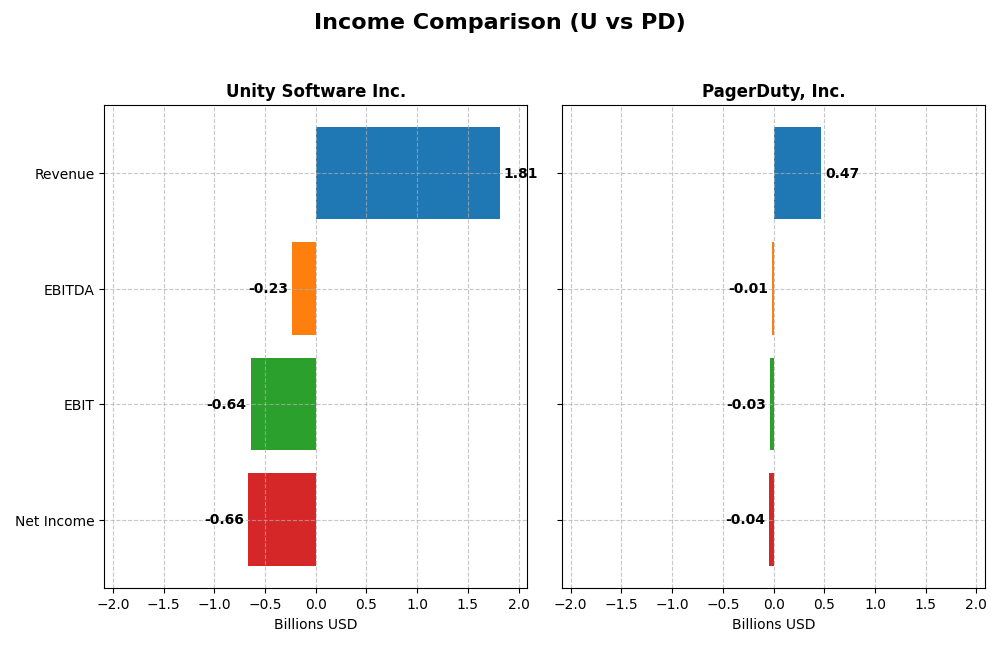

Income Statement Comparison

This table compares the most recent fiscal year income statement metrics for Unity Software Inc. and PagerDuty, Inc., highlighting revenue, earnings, and profitability indicators.

| Metric | Unity Software Inc. | PagerDuty, Inc. |

|---|---|---|

| Market Cap | 17.5B | 1.03B |

| Revenue | 1.81B | 467M |

| EBITDA | -235M | -12M |

| EBIT | -644M | -32.5M |

| Net Income | -664M | -54.5M |

| EPS | -1.68 | -0.59 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Unity Software Inc.

Unity Software Inc. showed a strong overall revenue growth of 135% from 2020 to 2024, though its net income declined by 135% over the same period. Gross margin remained favorable at 73.48%, but EBIT and net margins were consistently negative. In 2024, revenue fell by 17.1%, gross profit declined, but EBIT improved by 16.77%, signaling some operational progress despite persistent losses.

PagerDuty, Inc.

PagerDuty, Inc. experienced steady revenue growth of 119% between 2021 and 2025, accompanied by a net income increase of nearly 38%. Its gross margin was high at 82.96%, although EBIT and net margins remained negative but showed marked improvement. In 2025, revenues rose by 8.54% with strong gains in EBIT (+55.46%) and net margin (+51.84%), reflecting healthier profitability trends.

Which one has the stronger fundamentals?

PagerDuty demonstrates stronger fundamentals with predominantly favorable margin improvements and consistent positive growth in revenue, net income, and earnings per share. Unity, while growing revenue significantly over five years, struggles with persistent and deep net losses and margin deterioration. PagerDuty’s financial metrics suggest better operational efficiency and improving profitability compared to Unity’s ongoing challenges.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Unity Software Inc. (U) and PagerDuty, Inc. (PD) based on their most recent fiscal year data.

| Ratios | Unity Software Inc. (2024) | PagerDuty, Inc. (2025) |

|---|---|---|

| ROE | -20.8% | -32.9% |

| ROIC | -12.8% | -9.7% |

| P/E | -13.4 | -39.9 |

| P/B | 2.79 | 13.12 |

| Current Ratio | 2.50 | 1.87 |

| Quick Ratio | 2.50 | 1.87 |

| D/E (Debt to Equity) | 0.74 | 3.57 |

| Debt-to-Assets | 34.9% | 50.0% |

| Interest Coverage | -32.1 | -6.46 |

| Asset Turnover | 0.27 | 0.50 |

| Fixed Asset Turnover | 18.3 | 16.6 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Unity Software Inc.

Unity Software exhibits a mixed ratio profile with significant weaknesses in profitability, including a net margin of -36.63% and ROE at -20.81%, both unfavorable. Liquidity ratios are favorable, with a current ratio of 2.5, indicating sound short-term financial stability. The company does not pay dividends, likely due to ongoing reinvestment in R&D, which accounts for over 51% of revenue, reflecting a growth-focused strategy without shareholder distributions.

PagerDuty, Inc.

PagerDuty shows modest profitability struggles, with a net margin of -9.14% and ROE at -32.92%, both unfavorable, alongside a high debt-to-equity ratio of 3.57, raising financial risk concerns. Liquidity remains adequate, with a current ratio of 1.87. Similar to Unity, PagerDuty pays no dividends, prioritizing reinvestment and growth, supported by significant R&D spending at 30% of revenue, with no indication of share buybacks.

Which one has the best ratios?

Comparing both, Unity Software has a slightly more favorable liquidity position and a better balance of favorable to unfavorable ratios than PagerDuty, which faces higher leverage and more pronounced profitability issues. However, both companies carry multiple unfavorable indicators, particularly in profitability and coverage ratios, underscoring ongoing financial challenges for investors to consider.

Strategic Positioning

This section compares the strategic positioning of Unity Software Inc. and PagerDuty, Inc., focusing on market position, key segments, and exposure to technological disruption:

Unity Software Inc.

- Market leader in interactive real-time 2D/3D content platform with broad global presence.

- Key segments include Create Solutions and Operate Solutions driving software content creation and monetization.

- Platform technology supports 3D content creation with limited direct exposure to disruptive technologies mentioned.

PagerDuty, Inc.

- Operates digital operations management platform serving multiple industries internationally.

- Focuses on digital operations management using machine learning across diverse sectors.

- Leverages machine learning for predictive analytics, indicating moderate technological disruption exposure.

Unity Software Inc. vs PagerDuty, Inc. Positioning

Unity Software shows a diversified approach with two main solution segments and a global market footprint, while PagerDuty concentrates on digital operations management with AI-driven analytics. Unity’s broad content creation platform contrasts with PagerDuty’s niche operational focus, each with distinct market dynamics and growth drivers.

Which has the best competitive advantage?

Neither company currently shows a strong economic moat; Unity is shedding value with declining profitability, while PagerDuty also sheds value but demonstrates improving profitability, indicating slightly better competitive advantage potential for PagerDuty.

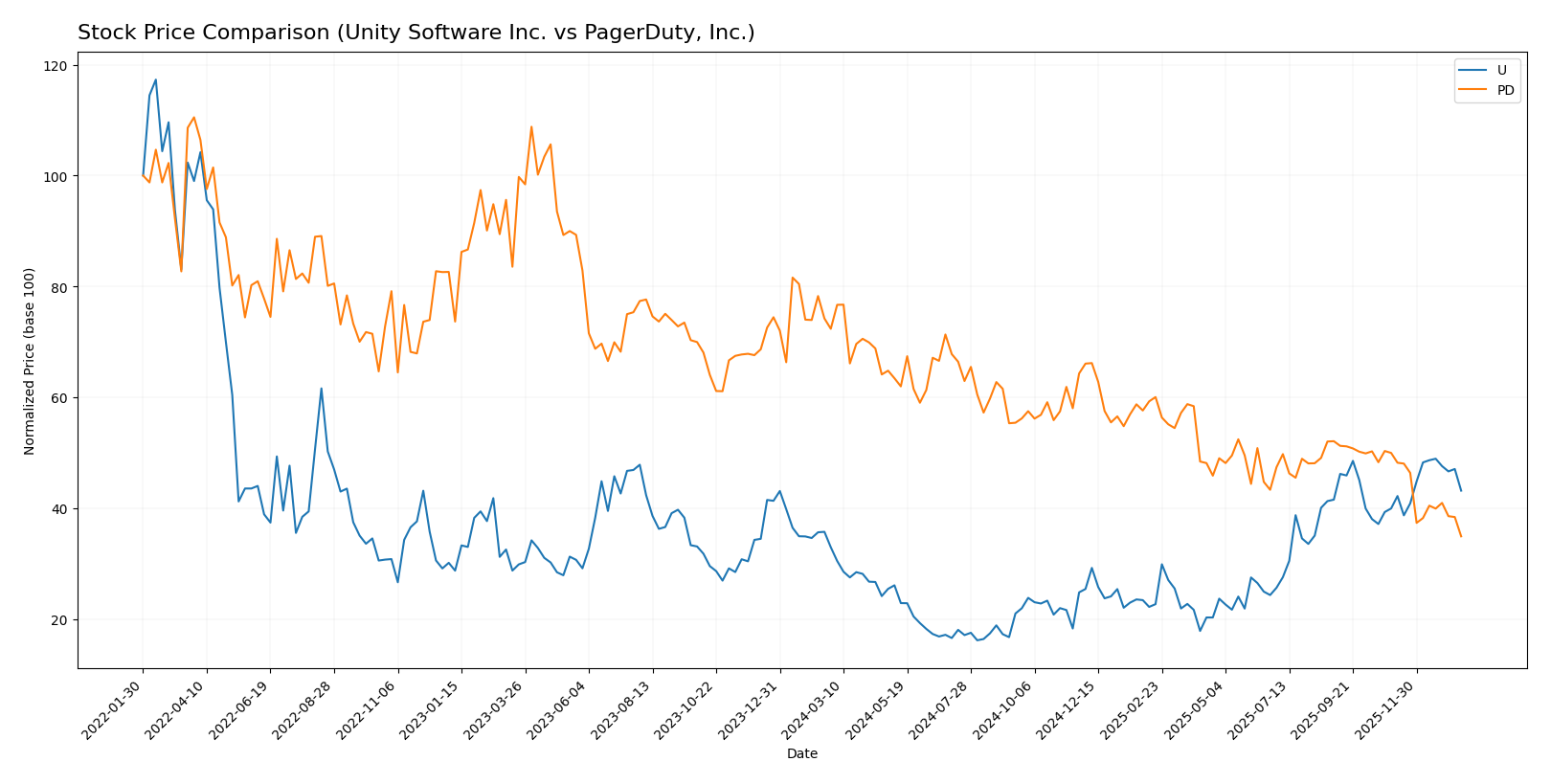

Stock Comparison

The stock price movements over the past year reveal a strong upward trajectory for Unity Software Inc., contrasted by a significant decline for PagerDuty, Inc., highlighting divergent trading dynamics and investor sentiment.

Trend Analysis

Unity Software Inc. experienced a 31.0% price increase over the past 12 months, indicating a bullish trend with accelerating momentum, a high volatility level (std deviation 9.04), and a range between 15.32 and 46.42.

PagerDuty, Inc. saw a 51.76% price decline over the same period, signaling a bearish trend with deceleration, lower volatility (std deviation 2.92), and a price range from 11.22 to 24.66.

Comparatively, Unity Software Inc. delivered the highest market performance over the past year, outperforming PagerDuty, Inc., which showed a pronounced downward trend.

Target Prices

The current analyst consensus provides a clear outlook on target prices for Unity Software Inc. and PagerDuty, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Unity Software Inc. | 60 | 39 | 50.98 |

| PagerDuty, Inc. | 19 | 15 | 16.2 |

Analysts expect Unity Software’s stock to rise significantly from its current price of $40.95, while PagerDuty’s consensus target of $16.2 suggests moderate upside from its $11.22 market price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Unity Software Inc. (U) and PagerDuty, Inc. (PD):

Rating Comparison

U Rating

- Rating: D+ with a very favorable overall rating status despite low scores on key financial metrics.

- Discounted Cash Flow Score: 1, considered very unfavorable, suggesting poor valuation metrics.

- ROE Score: 1, very unfavorable, showing low efficiency in generating profit from equity.

- ROA Score: 1, very unfavorable, indicating poor asset utilization efficiency.

- Debt To Equity Score: 1, very unfavorable, implying high financial risk due to debt levels.

- Overall Score: 1, very unfavorable, reflecting generally weak financial health.

PD Rating

- Rating: A- indicating a very favorable overall rating supported by strong financial scores.

- Discounted Cash Flow Score: 5, very favorable, indicating strong future cash flow prospects.

- ROE Score: 5, very favorable, reflecting excellent profitability from shareholders’ equity.

- ROA Score: 5, very favorable, demonstrating effective use of assets for earnings.

- Debt To Equity Score: 1, very unfavorable, indicating similar financial risk concerns.

- Overall Score: 4, favorable, showing strong financial standing overall.

Which one is the best rated?

PagerDuty, Inc. (PD) is better rated than Unity Software Inc. (U) with an A- rating versus D+, and higher scores in discounted cash flow, ROE, ROA, and overall financial health. Both share a very unfavorable debt-to-equity score.

Scores Comparison

Here is a comparison of the financial scores for Unity Software Inc. and PagerDuty, Inc.:

Unity Software Inc. Scores

- Altman Z-Score of 2.93 places Unity in the grey zone, indicating moderate bankruptcy risk.

- Piotroski Score of 4, classified as average, reflecting moderate financial strength.

PagerDuty, Inc. Scores

- Altman Z-Score of 1.26 places PagerDuty in the distress zone, indicating high bankruptcy risk.

- Piotroski Score of 7, classified as strong, reflecting good financial strength.

Which company has the best scores?

Based on the data, Unity Software has a better Altman Z-Score, signaling lower bankruptcy risk, while PagerDuty has a stronger Piotroski Score, indicating better financial health. Each company shows strengths in different score metrics.

Grades Comparison

Here is a comparison of the latest grades assigned to Unity Software Inc. and PagerDuty, Inc.:

Unity Software Inc. Grades

The following table shows recent grades from reputable financial institutions for Unity Software Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Overweight | 2026-01-13 |

| Goldman Sachs | maintain | Neutral | 2026-01-13 |

| Wells Fargo | maintain | Overweight | 2026-01-08 |

| Jefferies | maintain | Buy | 2026-01-05 |

| Piper Sandler | upgrade | Overweight | 2025-12-11 |

| BTIG | upgrade | Buy | 2025-12-11 |

| Wells Fargo | upgrade | Overweight | 2025-12-05 |

| Arete Research | upgrade | Buy | 2025-12-01 |

| Citigroup | maintain | Buy | 2025-11-11 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

Unity Software shows a positive trend with multiple upgrades and predominantly “Buy” or “Overweight” grades from well-known firms.

PagerDuty, Inc. Grades

The following table summarizes recent grades from recognized grading companies for PagerDuty, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | maintain | Buy | 2026-01-07 |

| RBC Capital | downgrade | Sector Perform | 2026-01-05 |

| TD Cowen | maintain | Buy | 2025-11-26 |

| Craig-Hallum | downgrade | Hold | 2025-11-26 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-26 |

| RBC Capital | maintain | Outperform | 2025-11-26 |

| Truist Securities | maintain | Buy | 2025-11-19 |

| Baird | maintain | Neutral | 2025-09-04 |

| RBC Capital | maintain | Outperform | 2025-09-04 |

| Canaccord Genuity | maintain | Buy | 2025-09-04 |

PagerDuty’s grades indicate mixed sentiment, with some downgrades and a balance of “Buy,” “Hold,” and “Neutral” ratings from respected firms.

Which company has the best grades?

Unity Software Inc. has received better and more consistent positive grades, predominantly “Buy” and “Overweight,” while PagerDuty, Inc. shows a more cautious stance with several downgrades and more “Hold” ratings. This suggests differing analyst confidence levels that investors should consider regarding growth expectations and risk.

Strengths and Weaknesses

Below is a comparative table highlighting the key strengths and weaknesses of Unity Software Inc. (U) and PagerDuty, Inc. (PD) based on the most recent financial and operational data:

| Criterion | Unity Software Inc. (U) | PagerDuty, Inc. (PD) |

|---|---|---|

| Diversification | Moderate: Revenue split between Create Solutions ($614M) and Operate Solutions ($1.2B) in 2024 | Limited: Primarily focused on incident response and operations management |

| Profitability | Weak: Negative net margin (-36.63%), ROIC (-12.78%), and ROE (-20.81%) | Weak: Negative net margin (-9.14%), ROIC (-9.66%), and ROE (-32.92%) |

| Innovation | Strong: High fixed asset turnover (18.35) indicating efficient use of assets in tech development | Strong: Also high fixed asset turnover (16.61), showing robust asset utilization |

| Global presence | Significant: Large and growing Operate Solutions segment suggests broad adoption | Moderate: Growing ROIC trend but smaller scale and limited diversification |

| Market Share | Challenged: Declining ROIC and value destruction indicate competitive pressures | Challenged: Slightly unfavorable moat with improving profitability trend |

In summary, both companies currently face profitability challenges and value destruction, but Unity shows better diversification and scale. PagerDuty’s improving ROIC trend is promising, yet higher debt levels and weaker market diversification suggest caution. Investors should weigh growth potential against ongoing financial weaknesses.

Risk Analysis

Below is a comparative risk assessment table for Unity Software Inc. (U) and PagerDuty, Inc. (PD) based on the most recent data available for 2024 and 2025.

| Metric | Unity Software Inc. (U) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Risk | High beta (2.048) indicating higher volatility | Low beta (0.627), less volatile |

| Debt level | Moderate debt-to-equity (0.74), neutral risk | High debt-to-equity (3.57), unfavorable |

| Regulatory Risk | Moderate, typical for US tech sector | Moderate, with US and international exposure |

| Operational Risk | Elevated, negative net margin (-36.63%) and low ROE (-20.81%) | Elevated, negative net margin (-9.14%) and very low ROE (-32.92%) |

| Environmental Risk | Low to moderate, standard for software sector | Low to moderate, standard for software sector |

| Geopolitical Risk | Moderate, global presence including China and Europe | Moderate, US and international exposure |

Unity Software’s major concerns are market volatility and operational inefficiency with a grey zone Altman Z-score (2.93) and an average Piotroski score (4), indicating moderate financial distress risk and average financial strength. PagerDuty faces higher financial distress risk with a distress zone Altman Z-score (1.26) but stronger operational fundamentals reflected in a strong Piotroski score (7). Debt levels are a significant risk for PagerDuty, potentially impacting stability. The most impactful risks are operational inefficiencies and leverage for both companies, requiring careful risk management.

Which Stock to Choose?

Unity Software Inc. shows a declining income trend with a 17.1% revenue drop in 2024, negative profitability, and high debt levels. Its financial ratios are slightly unfavorable overall, reflecting value destruction and a very unfavorable moat rating.

PagerDuty, Inc. has favorable income growth with 8.54% revenue increase in 2025, though profitability remains negative. Financial ratios are mostly unfavorable, especially due to high debt, but its moat is slightly unfavorable with improving profitability.

Investors seeking growth might find PagerDuty’s improving income and profitability trends more appealing, while those cautious about financial stability might view Unity’s rating and value destruction as signals to wait. The final choice could depend on the investor’s risk tolerance and strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Unity Software Inc. and PagerDuty, Inc. to enhance your investment decisions: