Home > Comparison > Technology > SNDK vs OUST

The strategic rivalry between Sandisk Corporation and Ouster, Inc. shapes the Technology sector’s Hardware, Equipment & Parts industry. Sandisk operates as a mature storage device manufacturer with broad scale, while Ouster pursues innovation in high-resolution digital lidar sensors with a leaner footprint. This face-off represents a clash between established industrial depth and agile technological advancement. This analysis aims to identify which trajectory delivers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Sandisk Corporation and Ouster, Inc. both hold critical roles in the hardware technology sector but operate in distinctly different niches.

Sandisk Corporation: Pioneer in Flash Storage Solutions

Sandisk Corporation dominates the NAND flash storage market, generating revenue primarily through solid state drives, embedded products, and removable cards. Founded in 1988, its strategic focus remains on advancing storage device performance and expanding its product portfolio to meet growing data demands. Sandisk’s large scale and established market position underpin its competitive advantage.

Ouster, Inc.: Innovator in High-Resolution Lidar Sensors

Ouster, Inc. specializes in digital lidar technology, providing 3D vision sensors for machinery, vehicles, and infrastructure. Revenue stems from its OS scanning sensor and DF solid-state flash sensor. Founded in 2020, Ouster’s strategy centers on innovation in lidar resolution and software integration to capture emerging autonomous systems markets with high growth potential.

Strategic Collision: Similarities & Divergences

Both companies operate in cutting-edge hardware but diverge sharply in business philosophy—Sandisk emphasizes scale and product breadth in storage, while Ouster pursues innovation in specialized sensor tech. Their primary battleground is the broader technology hardware market, competing on technological leadership and application reach. Sandisk offers a mature, stable investment profile; Ouster presents a high-risk, high-reward growth opportunity.

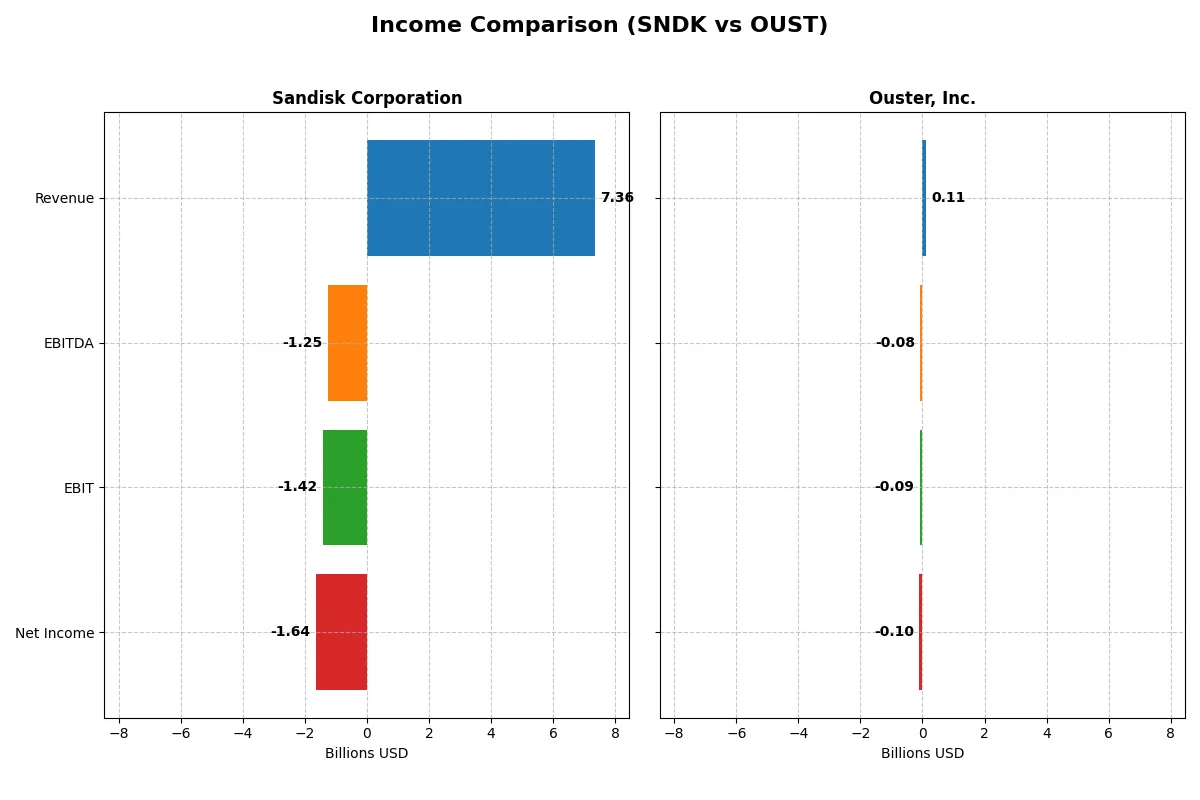

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Sandisk Corporation (SNDK) | Ouster, Inc. (OUST) |

|---|---|---|

| Revenue | 7.36B | 111.1M |

| Cost of Revenue | 5.14B | 70.6M |

| Operating Expenses | 3.59B | 144.6M |

| Gross Profit | 2.21B | 40.5M |

| EBITDA | -1.25B | -79.9M |

| EBIT | -1.42B | -94.7M |

| Interest Expense | 63.0M | 1.82M |

| Net Income | -1.64B | -97.0M |

| EPS | -11.32 | -2.08 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and sustainable profit engine in a challenging market environment.

Sandisk Corporation Analysis

Sandisk’s revenue declined 25% from 2022 to 2025 but rebounded 10% from 2024 to 2025, signaling mixed top-line momentum. Gross margin holds steady at 30%, yet the company suffers deep net losses, with a -22% net margin in 2025. Operating inefficiencies and escalating expenses erode profitability despite improving gross profits last year.

Ouster, Inc. Analysis

Ouster’s revenue soared nearly 5x over five years, growing 33% in the last year alone, reflecting strong market traction. Its gross margin expanded to 36%, a sign of improving cost control. However, it remains deeply unprofitable with an -87% net margin, though recent gains in EBIT and net margin indicate operational progress and scaling benefits.

Margin Power vs. Revenue Scale

Sandisk commands a higher revenue base but struggles to translate scale into profits, showing deteriorating margins. Ouster, while smaller, exhibits rapid revenue growth and improving margin trends. Based solely on income statement dynamics, Ouster’s profile offers greater growth momentum with early signs of operational leverage, appealing to investors favoring growth potential over current profitability.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Sandisk Corporation (SNDK) | Ouster, Inc. (OUST) |

|---|---|---|

| ROE | -17.8% | -53.6% |

| ROIC | -11.9% | -50.8% |

| P/E | -4.17 | -5.87 |

| P/B | 0.74 | 3.15 |

| Current Ratio | 3.56 | 2.80 |

| Quick Ratio | 2.11 | 2.59 |

| D/E | 0.22 | 0.11 |

| Debt-to-Assets | 15.7% | 7.3% |

| Interest Coverage | -21.9 | -57.1 |

| Asset Turnover | 0.57 | 0.40 |

| Fixed Asset Turnover | 11.88 | 4.54 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as the company’s DNA, unveiling hidden risks and operational strengths critical for informed investing.

Sandisk Corporation

Sandisk’s profitability metrics show negative ROE (-17.81%) and margins (-22.31%), signaling operational challenges. The stock trades at a favorable P/E of -4.17 and P/B of 0.74, suggesting undervaluation despite weak returns. No dividends are paid; instead, Sandisk appears to reinvest heavily in R&D (15.4% of revenue), aiming to fuel future growth.

Ouster, Inc.

Ouster posts deeper losses with a ROE of -53.64% and net margin of -87.35%, reflecting heavy operational inefficiency. Its valuation is stretched with a high P/B of 3.15, despite a favorable negative P/E (-5.87). The company pays no dividends, directing substantial resources toward R&D (52.3% of revenue), indicating a growth-focused, capital-intensive strategy.

Growth Ambition vs. Operational Reality

Sandisk offers a more balanced profile with reasonable valuation and moderate reinvestment, while Ouster’s metrics reveal a riskier, heavily invested growth story. Investors seeking operational stability may lean toward Sandisk, whereas those favoring aggressive expansion might prefer Ouster’s high-growth posture.

Which one offers the Superior Shareholder Reward?

I observe that Sandisk Corporation (SNDK) and Ouster, Inc. (OUST) both pay no dividends, focusing entirely on reinvestment and growth. Sandisk’s payout ratio stands at 0%, reflecting zero dividend yield and negative free cash flow of -0.83 per share in 2025, signaling reinvestment pressures despite a solid cash ratio of 1.04. Ouster, similarly dividend-free, shows a more strained free cash flow at -0.80 per share but boasts a stronger cash ratio of 0.58 and a higher asset turnover. Both run modest buyback programs, yet Sandisk’s superior current ratio (3.56 vs. 2.80) and lower leverage provide a more sustainable base for future shareholder returns. I conclude Sandisk offers a more attractive total return profile for 2026, balancing reinvestment with financial stability better than Ouster.

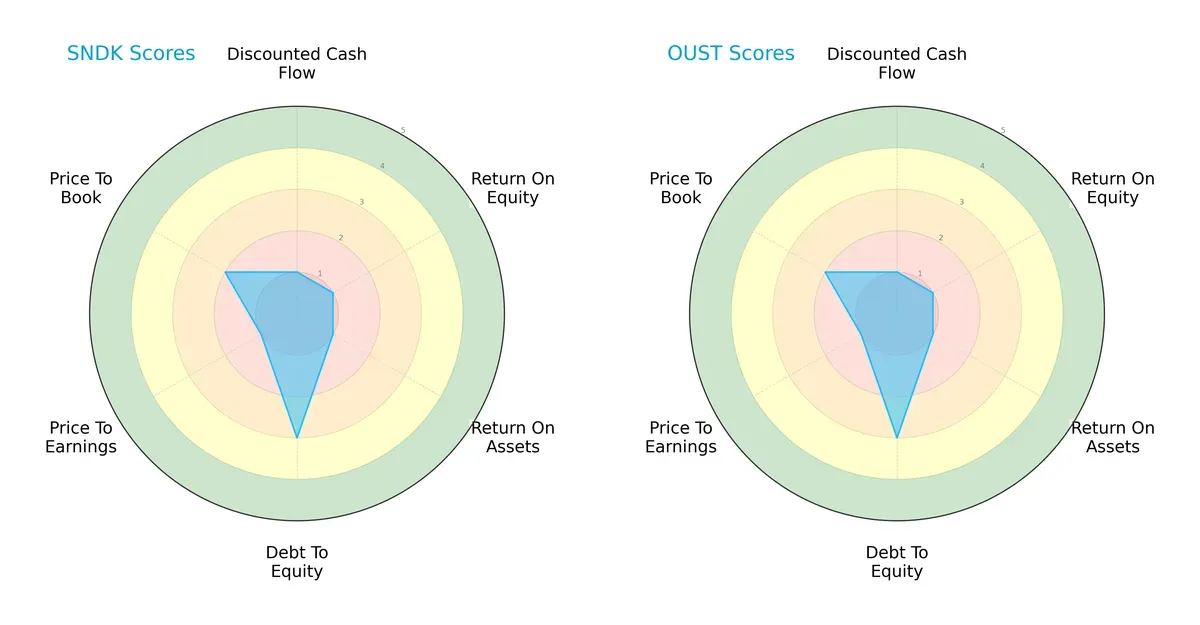

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Sandisk Corporation and Ouster, Inc., highlighting their financial strengths and weaknesses:

Both companies share identical scores across all key metrics: DCF, ROE, ROA, Debt/Equity, and valuation ratios. Each scores very unfavorably on profitability and valuation, with only moderate marks on debt management. Neither displays a clear competitive edge, reflecting equally challenged operational and market positions. This parity suggests both firms currently lack a balanced strategic profile.

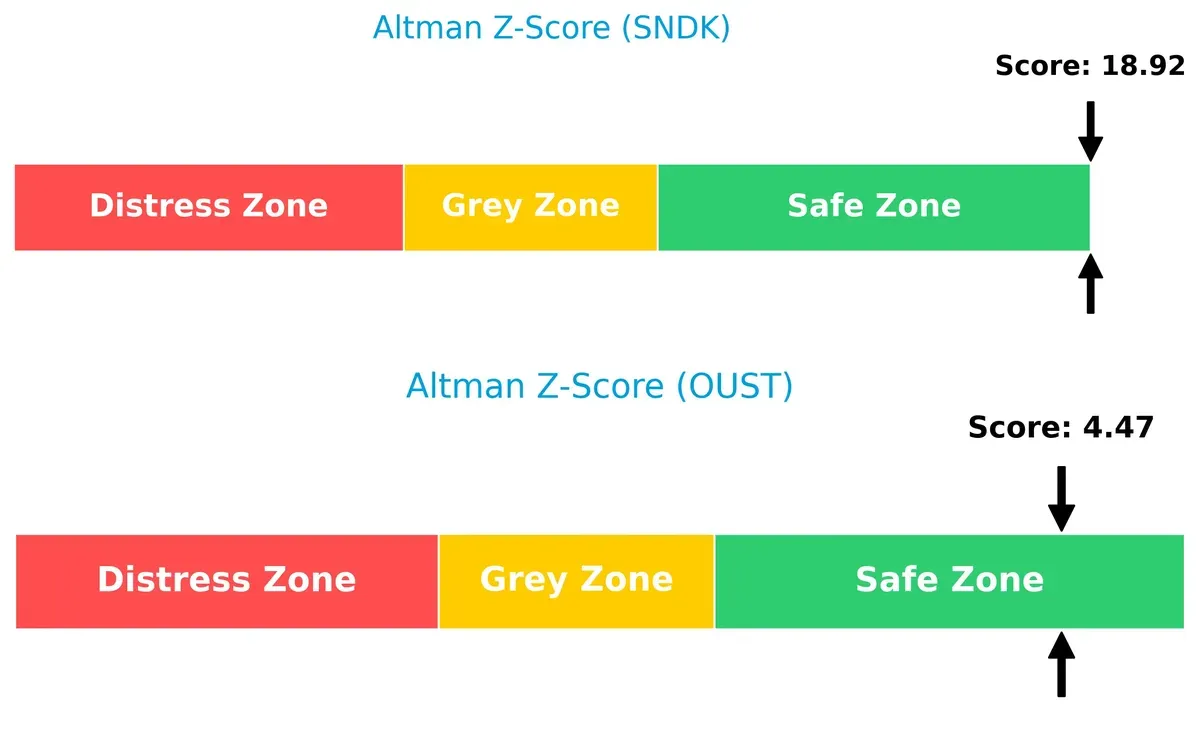

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score comparison exposes a significant solvency gap between Sandisk and Ouster:

Sandisk’s Z-Score of 18.9 places it deep in the safe zone, signaling robust financial stability and low bankruptcy risk. Ouster’s score of 4.5, while still safe, indicates a thinner margin of safety in this cycle. Investors should view Sandisk as far more resilient to economic stress.

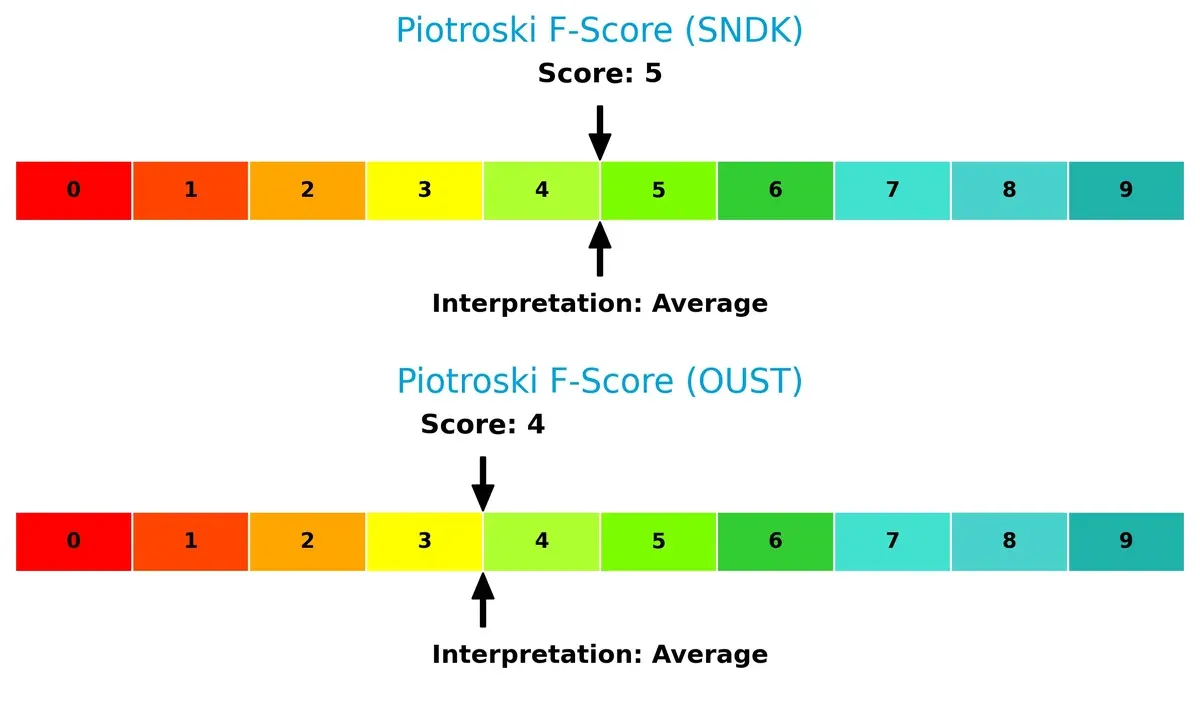

Financial Health: Quality of Operations

Piotroski F-Score analysis highlights subtle differences in operational quality:

Sandisk scores a 5, slightly above Ouster’s 4, both clustering in the average category. Neither company exhibits peak financial health or operational excellence. This signals caution, as internal metrics do not suggest strong value creation or balance sheet improvement. Investors should monitor closely for potential red flags.

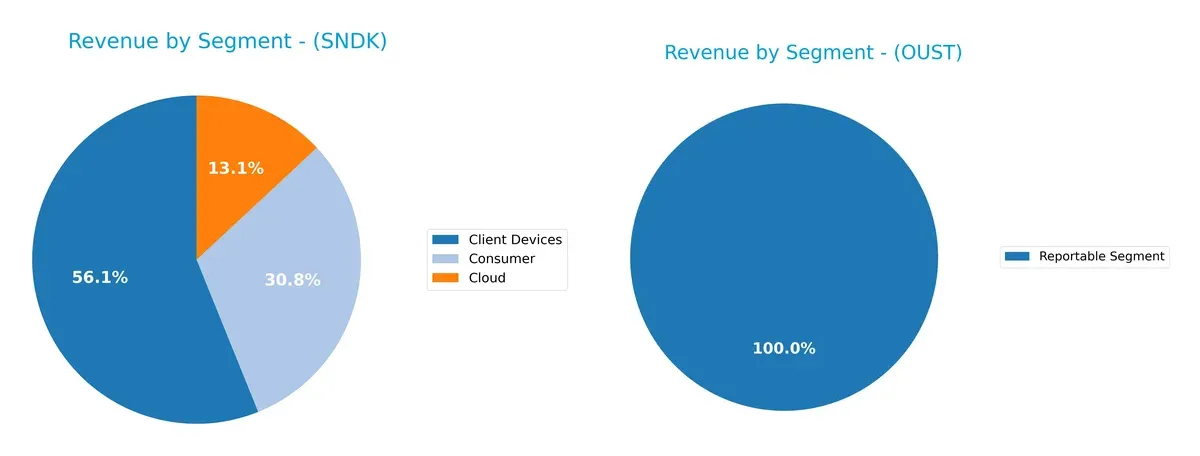

How are the two companies positioned?

This section dissects the operational DNA of Sandisk and Ouster by comparing their revenue mix and internal dynamics. The goal is to confront their economic moats and identify the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Sandisk Corporation and Ouster, Inc. diversify their income streams and where their primary sector bets lie:

Sandisk anchors its revenue in Client Devices with $4.13B, supported by Consumer at $2.27B and Cloud at $960M, showing a balanced but device-heavy mix. Ouster reports a single segment at $111M, signaling high concentration risk. Sandisk’s diversified streams reduce volatility and leverage ecosystem lock-in, while Ouster’s reliance on one segment exposes it to market shifts without a clear infrastructure moat.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Sandisk Corporation and Ouster, Inc.:

Sandisk Corporation Strengths

- Diversified revenue streams across Client Devices, Consumer, and Cloud segments

- Strong global presence with significant sales in China, US, and EMEA

- Favorable quick ratio and low debt-to-assets ratio

- Efficient fixed asset turnover

Ouster, Inc. Strengths

- Favorable current and quick ratios indicating liquidity strength

- Low debt-to-assets and debt-to-equity ratios

- Favorable fixed asset turnover

- Presence across Americas, Asia Pacific, and EMEA regions

Sandisk Corporation Weaknesses

- Negative net margin, ROE, and ROIC indicate weak profitability

- High WACC reduces capital efficiency

- Unfavorable interest coverage and zero dividend yield

- Slightly unfavorable overall financial ratios

Ouster, Inc. Weaknesses

- Deeply negative profitability ratios with net margin, ROE, and ROIC significantly below zero

- Elevated WACC impacts cost of capital

- Unfavorable asset turnover and negative interest coverage

- Unfavorable overall financial ratios and high price-to-book ratio

Sandisk shows broader diversification and stronger global sales but struggles with profitability and capital efficiency. Ouster demonstrates liquidity strengths but faces more severe profitability and efficiency challenges, highlighting differing strategic and operational pressures for both companies.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting long-term profits from relentless competition’s erosion. Let’s dissect how these firms defend their turf:

Sandisk Corporation: Cost Advantage in NAND Flash Storage

Sandisk’s moat stems from cost leadership in NAND flash tech. This shows in its solid gross margins despite margin pressures. Yet, declining ROIC warns of eroding efficiency heading into 2026.

Ouster, Inc.: Innovation-Driven Network Effects in Lidar

Ouster’s advantage lies in its cutting-edge 3D lidar sensors, building network effects through software integration. Its improving ROIC trend signals strengthening competitive positioning, with growth potential in autonomous markets.

Verdict: Cost Leadership vs. Innovation Momentum

Sandisk’s cost moat is broader but weakening, while Ouster’s innovation moat is narrower yet deepening. I see Ouster better poised to defend and expand its market share in 2026.

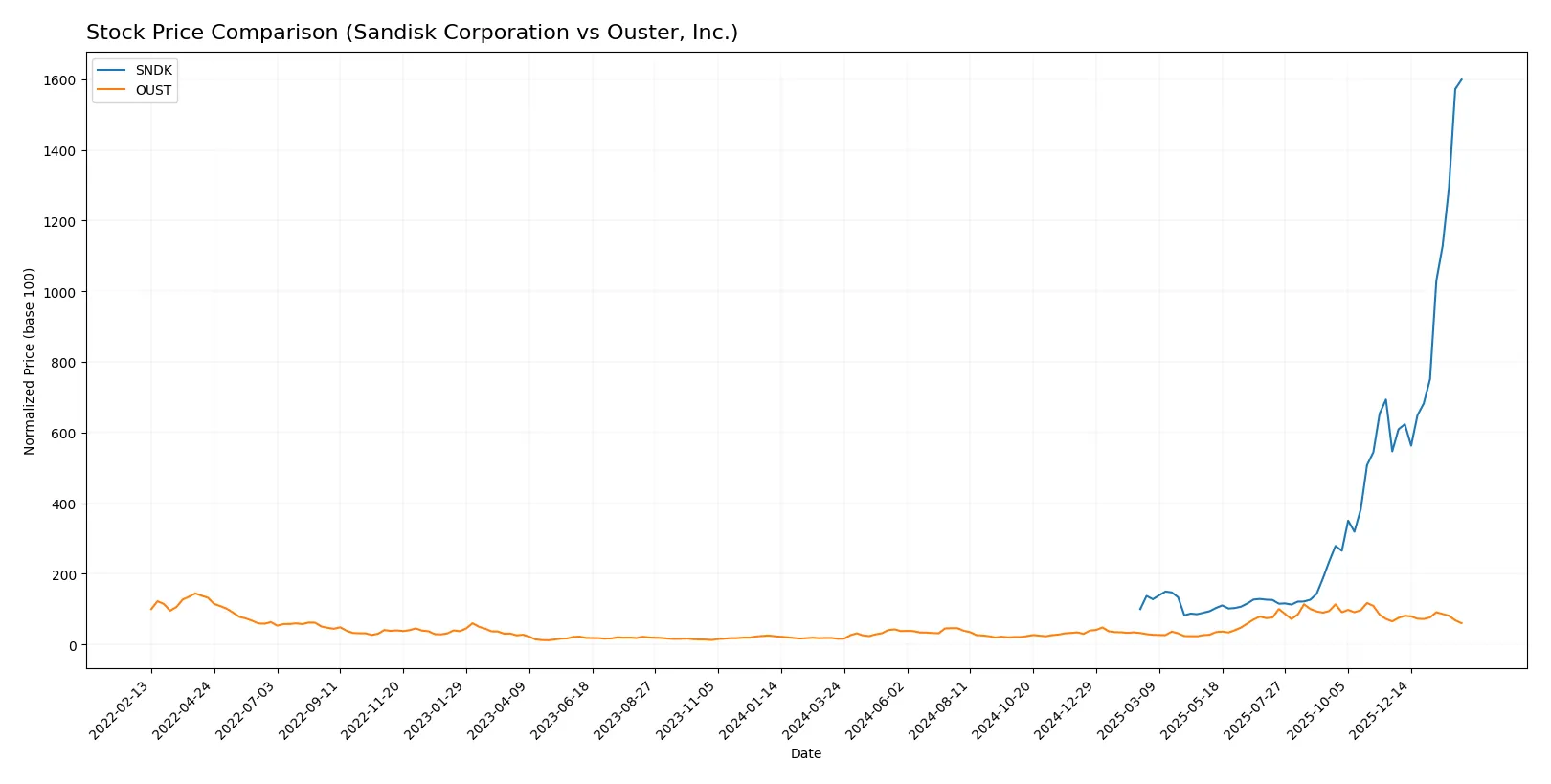

Which stock offers better returns?

Over the past year, Sandisk Corporation and Ouster, Inc. exhibited distinct price trajectories, with Sandisk showing substantial gains and Ouster displaying more moderate movements.

Trend Comparison

Sandisk’s stock surged 1498.91% over the last 12 months, demonstrating a strong bullish trend with accelerating momentum and a high volatility level (std dev 139.25). The highest price reached 586.0, reflecting robust investor interest.

Ouster’s stock gained 280.29% over the same period, maintaining a bullish but decelerating trend. Volatility was considerably lower (std dev 8.52), with a peak price of 35.8. However, recent weeks showed a slight negative trend (-8.03%).

Sandisk outperformed Ouster markedly with a higher percentage gain and accelerating trend, while Ouster’s growth slowed and recently turned slightly negative. Sandisk delivered the strongest market performance overall.

Target Prices

Analysts present a mixed but generally optimistic target consensus for Sandisk Corporation and Ouster, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Sandisk Corporation | 220 | 1000 | 675 |

| Ouster, Inc. | 33 | 39 | 36.67 |

Sandisk’s consensus target of 675 exceeds its current price of 588, signaling potential upside. Ouster’s target consensus of 36.67 is double its current price near 18.4, indicating strong growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Sandisk Corporation Grades

The following table summarizes recent grades assigned to Sandisk Corporation by major institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-02-02 |

| Citigroup | Maintain | Buy | 2026-02-02 |

| Jefferies | Maintain | Buy | 2026-01-30 |

| Wedbush | Maintain | Outperform | 2026-01-30 |

| RBC Capital | Maintain | Sector Perform | 2026-01-30 |

| Goldman Sachs | Maintain | Buy | 2026-01-30 |

| Morgan Stanley | Maintain | Overweight | 2026-01-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-30 |

| Citigroup | Maintain | Buy | 2026-01-20 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-15 |

Ouster, Inc. Grades

Below is a summary of recent grades for Ouster, Inc. from recognized grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Upgrade | Overweight | 2025-11-07 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-11-06 |

| WestPark Capital | Maintain | Buy | 2025-11-05 |

| Rosenblatt | Maintain | Buy | 2025-11-05 |

| WestPark Capital | Upgrade | Buy | 2025-08-13 |

| Oppenheimer | Maintain | Outperform | 2025-07-16 |

| WestPark Capital | Downgrade | Hold | 2025-06-12 |

| WestPark Capital | Upgrade | Buy | 2025-05-09 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-21 |

| WestPark Capital | Maintain | Hold | 2025-03-21 |

Which company has the best grades?

Sandisk Corporation consistently receives strong buy and outperform ratings from top-tier firms, reflecting broad institutional confidence. Ouster, Inc. shows mixed ratings with frequent upgrades but also downgrades, indicating more volatile sentiment. Investors may see Sandisk’s steadier grades as a sign of relative stability.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Sandisk Corporation

- Established leader in NAND flash storage with broad product range; faces intense competition from larger tech firms.

Ouster, Inc.

- Emerging player in lidar sensors; competes in a niche but rapidly evolving market with aggressive innovation demands.

2. Capital Structure & Debt

Sandisk Corporation

- Moderate debt-to-equity (0.22) signals balanced leverage; interest coverage negative, indicating earnings strain.

Ouster, Inc.

- Low debt-to-equity (0.11) shows conservative leverage; severely negative interest coverage reflects ongoing operating losses.

3. Stock Volatility

Sandisk Corporation

- High beta (4.8) reveals extreme price swings, increasing trading risk.

Ouster, Inc.

- Beta of 2.9 indicates elevated volatility but less extreme than Sandisk, reflecting startup market uncertainty.

4. Regulatory & Legal

Sandisk Corporation

- Operates in mature hardware sector with stable regulatory environment; potential IP litigation risk.

Ouster, Inc.

- Faces evolving lidar regulations and safety standards; regulatory shifts may increase compliance costs.

5. Supply Chain & Operations

Sandisk Corporation

- Long-standing supply chains but exposed to flash memory component shortages and geopolitical trade tensions.

Ouster, Inc.

- Smaller scale supply chain more vulnerable to disruptions; relies on specialized components with limited suppliers.

6. ESG & Climate Transition

Sandisk Corporation

- Faces pressure to reduce environmental footprint in manufacturing; sustainability initiatives underway but progress uneven.

Ouster, Inc.

- Positioned as innovative tech with potential ESG benefits; climate transition impact on lidar adoption remains uncertain.

7. Geopolitical Exposure

Sandisk Corporation

- US-based with global markets; exposed to trade tensions affecting semiconductor exports.

Ouster, Inc.

- Primarily US-focused but supply chain globally sensitive; geopolitical instability could disrupt component sourcing.

Which company shows a better risk-adjusted profile?

Sandisk’s most impactful risk is its earnings weakness indicated by negative net margin and interest coverage, despite solid liquidity and a safer Altman Z-Score. Ouster suffers extreme profitability losses and higher operational risk with weaker asset utilization and more volatile stock behavior. Despite Sandisk’s high beta, I see it as the better risk-adjusted choice because its scale and financial stability offer a stronger buffer against market shocks. Ouster’s persistent negative margins and interest coverage raise red flags, especially given its smaller size and higher uncertainty. The recent 15% price drop for Sandisk contrasts with Ouster’s 9% decline, reflecting market sensitivity but also Sandisk’s more resilient fundamentals.

Final Verdict: Which stock to choose?

Sandisk Corporation’s superpower lies in its ability to generate substantial cash flow and maintain a strong liquidity buffer. However, its persistent value destruction and declining profitability remain points of vigilance. It fits investors with an appetite for turnaround stories and aggressive growth potential.

Ouster, Inc. leverages a strategic moat based on innovation and rapid revenue expansion in a cutting-edge niche. Compared to Sandisk, it offers a slightly safer balance sheet but suffers from ongoing losses and value erosion. It suits investors focused on growth at a reasonable price with patience for operational scaling.

If you prioritize aggressive growth backed by liquidity strength, Sandisk commands attention despite its current challenges. However, if you seek innovation-driven expansion with a more stable financial footing, Ouster offers better stability and improving profitability trends. Both stocks carry elevated risks and demand a disciplined risk management approach.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Sandisk Corporation and Ouster, Inc. to enhance your investment decisions: