Onto Innovation Inc. and Silicon Laboratories Inc. are two prominent players in the semiconductor industry, each driving innovation in highly specialized segments. Onto Innovation focuses on process control tools and advanced metrology, while Silicon Labs excels in analog mixed-signal solutions for IoT applications. Their overlapping market presence and distinct innovation strategies make them compelling candidates for investment. In this article, I will help you determine which company offers the most promising opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Onto Innovation Inc. and Silicon Laboratories Inc. by providing an overview of these two companies and their main differences.

Onto Innovation Inc. Overview

Onto Innovation Inc. specializes in designing, developing, manufacturing, and supporting process control tools focused on macro defect inspection, 2D/3D optical metrology, lithography systems, and process control software globally. Its products serve semiconductor and advanced packaging device manufacturers, addressing yield management and device packaging with standalone and enterprise-wide software solutions. Founded in 1940, Onto is headquartered in Wilmington, Massachusetts, with a market cap of 10.7B USD.

Silicon Laboratories Inc. Overview

Silicon Laboratories Inc. is a fabless semiconductor company providing analog-intensive mixed-signal solutions, including wireless microcontrollers and sensor products. Its offerings target applications in the Internet of Things (IoT), such as smart homes, industrial automation, and medical instrumentation. Founded in 1996 and based in Austin, Texas, Silicon Labs has a market cap of 5B USD and distributes products through direct sales and independent representatives.

Key similarities and differences

Both Onto Innovation and Silicon Laboratories operate in the semiconductor industry within the technology sector in the US. Onto focuses on process control tools and software for semiconductor manufacturing, while Silicon Labs centers on mixed-signal semiconductor products for IoT applications. Onto’s business includes manufacturing and software licensing, whereas Silicon Labs is fabless, relying on external fabrication. Both companies have strong US headquarters but differ in market cap, product focus, and distribution models.

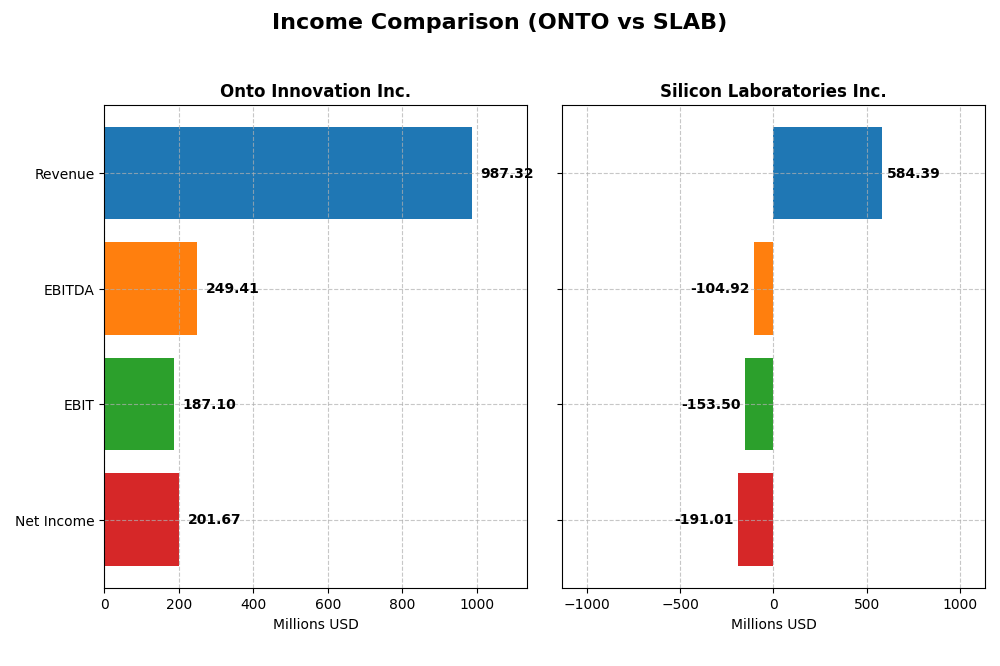

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Onto Innovation Inc. and Silicon Laboratories Inc. for the fiscal year 2024.

| Metric | Onto Innovation Inc. | Silicon Laboratories Inc. |

|---|---|---|

| Market Cap | 10.7B | 5.0B |

| Revenue | 987M | 584M |

| EBITDA | 249M | -105M |

| EBIT | 187M | -153M |

| Net Income | 202M | -191M |

| EPS | 4.09 | -5.93 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Onto Innovation Inc.

Onto Innovation has shown strong revenue growth from 2020 to 2024, increasing from $556M to $987M, with net income rising impressively from $31M to $202M. Margins have improved notably, with a gross margin above 52% and net margin exceeding 20% in 2024. The latest year saw revenue growth accelerate by 21%, alongside a 37.5% rise in net margin, signaling robust operational leverage.

Silicon Laboratories Inc.

Silicon Laboratories reported fluctuating revenue, peaking at $1.02B in 2022 before declining to $584M in 2024. Net income turned sharply negative, from a $91M profit in 2022 to a loss of $191M in 2024. Despite maintaining a favorable gross margin above 53%, the company’s EBIT and net margins were deeply negative in 2024, reflecting challenges in controlling operating expenses amid declining sales.

Which one has the stronger fundamentals?

Onto Innovation exhibits stronger fundamentals with consistent revenue and net income growth, solid and improving margins, and favorable earnings growth over the period. In contrast, Silicon Laboratories faces significant profitability pressures, marked by large net losses and unfavorable margin trends despite decent gross margins. The overall income statement outlook favors Onto Innovation’s financial health and operational performance.

Financial Ratios Comparison

The table below compares key financial ratios for Onto Innovation Inc. and Silicon Laboratories Inc. based on their most recent fiscal year data for 2024.

| Ratios | Onto Innovation Inc. (ONTO) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| ROE | 10.47% | -17.69% |

| ROIC | 8.77% | -14.71% |

| P/E | 41.76 | -21.53 |

| P/B | 4.37 | 3.81 |

| Current Ratio | 8.69 | 6.15 |

| Quick Ratio | 7.00 | 5.07 |

| D/E | 0.008 | 0.014 |

| Debt-to-Assets | 0.72% | 1.27% |

| Interest Coverage | 0 | -126.33 |

| Asset Turnover | 0.47 | 0.48 |

| Fixed Asset Turnover | 7.16 | 4.42 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Onto Innovation Inc.

Onto Innovation shows a mixed ratio profile, with strong net margin at 20.43% and favorable leverage metrics such as debt-to-equity at 0.01 and interest coverage at infinity. However, its high price-to-earnings ratio of 41.76 and price-to-book of 4.37 suggest overvaluation concerns, while a current ratio of 8.69 may indicate inefficient asset use. The company does not pay dividends, likely prioritizing reinvestment strategies or growth.

Silicon Laboratories Inc.

Silicon Laboratories presents mostly weak ratios, with negative net margin of -32.69% and negative returns on equity and invested capital, reflecting profitability challenges. Despite a favorable price-to-earnings ratio of -21.53 and low debt levels, its interest coverage ratio is deeply negative, raising solvency concerns. Like Onto, it does not distribute dividends, possibly due to losses or reinvestment in R&D.

Which one has the best ratios?

Onto Innovation offers a more balanced ratio landscape, combining profitability and solid leverage profiles, though some valuation and liquidity metrics are less favorable. Silicon Laboratories faces significant profitability and solvency issues, reflected in mostly unfavorable ratios. Therefore, Onto Innovation currently has the more favorable overall ratio assessment.

Strategic Positioning

This section compares the strategic positioning of Onto Innovation Inc. and Silicon Laboratories Inc., including their market position, key segments, and exposure to technological disruption:

Onto Innovation Inc.

- Market leader in semiconductor process control tools with moderate competitive pressure.

- Key segments include process control tools, optical metrology, lithography, and software solutions.

- Exposure to disruption through advanced semiconductor manufacturing technologies and software integration.

Silicon Laboratories Inc.

- Fabless semiconductor company focusing on analog-intensive mixed-signal products facing competitive pressures.

- Focused on wireless microcontrollers and sensors for IoT, industrial automation, and consumer electronics.

- Exposed to IoT and mixed-signal innovation disruptions in connected devices and automation.

Onto Innovation Inc. vs Silicon Laboratories Inc. Positioning

Onto Innovation pursues a diversified approach across hardware and software in semiconductor manufacturing, while Silicon Laboratories concentrates on analog mixed-signal solutions for IoT and industrial markets. Onto’s broad product portfolio contrasts with Silicon Labs’ focused IoT-driven segments, each with distinct market dynamics.

Which has the best competitive advantage?

Both companies are currently shedding value, but Onto Innovation shows growing profitability trends, whereas Silicon Laboratories experiences declining returns, indicating Onto holds a relatively stronger moat despite current challenges.

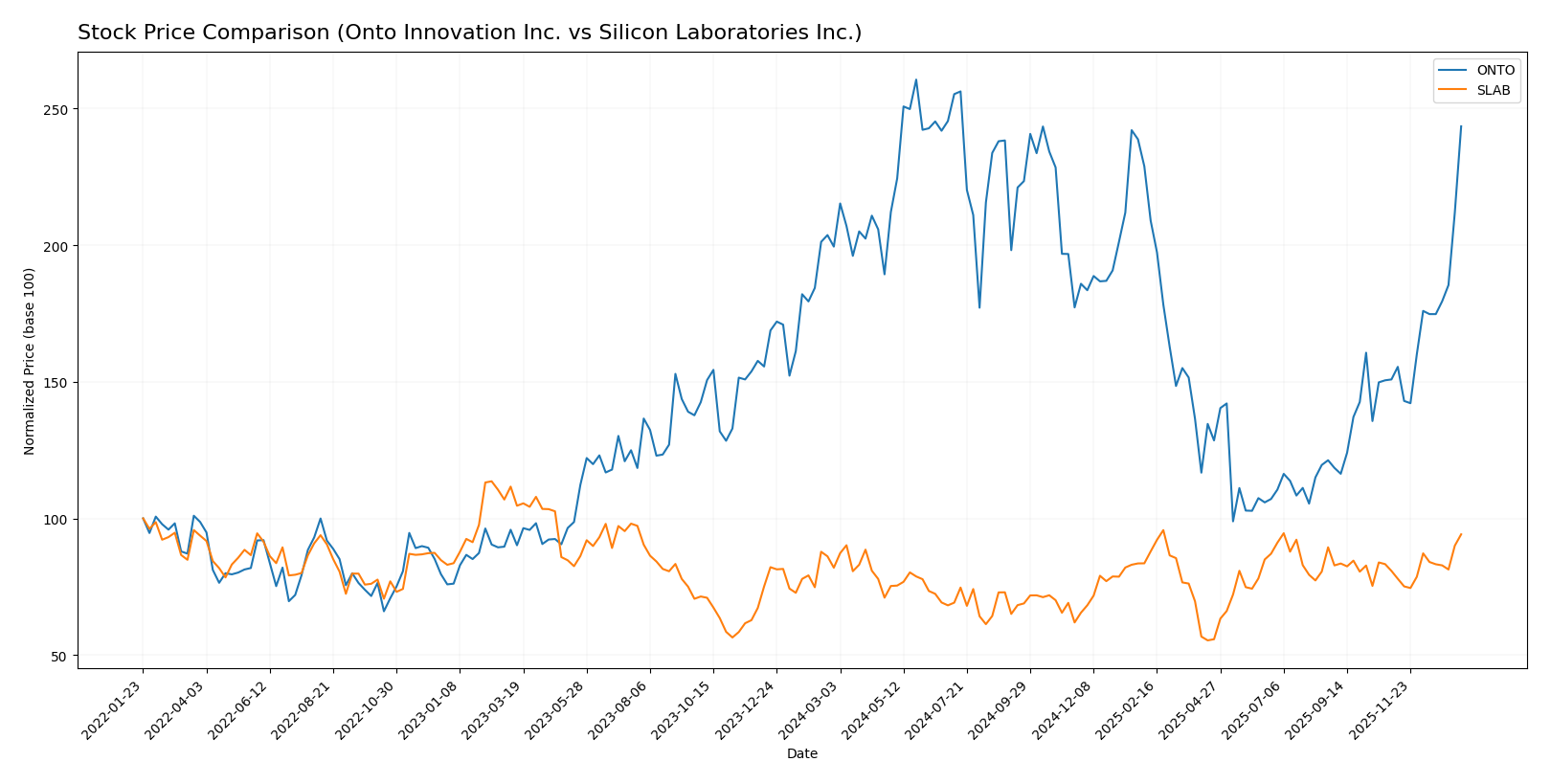

Stock Comparison

The stock price movements of Onto Innovation Inc. and Silicon Laboratories Inc. over the past year illustrate distinct bullish trends with varying acceleration and volatility profiles.

Trend Analysis

Onto Innovation Inc. displayed a bullish trend over the past 12 months with a 22.07% price increase and accelerating momentum, reaching a high of 233.14 and demonstrating significant volatility (42.61 std deviation). Recent months saw a sharper surge of 61.42%.

Silicon Laboratories Inc. also followed a bullish path with a 14.91% gain over the year and accelerating pace. It showed lower volatility (14.15 std deviation) and a more moderate recent increase of 16.59%, peaking at 155.33.

Comparatively, Onto Innovation Inc. outperformed Silicon Laboratories Inc., delivering the highest market performance and stronger recent price acceleration.

Target Prices

Here is the consensus target price overview based on verified analyst data for Onto Innovation Inc. and Silicon Laboratories Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Onto Innovation Inc. | 200 | 160 | 178 |

| Silicon Laboratories Inc. | 165 | 130 | 151.67 |

Analysts expect Onto Innovation’s price to be below its current 217.85 USD, signaling potential downside risk. Silicon Laboratories’ consensus target aligns closely with its current 152.82 USD, indicating a stable outlook.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Onto Innovation Inc. (ONTO) and Silicon Laboratories Inc. (SLAB):

Rating Comparison

ONTO Rating

- Rating: B+ indicating a very favorable status.

- Discounted Cash Flow Score: Moderate at 3.

- ROE Score: Moderate efficiency with a score of 3.

- ROA Score: Favorable at 4, showing good asset utilization.

- Debt To Equity Score: Favorable at 4, indicating lower financial risk.

- Overall Score: Moderate at 3.

SLAB Rating

- Rating: C- despite very favorable status.

- Discounted Cash Flow Score: Moderate at 2.

- ROE Score: Very unfavorable at 1, indicating poor efficiency.

- ROA Score: Very unfavorable at 1, showing poor asset use.

- Debt To Equity Score: Very unfavorable at 1, indicating higher financial risk.

- Overall Score: Very unfavorable at 1.

Which one is the best rated?

Based strictly on the data, Onto Innovation Inc. is better rated than Silicon Laboratories Inc. Onto shows higher and more favorable scores across all key financial metrics, reflecting stronger financial health and operational efficiency.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for Onto Innovation Inc. and Silicon Laboratories Inc.:

ONTO Scores

- Altman Z-Score: 34.16, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

SLAB Scores

- Altman Z-Score: 18.02, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

Which company has the best scores?

Both Onto Innovation Inc. and Silicon Laboratories Inc. show strong financial stability with Altman Z-Scores in the safe zone. Their Piotroski Scores are identical at 4, reflecting average financial strength. Neither company stands out clearly based on these scores alone.

Grades Comparison

Here is a comparison of the recent grades and ratings assigned to Onto Innovation Inc. and Silicon Laboratories Inc.:

Onto Innovation Inc. Grades

The following table shows the latest grade updates from major grading companies for Onto Innovation Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Hold | 2026-01-14 |

| Needham | maintain | Buy | 2026-01-06 |

| Jefferies | maintain | Buy | 2025-12-15 |

| B. Riley Securities | maintain | Buy | 2025-11-18 |

| Needham | maintain | Buy | 2025-11-18 |

| Evercore ISI Group | maintain | Outperform | 2025-11-05 |

| Oppenheimer | maintain | Outperform | 2025-10-14 |

| Stifel | maintain | Hold | 2025-10-13 |

| B. Riley Securities | maintain | Buy | 2025-10-10 |

| Jefferies | upgrade | Buy | 2025-09-23 |

Overall, Onto Innovation’s grades predominantly show buy and outperform ratings, with a few hold recommendations, indicating a generally positive but cautious sentiment.

Silicon Laboratories Inc. Grades

The following table shows the latest grade updates from major grading companies for Silicon Laboratories Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-08-06 |

| Susquehanna | maintain | Neutral | 2025-08-06 |

| Barclays | maintain | Equal Weight | 2025-08-05 |

| Susquehanna | maintain | Neutral | 2025-07-22 |

| Stifel | maintain | Buy | 2025-07-18 |

| Keybanc | maintain | Overweight | 2025-07-08 |

| Benchmark | maintain | Buy | 2025-05-27 |

| Benchmark | maintain | Buy | 2025-05-14 |

| Susquehanna | maintain | Neutral | 2025-05-14 |

| Needham | maintain | Buy | 2025-05-14 |

Silicon Laboratories exhibits a mix of buy, overweight, and neutral/equal weight ratings, reflecting a somewhat balanced but moderately positive outlook.

Which company has the best grades?

Both Onto Innovation and Silicon Laboratories hold a consensus “Buy” rating, but Onto Innovation has more consistent buy and outperform grades, while Silicon Laboratories shows a wider range including neutral and equal weight ratings. Investors might interpret Onto Innovation’s stronger buy signals as a clearer positive analyst sentiment.

Strengths and Weaknesses

The table below compares key strengths and weaknesses of Onto Innovation Inc. (ONTO) and Silicon Laboratories Inc. (SLAB) based on their recent financial performance and market positions.

| Criterion | Onto Innovation Inc. (ONTO) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| Diversification | Strong product diversification with Parts, Service, and Systems & Software segments totaling over 900M USD in 2024 | Mostly focused on Industrial & Commercial segment with 339M USD in 2024, less diversified |

| Profitability | Positive net margin (20.43%), neutral ROIC (8.77%), but ROIC below WACC | Negative net margin (-32.69%), negative ROIC (-14.71%), declining profitability |

| Innovation | Steady growth in Systems & Software revenue, indicating innovation focus | Revenue decline with shrinking segments, indicating challenges in innovation |

| Global presence | Moderate global footprint with increasing revenue in key segments | Limited diversification in markets, concentrated revenue streams |

| Market Share | Growing revenue trend suggesting expanding market share | Declining revenue and unfavorable financial ratios suggest shrinking market share |

Key takeaways: Onto Innovation shows improving profitability and revenue diversification despite slightly unfavorable capital efficiency, indicating potential for value creation. Silicon Laboratories faces significant profitability and growth challenges, with declining financial health and market presence, raising caution for investors.

Risk Analysis

Below is a comparative table summarizing key risk factors for Onto Innovation Inc. (ONTO) and Silicon Laboratories Inc. (SLAB) as of 2024:

| Metric | Onto Innovation Inc. (ONTO) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| Market Risk | Beta 1.46, moderate volatility | Beta 1.54, slightly higher volatility |

| Debt level | Very low debt (D/E 0.01), strong balance sheet | Very low debt (D/E 0.01), strong balance sheet |

| Regulatory Risk | Moderate, semiconductor industry compliance | Moderate, fabless semiconductor regulations |

| Operational Risk | Stable operations, diversified product portfolio | Operational losses, negative margins in 2024 |

| Environmental Risk | Low to moderate, standard industry impact | Low to moderate, industry typical impact |

| Geopolitical Risk | Exposure to global supply chains, US-based | Exposure to global markets, US-based |

Onto Innovation shows moderate market risk with very low financial leverage, maintaining operational stability and high Altman Z-score signaling low bankruptcy risk. Silicon Laboratories faces higher operational risk with significant losses and unfavorable profitability metrics, despite similarly low debt. Market volatility and geopolitical exposure remain comparable for both.

Which Stock to Choose?

Onto Innovation Inc. shows strong income growth with a 77% revenue increase over five years and a 550% rise in net income. Its financial ratios are mixed but lean towards neutral, supported by favorable profitability and low debt levels, earning a very favorable B+ rating. Despite a slightly unfavorable moat, its ROIC is improving, and liquidity remains solid.

Silicon Laboratories Inc. presents unfavorable income trends, including a 25% revenue decline in the last year and sustained net losses. Most financial ratios are unfavorable, reflecting weak profitability and higher debt risk, resulting in a very unfavorable C- rating. The company faces a very unfavorable moat with declining ROIC and moderate liquidity.

For investors prioritizing growth and improving profitability, Onto Innovation might appear more favorable given its strong income growth and stable financial metrics. Conversely, those with tolerance for higher risk and potential turnaround scenarios could interpret Silicon Laboratories’ current challenges as an opportunity, albeit with caution given its weaker financial standing.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Onto Innovation Inc. and Silicon Laboratories Inc. to enhance your investment decisions: