In the fast-evolving software application sector, Snowflake Inc. and PagerDuty, Inc. stand out as leaders driving innovation in cloud-based data management and digital operations, respectively. Both companies cater to enterprises seeking to optimize data and system performance, making their market overlap and technology strategies highly relevant. In this article, I will analyze these industry players to help you decide which stock could be the most compelling addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Snowflake Inc. and PagerDuty, Inc. by providing an overview of these two companies and their main differences.

Snowflake Inc. Overview

Snowflake Inc. provides a cloud-based data platform designed to consolidate data into a single source of truth, enabling businesses to generate meaningful insights, build data-driven applications, and share data efficiently. Headquartered in Bozeman, Montana, Snowflake serves a broad range of industries and operates internationally. With a market cap of approximately 70.4B USD, it is a significant player in the software application sector.

PagerDuty, Inc. Overview

PagerDuty, Inc. operates a digital operations management platform that uses machine learning to analyze data signals from software-enabled systems, forecasting issues and opportunities. Based in San Francisco, California, PagerDuty serves diverse industries globally, including technology, telecommunications, and financial services. The company has a market cap of about 1B USD and focuses on enhancing operational agility and incident response.

Key similarities and differences

Both Snowflake and PagerDuty operate in the technology sector within the software application industry, offering cloud-based solutions internationally. Snowflake emphasizes data consolidation and analytics, while PagerDuty concentrates on digital operations management through machine learning. A key difference lies in their scale: Snowflake’s market cap and workforce are substantially larger than PagerDuty’s, reflecting different sizes and possibly market reach.

Income Statement Comparison

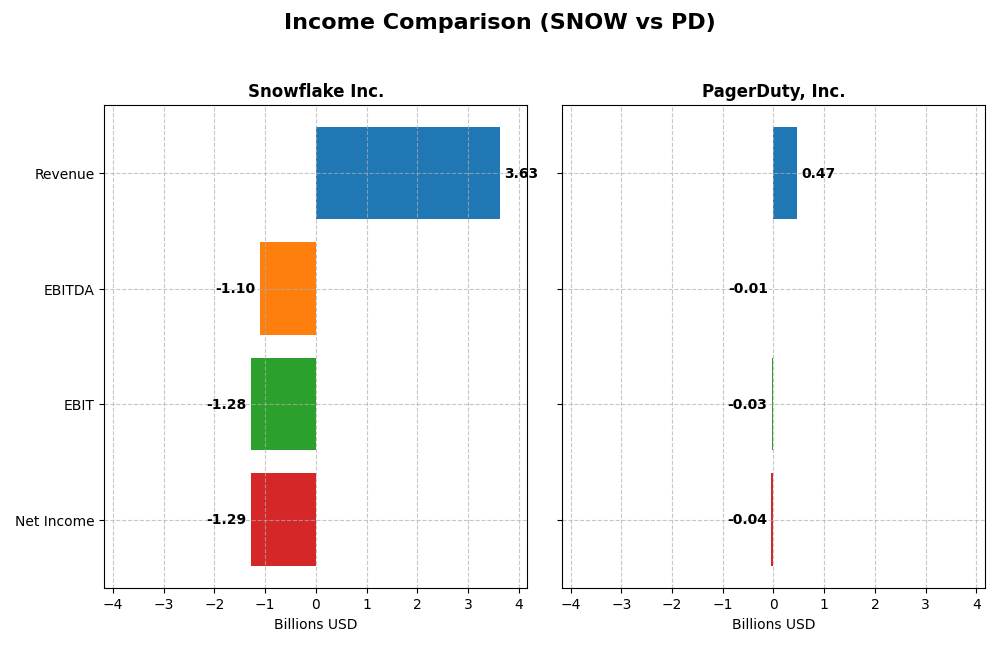

This table presents a side-by-side comparison of key income statement metrics for Snowflake Inc. and PagerDuty, Inc. for the fiscal year 2025, highlighting their recent financial performance.

| Metric | Snowflake Inc. (SNOW) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Cap | 70.4B | 1.03B |

| Revenue | 3.63B | 467.5M |

| EBITDA | -1.10B | -11.9M |

| EBIT | -1.28B | -32.5M |

| Net Income | -1.29B | -42.7M |

| EPS | -3.86 | -0.59 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Snowflake Inc.

Snowflake’s revenue showed strong growth from 592M in 2021 to 3.63B in 2025, a 512.52% increase overall, while net income remained negative and worsened from -539M to -1.29B. Gross margin stayed favorable at 66.5%, but EBIT and net margins were unfavorable, reflecting ongoing losses. The 2025 year saw revenue growth slow to 29.21%, with deteriorating profitability and margins.

PagerDuty, Inc.

PagerDuty’s revenue rose steadily from 213M in 2021 to 468M in 2025, an 118.91% increase, with net income losses narrowing from -69M to -43M. Gross margin remained strong and favorable at 83%, while EBIT and net margins were unfavorable but improving. In 2025, revenue growth was positive at 8.54%, supported by improved EBIT and net margin growth, indicating enhanced profitability.

Which one has the stronger fundamentals?

PagerDuty demonstrates stronger fundamentals with consistent revenue growth, improving net income, and favorable margin expansions over the period, supported by an 85.71% favorable income statement evaluation. Snowflake’s rapid revenue expansion is offset by persistent and deepening losses, reflected in a neutral overall income statement opinion with half of its metrics unfavorable.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Snowflake Inc. and PagerDuty, Inc., reflecting their fiscal year 2025 performance, offering a snapshot of operational efficiency, profitability, and financial health.

| Ratios | Snowflake Inc. (SNOW) | PagerDuty, Inc. (PD) |

|---|---|---|

| ROE | -42.9% | -32.9% |

| ROIC | -25.2% | -9.7% |

| P/E | -47.0 | -39.9 |

| P/B | 20.1 | 13.1 |

| Current Ratio | 1.75 | 1.87 |

| Quick Ratio | 1.75 | 1.87 |

| D/E | 0.90 | 3.57 |

| Debt-to-Assets | 29.7% | 50.0% |

| Interest Coverage | -528 | -6.46 |

| Asset Turnover | 0.40 | 0.50 |

| Fixed Asset Turnover | 5.53 | 16.6 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Snowflake Inc.

Snowflake shows mixed financial ratios with strengths in liquidity (current and quick ratio at 1.75, favorable) and fixed asset turnover (5.53, favorable), but weak profitability indicators like net margin (-35.45%) and return on equity (-42.86%), both unfavorable. The company does not pay dividends, reflecting a reinvestment strategy typical for high-growth tech firms focused on R&D and platform expansion.

PagerDuty, Inc.

PagerDuty presents similar challenges with unfavorable profitability ratios, including net margin (-9.14%) and return on equity (-32.92%), alongside a high debt-to-equity ratio (3.57, unfavorable). Favorable points include a solid current ratio (1.87) and weighted average cost of capital (WACC) at 5.85%. It also does not pay dividends, prioritizing growth and operational investments over shareholder payouts.

Which one has the best ratios?

Both companies face profitability challenges and negative returns, although Snowflake benefits from a stronger liquidity position and lower debt impact compared to PagerDuty. PagerDuty’s lower WACC and higher fixed asset turnover add some favorability, yet its higher leverage and weaker debt ratios weigh heavily. Overall, Snowflake’s ratios are slightly less unfavorable than PagerDuty’s.

Strategic Positioning

This section compares the strategic positioning of Snowflake Inc. and PagerDuty, Inc., including Market position, Key segments, and disruption:

Snowflake Inc.

- Large market cap of $70B with competitive pressure typical for cloud data platforms

- Focuses on cloud-based data platform with product revenue of $3.46B in 2025, plus professional services

- Platform-centric model exposed to ongoing technology shifts in cloud and data analytics

PagerDuty, Inc.

- Smaller market cap near $1B, niche player in digital operations management

- Operates digital operations management platform across multiple industries

- Uses machine learning to process digital signals, exposed to AI and automation disruptions

Snowflake Inc. vs PagerDuty, Inc. Positioning

Snowflake’s strategy centers on a diversified cloud data platform with significant scale and revenue, while PagerDuty concentrates on digital operations with fewer employees and smaller market size. Snowflake’s broader product base contrasts with PagerDuty’s specialized platform focus.

Which has the best competitive advantage?

Both companies are shedding value relative to their cost of capital. Snowflake shows a declining ROIC trend and very unfavorable moat status, while PagerDuty’s ROIC is growing slightly but remains slightly unfavorable, indicating marginally better competitive positioning.

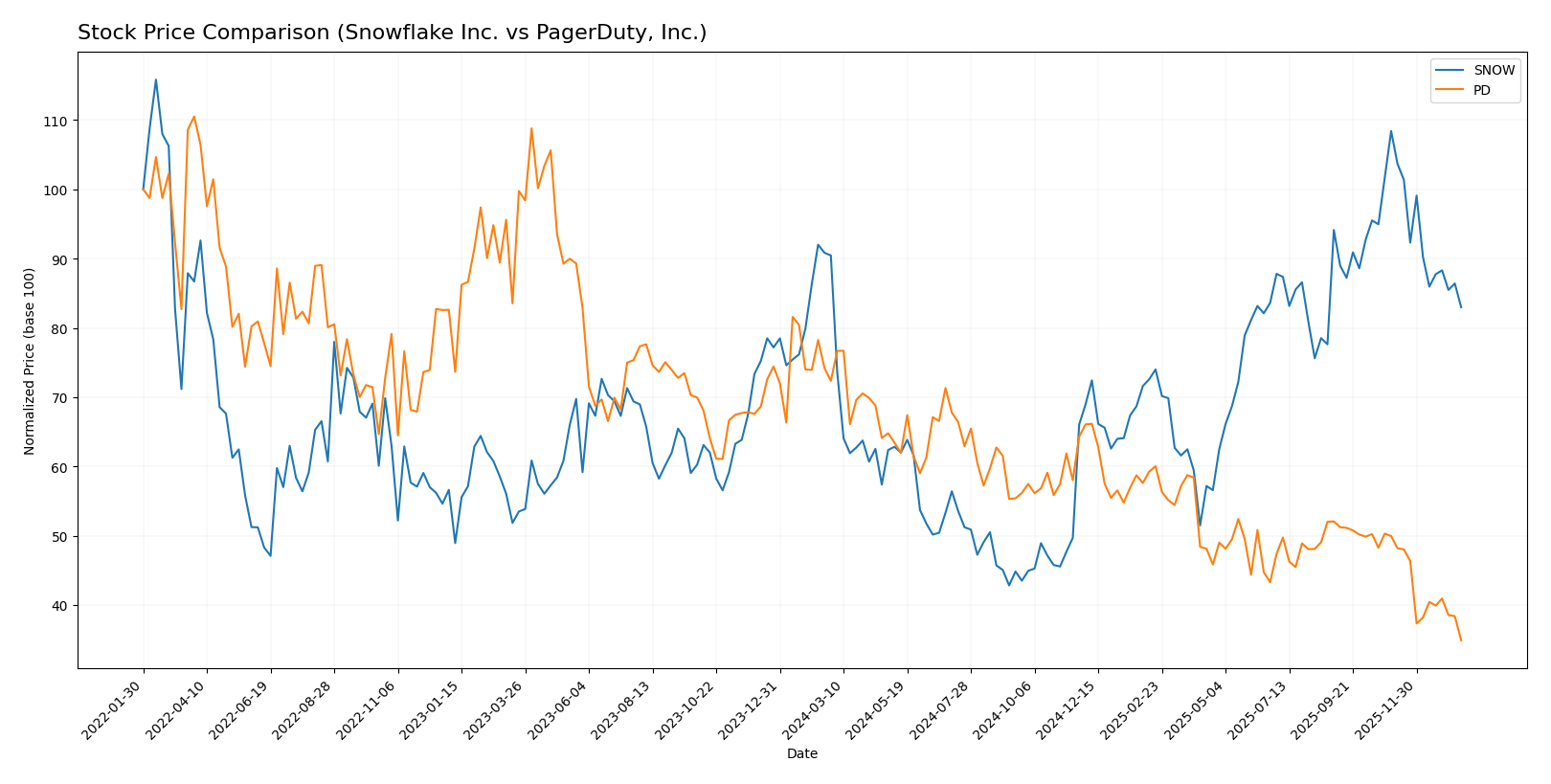

Stock Comparison

The stock price movements of Snowflake Inc. and PagerDuty, Inc. over the past 12 months reveal notable bearish trends with varying degrees of decline and trading volume dynamics.

Trend Analysis

Snowflake Inc. experienced a bearish trend with an 8.27% price decrease over the past 12 months, showing deceleration and a high volatility level with a standard deviation of 42.6. The stock peaked at 274.88 and bottomed at 108.56.

PagerDuty, Inc. showed a stronger bearish trend with a 51.76% price drop over the same period, also decelerating and exhibiting low volatility at a 2.92 standard deviation. Its price ranged from a high of 24.66 to a low of 11.22.

Comparing both stocks, PagerDuty delivered the lowest market performance with a more pronounced price decline than Snowflake during the last year.

Target Prices

Analysts present a mixed but optimistic consensus for Snowflake Inc. and PagerDuty, Inc. with clear target ranges.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Snowflake Inc. | 325 | 237 | 281.86 |

| PagerDuty, Inc. | 19 | 15 | 16.2 |

Snowflake’s consensus target price of 281.86 significantly exceeds its current 210.38 USD price, indicating potential upside. PagerDuty’s target consensus of 16.2 USD also suggests room for growth above the current 11.22 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Snowflake Inc. and PagerDuty, Inc.:

Rating Comparison

Snowflake Inc. Rating

- Rating: C-, considered very favorable overall

- Discounted Cash Flow Score: 3, moderate valuation indicator

- ROE Score: 1, very unfavorable efficiency in generating profit

- ROA Score: 1, very unfavorable asset utilization

- Debt To Equity Score: 1, very unfavorable financial risk

- Overall Score: 1, very unfavorable overall financial standing

PagerDuty, Inc. Rating

- Rating: A-, considered very favorable overall

- Discounted Cash Flow Score: 5, very favorable valuation indicator

- ROE Score: 5, very favorable profit generation efficiency

- ROA Score: 5, very favorable asset utilization

- Debt To Equity Score: 1, very unfavorable financial risk

- Overall Score: 4, favorable overall financial standing

Which one is the best rated?

PagerDuty, Inc. holds better ratings with an A- and higher scores in discounted cash flow, ROE, ROA, and overall score. Snowflake Inc. has lower ratings and scores, except for an equal debt-to-equity risk score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Snowflake Inc. and PagerDuty, Inc.:

Snowflake Inc. Scores

- Altman Z-Score: 5.36, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

PagerDuty, Inc. Scores

- Altman Z-Score: 1.26, in distress zone indicating higher bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

Snowflake shows a significantly stronger Altman Z-Score, signaling better bankruptcy safety, while PagerDuty has a higher Piotroski Score, indicating stronger financial health. Both scores highlight different aspects of financial stability.

Grades Comparison

Here is a detailed comparison of recent grades and ratings from reputable grading firms for both companies:

Snowflake Inc. Grades

This table summarizes the latest grades from major financial institutions for Snowflake Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Downgrade | Equal Weight | 2026-01-12 |

| Argus Research | Upgrade | Buy | 2026-01-08 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Wells Fargo | Maintain | Overweight | 2025-12-04 |

| Keybanc | Maintain | Overweight | 2025-12-04 |

| Piper Sandler | Maintain | Overweight | 2025-12-04 |

| Morgan Stanley | Maintain | Overweight | 2025-12-04 |

| Wedbush | Maintain | Outperform | 2025-12-04 |

| Deutsche Bank | Maintain | Buy | 2025-12-04 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-04 |

Snowflake’s grades predominantly show buy or overweight ratings with only one recent downgrade, indicating mostly positive sentiment and confidence in its performance.

PagerDuty, Inc. Grades

This table shows recent grades from recognized rating companies for PagerDuty, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-07 |

| RBC Capital | Downgrade | Sector Perform | 2026-01-05 |

| TD Cowen | Maintain | Buy | 2025-11-26 |

| Craig-Hallum | Downgrade | Hold | 2025-11-26 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-26 |

| RBC Capital | Maintain | Outperform | 2025-11-26 |

| Truist Securities | Maintain | Buy | 2025-11-19 |

| Baird | Maintain | Neutral | 2025-09-04 |

| RBC Capital | Maintain | Outperform | 2025-09-04 |

| Canaccord Genuity | Maintain | Buy | 2025-09-04 |

PagerDuty’s grading landscape is more mixed, with several downgrades and a consensus closer to hold or sector perform, reflecting more cautious investor sentiment.

Which company has the best grades?

Snowflake Inc. demonstrates stronger and more consistent buy and overweight ratings compared to PagerDuty, Inc., whose grades include several downgrades and hold-level ratings. This suggests Snowflake is viewed more favorably by analysts, potentially indicating better expected performance or lower perceived risk for investors.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Snowflake Inc. (SNOW) and PagerDuty, Inc. (PD), based on their recent financial performance and market positioning.

| Criterion | Snowflake Inc. (SNOW) | PagerDuty, Inc. (PD) |

|---|---|---|

| Diversification | Moderate, mainly product-driven with growing services segment (3.46B product revenue in 2025) | Limited data, focused on incident management software |

| Profitability | Negative net margin (-35.45%), negative ROIC (-25.24%), value destroying | Negative net margin (-9.14%), negative ROIC (-9.66%), but improving profitability trend |

| Innovation | High investment in technology but declining returns on invested capital | Steady innovation with improving ROIC trend, yet still unprofitable |

| Global presence | Strong global footprint with expanding enterprise adoption | Moderate global reach, niche market focus |

| Market Share | Significant in cloud data warehousing, but facing intense competition | Smaller market share in IT incident response, growth potential |

Key takeaways: Both companies are currently unprofitable and shedding value, with Snowflake showing a sharper decline in profitability. PagerDuty demonstrates a more favorable ROIC trend, suggesting improving operational efficiency, while Snowflake benefits from strong product revenue growth but struggles to convert this into positive returns. Investors should weigh growth potential against current profitability challenges.

Risk Analysis

Below is a comparison of key risks for Snowflake Inc. (SNOW) and PagerDuty, Inc. (PD) based on the most recent data from 2025.

| Metric | Snowflake Inc. (SNOW) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Risk | Beta 1.144, moderate volatility | Beta 0.627, lower volatility |

| Debt level | Debt-to-Equity 0.9 (neutral) | Debt-to-Equity 3.57 (high risk) |

| Regulatory Risk | Moderate, US & international compliance | Moderate, US & international compliance |

| Operational Risk | High due to negative margins and ROE | Moderate, improving profitability but still negative margins |

| Environmental Risk | Low, typical for software sector | Low, typical for software sector |

| Geopolitical Risk | Moderate, global cloud market exposure | Moderate, global digital operations exposure |

The most impactful risks are operational and financial leverage concerns. Snowflake’s negative profitability metrics and unfavorable financial ratios indicate operational challenges, despite a safe Altman Z-score. PagerDuty faces higher financial risk with a high debt-to-equity ratio and distress-level Altman Z-score, increasing bankruptcy risk despite stronger Piotroski score and improving profitability. Investors should weigh these factors carefully, prioritizing risk management.

Which Stock to Choose?

Snowflake Inc. (SNOW) shows strong revenue growth of 29.21% in 2025 and a favorable gross margin of 66.5%, but suffers from negative profitability ratios, including a -42.86% ROE and -35.45% net margin. Its debt levels are moderate with a 29.72% debt-to-assets ratio, and the overall rating is very favorable despite some unfavorable financial metrics.

PagerDuty, Inc. (PD) presents moderate revenue growth at 8.54% in 2025 and an excellent gross margin of 82.96%, with improving profitability marked by a -9.14% net margin and -32.92% ROE. However, it carries higher debt with a 50% debt-to-assets ratio and a favorable overall rating supported by strong return scores but weakened by financial leverage concerns.

Investors with a tolerance for volatility and a focus on growth could find Snowflake’s rapid revenue expansion appealing despite its value destruction signals, whereas those prioritizing improving profitability and financial ratings might see PagerDuty as a slightly more stable choice, albeit with higher leverage risk.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Snowflake Inc. and PagerDuty, Inc. to enhance your investment decisions: